Money Laundering, Meaning, Act, Stages, Prevention, UPSC Notes

Process of money laundering, methods used in money laundering, impacts of money laundering, anti-money laundering measures in india, anti-money laundering measures at the global level, money laundering upsc pyqs, money laundering faqs.

Mains: Challenges to internal security through communication networks, money laundering and its prevention

Money Laundering is the processing of illegitimate money to disguise its illegal origin and make it appear as coming from legitimate sources . It is the process of making the dirty money look clean . The illegitimate money/ Black money arises from either proceeds of corruption, proceeds of crime, or tax evasion on legally earned money. It enables the criminal to enjoy these profits without fear of law enforcement agencies. Therefore, it is an essential step in almost all types of organised criminal activities such as drug trafficking, human trafficking, arms smuggling, and so on. Moreover, money laundering is also crucial in funding terrorism activities around the globe including in India.

Money laundering involves three stages that finally release laundered funds into the legal financial system. These three stages are as follows:

This is the first stage of the money laundering process when illegal funds are first introduced into the legitimate financial system. It is done through several methods, including wire transfers or depositing money into financial institutions such as banks , casinos , shops , and other businesses. During this phase, the following techniques are employed to conceal the source and ownership of the funds.

- Breaking up the money: Money is divided into smaller sums and depositing it into multiple bank accounts to avoid detection.

- Depositing across borders: The cash may be transported across borders and deposited in offshore financial institutions to conceal or disguise to purchase high-value assets , such as artwork, diamonds, and gold, which can be resold later for payment by cheque or bank transfer, further distancing the illegal proceeds from their source.

It involves multiple financial intermediaries and transactions to confuse Anti-money laundering (AML) checks.Layering money laundering is gradually adding legitimacy to the source of illicit money, making it difficult to track. It is generally considered the most complex stage. Some of the methods utilised during this step include:

- Changing the money's currency.

- Multiple inter-bank transfers.

- Multiple structured deposits and withdrawals ( Smurfing )

- Purchasing high-value items such as diamonds, cars, or property.

- Multiple wire transfers between multiple accounts in different countries.

- Opening "shell" companies.

- Investing in businesses that require minimal paperwork, such as currency exchanges, art galleries, and car washes.

- Using money "mules ."

Integration

In the last stage, dirty money re-enters the mainstream financial system as a legitimate transaction. This is done in the form of business investment, purchase, or the sale of an asset bought during the layering. The major methods used are as follows:

- Property dealing

- Front companies and fraudulent loans

- Foreign bank complicity

- False import/export invoices

Money laundering involves carrying out several transactions to hide the origin of the money. Some major methods/types of transactions carried out are as follows:

- Structuring or Smurfing: A smurf evades government scrutiny by breaking up large transactions into a set of smaller transactions that are each below the reporting threshold.

- “Mules” or cash smugglers: A money mule is someone who accepts and transfers money from fraud victims to smuggle it across borders and deposit it into foreign accounts. Some money mules are aware that they are aiding in illegal activity, but some are not aware.

- Gaming and Gambling sectors: The susceptibility to money laundering is high in these sectors. Given its high transaction volume and potential for anonymity , effective AML measures are necessary.

- Shell companies: These are created to obscure or hide the assets of another entity. These companies exist only on paper and lack a physical presence , staff, revenue, or significant assets. However, they may hold bank accounts or investments.

- Transaction Laundering: It is a type of electronic money laundering that uses e-commerce to obscure transactions.

- Smugglers: This technique is the earliest form of money laundering, involving the physical transport of cash across borders. This has been a favoured method for terrorists.

- Hawala: It is an informal system for transferring money around the world. Hawala transfers money without any physical money actually moving .

- Cybercrime : Cyber crimes such as theft of identity, illegal access to email, and credit card fraud are being carried out to aid in money laundering and terrorist activities.

- Open Securities Market: Laundering is possible due to instruments like hedge funds and participatory notes which have very limited disclosures to the source.

- Money laundering through cryptocurrencies: Cryptocurrencies are anonymous therefore the placement stage of the money laundering process is often absent.

Money laundering has severe and extensive impacts on businesses, economies, societies, and nations. The major impacts of money laundering are as follows:

Threats to Internal Security

Organised and transnational crime include money laundering in some form or other.

- For example, funds flow from Pakistan’s ISI to the operatives of various terrorist groups like Harkat-ul-Mujahideen (HUM), the Harkat-ul-Jihad-al- Islamic (HUJI), the Lashkar-e-Taiba (LET) and the Jaish-e-Mohammad (JEM) to carry out terrorist acts against India.

- The 26/11 Mumbai Terrorist attack was financed through money laundering and hawala.

- Organised Crime: Narcotics trade, human trafficking, Illegal wildlife trade, and illegal arms trade all thrive on money laundering.

- Extremism: Naxalism/Left Wing extremism, and insurgency in northeast Indian states and other areas all benefit from money laundering.

- Cybercrime : Cybercriminals can use modern technology to launder money obtained through cybercrime.

Economic Implications

As emerging markets open up their economies and financial sectors, they become increasingly easy targets for money laundering activities. The major impacts are as follows:

- This results in the crowding-out of private-sector businesses by criminal organisations.

- It results in less profits and higher costs to businesses along with higher prices to consumers.

- Criminal activity is associated with bank failures around the globe such as in the case of the European Union Bank.

- In some emerging markets these illicit proceeds may surpass government budgets, leading to a loss of control of economic policy by governments.

- The unpredictable nature of money laundering leads to the loss of policy control.

- Reduced confidence in markets due to money laundering diminishes legitimate global opportunities, sustainable growth, and investments while attracting international criminal organisations.

- This also leads to higher tax rates for honest taxpayers.

Social Impacts

Apart from adversely affecting the economy and security of the nation money laundering also causes severe societal issues, listed as follows:

- Promote Crime: There are significant social costs and risks associated with money laundering. Money laundering is a crucial process for organised criminals that allows drug traffickers, smugglers, etc. to expand their operations.

- Increase Fiscal burden: This drives up the cost of government due to the need for increased law enforcement and health care expenditures (for example, for treatment of drug addicts) to combat the serious consequences that result.

- Rise in Corruption: Money laundering transfers economic power from the market, government, and citizens to criminals. Furthermore, the sheer magnitude of the economic power that accrues to criminals from money laundering has a corrupting effect on all elements of society. It may even lead to the virtual takeover of a legitimate government in extreme cases.

- Affect Stability: The social and ethical fabric of the society will be jeopardised, threatening the democratic institutions of society. Further, it can fuel distrust, protests, and anti-national activities.

Since 2020-21, the ED has registered 3,110 cases under the anti-money laundering law, and over 12,000 complaints to investigate alleged foreign exchange violations. The following Anti-Money Laundering measures are taken:

- It carries out verification of the identity of clients, maintenance of records, and reporting. Businesses with AML obligations report to the Financial Intelligence Unit.

