- +91-9556432150

- [email protected]

Business Area in SAP – A Detailed Overview & Set of Questions

Published by pradeep on october 22, 2022 october 22, 2022, business area in sap.

The Business Area in SAP is the highest organizational cost structure unit. You can specify it either as per Functional lines, Product lines or as per responsibilities assigned region-wise.

Below are some quick questions that may help you understand this term better. you can also read them to prepare for your SAP FICO job interviews .

A Business Area in SAP corresponds to specific business segments of a company and may cut across different Company Codes (Product Lines). They can further represent various responsibility areas, such as Branch Units, plant engineering, automotive, etc. Also, its configuration is optional (not mandatory).

‘0001- Plant engineering

‘0002- Automotive

Use of Business Area in SAP

Business areas we primarily use to facilitate external segment reporting across company codes , covering the company’s main areas of operation (product lines, subsidiaries).

Assign Balance Sheet Items

You can assign all balance sheet items, such as fixed assets, receivables , payables, material stock, and the entire P/L statement directly to business areas. You should assign banks’ capital and taxes only manually (indirectly) to business areas, not directly for this reason. Although, it is impossible to create legally-required financial statements, tax, and tax reports at the business areas level. Balance sheets and P/L statements at the business area level only are suitable for use in internal reporting.

Create a Balance sheet and P & L

To be able to create a balance sheet and P/L statement, we need to update the data for each business area in the transaction figures in the general ledger. Therefore, we have two different procedures to do this.

Procedure 1

When posting the original document, the system supplies the business area with the proper information.

You create a customer invoice. The system can allocate the sales revenue to exactly one business area. The receivables inherit this business area.

When we make an adjustment posting in the general ledger in a second step, the system changes the business area used in the original posting to the correct value. Particularly when we didn’t enter the initial value. This may sometimes distribute the posting to several business areas.

Procedure 2

You create a customer invoice. The system must allocate the sales revenue to several business areas. We post the receivables without a business area and make a transfer posting for the receivable in a second step.

After splitting

Business area in sap general ledger accounting, automatic/manual assignment.

You cannot directly assign G/L account master data to a business area. You must enter the business area either manually or derive from that entered in the CO account assignment object.

Though we have certain business transactions for which automatic procedures exist. These analyze documents/ transaction figures in the system and use them to create new documents (Foreign Currency valuation). Subsequently, they assign the line items generated to the business areas entered in the documents/transaction figures that were read.

Business Area in SAP Asset Accounting

This section describes the role played by the “business area” organizational unit within Asset Accounting .

Automatic/Manual Account Assignment

The system allocates Assets to a single business area in its master record. Further, it automatically posts every posting to an asset balances sheet account in that business area. Consequently, the business area for an asset is passed on to all line items connected with the asset. Therefore, you do not need to make a manual assignment to a business area at any point.

Asset Dr -UN1- 5000

Vendor Cr- UN1-5000

Depreciation

The asset balance is reduced by the depreciation amount in the value adjustment (accumulated depreciation) account with the business area of the asset. Also, the expense line items receive the business area of that asset.

Asset Retirement (Scrapping)

Here the system clears the asset amount and any existing depreciation with the business area of the asset. It assigns the asset’s business area to the expenses line item.

Business Area in Accounts Receivable and Accounts Payable

This segment describes the role played by the “Business area “organizational unit within the Accounts Payable and Accounts Receivable systems.

You cannot allocate customer or vendor master records to a business area. Thus, you usually determine the business area from the business area allocated to the related G/L account posting and do not need to enter it manually.

The business area for G/L account items has to be either manually entered or derived from the SAP CO allocation object that you enter.

How Business Area in SAP works for an invoice?

In an invoice, the customer/vendor item takes the business area of the expenses or revenue postings. If the business area has been entered in the document, it is copied into the line item automatically.

However, if there is more than one business area in the document, the customer/vendor items remain unallocated. Also, a transfer posting is made at a later date to the receivables or payable account.

Furthermore, the system checks that any business area entered in the customer/vendor item is the same as that in the offsetting G/L account item and issues an error message if this is not the case.

In customizing, you can set the status of this message or even suppress it from display entirely.

Noteworthy, the taxes are always posted without a business area. Subsequently, at a later date, the system makes a transfer posting from the tax account to the business areas allocated to the revenue or expenses account.

Business Area in SAP for Payment

For customer/vendor items in payment documents, the procedure is the same as it is for the items in the invoice that they clear. Therefore, these items take the business area from the invoice.

Cash discount and exchange rate difference postings take their business area from the customer/vendor item they originated from. If this item was posted without a business area and then later has one specified via a transfer posting in the general ledger. You must make this allocation yourself retroactively for both the cash discount and exchange rate difference posting.

