Manual Bank Statement in SAP: A Complete Configuration Guide

- House Bank in SAP: Use T-code FI12 to create it

- BAPI_ACC_DOCUMENT_POST: BAPI to Post Accounting Document in SAP

- BAPI To Show Accounting Entry Simulation: FAGL_SPL_SIM_GL_VIEW

- POSTING_INTERFACE_CLEARING – BAPI to Post Clearing in SAP

In my previous post, I talked about how you can set up a bank key and a house bank ID . Both the bank key and the house bank plays an instrumental role in defining the bank accounts in the system. And, these can help in identifying the bank account and can also be used to make automatic bank payments using the Automatic Payment Program (APP) in t-code F110. Today, I will show you how to do the configuration for the manual bank statement in SAP.

A manual bank statement in SAP is a process to do the bank reconciliations in the system. Any bank transaction that you make in the system should be reconciled with the statement provided by a bank. For example, you made 5 different payments to a vendor and received 10 payments from customers. Once you make or receive a payment, you clear the open invoice in the system. But, the original payments will be done via bank portals. At the end of the month, you can download all your bank transactions using a bank statement from the bank portals in any supported format.

The bank statement consists of all the bank transactions that happened with vendors & customers (for the example that I gave above). This bank statement can be loaded into the SAP system for the reconciliation of open invoices. There are 2 types of bank statements: Manual and Automatic . In this post, I will focus only on MANUAL BANK STATEMENT IN SAP which allows you to upload the bank statement in the system manually and perform the bank reconciliation. Let’s quickly jump to the configuration required to set up the manual bank statement process.

Table of Contents

Step 1: Create and Assign Business Transactions

The first step is to define the business transaction codes that are required to identify the different types of transactions. For instance, you can have a business transaction for a credit memo, debit memo, cheque deposit, cheque withdrawal, etc. For each type of transaction, you can define a business transaction code. You can define these using the SAP Path given below.

After you execute this transaction, you need to define the business transaction codes & assign the posting rules to it. As you might have already guessed, you also need to create the posting rules. For each transaction type, you need to assign a posting rule code. A posting rule helps in identifying the debit/credit transaction for a GL account.

Step 2: Define Account Symbols

After that, click on the second config node to define the rest of the configuration.

In the dialog structure box, you will see four different folders & all of these folders should be configured properly. Firstly, you need to maintain the account symbols for the bank transaction. An account symbol can be created for each bank clearing account. In SAP, usually, 3 bank GL accounts are created for each bank account (Main Bank GL, Incoming GL, Outgoing GL). For each type of bank GL account, you can define a separate account symbol. For example, I have created 3 different account symbols each for the main bank account, incoming bank account, & outgoing bank account.

Step 3: Assign Bank GL Accounts to Account Symbols

After creating the account symbols, you need to assign the bank GL accounts to it. For example, the 4th and 5th digit of my main bank GL account is 02, for the incoming account it’s 90, & for the outgoing account, it’s 91. I have assigned the main bank GL account to MY0, the outgoing bank GL account to MY1, & the Incoming bank GL account to MY2 account symbols.

Step 4: Create Posting Rules Keys

As I explained earlier, you also need to define the posting rules that determine the type of transaction. In this example, I have created two posting rules: one for Cash Deposit (MY02) and the other one for cash withdrawal (MY01).

Step 5: Define Posting Rules

After creating the posting rule keys, you need to define the posting rules. This posting rule will determine which GL account will be debited or credited during the bank reconciliation posting. For example, Posting rule MY01 is for Cash Withdrawal, and to this posting rule, I have assigned posting key 40 (Debit) to MY1 and posting key 50 (Credit) to MY0. Now you know that in Step 3, I assigned MY0 to the main Bank GL account and MY1 to the outgoing bank GL account. Hence, this posting rule with debit the outgoing bank GL account and credit the main bank GL account. Similarly, I have also created a posting rule MY02 for cash deposits where I’m debiting the main bank GL account and crediting the incoming bank GL account.

You can also assign the document type which will be used to post the bank reconciliation accounting entries. For example, I’m using document type ZX here. During the posting of bank reconciliation entries, the system will use the document type ZX for posting.

With these 5 steps, your system is now ready for processing the manual bank statements. I hope you liked it!!! In case of any queries, please feel free to drop a comment and stay tuned for more tutorials coming your way!!!

You May Also Like

AS01 in SAP: How to Create an Asset?

F-44 in SAP: Clear Vendor Open Items

ABAVN in SAP: Asset Retirement by Scrapping

The Ultimate Guide to Bank Statement Processing: Streamline Your Financial Management

- March 29, 2024

- Bank Statements

Checking your bank statements is key to understanding your financial health. They provide precise and current records, giving you a clear picture of your money situation.

However, going through bank statements can be tough without the right techniques, tools, and paperwork.

This blog is here to simplify the process of managing your bank statements. We’ll guide you on how to make it easier and manageable, right from the comfort of your home, so you can better handle your finances.

Elevate your accounting skills using AI with our eBook!

What is Bank Statement Processing?

Bank statement processing involves organizing, extracting, and managing financial details to help preserve, monitor, and use your money more effectively.

This process is widely used in various financial areas, including accounting, lending, tax preparation, auditing, and many others.

To save time and reduce the hassle, many modern financial institutions and businesses now use Optical Character Recognition (OCR) to automate this often time-consuming and tedious task.

Benefits of Automated Bank Statement Processing

Optical Character Recognition (OCR) is a key technology in automating the process of bank statement processing. It extracts information from diverse bank statement formats efficiently.

Many businesses and organizations are adopting automated bank statement processing using OCR software , benefiting from its numerous advantages.

- Scale Operations: As businesses grow, they often have to handle more information across numerous bank statements. Automating this process can significantly simplify the workload for their accounting teams.

- Save Time & Money: Automating bank statement processing saves time in handling each statement and reduces costs associated with personnel needed. Using OCR technology can cut down time spent on physical paperwork by 75%, as per Levvel LLC .

- Improve Accuracy & Data Quality: Most OCR bank statement converters and processing software boast an impressive 99.5% accuracy rate in data extraction . OCR accuracy varies on the format and software being used.

- Prevents Fraudulent Transactions: Automating the processing of bank statements can also enhance the detection of fraudulent transactions in f ake bank statements , making it easier to spot any irregularities.