- It carries out the investigation of and prosecution of money-laundering offences.

- Customer due diligence (CDD) requirements: The banking industry, financial institutions, financial service providers, gaming businesses, and casinos have to ensure CDD requirements. It helps determine the customer's risk level. These organisations have to conduct AML checks, detect suspicious transactions of customers, and report to authorised units.

- Foreign Exchange Management Act, 2000, (FEMA): It aims to prevent money laundering and other illegal activities related to foreign exchange transactions. It enables regulation of the flow of payments to and from people outside the country; regulation of all financial transactions involving foreign securities or exchange; enables the RBI to place restrictions on transactions from capital accounts, etc.

- RBI AML Guidelines: The guidelines enable Authorised Money Changers (AMCs) that engage in the purchase and/or sale of foreign currency notes/traveller cheques to put in place the policy framework and systems for the prevention of money laundering while undertaking money-changing transactions. Guidelines also include Know Your Customer (KYC) requirements.

- Benami Properties Transactions (Prohibition) Amendment Bill, 2015: The bill allows for the confiscation of Benami properties. A benami transaction is a property, held by one person but the consideration for it is paid by another.

- Narcotic Drugs and Psychotropic Substances Act, 1985: This Act does not explicitly mention money laundering, but it does include provisions to seize and confiscate the proceeds of drug trafficking.

- Measures to Prevent Terror Financing: The Unlawful Activities (Prevention) Act (UAPA) and amendments to the PMLA provide provisions to designate individuals and organisations as terrorist entities, freezing their assets and choking off funding.

- Mutual Legal Assistance Agreements: Mutual legal assistance agreements facilitate the exchange of evidence and prosecution of money laundering cases with global dimensions.

- Membership of FATF: India has effectively used the grouping to push for sanctions against countries like Pakistan which was placed in the grey list for indulging in money laundering to fund terrorism.

- India is a signatory to various conventions of the UN: India is a signatory to the Vienna Convention to combat Money Laundering and other relevant conventions of the UN.

The global nature of money laundering requires global standards and international cooperation . The Anti-Money Laundering measures taken at the Global Level are as follows:

- FATF Recommendations: These are a set of measures that are endorsed by over 180 countries .

- United Nations Global Programme against Money Laundering, Proceeds of Crime, and the Financing of Terrorism (GPML): The GPML was established in 1997 to help UN member states comply with UN conventions and other instruments related to money laundering and terrorism financing.

- The convention mandates the member states to criminalise the laundering of money.

- It promotes international cooperation and makes extradition between member states possible.

- Other UN conventions: the UN Transnational Organised Crime Convention (2000), Convention for Suppression of Financing of Terrorism (1999); Convention against Transnational Organised Crime (2000), and Convention against Corruption (2003) contain provisions related to combating money laundering.

- The APG aims to ensure that individual members effectively implement international standards against money laundering, terrorist financing, and proliferation financing related to weapons of mass destruction.

- It comprises nine countries from the Eurasian region i.e. Belarus, China, Kazakhstan, Kyrgyzstan, India, Russia, Tajikistan, Turkmenistan, and Uzbekistan.

- EAG is also an associate member of the FATF.

Question 1. Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (UPSC Mains 2021)

Question 2. India’s proximity to two of the world’s biggest illicit opium-growing states has enhanced her internal security concerns. Explain the linkages between drug trafficking and other illicit activities such as gunrunning, money laundering, and human trafficking. What countermeasures should be taken to prevent the same? (UPSC Mains 2018)

Question 3. Money laundering poses a serious security threat to a country’s economic sovereignty. What is its significance for India and what steps are required to be taken to control this menace? (UPSC Mains 2013)

Q1. What are the steps in the money laundering process?

Ans. The process involves three major steps i.e. placement, layering, and integration. Placement places illegitimate money into the legitimate financial system. Layering hides the source of the money through a series of transactions by making money non-traceable. Integration integrates the money back into the market as clean money.

Q2. What is black money?

Ans. When the income is not declared to evade taxes or hide its illegitimate origin, it is termed black money. Money Laundering is used as a means to convert black money into white money.

Q3. What Is an Example of Money Laundering?

Ans. Cash earned illegally by drug smuggling may be laundered using highly cash-intensive businesses such as a restaurant. Here the illegal cash is mixed with legitimate cash before being deposited in a bank account.

Q4. What is the full form of CDD?

Ans. Customer due diligence (CDD) includes performing background checks and other screening on the customer at the time of onboarding to ensure that they are properly risk-assessed. CDD and Know Your Customer (KYC) initiatives are at the heart of Anti-Money Laundering measures in India.

© 2024 Vajiram & Ravi. All rights reserved

Money and Banking Simplified | Prelims Capsules 2021

Pre-cum-Mains GS Foundation Program for UPSC 2026 | Starting from 5th Dec. 2024 Click Here for more information

Money and Banking Concepts Simplified

- Major problems of the Barter system

What is money?

- Functions of money

Full-bodied money

Token money , paper money .

- Fiat system

Legal tender

- Non-legal tender/optional money

- Fiduciary money

- Near money/Quasi money

Plastic money

Deposit money .

- Monetary Aggregates

- Types of deposits held by a bank

Money Multiplier (m)

Monetary system in India

- Credit Creation by a commercial bank

- What is a Digital Currency ?

This Article is part of our Prelims Capsules 2021 Initiative, if you want to read more content – Click Here

Introduction

Money and banking are the cornerstones of a strong & effective economic & financial system.

But both money and banking have evolved over centuries to reach where they are today. For a very long time in the past, there was no concept of either of the two .

People simply exchanged commodities with each other i.e. barter system existed. The barter system provided people with a way of acquiring things that they didn’t have.

And until we began producing a surplus, we didn’t feel the need to change anything. Subsistence was enough. But once production attained reasonable levels and due to other inherent problems of the existing barter system people gradually shifted towards a more nuanced concept – money and in time banking system was also invented to further other complex functions.

In fact, the history of the development of money and banking is often interrelated .

In India also we find evidence of loans being given during the Vedic period . In the Mauryan period, an instrument called adesha was in use, which was an order on a banker desiring him to pay the money of the note to a third person, which corresponds to the definition of a bill of exchange as we understand it today .

So, we can see that while the modern money and banking system might seem too big & advanced now but it all began centuries ago with simple exchange of commodities between people.

Let us understand this topic from UPSC’s perspective.

It all beg ins with the barter system.

The Barter system

As per NCERT,

Exchange of commodities with the mediation of money is called Barter exchange

In earlier times, when there was no concept of money and banking , people used barter system of exchange. They exchanged commodities.

