Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Properties Business Plan

You’ve come to the right place to create your Rental Property business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their rental property business.

Rental Property Business Plan Example

Below is a template to help you create each section of your rental property business plan.

Executive Summary

Business overview.

Noble Properties is a rental property agency in Seattle, Washington, that specializes in managing, renting, and leasing properties. Our mission is to provide luxury rentals that tenants can call home for years to come. Noble Properties rents out hundreds of homes across the Seattle area, including apartments, single-family homes, and trailers. To help prospective tenants find the perfect home, the company has created an online platform that allows them to search by their specific criteria (number of bedrooms, amenities, rent, etc.). We aim to be one of the most popular rental agencies in the area that customers can depend on again and again for their housing needs.

Noble Properties is founded and run by Joseph Pierce. He has worked in the industry for decades and has extensive knowledge of all aspects of the business. He will be in charge of most of the operations but will hire other staff to help with marketing, accounting, and managing the rentals.

Product Offering

Noble Properties offers a variety of properties for prospective tenants to choose from. Some of the options we provide include:

- 1-3 bedroom apartments

- Single-family homes

- Multi-unit buildings

- Short-term rentals

- Mobile homes or trailers

Customer Focus

Noble Properties will target renters located throughout the Seattle area. Most renters are under the age of 40 and earn about the median income. This means that we will primarily market to younger demographics and those who earn around the local median income or more.

Management Team

Noble Properties is led by Joseph Pierce, who has been in the rental property industry for 20 years. Throughout that time, he worked in various positions in local rental property agencies but is now eager to start a rental property business of his own. During his extensive experience in the rental property industry, he acquired an in-depth knowledge of the local area, local regulations, facilities, and the characteristics of different neighborhoods. He also has extensive experience in handling business management activities.

Karen Miller has been Joseph Pierce’s loyal administrative assistant for over ten years at his former rental agency. Joseph relies strongly on Karen’s diligence, attention to detail, and focus when organizing his clients, schedule, and files. Karen has worked in the rental agency industry for so long that she has a thorough knowledge of all aspects required to run a successful rental agency. She will help out with administrative tasks and some of the initial marketing efforts.

Success Factors

Noble Properties will be able to achieve success by offering the following competitive advantages:

- The founder, Joseph Pierce, has decades of extensive experience and knowledge of the industry that will prove invaluable for the company.

- The company will purchase rentals in popular areas around the city, putting our rentals in high demand.

- Noble Properties offers reasonable and affordable rates for all our rentals. Our pricing will be far more cost-effective than the competition.

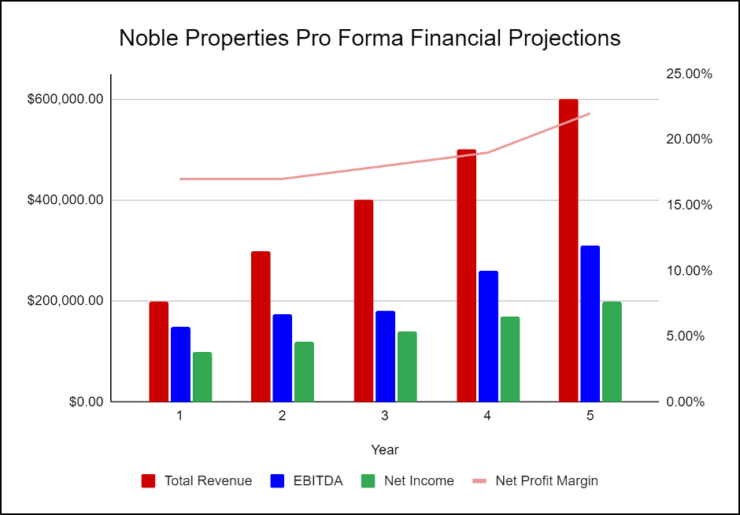

Financial Highlights

Noble Properties is seeking $1,100,000 in debt financing to launch its rental property agency. The funding will be dedicated to securing initial rental spaces, securing an office space, and purchasing office equipment and supplies. Funding will also be dedicated toward six months of overhead costs, including payroll, rent, and marketing costs. The breakdown of the funding is below:

- Purchasing initial rentals: $600,000

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $20,000

- Six months of overhead expenses (payroll, rent, utilities): $350,000

- Marketing costs: $50,000

- Working capital: $60,000

Company Overview

Who is noble properties, noble properties’ history.

After decades of working for other rental agencies, Joseph Pierce decided to launch an agency of his own. He conducted extensive research on the rental market in the Seattle area. This helped him determine the best spots to find in-demand rentals and how much he should rent them out for. He also did extensive marketing research to determine the best customer segments to market to. After conducting this research and finding a potential office location, Joseph Pierce incorporated Noble Properties as an S-Corporation.

Noble Properties’ operations are currently being run out of Joseph Pierce’s home office but will move to the office location once the lease is finalized.

Since incorporation, Noble Properties has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined rent/leasing and financing requirements

- Found a potential office location and signed a Letter of Intent to lease it

- Began recruiting key employees with experience in the rental homes/apartment industry

Noble Properties’ Products

Industry analysis.

The rental market is expected to continue to grow over the next five years. According to RentCafe, the average rent for a Seattle apartment is around $2,300 per month. This value is only expected to increase as the demand for apartments and other rentals skyrockets. Furthermore, Seattle’s vacancy rate is incredibly low and expected to decrease further, meaning there aren’t enough rentals to keep up with demand.

The growth is primarily driven by increasing housing prices. Now that housing prices have increased substantially, fewer and fewer people can afford to buy a home. Therefore, many people seek out rentals to live in since they are far more affordable.

Another factor that will help the Seattle rental market is the increasing population. More people are moving to the city, meaning the demand for homes and rentals will continue to soar. This will only push rental prices even higher, which will increase the local rental market’s value substantially.

This is a great market to start a rental agency in. By capitalizing on these trends, Noble Properties is expected to have great success.

Customer Analysis

Demographic profile of target market.