How to Process Bank Statements Automatically

Processing bank statements automatically requires OCR bank statement converters . These converters can go beyond extracting data but do reconciliation and categorization.

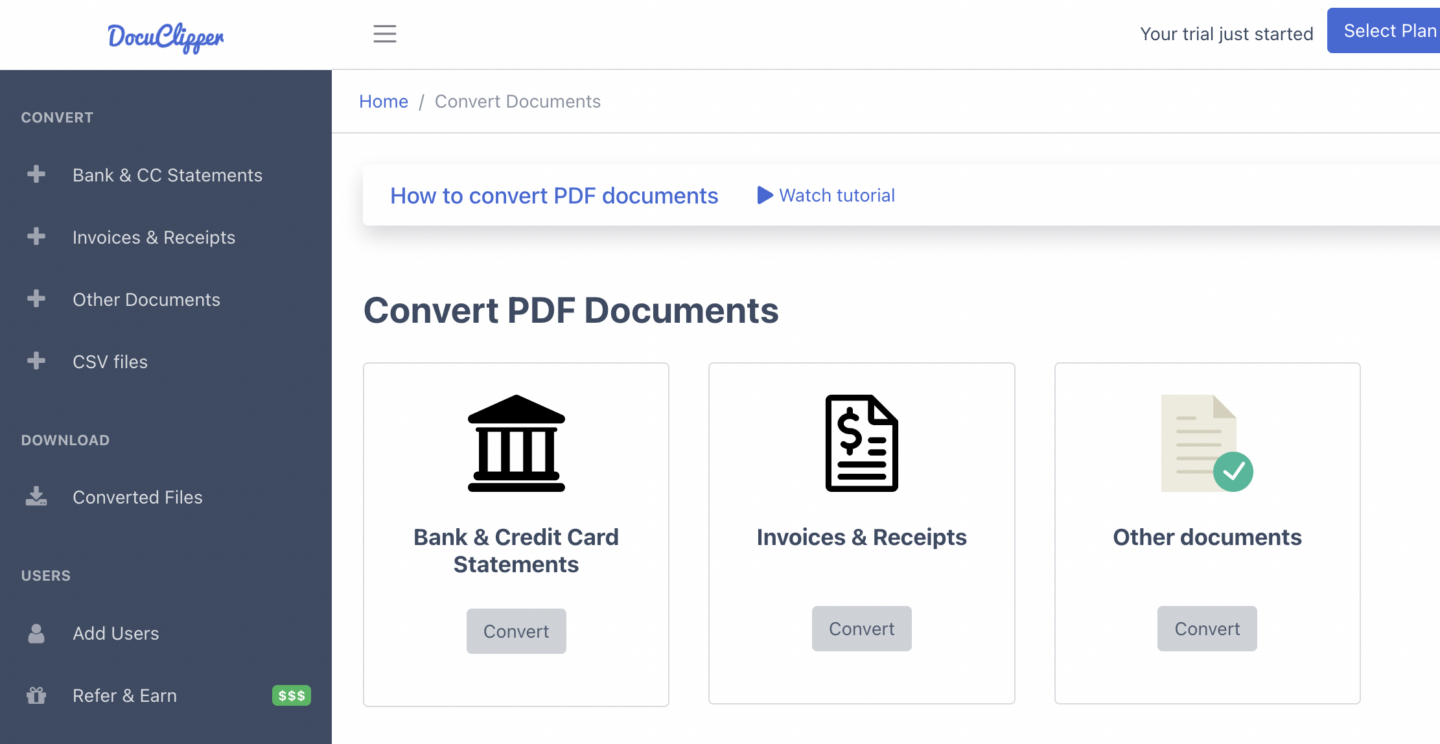

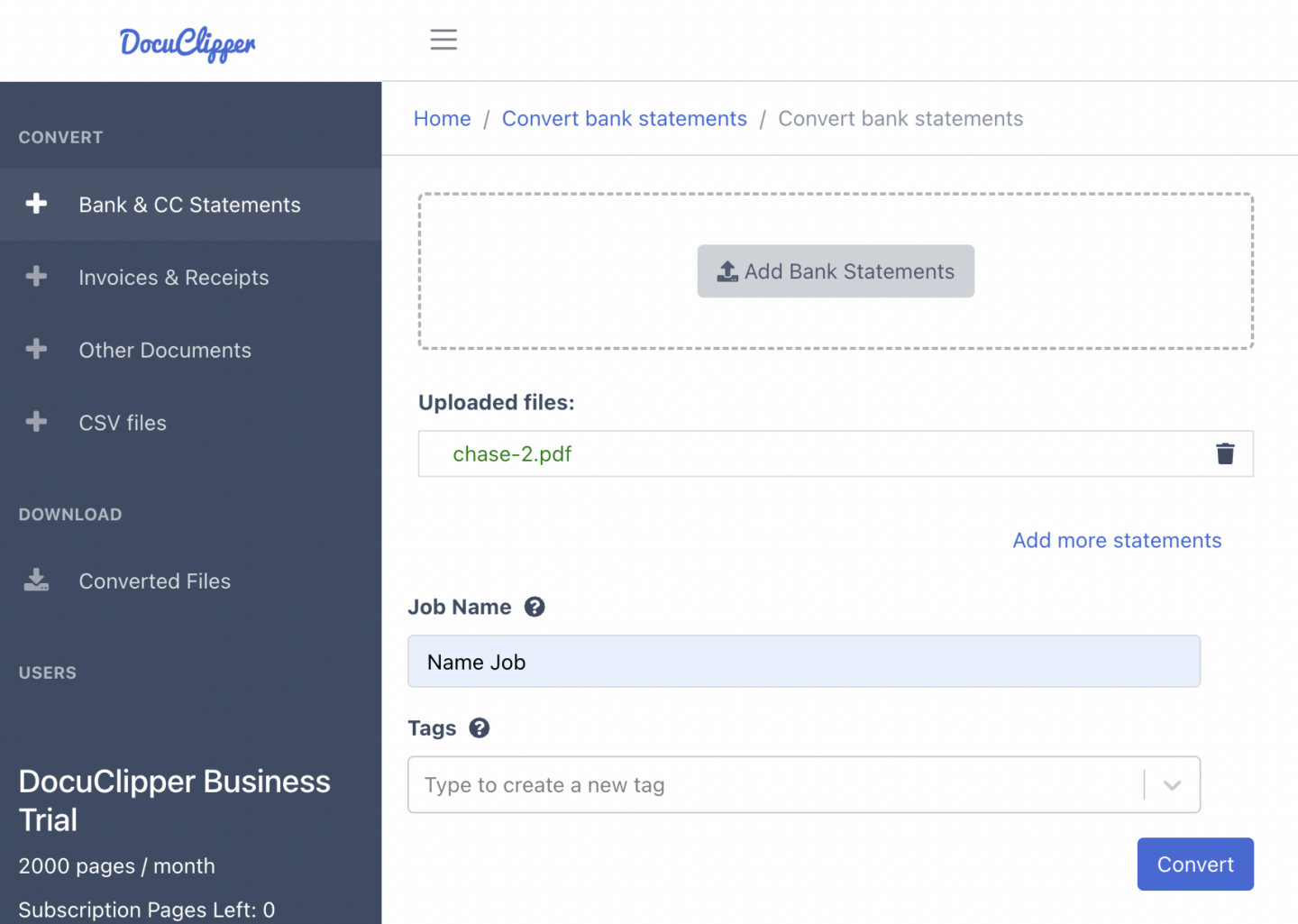

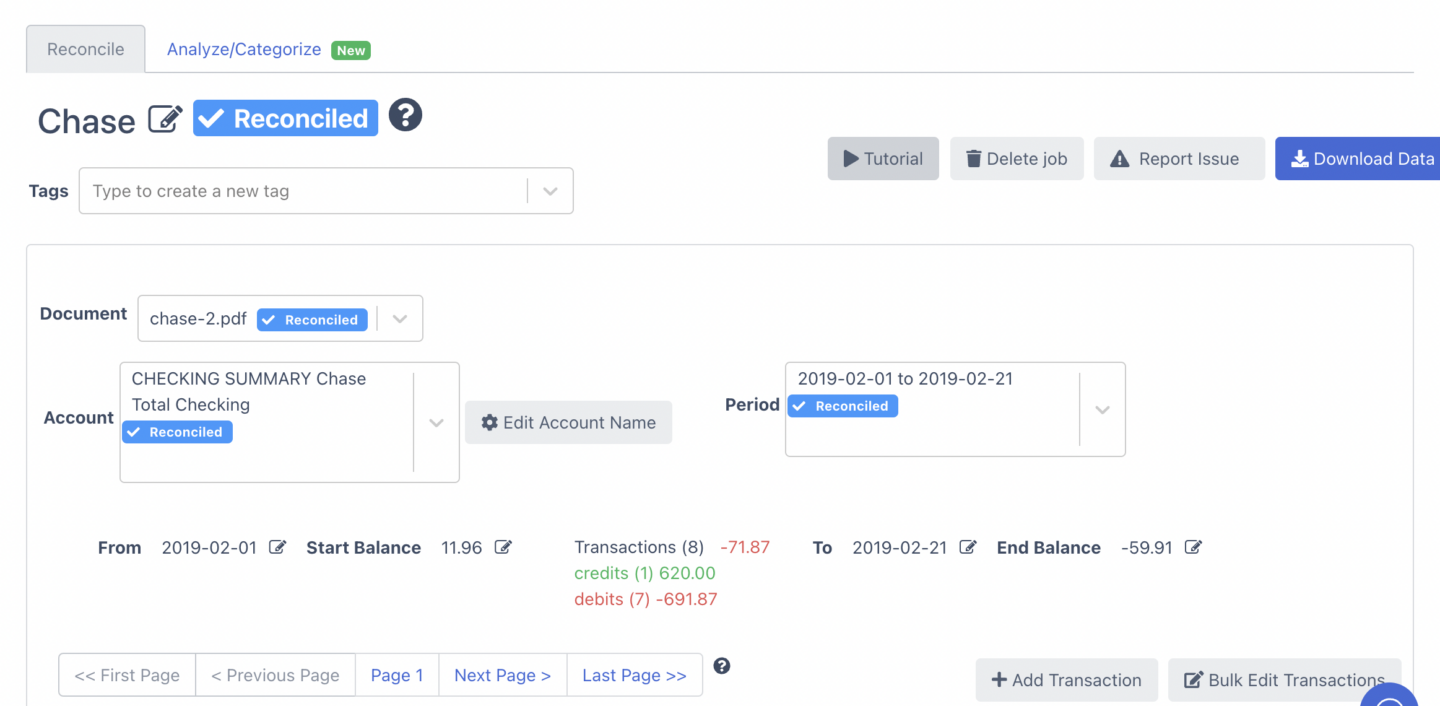

One of the most accurate convert bank statements is through DocuClipper with its features that use a cloud-based system that can easily be integrated with accounting software like Xero, Sage, and Quickbooks.

Here are some ways to process your bank statements in a snap with DocuClipper.

Upload Documents

Begin the process by choosing the bank statements you want to work with. Upload them to the platform, setting the stage for efficient processing.