Let us illustrate this with a simple example:

Suppose I want to buy clothes and I have 1 kg apple with me. Now, all I have to do is to find a person who wants apples and has clothes to sell. I’ll approach the person and we both shall finalize a mutually agreeable deal wherein I get what I want (clothes) and the other person gets what he wants (apples). Both parties return home satisfied. This transaction has been successfully done under a barter system

Bu t there are few obvious problems with this system.

Major p roblems of the Barter system

There are many issues with barter exchange, but here are few major ones:

- Double coincidence of wants : Everyone must find a person who is willing to buy what they are willing to sell and a person who is willing to sell what they want to buy. In the above example, I need to find someone who has surplus clothing to sell and not only this but a person who also wants apples in exchange for clothing.

- Difficult to carry forward wealth : In the above example, I cannot store apples for an indefinite amount of time. They cannot act as a store of wealth like gold or cash can.

- Absence of a standard unit of account : How many apples must I give in return for how much clothing would always be an issue in the above example. There is no standard unit of account.

As we can see above, to facilitate a transaction, a common medium of exchange acceptable to parties involved was necessary. Hence, the concept of money originated.

Now, a person was able to sell apples for money & buy clothes from the money earned. Similarly, the other person was able to sell clothing for money and then buy apples from that money.

Note : Barter system has its advantage s too, like in cases of a monetary crisis or hyperinflation when the currency has lost its value, barter system works perfectly as an alternative.

Money and banking is an important topic for UPSC preparation but to understand it fully one must be thorough with underlying concepts, like money, money supply, monetary aggregates, etc.

Money is the most commonly accepted medium of exchange

- Any object that is generally accepted as means of payment. Currency, in the form of notes or coins, is one type of money

- Do remember that money is not a necessity and our society can exist without it . It acts as a facilitator only.

Functions of money

- It acts as a medium of exchange : Any commodity can be bought through money

- A common measure of value : All commodities have their value that is expressed in terms of money

- Store of value

- Acts as a standard for deferred payments : Future monetary obligations can be settled using money . For example A loan which is taken today is settled in installments .

Types of money

- Token money (paper money/credit money)

- Representative full-bodied paper money

- Inconvertible paper money

- Fiat money

- Near money

- Money whose face value is equivalent to its intrinsic value. Full value is embedded in the currency itself

- Money value = commodity value

- For example; gold currency

- Its value as money is much more than its value as a commodity

- Money value > commodity value

As an example, consider the following two coins:

- One coin is of gold and its money value is 1000 Rs (meaning you can buy things worth this much from this coin)

- The second coin is of copper and its money value is 10 Rs

- This type of currency is called Full-bodied money

- This type of currency is called Token money

- Another example of this type of currency is a paper note. A 500 Rs note is worth very little if you decide to sell it as a commodity in the market (As a commodity it is just a piece of paper with 500 Rs written on it. That paper will be worth nothing)

Money made out of paper is termed paper money. It is further divided into two parts:

- Anyone who holds this type of paper money can go to the central bank and get that converted to an equivalent amount of gold or silver i.e., paper money of this type can be converted to full-bodied money. Hence it is also termed convertible money

- No obligation on the central bank to convert it

- India currently has token money. RBI has no such obligation to convert representative paper money to an equivalent amount of gold/silver.

Note: Token money is solely based on trust that people have in the government.

- Consider a time in medieval India.

- You live in a kingdom that has its own full-bodied coin system. Coins are made up of gold.

- After one year a new ruler comes who states that he is ending all the previous coins and issuing new coins in his name.

- This is similar to a sudden pan-economic demonetization where every coin is demonetized.

- What will happen to your wealth? You might have had 1000’s coins of the previous regime but now they are useless and you don’t have any means to get them exchanged. There are no banks yet 😀

- Suddenly you have become poor.

- So, foreseeing such circumstances people hoarded coins, melted them, and kept gold or silver instead because the utility of gold or silver was independent of any ruler.

- A lack of trust in the ruling dispensation meant people had no trust in the currency. They hoarded it.

- Slowly when kingdoms went away and democracy came, people developed trust a nd the countries shifted to a token money system.

Fiat system

- Fiat means orde r

- It serves as money on the order (fiat) of the government

- This type of money is issued without any backing of an equivalent amount of gold or silver

- There is no obligation on any person to accept this money as a medium of exchange. No legal action can be initiated in this case

It is compulsory to accept this type of money for the settlement of any monetary obligation.

- Legal tender is the money that is recognized by the law of the land, as valid for payment of debt. Similarly, It must be accepted for discharge of debt.

- The RBI Act of 1934, which gives the central bank the sole right to issue banknotes, states that “ Every banknote shall be legal tender at any place in India in payment for the amount expressed therein ”.

- Hence, the government can issue fiat money and can declare it to be a legal tender

- The One Rupee notes issued by the Ministry of Finance (Government of India) under the Currency Ordinance, 1940 are legal tender

- Did you notice that all coins and 1 Rs note are issued by the government of India while banknotes are issued by RBI!

- Also, coins are issued under Coinage Act while banknotes are issued under RBI Act 1934

Two types of legal tender: –

- 50 p paise coin cannot be used to make a payment beyond 10 Rs

- Coin >= 1Rs can be used to make a payment of only up to 1000 Rs.

- Unlimited legal tender money : Currency notes are unlimited legal tender and can be offered as payment for dues of any size

Non-legal tender/optional money

- Money which has no legal obligation to being accepted by anyone, like Cheque, Demand Drafts, etc. They are generally used and accepted but no one is legally bound to accept them as a mode of payment.

Fiduciary money

- This type of money is accepted on the basis of the trust between the payee and the payer.

- For eg : Cheque. You are not bound to accept it legally but when there is trust between you and the person who is making the payment via cheque then you’ll readily accept it as a mode of repayment.

Near money /Quasi money

It refers to highly liquid assets that can be quickly converted into cash . These are generally n on-cash assets that are very liquid but cannot be used directly for transactions.

- Near money takes some time to convert to money

- For example, Your fixed deposit account in any bank is a type of near money. It is liquid but still not liquid as cash because you’ll have to go to the bank first , fill in the paperwork to get the cash out from your FD before you can spend it. That’s why it’s near money.

It is used to refer to credit cards, debit cards, etc that we routinely use instead of actual cash.

Money deposited in banks & financial institutions. For example, your saving accounts, fixed deposits, recurring deposits, etc are all different types of deposit money

What is Money Supply ?

It is the total stock of all types of money held by the public at any point in time.

- ‘Public’ here signifies all economic entities except the government & banking system because these entities create money.

- Hence, money supply (MS) is,

- MS shows the total purchasing power of an economy

There are various ways in which Money Supply is measured. These are called Monetary Aggregates. It is only once the money supply in the entire money and banking s ystem is known that the central bank can take steps to regulate it.

Before explaining monetary aggregates, we should be fully aware of the banking concepts involved .

