Business Acquisition Plan: What to Include in 2024 (+ Template)

Kison Patel is the Founder and CEO of DealRoom, a Chicago-based diligence management software that uses Agile principles to innovate and modernize the finance industry. As a former M&A advisor with over a decade of experience, Kison developed DealRoom after seeing first hand a number of deep-seated, industry-wide structural issues and inefficiencies.

A business acquisition plan is an important component of planning for an M&A transaction, regardless of whether you require external financing. A solid business acquisition plan should lay out the rationale for the investment, and how it will add value for the entity. In this article, FirmRoom takes a closer look at how these documents should be crafted.

Understanding Business Acquisition Plan

A business acquisition plan is a strategy document, which serves the purpose of a business plan for an M&A transaction.

It outlines the motives behind a transaction, profiles of the companies involved in the transaction, how the transaction will generate value for the entity which is driving it, how the two companies will be integrated, and how the merged company (or simply acquired company in the case of an investment firm acquiring a company) is expected to perform.

Reasons to Have a Business Acquisition Plan

An acquisition plan provides its users with a roadmap to making the transaction a success. Even before the transaction is initiated, it acts as a reminder to the sponsors, what they’re looking for, why they’re looking for it, and how they’re going to ensure that the transaction is a success.

In general terms, the reasons to have a business acquisition plan are:

Strategic alignment

The overriding goal of a business acquisition plan, as the opening text alludes to, is strategic alignment: ensuring that those undertaking the deal, for lack of a better expression, ‘stick to the plan’, around the motives and means for making the deal a success.

Valuation and pricing

The plan should include strategies and methodologies for valuing the target company. It should guide the deal participants on how to determine a fair value for the target, assess synergies, and estimate future financial returns. It also sets a limit on how much the company can extend itself financially for a deal to occur.

Financing and resource allocation

Financing (sources and uses of funds) is just one part of the resource allocation conundrum. The business acquisition plan also outlines the working capital needs, who works where, how expenditures are going to shift, what capital assets are required, and more.

Business Acquisition Plan Template

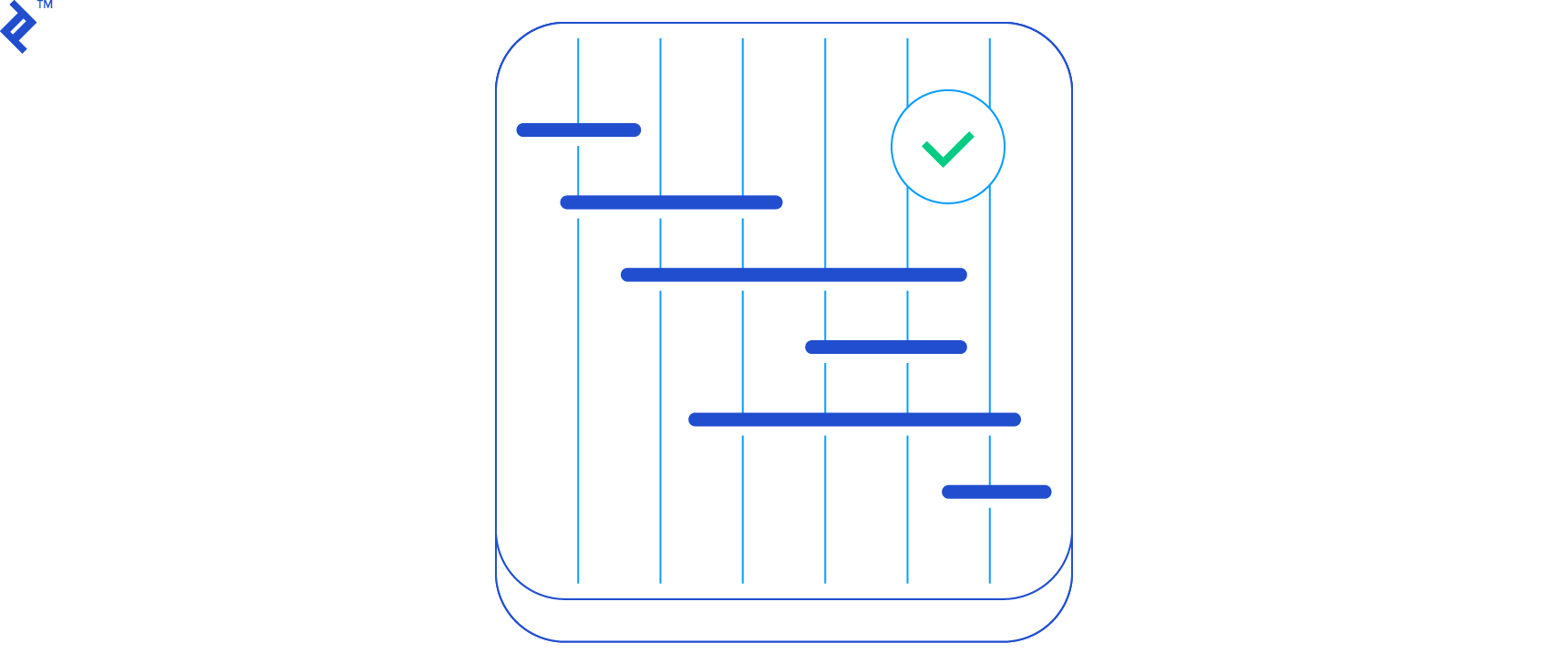

The insight that FirmRoom has gained from working with hundreds of companies on thousands of transaction, have been collated in a business acquisition plan template.

This provides a detailed roadmap of what should be included in an effective business acquisition plan, ensuring that its users have everything in place for the conclusion of a successful transaction.

{{widget-download}}

Creating a Business Acquisition Plan Step-by-Step

While developing a business acquisition plan is recommended, having an ineffective acquisition plan is worse than having none at all.

The document has to be watertight, creating no doubt in the reader’s mind about the benefits of an acquisition.

A strong business acquisition plan should make the reader think that it makes far more sense to go ahead with the transaction than for the company to continue in the status quo.

That being said, the following should only be seen as a rough step-by-step guide to putting together a business acquisition plan:

Strategy development

Best practice:

- Identify where the company wants to be in each of the next five years, possibly on a month-by-month basis, and how it plans to get there. See here for example.

- Identify the key performance indicators that need to be tracked to ensure that the company meets these objectives.

- Based on both of the above, ask whether an acquisition is a crucial part of the company achieving those objectives, before moving forward.

Identifying and evaluating target companies

- Understand where the companies that fit into the strategy will be found , and be thorough and objective in the search for them.

- Be realistic about the companies that can be acquired/merged with, including valuations , so as not to waste resources for other companies and your own.

- Remember that just because a company is the only one that’s available, it doesn’t mean that a transaction is a good idea.

Due Diligence

- Use technology ; any M&A practitioner that decides against using a sound technology platform for due diligence is doomed to failure.

- Adopt a mindset where due diligence is considered an investment in the acquisition, rather than a cost to your own company;

- Do not fall for the M&A acquirer’s fallacy of ‘we’ve come this far, so we can’t go back.’ If due diligence says the deal isn’t right, it isn’t.

- Begin the post-merger integration phase as soon as the deal begins to look like a realistic possibility (something which DealRoom is designed to cater for).

Deal structure and negotiation

- Leverage the findings of due diligence to create a more informed negotiation process.

- Remember that there will be back and forth with the seller, and they can be reasonably expected to overvalue their asset.

- Consider all market outcomes (i.e. downturns, current value of stock vs. future value, etc.) when creating an offer. Avoid irrational exuberance.

Post merger integration (PMI)

- Keep in mind at all times during the PMI phase that this is where most of the value can be generated and lost in a transaction.