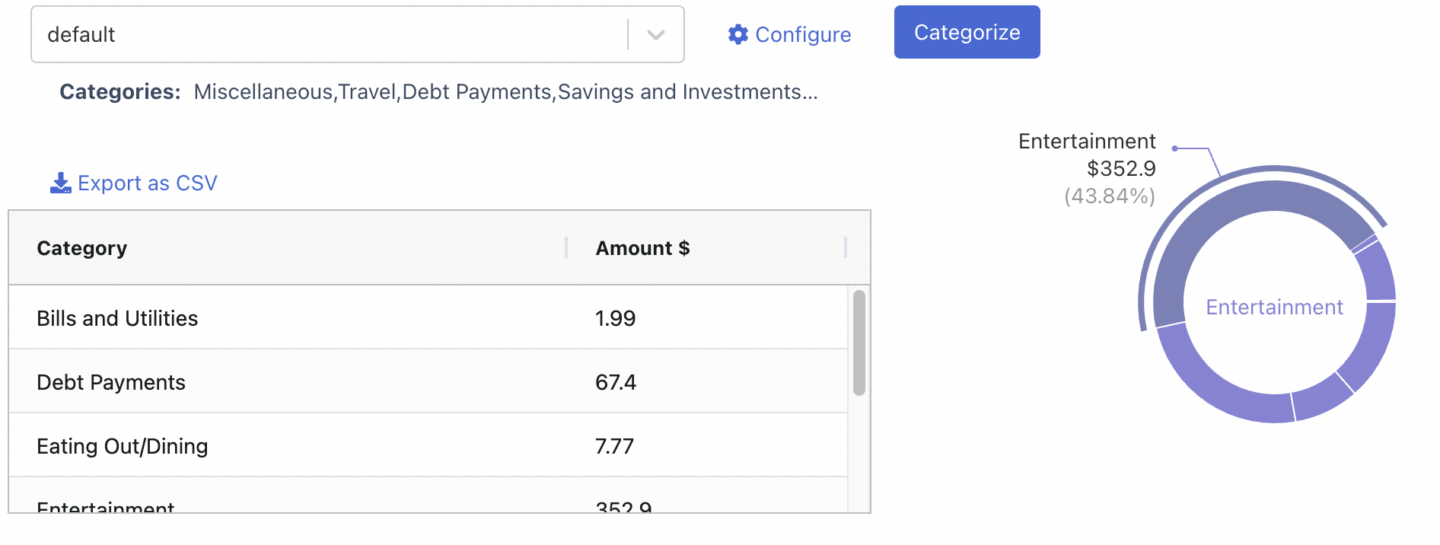

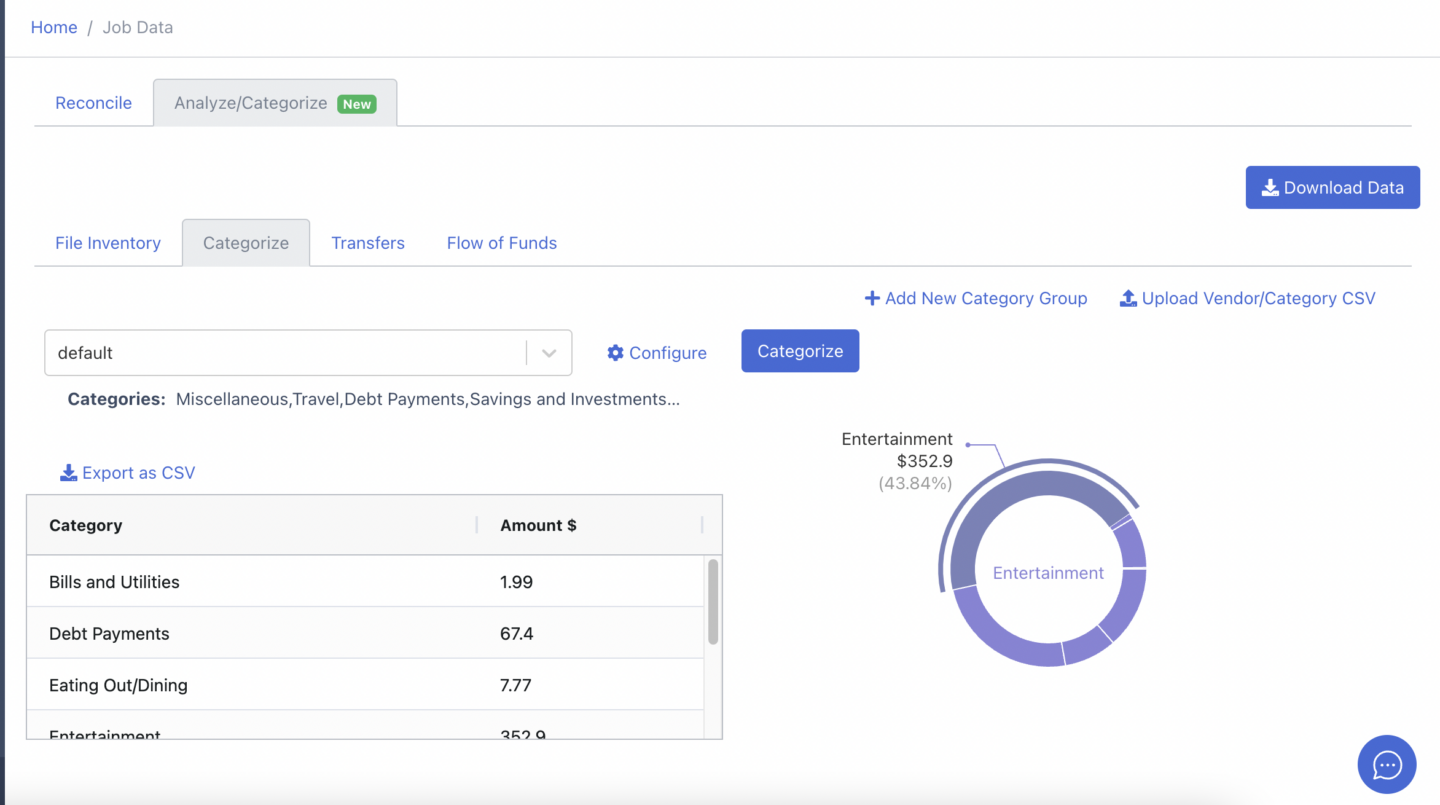

Categorize Transaction

Utilize DocuClipper for precise transaction tracing and categorization. You have the flexibility to select specific fields for a customized approach or employ the default feature for quick categorization.

Carefully review each transaction, adjusting keywords to ensure each transaction is accurately matched and categorized.

