Last updated 27/06/24: Online ordering is currently unavailable due to technical issues. We apologise for any delays responding to customers while we resolve this. For further updates please visit our website: https://www.cambridge.org/news-and-insights/technical-incident

We use cookies to distinguish you from other users and to provide you with a better experience on our websites. Close this message to accept cookies or find out how to manage your cookie settings .

Login Alert

- > Doing Interview-based Qualitative Research

- > Designing the interview guide

Book contents

- Frontmatter

- 1 Introduction

- 2 Some examples of interpretative research

- 3 Planning and beginning an interpretative research project

- 4 Making decisions about participants

- 5 Designing the interview guide

- 6 Doing the interview

- 7 Preparing for analysis

- 8 Finding meanings in people's talk

- 9 Analyzing stories in interviews

- 10 Analyzing talk-as-action

- 11 Analyzing for implicit cultural meanings

- 12 Reporting your project

5 - Designing the interview guide

Published online by Cambridge University Press: 05 October 2015

This chapter shows you how to prepare a comprehensive interview guide. You need to prepare such a guide before you start interviewing. The interview guide serves many purposes. Most important, it is a memory aid to ensure that the interviewer covers every topic and obtains the necessary detail about the topic. For this reason, the interview guide should contain all the interview items in the order that you have decided. The exact wording of the items should be given, although the interviewer may sometimes depart from this wording. Interviews often contain some questions that are sensitive or potentially offensive. For such questions, it is vital to work out the best wording of the question ahead of time and to have it available in the interview.

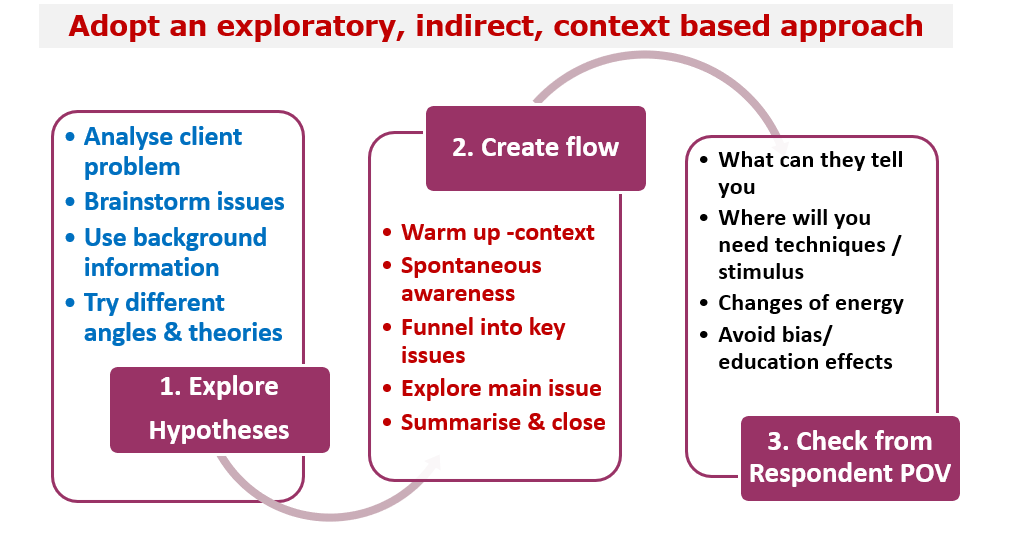

To study people's meaning-making, researchers must create a situation that enables people to tell about their experiences and that also foregrounds each person's particular way of making sense of those experiences. Put another way, the interview situation must encourage participants to tell about their experiences in their own words and in their own way without being constrained by categories or classifications imposed by the interviewer. The type of interview that you will learn about here has a conversational and relaxed tone. However, the interview is far from extemporaneous. The interviewer works from the interview guide that has been carefully prepared ahead of time. It contains a detailed and specific list of items that concern topics that will shed light on the researchable questions.

Often researchers are in a hurry to get into the field and gather their material. It may seem obvious to them what questions to ask participants. Seasoned interviewers may feel ready to approach interviewing with nothing but a laundry list of topics. But it is always wise to move slowly at this point. Time spent designing and refining interview items – polishing the wording of the items, weighing language choices, considering the best sequence of topics, and then pretesting and revising the interview guide – will always pay off in producing better interviews. Moreover, it will also provide you with a deep knowledge of the elements of the interview and a clear idea of the intent behind each of the items. This can help you to keep the interviews on track.

Access options

Save book to kindle.

To save this book to your Kindle, first ensure [email protected] is added to your Approved Personal Document E-mail List under your Personal Document Settings on the Manage Your Content and Devices page of your Amazon account. Then enter the ‘name’ part of your Kindle email address below. Find out more about saving to your Kindle .

Note you can select to save to either the @free.kindle.com or @kindle.com variations. ‘@free.kindle.com’ emails are free but can only be saved to your device when it is connected to wi-fi. ‘@kindle.com’ emails can be delivered even when you are not connected to wi-fi, but note that service fees apply.

Find out more about the Kindle Personal Document Service .

- Designing the interview guide

- Eva Magnusson , Umeå Universitet, Sweden , Jeanne Marecek , Swarthmore College, Pennsylvania

- Book: Doing Interview-based Qualitative Research

- Online publication: 05 October 2015

- Chapter DOI: https://doi.org/10.1017/CBO9781107449893.005

Save book to Dropbox

To save content items to your account, please confirm that you agree to abide by our usage policies. If this is the first time you use this feature, you will be asked to authorise Cambridge Core to connect with your account. Find out more about saving content to Dropbox .

Save book to Google Drive

To save content items to your account, please confirm that you agree to abide by our usage policies. If this is the first time you use this feature, you will be asked to authorise Cambridge Core to connect with your account. Find out more about saving content to Google Drive .

Chapter 11. Interviewing

Introduction.

Interviewing people is at the heart of qualitative research. It is not merely a way to collect data but an intrinsically rewarding activity—an interaction between two people that holds the potential for greater understanding and interpersonal development. Unlike many of our daily interactions with others that are fairly shallow and mundane, sitting down with a person for an hour or two and really listening to what they have to say is a profound and deep enterprise, one that can provide not only “data” for you, the interviewer, but also self-understanding and a feeling of being heard for the interviewee. I always approach interviewing with a deep appreciation for the opportunity it gives me to understand how other people experience the world. That said, there is not one kind of interview but many, and some of these are shallower than others. This chapter will provide you with an overview of interview techniques but with a special focus on the in-depth semistructured interview guide approach, which is the approach most widely used in social science research.

An interview can be variously defined as “a conversation with a purpose” ( Lune and Berg 2018 ) and an attempt to understand the world from the point of view of the person being interviewed: “to unfold the meaning of peoples’ experiences, to uncover their lived world prior to scientific explanations” ( Kvale 2007 ). It is a form of active listening in which the interviewer steers the conversation to subjects and topics of interest to their research but also manages to leave enough space for those interviewed to say surprising things. Achieving that balance is a tricky thing, which is why most practitioners believe interviewing is both an art and a science. In my experience as a teacher, there are some students who are “natural” interviewers (often they are introverts), but anyone can learn to conduct interviews, and everyone, even those of us who have been doing this for years, can improve their interviewing skills. This might be a good time to highlight the fact that the interview is a product between interviewer and interviewee and that this product is only as good as the rapport established between the two participants. Active listening is the key to establishing this necessary rapport.

Patton ( 2002 ) makes the argument that we use interviews because there are certain things that are not observable. In particular, “we cannot observe feelings, thoughts, and intentions. We cannot observe behaviors that took place at some previous point in time. We cannot observe situations that preclude the presence of an observer. We cannot observe how people have organized the world and the meanings they attach to what goes on in the world. We have to ask people questions about those things” ( 341 ).