Types of deposits held by a bank

- Demand Deposits (DD)

- Time Deposits (TD)

- Other Deposits (OD)

Demand Deposits : This money can be withdrawn at any time (on-demand) from the bank. These deposits include:

- Current account

- The demand liability portion of a saving account

These deposits are 100% liquid

Time Deposits : Money can be withdrawn only after maturity or with a penalty before maturity. These include:

- Fixed Deposits

- Recurring Deposits

- Time liability of saving account

Other Deposits : Demand Deposits with RBI which includes demand deposits of public financial institutions, demand deposits of foreign central banks and international financial institutions like IMF, World Bank, etc.

Net Bank Deposits = DD + TD

Note : Total bank deposits are different from Net bank deposits. Why? Because banks have other deposits too like the borrowings from RBI

Now, lets take a look at the monetary aggregates:

Monetary Aggregates

- M1 (Narrow Money)

- M2 (Narrow Money)

- M3 ( Broad Money)

- M4 (Broad Money)

- M0 ( Reserve/High-powered money )

M1 ( Narrow Money )

- M1 = C + DD + OD

- C – Currency held by public

- DD – Net Demand Deposits with banks (Doesn’t include interbank deposits i.e., deposits which a commercial bank holds in other commercial banks )

- OD – These include Deposits with RBI held by certain individuals (former RBI governors can open an account with RBI) & institutions (IMF etc)

Note :

- For all practical purposes, OD is near about negligible

- Since the money included in M1 is most liquid so it is termed as narrow money

M 2 (Narrow Money)

- M2 = M1 + Saving account deposits with Post office banks

- M2 is almost equal to M1 as deposits with Post office banks is not much

M 3 (Broad Money)

- M3 = M1 + TD (time deposits with commercial banks like Fixed deposits, Recurring deposits)

- M3 denotes currency and total bank deposits. Therefore, it signifies purchasing power of an economy. In the case of M2 and M4 deposits with Post Office banks are also included. These banks cannot give out loans and purchasing power is equal to the currency held by the public plus loans given out by the banks. So, instead o f M2 or M4, we use M3 to s how the purchasing power

- M3 is the most commonly used measure of the money supply . It is also known as aggregate monetary resources

M 4 (Broad Money)

- M4 = M3 + Total Deposits with Post Office banks (excludes deposits under National Savings Certificate, Kisan Vikas Patra)

Note : For practical purposes, total deposits with Post office banks is very less so M4 is taken almost equal to M3

Rank monetary aggregates in terms of increasing liquidity

M0 (High-powered money/ Primary money)

- It is the total stock of all types of currency (notes, coins) held by money held by all types of economic entities (public & banks) at any point of time except the government

- C – Currency in circulation : It is the total value of the currency (coins and paper currency) that has ever been issued by the Reserve Bank of India minus the amount that has been withdrawn by it.

- R – Cash Reserves of banks

- OD – Other Deposits

- Vault cash is also not a part of the money supply

- Also, M3 > M0 (because M3 includes deposits held by banks while M0 includes cash reserve of the banks and deposits held by a bank is always greater than its cash reserve)

- It is the ratio of money supply (MS) to the reserve money (M0)

- m = MS/M0

- India follows the ‘ Minimum Reserve System (MRS) . This system was adopted in place of proportional Reserve System

- Under MRS, RBI has to maintain reserves of at least 200 Crore in the form of gold & foreign securities.

- Out of these, at least 115 Crore should be maintained in terms of gold

- On the maintenance of these reserves, RBI can print unlimited currency against the backing of gold, foreign securities and securities of GOI

Things against which RBI can print money

- Foreign securities

- Securities of GoI (G-sec)

Credit Creation by a commercial bank

So far, we have understood few basic concepts of money and banking . Now, l et us understand in the simplest of terms the entire process of credit creation. First of all, let us see what is an asset and what is a liability for a bank.

- The asset is something that generates a cash flow in the future

- Liabilities : Deposits made in the bank are liabilities for the bank because they have to be paid back to the customer

Note : Banks are allowed to engage in fractional reserve banking meaning a fraction of the deposits made in the bank have to be kept as a reserve and the rest can be given out as a loan. This is done to prevent problems to the general public.

- This reserve requirement is done under Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)

- SRR & CRR together is known as Legal Reserve Ratio (LRR)

Process of credit creation :

With your money and banking fundamentals clear, let’s see how credit creation is actually done by commercial banks.

Here we shall assume that the LRR requirement is 10%

- Consider a person A who has 100 Rs with him. He has not deposited it in the bank yet.

- Thinking that he is not going to spend that money and that his neighbor might try to steal it from him, he decides to deposit that money in a bank.

- He goes to an SBI branch and deposits Rs 100 in a savings account. Satisfied that his money is safe he comes back home happily.

- It also keeps a reserve of 10 Rs as per the LRR requirement

- So, the loanable amount at this point is 90 Rs , not 100 Rs.

- One day, Mr. B enters the bank and asks for a loan.

- SBI is more than happy to lend money to him. It gives him a loan of 90 Rs but this loan is not given in cash, for the obvious reasons.

- Mr. B has an account in ICICI. SBI transfer this amount to his ICICI account.

- It keeps 10% i.e., 9 Rs as a reserve and it can now loan 81 Rs further to another customer.

- Now, Axis bank keeps 10% (8.1 Rs) and can now loan 72.9 Rs as a loan

Did you notice how an initial deposit with SBI went on to create credit in the economy! That’s how credit is created and money gets multiplied in the process. This process of credit creation will go on until the initial deposit of 100 Rs is exhausted.

There is a formula to calculate this.

Money Multiplier = 1 /LRR (For this example: Money Multiplier = 1/0.1 = 10)

Credit Creation = Initial deposit* money multiplier = 100 * 10 = Rs 1000

So, in the above example, the initial deposit was 100 Rs which means credit creation will be equal to 100*1/10% = Rs 1000

Hence, in this case, 100 Rs will generate a credit flow of 1000 Rs in the economy.

PS : No need to remember the formula for credit creation. Given just for your better understanding.

Note : Please remember that here we have assumed that all people will not turn up on the same day to ask for their deposit money. This is termed as a bank run and it happens rarely but if it happens then obviously a bank will not be able to extended loans to anyone.

We hope you are now clear with the basics of money and banking and have a better idea of how the entire system works to benefit society by encouraging transactions and increased credit flow in an economy.

This is an age of rapid technological innovation and adaptation. As a result, the w orld economic and financial system has grown tremendously and so has the concept of money along with it . Everything is being digitized. It has led us to a point where we now have a digital form of money i.e., a digital currency.

Let us know more about it.

What is a Digital Currency ?

Digital currency is any currency that’s available exclusively in electronic form.

- Cryptocurrency is a type of digital currency .

- The majority of currencies in this world are digital. A s per an estimate, a round 92% of the world’s currency is already in digital form. Only 8 % is in cash .

What is a Central Bank Digital Currency (CBDC)?