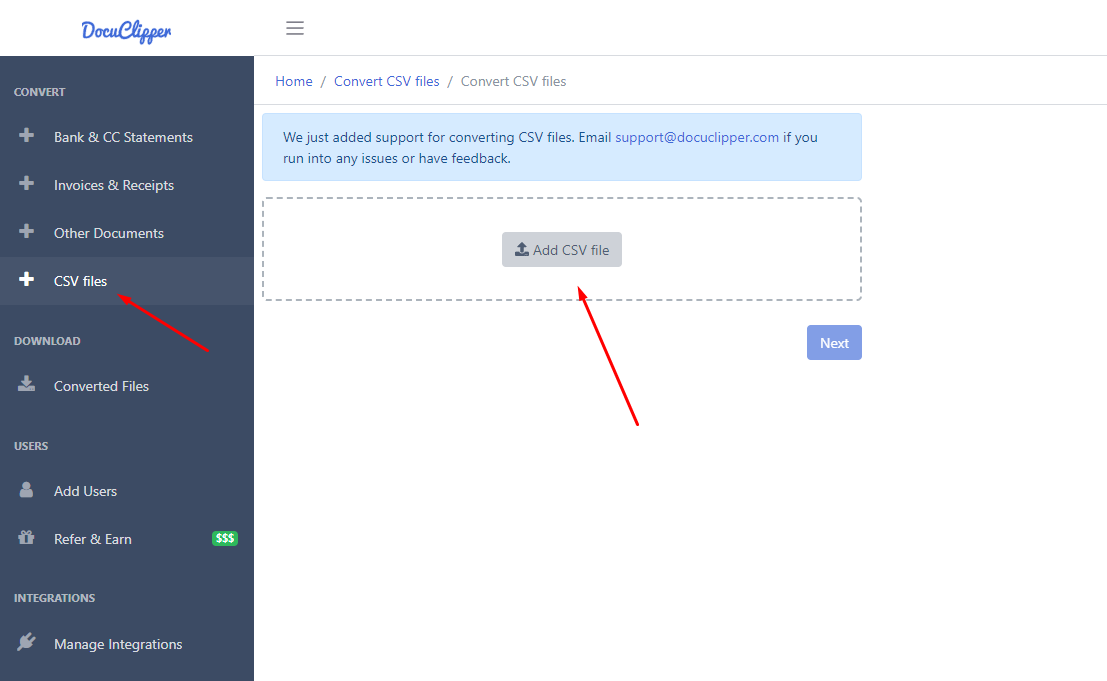

Convert into CSV

For converting your data into a CSV format:

- Navigate to the sidebar menu in DocuClipper and click on “CSV Files.”

- Upload your CSV file by either dragging and dropping it into the designated box or by clicking “Add CSV File” to select and upload your file.

Once uploaded, your CSV file can be processed and converted within the DocuClipper platform.

Review Fields

Carefully check for any missing fields which might impact the accuracy of your results. Pay special attention to unreconciled data, as this could indicate critical missing or incorrectly arranged information.

Map Columns to QBO Fields

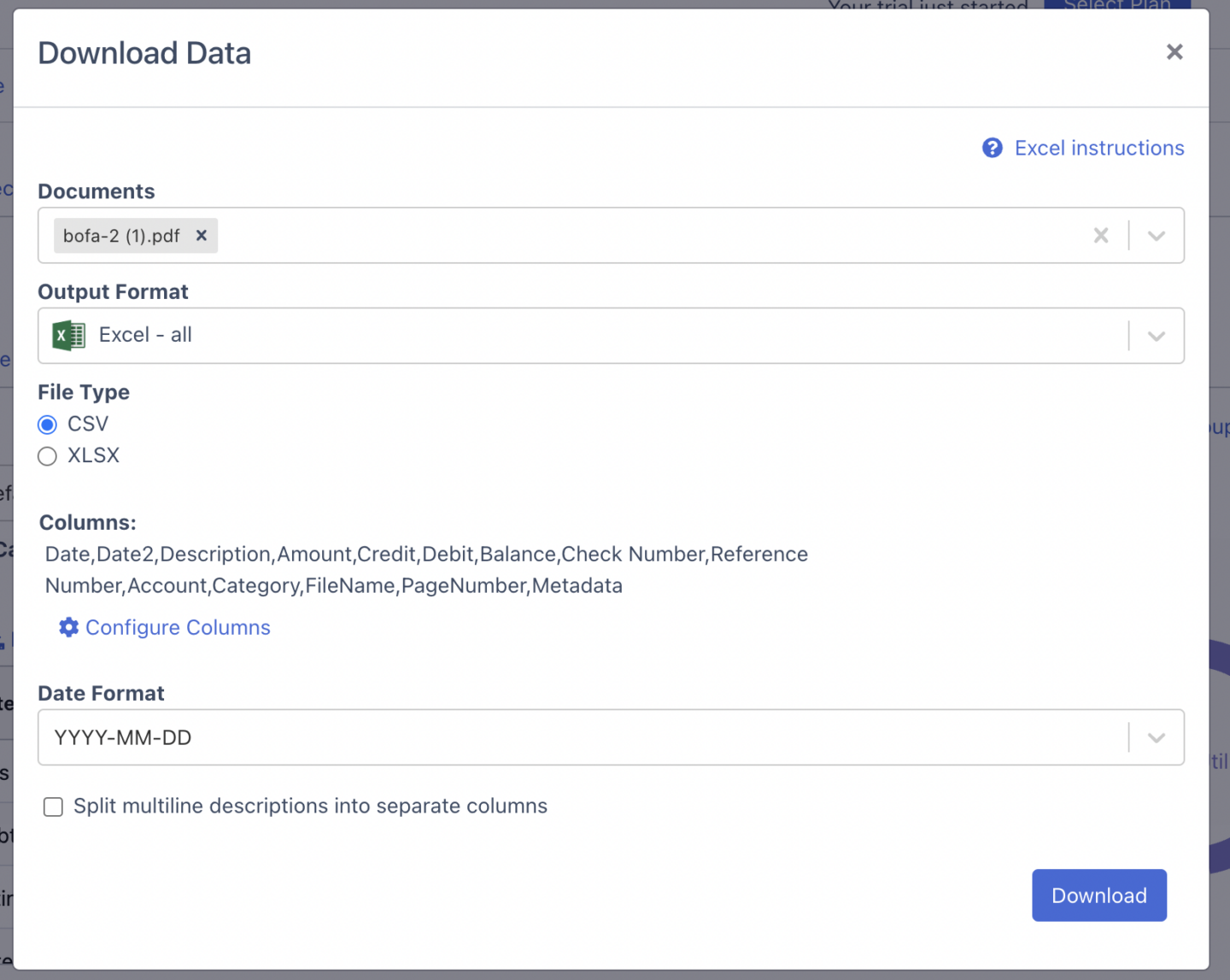

When you’re confident that all transactions in DocuClipper are accurate and complete:

- Click on “Download Data” and opt for the QBO format.

- Select your bank, or if applicable, use Chase Web Connect.

- Determine the account type, choosing either Bank or Credit Card.

- Input the routing and account numbers.

- Choose the currency that applies to your transactions.

- Finally, click “Download QBO Web Connect.”

This action converts your optimized CSV data into a QBO file format , ready for efficient import into QuickBooks Online.

Use Cases of Bank Statement Processing

Automated bank statement processing has been used across many industries to make things easier and to put more control into managing finances.

In this section, we’re going to show you a couple of common use cases using bank statement processing:

Cash Flow Analysis

Processing bank statements is important for understanding cash flow when doing bank statement analysis . In a retail store, it helps identify revenue trends and manage expenses. It also aids in forecasting financial health by providing a clear picture of current financial status.