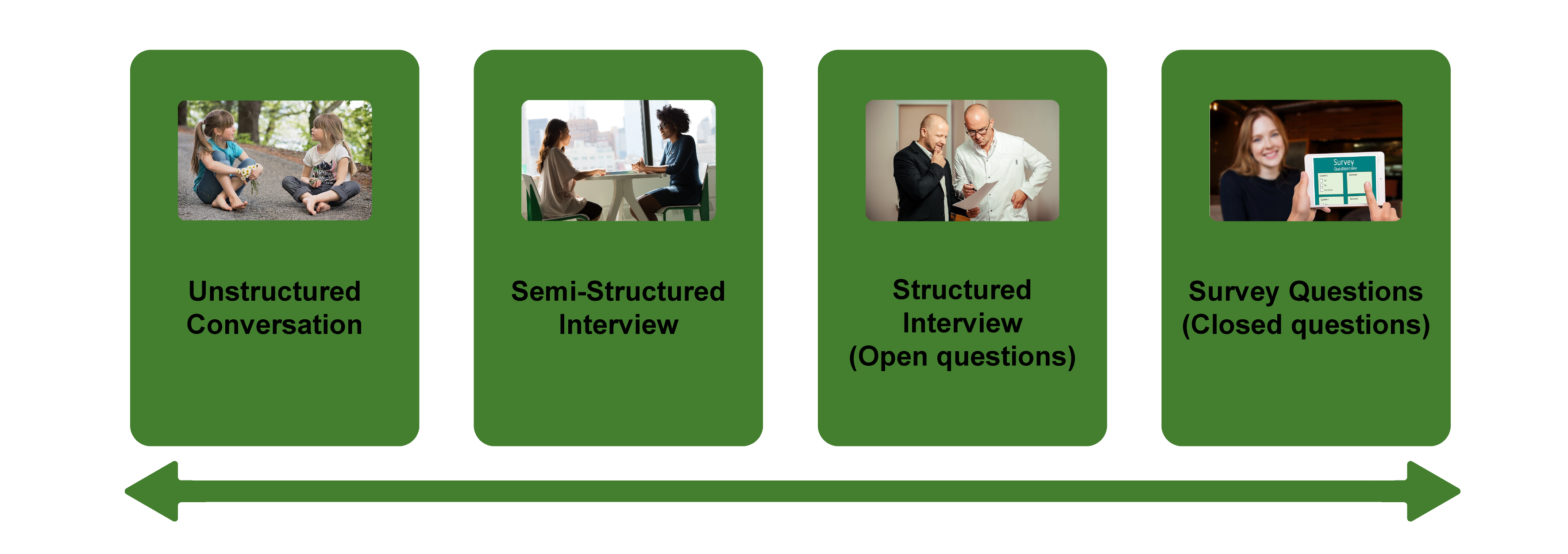

Types of Interviews

There are several distinct types of interviews. Imagine a continuum (figure 11.1). On one side are unstructured conversations—the kind you have with your friends. No one is in control of those conversations, and what you talk about is often random—whatever pops into your head. There is no secret, underlying purpose to your talking—if anything, the purpose is to talk to and engage with each other, and the words you use and the things you talk about are a little beside the point. An unstructured interview is a little like this informal conversation, except that one of the parties to the conversation (you, the researcher) does have an underlying purpose, and that is to understand the other person. You are not friends speaking for no purpose, but it might feel just as unstructured to the “interviewee” in this scenario. That is one side of the continuum. On the other side are fully structured and standardized survey-type questions asked face-to-face. Here it is very clear who is asking the questions and who is answering them. This doesn’t feel like a conversation at all! A lot of people new to interviewing have this ( erroneously !) in mind when they think about interviews as data collection. Somewhere in the middle of these two extreme cases is the “ semistructured” interview , in which the researcher uses an “interview guide” to gently move the conversation to certain topics and issues. This is the primary form of interviewing for qualitative social scientists and will be what I refer to as interviewing for the rest of this chapter, unless otherwise specified.

Informal (unstructured conversations). This is the most “open-ended” approach to interviewing. It is particularly useful in conjunction with observational methods (see chapters 13 and 14). There are no predetermined questions. Each interview will be different. Imagine you are researching the Oregon Country Fair, an annual event in Veneta, Oregon, that includes live music, artisan craft booths, face painting, and a lot of people walking through forest paths. It’s unlikely that you will be able to get a person to sit down with you and talk intensely about a set of questions for an hour and a half. But you might be able to sidle up to several people and engage with them about their experiences at the fair. You might have a general interest in what attracts people to these events, so you could start a conversation by asking strangers why they are here or why they come back every year. That’s it. Then you have a conversation that may lead you anywhere. Maybe one person tells a long story about how their parents brought them here when they were a kid. A second person talks about how this is better than Burning Man. A third person shares their favorite traveling band. And yet another enthuses about the public library in the woods. During your conversations, you also talk about a lot of other things—the weather, the utilikilts for sale, the fact that a favorite food booth has disappeared. It’s all good. You may not be able to record these conversations. Instead, you might jot down notes on the spot and then, when you have the time, write down as much as you can remember about the conversations in long fieldnotes. Later, you will have to sit down with these fieldnotes and try to make sense of all the information (see chapters 18 and 19).

Interview guide ( semistructured interview ). This is the primary type employed by social science qualitative researchers. The researcher creates an “interview guide” in advance, which she uses in every interview. In theory, every person interviewed is asked the same questions. In practice, every person interviewed is asked mostly the same topics but not always the same questions, as the whole point of a “guide” is that it guides the direction of the conversation but does not command it. The guide is typically between five and ten questions or question areas, sometimes with suggested follow-ups or prompts . For example, one question might be “What was it like growing up in Eastern Oregon?” with prompts such as “Did you live in a rural area? What kind of high school did you attend?” to help the conversation develop. These interviews generally take place in a quiet place (not a busy walkway during a festival) and are recorded. The recordings are transcribed, and those transcriptions then become the “data” that is analyzed (see chapters 18 and 19). The conventional length of one of these types of interviews is between one hour and two hours, optimally ninety minutes. Less than one hour doesn’t allow for much development of questions and thoughts, and two hours (or more) is a lot of time to ask someone to sit still and answer questions. If you have a lot of ground to cover, and the person is willing, I highly recommend two separate interview sessions, with the second session being slightly shorter than the first (e.g., ninety minutes the first day, sixty minutes the second). There are lots of good reasons for this, but the most compelling one is that this allows you to listen to the first day’s recording and catch anything interesting you might have missed in the moment and so develop follow-up questions that can probe further. This also allows the person being interviewed to have some time to think about the issues raised in the interview and go a little deeper with their answers.

Standardized questionnaire with open responses ( structured interview ). This is the type of interview a lot of people have in mind when they hear “interview”: a researcher comes to your door with a clipboard and proceeds to ask you a series of questions. These questions are all the same whoever answers the door; they are “standardized.” Both the wording and the exact order are important, as people’s responses may vary depending on how and when a question is asked. These are qualitative only in that the questions allow for “open-ended responses”: people can say whatever they want rather than select from a predetermined menu of responses. For example, a survey I collaborated on included this open-ended response question: “How does class affect one’s career success in sociology?” Some of the answers were simply one word long (e.g., “debt”), and others were long statements with stories and personal anecdotes. It is possible to be surprised by the responses. Although it’s a stretch to call this kind of questioning a conversation, it does allow the person answering the question some degree of freedom in how they answer.

Survey questionnaire with closed responses (not an interview!). Standardized survey questions with specific answer options (e.g., closed responses) are not really interviews at all, and they do not generate qualitative data. For example, if we included five options for the question “How does class affect one’s career success in sociology?”—(1) debt, (2) social networks, (3) alienation, (4) family doesn’t understand, (5) type of grad program—we leave no room for surprises at all. Instead, we would most likely look at patterns around these responses, thinking quantitatively rather than qualitatively (e.g., using regression analysis techniques, we might find that working-class sociologists were twice as likely to bring up alienation). It can sometimes be confusing for new students because the very same survey can include both closed-ended and open-ended questions. The key is to think about how these will be analyzed and to what level surprises are possible. If your plan is to turn all responses into a number and make predictions about correlations and relationships, you are no longer conducting qualitative research. This is true even if you are conducting this survey face-to-face with a real live human. Closed-response questions are not conversations of any kind, purposeful or not.

In summary, the semistructured interview guide approach is the predominant form of interviewing for social science qualitative researchers because it allows a high degree of freedom of responses from those interviewed (thus allowing for novel discoveries) while still maintaining some connection to a research question area or topic of interest. The rest of the chapter assumes the employment of this form.

Creating an Interview Guide

Your interview guide is the instrument used to bridge your research question(s) and what the people you are interviewing want to tell you. Unlike a standardized questionnaire, the questions actually asked do not need to be exactly what you have written down in your guide. The guide is meant to create space for those you are interviewing to talk about the phenomenon of interest, but sometimes you are not even sure what that phenomenon is until you start asking questions. A priority in creating an interview guide is to ensure it offers space. One of the worst mistakes is to create questions that are so specific that the person answering them will not stray. Relatedly, questions that sound “academic” will shut down a lot of respondents. A good interview guide invites respondents to talk about what is important to them, not feel like they are performing or being evaluated by you.

Good interview questions should not sound like your “research question” at all. For example, let’s say your research question is “How do patriarchal assumptions influence men’s understanding of climate change and responses to climate change?” It would be worse than unhelpful to ask a respondent, “How do your assumptions about the role of men affect your understanding of climate change?” You need to unpack this into manageable nuggets that pull your respondent into the area of interest without leading him anywhere. You could start by asking him what he thinks about climate change in general. Or, even better, whether he has any concerns about heatwaves or increased tornadoes or polar icecaps melting. Once he starts talking about that, you can ask follow-up questions that bring in issues around gendered roles, perhaps asking if he is married (to a woman) and whether his wife shares his thoughts and, if not, how they negotiate that difference. The fact is, you won’t really know the right questions to ask until he starts talking.

There are several distinct types of questions that can be used in your interview guide, either as main questions or as follow-up probes. If you remember that the point is to leave space for the respondent, you will craft a much more effective interview guide! You will also want to think about the place of time in both the questions themselves (past, present, future orientations) and the sequencing of the questions.