Noble Properties’ target market includes people of all demographics. We are open to offering rentals to people of all ages and groups as long as they can afford to pay their rent. From our initial market research, we expect most of our marketing efforts will target young adults, medium and high-income individuals, and families.

The precise demographics for Seattle, Washington, are:

Customer Segmentation

Noble Properties will primarily target the following customer profiles:

- Young adults

- Individuals who earn the region’s median income or more

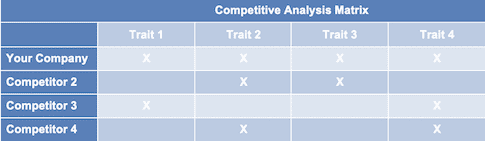

Competitive Analysis

Direct and indirect competitors.

Noble Properties will face competition from other companies with similar business profiles. A description of each competitor company is below.

Leasing Inc.

Leasing Inc. is a marketplace for finding rental homes and apartments in multiple metropolitan areas around the country. It originally started more than a decade ago as a networking tool for real estate agents, but today it is a fully searchable online database of homes for both sale and rent. Leasing Inc. offers ideal rental properties, all with different amenities that can best suit the tenant’s requirements. Leasing Inc.’s properties are well furnished with all modern accessories and priced competitively.

Rental Barn

Rental Barn is the most visited rental agency website in the United States. Rental Barn and its affiliates offer customers an on-demand experience for selling, buying, renting, and financing with transparency and nearly seamless end-to-end service. The company’s rental property portfolio provides multiple rental apartments according to the customer’s needs and requirements.

Seattle Properties

Seattle Properties is a local rental property business that has dominated the market since 1982. The company manages and rents out hundreds of properties all across the city, including apartments, single-family homes, and mobile homes. All prices are competitive, and some rentals qualify for government programs to help low-income individuals. The company also utilizes a well-designed website to help prospective tenants find their perfect home based on rent, location, and accessories.

Competitive Advantage

- The company will purchase rentals in popular areas around the city, making our rentals in high demand.

Marketing Plan

Brand & value proposition.

The Noble Properties brand will focus on the company’s unique value proposition:

- Offering homes/apartments for rent suited for families and working professionals.

- Offering a diverse range of rental homes in a prime location for a competitive rate.

- Providing excellent customer service.

Promotions Strategy

The promotions strategy for Noble Properties is as follows:

Print Advertising

Noble Properties will invest in professionally designed print ads to display in programs or flyers at industry networking events and relevant local establishments.

Website/SEO Marketing

Noble Properties has designed a website that is well-organized and informative, and lists all our available properties. The website also lists the company’s contact information and other services it provides. We will utilize SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Seattle rental properties” or “rentals near me,” Noble Properties will be listed at the top of the search results.

Referrals

Noble Properties understands that the best promotion comes from satisfied tenants. The company will encourage its tenants to refer other individuals by providing economic or financial incentives for every new tenant produced. This strategy will increase effectiveness after the business has already been established.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand the changing customer needs.

The real estate industry fluctuates, and therefore, rental prices, for the most part, are usually out of a company’s control. However, Noble Properties will market its properties at a competitive rate to ensure we do not have vacant properties. We will also keep tight control of costs in order to maximize profits.

Operations Plan

The following will be the operations plan for Noble Properties.

Operation Functions:

- Joseph Pierce will be the Owner and President of the company. He will oversee all staff and manage tenant relations. Jay has spent the past year recruiting the following staff:

- Karen Miller will serve as the Office Manager. She will manage the office administration, client files, and accounts payable. She will also handle much of the marketing efforts until the agency becomes large enough to hire a marketing team.

- Tim Johnson will be the Maintenance Director, who will provide all maintenance at the properties.

- Joseph will outsource professionals to handle the accounting and human resources aspects of the business.

- Joseph will also hire Rental Managers for the various properties as the agency continues to grow.

Milestones:

Noble Properties will have the following milestones completed in the next six months.

5/1/202X – Finalize contract to lease office space.

5/15/202X – Finalize personnel and staff employment contracts for the Noble Properties team.

6/1/202X – Begin moving into Noble Properties office.

7/1/202X – Finalize purchases of initial properties that will be rented.

7/15/202X – Begin networking and marketing efforts.

8/1/202X – Noble Properties opens its office and rentals for business.

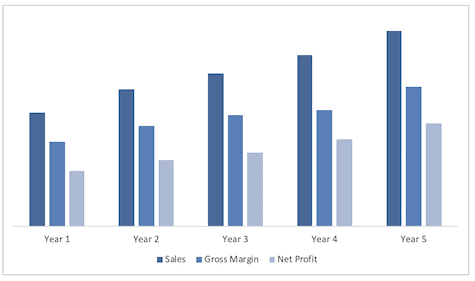

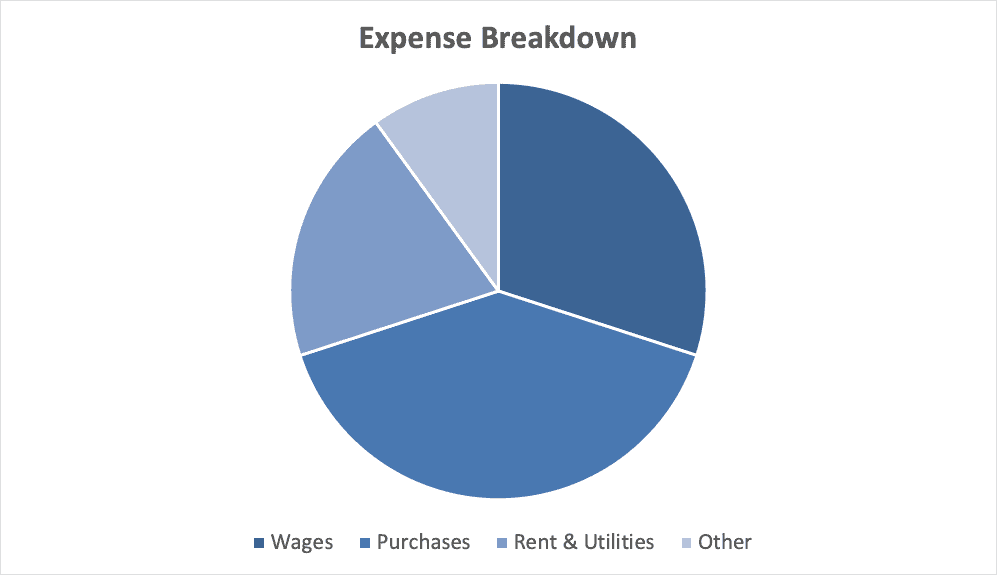

Financial Plan

Key revenue & costs.