Following the success of decentralized digital currencies like Bitcoin, Ethereum, etc countries the world over are thinking to introduce their own digital currencies known as Central Bank Digital Currency (CBDC), or national digital currency, in India.

- CBDC is simply the digital form of a country’s fiat currency. Instead of printing paper currency or minting coins, the central bank issues electronic tokens.

- This token value is backed by the full faith and credit of the government.

Note : Please keep in mind that Cryptocurrency (like Bitcoin, Dogecoin etc) is a type of digital currency. They are not same. There are major differences between them.

Cryptocurrency vs Digital currency

Here are some key differences –

- Decentralization : Digital Currencies are centralized meaning they are regulated and issued by a single entity like a central bank.

- Opennes s: In Cryptocurrencies, one can see all the transactions as the directory (ledger) is kept open. This functionality is an integral feature of blockchain where every block contains information about the previous transaction. In Digital Currencies one would not be able to visualize the entire chain of transactions.

- Legal framework : Most Cryptocurrencies have no legal frameworks while a digital currency is backed by an appropriate legal framework

National Digital Currencies around the world

- According to the Bank for International Settlements, more than 60 countries are currently experimenting with the CBDC. There are few countries that already rolled out their national digital currency. Such as,

- Sweden is conducting real-world trials of its digital currency ( krona )

- The Bahamas already issued their digital currency “ Sand Dollar ” to all citizens .

- China started a trial run of their digital currency e- RMB amid pandemic. They plan to implement pan- china in 2022. This is the first national digital currency operated by a major economy. The e-RMB has no anonymity and requires users to download and register to an app on their smartphone. This centralisation means that the Chinese government would be able to shut down and seize accounts, something that is nearly impossible with the more democratic cryptocurrencies.

National Digital Currency in India

With the growth of digital currencies worldwide, various start-ups dealing with cryptocurrency have come up in India, such as Unocoin in 2013 and Zebpay in 2014. Further, their volatility is a cause of concern for India.

So, the government-appointed SC Garg Committee for suggestions. The committee recommended banning cryptocurrencies and allow an official digital currency. Further, the committee also drafted a bill Banning of Cryptocurrency & Regulation of Official Digital Currency Bill.

PS : Read more about the National Digital Currency issue in this article

Type your email…

Search Articles

Prelims 2024 current affairs.

- Art and Culture

- Indian Economy

- Science and Technology

- Environment & Ecology

- International Relations

- Polity & Nation

- Important Bills and Acts

- International Organizations

- Index, Reports and Summits

- Government Schemes and Programs

- Miscellaneous

- Species in news

Post-Mains Strategy Session by Mr. Ayush Sinha | ForumIAS

- IAS Preparation

- UPSC Preparation Strategy

Money Supply

The money supply is the total amount of money(currency+deposit money) present in an economy at a particular point in time. The standard measures to define money usually include currency in circulation and demand deposits.

The record of the total money supply is kept by the Central Bank of the country. The change in the supply of money in an economy can affect the price level of securities, inflation , rates of exchange, business policies, etc.

This is an important topic for the IAS exam . In this article, aspirants can find information related to the money supply in an economy.

Money Supply (UPSC Notes):- Download PDF Here

Aspirants would find the article very helpful in their preparation for the UPSC 2022 examination.

Money Supply – Latest Updates

According to recent Reserve Bank of India data, the uncertainty caused by the Covid-19 pandemic has led to a surge in the money supply. Know in detail about the Reserve Bank of India – RBI on the linked page. The currency held by the public increased by 8.2% since March-end 2020 and the savings and current account deposits decreased by 8%.

- The reason for this increase in Money supply is that there were higher cash withdrawals by depositors to meet needs during the lockdown period and also to safeguard themselves against salary cuts or job losses.

- People have curtailed their discretionary spending as they’re not sure of their permanent income.

- A rise in money supply usually is seen as a leading indicator of growth in consumption and business investments, but due to the Covid-19 pandemic, the rise did not encouraged either.

- Due to the decrease in discretionary spending the demand for industrial and manufactured goods alos decreased, therefore even the Lenders are not willing to take risks.

Types of Money

The types of money circulated in an economy are as follows:

Full-bodied money

It is the type of money whose value as money is equivalent to its value as a commodity. E.g. – Gold coin

Token Money/Credit Money/Paper Money

Value as money is much more than the value as a commodity. E.g. – Paper Currency

Representative full-bodied money

It is a kind of token money but is issued against the backing of equivalent value of bullion (gold and silver in bulk) with the issuing authority.

To know about the different monetary systems in the economy, refer to the linked article.

Monetary aggregates Concept – Money Supply

Types of bank deposits

- Current Account

- Fixed deposit

- Recurring deposit account

M1 = C + DD + OD (Narrow Money)

- Where C denotes Currency held by the public

- DD- Demand Deposits with Banks

- OD- Other deposits (Demand Deposits held by RBI)

Demand Deposits (DD) can be withdrawn on demand from banks.

Time Deposits (TD) can be withdrawn only after a specific time.

Total Deposits = DD+TD

Other deposits(OD) include demand deposits with the RBI.

DD with RBI can be held only by Quasi- Governmental agencies, international agencies, or former Governors of RBI.

M1 is known as narrow money as it includes only 100% liquid deposits which is a very narrow definition of the money supply.

M2 includes M1 and only saving account deposits with Post offices

M2 = M1 + Savings account deposits with Post Offices

Note- Post offices have no facility for the opening of current accounts. The types of accounts that can be opened are – Savings account, Fixed deposit, and Recurring deposit.

Though the size of post office saving accounts is negligible M2 term is used as all the deposits in M2 are not liquid.

M3 is called Broad money as along with liquid deposits it also includes time deposits thus making it a broad classification of Money.

M3 = M1 + TD (Broad Money)

TD – Time Deposits with Banks Includes fixed deposits, Recurring deposits, and time liability of Savings accounts

The most common measure used for money supply is M3

M4 = M3 + Total Deposits with Post Office

As the total deposits with the post office are negligible there is not much difference between M3 and M4

Money Supply Control

The money supply in the economy can be influenced by the Central Bank of the country. The money supply can be increased in an economy by purchasing government securities such as treasury bills and government bonds.

The reverse happens when the central bank tightens the money supply, by selling securities on the open market, drawing liquid funds out of the banking system. The prices of such securities fall as supply is increased, and interest rates rise.

Cash reserve ratio is an essential monetary policy tool used for controlling the money supply in the economy. It is a regulation implemented in almost every nation by the Central Bank of that country.

Related Links:

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

IAS 2024 - Your dream can come true!

Download the ultimate guide to upsc cse preparation, register with byju's & download free pdfs, register with byju's & watch live videos.