Researcher Note

Suggestion : As you read the next three sections (types of questions, temporality, question sequence), have in mind a particular research question, and try to draft questions and sequence them in a way that opens space for a discussion that helps you answer your research question.

Type of Questions

Experience and behavior questions ask about what a respondent does regularly (their behavior) or has done (their experience). These are relatively easy questions for people to answer because they appear more “factual” and less subjective. This makes them good opening questions. For the study on climate change above, you might ask, “Have you ever experienced an unusual weather event? What happened?” Or “You said you work outside? What is a typical summer workday like for you? How do you protect yourself from the heat?”

Opinion and values questions , in contrast, ask questions that get inside the minds of those you are interviewing. “Do you think climate change is real? Who or what is responsible for it?” are two such questions. Note that you don’t have to literally ask, “What is your opinion of X?” but you can find a way to ask the specific question relevant to the conversation you are having. These questions are a bit trickier to ask because the answers you get may depend in part on how your respondent perceives you and whether they want to please you or not. We’ve talked a fair amount about being reflective. Here is another place where this comes into play. You need to be aware of the effect your presence might have on the answers you are receiving and adjust accordingly. If you are a woman who is perceived as liberal asking a man who identifies as conservative about climate change, there is a lot of subtext that can be going on in the interview. There is no one right way to resolve this, but you must at least be aware of it.

Feeling questions are questions that ask respondents to draw on their emotional responses. It’s pretty common for academic researchers to forget that we have bodies and emotions, but people’s understandings of the world often operate at this affective level, sometimes unconsciously or barely consciously. It is a good idea to include questions that leave space for respondents to remember, imagine, or relive emotional responses to particular phenomena. “What was it like when you heard your cousin’s house burned down in that wildfire?” doesn’t explicitly use any emotion words, but it allows your respondent to remember what was probably a pretty emotional day. And if they respond emotionally neutral, that is pretty interesting data too. Note that asking someone “How do you feel about X” is not always going to evoke an emotional response, as they might simply turn around and respond with “I think that…” It is better to craft a question that actually pushes the respondent into the affective category. This might be a specific follow-up to an experience and behavior question —for example, “You just told me about your daily routine during the summer heat. Do you worry it is going to get worse?” or “Have you ever been afraid it will be too hot to get your work accomplished?”

Knowledge questions ask respondents what they actually know about something factual. We have to be careful when we ask these types of questions so that respondents do not feel like we are evaluating them (which would shut them down), but, for example, it is helpful to know when you are having a conversation about climate change that your respondent does in fact know that unusual weather events have increased and that these have been attributed to climate change! Asking these questions can set the stage for deeper questions and can ensure that the conversation makes the same kind of sense to both participants. For example, a conversation about political polarization can be put back on track once you realize that the respondent doesn’t really have a clear understanding that there are two parties in the US. Instead of asking a series of questions about Republicans and Democrats, you might shift your questions to talk more generally about political disagreements (e.g., “people against abortion”). And sometimes what you do want to know is the level of knowledge about a particular program or event (e.g., “Are you aware you can discharge your student loans through the Public Service Loan Forgiveness program?”).

Sensory questions call on all senses of the respondent to capture deeper responses. These are particularly helpful in sparking memory. “Think back to your childhood in Eastern Oregon. Describe the smells, the sounds…” Or you could use these questions to help a person access the full experience of a setting they customarily inhabit: “When you walk through the doors to your office building, what do you see? Hear? Smell?” As with feeling questions , these questions often supplement experience and behavior questions . They are another way of allowing your respondent to report fully and deeply rather than remain on the surface.

Creative questions employ illustrative examples, suggested scenarios, or simulations to get respondents to think more deeply about an issue, topic, or experience. There are many options here. In The Trouble with Passion , Erin Cech ( 2021 ) provides a scenario in which “Joe” is trying to decide whether to stay at his decent but boring computer job or follow his passion by opening a restaurant. She asks respondents, “What should Joe do?” Their answers illuminate the attraction of “passion” in job selection. In my own work, I have used a news story about an upwardly mobile young man who no longer has time to see his mother and sisters to probe respondents’ feelings about the costs of social mobility. Jessi Streib and Betsy Leondar-Wright have used single-page cartoon “scenes” to elicit evaluations of potential racial discrimination, sexual harassment, and classism. Barbara Sutton ( 2010 ) has employed lists of words (“strong,” “mother,” “victim”) on notecards she fans out and asks her female respondents to select and discuss.

Background/Demographic Questions

You most definitely will want to know more about the person you are interviewing in terms of conventional demographic information, such as age, race, gender identity, occupation, and educational attainment. These are not questions that normally open up inquiry. [1] For this reason, my practice has been to include a separate “demographic questionnaire” sheet that I ask each respondent to fill out at the conclusion of the interview. Only include those aspects that are relevant to your study. For example, if you are not exploring religion or religious affiliation, do not include questions about a person’s religion on the demographic sheet. See the example provided at the end of this chapter.

Temporality

Any type of question can have a past, present, or future orientation. For example, if you are asking a behavior question about workplace routine, you might ask the respondent to talk about past work, present work, and ideal (future) work. Similarly, if you want to understand how people cope with natural disasters, you might ask your respondent how they felt then during the wildfire and now in retrospect and whether and to what extent they have concerns for future wildfire disasters. It’s a relatively simple suggestion—don’t forget to ask about past, present, and future—but it can have a big impact on the quality of the responses you receive.

Question Sequence

Having a list of good questions or good question areas is not enough to make a good interview guide. You will want to pay attention to the order in which you ask your questions. Even though any one respondent can derail this order (perhaps by jumping to answer a question you haven’t yet asked), a good advance plan is always helpful. When thinking about sequence, remember that your goal is to get your respondent to open up to you and to say things that might surprise you. To establish rapport, it is best to start with nonthreatening questions. Asking about the present is often the safest place to begin, followed by the past (they have to know you a little bit to get there), and lastly, the future (talking about hopes and fears requires the most rapport). To allow for surprises, it is best to move from very general questions to more particular questions only later in the interview. This ensures that respondents have the freedom to bring up the topics that are relevant to them rather than feel like they are constrained to answer you narrowly. For example, refrain from asking about particular emotions until these have come up previously—don’t lead with them. Often, your more particular questions will emerge only during the course of the interview, tailored to what is emerging in conversation.

Once you have a set of questions, read through them aloud and imagine you are being asked the same questions. Does the set of questions have a natural flow? Would you be willing to answer the very first question to a total stranger? Does your sequence establish facts and experiences before moving on to opinions and values? Did you include prefatory statements, where necessary; transitions; and other announcements? These can be as simple as “Hey, we talked a lot about your experiences as a barista while in college.… Now I am turning to something completely different: how you managed friendships in college.” That is an abrupt transition, but it has been softened by your acknowledgment of that.

Probes and Flexibility

Once you have the interview guide, you will also want to leave room for probes and follow-up questions. As in the sample probe included here, you can write out the obvious probes and follow-up questions in advance. You might not need them, as your respondent might anticipate them and include full responses to the original question. Or you might need to tailor them to how your respondent answered the question. Some common probes and follow-up questions include asking for more details (When did that happen? Who else was there?), asking for elaboration (Could you say more about that?), asking for clarification (Does that mean what I think it means or something else? I understand what you mean, but someone else reading the transcript might not), and asking for contrast or comparison (How did this experience compare with last year’s event?). “Probing is a skill that comes from knowing what to look for in the interview, listening carefully to what is being said and what is not said, and being sensitive to the feedback needs of the person being interviewed” ( Patton 2002:374 ). It takes work! And energy. I and many other interviewers I know report feeling emotionally and even physically drained after conducting an interview. You are tasked with active listening and rearranging your interview guide as needed on the fly. If you only ask the questions written down in your interview guide with no deviations, you are doing it wrong. [2]

The Final Question

Every interview guide should include a very open-ended final question that allows for the respondent to say whatever it is they have been dying to tell you but you’ve forgotten to ask. About half the time they are tired too and will tell you they have nothing else to say. But incredibly, some of the most honest and complete responses take place here, at the end of a long interview. You have to realize that the person being interviewed is often discovering things about themselves as they talk to you and that this process of discovery can lead to new insights for them. Making space at the end is therefore crucial. Be sure you convey that you actually do want them to tell you more, that the offer of “anything else?” is not read as an empty convention where the polite response is no. Here is where you can pull from that active listening and tailor the final question to the particular person. For example, “I’ve asked you a lot of questions about what it was like to live through that wildfire. I’m wondering if there is anything I’ve forgotten to ask, especially because I haven’t had that experience myself” is a much more inviting final question than “Great. Anything you want to add?” It’s also helpful to convey to the person that you have the time to listen to their full answer, even if the allotted time is at the end. After all, there are no more questions to ask, so the respondent knows exactly how much time is left. Do them the courtesy of listening to them!