- As mentioned, begin the process as soon as possible. If the transaction is visible on the horizon, you need to start thinking about its integration.

- Don’t write this off as a ‘soft’ or unnecessary part of the transaction - it won’t be soft when it impacts on your income statement.

Common mistakes to avoid when writing a business acquisition plan

Despite plenty of advice to the contrary, enthusiastic CXOs often write acquisition plans which fail to avoid the pitfalls.

These are among the most common:

Putting the acquisition before the strategy

The acquisition is part of the overall strategy, not the other way around. Companies that are approached by others about a deal, and then somehow convince themselves that there is a strong rationale for a deal, fall foul to this backwards logic.

Management hubris

M&A is an area ripe with management hubris (take a glance at Google Scholar at all the academic texts that link the two). That means management hubris inevitably finds its way into business acquisition plans. Avoid it at all costs - it’s a highly costly behavioural pattern for companies of all sizes.

Lack of detail

The business acquisition plan is a strategy document, not a marketing one. That is to say, it should break down in a step-by-step fashion how the deal will generate value. The more detailed the better. “Creating an outstanding organization” is great, but writing it in the business acquisition plan won’t add any value.

Business acquisition plan template

A business acquisition plan is a hugely worthwhile document that all M&A practitioners should write in order to discern the value of a transaction and how that value can be extracted. It is the business plan for an M&A transaction.

Get your free template below to receive guidelines on how to create the document and make it work for your transaction.

Frequently Asked Questions (FAQs)

Successful acquisition starts with a great plan

Get your roadmap for precise valuation planning to due diligence checklists and synergy tracking. Close deals faster, smarter.

.png)

Quick Links

Training & Support

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

How To Write an Acquisition Business Plan

In the world of business, acquiring another company is a bold move. It’s a venture filled with both opportunities and risks. To navigate this complex journey successfully, you need a well-structured acquisition business plan. This isn’t just any document; it’s your guiding star, your blueprint, and your key to making this business acquisition a triumphant success.

Acquiring a business is no small feat. It’s a defining moment in the life of any company, and the acquisition business plan is the compass that will lead you through this challenging journey. In this guide, we will not only emphasize the significance of having a comprehensive plan but also provide you with an in-depth understanding of the critical elements that should be present in your plan.

What is Acquisition Planning?

Acquisition planning is a structured process for identifying and acquiring goods or services to meet an organization’s needs. It is a critical part of the procurement process, as it helps to ensure that the organization gets the best value for its money.

Need a Professional business plan writer?

Elevate your acquisition strategy today!

How to create an acquisition business plan step by step

Start with an executive summary.

The executive summary is like the opening scene of a blockbuster movie – it sets the tone and captures the audience’s attention. It’s a concise yet impactful overview of your acquisition strategy. This section serves as the very first impression potential investors and partners will have of your plan.

In your executive summary, include key highlights such as the purpose of the acquisition, the target business, and the expected benefits. Remember, it should be captivating, informative, and compelling.

Get to Know Your Company

In the ‘Get to Know Your Company’ section, you provide an extensive profile of your own organization. This is your opportunity to showcase your strengths, experience, and financial stability. It’s essentially the part where you introduce yourself before a crucial presentation.

Outline your company’s history, achievements, and expertise. Explain why your company is the right entity for this acquisition. Make sure to instill confidence in the minds of your readers and potential stakeholders.

Understand the Industry

An acquisition is not just about buying another company; it’s about entering a new landscape. Understanding the industry in which your target business operates is crucial.

Here, you need to delve deep into the industry. Share insights about market trends, potential for growth, and any challenges that might be on the horizon. This section serves as evidence that you’ve done your homework and are prepared for what lies ahead.

Evaluate the Target Business

Let’s talk about the business you plan to acquire. In this part of your business plan , it’s your chance to discuss the target business in detail. This includes its history, financial performance, and the assets it brings to the table.

Highlight the aspects of the target business that are promising, and also acknowledge where improvements can be made. This demonstrates your realistic approach and your clear vision for the future.

Lay Out Your Acquisition Strategy

This is where you outline your plan for acquiring the target business. Your strategy should include the deal structure, financing details, and a clear timeline. Explain how you intend to integrate the newly acquired business into your existing operations seamlessly.

In this section, it’s essential to exhibit your strategic thinking and your ability to execute the acquisition effectively.

Your Marketing and Sales Game Plan

Once the acquisition is complete, what’s your strategy for marketing and selling? How will you use this new addition to your portfolio to grow your customer base and, consequently, your revenue?

This part of your plan should outline your marketing and sales strategies post-acquisition. It’s the place to showcase your vision for the future and your ability to drive results.

Crunch the Numbers

This is where the hard numbers come into play. Provide detailed financial projections, including income statements, balance sheets, and cash flow forecasts. These projections should offer a clear picture of the expected financial benefits of the acquisition.

These figures are not just dry statistics; they are the financial backbone of your plan, demonstrating the potential return on investment.

Deal with Potential Risks

Every business venture comes with its share of risks. In this section, you should identify potential risks associated with the acquisition and explain how you plan to address them.

This shows your meticulousness and your commitment to risk mitigation, which is crucial for building trust and confidence among your stakeholders.

Navigate Legal and Regulatory Matters

Acquisitions often involve complex legal and regulatory matters. It’s essential to discuss these aspects in your plan. If there are compliance issues, explain in detail how you intend to address them.

This section assures your readers that you’re well-prepared to navigate the legal intricacies involved in the acquisition.

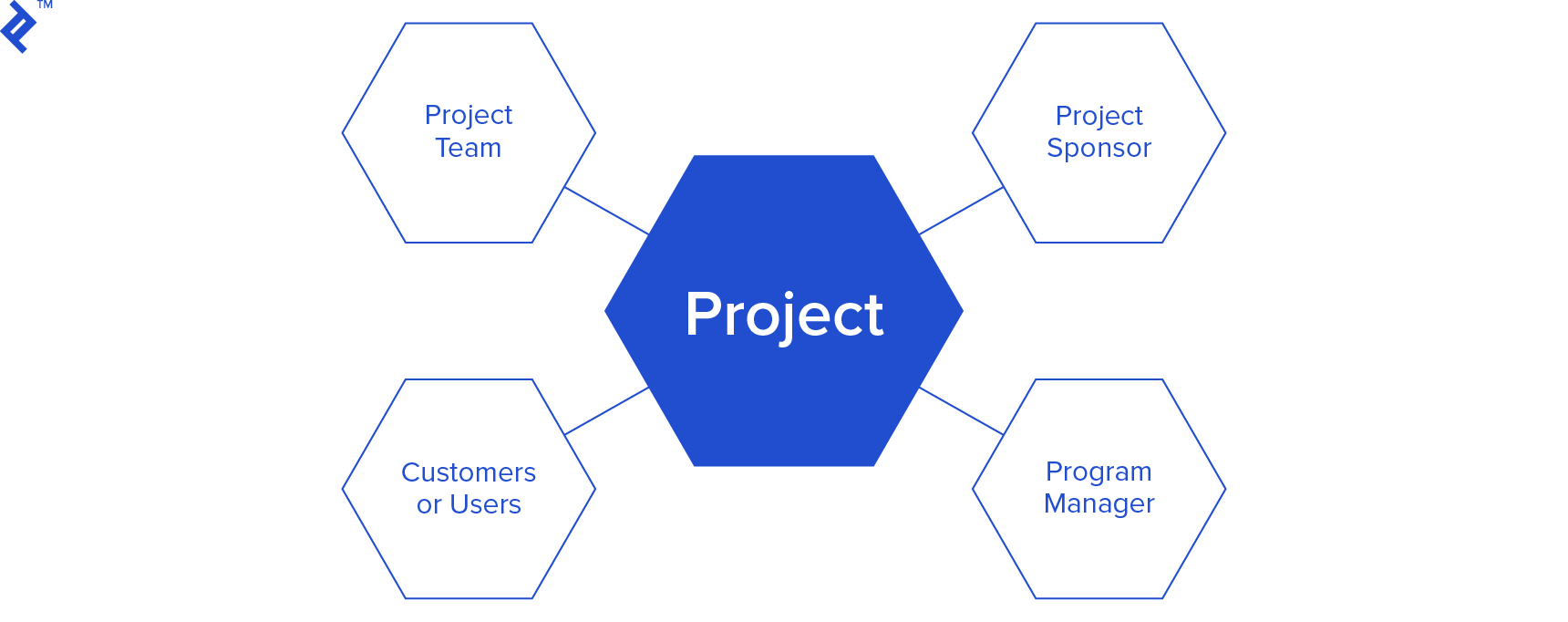

Meet the Team

A successful acquisition is a team effort. Introduce the key players involved in the acquisition and explain their roles. Highlight their experience, qualifications, and achievements.

