Market Research Techniques: A Comprehensive Guide for Product Managers

The Role of Market Research in Product Management

The goals of market research, identifying customer needs, assessing market opportunities, analyzing competitors, market research techniques and tools, surveys and questionnaires, focus groups, observational research, secondary research, analyzing and interpreting market research data, quantitative data analysis, qualitative data analysis, applying market research findings to product strategy, product development, pricing strategy, positioning and messaging, related courses.

.jpg&w=1536&q=75)

Startup Product Management- How To Build Successful Products Faster

Learn to build successful products for startups, apply lessons to your products, and identify your areas of impact for immediate results

How To Accelerate Market Research With AI

In just 3h, master AI for market research customer research, and competitor research with the exact toolset that frees 40% of research time

Product Marketing for High Growth Tech Products

Develop the mindset and skills to help you execute an effective marketing strategy for your disruptive high growth tech product

.jpg&w=1536&q=75)

Create unique positioning for your product

One of it's kind practical course to nail your product positioning and all what comes with it: landing pages, pitch decks and GTM strategy

Uplevel Your Product Thinking

Understand the frameworks to rigorously think about markets to come up with compelling solutions. Apply them to 12 different product themes!

Data Mastery for Product Managers

Make better decisions and build more impactful products by mastering your data. Learn data model, experiment, ML fundamental in 3 weeks 🔥

You might also like

Creating an Effective Product Roadmap

How to Get a Product Manager Job: Ultimate 2023 Guide

The Product Manager Role: Responsibilities, Skills, and Salary

Product Dependency Management: Strategies for Streamlining Development

Be the first to know what's new on maven.

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

A guide to conducting market research

Assumptions only get you so far when it comes to developing a product and growing your business. Market research can provide you with crucial insights into what your audience and customers need from you. Armed with this data, you can differentiate your product from your competitors and work towards winning your market.

In this article, you will learn what market research is, the four approaches to it, and the steps you need to take to make more informed product decisions.

What is market research?

Market research is the process of gathering information about potential and current customers and your target audience. The data can reveal the viability of a new product idea based on customer needs and wants. Market research is an essential part of developing products and services that are desirable to consumers.

Market research is also used to:

- Evaluate customer attitude toward a newly released product or feature

- Discover customer pain points

- Understand brand perception

- Develop product differentiation

- Craft a marketing strategy that resonates with the target audience

- Find opportunities for product improvement

- Test your assumptions about your product or audience

- Create a competitive advantage

Market research is a critical part of research and development (R&D) . Bad market research can lead to making decisions based on assumptions, emotional reasoning, and other guesswork. Ultimately, market research is the only way to make informed decisions about what you need to develop for your product.

What are the 4 ways to do market research?

Market research falls into two categories: Primary and secondary. Primary research is gathered by the company, while secondary research comes from outside sources. Both of these options provide valuable information on your target audience.

For this article, let’s focus on primary research. There are four methods you can use to collect primary data for your market research:

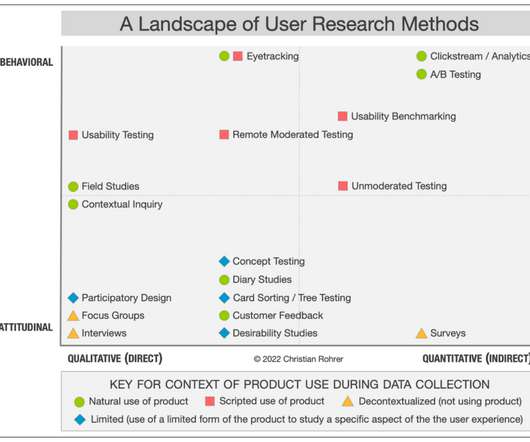

Interviews are face-to-face meetings with an individual. This can be one of the most insightful market research methods since there is no interaction with outside influences that may affect the opinion of the interviewee. It allows an interviewer to ask deeper questions, while also providing a chance to observe body language.

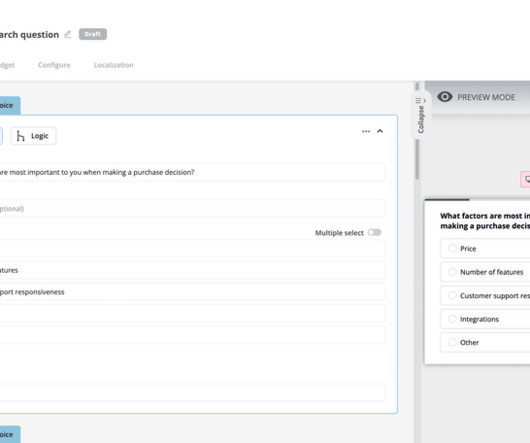

Surveys are a useful method for collecting data quickly. Surveys can appear on the company website or app and ask questions directly to consumers. You can have multiple choice, scales, or yes and no questions to gain several types of data points. It’s also a relatively easy and cost-effective method to deploy.

Focus groups

Focus groups are a tricky method of market research. Participants of a focus group make up the company’s target audience. When done well, they can provide insights into a group’s perceptions of a company’s products, advertising, or competitors. However, it requires a trained moderator to ensure participation from all members of the focus group and prevent a minority party from leading the conversation.

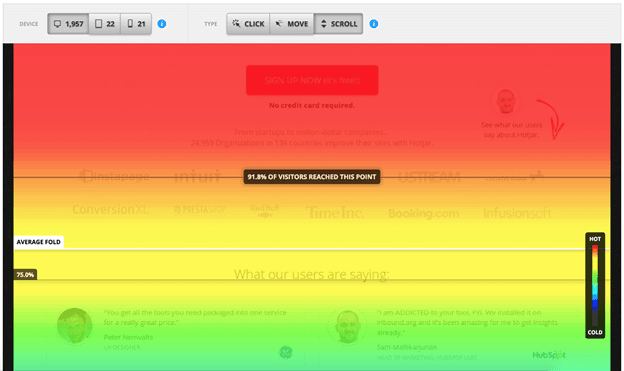

Customer observation

Customer observation is a powerful way to gain an understanding of how customers are interacting with your product. You can learn a lot from how they react to the product, what obstacles they encounter, and what questions they have while using it.

While you can observe in person, you could also use tools like a heat map to conduct customer observation. Alternatively, you can also ask participants to test out a competitor’s product to see how they engage with the product.

While interviews, surveys, focus groups, and customer observations are the 4 most common types of market research, companies can also use these other methods to do their research, including:

- Buyer persona research

- Market segmentation research

- Competitive analysis

- SWOT analysis

- Pricing research

- Customer satisfaction and loyalty research

- Brand research

- Campaign results

A step-by-step guide to conducting market research

Market research can seem like a large and daunting project. To help you break it down into manageable tasks, here is a basic step-by-step guide to conducting market research.

1. Determine the market research goal

Begin by determining what you want to learn from the market research. You’ll get the best results when you can clearly define the problem or question. Once you have defined your market research goal, then you can choose which market research method would work best.