Noble Properties’ revenue will come from rental income, property management fees and deposits received from tenants.

The major costs for the company will be staff salaries and property maintenance. In the initial years, the company’s marketing spending will be high to establish itself in the market.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Number of Managed Properties Per Month: 10

- Average Rent Per Month: $2,300

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, rental properties business plan faqs, what is a rental property business plan.

A rental property business plan is a plan to start and/or grow your rental properties business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your rental properties business plan using our rental properties Business Plan Template here .

What are the Main Types of Rental Property Businesses?

There are a number of different kinds of rental property companies , some focus on Single family homes, Multi-family properties and others on Short-Term Rental properties.

How Do You Get Funding for Your Rental Property Business Plan?

Rental Property Businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding. This is true for a real estate rental business plan or a rental property business plan.

A well-crafted rental property business plan is essential to securing funding from any type of potential investor.

What are the Steps To Start a Rental Properties Business?

Starting a rental property business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Rental Property Business Plan - The first step in starting a business is to create a detailed business plan for a rental property that outlines all aspects of the venture. This should include a market analysis, information on the services you will offer, marketing strategy, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your rental properties business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your rental properties business is in compliance with local laws.

3. Register Your Rental Properties Business - Once you have chosen a legal structure, the next step is to register your rental properties business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your rental properties business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Rental Properties Equipment & Supplies - In order to start your rental properties business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your rental properties business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful rental properties business:

- How to Start a Rental Properties Business

Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Property Business Plan

Over the past 20+ years, we have helped over 10,000 entrepreneurs and business owners create business plans to start and grow their rental property business. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a rental property business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Rental Properties Business Plan?

A business plan provides a snapshot of your rental property business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Rental Properties Business

If you’re looking to purchase a rental property, multiple rental properties, or add to your existing rental properties business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your rental property business in order to improve your chances of success. Your rental property business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Rental Property Companies

With regards to funding, the main sources of funding for rental properties are personal savings, credit cards, mortgages, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a rental property is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund a rental property company. They might consider funding a rental property company with a national presence, but never an individual location. This is because most venture capitalists are looking for millions of dollars in return when they make an investment, and an individual location could never achieve such results.

Finish Your Business Plan Today!

How to write a business plan for a rental property company.

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property you are operating and the status; for example, are you a startup, or do you have a portfolio of existing rental properties that you would like to add to?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the rental properties industry. Discuss the type of rental property you are offering. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of rental properties you are offering.

For example, you might offer the following options:

- Single family homes – This type of rental property is often owned by a single individual, rather than a company, who acts as both landlord and property manager.

- Multi-family properties – These types of properties can be subcategorized by the number of units per site. Buildings with 2 – 4 units are the most common (17.5%), while multistory apartment complexes with more than 50 units represent the next-largest, at 12.6% of the industry.

- Short-Term Rental properties – These are fully furnished properties that are rented for a short period of time – usually on a weekly basis for vacation purposes.

In addition to explaining the type of rental property you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include occupancy goals you’ve reached, number of property acquisitions, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the rental properties industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the rental property industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your rental property business plan:

- How big is the rental properties industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your rental property. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population or tourist arrivals.

Customer Analysis

The customer analysis section of your rental property business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: households, tourists, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of rental property you offer. Clearly, vacationers would want different amenities and services, and would respond to different marketing promotions than long-term tenants.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Rental Properties Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other rental property companies.

Indirect competitors are other options customers may use that aren’t direct competitors. This includes the housing market, or hotels. You need to mention such competition to show you understand that not everyone who needs housing or accommodation will seek out a rental property.

With regards to direct competition, you want to detail the other rental properties with which you compete. Most likely, your direct competitors will be rental properties in the vicinity.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What lease lengths or amenities do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior properties?

- Will you provide services that your competitors don’t offer?

- Will you make it easier or faster for customers to book the property or submit a lease application?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a rental property business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of rental property business that you documented in your Company Analysis. Then, detail the specific options you will be offering. For example, in addition to long-term tenancy, are you offering month-to-month, or short-term rental?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the properties and term options you offer and their prices.

Place : Place refers to the location of your rental property. Document your location and mention how the location will impact your success. For example, is your rental property located in a tourist destination, or in an urban area, etc. Discuss how your location might draw customer interest.

Promotions : the final part of your rental property marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your rental property business, such as customer service, maintenance, processing applications, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect 100% occupancy, or when you hope to reach $X in sales. It could also be when you expect to acquire a new property.

Management Team

To demonstrate your rental property business’ ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in rental property management. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in real estate, and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you have 1 rental unit or 10? And will revenue grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $200,000 on purchasing and renovating your rental property, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $200,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a rental property business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers, software, etc.

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your property blueprint or map.

Putting together a business plan for your rental properties company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the rental property industry, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful rental properties business.

Rental Properties Business Plan FAQs

What is the easiest way to complete my rental properties business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Rental Properties Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property business you are operating and the status; for example, are you a startup, do you have a rental properties business that you would like to grow, or are you operating multiple rental property businesses.

Don’t you wish there was a faster, easier way to finish your Rental Properties business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

BUSINESS STRATEGIES

How to start a rental property business: A comprehensive guide

- Annabelle Amery

- 14 min read

Owning rental properties can be a great way to generate passive income and build wealth over time. But it's not as easy as buying a few properties and collecting rent checks. There's a lot of work involved in managing tenants, maintaining properties and staying up-to-date on the latest laws and regulations.