By showcasing the strength of your team, you demonstrate that you have the right people in place to execute the plan effectively.

Get specialized business plan services now!

Merger and acquisition business plan template.

Grab our Merger and Acquisition Business Plan Template to make your merger or acquisition journey smoother. This template is packed with key sections and detailed insights, ensuring you cover all aspects of your acquisition strategy. Let this template be your roadmap as you navigate the complexities of business acquisitions. Start your journey toward a triumphant merger or acquisition business plan today! Download M&A Business Plan Template

Optimizing a Business Acquisition Plan with Structured Processes

Crafting a business acquisition plan isn’t just about signing papers; it’s about blending smart strategies that supercharge success. By weaving organized methods into this plan, you’re making sure that the merging companies don’t just coexist but flourish together.

Making It Work Together

Think of it as putting puzzle pieces together. Show how a carefully planned approach isn’t just about buying a company; it’s about merging their ways of doing things into a cohesive strategy. This part is about combining different systems, rules, and methods smoothly.

Sharing the Secrets

Talk about finding and using the best ways of doing things from the company you’re acquiring. Explain how mixing their successful methods with yours makes everything run smoother and more efficiently.

One Size Fits All

Show why having a set way of doing things helps. Discuss how having consistent methods, from handling money to everyday tasks, helps the new company grow without unnecessary overlaps.

More Bang for Your Buck

Explain how having a well-thought-out plan gets you more than just a new company—it increases your profits too. Highlight how bringing in smart strategies boosts how well the business works and makes it stronger.

What Makes You Special

Talk about the advantage you have—the ability to look at different ways companies work. Explain how this helps you find and use the best ideas, making all your businesses better.

The Big Picture

Wrap it up by saying this plan isn’t just a bunch of papers—it’s a map to a successful future. It brings together the best parts of different companies, wipes out any problems, and sends everyone toward success.

In the concluding section of your plan, summarize the key points. Emphasize the potential for success that your acquisition business plan represents. Leave your readers with confidence in your approach and a sense of optimism about the future.

In conclusion, an acquisition business plan is more than just a document; it’s the heart and soul of your acquisition strategy. A meticulously crafted plan, like the one described here, can be your key to not only a successful acquisition but also a confident and prosperous future in the complex world of business acquisitions.

By following these steps and adding depth to each section of your plan, you can create a compelling narrative that instills trust and confidence in your stakeholders. This detailed roadmap will position you to excel in the intricate and rewarding realm of business acquisitions.

What is acquisition in business strategy?

An acquisition is a business deal where one company acquires and assumes control of another company. These transactions are a fundamental component of mergers and acquisitions (M&A), which represents a professional field in corporate law and finance centered on the acquisition, sale, and merging of businesses.

What is acquisition in business example?

An acquisition is a business deal in which one company obtains companies, organizations, or their assets in exchange for some form of consideration from another company. Examples of such transactions include Google’s purchase of Android for $50 million in 2005 and Pfizer’s acquisition of Warner-Lambert for $90 billion in 2000.

How do I prepare my business for acquisition?

- Perform an internal audit.

- Establish a well-organized company structure.

- Tidy up your financial statements.

- Renew your most crucial contracts.

- Create a strategic plan for the next five years.

- Address any pending legal and tax matters.

- Optimize your business operations.

- Ensure you have a top-notch team in position.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

How to Write a Business Plan for an Acquisition

- Small Business

- Business Planning & Strategy

- Write a Business Plan

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Write a Business Plan Outline

How to amend the business name on a court document, how to overcome corporate cultural issues in mergers & acquisitions.

- How to Write a Wedding Planning Business Plan

- Step-Ups in Valuation of Assets for a Newly Acquired Business

Many considerations come with a business acquisition. Not only do you have to consider the cost of the purchase, you have to consider how your business will integrate the newly purchased assets and utilize, or relieve, the employees that come along with the business. The business plan takes these and other acquisition considerations, along with their pros and cons, and organizes them into reusable research and analysis.

Create the business description for your business plan. List the legal business description of your business and indicate that your business is acquiring a business. Provide a detailed account of that business’ history, including staff size, location, legal business description and financial history. Identify the business’ short- and long-term goals and projections.

Create your business plan’s staffing section. List the managers and staff required to complete the business’ operations in a timely and efficient manner. Explain the functions of each manager and identify each of your business’ departments.

Identify the number of acquired employees and show how those employees will be integrated into the business. List the costs of all employment aspects, including costs, such as payroll, training, benefits and severance packages. Create an organizational chart to show the chain of command.

List the location of your business, as well as the locations of any acquired property. Explain how the properties are utilized by the business, as well as the costs for each. Include items such as zoning compliance fees, utilities and taxes in your expense list.

Show if the properties are owned, leased or rented. Address which properties will be retained and which will be released. Determine how your business will utilize the equipment and inventory acquired during the acquisition. Explain the steps that your business will use to control its losses and increase its assets.

Identify the external threats and opportunities that accompany the business acquisition. Look at areas such as customer demands, government regulation and industry competition. Research the identified areas thoroughly. Develop strategies to overcome the threats that accompany the acquisition and ascertain how your company will take advantage of its underlying opportunities.

Identify the products and services that your business will focus on after the acquisition. Categorize the original products and services against the newly acquired ones. Show and explain the costs and procedures of implementing the change requirements and merging the businesses. Identify any newly created products that result from the merge of company resources and identify any new equipment or inventory that will be required.

Identify the target market for your business. Explain how this market has changed as a result of the acquisition. Differentiate the market by separating it into categories of original, acquired and new markets. Address each category separately. Ascertain how your business will maintain its original customer base, and welcome its acquired and new customers.

Create financial statements for your business acquisition. Include personal financial statements for each owner of the business. Provide a balance sheet, income statement and cash flow statement for the business at a point just after the acquisition. Use realistic figures and assumptions when forecasting the business. Include complete financial statements for your original business and acquired business, for the past three years, to support and justify your forecasts.

Use the executive summary to introduce your business, along with the new products and services that result from the acquisition. Highlight your company’s various target markets and briefly review the trends within the industry. Review the reasons for the acquisition and explain how the acquisition will make your company stronger. Limit the executive summary to no more than three pages.

Include a copy of the acquisition contract in the appendix of your business plan, along with supporting documents, such as lease agreements, warranties and building appraisals. Begin the appendix with a content page. Label the documents accordingly and place the appendix at the end of your business plan.

- MasterCard International: The Plan

Writing professionally since 2004, Charmayne Smith focuses on corporate materials such as training manuals, business plans, grant applications and technical manuals. Smith's articles have appeared in the "Houston Chronicle" and on various websites, drawing on her extensive experience in corporate management and property/casualty insurance.