Over 200k developers and product managers use LogRocket to create better digital experiences

Let’s explore this example throughout the guide: Your company wants to know if your product is satisfying the needs of your current customers

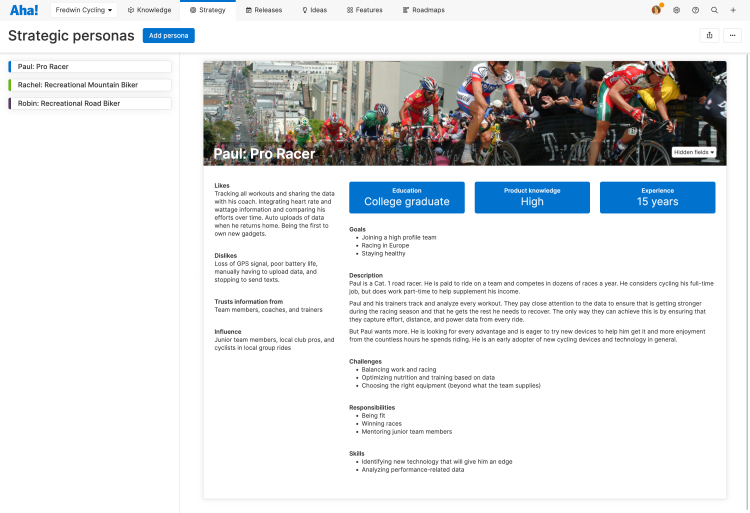

2. Identify what persona group to engage

If you don’t know who your customers are, then you should create buyer personas before you move further along in the market research process.

The next step is to identify which buyer persona or persona groups have the information you need to answer your market research goal. Choosing the right personas to participate is necessary to avoid wasting resources.

Example: You want to collect data from active users. You may also receive valuable insights from users who use your product infrequently or didn’t purchase the product

3. Prepare questions and collect data

At this stage, you can determine which research methods are best for collecting data. You’ll also form the right questions to ask. All questions should be open-ended to give participants the chance to share their opinions freely without feeling judged or influenced by the moderator.

Preparing questions in advance helps you stay focused on the market research. However, if you’re conducting interviews or focus groups, then it’s important to stay flexible and ask deeper questions based on how the conversation is going. You should consider these core principles while interviewing an individual or a group:

- Don’t ask leading questions — A leading question is when moderator bias appears and steers the participant toward a certain answer. For example, “Did you think the new product feature was great?” is leading. An objective question is “Did the new product feature solve your problem?”

- Don’t ask loaded questions — Loaded questions have a built-in assumption the participant may disagree with and limits replies. For example, “Why are we better than our competitor?” is loaded because it assumes the participant thinks your company is better than your competition. An objective question might be, “How do you feel about our competitor?”

Once the methods and questions are determined, you can start to collect your data.

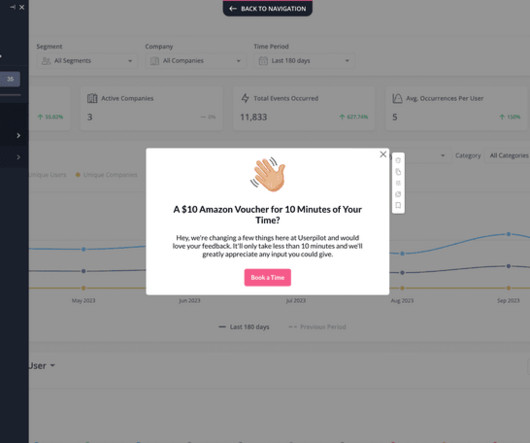

Example: To collect data from current users, a pop-up survey will appear when a user logs into their account. It has a scale of 1-10 and asks “How satisfied are you with our product?” Once a user answers, they have the option to provide a short answer on what the product could do better

4. Analyze data

When analyzing data, you should look for themes or patterns in responses. You can also utilize data visualization tools to help detect any trends. Once you have analyzed your data, you can create a report based on the findings. It may include items like:

- What are the main problems participants faced while using a product

- What participants consider when choosing a product

- What feature was a deal breaker or clincher

Most importantly, your report should include an action plan on how to resolve issues discovered in the market research. This could involve creating more useful user guides, creating or modifying a new feature, or a more efficient onboarding process.

Example: Results from the survey showed that unhappy customers frequently didn’t know where to go to get help on using the product. An action plan is created to develop how-to tutorials

5. Implement changes

The market research report is presented to executives, and they need to decide on the best way to move forward. It may involve approving the action plan or finding alternative solutions. The good news is that they are going to make a data-based decision because they have accurate information on their customers and target audience.

Once a plan is approved, product managers or other departments can begin working on implementing changes.

Example: Executives approve an action plan to develop how-to tutorials. A knowledge base is created for users filled with written and video tutorials on how to use product features