In this comprehensive guide, we will walk you through the fundamental steps of starting a rental property business. Learn everything from creating your business plan to build your business website and spreading the word about your new venture.

What is a rental property business?

A rental property business is a business venture in which an investor purchases and manages one or more income-producing properties. These properties can have one or more units leased out to tenants in exchange for monthly rental fees. Rental property businesses can be operated by individuals, or they can be more complex operations involving multiple properties and team members.

Is your rental property a business?

Whether or not your rental property is considered a business depends on a number of factors, including:

Your level of involvement in the management of the property. If you're actively involved in managing the property, such as by handling maintenance requests, showing the property to prospective tenants and collecting rent, then your rental property is more likely to be considered a business.

The number of properties you own. If you own multiple rental properties, then your rental activity is more likely to be considered a business.

The amount of income you generate from your rental properties. If you generate a significant amount of income from your rental properties, then your rental activity is more likely to be considered a business.

If you meet all of the following criteria, then your rental property is likely to be considered a business:

You rent the property to earn a profit.

You work at the property regularly and continuously.

You provide significant services to your tenants, such as maintenance and repairs.

You have a significant investment in the property.

If your rental property meets all of these criteria, then you may be able to deduct certain expenses related to the property from your personal income taxes. You may also be able to claim certain tax credits, such as the qualified business income (QBI) deduction.

If you're not sure whether your rental property is considered a business, you should consult with a tax advisor.

Why should you start a rental property business?

Approximately 10.6 million in the U.S. declared rental income when filing taxes, with the average landlord bringing in $61,920 annually . Along with the financial benefits, there are many reasons to start a business in rental property and enter the real estate market.

Firstly, it allows you to create passive income with minimal daily involvement by generating consistent rental payments. You also have the potential for long-term wealth accumulation through property appreciation and the combo of cash flow and equity growth. On top of that, owning rental properties enables you to diversify your investment portfolio, providing stability and acting as a hedge against stock market volatility. There are also various tax advantages to consider, such as depreciation, mortgage interest deductions, property tax deductions and eligible expenses.

How to start a rental property business

To set yourself up for success, follow these steps to start your rental property business:

Define your business goals

Conduct market research

Create a business plan

Secure financing

Identify and acquire properties

Set up property management systems

Market and advertise your rental properties

01. Define your business goals

Determine your investment goals and strategy. Consider factors like property types (residential or commercial), location preferences, target tenant market and desired return on investment (ROI). Establish a clear vision for your rental property business.

02. Conduct market research

Thoroughly research your target market to identify areas with strong rental demand, favorable vacancy rates and potential for property appreciation. Analyze rental rates, property prices, local regulations and economic indicators. Evaluate the competition and your unique selling proposition to assess the viability of your rental business in the chosen market.

03. Create a business plan

Develop a comprehensive business plan that outlines your investment strategy, financial projections, marketing strategies, executive summary , property management processes and risk management strategies. A well-crafted rental property business plan serves as a roadmap for your rental property business and helps you attract potential investors or secure financing.

04. Secure financing

Determine your financing needs and explore how to raise money for your business . These may include traditional bank loans, private investors, partnerships, crowdfunding or using personal funds. Prepare a solid financial plan, including cash flow projections, expenses and potential return on investment, to present to lenders or investors. Once you’ve secured financing you’ll be able to register your business to make it official.

05. Identify and acquire properties

Once you have secured financing, start searching for suitable properties that align with your investment goals. Consider factors such as location, property condition, potential rental income and market appreciation. Conduct property inspections, perform due diligence and negotiate purchase prices.

06. Set up property management systems

Establish efficient property management systems to handle tenant relations, rent collection, property maintenance and legal compliance. Consider using property management software or hiring a professional property management company to streamline operations.

07. Market and advertise your rental properties

Develop a marketing strategy to attract potential tenants. List your properties on rental listing websites, utilize social media platforms and try networking with local real estate agents or relocation services. Create compelling property listings with high-quality photos, detailed descriptions and competitive rental prices.

How to write a rental property business plan

To write a rental property business plan, you need to consider the following sections:

Executive summary: The executive summary is a brief overview of your entire business plan. It should include your business goals, target market and competitive advantage.

Company description: The company description section provides more detail about your business, such as your business structure, ownership and services offered.

Market analysis: The market analysis section provides an overview of the rental property market in your area. It should include information about the demographic makeup of your target market, the supply and demand for rental properties, and the average rental rates.

Marketing strategy: The marketing strategy section describes how you plan to attract and retain tenants. It should include information about your target market, your marketing channels and your pricing strategy.

Management and operations: The management and operations section describes how you plan to manage your rental properties. It should include information about your team, your maintenance procedures and your tenant screening process.

Financial projections: The financial projections section provides an overview of your expected revenue and expenses. It should include information about your startup costs, your monthly operating expenses and your cash flow statement.

Exit strategy: The exit strategy section describes how you plan to exit your rental property business in the future. It could include selling your properties, passing them down to your heirs or exchanging them for other assets.

Once you have written your rental property business plan, you should review it with a trusted advisor, such as a lawyer or accountant. This will help you identify any potential problems and make sure that your plan is sound.

Here are some additional tips for writing a rental property business plan:

Be specific. Don't just say that you want to "make money." Instead, set specific goals, such as "I want to generate a 10% return on my investment within five years."

Be realistic. Don't overstate your income potential or underestimate your expenses.

Be flexible. Your business plan should be a living document that you can update as needed.

Seek feedback from others. Ask a lawyer, accountant or other experienced real estate investor to review your business plan and provide feedback.

With a well-written rental property business plan, you will be well on your way to success.

How much does it cost to start a rental property business?

The cost to start a rental property business can vary depending on a number of factors, including the type of property you buy, the location of the property and the condition of the property. However, there are some general costs that you can expect to incur, including:

Down payment: Most lenders will require you to make a down payment of at least 20% of the purchase price of the property.