Related Articles

How to create a business plan & where should the executive summary be located, how to write a business plan for an existing business, how to write a farm business plan, how to write a day spa business plan, how to write a business plan for a restaurant or food business, how to create a food service business plan, how to write a clothing boutique business plan, how to create your own shoe line's business plan, how to prepare a business plan for a window cleaning business, most popular.

- 1 How to Create a Business Plan & Where Should the Executive Summary Be Located?

- 2 How to Write a Business Plan for an Existing Business

- 3 How to Write a Farm Business Plan

- 4 How to Write a Day Spa Business Plan

- Running a business

Business acquisitions: how to take over another company

How to take over another company, the pros and cons, the risks, and how to choose an acquisition target.

A company acquisition can be a fast track to business growth .

Like merging with another business, it can give you access to new customers, distribution channels, skills and knowledge, while putting more resources at your disposal (e.g. personnel, additional branches, intellectual property and so forth).

A business acquisition may also help you to develop your own products or services.

But with such a great opportunity does come risk. There’s no magic formula to guarantee a smooth ride, but with a considered approach you can keep the risks manageable.

Here are the key steps to start you on that road.

What is a company acquisition / takeover?

A company acquisition or takeover is where one company purchases most or all of the shares of another company, to become the majority shareholder or outright owner.

As majority shareholder, you can make decisions without the consent of other shareholders, so effectively run the business.

You may choose to absorb the acquired business into your own company and put your own branding in place, or keep its current identity and make it a sub-brand of your own.

Keeping its original identity may be preferable if good brand recognition and customer goodwill.are among the target company's most important assets.

I’m thinking about an acquisition. Where should I start?

The first thing you need is a specific strategic rationale.

There should be a clear reason for making the acquisition of that particular company at that particular time.

If the reason for a merger or acquisition is vague, like ‘to grow the business’, it’s worth giving it more thought.

Your specific reason and objectives will ultimately be the driving force of all decisions around the acquisition, and will allow you to measure your success later, so be as clear on this as possible.

How to find a target company for takeover

The best way to choose a business for acquisition is to pick the one that complements your own most effectively.

A badly performing business may represent good value – if you have what it takes to turn it around. Lots of large firms do this, but it’s a margins game.

Before attempting it, you need to be absolutely sure of your sums (speak to an accountant about those) and your capabilities.

Put simply, it is a question of looking at what your own business currently lacks but could benefit from - whether that is additional capacity, better systems and processes, supply chains, technologies, personnel, reputation, branding, customer goodwill or anything else.

You then have to calculate what these assets might be worth to your company, and whether this exceeds (in the long term) the costs of any takeover.

Reasons to make an acquisition

Here are some of the main reasons why you might want to take over another business. In most cases, more than one will apply.

Your reasons should directly complement your current business goals – see ‘Your acquisition strategy’ below.

1. You believe you can improve the performance of the target company

A badly performing business may represent good value – if you have what it takes to turn it around. Lots of large firms do this, but it’s a margins game. Before attempting it, you need to be absolutely sure of your sums (speak to an accountant about those) and your capabilities.

2. You want to remove excess capacity from the industry

If you’re in a mature industry in which supply is outstripping demand, acquiring a competitor gives you the opportunity to streamline the supply more effectively.

3. You can help the target company to penetrate the market

A smaller target company may be struggling to penetrate the market. What they may be missing is your negotiating power – while you in turn can benefit from the particular qualities they have. Together, you stand a much better chance of securing the big, lucrative contracts.

4. You want to acquire new skills or technologies

By acquiring a company with the skills or technologies that your business doesn’t have, you can expand or enhance your own product offering. It can be far quicker, cheaper and more effective to acquire these skills and technologies than to develop them independently.

5. You see the opportunity to scale a scalable business

This is most applicable to smaller acquisitions, because many large companies are using all of their resources. If your business is unable to improve margins by scaling down , it can be a smart move to acquire a smaller business and increase the team or equipment to reduce operational costs.

6. You want to pick a winner

If you can spot a young business with a huge amount of potential, it can result in a really lucrative acquisition. Some of the most successful acquisitions involve a large company acquiring a startup business and helping it grow and develop. This can be a winning strategy, as long as the target company can keep the magic alive.

In choosing your acquisition target(s), you will also need to consider your acquisition strategy.

Your acquisition strategy

Your acquisition strategy is, essentially, the sum of all your business reasons for seeking this acquisition.

You will need to be clear in your own business plan what the long-term goals of your company are, as this will help you choose the right strategy – and the right target for takeover.

For example, you can spot a young business with a huge amount of potential, it can result in a really lucrative acquisition.

Some of the most successful acquisitions involve a large company acquiring a startup business and helping it grow and develop. This can be a winning strategy, as long as the target company can keep the magic alive.

The eleven basic acquisition strategies:

Sales growth: By acquiring other businesses, you can grow at a much faster rate than you could achieve through organic growth.

Regional growth: If you want to expand your business into new locations (or other countries), you can face many obstacles such as setting up new offices, warehouses, supply chains and staffing. Buying a similar business in your desired location can be a way to have ready-made infrastructure in place.

Industry roll-up: A roll-up is where you buy lots of small, similar businesses and ‘roll them up’ into one company. When it works, this has the effect of combining their market share and thus dominating the market. In practice, however, roll-ups are tricky to get right, as all the different businesses need to be aligned, harmonised and rebranded.

Diversification: If your company revenue comes mostly from one narrow source or market, you may want to branch out into other revenue streams to create greater security and risk tolerance. You could do this organically, but a faster way is to acquire businesses that are already thriving in these other niches.

Full service: Similar to diversification, this strategy involves expanding your services or products to offer a broader range. The way it differs from diversification is that the new products or services are inherently related to your core offering. For example, if your business is hairdressing, then acquiring a beauty salon would be a move towards a full service offering.

Adjacent industry: Another variant on diversification, this is where you buy a business in another industry that is adjacent to your own. Another example of an adjacent industry might be Nike entering the mountaineering market. Initially selling climbing footwear, it then expanded into other climbing equipment.

Vertical integration: Vertical integration is where you buy up the businesses in your own supply chain, so as to have complete control over every stage. This can produce greater efficiencies or synergies (see point 9) and may also be good from a branding point of view. For example, if you produce health foods or luxury goods, it is an outstanding selling point to be able to boast that you oversee every stage of their production.

Product supplementation: This is where you identify a business that offers products or services that would complement or supplement your own. You can thus quickly fill the gap in your own product line by taking over the target company.

Synergy: A popular buzzword, synergy is apparently short for ‘synchronised energy’. In English, this can be summed up as simply, ‘Find the most efficient ways of working together.’ So for instance, if one company has an outstanding supply chain and another has exceptional distribution (but each lacks what the other has), combining the two will create good synergy. The result should be greater profitability than either company could have achieved on their own.

Low-cost: One way to dominate a market is, quite simply, to be the cheapest option. But in order to make a profit while selling your products at the lowest cost, you must achieve high sales volume (known as the ‘pile ‘em high, sell ‘em cheap’ approach). Attaining this position quickly usually requires making multiple acquisitions of businesses that already have a good market share, and then working to achieve synergies (see point 9) between them.

Market window: Let’s suppose you see an opportunity to launch a brand new product or service, to catch a market trend and perhaps lead it. The problem is, you can’t mobilise your own company to deliver it fast enough to optimise the opportunity – perhaps because you don’t have the expertise, resources or market positioning. In this scenario, you might target a company that is in a more advantageous position, and achieve your vision through the acquisition.

How to analyse a company for acquisition

Be sure to do your homework on a target company before making your initial approach.