Bank items are currently posted without a business area (unless one is entered manually). There is also no standard function that allocates the bank items to the business area of the cleared customer/vendor items.

Business Area for Down payment

The system cannot automatically derive the business area of the underlying item with down payments since the invoice that belongs to the down payment is not entered until later.

The business area in the customer/vendor item from the invoice is therefore not entered automatically and has to be entered manually.

The bank item is currently posted without a business area. There is no standard function that allocates the bank item to the business areas of the customer/vendor items.

Business Area in SAP Cost Accounting

Automatic/ manual account assignment.

Account assignment objects in Cost Accounting are allocated to a single business area in the master record. When you post to an account assignment object in Cost Accounting, the system automatically determines the business area. You do not have to assign the posting to the business area manually.

Assessment, Distribution, Activity Allocation

Costs that have initially been allocated to an allocation object in Cost Accounting (default cost center) and therefore also to a default business area are later broken down by certain distribution keys to final recipients (such as cost centers). The allocation object is then relieved of the costs.

Business Area in SAP Material Management

Materials are assigned to a business area based on the combination of division and plant. Every time a material is posted, the relevant material stock account is automatically assigned to the business area belonging to that account.

The business area from the other line items is either (depending on the business transaction in question) derived from the account assignment object posted in Cost Accounting or from the material involved. You do not need to manually assign a business area.

Initial Entry of Stock Balances Goods/Invoices Received

The notable thing about the business transactions being examined here is that they generate a posting record that makes a posting to the material stock account (or the account representing this account) and whose offsetting posting has no business area in it. In this case, the offsetting item takes the business area from the material.

Additional, automatically-generated items that are directly linked to a certain material (price differences, exchange rate differences, freight charges) are also assigned to the same business area as the material.

The payable (vendor) is only allocated to a business area if there is one specified for the material. If more than one is specified in the invoice, the payable is posted without a business area.

Goods Receipt

Invoice receipt

Some Important Questions related to Business Area in SAP

How to draw financial statements in a business area in sap.

We draw Financial statements per business area for internal reporting purposes. It will help if you put a “tick mark in the check box in the configuration against the company for which you want to enable business area financial statements.

When we post transactions in SAP FI we can assign the same to a Business Area so that the system captures the values per business area for internal financial statements.

Can we attach “Business Area” to a Transaction by not assigning the same in a posting?

Yes, you can derive the business area from other account assignments, for example, cost center and Asset Master. We need to define the business area in the master record of Cost Center & Asset Master.

How to post Cross-Company Code Business Area posting?

Using a Cross Company code transaction, one should be able to post to different Business Areas cutting across various Company Codes. Also, any number of Business Area-Company code combinations are possible.

Why do you need to know this?

Though the Business Area in SAP is an optional setting in FICO or S/4HANA Finance , it is essential for a consultant to have good knowledge. This is because a company may demand it in their plant or business to configure. Secondly, it is part of the Cost Structure which is a must-have skill for SAP Functional-consultants. Hence, this is when you must possess relevant skills to work on it.

Additionally, you may have questions on business areas in SAP Finance Interviews . You should have a good configuration knowledge of the business area in SAP in order to perform the task that your client delegated.

Visit Course Page: SAP S4 HANA FICO Training

Related Posts

Tax on Sale Purchase in SAP S/4HANA

SAP S/4 HANA covers the business processes like Procure-to-Pay, Order-to-Cash and record-to-report. To understand the functioning of tax on sale purchase in SAP we need to know all tax-relevant steps within the end-to-end scenarios. Additionally, Read more…

SAP New GL Activation & Migration Process

SAP New GL Activation and Migration From Classic GL During a new installation, the New G/L accounting in the standard system is set to active. While the use of classic General Ledger is theoretically also Read more…

SAP Order to Cash & its Process Flow

SAP Order-To-Cash The SAP order to cash process is used for processing the business’s sales orders for goods and services. It manages the company’s receivables and accumulates the relevant payments from its customers. This is Read more…

Blog about all things SAP

ERProof » SAP CO » SAP CO Training » SAP Business Area

SAP Business Area

In some cases, organizations opt for using profit centers for the type of reporting satisfied by Business Areas. However, profit center use is more for analyzing the profitability of specific products, whereas Business Areas are more intended to report on the type of Business.

SAP Business Area Configuration

Configuration of SAP Business area is straightforward and generally requires just two steps – creation of the SAP business area and activating it for use across financial statements.