Conducting the Interview

Once you have your interview guide, you are on your way to conducting your first interview. I always practice my interview guide with a friend or family member. I do this even when the questions don’t make perfect sense for them, as it still helps me realize which questions make no sense, are poorly worded (too academic), or don’t follow sequentially. I also practice the routine I will use for interviewing, which goes something like this:

- Introduce myself and reintroduce the study

- Provide consent form and ask them to sign and retain/return copy

- Ask if they have any questions about the study before we begin

- Ask if I can begin recording

- Ask questions (from interview guide)

- Turn off the recording device

- Ask if they are willing to fill out my demographic questionnaire

- Collect questionnaire and, without looking at the answers, place in same folder as signed consent form

- Thank them and depart

A note on remote interviewing: Interviews have traditionally been conducted face-to-face in a private or quiet public setting. You don’t want a lot of background noise, as this will make transcriptions difficult. During the recent global pandemic, many interviewers, myself included, learned the benefits of interviewing remotely. Although face-to-face is still preferable for many reasons, Zoom interviewing is not a bad alternative, and it does allow more interviews across great distances. Zoom also includes automatic transcription, which significantly cuts down on the time it normally takes to convert our conversations into “data” to be analyzed. These automatic transcriptions are not perfect, however, and you will still need to listen to the recording and clarify and clean up the transcription. Nor do automatic transcriptions include notations of body language or change of tone, which you may want to include. When interviewing remotely, you will want to collect the consent form before you meet: ask them to read, sign, and return it as an email attachment. I think it is better to ask for the demographic questionnaire after the interview, but because some respondents may never return it then, it is probably best to ask for this at the same time as the consent form, in advance of the interview.

What should you bring to the interview? I would recommend bringing two copies of the consent form (one for you and one for the respondent), a demographic questionnaire, a manila folder in which to place the signed consent form and filled-out demographic questionnaire, a printed copy of your interview guide (I print with three-inch right margins so I can jot down notes on the page next to relevant questions), a pen, a recording device, and water.

After the interview, you will want to secure the signed consent form in a locked filing cabinet (if in print) or a password-protected folder on your computer. Using Excel or a similar program that allows tables/spreadsheets, create an identifying number for your interview that links to the consent form without using the name of your respondent. For example, let’s say that I conduct interviews with US politicians, and the first person I meet with is George W. Bush. I will assign the transcription the number “INT#001” and add it to the signed consent form. [3] The signed consent form goes into a locked filing cabinet, and I never use the name “George W. Bush” again. I take the information from the demographic sheet, open my Excel spreadsheet, and add the relevant information in separate columns for the row INT#001: White, male, Republican. When I interview Bill Clinton as my second interview, I include a second row: INT#002: White, male, Democrat. And so on. The only link to the actual name of the respondent and this information is the fact that the consent form (unavailable to anyone but me) has stamped on it the interview number.

Many students get very nervous before their first interview. Actually, many of us are always nervous before the interview! But do not worry—this is normal, and it does pass. Chances are, you will be pleasantly surprised at how comfortable it begins to feel. These “purposeful conversations” are often a delight for both participants. This is not to say that sometimes things go wrong. I often have my students practice several “bad scenarios” (e.g., a respondent that you cannot get to open up; a respondent who is too talkative and dominates the conversation, steering it away from the topics you are interested in; emotions that completely take over; or shocking disclosures you are ill-prepared to handle), but most of the time, things go quite well. Be prepared for the unexpected, but know that the reason interviews are so popular as a technique of data collection is that they are usually richly rewarding for both participants.

One thing that I stress to my methods students and remind myself about is that interviews are still conversations between people. If there’s something you might feel uncomfortable asking someone about in a “normal” conversation, you will likely also feel a bit of discomfort asking it in an interview. Maybe more importantly, your respondent may feel uncomfortable. Social research—especially about inequality—can be uncomfortable. And it’s easy to slip into an abstract, intellectualized, or removed perspective as an interviewer. This is one reason trying out interview questions is important. Another is that sometimes the question sounds good in your head but doesn’t work as well out loud in practice. I learned this the hard way when a respondent asked me how I would answer the question I had just posed, and I realized that not only did I not really know how I would answer it, but I also wasn’t quite as sure I knew what I was asking as I had thought.

—Elizabeth M. Lee, Associate Professor of Sociology at Saint Joseph’s University, author of Class and Campus Life , and co-author of Geographies of Campus Inequality

How Many Interviews?

Your research design has included a targeted number of interviews and a recruitment plan (see chapter 5). Follow your plan, but remember that “ saturation ” is your goal. You interview as many people as you can until you reach a point at which you are no longer surprised by what they tell you. This means not that no one after your first twenty interviews will have surprising, interesting stories to tell you but rather that the picture you are forming about the phenomenon of interest to you from a research perspective has come into focus, and none of the interviews are substantially refocusing that picture. That is when you should stop collecting interviews. Note that to know when you have reached this, you will need to read your transcripts as you go. More about this in chapters 18 and 19.

Your Final Product: The Ideal Interview Transcript

A good interview transcript will demonstrate a subtly controlled conversation by the skillful interviewer. In general, you want to see replies that are about one paragraph long, not short sentences and not running on for several pages. Although it is sometimes necessary to follow respondents down tangents, it is also often necessary to pull them back to the questions that form the basis of your research study. This is not really a free conversation, although it may feel like that to the person you are interviewing.

Final Tips from an Interview Master

Annette Lareau is arguably one of the masters of the trade. In Listening to People , she provides several guidelines for good interviews and then offers a detailed example of an interview gone wrong and how it could be addressed (please see the “Further Readings” at the end of this chapter). Here is an abbreviated version of her set of guidelines: (1) interview respondents who are experts on the subjects of most interest to you (as a corollary, don’t ask people about things they don’t know); (2) listen carefully and talk as little as possible; (3) keep in mind what you want to know and why you want to know it; (4) be a proactive interviewer (subtly guide the conversation); (5) assure respondents that there aren’t any right or wrong answers; (6) use the respondent’s own words to probe further (this both allows you to accurately identify what you heard and pushes the respondent to explain further); (7) reuse effective probes (don’t reinvent the wheel as you go—if repeating the words back works, do it again and again); (8) focus on learning the subjective meanings that events or experiences have for a respondent; (9) don’t be afraid to ask a question that draws on your own knowledge (unlike trial lawyers who are trained never to ask a question for which they don’t already know the answer, sometimes it’s worth it to ask risky questions based on your hypotheses or just plain hunches); (10) keep thinking while you are listening (so difficult…and important); (11) return to a theme raised by a respondent if you want further information; (12) be mindful of power inequalities (and never ever coerce a respondent to continue the interview if they want out); (13) take control with overly talkative respondents; (14) expect overly succinct responses, and develop strategies for probing further; (15) balance digging deep and moving on; (16) develop a plan to deflect questions (e.g., let them know you are happy to answer any questions at the end of the interview, but you don’t want to take time away from them now); and at the end, (17) check to see whether you have asked all your questions. You don’t always have to ask everyone the same set of questions, but if there is a big area you have forgotten to cover, now is the time to recover ( Lareau 2021:93–103 ).

Sample: Demographic Questionnaire

ASA Taskforce on First-Generation and Working-Class Persons in Sociology – Class Effects on Career Success

Supplementary Demographic Questionnaire

Thank you for your participation in this interview project. We would like to collect a few pieces of key demographic information from you to supplement our analyses. Your answers to these questions will be kept confidential and stored by ID number. All of your responses here are entirely voluntary!

What best captures your race/ethnicity? (please check any/all that apply)

- White (Non Hispanic/Latina/o/x)

- Black or African American

- Hispanic, Latino/a/x of Spanish

- Asian or Asian American

- American Indian or Alaska Native

- Middle Eastern or North African

- Native Hawaiian or Pacific Islander

- Other : (Please write in: ________________)

What is your current position?

- Grad Student

- Full Professor

Please check any and all of the following that apply to you:

- I identify as a working-class academic

- I was the first in my family to graduate from college

- I grew up poor

What best reflects your gender?

- Transgender female/Transgender woman

- Transgender male/Transgender man

- Gender queer/ Gender nonconforming

Anything else you would like us to know about you?

Example: Interview Guide

In this example, follow-up prompts are italicized. Note the sequence of questions. That second question often elicits an entire life history , answering several later questions in advance.

Introduction Script/Question

Thank you for participating in our survey of ASA members who identify as first-generation or working-class. As you may have heard, ASA has sponsored a taskforce on first-generation and working-class persons in sociology and we are interested in hearing from those who so identify. Your participation in this interview will help advance our knowledge in this area.

- The first thing we would like to as you is why you have volunteered to be part of this study? What does it mean to you be first-gen or working class? Why were you willing to be interviewed?

- How did you decide to become a sociologist?

- Can you tell me a little bit about where you grew up? ( prompts: what did your parent(s) do for a living? What kind of high school did you attend?)

- Has this identity been salient to your experience? (how? How much?)

- How welcoming was your grad program? Your first academic employer?

- Why did you decide to pursue sociology at the graduate level?

- Did you experience culture shock in college? In graduate school?

- Has your FGWC status shaped how you’ve thought about where you went to school? debt? etc?

- Were you mentored? How did this work (not work)? How might it?