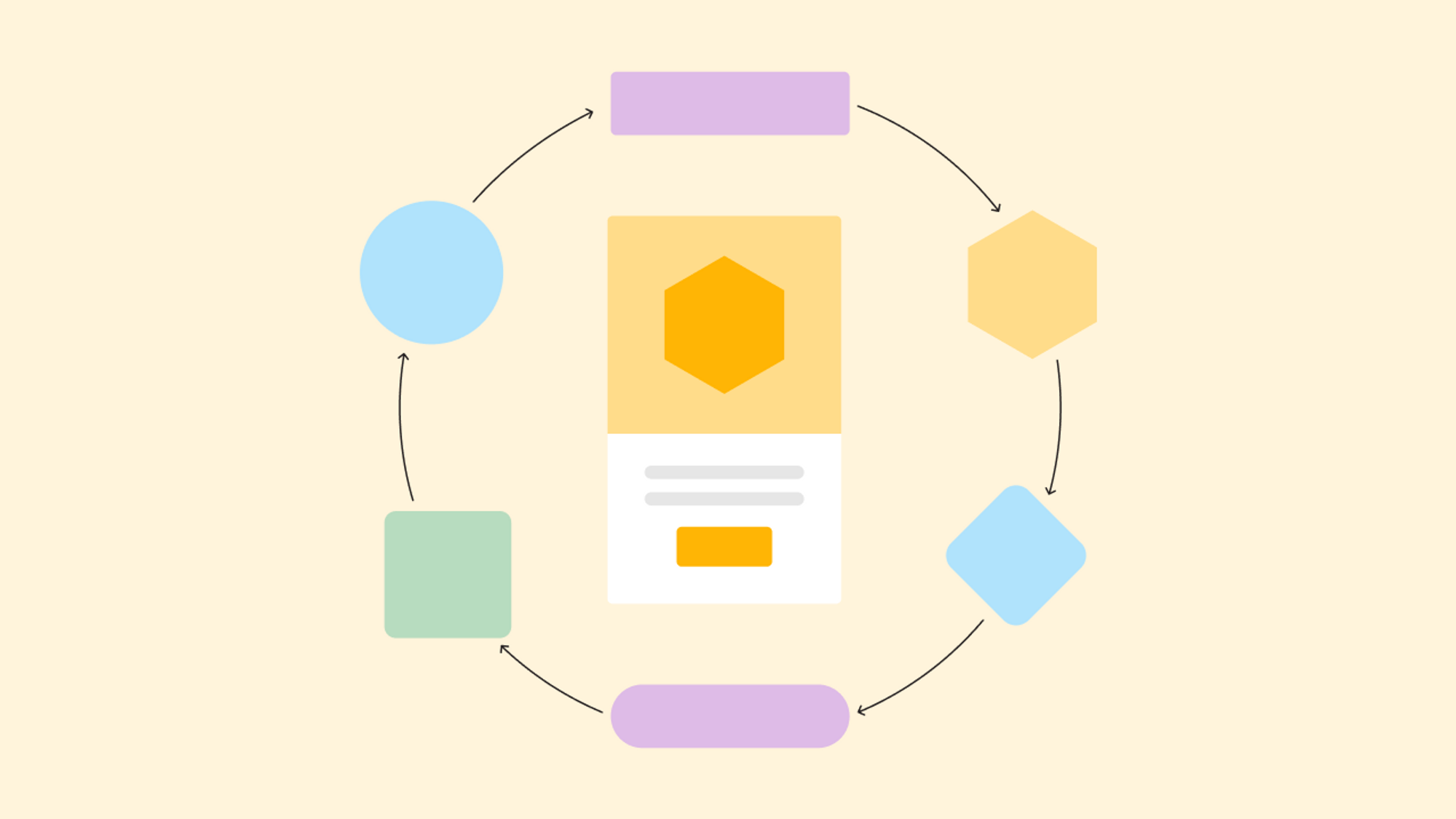

6. Test results

Market research is not a one-time-only project. It should be continually conducted to provide insights into your product, industry, trends, and other factors that could affect your business. The market research process will help you maintain a competitive advantage while ensuring every iteration of your product is meeting the needs of your target audience.

Key takeaways

Market research is more than something you do to confirm if there is customer interest in your product idea. It’s there to support you for nearly every important pillar of your business, including product development, marketing, and business growth. Continuously conducting market research will help your company stay in touch with your customers and emerging trends.

Market research can be as simple as a one-question survey to 30-minute interviews with your target market. Regardless of the method, you stand to glean valuable insights that you can turn into a data-informed action plan.

Featured image source: IconScout

LogRocket generates product insights that lead to meaningful action

Get your teams on the same page — try LogRocket today.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #customer experience

- #market analysis

Stop guessing about your digital experience with LogRocket

Recent posts:.

Leader Spotlight: Balancing security, user control, and UX, with Carolyne Moran

Carolyne Moran discusses how to balance accessibility, regulations, compliance, and self-serve capabilities within a complex security product.

A guide to developing customer profiles

A customer profile is a document that outlines the ideal customers of a business-to-business (B2B) company.

Evaluating customer experience metrics

Customer experience metrics are metrics that you can use to determine how customers perceive their interaction with your product.

Leader Spotlight: Tailoring products by industry and market, with Orly Stern Izhaki

Orly Stern Izhaki discusses how expanding products globally requires adjusting the user journey based on the market, region, or culture.

Leave a Reply Cancel reply

- Certifications

- Our Instructors

Product Management Skills: Market Research

Author: Ellen Merryweather

Updated: January 24, 2024 - 7 min read

Market research, for Product Managers, is an absolute necessity for success. Much of the time, you’ll find that your company has already outsourced your market research to a firm. But if you’re working on your own project or at a smaller startup, you might find this responsibility falling into your lap.

That’s why you need us! And we’re here to help.

Here, we’ll go over the different types of market research, whether or not you should outsource, and 4 methods for lean market research.

Different Types of Market Research

1. Exploratory research

If you’re a startup founder, or rather a wannabe startup founder, you at least have an inkling of the problem you want to solve. But rarely will you have a properly defined problem statement right off the bat, even if the problem is something you’ve experienced personally.

This is where exploratory research comes in. What you’re essentially doing here is finding out the nature of the problem, whilst also asking yourself if it’s extensive enough to be worth solving.

If the problem exists, but the pool of potential customers attached to it is incredibly small, it may not be worth pursuing a full-blown product development cycle to solve it!

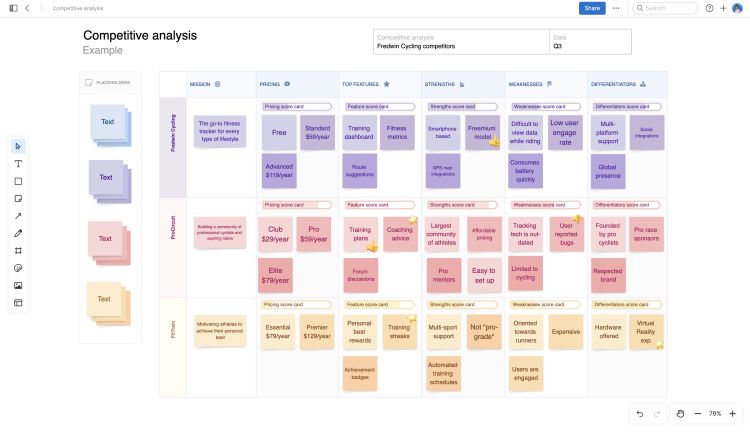

2. Competitive Analysis

This stage is absolutely key before you decide how you’re going to approach development.

For example, let’s say you’re passionate about podcasts, but you haven’t found a podcast app that you really like. You have some great ideas and so you decide to build your own. Once you’ve spent a lot of time, money, and resources on getting an MVP of your app built…you realize that most of your target market listen to podcasts on Spotify, which also has music. You’ve got no way to compete, because you didn’t do enough competitive analysis to be able to come up with your USP (unique selling point.)

Not performing competitive analysis is like going to war with no understanding of enemy territory.

Find out what happens when products don’t achieve product-market fit.

3. User Insights

Before you can being to build for your customers, you need to know who they are. For established products, this is also a useful tool for understanding the current state of your user base.

User insights influence every part of product development, from engineering, to UX, to marketing. So it’s not a type of research that you get to perform once and then forget about, it’s an iterative process. You need to constantly be aware of what your users are thinking and feeling, what their problems are, and where their loyalties are.

4. Beta testing

If you follow the agile methodology, the first thing you manage to get into user’s hands is an MVP or a beta version of your product. User insights might have told you that customers are interesting in a product like yours, but an MVP will make sure that you’re building it in the right way.

It’s not only useful for whole products, as you can also use it to test out new features on established products, or to A/B test your homepage.

5. Segmentation

Once you have your user base, or at least a potential user base, you can begin segmentation research. The act of separating your users into specific segments isn’t only useful for marketing. It’s also an extra step into properly understanding your users.

They could be separated in a number of different ways, for example by geography, demographic, or behavior.

It allows you to test more effectively, and communicate with your users in more personalized ways. It’s another way of understanding why your users take certain actions. For example, people in Europe may use feature A more than feature B, whereas the reverse is true for users in Africa.

To Outsource, or Not to Outsource…

Outsourcing to a market research firm can take the pressure off of you and your teams. If you need insights but you lack the time, resources, or personnel to complete it, outsourcing is a fantastic option.

But does every single company need to outsource their research efforts?

If you work with experienced individuals who are adept at conducting research, and they can spare enough of their time to do it right, there’s no reason why you’d need to outsource. A firm doesn’t automatically produce more accurate research reports just because they’re outsourced.

So if you have money but a lack of time, outsourcing is an option.

If you have the resources and the time, you’re at no disadvantage if you conduct your own research.

4 Steps to Lean Market Research

If you’ve decided to conduct your own market research, chances are that you don’t have a bottomless budget to spend on your data collection methods. That’s where lean market research comes in, because it’s simple, cost-effective, and easy to replicate.

Most of the methods you’ll use are a form of primary market research, meaning that you’re conducting specific research for your product or target market.