To create a new business area, use transaction code OX03 or follow menu path:

SPRO > Reference IMG > Enterprise Structure > Definition > Financial Accounting > Define Business Area

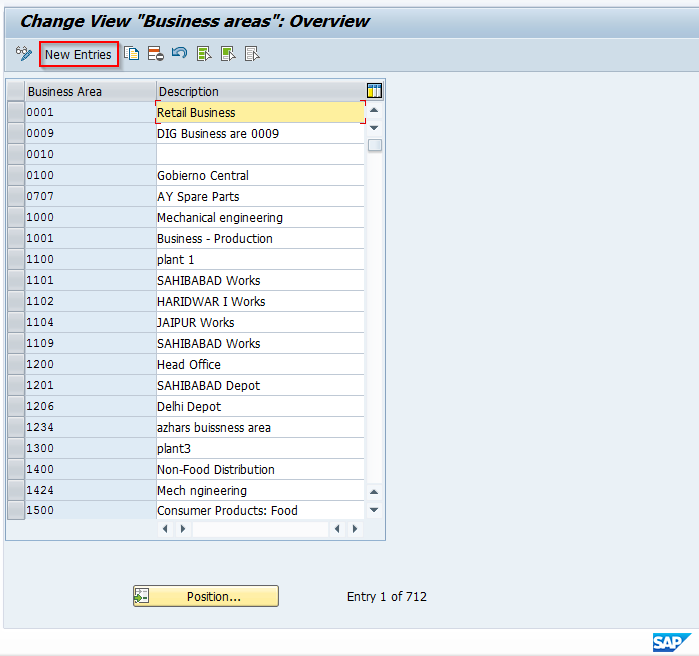

You will be taken to a screen that appears as follows. Click on the New entries button on the menu.

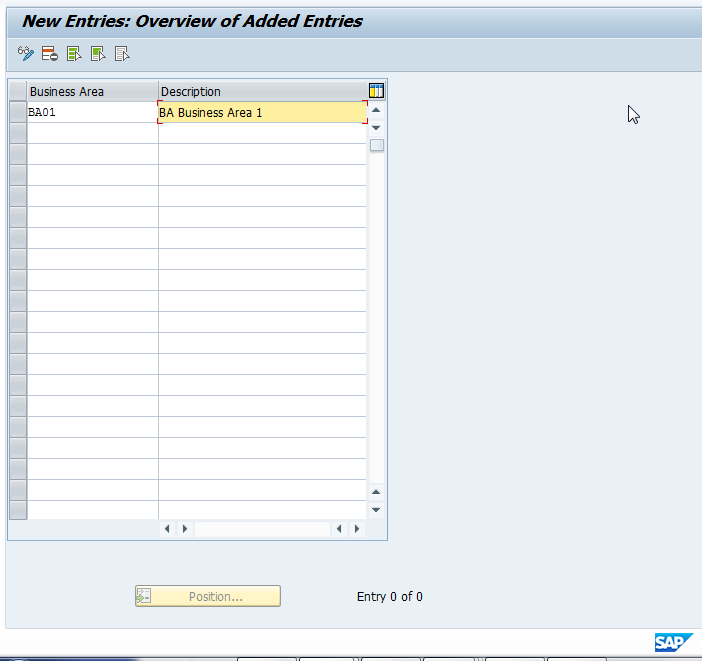

Add a four-characters value for the name of your new business area entry and give it a meaningful description. An example may look as follows:

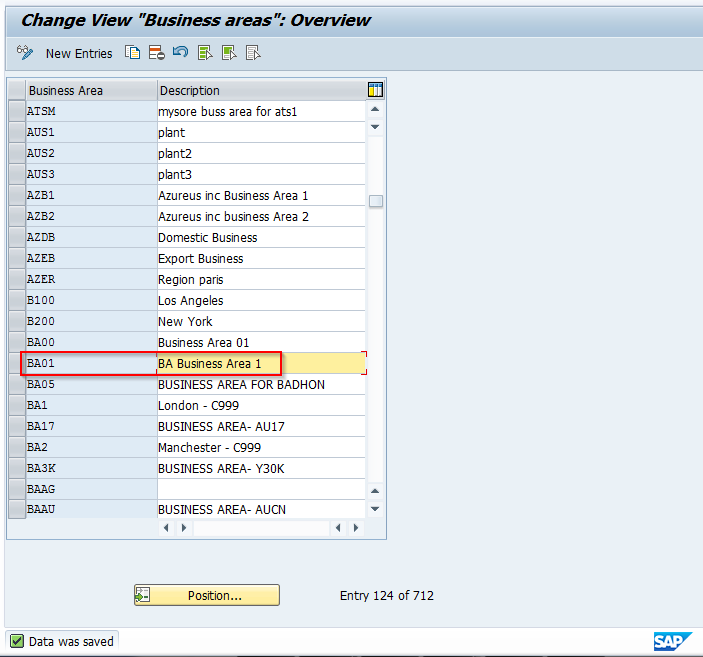

Save your entry and create a new transport request if required by your system. SAP Business Area has now been created and is available in the list of values.