- What did you consider when deciding where to go to grad school? Where to apply for your first position?

- What, to you, is a mark of career success? Have you achieved that success? What has helped or hindered your pursuit of success?

- Do you think sociology, as a field, cares about prestige?

- Let’s talk a little bit about intersectionality. How does being first-gen/working class work alongside other identities that are important to you?

- What do your friends and family think about your career? Have you had any difficulty relating to family members or past friends since becoming highly educated?

- Do you have any debt from college/grad school? Are you concerned about this? Could you explain more about how you paid for college/grad school? (here, include assistance from family, fellowships, scholarships, etc.)

- (You’ve mentioned issues or obstacles you had because of your background.) What could have helped? Or, who or what did? Can you think of fortuitous moments in your career?

- Do you have any regrets about the path you took?

- Is there anything else you would like to add? Anything that the Taskforce should take note of, that we did not ask you about here?

Further Readings

Britten, Nicky. 1995. “Qualitative Interviews in Medical Research.” BMJ: British Medical Journal 31(6999):251–253. A good basic overview of interviewing particularly useful for students of public health and medical research generally.

Corbin, Juliet, and Janice M. Morse. 2003. “The Unstructured Interactive Interview: Issues of Reciprocity and Risks When Dealing with Sensitive Topics.” Qualitative Inquiry 9(3):335–354. Weighs the potential benefits and harms of conducting interviews on topics that may cause emotional distress. Argues that the researcher’s skills and code of ethics should ensure that the interviewing process provides more of a benefit to both participant and researcher than a harm to the former.

Gerson, Kathleen, and Sarah Damaske. 2020. The Science and Art of Interviewing . New York: Oxford University Press. A useful guidebook/textbook for both undergraduates and graduate students, written by sociologists.

Kvale, Steiner. 2007. Doing Interviews . London: SAGE. An easy-to-follow guide to conducting and analyzing interviews by psychologists.

Lamont, Michèle, and Ann Swidler. 2014. “Methodological Pluralism and the Possibilities and Limits of Interviewing.” Qualitative Sociology 37(2):153–171. Written as a response to various debates surrounding the relative value of interview-based studies and ethnographic studies defending the particular strengths of interviewing. This is a must-read article for anyone seriously engaging in qualitative research!

Pugh, Allison J. 2013. “What Good Are Interviews for Thinking about Culture? Demystifying Interpretive Analysis.” American Journal of Cultural Sociology 1(1):42–68. Another defense of interviewing written against those who champion ethnographic methods as superior, particularly in the area of studying culture. A classic.

Rapley, Timothy John. 2001. “The ‘Artfulness’ of Open-Ended Interviewing: Some considerations in analyzing interviews.” Qualitative Research 1(3):303–323. Argues for the importance of “local context” of data production (the relationship built between interviewer and interviewee, for example) in properly analyzing interview data.

Weiss, Robert S. 1995. Learning from Strangers: The Art and Method of Qualitative Interview Studies . New York: Simon and Schuster. A classic and well-regarded textbook on interviewing. Because Weiss has extensive experience conducting surveys, he contrasts the qualitative interview with the survey questionnaire well; particularly useful for those trained in the latter.

- I say “normally” because how people understand their various identities can itself be an expansive topic of inquiry. Here, I am merely talking about collecting otherwise unexamined demographic data, similar to how we ask people to check boxes on surveys. ↵

- Again, this applies to “semistructured in-depth interviewing.” When conducting standardized questionnaires, you will want to ask each question exactly as written, without deviations! ↵

- I always include “INT” in the number because I sometimes have other kinds of data with their own numbering: FG#001 would mean the first focus group, for example. I also always include three-digit spaces, as this allows for up to 999 interviews (or, more realistically, allows for me to interview up to one hundred persons without having to reset my numbering system). ↵

A method of data collection in which the researcher asks the participant questions; the answers to these questions are often recorded and transcribed verbatim. There are many different kinds of interviews - see also semistructured interview , structured interview , and unstructured interview .

A document listing key questions and question areas for use during an interview. It is used most often for semi-structured interviews. A good interview guide may have no more than ten primary questions for two hours of interviewing, but these ten questions will be supplemented by probes and relevant follow-ups throughout the interview. Most IRBs require the inclusion of the interview guide in applications for review. See also interview and semi-structured interview .

A data-collection method that relies on casual, conversational, and informal interviewing. Despite its apparent conversational nature, the researcher usually has a set of particular questions or question areas in mind but allows the interview to unfold spontaneously. This is a common data-collection technique among ethnographers. Compare to the semi-structured or in-depth interview .

A form of interview that follows a standard guide of questions asked, although the order of the questions may change to match the particular needs of each individual interview subject, and probing “follow-up” questions are often added during the course of the interview. The semi-structured interview is the primary form of interviewing used by qualitative researchers in the social sciences. It is sometimes referred to as an “in-depth” interview. See also interview and interview guide .

The cluster of data-collection tools and techniques that involve observing interactions between people, the behaviors, and practices of individuals (sometimes in contrast to what they say about how they act and behave), and cultures in context. Observational methods are the key tools employed by ethnographers and Grounded Theory .

Follow-up questions used in a semi-structured interview to elicit further elaboration. Suggested prompts can be included in the interview guide to be used/deployed depending on how the initial question was answered or if the topic of the prompt does not emerge spontaneously.

A form of interview that follows a strict set of questions, asked in a particular order, for all interview subjects. The questions are also the kind that elicits short answers, and the data is more “informative” than probing. This is often used in mixed-methods studies, accompanying a survey instrument. Because there is no room for nuance or the exploration of meaning in structured interviews, qualitative researchers tend to employ semi-structured interviews instead. See also interview.

The point at which you can conclude data collection because every person you are interviewing, the interaction you are observing, or content you are analyzing merely confirms what you have already noted. Achieving saturation is often used as the justification for the final sample size.

An interview variant in which a person’s life story is elicited in a narrative form. Turning points and key themes are established by the researcher and used as data points for further analysis.

Introduction to Qualitative Research Methods Copyright © 2023 by Allison Hurst is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License , except where otherwise noted.

Qualitative Research 101: Interviewing

5 Common Mistakes To Avoid When Undertaking Interviews

By: David Phair (PhD) and Kerryn Warren (PhD) | March 2022

Undertaking interviews is potentially the most important step in the qualitative research process. If you don’t collect useful, useable data in your interviews, you’ll struggle through the rest of your dissertation or thesis. Having helped numerous students with their research over the years, we’ve noticed some common interviewing mistakes that first-time researchers make. In this post, we’ll discuss five costly interview-related mistakes and outline useful strategies to avoid making these.

Overview: 5 Interviewing Mistakes

- Not having a clear interview strategy /plan

- Not having good interview techniques /skills

- Not securing a suitable location and equipment

- Not having a basic risk management plan

- Not keeping your “ golden thread ” front of mind

1. Not having a clear interview strategy

The first common mistake that we’ll look at is that of starting the interviewing process without having first come up with a clear interview strategy or plan of action. While it’s natural to be keen to get started engaging with your interviewees, a lack of planning can result in a mess of data and inconsistency between interviews.

There are several design choices to decide on and plan for before you start interviewing anyone. Some of the most important questions you need to ask yourself before conducting interviews include:

- What are the guiding research aims and research questions of my study?

- Will I use a structured, semi-structured or unstructured interview approach?

- How will I record the interviews (audio or video)?

- Who will be interviewed and by whom ?

- What ethics and data law considerations do I need to adhere to?

- How will I analyze my data?

Let’s take a quick look at some of these.

The core objective of the interviewing process is to generate useful data that will help you address your overall research aims. Therefore, your interviews need to be conducted in a way that directly links to your research aims, objectives and research questions (i.e. your “golden thread”). This means that you need to carefully consider the questions you’ll ask to ensure that they align with and feed into your golden thread. If any question doesn’t align with this, you may want to consider scrapping it.

Another important design choice is whether you’ll use an unstructured, semi-structured or structured interview approach . For semi-structured interviews, you will have a list of questions that you plan to ask and these questions will be open-ended in nature. You’ll also allow the discussion to digress from the core question set if something interesting comes up. This means that the type of information generated might differ a fair amount between interviews.

Contrasted to this, a structured approach to interviews is more rigid, where a specific set of closed questions is developed and asked for each interviewee in exactly the same order. Closed questions have a limited set of answers, that are often single-word answers. Therefore, you need to think about what you’re trying to achieve with your research project (i.e. your research aims) and decided on which approach would be best suited in your case.

It is also important to plan ahead with regards to who will be interviewed and how. You need to think about how you will approach the possible interviewees to get their cooperation, who will conduct the interviews, when to conduct the interviews and how to record the interviews. For each of these decisions, it’s also essential to make sure that all ethical considerations and data protection laws are taken into account.

Finally, you should think through how you plan to analyze the data (i.e., your qualitative analysis method) generated by the interviews. Different types of analysis rely on different types of data, so you need to ensure you’re asking the right types of questions and correctly guiding your respondents.