User personas

User personas help you to put a face to your customers. It helps you to understand their motivations, their problems, what they enjoy, what their economic situations are, and basically what kind of product they want you to build for them.

They’re useful across all parts of development. The design team use them to inform important UX decisions, the marketing team use them to drive campaigns, and the sales team use them to strategize.

To find out more, check out our guide to user personas.

User surveys

Online surveys are one of the most popular ways of gathering information. There are a vast number of tools to suit all budgets, and they’re very easy to set up. So they’re a great choice for any stage of development, but especially in the beginning when your operations are more bootstrapped.

They’re not the best thing to use if you’re looking for a more in depth interview, but when you’re looking for a broad understanding of your users from as wide a pool as possible, surveys are a great option.

The main tip is to balance qualitative and quantitative data. There’s going to be some information that you want which requires a yes/no answer, but remember to also include some more open ended questions.

User interviews

Face to face interviews allow you to conduct more in depth research, and help you to understand on a more personal level the buying habits of your customers. It’ll also be helpful to put a face to your user personas.

The main downside of user interviews is that the information you get from them is deep, but not broad. This makes them time consuming to conduct, and not an efficient way of gathering information at scale.

Focus groups

Focus groups are especially useful when you have something for people to test. You get to observe your potential customer’s reaction to your product in real time, which will help you to find your product-market fit and give you an opportunity to pivot if it doesn’t get the reaction you were expecting.

Focus groups are more time-consuming and resource-heavy than surveys, but they shouldn’t be underestimated. There’s nothing quite as informative as being able to see your product in user’s hands, and get their authentic in-the-moment feedback.

What to Do With the Data

Qualitative vs Quantitative: Use these different types of data to complement each other, as this will lead you from data to insights. You need to know the difference between these two types of data in order to better know how to use it.

Democratize your data: Not everyone needs every kind of data, but almost everyone working in product development will need access to your market research at some point. Make sure the data is available and accessible to your teams. There’s no glory in hoarding insights!

Market segmentation: Narrowing down the target market for your product or service to a particular corner will help you when launching something new. You can’t be everything to everyone. But you can be everything to someone .

Data visualization: More than just a pretty picture, data visualizations help to break down your data and make it easier to digest. Even if you’re a data expert who can make sense of the messiest of spreadsheets, not everyone in your company will share that skill. Visualizations help you to communicate insights and make data easier to understand for everyone.

Updated: January 24, 2024

Subscribe to The Product Blog

Discover Where Product is Heading Next

Share this post

By sharing your email, you agree to our Privacy Policy and Terms of Service

How Digital Product Managers Can Perform Effective Market Research

Shehab Beram

Product Coalition

M arket research is the process of gathering information about your business's buyer personas, target audiences, and customers. Market research also helps to provide a deeper understanding of the varying market factors, such as the nature of the market, the problems of the users, and the value of what you are building.

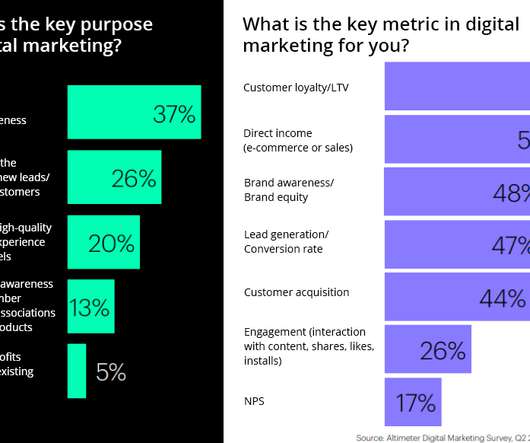

Researching the market is one of the most important roles of a digital product manager. In order to produce a profitable and effective strategy for your product, research into the demands of your consumers is highly important in ensuring that you are successful as a digital product manager.

But in competitive markets, time is of the essence. Other businesses are constantly looking for a competitive advantage above your own, with new developments arising every second to put the success of your product firmly in jeopardy. This is why effective research is highly important to a business. Here are some techniques for how digital product managers can perform market research successfully.

What Problems Can Market Research Solve?

Market research informs your decisions as a product manager. Here are four categories of decisions product managers use market research for.

Identifying markets

- Identifying market needs and customer problems

- Segmenting markets

- Documenting the customer journey

- Evaluating new markets

Scoping products

- Defining or testing new product concepts

- Solidifying pricing

- Prioritizing features and releases

Investigating the best marketing options

- Creating or testing product messaging

- Measuring marketing programs and campaigns results

Analyzing business success

- Measuring customer satisfaction

- Learning about the competition

How to Get Started

Market research is a method of gaining information on the needs and wants of your market in order to appeal to them in greater or more novel ways. An example of market research is conducting an online search on a particular topic and making note of the most recent data published on that topic to help sell your services to a greater degree.

Market research is important for digital product managers to gain a competitive advantage against other businesses who are developing or launching similar products. By meeting consumer demands more closely than competitors, your business will be at a greater advantage within the market.

Now that the benefits of market research are known, here are the five steps you can take to research your market effectively as a digital product manager.

Define The Problem

In most cases, the problems that you need to identify within your market are silent problems. This could include existing inefficiencies, awkward workflows or non-optimal solutions.

To define these issues, you could utilise your role as a digital product manager by conducting online secondary research (such as observing competitors’ websites or relevant statistical data) into the issues. You could also use elements of primary research, such as focus groups, to understand the issues associated with your users and how you can solve them.

The importance of accurate and reliable secondary research specifically can be reflected in the recent 3D TV product failure. Manufacturers identified the success of Avatar as a brand within this market, and assumed that demand was there. But, the 3DTV became obsolete as it required glasses, eliminated second-screening, and gave some people headaches and neck strain. Their failure to use primary research also became an issue; this did not research what shows consumers could actually watch on the device, leading to discontinuation. Although the solution was identified, the problem was not accurately noted, leading to a failure to solve anything.

By defining the problem clearly, you have a stronger chance of solving the right problem and you can improve the user’s experience with your product or service to ensure an optimum method of improving these experiences is created.

Develop Your Strategy

Once you have identified the issue, you need to evaluate the most efficient solution to the problem. As a digital product manager, it is your responsibility to make sure the solution to the issue is optimal for both the company and their users.

You can effectively research what strategy may be best through the use of focus groups to gain an understanding of how clients would like the problem to be solved,

or through other elements of primary research like questionnaires or forms to collect qualitative data on the market you are trying to fill. This would enable you as a digital product manager to orient your strategy towards this data for the most effective results and solutions to the problem.

However, the execution of your strategy is also highly important, as seen through the failure of Ford Edsel. Initially released in the late 1950s as “the new American car for the New American family”, the finished product did not live up to the glorious marketing campaigns and quickly lost demand. Due to this lack of strategy, the product failed significantly.

By creating an effective strategy, you can organise your market research more effectively to gain a greater understanding of how customers would like their solutions met. This would help you as a digital product manager to provide the ideal solution to the market’s problems.

Collect Quantitative Data

Quantitative data will help you to produce an unbiased approach to the issue at hand, balancing out the qualitative data gathered in previous steps and allowing for a more rounded and conceptualised view of the situation.

The most beneficial and cost-effective ways for you to collect quantitative data are through longitudinal studies and face-to-face interviews. This would provide high-quality information with the opportunity for a range of question types, such as closed questions, to reaffirm the statistical data needed for you to proceed.