- Our Selections

- About NEXT IAS

- Director’s Desk

- Advisory Panel

- Faculty Panel

- General Studies Courses

- Optional Courses

- Current Affairs Program (CA-VA)

- Mentorship Program (AIM)

- Interview Guidance Program

- Postal Courses

- Prelims Test Series

- Mains Test Series (GS & Optional)

- ANUBHAV (All India Open Mock Test)

- Daily Current Affairs

- Current Affairs MCQ

- Monthly Current Affairs Magazine

- Previous Year Papers

- Down to Earth

- Kurukshetra

- Union Budget

- Economic Survey

- Download NCERTs

- NIOS Study Material

- Beyond Classroom

- Toppers’ Copies

- Student Portal

TABLE OF CONTENTS

Monetary policy in india: meaning, types, tools & more.

Monetary Policy in India is the lifeblood of India’s economy. As a critical economic management tool, it helps the RBI and the Government to control the supply of money, manage inflation, and achieve economic stability. This article of NEXT IAS aims to study in detail the Monetary Policy in India, its meaning, types, the process of formulation, major tools used therein, and other related concepts.

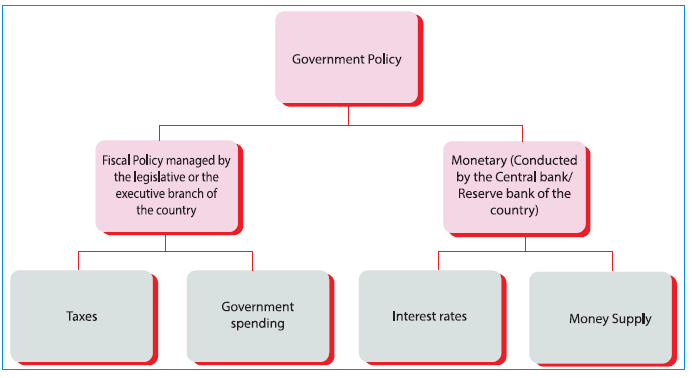

What is Monetary Policy?

It is a macroeconomic policy tool used by the Central Bank to influence the money supply in the economy to achieve certain macroeconomic goals. It involves the use of monetary instruments by the central bank to regulate the availability of credit in the market to achieve the ultimate objective of economic policy.

Objectives of Monetary Policy

Some of its major objectives are as follows:

- Accelerating the growth of the economy.

- Maintaining price stability.

- Generating employment.

- Stabilizing the exchange rate.

Monetary Policy vs Fiscal Policy

The two policies differ in various respects as can be seen below.

Types of Monetary Policy

Broadly, there are two types of monetary policy – Expansionary Monetary Policy, and Contractionary Monetary Policy.

What is Expansionary Monetary Policy?

- It is also called Accommodative Monetary Policy.

- Decreasing interest rates – It makes it less expensive for consumers to borrow money, thus increasing the money supply in the market.

- Lowering reserve requirements for banks – It leaves commercial banks with more money to lend to the public, thus infusing more money into the economy.

- Purchasing government securities by central banks – The RBI buys government securities by paying cash. This means that money available in the market increases.

- It is aimed at fueling economic growth by stimulating business activities and consumer spending and also helps to lower unemployment rates.

- However, it may have an adverse effect of occasional hyperinflation.

What is Contractionary Monetary Policy?

- Raising interest rates – It makes it more expensive for consumers to borrow money, thus reducing the money supply in the market.

- Increasing the reserve requirements for banks – It leaves commercial banks with less money to lend to the public, thus reducing the money supply in the economy.

- Selling government bonds – The buyers of government securities pay cash to the RBI. This means that money available in the market decreases.

- It is aimed at reducing inflation.

Monetary Policy in India

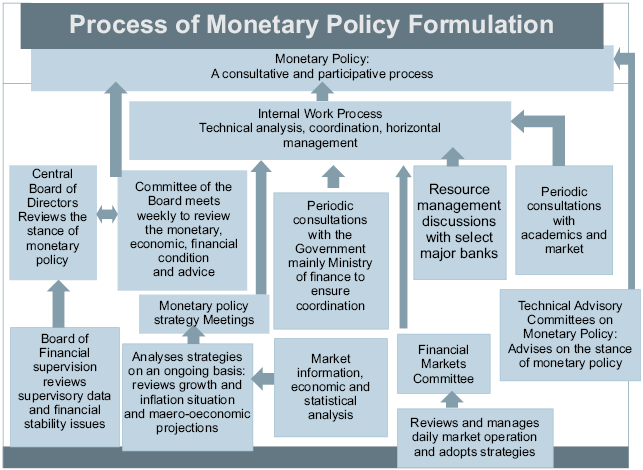

In India, the Reserve Bank of India Act of 1934 explicitly mandates the Reserve Bank of India (RBI) with the responsibility of formulating the monetary policy for the country. The process of monetary policy formulation in India underwent a paradigm shift in the year 2016 as explained below.

Prior to the year 2016, the Governor of RBI was singularly responsible for the formulation of monetary policy in India. Although the Governor was advised by a Technical Committee, but he could veto decisions.

- At present, monetary policy in India is formulated by this committee.

Monetary Policy and Inflation in India – Flexible Inflation Target (FIT) Framework

- In 2015, the RBI and the Center entered into a Monetary Policy Framework Agreement that stipulated a primary objective of ensuring price stability while keeping in mind the objective of growth.

- Accordingly, the Reserve Bank of India Act, of 1934 was amended and the Flexible Inflation Target (FIT) was adopted in 2016 to establish a liaison between monetary policy and inflation in India.

Prominent Provisions

- The inflation target is set by the Center, in consultation with the RBI, once every 5 years.

- For the period 2021-25, the inflation is to be kept in the range of 4 (+/-2) percent.

- The Headline Consumer Price Inflation has been chosen as a key indicator.

Pros of Flexible Inflation Targeting (FIT)

- Rising prices create uncertainties and adversely affect savings and investments. By keeping inflation in check, it aims to bring more stability, predictability, and transparency in deciding major policies.

- To make the RBI more accountable to the government if it fails to meet the inflation targets.

Cons of Flexible Inflation Targeting (FIT)

Fixed inflation targets restrain the RBI from taking any tight policy stance.

Monetary Policy Committee (MPC)

- The idea to set up MPC was mooted by an RBI-appointed Urjit Patel Committee.

- Section 45ZB of the amended RBI Act, 1934 provides for an empowered 6-member Monetary Policy Committee (MPC).

- The Committee is to meet at least 4 times a year.

- The Committee will have 6 members.

- The members of MPC shall hold office for a period of 4 years and shall not be eligible for re-appointment .

- The quorum for a meeting of the MPC is 4 members.

- The RBI Governor will have a casting vote in case of a tie

Composition of MPC

- RBI Governor – Chairperson

- RBI Deputy Governor in charge of monetary policy,

- One official nominated by the RBI Board,

- the Cabinet Secretary

- the Secretary of the Department of Economic Affairs

- the RBI Governor, and

- three experts in the field of economics or banking as nominated by the Central Government.