Tax Preparations & Reporting

Automated bank statement processing is invaluable during tax season. It helps individuals and businesses, like freelancers, accurately report income and expenses. This process ensures compliance with tax regulations and aids in maximizing potential deductions.

Bank Statement Reconciliation

Reconciliation using processed bank statements ensures financial records match bank records. Consider a small café reconciling its daily sales with bank deposits; this helps in identifying discrepancies and maintaining accurate financial records.

Transaction Categorization

Transaction categorization through automated processing simplifies financial management. It helps businesses categorize transactions , seeing their expenses and income, aiding in more effective budgeting and financial planning. This feature is especially useful for companies with diverse transaction types. Check out our guide on:

- How To Automatically Categorize Bank Transactions in Excel: Template Included

- How to Categorize Business Expenses

Assessment of Creditworthiness

Lenders use processed bank statements to assess a borrower’s financial health. For instance, a bank may review a small business’s statements to decide on a loan application, looking for red flags like inconsistent income or high spending. Learn more about OCR for underwriting .

Fraud Detection

Bank statement verifications are effective in detecting fraud. A company might use this technology to spot irregular transactions like altered dates or amounts, which could indicate fraudulent activity.

Alimony and Child Support Calculations

In legal scenarios, processed bank statements are used to assess alimony and child support. A law firm might analyze a client’s financial status to argue for a fair support amount, ensuring all income sources are considered.

Insurance Risk Assessment

Insurance companies utilize bank statement processing for risk assessment. Analyzing spending habits helps in determining lifestyle risks, which can influence policy rates and terms. This approach is essential for customizing insurance plans based on individual risk profiles.

Budget Planning

Effective budget planning is facilitated by automated bank statement processing. It allows organizations to track and manage their financial resources better, leading to more informed decisions in resource allocation and financial strategy development.

Best Practices in Bank Statement Processing

Here are some practices when you process bank statements:

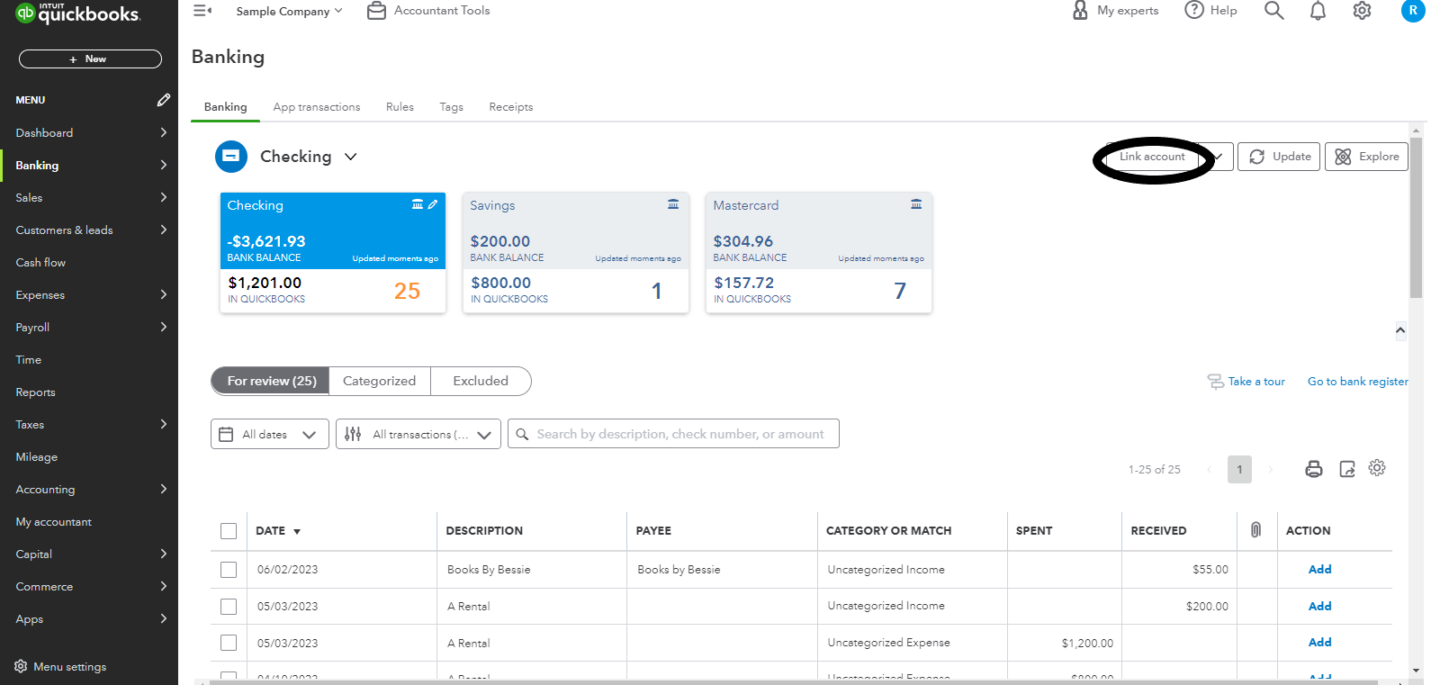

Utilize Bank Feeds

Image Source

Bank feeds offer a convenient shortcut for simplifying bank statement processing. They automatically link your bank statements to your database or accounting software, streamlining the entire process of managing financial transactions.

Use Accurate Bank Statement Converters

Select a top-quality bank statement converter that’s accurate, fast, and fits your budget. Make sure it supports various formats and connects with numerous banks nationwide for greater convenience.

Automate Categorization Rules

Automating transaction categorization can be tricky, but DocuClipper simplifies it. You can set specific rules for how transactions are categorized, making it easier to sort and analyze your data for different financial processes.