Closing costs: Closing costs can range from 2% to 5% of the purchase price of the property.

Repairs and renovations: You may need to make some repairs or renovations to the property before you can rent it out.

Appliances and furniture: If the property is unfurnished, you will need to purchase appliances and furniture.

Marketing and advertising: You will need to market and advertise your property to potential tenants.

Landlord insurance: Landlord insurance will protect you financially in the event of a lawsuit or other covered event.

In addition to these upfront costs, there are also ongoing costs that you will need to budget for, such as property taxes, homeowner's association fees and maintenance and repairs.

According to a recent survey by the National Association of Realtors, the median down payment for a rental property purchase was 23% in 2022. The median closing costs were 2.1% of the purchase price. And the median amount spent on repairs and renovations was 1.2% of the purchase price.

Based on these estimates, you can expect to spend around 25%-26% of the purchase price of the property on upfront costs. So, if you are buying a $300,000 rental property, you can expect to spend around $75,000-$78,000 on upfront costs.

Of course, the actual cost of starting a rental property business will vary depending on your specific circumstances. It's important to do your research and create a budget before you start investing in rental properties.

Can a rental property business be profitable?

The profitability of a rental property business can vary significantly based on factors such as property location, market conditions, rental rates, expenses, and financing terms.

The "1% rule" is a general guideline often used by real estate investors to quickly evaluate the potential profitability of a rental property. It says that a rental property's monthly rental income should be at least 1% of the property's total acquisition cost. This is used as a quick initial screening tool to determine if a property might be worth the investment.

Here's how the 1% rule works:

1% Rule:** Monthly Rental Income ≥ 1% of Property Acquisition Cost

For example, if you're considering purchasing a rental property for $200,000, the monthly rental income should ideally be at least 1% of $200,000, which is $2,000.

Keep in mind that the 1% rule is a simplified guideline and shouldn't be the sole determining factor for making an investment decision. It's important to consider other factors such as location, market conditions, property management costs, financing terms, potential for appreciation, and the overall financial feasibility of the investment. The 1% rule can provide a quick initial assessment, a thorough analysis that takes into account all relevant factors is necessary to make informed investment decisions in the real estate market.

Properties that meet the 1% rule often have a higher likelihood of generating positive cash flow, where rental income exceeds expenses like mortgage payments, property taxes, insurance, and maintenance costs. However, markets with higher property prices and lower rental rates may make it challenging to find properties that meet the 1% rule while still being viable investment opportunities.

How to manage a rental property business effectively

Managing a rental property business requires effective systems, strong communication and ongoing attention to detail. More specifically, you’ll want to pay special attention to:

Tenant screening: Implement a thorough tenant screening process to ensure you select reliable and responsible tenants. Screen applicants' credit history, employment status and rental history, plus conduct background checks to minimize risks.

Lease agreements: Develop clear and comprehensive lease agreements that outline tenant responsibilities, rent payment terms, property rules and lease duration. Consult a legal professional to double-check that your lease agreements comply with local regulations and protect your interests.

Property maintenance and repairs: Regularly inspect and maintain your rental properties to keep them in good condition. Promptly address maintenance requests and conduct repairs as needed. Establish relationships with reliable contractors or property maintenance teams to ensure efficient service.

Rent collection and financial management: Establish streamlined rent collection processes. Clearly communicate rent payment methods and due dates to tenants. Utilize property management software or online platforms to track rent payments, generate financial reports and monitor cash flow.

Legal compliance: Stay informed about local and national rental regulations, fair housing laws and landlord-tenant rights. Make sure that your rental property business complies with these laws to avoid legal issues or disputes. Speak with legal professionals or local housing authorities when needed.

Regular communication: Foster good tenant relations through clear and open communication. Respond to inquiries or concerns promptly, provide regular updates or newsletters and address issues professionally and efficiently. Good communication builds trust and reduces conflicts.

How to promote your rental property business

As you’re looking to market your business, you’ll need to make sure that your brand's look and feel is professional. Consider things like how to name a business effectively so that your audience remembers you. If you’re struggling, you could use a business name generator . You’ll also need to design an eye-catching logo. Use a logo maker and/or check out these construction logo ideas for a little inspiration. Once you’re happy with your branding, it’s time to get promoting.

Create a professional website: Making a website for your rental property business is important. You can use small business website builders like Wix to showcase your properties, provide property details, highlight amenities and allow prospective tenants to contact you easily. Note that in 2022, renters used mobile devices (74%) to research rental properties, so you’ll want to ensure that your site’s mobile-friendly.

Optimize online listings: List your rental properties on popular rental listing websites like Zillow, Apartments.com or Rent.com. Optimize your listings with high-quality photos, detailed descriptions and competitive rental prices to attract potential tenants.

Leverage social media: Utilize social media platforms like Facebook, Instagram or LinkedIn to promote your rental properties. Create engaging content, share property photos or virtual tours and interact with potential tenants. Consider running targeted ads to reach your desired audience.

Network with local real estate agents: Build relationships with local real estate agents who can refer potential tenants to your rental properties. Offer incentives or commissions for successful referrals to encourage collaboration.

Offer incentives and referral programs: Attract tenants by offering incentives like move-in specials, discounted rent for the first month or referral programs. Encourage satisfied tenants to refer their friends, family or colleagues to your properties.

Showcase tenant testimonials: Collect testimonials from satisfied tenants and showcase them on your website, social media platforms or promotional materials. Positive reviews and testimonials can instill confidence in potential tenants.

Enhance curb appeal: Maintain attractive and well-maintained exteriors for your rental properties. Enhancing curb appeal through landscaping, exterior upgrades or fresh paint (see our guide on how to start a painting business ) can attract potential tenants and create a positive first impression.

In summary, here are the top benefits of starting a rental property business:

Cash flow: Rental properties generate rental income that can provide consistent cash flow. With proper management and strategic property selection, you can ensure a positive cash flow that covers expenses and generates profit.

Appreciation: Real estate properties have the potential to appreciate in value over time. As the value of your properties increases, so does your equity, allowing you to build wealth through appreciation.