By collecting relevant data, you can fulfil your objective of improving the chances of success of your product or service. The information gathered may help you understand how best to tailor your services to your client to ensure that customer satisfaction and business efficiency is both guaranteed. As always, the accuracy of your market share will make your strategy more effective, so this is important to keep in mind.

Quantitative data collection is also beneficial in providing confidence to your team as you have a strong platform of concrete evidence to stand on before you begin building and marketing your product or service.

It is highly important for digital product managers to utilise the benefits of having a team. By gathering their team, digital product managers can discuss the data and the implications of the collected data on their strategy to determine the best course of action.

Analyse Quantitative Data

Once all of the relevant information has been collected, it is important to analyse it and find patterns in the data for the best results.

For your research to actually become effective, you must utilise methods such as scatter graphs to find positive correlations between data. This would enable you to direct your team towards the optimum path to meet consumer demands and needs, improving the overall success of your product management.

Effective development and identification of correlation is important for a business. Take Coke, for example; as the popularity of Coke began to decline in the early 1980s, the choice to rebrand into ‘New Coke’ was made, with taste tests and forecasts indicating that significant success was on the horizon. However, they failed to take into account the emotional impact of Coke’s branding and design, leading to catastrophic brand damage.

By ensuring that your data correlates to your projected results, it guarantees that your market research has been effective in creating your strategy and that your product or service development will be successful. As a digital product manager, this would be highly beneficial in reaffirming the success of the business and you as a product lead manager.

Moreover, it would be highly advantageous in directing your team to act upon the wishes of the market, as you would have a strong sense of direction regarding how to appeal to the market. As a digital product manager, this would help in providing a target to aim for and how best to achieve it.

Take Action

The key to effectively researching your market is to act on the research gathered. Without action, the planning and organisation of your research is pointless.

A clear example of this can be seen through Kodak’s product failure in the 1980s. After identifying changes in the market that favour digital photography, they chose not to act on it and to attempt to save money instead of listening to what the camera market research revealed. This resulted in a massive failure to gain market share and profit.

The importance of action is significant; without it, your market research cannot be effective as it is wasted. Examples such as Kodak outline how market research alone cannot impact a business, but instead, the effectiveness of the research is determined by whether or not relevant action is taken.

By formulating a good strategy driven by good market research, why it can work, and how you’ll communicate that strategy to your team and stakeholders — as a product manager you can help you establish a solid product strategy that will position your company to win in the market.

Special thanks to Tremis Skeete, Executive Editor at Product Coalition for the valuable input which contributed to the editing of this article.

Written by Shehab Beram

Product Manager | UX Design & Product Consultant | I also write essays that help you get smarter at your product management game. More at: shehabberam.com

More from Shehab Beram and Product Coalition

Getting Started in Product

Breaking Into Product Management Out of College: Practical Guidelines

Product managers shape the life cycle of the products we use — from their first proposal to their last stop with the consumer. product….

Clayton Tarics

Strategy Storytelling: The Product Narrative Canvas

Let’s talk about how to elevate your product strategy with an outcome-driven storytelling model..

Michael H. Goitein

How Listening to the Right Customers Can Reduce Wasted Effort and Increase Revenue

Prioritize user needs, not your features.

Stakeholder Management: An Introduction and Beginner’s Guide

I was having lunch with a friend who recently interviewed with one of the biggest companies in the world. while we were talking about his…, recommended from medium.

Nima Torabi

Beyond the Build

Effective Product Management: Building Successful Generative AI-Powered MVPs

Developing successful mvps powered by generative ai requires navigating a unique set of challenges compared to traditional software….

How to set OKRs when your key result is a project

This might be blasphemy, but projects can be krs too..

Good Product Thinking

Growth Marketing

A Guide to OKRs – Objectives and Key Results

Jane Sydorova

Muzli - Design Inspiration

How to Conduct Product Discovery

Product discovery is the practice of ongoing research and user validation methods to make sure you’re creating the correct solutions for….

Paweł Huryn

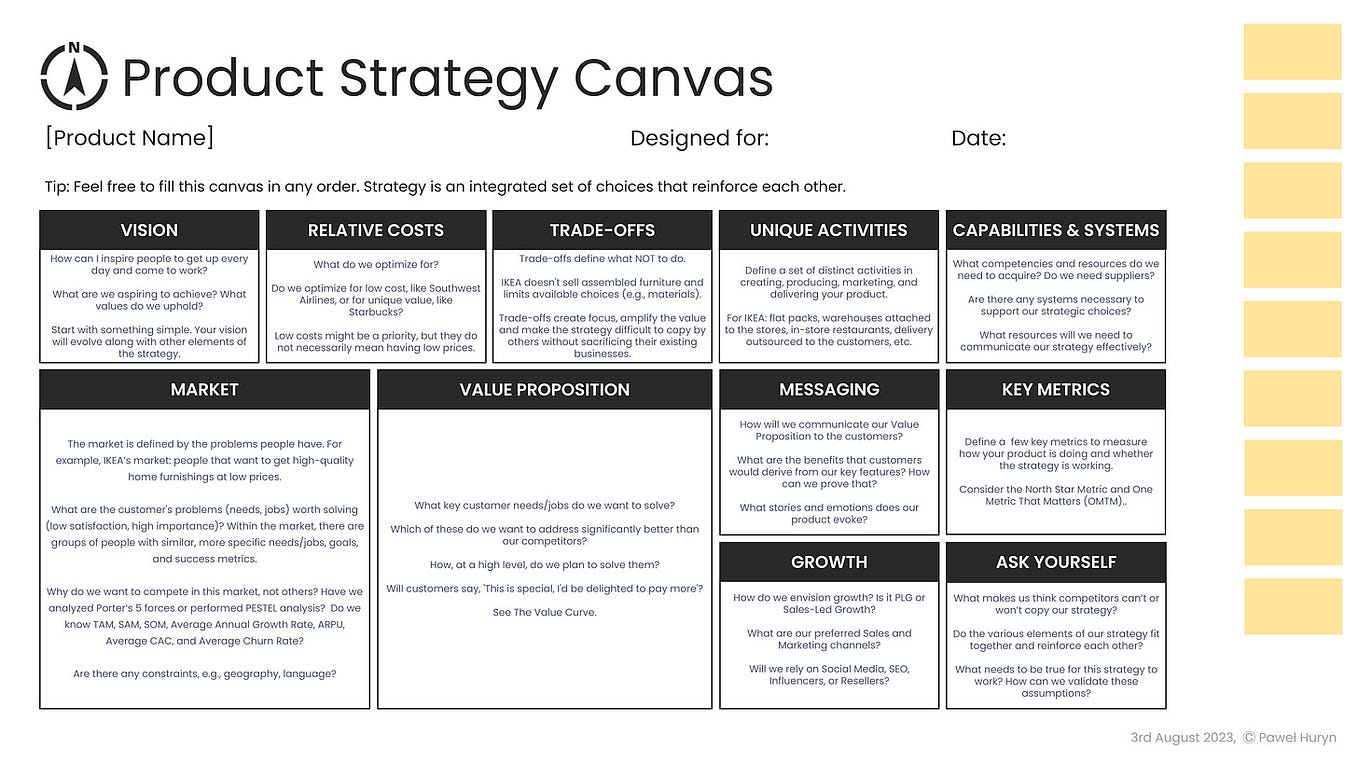

What is Product Strategy? Product Strategy Canvas.