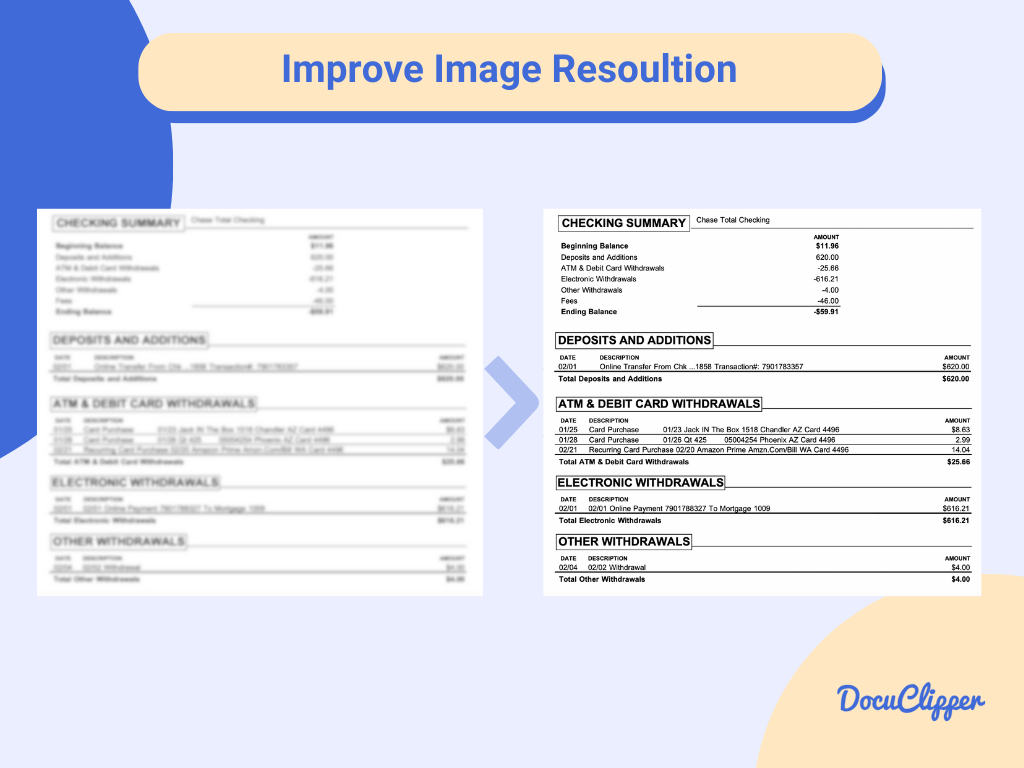

Ensure High-Quality Scans and Resolutions

Although OCR technology has advanced in enhancing image and scanning quality, it remains important to regularly inspect the quality of each image. This step helps to ensure that accuracy is maintained and not impacted by any unexpected variables.

Standardize the Processing Workflow

It’s efficient to follow a workflow that includes screening, sourcing, and checking when processing bank statements. This way, you avoid the time-consuming issue of categorizing bank transactions , only to discover later that the statement is fraudulent.

In conclusion, effective bank statement processing is crucial for financial management. Utilizing advanced OCR technology, modern software simplifies this task. These tools facilitate streamlined analysis, accurate reconciliation, and efficient transaction categorization. Their adoption significantly enhances operational efficiency, reduces costs, and improves data accuracy and fraud detection.

For businesses and individuals alike, using these technological advancements is a strategic step towards more effective and stress-free financial management, ensuring a clearer understanding and better control of their financial health.

Process Bank Statements with DocuClipper

DocuClipper is one of the best bank statement processing software in the market. It utilizes OCR technology to convert PDFs and images of bank statements into editable text. It also has features that can streamline and automate your bank statement analysis with its bank statement reconciliation and transaction categorization feature.

With its top-notch accuracy, your processing bank statements with DocuClipper goes without any worry.

Related Articles:

- How to Get Old Bank Statements from a Closed Account

- 101 Bank Statement Abbreviations & Other Bank Related Jargon

- 10 Best Bank Statement Extraction Software

Share the Content

Get Started with DocuClipper

Transform your business with our bank statement converter. Sign up for free and explore our powerful tools.

- #1 bank statement converter

- Works with any bank

- 99% Accuracy

- Fast conversions in seconds

- Very easy to use

- Highly secure

Get the week's best financial automation content.

DocuClipper Blog

Get weekly financial automation tips straight to your inbox.

We’re committed to your privacy. DocuClipper uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time.

Take This Ebook Before You Leave!

How to Use AI in Accounting Business to improve, simplify, and streamline processes.

In this ebook you’ll learn:

- Benefits of Using AI in Accounting Business

- How Accounting Businesses Already Use AI

- How employees can use AI to work faster, better.

- How to Write Effective ChatGPT Prompts

- SAP Error Message

- Message Class IHC

Unlimited SAP Training

Unlimited Access to all Courses.

Live SAP Access

Get hands-on SAP experience.

Reset of item &1/&2 in the account management system failed

Message type: E = Error

Message class: IHC - IHC Messages

Message number: 228

Message text: Reset of item &1/&2 in the account management system failed

Self-Explanatory Message

SAP has defined this message as ‘self-explanatory’ and therefore, has not provided any further details for it.

All messages in SAP have a message text (shown above). However, the message text is not always useful enough to understand or resolve the issue.

Therefore, most messages in the SAP system provide additional long text with details about what caused the issue, how it can be resolved, what actions to take or configuration changes to make, etc

Unfortunately, this specific error message does not provide such additional information.

What else can you do?

Even though this error message does not provide any useful or additional message details, you can still try to solve the issue by searching on SAP’s support portal. In many cases, there could be an SAP support note that provides further error explanations or even directions for resolving the error.

Related Error Messages

IHC227 Display of change documents failed

IHC226 Reverse terminated due to executable payment order &1/&2/&3 in &4

IHC229 Limit update for payment order &1/&2/&3 failed

IHC230 Bank area assignment in bank statement Customizing is missing

Unlimited Access to all Courses

We offer thousands of SAP courses and real-world SAP sandboxes for individuals and corporate teams.

Support: [email protected]

Sales: [email protected]

+1 (415) 360-6249

- Success Stories

- Become an Affiliate

- Become an Instructor

- Scholarships

- Search Entire Website

- SAP Transaction Codes

- SAP Error Messages

- Authenticate Certificate

Have Questions?

Get In Touch.

Join The Community!

Stay up-to-date with the latest from Michael Management. Plus, be the first to know about new SAP courses, products,and promotions.

Training License Required

/support/notes/service/sap_logo.png)

1958300 - Missing Work Center View Assignment When Postprocessing a Bank Statement Line Item

You are trying to access the payment allocation by clicking on the Required link of a manually added entry in the third step of the guided activity for creating bank statements, however the system raises a warning message, and then you cannot access the required screen.