Equity build-up: Each mortgage payment made by tenants helps to build equity in the property. Over time, as the mortgage balance decreases, your ownership stake increases, leading to increased wealth and financial stability.

Control and flexibility: As the owner of rental properties, you have control over property selection, rental prices, tenant screening and property management. This provides you with flexibility in decision-making and the ability to shape your business according to your goals.

Challenges of running a rental property business

While starting a rental property business has its advantages, it can come with its fair share of challenges. Here are some common challenges to be aware of:

Initial capital investment: Acquiring rental properties requires a significant upfront investment. Costs include property purchase, down payment, closing costs, property improvements and potentially renovations or repairs. Securing financing or having access to sufficient startup capital is crucial.

Property management: Managing rental properties involves various responsibilities, such as screening tenants, collecting rent, property maintenance, addressing tenant concerns and ensuring legal compliance. Effective property management requires time organization and problem-solving skills.

Tenant relations: Dealing with tenants can present challenges, including late rent payments, property damage, tenant turnover and potential conflicts. Building good tenant relationships and addressing issues promptly are key to maintaining a successful rental property business.

Market fluctuations: Real estate markets can experience fluctuations and cyclical patterns. Economic downturns, changes in demand or local market factors can affect rental rates, property values and vacancy rates. Staying informed about market trends and business cycle and adjusting your strategies accordingly is essential.

Features of successful rental properties

Successful rental properties typically have the following features:

Location: The property is located in a desirable area with good amenities, such as schools, shopping and public transportation.

Condition: The property is in good condition and well-maintained.

Price: The property is priced competitively and offers good value for tenants.

Target market: The property is appealing to a specific target market, such as families, students or professionals.

Management: The property is well-managed, with a system in place to handle maintenance requests, tenant screening and rent collection.

In addition to these general features, there are some specific features that may be more important for certain types of rental properties. For example, vacation rentals may need to have certain amenities, such as a pool or hot tub, in order to be successful. Commercial rental properties may need to be located in a high-traffic area with plenty of parking.

Here are some additional features that can make rental properties more successful:

Energy efficiency: Energy-efficient properties save tenants money on their utility bills, which makes them more attractive.

Security features: Security features, such as alarm systems and security cameras, can make tenants feel safer and more secure.

Pet-friendly policies: Pet-friendly rental properties are in high demand, as many people have pets.

Outdoor spaces: Outdoor spaces, such as patios, balconies and yards, are a valuable amenity for tenants.

Smart home features: Smart home features, such as thermostats and door locks, can make rental properties more convenient and efficient for tenants.

By investing in a property with these features, you can increase your chances of success as a landlord.

Can I start a rental property business with no experience?

Yes, it's possible to start a rental property business with no prior experience, but it's important to approach it carefully and educate yourself to increase your chances of success. Here are some key steps to consider:

Educate yourself: Learn about the real estate market, property management and landlord-tenant laws. Understanding the basics is crucial for making informed decisions.

Research the market: Conduct thorough market research to identify potential areas for investment. Look for locations with growing demand, low vacancy rates and potential for rental income.

Create a business plan: Develop a comprehensive business plan outlining your goals, target market, financial projections and strategies for property management. This plan will serve as a roadmap for your business.

Build a knowledge network: Connect with experienced professionals in the real estate industry, such as real estate agents, property managers and other investors. Their insights and advice can be valuable as you navigate the business.

Start small: Consider beginning with a smaller property to minimize risk and gain hands-on experience. As you become more comfortable and experienced, you can explore larger investments.

Financing: Explore financing options and understand the costs involved. This includes the purchase price, property maintenance, insurance, property taxes and potential vacancies.

Legal compliance: Familiarize yourself with local landlord-tenant laws and regulations. Compliance is crucial to avoid legal issues and ensure a positive landlord-tenant relationship.

Property management: Decide whether you will manage the property yourself or hire a professional property management company. Managing on your own may save costs but requires a commitment of time and effort.

Example of rental property businesses built on Wix

Need a little extra inspiration? Check out these rental property businesses on Wix.

TurnkeyRents

TurnkeyRents has been managing rental homes in Columbus, Indiana since as early as 1994. The company offers newly renovated homes, and provides its application docs and Airbnb calendar right from its Wix site.

Rent DIICO provides a simple landing page for viewing all of its available properties in Southern California. Rental units include apartments, studios and bungalows in some of the hottest parts of town.

How to start a rental property business FAQ

Is a rental property a good investment.

Yes, rental properties can be a good investment. They offer potential for passive income through rental payments and the opportunity for property appreciation over time. Additionally, real estate investments provide tax benefits, including deductions for mortgage interest, property taxes and operating expenses.

What rental properties are most profitable?

Looking to start your business in a new state.

If you're eager to launch your rental business in a particular state, check out these helpful articles:

Start a business in Pennsylvania

Start a business in Connecticut

Start a business in Texas

Start a business in New York

Start a business in Arizona

Start a business in Tennessee

Or, if you’re looking to learn about other business types , check out these related posts:

How to start an online business

How to start a consulting business

How to start a fitness business

How to start a fitness clothing line

How to start a makeup line

How to start a candle business

How to start a clothing business

How to start an online boutique

How to start a T-shirt business

How to start a jewelry business

How to start a subscription box business

How to start a beauty business

How to start a trucking business

How to start a hotel business

How to start a laundromat business

How to start a wedding business

Related Posts

How to create a website from scratch in 11 steps (for beginners)

How to start a business in 14 steps: a guide for 2024

How to create a rental property business plan

Was this article helpful?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

- Real Estate & Rentals

Rental Property Business Plan

A rental property business is a great way of earning a passive income. It can help you have great finances if you go about it in the right way.

The rental property market stood at a size of 174.2 bn dollars in the US in 2021. And with the subsiding pandemic isn’t about to shrink any time soon.

Now, if you are planning to become a landlord, you might need just one thing before you start your business. A business plan.