Activation of SAP Business Area

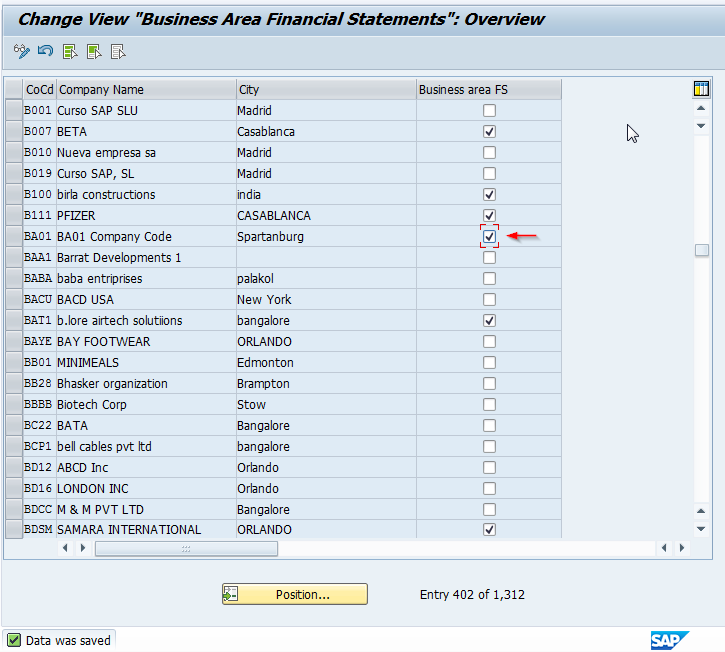

The next step is to activate the business area functionality within company codes you will using them. If you have several company codes that will be using business area functionality for financial statements, make the setting here so that the field is always ready for input when you post documents, regardless of other field controls.

To activate, use transaction code OB65 , or follow menu path:

SPRO > SAP Reference IMG > Financial Accounting > Financial Accounting Global Settings > Business Area > Enable Business Area Balance Sheet

The screen will look as follows. Scroll to the company codes that will be using the business area functionality and select the Business Area FS check box for each.

A business area has now been created and company codes that will be using it have been activated to ensure field input is always available.

Assignment in Master Data

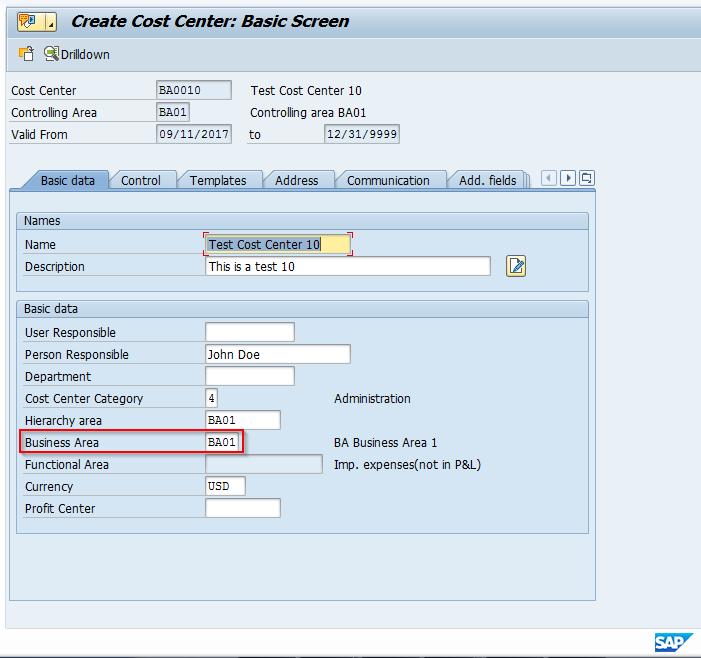

SAP Business Areas are most often populated from master data records in which they are assigned. An example would be the assignment of SAP business area within a cost center master record. Let’s take a look at where on a cost center this would be done.

To create a cost center, use transaction KS01 or follow the menu path:

SAP Easy Access Menu > Accounting > Controlling > Cost Center Accounting > Master Data > Cost Center > Individual Processing > Create

Create a cost center with a unique ID, assign a validity date range, and hit the enter key. You will come to the basic data tab for the cost center creation. Enter all required fields as well as the business area. Note that the business area is time dependent and can be changed at each new fiscal year, if required.