Investigate the business’s finances: You’ll want financial statements for the past five years, preferably audited. See if they’ve been growing, and also explore their cash flows and working capital .

Check out their assets: Find out what assets belong to the company itself, e.g. buildings, plant, equipment, vehicles , land, and also any brands and goodwill. Make sure you know exactly what you’re getting.

Look at their liabilities: Liabilities include not just debts but also taxes, the salaries of employees, contractual obligations and any ongoing legal proceedings. Also find out if you need any special permits or insurance.

Ask: how do we benefit?: Finally, identify all the areas that will complement your existing business, including areas of synergy (i.e. ways that it will make both businesses more efficient).

How should I go about it?

So you’ve decided to make an acquisition. Do you start by looking around at the companies that are available?

Wrong! That’s a reactive approach. Doing it that way would mean you only find a limited range of opportunities that might not be the best fit for your long-term business goals.

Broadly speaking, the correct approach looks more like this:

Pick a team. Within your company you should have a working group with representatives from each area of the business. They need to be able to work together and communicate clearly from the off.

Make a plan. Why are you doing this? What are your specific objectives? How will you finance the deal? Consider the list of goals above and make sure your plan is designed to meet at least one.

Name a price. Value is a tricky thing, and it’s hard to nail down what the right acquisition is worth to your company. You need to understand the financials inside out, which is when a good accountant is essential. A solicitor will help make sure your contracts are watertight, and you’re also need to think ahead about how you’ll raise funds if you need them.

Approach. Once you've got your plan and your optimal price tag for your acquisition, it's time to identify potential targets and make your approach. A phone call is the best way to begin, as it comes across as more personal, committed and bold, and so helps to build trust from the outset.

Obtaining funding for business acquisitions

Acquisitions are expensive, so it is likely you will need additional funding to achieve one (often known as 'corporate finance').

Some accountants are corporate finance specialists and can help you obtain the funding you need.

You will need a strong new business pitch to demonstrate how your company will thrive post-acquisition and repay the investment.

Ultimately, the golden rule of acquisitions is ‘Be 100 per cent sure of why you are doing this’.

With your specific goal fixed in your mind, you should be able to press on through each challenge even when things aren’t going your way.

Now find out about mergers and how they’re different from acquisitions.

If you found this article helpful, make sure to have a look at our article all about how to buy out a business partner , too.

:quality(20))

The six types of successful acquisitions

There is no magic formula to make acquisitions successful. Like any other business process, they are not inherently good or bad, just as marketing and R&D aren’t. Each deal must have its own strategic logic. In our experience, acquirers in the most successful deals have specific, well-articulated value creation ideas going in. For less successful deals, the strategic rationales—such as pursuing international scale, filling portfolio gaps, or building a third leg of the portfolio—tend to be vague.

Stay current on your favorite topics

Empirical analysis of specific acquisition strategies offers limited insight, largely because of the wide variety of types and sizes of acquisitions and the lack of an objective way to classify them by strategy. What’s more, the stated strategy may not even be the real one: companies typically talk up all kinds of strategic benefits from acquisitions that are really entirely about cost cutting. In the absence of empirical research, our suggestions for strategies that create value reflect our acquisitions work with companies.

In our experience, the strategic rationale for an acquisition that creates value typically conforms to at least one of the following six archetypes: improving the performance of the target company, removing excess capacity from an industry, creating market access for products, acquiring skills or technologies more quickly or at lower cost than they could be built in-house, exploiting a business’s industry-specific scalability, and picking winners early and helping them develop their businesses.

Six archetypes

An acquisition’s strategic rationale should be a specific articulation of one of these archetypes, not a vague concept like growth or strategic positioning, which may be important but must be translated into something more tangible. Furthermore, even if your acquisition is based on one of the archetypes below, it won’t create value if you overpay.

Improve the target company’s performance

Improving the performance of the target company is one of the most common value-creating acquisition strategies. Put simply, you buy a company and radically reduce costs to improve margins and cash flows. In some cases, the acquirer may also take steps to accelerate revenue growth.

Pursuing this strategy is what the best private-equity firms do. Among successful private-equity acquisitions in which a target company was bought, improved, and sold, with no additional acquisitions along the way, operating-profit margins increased by an average of about 2.5 percentage points more than those at peer companies during the same period. 1 1. Viral V. Acharya, Moritz Hahn, and Conor Kehoe, “Corporate governance and value creation: Evidence from private equity,” Social Science Research Network working paper, February 19, 2010. This means that many of the transactions increased operating-profit margins even more.

Keep in mind that it is easier to improve the performance of a company with low margins and low returns on invested capital (ROIC) than that of a high-margin, high-ROIC company. Consider a target company with a 6 percent operating-profit margin. Reducing costs by three percentage points, to 91 percent of revenues, from 94 percent, increases the margin to 9 percent and could lead to a 50 percent increase in the company’s value. In contrast, if the operating-profit margin of a company is 30 percent, increasing its value by 50 percent requires increasing the margin to 45 percent. Costs would need to decline from 70 percent of revenues to 55 percent, a 21 percent reduction in the cost base. That might not be reasonable to expect.

Consolidate to remove excess capacity from industry

As industries mature, they typically develop excess capacity. In chemicals, for example, companies are constantly looking for ways to get more production out of their plants, even as new competitors, such as Saudi Arabia in petrochemicals, continue to enter the industry.

The combination of higher production from existing capacity and new capacity from recent entrants often generates more supply than demand. It is in no individual competitor’s interest to shut a plant, however. Companies often find it easier to shut plants across the larger combined entity resulting from an acquisition than to shut their least productive plants without one and end up with a smaller company.

Reducing excess in an industry can also extend to less tangible forms of capacity. Consolidation in the pharmaceutical industry, for example, has significantly reduced the capacity of the sales force as the product portfolios of merged companies change and they rethink how to interact with doctors. Pharmaceutical companies have also significantly reduced their R&D capacity as they found more productive ways to conduct research and pruned their portfolios of development projects.

While there is substantial value to be created from removing excess capacity, as in most M&A activity the bulk of the value often accrues to the seller’s shareholders, not the buyer’s. In addition, all the other competitors in the industry may benefit from the capacity reduction without having to take any action of their own (the free-rider problem).

Would you like to learn more about our Strategy & Corporate Finance Practice ?

Accelerate market access for the target’s (or buyer’s) products.

Often, relatively small companies with innovative products have difficulty reaching the entire potential market for their products. Small pharmaceutical companies, for example, typically lack the large sales forces required to cultivate relationships with the many doctors they need to promote their products. Bigger pharmaceutical companies sometimes purchase these smaller companies and use their own large-scale sales forces to accelerate the sales of the smaller companies’ products.

IBM, for instance, has pursued this strategy in its software business. Between 2010 and 2013, IBM acquired 43 companies for an average of $350 million each. By pushing the products of these companies through IBM’s global sales force, IBM estimated that it was able to substantially accelerate the acquired companies’ revenues, sometimes by more than 40 percent in the first two years after each acquisition. 2 2. IBM investor briefing 2014, ibm.com.

In some cases, the target can also help accelerate the acquirer’s revenue growth. In Procter & Gamble’s acquisition of Gillette, the combined company benefited because P&G had stronger sales in some emerging markets, Gillette in others. Working together, they introduced their products into new markets much more quickly.

Get skills or technologies faster or at lower cost than they can be built

Many technology-based companies buy other companies that have the technologies they need to enhance their own products. They do this because they can acquire the technology more quickly than developing it themselves, avoid royalty payments on patented technologies, and keep the technology away from competitors.