A business plan would become a guide in your business journey. It would also make your journey a less difficult and more successful one. So, if you are ready to start your rental property business , read on to find out all about a rental property business plan.

How can a rental property business plan help you?

A rental property business plan can help you have a clear goal, a well-defined business model, and strategies that work. It can also help you navigate smoothly through roadblocks in your journey and steer clear of costly business mistakes.

Also, putting your idea on paper makes it look more real and clear. Moreover, a business plan also comes in handy while you explain your ideas to your collaborators and investors.

All in all a business plan will help you figure out your way around obstacles through rigorous analysis and strategic planning. This brings us to our next section, how to write a business plan.

Rental Property Business Plan Outline

This is the standard rental property business plan outline which will cover all important sections that you should include in your business plan.

- Business Objectives

- Mission Statement

- Guiding Principles

- Keys to Success

- Start-Up Summary

- Location and Facilities

- Products/Services Descriptions

- Competitive Comparison

- Market Size

- Industry Participants

- Main Competitors

- Market Segments

- Market Tests

- Market Needs

- Market Trends

- Market Growth

- Positioning

- SWOT Analysis

- Strategy Pyramid

- Unique Selling Proposition (USP)

- Competitive Edge

- Positioning Statement

- Pricing Strategy

- Promotion and Advertising Strategy

- Marketing Programs

- Sales Forecast

- Sales Programs

- Exit Strategy

- Organizational Structure

- Steve Rogers

- Linda Rogers

- Management Team Gaps

- Personnel Plan

- Important Assumptions

- Start-Up Costs

- Source and Use of Funds

- Projected Profit and Loss

- Projected Cash Flow

- Projected Balance Sheet

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

After getting started with Upmetrics , you can copy this rental property business plan example into your business plan and modify the required information and download your rental property business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

How to write a rental property business plan?

Before writing a business plan, it is always good to ask yourself a few questions. It would surely make the process shorter and easier.

You should think about the following questions:

- What do you wish to achieve with your business?

- Who is your target audience?

- How would your business model work?

- What are your sources of funding?

- What would be your marketing strategy and so on?

All these questions would help you understand what you are getting yourself into. After that, you can start writing a business plan that focuses on all the different aspects of your business.

You can easily write such a plan either by using a premade template on the internet or through an online business plan software that’ll help you write a flexible and ever-changing plan.

What to include in a rental property business plan?

This section would give you a brief overview of the segments you can include in your business plan to make it a well-rounded one. They are as follows:

1. Executive Summary

The executive summary section contains a precise summary of all that your business stands for. If written well, it can help your business in getting funded. As it is mostly the only page an investor would read.

Professionals frequently suggest that this section should be written at the very end while writing your business plan, even if it is the first page. This helps you in summing up your business ideas properly.

2. Company Description

This section would consist of all the information about your business including its location, the services you offer, and your team.

It would also have information about your company’s history and its current position in the market. You can also include information about the projects you have worked on in the past.

3. Market Analysis

This is one of the chief sections of any business plan. It helps you understand what you are getting yourself into.

In this section, write down everything you can find out about the market. Include your target market, ways of reaching out to them, your market position, etc. Also, it is a good practice to include competitive analysis and take note of what your direct and indirect competitors are doing.

4. Marketing Strategy

While market analysis helps you in understanding the market, a marketing strategy helps you while getting into the market.

While formulating a marketing strategy, the most important thing is to have your target audience and market position in mind. Besides, keep in mind that your branding campaign should resonate with the client base you plan on serving.

5. Organization and management

This section includes information about the functioning aspects of your firm as well as about your team.

Include the roles and responsibilities of your team members as well as the progress they are making in their work.

If you write this section clearly and precisely, you’ll be able to identify the gaps you have in your team and your management system. This helps you in resolving those issues on time.

6. Financial Plan

This is one of the most crucial aspects of your business plan. More so in the rental property business. Planning your finances early on saves you from having financial troubles later on.

A financial plan section includes everything from your financial history, funding options, and requirements to projected cash flow and profits.

Download a sample rental property business plan

Need help writing your business plan from scratch? Here you go; download our free rental property business plan pdf to start.

It’s a modern business plan template specifically designed for your rental property business. Use the example business plan as a guide for writing your own.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Rental property business plan summary

In conclusion, a good business plan can help you have good finances, a proper marketing strategy, a well-managed company and team as well as clear business goals.

Especially, in the rental property business, planning the flow and structure of your business as well as your finances can take you a long way.

A rental property business depends highly upon well-managed finances and strategies. Planning your business is necessary to make it a good source of passive or primary income.

Moreover, it also makes the process of carrying out your business easier and smoother. So, if you are ready to start your rental property business, go ahead and start planning.

Related Posts

Party Rental Business Plan

Real Estate Investment Business Plan

400+ Business Plan Samples

How to Write Business Plan Step By Step

10 Main Components of a Business Plan

Important Location Strategy for a Business

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to start a rental property business in 14 steps

Real estate investing is a popular choice for entrepreneurs looking to create passive income and sustainable wealth. In particular, rental properties provide you the opportunity to create a diverse portfolio with multiple revenue streams. There are multiple ways you can approach a rental property business, but to rent out that first property, you’ll need to know how to start your business officially. Let’s take a look at the 14 steps you should follow to open your investment property business.

Can I start a rental property business with no experience?

You are not required to have a particular license to buy and sell a rental property. However, you will need to have a strong business sense and an in-depth understanding of real estate investing before you can confidently make both investment and property management decisions. You can go to school to learn this information or work directly with a mentor or other real estate-oriented professional who is willing to guide you through the process and teach you what you need to know.

1) Business plan

Now that you know you’re ready to start your rental property business, you’ll need a written business plan. A rental property business plan acts as both a map for you to stay on track as you build and grow your business and as a concrete document that proves to banks and investors why they should lend to or partner with you.

A strong business plan will have the following components:

- Executive Summary: A high-level overview of your entire business plan. What does success look like for you in this business, and how do you plan to reach that level of success?