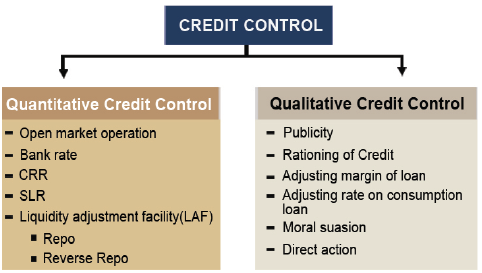

Monetary Policy Tools in India

Various instruments used by the RBI to control the money supply can be categorized into two categories:

- Quantitative Tools – Quantitative tools of monetary policy are aimed at controlling the cost and quantity of credit.

- The qualitative measures do not regulate the total amount of credit created by commercial banks. Rather, they make a distinction between good credit and bad credit and regulate only such credit which creates economic instability. Therefore, qualitative measures are known as the selective measures of credit control.

Quantitative Tools of Monetary Policy

Major instruments coming in this category are explained below:

Bank Rate or Discount Rate

- Bank Rate or Discount Rate is the rate at which the RBI is ready to buy or rediscount Bills of Exchange or other Commercial Papers from the Scheduled Commercial Banks (SCBs).

- If the RBI fixes a high Bank Rate, banks would not want to rediscount bills from the RBI as their profits will be low. This will have the effect of reducing the money supply in the market.

- Thus, an increase in the Bank Rate results in a tightening of money supply and vice versa.

Reserve Requirements

The reserve requirement or required reserve ratio is a bank regulation that sets the minimum reserves each bank must hold as a part of the deposits.

It comprises two instruments:

Cash Reserve Ratio (CRR)

- Cash Reserve Ratio (CRR) is the minimum percentage of a bank’s total Demand and Time Liabilities (DTL) that a Scheduled Commercial Bank is obligated to deposit with the RBI in the form of cash.

- RBI does not pay any interest on CRR deposits.

- If CRR is increased : If the RBI increases the CRR, the commercial banks have to deposit more money with the RBI and are left with less money to lend to customers. Thus, the effect is reduced money supply in the economy.

- If CRR is decreased : If the RBI decreases the CRR, the commercial banks have to deposit less money with the RBI and are left with more money to lend to customers. Thus, the effect is increased money supply in the economy.

Statutory Liquidity Ratio (SLR)

- SLR Securities (such as government bonds, treasury bills, and any other instrument notified by the RBI), or

- Any combination of the above three.

- Unlike the CRR, SLR need not be deposited with RBI.

- If SLR is increased: If the RBI increases the SLR, the commercial banks are left with less money to lend to customers. Thus, the effect is reduced money supply in the economy.

- If CRR is decreased : If the RBI decreases the SLR, the commercial banks are left with more money to lend to customers. Thus, the effect is increased money supply in the economy.

- If the shortfall continues for the next succeeding day, penal interest is to be paid at (Bank Rate + 5%).

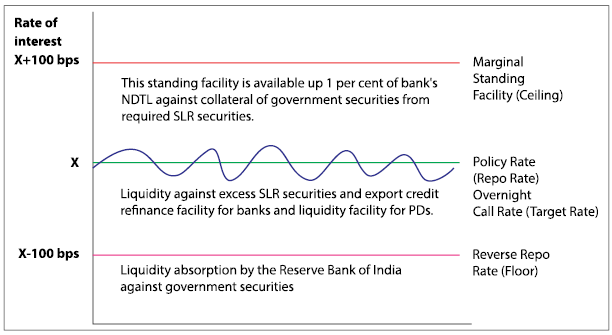

Liquidity Adjustment Facility (LAF)

- Liquidity Adjustment Facility (LAF) allows banks to borrow money from the RBI through repurchase agreements (repos) or to make loans to RBI through reverse repo agreements.

- It is aimed to aid banks in adjusting the day-to-day mismatches in liquidity.

- It comprises the following 2 sub-instruments:

Repo Rate (Re-purchase Option Rate)

Repo Rate is the rate of interest at which the RBI provides short-term loans to SCBs against approved securities.

Reverse Repo Rate

Reverse Repo Rate is the rate of interest at which the RBI borrows funds from the SCBs. In other words, it is the rate at which SCBs park their excess funds with the RBI for a short period of time.

Marginal Standing Facility (MSF)

- This facility was introduced by the RBI in 2011 on the basis of the recommendations of the Narasimhan Committee on banking sector reforms.

- Under this, all the SCBs having current accounts with the RBI can avail of an overnight short-term loan of up to 1% of their Net Demand and Time Liabilities (NDTL) outstanding at the end of the second preceding fortnight, against Government Securities as collateral.

- This facility is like the penal rate at which banks can borrow money from the central bank over and above what is available to them through the LAF window.

- MSF being a penal rate, the rate of interest under MSF is 25 basis points (0.25%) above the Repo Rate.

- Amounts in multiples of ₹1 crore (with a minimum amount of ₹1 crore) can be accessed through MSF.

Comparison among MSF, Repo Rate and Reverse Repo Rate

MSF represents the upper band of the interest corridor, and Reverse Repo Rate is the lower band . The Repo Rate stands in the middle and acts as an anchor rate.

Open Market Operations (OMOs)

- Open Market Operations (OMOs) refer to the buying and selling of government securities by RBI to regulate the short-term money supply.

- If RBI wants to induce liquidity or more funds in the system, it will buy government securities and inject funds into the system.

- On the other hand, if the RBI, wants to curb the amount of money in the system, it will sell government securities to the banks thereby reducing the amount of cash that banks have.

Market Stabilization Scheme (MSS)

- Market Stabilization Scheme (MSS) refers to intervention by the RBI to withdraw excess liquidity by selling government securities in the economy.

- This withdrawal of excess liquidity is called sterilization .

- The securities issued under the MSS are, basically, government bonds and are called Market Stabilization Bonds (MSBs).

- Since October 2013, the RBI has introduced Term Repos (of different tenors, such as 7/14/28 days), to inject liquidity over a period that is longer than overnight.

- The aim of Term Repo is to help develop an inter-bank money market, which in turn can set market-based benchmarks for the pricing of loans and deposits, and through that improve the transmission of monetary policy.

Qualitative Tools of Monetary Policy

Major instruments coming in this category are explained below

Margins Requirements

- Margin refers to the difference between the value of securities offered for loans and the value of loans actually granted.

- If RBI wants to control the flow of credit to a particular sector, it fixes a high margin for that sector. As a result, customers will take lesser loans for that sector.

Consumer Credit Regulation

- Credit made available by commercial banks (installments) for the purchase of consumer durables is known as consumer credit.

- increasing down payment, and/or

- reducing the number of installments of repayment of such credit.

Moral Suasion

- Moral Suasion means persuasion and request.