For example, Apple bought Siri (the automated personal assistant) in 2010 to enhance its iPhones. More recently, in 2014, Apple purchased Novauris Technologies, a speech-recognition-technology company, to further enhance Siri’s capabilities. In 2014, Apple also purchased Beats Electronics, which had recently launched a music-streaming service. One reason for the acquisition was to quickly offer its customers a music-streaming service, as the market was moving away from Apple’s iTunes business model of purchasing and downloading music.

Cisco Systems, the network product and services company (with $49 billion in revenue in 2013), used acquisitions of key technologies to assemble a broad line of network-solution products during the frenzied Internet growth period. From 1993 to 2001, Cisco acquired 71 companies, at an average price of approximately $350 million. Cisco’s sales increased from $650 million in 1993 to $22 billion in 2001, with nearly 40 percent of its 2001 revenue coming directly from these acquisitions. By 2009, Cisco had more than $36 billion in revenues and a market cap of approximately $150 billion.

Exploit a business’s industry-specific scalability

Economies of scale are often cited as a key source of value creation in M&A. While they can be, you have to be very careful in justifying an acquisition by economies of scale, especially for large acquisitions. That’s because large companies are often already operating at scale. If two large companies are already operating that way, combining them will not likely lead to lower unit costs. Take United Parcel Service and FedEx, as a hypothetical example. They already have some of the largest airline fleets in the world and operate them very efficiently. If they were to combine, it’s unlikely that there would be substantial savings in their flight operations.

Economies of scale can be important sources of value in acquisitions when the unit of incremental capacity is large or when a larger company buys a subscale company. For example, the cost to develop a new car platform is enormous, so auto companies try to minimize the number of platforms they need. The combination of Volkswagen, Audi, and Porsche allows all three companies to share some platforms. For example, the VW Toureg, Audi Q7, and Porsche Cayenne are all based on the same underlying platform.

Some economies of scale are found in purchasing, especially when there are a small number of buyers in a market with differentiated products. An example is the market for television programming in the United States. Only a handful of cable companies, satellite-television companies, and telephone companies purchase all the television programming. As a result, the largest purchasers have substantial bargaining power and can achieve the lowest prices.

While economies of scale can be a significant source of acquisition value creation, rarely are generic economies of scale, like back-office savings, significant enough to justify an acquisition. Economies of scale must be unique to be large enough to justify an acquisition.

Pick winners early and help them develop their businesses

The final winning strategy involves making acquisitions early in the life cycle of a new industry or product line, long before most others recognize that it will grow significantly. Johnson & Johnson pursued this strategy in its early acquisitions of medical-device businesses. J&J purchased orthopedic-device manufacturer DePuy in 1998, when DePuy had $900 million of revenues. By 2010, DePuy’s revenues had grown to $5.6 billion, an annual growth rate of about 17 percent. (In 2011, J&J purchased Synthes, another orthopedic-device manufacturer, so more recent revenue numbers are not comparable.) This acquisition strategy requires a disciplined approach by management in three dimensions. First, you must be willing to make investments early, long before your competitors and the market see the industry’s or company’s potential. Second, you need to make multiple bets and to expect that some will fail. Third, you need the skills and patience to nurture the acquired businesses.

Harder strategies

Beyond the six main acquisition strategies we’ve explored, a handful of others can create value, though in our experience they do so relatively rarely.

Roll-up strategy

Roll-up strategies consolidate highly fragmented markets where the current competitors are too small to achieve scale economies. Beginning in the 1960s, Service Corporation International, for instance, grew from a single funeral home in Houston to more than 1,400 funeral homes and cemeteries in 2008. Similarly, Clear Channel Communications rolled up the US market for radio stations, eventually owning more than 900.

This strategy works when businesses as a group can realize substantial cost savings or achieve higher revenues than individual businesses can. Service Corporation’s funeral homes in a given city can share vehicles, purchasing, and back-office operations, for example. They can also coordinate advertising across a city to reduce costs and raise revenues.

Size is not what creates a successful roll-up; what matters is the right kind of size. For Service Corporation, multiple locations in individual cities have been more important than many branches spread over many cities, because the cost savings (such as sharing vehicles) can be realized only if the branches are near one another. Roll-up strategies are hard to disguise, so they invite copycats. As others tried to imitate Service Corporation’s strategy, prices for some funeral homes were eventually bid up to levels that made additional acquisitions uneconomic.

Consolidate to improve competitive behavior

Many executives in highly competitive industries hope consolidation will lead competitors to focus less on price competition, thereby improving the ROIC of the industry. The evidence shows, however, that unless it consolidates to just three or four companies and can keep out new entrants, pricing behavior doesn’t change: smaller businesses or new entrants often have an incentive to gain share through lower prices. So in an industry with, say, ten companies, lots of deals must be done before the basis of competition changes.

Enter into a transformational merger

A commonly mentioned reason for an acquisition or merger is the desire to transform one or both companies. Transformational mergers are rare, however, because the circumstances have to be just right, and the management team needs to execute the strategy well.

Transformational mergers can best be described by example. One of the world’s leading pharmaceutical companies, Switzerland’s Novartis, was formed in 1996 by the $30 billion merger of Ciba-Geigy and Sandoz. But this merger was much more than a simple combination of businesses: under the leadership of the new CEO, Daniel Vasella, Ciba-Geigy and Sandoz were transformed into an entirely new company. Using the merger as a catalyst for change, Vasella and his management team not only captured $1.4 billion in cost synergies but also redefined the company’s mission, strategy, portfolio, and organization, as well as all key processes, from research to sales. In every area, there was no automatic choice for either the Ciba or the Sandoz way of doing things; instead, the organization made a systematic effort to find the best way.

Novartis shifted its strategic focus to innovation in its life sciences business (pharmaceuticals, nutrition, and products for agriculture) and spun off the $7 billion Ciba Specialty Chemicals business in 1997. Organizational changes included structuring R&D worldwide by therapeutic rather than geographic area, enabling Novartis to build a world-leading oncology franchise.

Across all departments and management layers, Novartis created a strong performance-oriented culture supported by shifting from a seniority- to a performance-based compensation system for managers.

The final way to create value from an acquisition is to buy cheap—in other words, at a price below a company’s intrinsic value. In our experience, however, such opportunities are rare and relatively small. Nonetheless, although market values revert to intrinsic values over longer periods, there can be brief moments when the two fall out of alignment. Markets, for example, sometimes overreact to negative news, such as a criminal investigation of an executive or the failure of a single product in a portfolio with many strong ones.

Such moments are less rare in cyclical industries, where assets are often undervalued at the bottom of a cycle. Comparing actual market valuations with intrinsic values based on a “perfect foresight” model, we found that companies in cyclical industries could more than double their shareholder returns (relative to actual returns) if they acquired assets at the bottom of a cycle and sold at the top. 3 3. Marco de Heer and Timothy Koller, “ Valuing cyclical companies ,” McKinsey Quarterly , May 2000.

While markets do throw up occasional opportunities for companies to buy targets at levels below their intrinsic value, we haven’t seen many cases. To gain control of a target, acquirers must pay its shareholders a premium over the current market value. Although premiums can vary widely, the average ones for corporate control have been fairly stable: almost 30 percent of the preannouncement price of the target’s equity. For targets pursued by multiple acquirers, the premium rises dramatically, creating the so-called winner’s curse. If several companies evaluate a given target and all identify roughly the same potential synergies, the pursuer that overestimates them most will offer the highest price. Since it is based on an overestimation of the value to be created, the winner pays too much—and is ultimately a loser. 4 4. K. Rock, “Why new issues are underpriced,” Journal of Financial Economics , 1986, Volume 15, pp. 187–212. A related problem is hubris, or the tendency of the acquirer’s management to overstate its ability to capture performance improvements from the acquisition. 5 5. R. Roll, “The hubris hypothesis of corporate takeovers,” Journal of Business , 1986, Volume 59, Number 2, pp. 197–216.