- Industry Analysis: What is the state of the housing market? What insights can you glean from local real estate research? Where do you see investment opportunities?

- Competitive Analysis: Are there any direct competitors with your business, and how will you differentiate yourself?

- Marketing Plan: How will you source and secure quality tenants for your properties?

- Management: What is your plan for property management? Do you intend to work with a property manager, or do you plan to handle all maintenance and tenant activities on your own?

- Operations: How will you ensure that your properties are maintained in addition to the everyday operations of your business? Will you have offices? Will you hire staff members?

- Financial Plan: Do you have a clear understanding of how your proposed or intended rental properties will generate cash flow for your business? Will there be enough rental income to make your mortgage payment and then some? Do you have startup costs? What is your plan for continued growth and investment in additional properties over the next several years?

2) Business structure

As part of your business plan, you’ll also need to determine the right business model for you. There are multiple business structures you can set up for your rental property business. These are:

- Sole proprietorship

- Limited liability Company (LLC)

- Partnership

- Corporation

There are additional options within some of these categories. Review your choices carefully and select the business structure that’s best for your business goals.

3) Business name

Your business name will appear on your business cards, website, brochures, and any other marketing materials you use. A solid business name is:

- Clear, simple, and memorable

- Easy to say and spell

- Relevant to your type of business (for example, you could include the word “rental property” in your business name)

- In line with your brand

Use a business name generator to help you brainstorm. No matter which name you choose, make sure the matching website domain and social media handles are available.

4) Ideal clients

While it’s important to consider who you want to do business with when it comes to purchasing property, your ideal clients, in this case, are actually your tenants. If you could choose the perfect tenant to rent from you forever, who would they be? Consider the following questions when determining your ideal tenant type:

- Are they residential or commercial clients?

- What is their annual income or revenue?

- What do they do for a living, or what sort of business are they?

- Are they looking to become homeowners eventually, or do they only want to rent?

- Have they ever owned their own home before?

- What do they value in a rental property?

- Are they married? Single? In a relationship?

- Do they have children?

- Do they like to use their rental home, apartment, or business for parties or social events? How often?

- What social media platforms do they use?

You’ll continue to clarify who your ideal tenant is as you fill your rental property and see what type of person is truly the best fit. Hone your marketing strategy (which we’ll discuss later in this guide) to target your ideal client.

5) Niche, unique value proposition, and branding

Are you interested in filling your portfolio with a very specific type of property? If so, you have a niche. Some niche examples include:

- Vacation rental properties (such as Airbnb)

- Luxury rental properties

- Multi-family rental units

- Single-family homes

- Short-term rentals

- Condominiums

You do not have to have a niche, but it can be useful if you identify a market gap or have specific deep knowledge of your selected property type.

Unique Value Proposition (UVP)

Unlike your niche, your UVP has less to do with the type of property you own and more to do with how you operate your business. What can you offer to your prospective tenants that's so compelling they feel they simply must reach out to learn more about your properties?

Branding for a rental property business includes defining who you are as a business and what your prospective or current tenants can expect from your properties. Your branding should include:

- Color palette

- Mission statement

- Managing style

- Ideal tenant type

- Property type and style

- Design aesthetic

- Rental packages and special offers

Ensure that your branding is cohesive not just in your marketing but also across all your rental properties.

6) Services

Think of your services as what your tenants receive when they choose to rent from you. What are the perks of renting from you over a competitor’s property? What’s included in the rent? Is the management team responsive? These included services help to justify your pricing, so make sure they’re clearly promoted in your marketing.

7) Location

You know how much location matters when making a rental property purchase. But, have you thought about your business location as well? Do you require an office location, or will you operate from your home? If you feel that leasing a space is your best option, work with a real estate agent. Realtors can help you find the right fit for your budget and needs.

8) Equipment

Rental properties require a lot of maintenance and repairs to remain competitive in the market. You may find that your properties need additional fixtures, appliances, and repairs before they’re ready to rent out. You will need to work both the materials cost and the labor cost into your startup budget so that you can achieve a quality product without financial strain.

9) Finances

You will need to be able to qualify for a loan from a bank or other lender to finance the full amount of each of your properties, minus the down payment, which is paid out-of-pocket.

Your chosen bank will probably require that specific types of insurance coverage are in place before they lend to you. They will also want to see your business plan to understand in detail how you intend to pay off any loan they may give you.

Beyond the initial investment, recurring costs are also a factor in your overall budget. These can include property management fees, property taxes, legal and accounting fees, and more. Ensure that all these are accounted for in your business plan.

10) Insurance

As a new real estate business owner, you must have certain small business insurance policies in place. This applies to all businesses. However, the exact type of insurance coverage needed changes based on the type of business you are in. As a rental property business owner, you’ll require a specific set of policies . Some of these policies may include:

- Workers' Compensation : If you have one or more employees, you are required to have workers’ comp. This form of insurance covers you if one of your employees becomes injured or sick at work. Securing workers’ compensation used to be a long process, but now you can purchase it online . Get a fast estimate of your workers’ comp premium with Huckleberry’s 60-second workers' compensation calculator .

- General Liability Insurance : Covers your business if you are ever sued for injury or property damage .

- Business Property Insurance : Protects your building in case of serious damage. This policy also applies to any fixed components of your building, such as permanently installed equipment. It does not cover removable items.

- Business Owner's Policy : A Business Owner’s Policy bundles several insurance policies together. Your Business Owner’s Policy may include general liability and business property insurance, among others.Find out your estimated business insurance expenses with a fast and free quote from Huckleberry.

11) Paperwork, licenses, permits, and accounts

You’re almost ready to rent out your property, but first, there’s some important administrative work to handle.

- Register your business name: Go through the Small Business Association (SBA) website to learn how to register your business name.

- Get your Employer Identification Number (EIN): Your EIN acts as a Social Security Number (SSN) for your business. An EIN gives you multiple benefits , so get yours ASAP.

- Secure your business license: Each state is different, so check with your state to see how to get your business license. Each property you rent may need its own business license, so read your state’s guidelines carefully.