Simply put, you need to have a plan of action regarding the specifics of your interview approach before you start collecting data. If not, you’ll end up drifting in your approach from interview to interview, which will result in inconsistent, unusable data.

2. Not having good interview technique

While you’re generally not expected to become you to be an expert interviewer for a dissertation or thesis, it is important to practice good interview technique and develop basic interviewing skills .

Let’s go through some basics that will help the process along.

Firstly, before the interview , make sure you know your interview questions well and have a clear idea of what you want from the interview. Naturally, the specificity of your questions will depend on whether you’re taking a structured, semi-structured or unstructured approach, but you still need a consistent starting point . Ideally, you should develop an interview guide beforehand (more on this later) that details your core question and links these to the research aims, objectives and research questions.

Before you undertake any interviews, it’s a good idea to do a few mock interviews with friends or family members. This will help you get comfortable with the interviewer role, prepare for potentially unexpected answers and give you a good idea of how long the interview will take to conduct. In the interviewing process, you’re likely to encounter two kinds of challenging interviewees ; the two-word respondent and the respondent who meanders and babbles. Therefore, you should prepare yourself for both and come up with a plan to respond to each in a way that will allow the interview to continue productively.

To begin the formal interview , provide the person you are interviewing with an overview of your research. This will help to calm their nerves (and yours) and contextualize the interaction. Ultimately, you want the interviewee to feel comfortable and be willing to be open and honest with you, so it’s useful to start in a more casual, relaxed fashion and allow them to ask any questions they may have. From there, you can ease them into the rest of the questions.

As the interview progresses , avoid asking leading questions (i.e., questions that assume something about the interviewee or their response). Make sure that you speak clearly and slowly , using plain language and being ready to paraphrase questions if the person you are interviewing misunderstands. Be particularly careful with interviewing English second language speakers to ensure that you’re both on the same page.

Engage with the interviewee by listening to them carefully and acknowledging that you are listening to them by smiling or nodding. Show them that you’re interested in what they’re saying and thank them for their openness as appropriate. This will also encourage your interviewee to respond openly.

Need a helping hand?

3. Not securing a suitable location and quality equipment

Where you conduct your interviews and the equipment you use to record them both play an important role in how the process unfolds. Therefore, you need to think carefully about each of these variables before you start interviewing.

Poor location: A bad location can result in the quality of your interviews being compromised, interrupted, or cancelled. If you are conducting physical interviews, you’ll need a location that is quiet, safe, and welcoming . It’s very important that your location of choice is not prone to interruptions (the workplace office is generally problematic, for example) and has suitable facilities (such as water, a bathroom, and snacks).

If you are conducting online interviews , you need to consider a few other factors. Importantly, you need to make sure that both you and your respondent have access to a good, stable internet connection and electricity. Always check before the time that both of you know how to use the relevant software and it’s accessible (sometimes meeting platforms are blocked by workplace policies or firewalls). It’s also good to have alternatives in place (such as WhatsApp, Zoom, or Teams) to cater for these types of issues.

Poor equipment: Using poor-quality recording equipment or using equipment incorrectly means that you will have trouble transcribing, coding, and analyzing your interviews. This can be a major issue , as some of your interview data may go completely to waste if not recorded well. So, make sure that you use good-quality recording equipment and that you know how to use it correctly.

To avoid issues, you should always conduct test recordings before every interview to ensure that you can use the relevant equipment properly. It’s also a good idea to spot check each recording afterwards, just to make sure it was recorded as planned. If your equipment uses batteries, be sure to always carry a spare set.

4. Not having a basic risk management plan

Many possible issues can arise during the interview process. Not planning for these issues can mean that you are left with compromised data that might not be useful to you. Therefore, it’s important to map out some sort of risk management plan ahead of time, considering the potential risks, how you’ll minimize their probability and how you’ll manage them if they materialize.

Common potential issues related to the actual interview include cancellations (people pulling out), delays (such as getting stuck in traffic), language and accent differences (especially in the case of poor internet connections), issues with internet connections and power supply. Other issues can also occur in the interview itself. For example, the interviewee could drift off-topic, or you might encounter an interviewee who does not say much at all.

You can prepare for these potential issues by considering possible worst-case scenarios and preparing a response for each scenario. For instance, it is important to plan a backup date just in case your interviewee cannot make it to the first meeting you scheduled with them. It’s also a good idea to factor in a 30-minute gap between your interviews for the instances where someone might be late, or an interview runs overtime for other reasons. Make sure that you also plan backup questions that could be used to bring a respondent back on topic if they start rambling, or questions to encourage those who are saying too little.

In general, it’s best practice to plan to conduct more interviews than you think you need (this is called oversampling ). Doing so will allow you some room for error if there are interviews that don’t go as planned, or if some interviewees withdraw. If you need 10 interviews, it is a good idea to plan for 15. Likely, a few will cancel , delay, or not produce useful data.

5. Not keeping your golden thread front of mind

We touched on this a little earlier, but it is a key point that should be central to your entire research process. You don’t want to end up with pages and pages of data after conducting your interviews and realize that it is not useful to your research aims . Your research aims, objectives and research questions – i.e., your golden thread – should influence every design decision and should guide the interview process at all times.

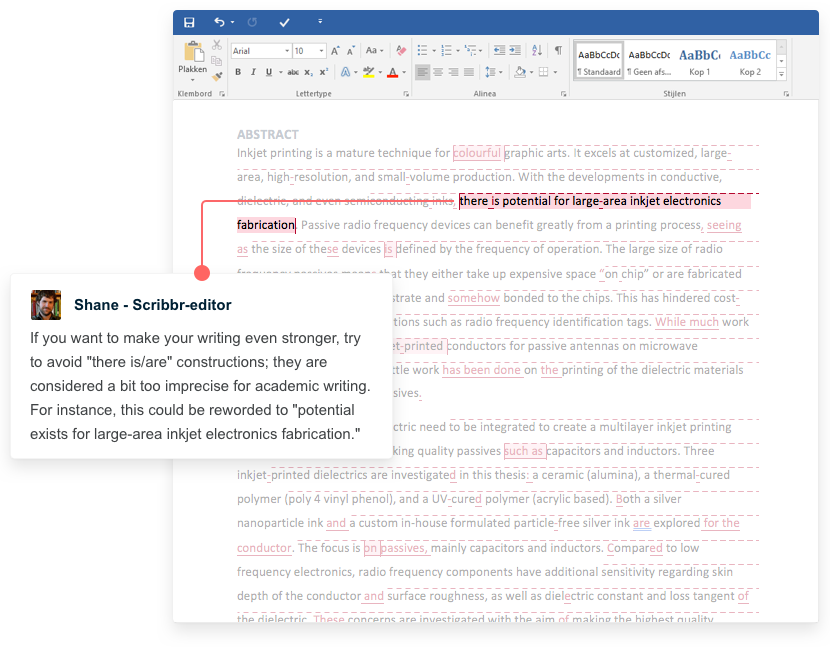

A useful way to avoid this mistake is by developing an interview guide before you begin interviewing your respondents. An interview guide is a document that contains all of your questions with notes on how each of the interview questions is linked to the research question(s) of your study. You can also include your research aims and objectives here for a more comprehensive linkage.

You can easily create an interview guide by drawing up a table with one column containing your core interview questions . Then add another column with your research questions , another with expectations that you may have in light of the relevant literature and another with backup or follow-up questions . As mentioned, you can also bring in your research aims and objectives to help you connect them all together. If you’d like, you can download a copy of our free interview guide here .

Recap: Qualitative Interview Mistakes

In this post, we’ve discussed 5 common costly mistakes that are easy to make in the process of planning and conducting qualitative interviews.

To recap, these include:

If you have any questions about these interviewing mistakes, drop a comment below. Alternatively, if you’re interested in getting 1-on-1 help with your thesis or dissertation , check out our dissertation coaching service or book a free initial consultation with one of our friendly Grad Coaches.

Psst... there’s more!

This post was based on one of our popular Research Bootcamps . If you're working on a research project, you'll definitely want to check this out ...

You Might Also Like:

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

9.2 Qualitative interviews

Learning objectives.

- Define interviews from the social scientific perspective

- Identify when it is appropriate to employ interviews as a data-collection strategy

- Identify the primary aim of in-depth interviews

- Describe what makes qualitative interview techniques unique

- Define the term interview guide and describe how to construct an interview guide

- Outline the guidelines for constructing good qualitative interview questions

- Describe how writing field notes and journaling function in qualitative research

- Identify the strengths and weaknesses of interviews

Knowing how to create and conduct a good interview is an essential skill. Interviews are used by market researchers to learn how to sell their products, and journalists use interviews to get information from a whole host of people from VIPs to random people on the street. Police use interviews to investigate crimes.

In social science, interviews are a method of data collection that involves two or more people exchanging information through a series of questions and answers. The questions are designed by the researcher to elicit information from interview participants on a specific topic or set of topics. These topics are informed by the research questions. Typically, interviews involve an in-person meeting between two people—an interviewer and an interviewee — but interviews need not be limited to two people, nor must they occur in-person.