Since market values can sometimes deviate from intrinsic ones, management must also beware the possibility that markets may be overvaluing a potential acquisition. Consider the stock market bubble during the late 1990s. Companies that merged with or acquired technology, media, or telecommunications businesses saw their share prices plummet when the market reverted to earlier levels. The possibility that a company might pay too much when the market is inflated deserves serious consideration, because M&A activity seems to rise following periods of strong market performance. If (and when) prices are artificially high, large improvements are necessary to justify an acquisition, even when the target can be purchased at no premium to market value.

By focusing on the types of acquisition strategies that have created value for acquirers in the past, managers can make it more likely that their acquisitions will create value for their shareholders.

Marc Goedhart is a senior expert in McKinsey’s Amsterdam office, Tim Koller is a partner in the New York office, and David Wessels, an alumnus of the New York office, is an adjunct professor of finance and director of executive education at the University of Pennsylvania’s Wharton School. This article, updated from the original, which was published in 2010, is excerpted from the sixth edition of Valuation: Measuring and Managing the Value of Companies , by Marc Goedhart, Tim Koller, and David Wessels (John Wiley & Sons, 2015).

Explore a career with us

Related articles.

M&A as competitive advantage

How M&A practitioners enable their success

Building the right organization for mergers and acquisitions

How to Prepare a Successful Takeover Bid

Try our Legal AI - it's free while in beta 🚀

Genie's Legal AI can draft , risk-review and negotiate 1000s of legal documents

Note: Links to our free templates are at the bottom of this long guide. Also note: This is not legal advice

Introduction

Takeovers form an important part of the business landscape and have been since centuries ago. To ensure a successful bid, it is vital to understand why they matter and how they can be used to benefit both parties involved. A takeover bid usually involves making an offer to purchase a controlling stake in a company, usually through buying shares. This process is typically initiated by a larger entity, such as an enterprise or an individual investor, with the aim of gaining control of the target company and influencing its operations further down the line.

For larger companies, takeovers present opportunities for growth via consolidation: having greater access to resources and expertise for smaller companies; or providing individual investors with control over certain businesses. While takeover bids may ultimately prove beneficial for both parties involved, there are also potential pitfalls that require careful consideration before proceeding - such as hostile bids from acquirers or changes in operational strategy that don’t benefit the target company.

This is where experienced guidance can be invaluable; Genie AI provides assistance on understanding why takeovers are important and how you can best approach them with your team’s interests at heart. Our free template library has millions of data points which define and shape what constitutes a market-standard takeover bid - enabling anyone to customize high quality legal documents without paying lawyer fees upfront! There are also key legal aspects which need to be taken into account when undertaking these types of deals: ensuring fair pricing when selling off the target company; protecting it from hostile attempts; and managing tax implications accordingly.

In conclusion then, having sound advice on hand during takeover bids can help ensure that all parties involved benefit from them - from negotiations to considerations during execution - so click here ‘read on’ below for our step-by-step guidance and for information on how you can access our template library today!

Definitions

Takeover Bid: An offer made by one company to buy another company. Due Diligence: The process of gathering and analyzing information about a potential investment to make an informed decision. Competitive Advantages: Characteristics of a business that give it an edge over its competitors. Disadvantages: Weaknesses or drawbacks of a business. Incentives: An offer of something that encourages a person or company to do something. Equity Financing: A method of raising capital through the sale of shares in a company. Private Equity: An investment made in a private company, such as a startup. Venture Capital: Money provided by investors to finance a new or growing business. Stakeholders: Individuals or groups with an interest in the success of a company. Due Process: A legal concept that requires fair and consistent treatment of all parties involved in a transaction.

Defining a Target

Identifying the company that you wish to purchase and assessing its potential as an acquisition target., researching the market and industry, understanding the target’s competitive advantages and disadvantages, and developing a comprehensive understanding of the target’s financials., preparing a takeover bid, establishing the terms of the offer, the structure of the bid, and any other relevant details to make the takeover bid attractive., crafting the takeover bid to make it as competitive as possible and addressing any issues the target company may have with the bid., financing the takeover, determining how to finance the takeover, either through traditional methods such as debt or equity financing or through alternative methods such as private equity or venture capital., securing the required financing and ensuring that the financing is in place prior to making the bid., negotiating the deal, engaging in negotiations and communicating with the target company to ensure that the takeover bid is accepted., understanding the target company’s perspective and addressing their concerns and objections., executing the takeover, finalizing the deal and ensuring that all legal and regulatory requirements are met., completing due diligence and any other required legal or financial steps to ensure the deal is legally sound., integrating the acquisition, managing the integration of the acquired company, including the cultural, operational, and financial aspects of the transition., developing a plan to ensure the transition is successful and that the acquired company is integrated smoothly into the parent company., assessing the acquisition, evaluating the success of the acquisition and determining whether the takeover achieved the desired objectives., examining the financial performance of the target company and assessing whether the takeover was profitable., communicating the acquisition, making sure that all stakeholders are informed of the acquisition and that the transition is communicated effectively., keeping employees and customers informed of the acquisition and any changes that may result from it., managing the integration, overseeing the integration process to ensure that it is successful and that the target company is properly integrated into the parent company., monitoring the performance of the acquired company and ensuring that the transition is going smoothly., evaluating the acquisition, analyzing the success of the acquisition and determining whether the takeover achieved the desired objectives., get started.

- Establish a team that will be responsible for researching potential takeover targets, drawing up a list of achievable goals and preparing the takeover bid

- Analyze potential acquisition targets according to the company’s financial health and industry trends

- Research the company’s management, board of directors, shareholders, and other stakeholders that could be impacted by a takeover bid

- Identify potential benefits and risks of a takeover bid

- Establish a timeline and budget for the takeover bid

- Check off this step when you have identified a suitable company and assessed its potential as an acquisition target.

- Identify the company you wish to purchase and assess its potential as an acquisition target

- Research the company’s financials and competitive position in the market

- Analyze the company’s competitive advantages and disadvantages

- Consider the company’s potential for growth and profitability

- Calculate the value of the company

You will know you can check this off your list and move on to the next step when you have completed the research and analysis required to make an informed decision on the company’s potential as an acquisition target.

- Utilize resources such as research reports and industry analysts to gain knowledge of the target company’s market and industry

- Analyze the target company’s competitive advantages and disadvantages and understand how it fits into the industry

- Obtain and review the target company’s financial statements, including balance sheet and income statement

- Consider other relevant documents such as corporate financial ratios

- Analyze the target company’s financial history and trends

You will know that you have completed this step when you have a comprehensive understanding of the target company’s market, industry, competitive advantages and disadvantages, and financials.

• Put together a team of legal and financial advisors to help with the takeover bid. • Analyze the target company’s financials and current operations in order to determine realistic pricing and terms for the bid. • Research the company’s shareholders and board members to gain insight into the target’s ownership structure and voting power. • Draft the bid document, outlining the terms and conditions of the proposed takeover. • Submit the bid to the target company and its shareholders.

You will know that this step is complete when you have submitted the bid document to the target company and its shareholders.

- Research the target company, including their financials, financial health, and any potential liabilities

- Identify potential areas in which the takeover bid can be made attractive to the target company

- Establish the terms and structure of the takeover bid accordingly to make it as attractive as possible

- Share the terms of the offer with the target company and ensure they are agreeable

- Finalize any other details to make the takeover bid attractive, such as payment terms and conditions

- You will know you can move on to the next step when you have established the terms and structure of the takeover bid and finalized any other relevant details to make the bid attractive.