Understanding and implementing a product strategy is crucial for everyone in a product organization. the strategy is simple. but it’s not….

Best Product Management Podcasts to Follow

Whether you’re a seasoned product manager or an intern just starting out, product management podcasts offer valuable insights, tips, and….

Creating Clarity in a Complex Reality

Product leadership goes beyond guiding the product. it’s about making complex decisions. this tool aids in clarity and better choices..

Text to speech

- Product management

- Product research

- How to research competitors

How product managers should research competitors

Competition is healthy. It motivates you to constantly find new ways to differentiate, meet customer needs, and ultimately deliver a better product. Researching and evaluating competitors is an essential skill for any product manager . And competitive research is not just about pricing structures and feature lists — it is about deeply understanding the market that you operate in and the unique value that you provide.

Competitive research is a key step in the strategic planning process. You need to know where your product fits in the market and what opportunities exist before you can set goals and prioritize what to build next.

Read on to learn more about:

What is a competitor analysis?

How to perform a competitive analysis

Direct vs. indirect competitors

Conduct competitor analysis in Aha! Roadmaps. Sign up for a trial .

What is competitor analysis.

Competitor analysis (also called competitive research) is the process of assessing the strengths and weaknesses of companies offering products similar to yours. This research can help you confirm your competitive differentiation — the unique value you offer and how your product stands out from others like it.

Before you get into the details of each competitor, spend time researching the market landscape. A thorough market analysis confirms customer needs, industry changes, and fiscal opportunity. It is this level of understanding that will allow you to act on your competitive research.

Questions to answer during the market research phase:

Who is your ideal customer?

What is the size of the market of ideal customers?

How has this market changed in recent years and where is it headed?

After defining the current market landscape, you can move on to examining your competitors. A thorough competitor analysis requires exploration of a wide range of sources for each competitor — everything from product reviews and sales collateral to press releases and revenue details. And you should also get firsthand experience in each product so you can see for yourself how they compare to your own.

Competitor analysis can help answer these core questions:

Are there other companies offering a product that provides a solution similar to ours?

Are my potential customers getting a product or service at the level that they want or need?

How can we enhance the value of our product to help it stand out in the marketplace?

Related guides:

Competitor analysis templates

SWOT analysis templates

Before we get into the details, here are the basic steps you will follow to perform a competitive analysis. Consider collaborating with your product marketing team — they conduct similar research and will likely be able to share insights into customers that can help guide your efforts.

Follow these steps to conduct a thorough competitor analysis:

Establish a list of direct and indirect competitors.

Examine available research materials — such as the company's website, customer reviews, financial information, and press releases.

Test the products yourself, if possible.

Briefly document user experience (UX), functionality issues, and any information relevant to your target customer.

Identify product strengths and weaknesses based on customer reviews.

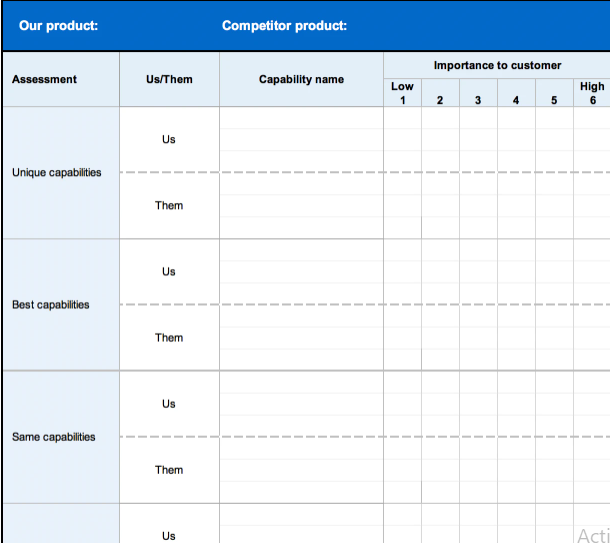

Create a competitive analysis report. These templates provide a good starting point.

Share your report with the product team and others in sales and marketing

As you go along, it can be helpful to use a competitive analysis template to organize your observations. This whiteboard template is great for getting started quickly — it highlights several areas of analysis in one streamlined, shareable view.

Start using this template now

Identifying direct vs. indirect competitors

Before you conduct competitor analysis, you need to identify who and what your product is up against in the market. It is wise to document both direct and indirect competitors.

A direct competitor is a company that offers (more or less) the same good or service within the same market. For example, Netflix and Hulu streaming services are direct competitors.

An indirect competitor is a company that offers a different type of product to serve the same need for the same customer segment. For example, YouTube is an indirect competitor to both Netflix and Hulu.

Here are two ways to build your list of competitors:

Customer feedback: Which other products do people mention during demos or support calls? If they are a prospective customer , which product do they currently use to meet similar needs as your product? If they no longer use your product, which competitor is now getting their business?

Keyword research: This can be as simple as entering your product category (ex. "online whiteboard") into a search engine and seeing which products show up in the search results. If you have the right tools (or collaborate with a marketing team), you can also go deeper — tracking organic search rankings and which companies are vying for similar online ad placements.

Evaluating both direct and indirect competitors is a valuable exercise. Understanding the strengths and weaknesses of your direct competitors can help you discover opportunities where you can stand out and gain a market advantage. And knowing how your potential customers are using indirect competitors can highlight problems that you could potentially solve more effectively.

How should I research competitors?

Once you have identified your direct and indirect competitors, you can start gathering key information about each one. You can find this information on company websites, third-party review sites, and within industry news coverage. Take notes on what you learn — to share with your team a bit later in this process.

Here are some useful sources to include in your competitive analysis:

With your list of competitors and source materials in hand, here are some of the categories you can examine for each competitor — including key questions to guide your research:

Identify each competitor's vision — where they are headed and what they aim to achieve in the market. Most companies offer this information in some form on their website. When reviewing, assess how they present themselves to both customers and prospects. Questions to answer:

Why do these products exist?

Which problems do they aim to solve?

Are there any problems that these products do not seem to solve?

Positioning

Assess where your competitors see themselves within the shared market. The best place to find this information is in your competitors' marketing messages — anything on their own websites as well as external sites such as social media networks or industry news outlets. Questions to answer:

How do your competitors market their products?

What language do they use to describe what they offer in market?

Which core problems do they believe they solve?

Learn about the target audience for your competitors' products. While researching competitors and using their products, try to envision their user personas — the profile of their ideal customer. And revisit customer reviews to look for patterns. Questions to answer:

What are the job titles of competitors' typical customers?

What industry do target customers work in?

What are their target customer's skills and interests?

How do their personas differ from yours?

Differentiators

Determine what distinguishes each competitor's product from yours and the rest of the market. When doing your research, focus on the factors that are most important to your customers, such as customer service, integrations, and price . Questions to answer:

What are the product's key benefits?

Is the look and feel of this product superior to mine and others on the market?

Is the price lower or higher than the rest of the competition?

Does the product work better than the rest?

Does the company offer superior customer service?

Aim to understand what drives your competitors to do what they do and where their products stand out. Take your competitors' product tours or even sign up for a free trial to understand all aspects of their offerings. Also look up the companies' founders on LinkedIn — many products are built out of deep, personal passion. Questions to answer:

What does the competition excel at?