The question of when to conduct an interview might be on your mind. Interviews are an excellent way to gather detailed information. They also have an advantage over surveys—they can change as you learn more information. In a survey, you cannot change what questions you ask if a participant’s response sparks some follow-up question in your mind. All participants must get the same questions. The questions you decided to put on your survey during the design stage determine what data you get. In an interview, however, you can follow up on new and unexpected topics that emerge during the conversation. Trusting in emergence and learning from participants are hallmarks of qualitative research. In this way, interviews are a useful method to use when you want to know the story behind the responses you might receive in a written survey.

Interviews are also useful when the topic you are studying is rather complex, requires lengthy explanation, or needs a dialogue between two people to thoroughly investigate. Also, if people will describe the process by which a phenomenon occurs, like how a person makes a decision, then interviews may be the best method for you. For example, you could use interviews to gather data about how people reach the decision not to have children and how others in their lives have responded to that decision. To understand these “how’s” you would need to have some back-and-forth dialogue with respondents. When they begin to tell you their story, inevitably new questions that hadn’t occurred to you from prior interviews would come up because each person’s story is unique. Also, because the process of choosing not to have children is complex for many people, describing that process by responding to closed-ended questions on a survey wouldn’t work particularly well.

Interview research is especially useful when:

- You wish to gather very detailed information

- You anticipate wanting to ask respondents follow-up questions based on their responses

- You plan to ask questions that require lengthy explanation

- You are studying a complex or potentially confusing topic to respondents

- You are studying processes, such as how people make decisions

Qualitative interviews are sometimes called intensive or in-depth interviews. These interviews are semi-structured ; the researcher has a particular topic about which she would like to hear from the respondent, but questions are open-ended and may not be asked in exactly the same way or in exactly the same order to each and every respondent. For in-depth interviews , the primary aim is to hear from respondents about what they think is important about the topic at hand and to hear it in their own words. In this section, we’ll take a look at how to conduct qualitative interviews, analyze interview data, and identify some of the strengths and weaknesses of this method.

Constructing an interview guide

Qualitative interviews might feel more like a conversation than an interview to respondents, but the researcher is in fact usually guiding the conversation with the goal in mind of gathering specific information from a respondent. Qualitative interviews use open-ended questions, which are questions that a researcher poses but does not provide answer options for. Open-ended questions are more demanding of participants than closed-ended questions because they require participants to come up with their own words, phrases, or sentences to respond.

In a qualitative interview, the researcher usually develops an interview guide in advance to refer to during the interview (or memorizes in advance of the interview). An interview guide is a list of questions or topics that the interviewer hopes to cover during the course of an interview. It is called a guide because it is simply that—it is used to guide the interviewer, but it is not set in stone. Think of an interview guide like an agenda for the day or a to-do list—both probably contain all the items you hope to check off or accomplish, though it probably won’t be the end of the world if you don’t accomplish everything on the list or if you don’t accomplish it in the exact order that you have it written down. Perhaps new events will come up that cause you to rearrange your schedule just a bit, or perhaps you simply won’t get to everything on the list.

Interview guides should outline issues that a researcher feels are likely to be important. Because participants are asked to provide answers in their own words and to raise points they believe are important, each interview is likely to flow a little differently. While the opening question in an in-depth interview may be the same across all interviews, from that point on, what the participant says will shape how the interview proceeds. Sometimes participants answer a question on the interview guide before it is asked. When the interviewer comes to that question later on in the interview, it’s a good idea to acknowledge that they already addressed part of this question and ask them if they have anything to add to their response. All of this uncertainty can make in-depth interviewing exciting and rather challenging. It takes a skilled interviewer to be able to ask questions; listen to respondents; and pick up on cues about when to follow up, when to move on, and when to simply let the participant speak without guidance or interruption.