- Determine the target company’s financial and operational needs

- Evaluate the amount of capital required for the takeover

- Analyze and consider the target company’s current structure and operations

- Analyze the target company’s competitive environment

- Analyze the target company’s market share

- Analyze the target company’s profitability

- Analyze the target company’s debt position

- Consider the target company’s current valuation

- Consider the target company’s likely reaction to the bid

- Research any legal or regulatory issues that may affect the bid

- Develop a strategy to address any potential issues

- Finalize the bid and make it as attractive as possible

You’ll know when you can check this off your list when you have successfully crafted the takeover bid to make it as competitive as possible and addressed any potential issues the target company may have with the bid.

- Analyze the target company’s financials to determine the amount of debt and equity financing required to complete the takeover

- Analyze potential sources of debt and equity financing, such as banks, venture capital, or private equity

- Identify potential sources of alternative financing, such as asset-based financing, bridge loans, or mezzanine financing

- Evaluate the pros and cons of each financing option

- Select the financing option that best suits the needs of the takeover

- Negotiate terms and conditions of the financing package

- Secure the financing package for the takeover

- Once the financing package is secured, you are ready to proceed with the takeover bid

- Research the different financing options available, such as traditional debt or equity financing, or alternative methods such as private equity or venture capital.

- Consider the risks associated with each financing option and decide on the best option for the takeover.

- Calculate the costs associated with each financing option and assess the potential returns.

- Speak to financial advisors and legal representatives to ensure that the financing option is suitable for the takeover.

- Once the financing option has been decided, you will be ready to move onto the next step.

- Research financing options and decide which one is the best for your needs

- Contact potential financiers and negotiate terms of financing

- Ensure all documents associated with the financing are legally binding, clear and concise

- Have the finances in place before making the bid

- Track the financing to make sure all funds are received

You will know when you can move on to the next step when all funds are secured and have been received in full.

• Develop a strategy for negotiating the deal that takes into account the interests of all parties involved. • Draft a bid that is attractive to the target company, taking into account its needs and objectives. • Engage in negotiations with the target company to reach an agreement. • Ensure that any agreement reached is legally binding and meets all applicable legal and regulatory requirements. • Finalize the agreement and sign it, ensuring that all the necessary paperwork is complete.

You’ll know that you can check this step off your list and move on to the next step when you’ve signed the agreement and all the necessary paperwork is complete.

- Research the target company and their shareholders to identify potential areas of negotiation

- Utilize advisors to help in the negotiation process

- Make sure to communicate effectively with the target company to ensure that you are on the same page

- Address any potential concerns and objections from the target company to ensure that they are comfortable with the deal

- Take your time to negotiate the deal and make sure that both parties have a good understanding of the terms

- When the negotiation process is complete and both parties are satisfied, you can move on to the next step.

- Research the target company thoroughly to determine their viewpoint and any concerns or objections they may have about the takeover

- Speak directly with key members of the target company’s management to understand their concerns and objectives

- Develop a strategy to address the target company’s concerns and objections

- Present the strategy and negotiate with the target company to get their approval

- Present the agreement to the target company’s board of directors for final approval

Once you have addressed the target company’s concerns and objections, you have completed this step and can move on to the next one, which is executing the takeover.

- Consult with financial advisors and lawyers to review the legal and regulatory requirements for the takeover.

- Issue a formal offer to the target company with a detailed plan for the takeover.

- Monitor the reaction of the target company to assess their acceptance or rejection of the offer.

- Negotiate with the target company to ensure that all parties are satisfied with the terms and conditions of the takeover.

- Prepare the required documents and contracts to ensure the takeover is legally binding.

- Monitor the progress of the takeover and address any potential delays or issues.

When you can check this off your list and move on to the next step:

- Once the target company has accepted the offer and all legal and regulatory requirements have been met.

- Review and sign off on the acquisition agreement and any other legal documents

- File any necessary paperwork with the Securities and Exchange Commission and other regulatory bodies

- Set up any new legal entities, if needed

- Ensure that all legal and regulatory requirements have been met

- Prepare to make any necessary announcements and disclosures

- When you’ve verified that all necessary paperwork and legal requirements have been met, you can check this step off your list and move on to completing due diligence and any other required legal or financial steps to ensure the deal is legally sound.

- Identify any legal or financial risks associated with the takeover bid

- Research the target company to understand their legal, financial, and operational structure

- Examine the target company’s financial statements and other relevant documents

- Consult with financial and legal advisors

- Prepare a due diligence checklist with all the necessary steps to complete the takeover bid

- Obtain the necessary paperwork to complete the takeover bid

- Carry out additional due diligence and legal or financial steps to ensure a sound deal

Once you have completed all of the due diligence and legal/financial steps associated with the takeover bid, you can move on to the next step of integrating the acquisition.

- Establish a cohesive transition plan and timeline for integrating the newly acquired company into the existing business.

- Analyze the cultures of both companies to develop an effective integration strategy that emphasizes the strengths of both organizations.

- Identify areas of overlap and potential conflict between the two companies, such as overlapping services, customer base, and pricing structures.

- Develop and implement systems for effective communication and collaboration between the two organizations.

- Establish clear lines of authority and responsibility between the two companies.

- Create a plan for transitioning employees and transitioning their roles and responsibilities.

- Assess the financial implications of the acquisition and develop a plan to integrate financial and accounting systems.

- Identify legal implications of the acquisition and create a plan to address any legal issues.

Once all of the steps above have been completed, you can check this off your list and move on to the next step.

- Analyze the acquired company’s current practices, culture, and operations

- Identify the risks associated with the acquisition and develop a plan to mitigate them

- Establish a transition team and assign responsibilities to ensure a smooth integration

- Communicate clearly and regularly with the acquired company’s staff and stakeholders

- Establish a timeline for integration and ensure all deadlines are met

- Put in place policies and procedures to ensure the transition is successful

- Monitor the financial impact of the acquisition and ensure all costs are controlled

- Review the operational and financial performance of the acquired company and adjust accordingly

How you’ll know when you can check this off your list and move on to the next step:

- When the integration process is running smoothly and all risks have been addressed and mitigated, you can move on to the next step.

- Analyze the acquired company’s business model and identify areas of potential synergy with the parent company.

- Develop a detailed integration plan that outlines the objectives, timelines, and resources necessary to ensure a successful transition.

- Create a roadmap for the integration process that specifies the steps that need to be taken, how they will be executed, and who will be responsible for each task.

- Establish clear communication channels between the parent company and the acquired company to ensure transparency and collaboration throughout the transition process.

- Develop metrics and KPIs to track the progress of the integration.

When you have a detailed integration plan and roadmap in place, you can check this step off your list and move on to the next step of assessing the acquisition.

- Research the target company to understand its financials, operations, and management

- Analyze the target company’s current financial position and performance

- Project the expected performance of the target company post-acquisition

- Analyze the market conditions and competitive landscape of the target company

- Determine the potential risks and rewards of the acquisition

- Analyze the potential synergies that can be realized through the acquisition

Once these tasks have been completed, you can move on to the next step in the guide: Evaluating the success of the acquisition and determining whether the takeover achieved the desired objectives.

- Analyze the financial performance of the target company post-acquisition and compare it to the performance prior to the takeover.

- Evaluate the strategic objectives of the takeover to determine if they were achieved.

- Analyze the success of the takeover in terms of market share, customer satisfaction, and other key performance indicators.

- Examine the financial performance of the target company post-acquisition and assess whether the merger or acquisition was profitable.

- When you have completed a thorough analysis of the success of the takeover in terms of financial performance, strategic objectives, and other key performance indicators.

- Gather financial documents such as balance sheets, income statements, cash flow statements and other relevant documents to get a better understanding of the target company’s financial performance.