Reproducing the Issue

- Go to Liquidity Management work center.

- Go to Bank Statements view.

- Create a new bank statement and proceed to the third step, Create and Edit Items .

- Add a new line item according to your needs.

- Click on Required.

The following warning message is displayed: You are not able to open this link due to a missing work center view assignment.

The user needs to have authorization to access the Payment Allocation view, otherwise it cannot be accessed through the Required link in the bank statement.

In order to assign the Payament Allocaton view to the user, follow the steps below:

- Go to Application and User Managament work center.

- Go to Business Users view.

- Find the concerned user and click on Edit -> Access Rights .

- Go to the Work Center and View Assignment tab.

- Click on Find .

- Search for FIN_PAYMENTALLOCATION.

- Click on Locate .

- Flagg the Assigned to User check box for the mentioned view.

- Click on Save .

After the above settings, the user should be able to go ahead with the required postprocessing.

Note that the user needs to logout the system, and login again so that the changes take place.

KBA , SRD-CC , Cross Components , How To

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

IMAGES

VIDEO

COMMENTS

Entry was missing in table: IHC_DB_CL_XBS (IHC Bank Statement: Determine Sender or Clearing Partner) and the issue got resolved. Ask a Question Type your question here...

Message text: Bank area assignment in bank statement Customizing is missing. Self-Explanatory Message. ... IHC231 The assignment of FI acct no. for &1 is missing in bank statement Cust. IHC232 The assignment of the header acct is missing in bank statemnt Customizing. Unlimited SAP Training.

FEB_BSPROC, FEB_BSPROC020, bank statement items, missing, FEBEP, FEBKO , KBA , FI-BL-PT-BA , bank statement , Problem . About this page This is a preview of a SAP Knowledge Base Article. Click more to access the full version on SAP for Me (Login required). Search for additional results. Visit ...

6. Assign bank account to transaction types - Last step involved is assigning bank accounts with transaction types as defined above. This step contains the list of external transaction which are valid for a house bank. Please note that assignment is of Bank account number and Bank Routing Number and not of GL account in this step. Summary ...

One of the newer features of SAP allows simple workaround - configuration of so called default posting rules for miscellaneous transactions. The logic behind this feature is as follows: allocate as many external business transaction codes to posting rules as you can; add two additional entries with fixed key "UNALLOCATED" and assign them ...

Use. You can use the postprocessing of bank statements function (transaction FEBA_BANK_STATEMENT) to process in a timely and straightforward way any bank statements that could not be posted by the system automatically. The single screen transaction for postprocessing bank statement items supports you with information and functions needed in ...

To mark this page as a favorite, you need to log in with your SAP ID. If you do not have an SAP ID, you can create one for free from the login page.

Visit SAP Support Portal's SAP Notes and KBA Search. You find out some tab Assignment/On Account/Acct Assignment/DME is missing in FEB_BSPROC (new FEBAN). Image/data in this KBA is from SAP internal systems, sample data, or demo systems. Any resemblance to real data is purely coincidental.

You make settings for bank areas in Customizing for Bank Customer Accounts (BCA). The important settings are described below: Special Feature: Bank Area and Bank Key. The bank key is particularly significant, since bank keys, along with the account number, are used for the processing of payment transactions. All banks participating in payment ...

For populating the assignment field with value "NISSAN CORP USA", you can use the below steps, 1) BDC Field Value 1 = "NISSAN CORP USA". 2) BDC Field Name 1 = BSEG-ZUONR -. Assignment field. 3) BDC Account Type 1 = 0 (depends on the requirement), The options for step 3 are, 0: First line, posting area 1.

A manual bank statement in SAP is a process to do the bank reconciliations in the system. Any bank transaction that you make in the system should be reconciled with the statement provided by a bank. For example, you made 5 different payments to a vendor and received 10 payments from customers. Once you make or receive a payment, you clear the ...

Here are some practices when you process bank statements: Utilize Bank Feeds. Image Source. Bank feeds offer a convenient shortcut for simplifying bank statement processing. They automatically link your bank statements to your database or accounting software, streamlining the entire process of managing financial transactions.

Reproducing the Issue. Go to Liquidity Management work center. Go to List view. Open Bank Statement Items Details. Run the report with the relevant parameters. You'll see that the bank statement or some of its items is not returned in the report.

IHC230 Bank area assignment in bank statement Customizing is missing. Unlimited SAP Training. $169/month. Unlimited Access to all Courses Live SAP Access. From $119/Month. Get hands-on SAP experience. Back to top. We offer thousands of SAP courses and real-world SAP sandboxes for individuals and corporate teams.

Mask "+" in the field currency means that GL account 479000 is default GL account for all currencies. However, when it is the bank statement in EUR - the program will retrieve different GL i.e., 479200. 3. Account Modification In most cases, you will not need to use account modifications to derive proper GL account.

The system can only clear an item by means of the assignment number if it can locate the account to be cleared (from the bank data in the case of customers/vendors or the posting rule in the case of G/L accounts). To select items using the assignment number, the system uses the Bank Reference or Check Number field from the account statement.

During the customizing Activity "Define Account Determination for Bank Clearing Accounts" the field 'Bank subacct' is blank after saving the settings. "Image/data in this KBA is from SAP internal systems, sample data, or demo systems. Any resemblance to real data is purely coincidental." Read more...

1. Choose Cash Management ® Incomings ® Manual Bank Statement. 2. On the next screen, enter the following basic data: u2013 Bank key and/or bank data. u2013 Statement number and statement date. u2013 Beginning balance and ending balance. u2013 Selection criteria for transferring the payment advices.

There are four main steps to be carried out: 1. Create account symbol. Specify G/L accounts (such as bank, cash receipt, outgoing checks) to which postings are to be made from account statement. You assign account symbols to the G/L account numbers. These are required for the posting rules in step 2. 2.

FEBA ERROR MESSAGE IHC230 - Bank area assignment in bank statement Customizing is missing in Supply Chain Management Q&A 11-10-2023; ACH void issue in Supply Chain Management Q&A 11-08-2023; Configuration of Intraday bank statements- Cash Flows in Supply Chain Management Blogs by Members 10-13-2023

Go to Liquidity Management work center.; Go to Bank Statements view.; Create a new bank statement and proceed to the third step, Create and Edit Items. Add a new line item according to your needs. Click on Required.; The following warning message is displayed: You are not able to open this link due to a missing work center view assignment.