What do they do better than you?

What unique insight and experience do the company's founders offer?

You can also spot weaknesses in product tours or while experimenting in a free trial. You can gain the customer perspective by searching relevant online forums for reviews and insights on these products. Quora, Product Hunt, and LinkedIn are three potential platforms that offer unbiased opinions on what customers and prospects think. Questions to answer:

What do competitors' users struggle with?

Which aspects of these products are lacking?

What customer needs are these products failing to meet?

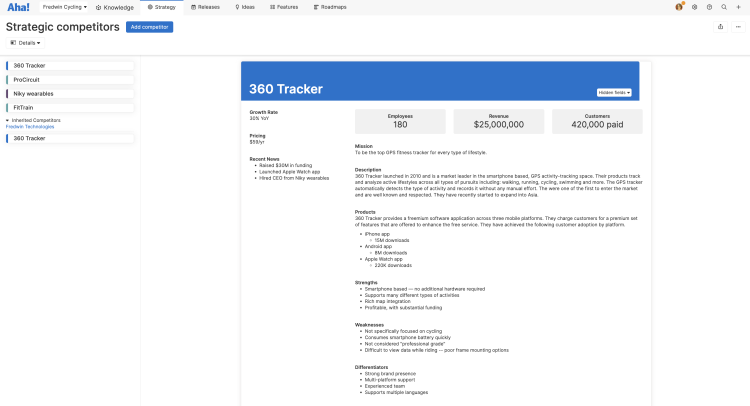

Document your findings in a central location that your team — and other teams such as sales and marketing — can access. A competitive analysis template can help keep everything clearly organized. Excel spreadsheets or PowerPoint documents are a good start. But many product teams also use tools like Aha! Roadmaps to document competitive research as a part of strategic product planning. This ensures that your research informs your goals , initiatives, and tactical work.

While competitive analysis is a key component of any good product strategy , it is important that you treat it as just a guideline. You should never make decisions about your product based solely on a desire to get ahead of your competitors. Instead, use your research alongside what you know is best for your customers and company to inform your decisions. Staying focused on what your customers need and want will help you successfully create value for your business and your customers.

Plan today what you will achieve tomorrow. Aha! Roadmaps can help.

- What is a business model?

- What is customer experience?

- What is the Complete Product Experience (CPE)?

- What is a customer journey map?

- What is product-led growth?

- What are the types of business transformation?

- What is enterprise transformation?

- What is digital transformation?

- What is the role of product management in enterprise transformation?

- What is a Minimum Viable Product (MVP)?

- What is a Minimum Lovable Product (MLP)?

- What is product vision?

- How to set product strategy

- What is product-market fit?

- What is product differentiation?

- How to position your product

- How to price your product

- What are product goals and initiatives?

- How to set product goals

- How to set product initiatives

- What is product value?

- What is value-based product development?

- Introduction to marketing strategy

- Introduction to marketing templates

- What is a marketing strategy?

- How to set marketing goals

- Marketing vs. advertising

- What is a creative brief?

- How to define buyer personas

- Understanding the buyer's journey

- What is competitive differentiation?

- 10Ps marketing matrix

- 2x2 prioritization matrix

- Business model

- Customer journey map

- Decision log

- Decision tree

- Fit gap analysis

- Gap analysis

- Lean canvas

- Marketing strategy

- Opportunity canvas

- Porter's 5 forces

- Pricing and packaging research

- Pricing plan chart

- Pricing strategies (Kotler)

- Product positioning

- Product vision

- Segment profile

- SMART goals

- Strategic roadmap

- Strategy mountain

- SWOT analysis

- Value proposition

- VMOST analysis

- Working backwards

- Collections: Business model

- Collections: SWOT

- Collections: Objectives and key results (OKR)

- Collections: Product positioning

- Collections: Market positioning

- Collections: Marketing strategy

- Collections: Marketing messaging

- What is product discovery?

- How to do market research

- How to define customer personas

- How to gather customer feedback

- Asking the right questions to drive innovation

- Approaches table

- Competitive analysis

- Customer empathy map

- Customer interview

- Customer research plan

- PESTLE analysis

- Problem framing

- Product comparison chart

- Pros and cons

- Target audience

- Collections: Customer research

- Collections: Competitor analysis

- Collections: Marketing competitor analysis

- How to brainstorm product ideas

- Brainstorming techniques for product builders

- Why product teams need an internal knowledge hub

- Why product teams need virtual whiteboarding software

- What is idea management?

- 4 steps for product ideation

- How to estimate the value of new product ideas

- How to prioritize product ideas

- What is idea management software?

- Introduction to marketing idea management

- How to gather marketing feedback from teammates

- Brainstorming new marketing ideas

- How to estimate the value of new marketing ideas

- Brainstorming meeting

- Brainstorming session

- Concept map

- Data flow diagram

- Fishbone diagram

- Ideas portal guide

- Jobs to be done

- Process flow diagram

- Proof of concept

- Sticky note pack

- User story map

- Workflow diagram

- Roadmapping: Your starter guide

- Business roadmap

- Features roadmap

- Innovation roadmap

- Marketing roadmap

- Product roadmap

- Product portfolio roadmap

- Project roadmap

- Strategy roadmap

- Technology roadmap

- How to choose a product roadmap tool

- What to include on your product roadmap

- How to visualize data on your product roadmap

- What milestones should be included on a roadmap?

- How often should roadmap planning happen?

- How to build a roadmap for a new product

- How to build an annual product roadmap

- How to build a brilliant roadmap

- How to customize the right roadmap for your audience

- How to build an agile roadmap

- Product roadmap examples

- How to report on progress against your roadmap

- How to communicate your product roadmap to customers

- What is a content marketing roadmap?

- What is a digital marketing roadmap?

- What is an integrated marketing roadmap?

- What is a go-to-market roadmap?

- What is a portfolio marketing roadmap?

- How to choose a marketing roadmap tool

- Epics roadmap

- Now, Next, Later roadmap

- Portfolio roadmap

- Release roadmap

- Collections: Product roadmap

- Collections: Product roadmap presentation

- Collections: Marketing roadmap

- What is product planning?

- How to diagram product use cases

- How product managers use Gantt charts

- How to use a digital whiteboard for product planning

- Introduction to release management

- How to plan product releases across teams

- What is a product backlog?

- Product backlog vs. release backlog vs. sprint backlog

- How to refine the product backlog

- Capacity planning for product managers

- What is requirements management?

- What is a market requirements document (MRD)?

- How to manage your product requirements document (PRD)

- What is a product feature?

- What is user story mapping?

- How to prioritize product features

- Common product prioritization frameworks

- JTBD prioritization framework

- Introduction to marketing plans

- What is a marketing plan?

- How to create a marketing plan

- What is a digital marketing plan?

- What is a content marketing plan?

- Why is content marketing important?

- What is a social media plan?

- How to create a marketing budget

- 2023 monthly calendar

- 2024 monthly calendar

- Feature requirement

- Kanban board

- Market requirements document

- Problem statement

- Product requirements document

- SAFe® Program board

- Stakeholder analysis

- Stakeholder map

- Timeline diagram

- Collections: Product development process

- Collections: MRD

- Collections: PRD

- Collections: Gantt chart

- Collections: User story

- Collections: User story mapping

- Collections: Feature definition checklist

- Collections: Feature prioritization templates

- Collections: Marketing plan templates

- Collections: Marketing calendar templates

- Product design basics

- What is user experience design?