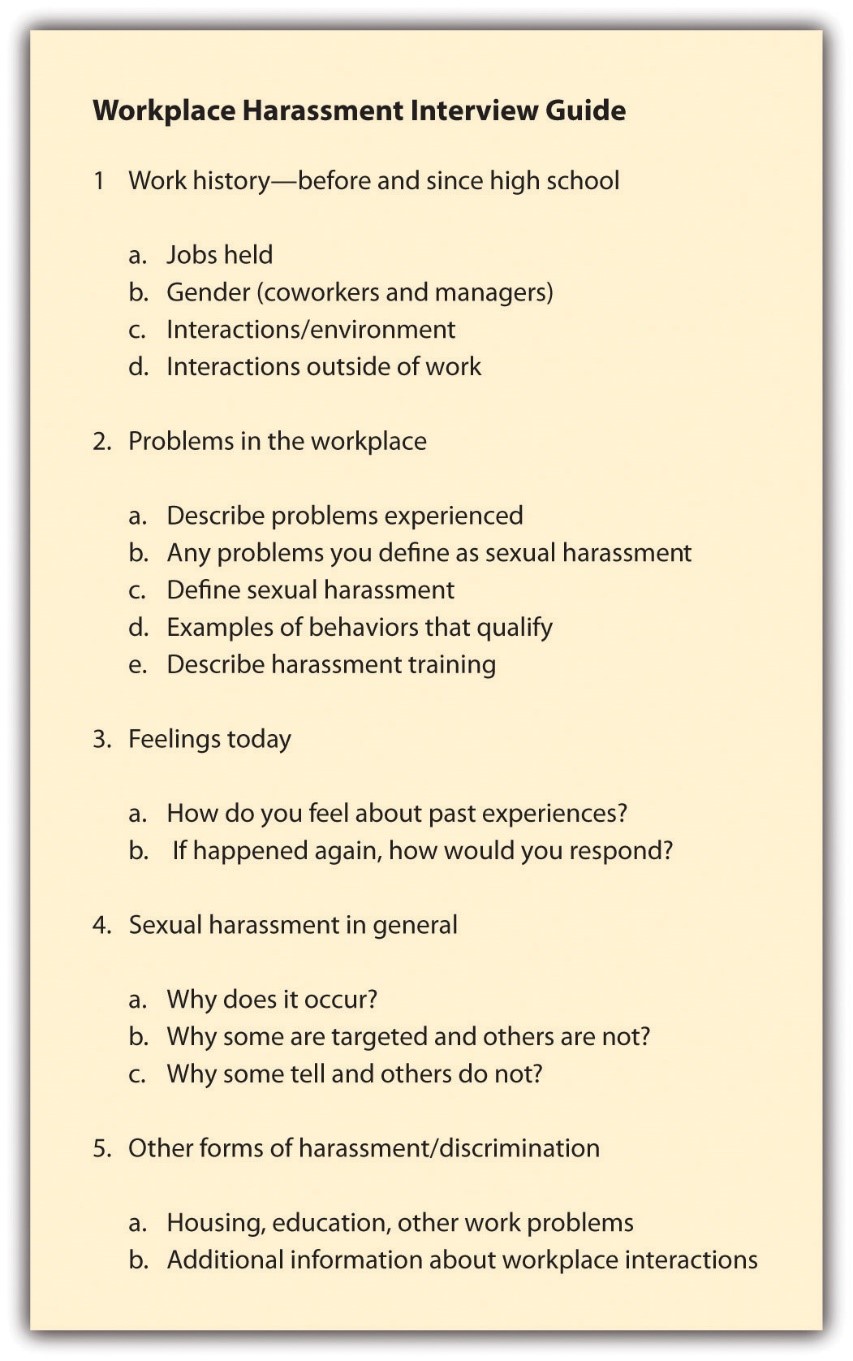

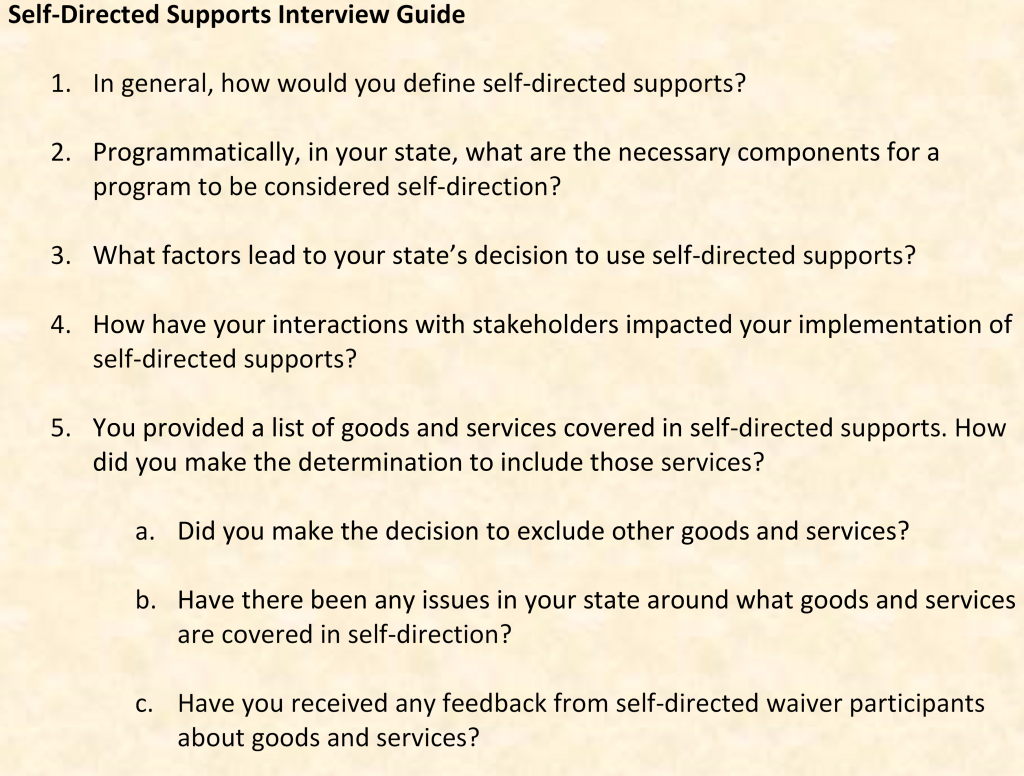

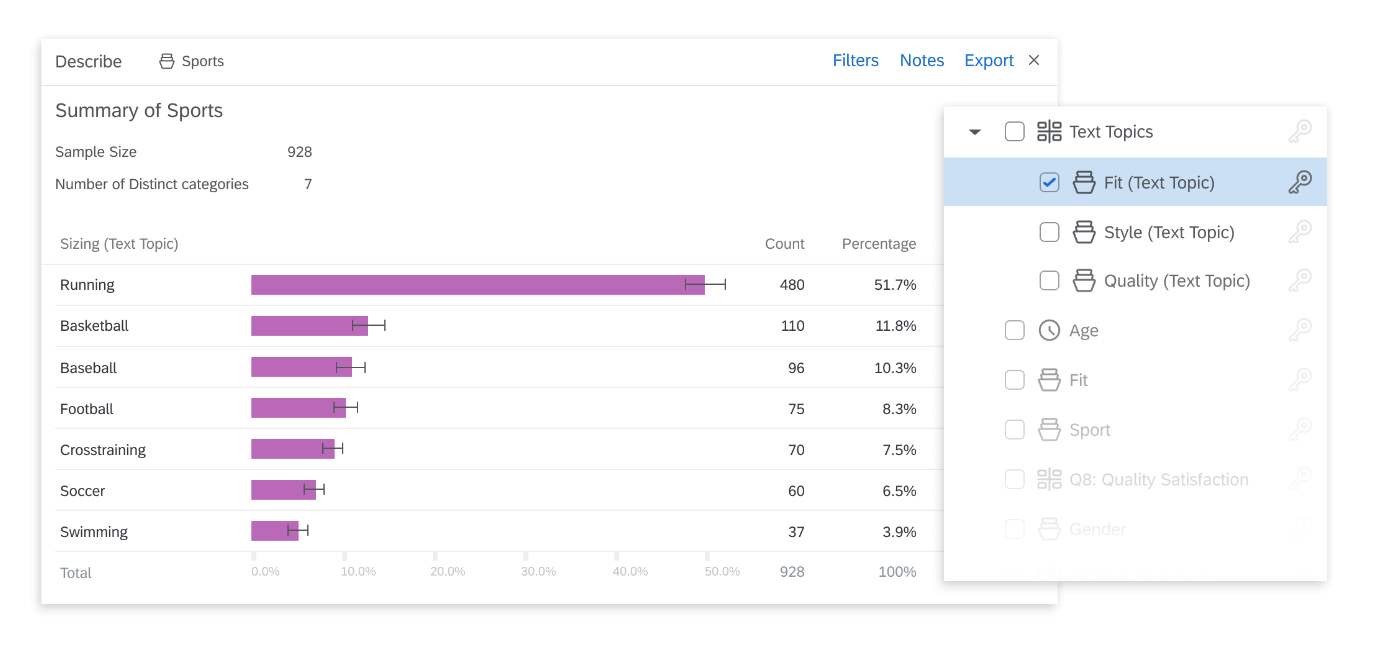

As we’ve discussed, interview guides can list topics or questions. The specific format of an interview guide might depend on your style, experience, and comfort level as an interviewer or with your topic. Figure 9.1 provides an example of an interview guide for a study of how young people experience workplace sexual harassment. The guide is topic-based, rather than a list of specific questions. The ordering of the topics is important, though how each comes up during the interview may vary.

For interview guides that use questions, there can also be specific words or phrases for follow-up in case the participant does not mention those topics in their responses. These probes , as well as the questions are written out in the interview guide, but may not always be used. Figure 9.2 provides an example of an interview guide that uses questions rather than topics.

As you might have guessed, interview guides do not appear out of thin air. They are the result of thoughtful and careful work on the part of a researcher. As you can see in both of the preceding guides, the topics and questions have been organized thematically and in the order in which they are likely to proceed (though keep in mind that the flow of a qualitative interview is in part determined by what a respondent has to say). Sometimes qualitative interviewers may create two versions of the interview guide: one version contains a very brief outline of the interview, perhaps with just topic headings, and another version contains detailed questions underneath each topic heading. In this case, the researcher might use the very detailed guide to prepare and practice in advance of actually conducting interviews and then just bring the brief outline to the interview. Bringing an outline, as opposed to a very long list of detailed questions, to an interview encourages the researcher to actually listen to what a participant is saying. An overly detailed interview guide can be difficult to navigate during an interview and could give respondents the mis-impression the interviewer is more interested in the questions than in the participant’s answers.

Constructing an interview guide often begins with brainstorming. There are no rules at the brainstorming stage—simply list all the topics and questions that come to mind when you think about your research question. Once you’ve got a pretty good list, you can begin to pare it down by cutting questions and topics that seem redundant and group similar questions and topics together. If you haven’t done so yet, you may also want to come up with question and topic headings for your grouped categories. You should also consult the scholarly literature to find out what kinds of questions other interviewers have asked in studies of similar topics and what theory indicates might be important. As with quantitative survey research, it is best not to place very sensitive or potentially controversial questions at the very beginning of your qualitative interview guide. You need to give participants the opportunity to warm up to the interview and to feel comfortable talking with you. Finally, get some feedback on your interview guide. Ask your friends, other researchers, and your professors for some guidance and suggestions once you’ve come up with what you think is a strong guide. Chances are they’ll catch a few things you hadn’t noticed. Once you begin your interviews, your participants may also suggest revisions or improvements.

In terms of the specific questions you include in your guide, there are a few guidelines worth noting. First, avoid questions that can be answered with a simple yes or no. Try to rephrase your questions in a way that invites longer responses from your interviewees. If you choose to include yes or no questions, be sure to include follow-up questions. Remember, one of the benefits of qualitative interviews is that you can ask participants for more information—be sure to do so. While it is a good idea to ask follow-up questions, try to avoid asking “why” as your follow-up question, as this particular question can come off as confrontational, even if that is not your intent. Often people won’t know how to respond to “why,” perhaps because they don’t even know why themselves. Instead of asking “why,” you say something like, “Could you tell me a little more about that?” This allows participants to explain themselves further without feeling that they’re being doubted or questioned in a hostile way.

Also, try to avoid phrasing your questions in a leading way. For example, rather than asking, “Don’t you think most people who don’t want to have children are selfish?” you could ask, “What comes to mind for you when you hear someone doesn’t want to have children?” Finally, remember to keep most, if not all, of your questions open-ended. The key to a successful qualitative interview is giving participants the opportunity to share information in their own words and in their own way. Documenting the decisions made along the way regarding which questions are used, thrown out, or revised can help a researcher remember the thought process behind the interview guide when she is analyzing the data. Additionally, it promotes the rigor of the qualitative project as a whole, ensuring the researcher is proceeding in a reflective and deliberate manner that can be checked by others reviewing her study.

Recording qualitative data

Even after the interview guide is constructed, the interviewer is not yet ready to begin conducting interviews. The researcher has to decide how to collect and maintain the information that is provided by participants. Researchers keep field notes or written recordings produced by the researcher during the data collection process. Field notes can be taken before, during, or after interviews. Field notes help researchers document what they observe, and in so doing, they form the first step of data analysis. Field notes may contain many things—observations of body language or environment, reflections on whether interview questions are working well, and connections between ideas that participants share.

Unfortunately, even the most diligent researcher cannot write down everything that is seen or heard during an interview. In particular, it is difficult for a researcher to be truly present and observant if she is also writing down everything the participant is saying. For this reason, it is quite common for interviewers to create audio recordings of the interviews they conduct. Recording interviews allows the researcher to focus on the interaction with the interview participant.

Of course, not all participants will feel comfortable being recorded and sometimes even the interviewer may feel that the subject is so sensitive that recording would be inappropriate. If this is the case, it is up to the researcher to balance excellent note-taking with exceptional question-asking and even better listening.

Whether you will be recording your interviews or not (and especially if not), practicing the interview in advance is crucial. Ideally, you’ll find a friend or two willing to participate in a couple of trial runs with you. Even better, find a friend or two who are similar in at least some ways to your sample. They can give you the best feedback on your questions and your interview demeanor.