- RBI makes the banks adhere to the policy and directives through persuasion or pressure in order to maintain a certain level of money supply in the economy.

Direct Action

The RBI takes direct action such as refusing to rediscount the bills or charging penal interest rates, etc when a commercial bank does not co-operate with the central bank in achieving its desirable objectives.

Rationing of Credit or Credit Ceiling

Under this, the RBI fixes a ceiling on the amount of loans that can be granted by SCBs. As a result, SCBs tighten in advancing loans to the public.

Priority Sector Lending

Under this, the RBI prescribes the banks to provide a specified portion of the bank lending to a few specific sectors like agriculture and allied activities, micro and small enterprises, poor people for housing, etc.

Significance of Monetary Policy

- It plays an important role in maintaining price stability and ensuring economic growth.

- By maintaining price stability, it helps manage inflation.

- It shapes variables like Consumption, Savings, Investment, and capital formation.

- An increase in the money supply helps to stimulate the business sector, which also helps to create more jobs.

- By controlling the money supply in the market, it helps balance Currency Exchange Rates.

Limitations of Monetary Policy in India

- Unfavorable Banking Habits : People in India prefer to make use of cash rather than make transactions through banks. This reduces the credit creation capacity of the banks.

- Underdeveloped Money Market : The weak money market limits the coverage as well as the efficient working of the RBI’s policy actions.

- Existence of Black Money : Black money is not recorded since the borrowers and lenders keep their transactions secret. Consequently, the supply and demand of the money also do not remain as desired.

- Conflicting Objectives : Ensuring economic development requires expansionary policy measures, whereas curbing inflation requires contractionary policy measures. Striking a proper balance between these two objectives becomes difficult.

- Limitations of Monetary Instruments : There are several kinds of interest rates in India. Influencing them all appropriately becomes very difficult as most of the monetary policy instruments available in India have some or other kinds of limitations.

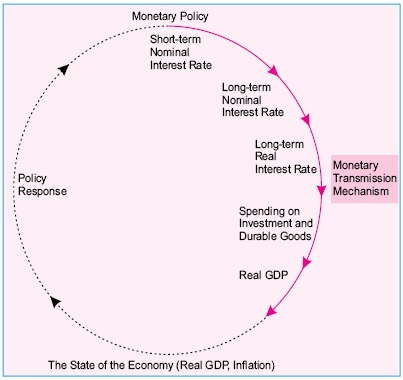

Monetary Policy Transmission

- It refers to the process by which the Central Bank’s actions to control the money supply (such as a change in the Repo Rate) are transmitted to the final objectives of stable inflation and growth.

- It involves the entire process starting from the change in the Policy Rate ( such as the Repo Rate) by the RBI, its response in the financial markets, and the ultimate effect on businesses and households.

- As the Repo Rate brings changes in the market interest rate, the Repo Rate Channel is often referred to as the Interest Rate Channel of Monetary Policy Transmission.

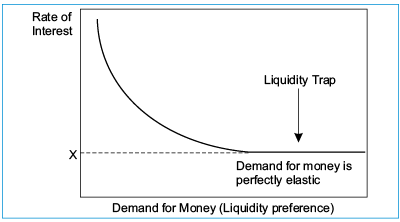

Liquidity Trap

- Liquidity Trap is an adverse economic situation that occurs when consumers and investors prefer to hold onto their cash rather than spend or invest them, even when interest rates are low.

- A Liquidity trap emerges when interest charges are nil or during a downturn. In such a situation, people are afraid to spend money, hence they feel safe to hold onto the cash. As a result, even expansionary policy measures fail to increase the interest rate, income, and economic growth.

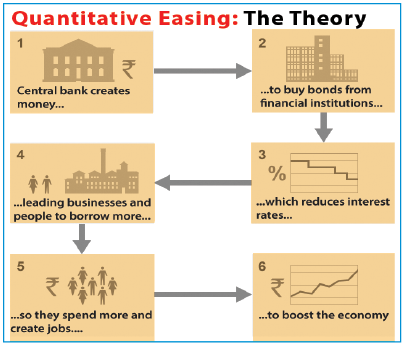

Quantitative Easing (QE)

- Quantitative Easing (QE) refers to the Central Bank’s action of purchasing securities from the open market to reduce interest rates and increase the money supply.

- It is aimed to create new bank reserves, providing banks with more liquidity, and encouraging lending and investment.

Sterilization

It refers to the process by which the RBI takes away money from the banking system to neutralize the fresh money that enters the system.

Inflation Targeting

- It is a central banking policy that revolves around adjusting monetary policy to achieve a specified annual rate of inflation.

- The principle of inflation targeting is based on the belief that long-term economic growth is best achieved by maintaining price stability, and price stability is achieved by controlling inflation.

- Broadly, there are two types of Inflation Targeting:

Strict Inflation Targeting

Under Strict Inflation Targeting, the central bank is only concerned about keeping inflation as close to a given inflation target as possible, and nothing else.

Flexible Inflation Targeting

Under Flexible Inflation Targeting, apart from keeping inflation within the target range, the central bank is also concerned about other things, such as the stability of interest rates, exchange rates, output, and employment.

Monetary Policy in India plays a pivotal role in stabilizing the economy and fostering a conducive environment for sustainable growth. The dynamic nature of the global economy, internal structural constraints, and the complex interplay between fiscal and monetary policies mean that constant vigilance and adaptability are required to navigate the path ahead. As India continues to develop and integrate further into the global economy, the formulation and implementation of monetary policy will remain a key area of focus for policymakers.

FAQs on Monetary Policy in India

Who controls monetary policy in india.

The RBI Act of 1934 explicitly mandates the Reserve Bank of India (RBI) with the responsibility of controlling the monetary policy for the country.

Who formulates Monetary Policy in India?

At present, monetary policy in India is formulated by the Monetary Policy Committee (MPC), which was set up by an amendment in the RBI Act of 1934 through the Finance Act of 2016.

What is the Function of Monetary Policy in India?

Its most important function is to control the supply of money in the market. Along with this, it also ensures the growth of the economy and price stability.

What is the Monetary Policy Framework Agreement?

It is an agreement signed between the RBI and the Center in 2015, the primary objective of which is to ensure price stability while accelerating economic growth.

Latest Article

हिन्द महासागर द्विध्रुव (IOD): विशेषताएं, प्रभाव और अन्य जानकारी

Anglo-Sikh Wars in India

Anglo-Maratha Wars in India (1775-1819)

Stealth Technology

Nuclear Technology (Basic Concepts)

Aircraft Carriers: About, History & More

Explore Categories

- Art and Culture

- Disaster Management

- Environment and Ecology

- Important Days

- Indian Economy

- Indian Polity

- Indian Society

- Internal Security

- International Relations

- Science and Technology

Subscribe to our Newsletter!

IMAGES

VIDEO