The screen will appear as follows:

Enter any of the other required information on other tabs and save your master record. The cost center has now been created with the business area field populated.

This tutorial explained the concept of SAP Business Area within the FI – CO organizational structure. A brief explanation of the functionality was given, the configuration steps required were reviewed including creation and activation of SAP Business Area on a company code, and finally assignment to a master data record was completed.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Operating Concern

Go to previous lesson: SAP Controlling Area

Go to overview of the course: Free SAP CO Training

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Management Accounting: Explore SAP Cost Center and Internal Order Accounting

.png&w=3840&q=75)

This session will cover the topic of Cost Center Accounting a sub module of Management Accounting. Participants will learn to use the fundamental business processes and tasks of Cost Center and Internal Order Accounting with SAP S/4HANA. Participants will gain the mandatory foundation knowledge required in order to understand and configure business processes for SAP S/4HANA in the areas of cost center and internal order master data maintenance. This session will expand on the content in the learning journey covering additional features and functionality in the area of Product Costing.

Learning objectives

Your current experience in this topic.

Intermediate

Discover new Live Sessions

IMAGES

VIDEO

COMMENTS

For internal accounting, you generally need to assign asset costs to cost centers. Therefore, you can assign each asset in Asset Accounting to exactly one cost center. You make this assignment in the asset master record. At the level of the cost center, you can then. Post all depreciation and interest for the asset (see System Settings for ...

A cost center can also be assigned to a business area as can an asset. In asset master record maintenance, therefore, the system ensures that the business area of the cost center matches the business area of the asset. If you assign assets to more than one cost center at the same time, you have to:

Business Area in SAP Cost Accounting Automatic/ Manual Account Assignment. ... Yes, you can derive the business area from other account assignments, for example, cost center and Asset Master. We need to define the business area in the master record of Cost Center & Asset Master.

Assignment in Master Data. SAP Business Areas are most often populated from master data records in which they are assigned. An example would be the assignment of SAP business area within a cost center master record. Let's take a look at where on a cost center this would be done. To create a cost center, use transaction KS01 or follow the menu ...

The cost center is master data in a CO area that represents a delimited location where costs occur. You can use cost centers for differentiated assignment of overhead costs to organizational activities based on utilization of the relevant areas (cost determination function), and for differentiated controlling of costs arising in an organization (cost controlling function).

Cost Center. A cost center is an organizational unit that represents the location where costs are incurred. Typical cost centers include, for example, a company's accounting department, the information technology (IT) department, and marketing. What you might be familiar with as the department of a company may be split into multiple cost ...

A. Yes, It is always possible to assign another Cost Center to the sub-object, in your case, the Position. This is done through the Account Assignment Infotype (1008). Cost center gets inheritance from the root object...therefore, if you do not assign any cost center to the position, it will pick up the cost center of the Org unit in your case. Q.

Lesson Overview. In this lesson, we will introduce the areas of Management Accounting supported by SAP S/4HANA. You will then be able to explain the importance of using various cost assignment objects to collect overhead costs in multiple valuations. In your company, your costs need to be monitored regularly and efficiently.

I have Business Areas assigned to all Cost Centers. This assignment needs to be changed during fiscal year (i.e. since to ... Mark Your Calendars. Mark Your Calendars with these Important Dates. SAP Community is moving in January 2024! ... Search Questions and Answers . 0. Robert Ostrowski. Feb 16, 2007 at 08:39 AM Cost Center assignment to ...

The replication of cost centers from Employee Central to SAP ERP HCM then cuts the concatenated string, using 4 characters as the controlling area key and 10 characters as the cost center key. If you make these settings, the assignment of cost centers in the replication doesn't require the cost center keys to be entered in the mapping tables.

Assignment Fields in Cost Center Master Data; Controlling (CO) 2023 Latest. Available Versions: 2023 Latest ; ... If you do not have an SAP ID, you can create one for free from the login page. ... Share. Table of Contents This page was not found. On this page. Company Code; Business Area; Profit Centers; Currency; Joint Venture;

The essential difference between a profit center and a business area is that profit centers are used for internal control, while business areas are more geared toward an external viewpoint. Business area and profit center can be used together because two of them are serving different purposes. Please assign points. Show replies.

Overview. This session will cover the topic of Cost Center Accounting a sub module of Management Accounting. Participants will learn to use the fundamental business processes and tasks of Cost Center and Internal Order Accounting with SAP S/4HANA. Participants will gain the mandatory foundation knowledge required in order to understand and ...