- What is the role of a UX designer?

- What is the role of a UX manager?

- How to use a wireframe in product management

- Wireframe vs. mockup vs. prototype

- Analytics dashboard wireframe

- Product homepage wireframe

- Signup wireframe

- Collections: Creative brief

- Common product development methodologies

- Common agile development methodologies

- What is agile product management?

- What is agile software development?

- What is agile project management?

- What is the role of a software engineer?

- What is waterfall product management?

- What is agile transformation?

- Agile vs. lean

- Agile vs. waterfall

- What is an agile roadmap?

- What is an agile retrospective?

- Best practices of agile development teams

- What is a burndown chart?

- What is issue tracking?

- What is unit testing?

- Introduction to agile metrics

- Agile glossary

- What is kanban?

- How development teams implement kanban

- How is kanban used by product managers?

- How to set up a kanban board

- Kanban vs. scrum

- What is scrum?

- What are scrum roles?

- What is a scrum master?

- What is the role of a product manager in scrum?

- What is a sprint?

- What is a sprint planning meeting?

- What is a daily standup?

- What is a sprint review?

- Product release vs. sprint in scrum

- Themes, epics, stories, and tasks

- How to implement scrum

- How to choose a scrum certification

- What is the Scaled Agile Framework®?

- What is the role of a product manager in SAFe®?

- SAFe® PI planning

- SAFe® PI retrospective

- SAFe® Sprint planning

- Sprint planning

- Sprint retrospective

- Sprint retrospective meeting

- UML class diagram

- Collections: Sprint retrospective

- How to test your product before launch

- What is a go-to-market strategy?

- How to write excellent release notes

- How to plan a marketing launch

- Knowledge base article

- Product launch plan

- Product updates

- Release notes

- Collections: Product launch checklist

- Collections: Marketing launch checklist

- How to make data-driven product decisions

- How to measure product value

- What is product analytics?

- What are product metrics?

- What is a product?

- What is a product portfolio?

- What is product development?

- What is product management?

- What is the role of a product manager?

- What is portfolio product management?

- What is program management?

- What is product operations?

- What are the stages of product development?

- What is the product lifecycle?

- What is a product management maturity model?

- What is product development software?

- How to create internal product documentation

- What to include in an internal product documentation hub

- Internal vs. external product documentation

- How to build a product knowledge base

- Introduction to marketing methods

- What is agile marketing?

- What is digital marketing?

- What is product marketing?

- What is social media marketing?

- What is B2B marketing?

- Collections: Product management

- How to structure your product team meeting

- 15 tips for running effective product team meetings

- Daily standup meeting

- Meeting agenda

- Meeting notes

- Product backlog refinement meeting

- Product feature kickoff meeting

- Product operations meeting

- Product strategy meeting

- Sprint planning meeting

- What are the types of product managers?

- 10 skills to succeed as a product manager

- Common product management job titles

- What does a product manager do each day?

- What is the role of a product operations manager?

- What is the role of a program manager?

- How to become a product manager

- How to prepare for a product manager interview

- Interview questions for product managers

- Typical salary for product managers

- Tips for new product managers

- How to choose a product management certification

- Introduction to marketing

- What are some marketing job titles?

- What is the role of a marketing manager?

- What is the role of a product marketing manager?

- How are marketing teams organized?

- Which tools do marketers use?

- Interview questions for marketing managers

- Typical salary for marketing managers

- How to make a career switch into marketing

- Job interview

- Negotiating an offer

- Product manager resume

- Collections: Product manager resume

- How to structure your product development team

- Best practices for managing a product development team

- Which tools do product managers use?

- How to streamline your product management tools

- Tips for effective collaboration between product managers and engineers

- How do product managers work with other teams?

- How product managers achieve stakeholder alignment

- Aha! record map

- Creative brief

- Marketing calendar

- Organizational chart

- Presentation slides

- Process improvement

- Collections: Product management meeting

- Collections: Diagrams, flowcharts for product teams

- Collections: Whiteboarding

- Collections: Templates to run product meetings

- Product development definitions

- Marketing definitions

- Privacy policy

- Terms of service

- Product Management Tutorial

- What is Product Management

- Product Life Cycle

- Product Management Process

- General Availability

- Product Manager

- PM Interview Questions

- Courses & Certifications

- Project Management Tutorial

- Agile Methodology

- Software Engineering Tutorial

- Software Development Tutorial

- Software Testing Tutorial

- What is Product Positioning? Definition, Strategies, and Example

- Digital Product Manager | Introduction, Skills, Roles and Responsibilities

- Who is an Agile Product Manager?

- How to Become an AI Product Manager?

- A/B Testing in Product Management

- Who is (Vice President) VP of Product in Product Management?

- Annual Recurring Revenue (ARR) in Product Management: Formula, Calculation, and Importance

- Go to Market Strategy in Product Management

- What is Product Differentiation?

- Competitive Analysis in Product Management

- Competitive Benchmarking in product management

- Product Planning | Introduction, Purpose, Importance and Steps

- Brand Equity: Definition, Importance, Elements and Examples

- What is Customer Acquisition Cost - CAC Explained

- Product Segmentation: Definition, Importance and Examples

- Best Tools for Product Manager

- Acceptance Criteria in Product Management

- Product Management Process | 7 stages of product management

- What is Agile Product Management?

Market Research in Product Management

Market Research is a crucial component of product management, encompassing a range of activities aimed at understanding the dynamics of a particular market. It involves gathering, interpreting, and analyzing information about potential customers, competitors, and the overall industry. In essence, It serves as the foundation for informed decision-making in product management. .

Table of Content

What is Market Research?

- Why is market research important?

Steps to Conduct Marketing Research:

Market research and competitive analysis:, components of market research:, market research methods:.

- How to do market research as a Product Manager:

What Problems Can Market Research Solve?

Conclusion: market research.

The practice of assessing a new service or product’s viability through in-person interviews with potential consumers is known as market research. It enables a business to identify its target market and gather consumer comments and other input regarding their interest in a given good or service.

Either internal research or research from a third party with expertise in market research can be done. Among other methods, surveys and focus groups can be used for it. Product samples or a small stipend are typically given to test subjects as payment for their time.

Why is Market Research important?

Understanding the market is an important part of developing your product strategy, as is defining your goals and how you intend to achieve them. Market research takes into account external factors. This is significant because market research is essential for determining product-market fit. If you want your product to succeed, you must first thoroughly understand your market position, target audience, and any alternative solutions. This is important whether you are introducing a new product, improving an existing offering, or entering a new market.

Furthermore, market research allows all members of the core product team to make better decisions. The following are just a few of many examples, but market research can help:

- Product management entails empathizing with customers and learning about their needs to better prioritize upcoming product work.

- UX design entails making design decisions that reflect how customers want to interact with modern products.

- Engineering — Stay current on competitors’ technologies.

- Product marketing entails updating product positioning to reflect what customers want to hear.

- Once the objectives are established, product managers need to choose appropriate research methods based on the nature of the information sought.

- Developing a detailed research plan and a well-thought-out sampling strategy ensures that the collected data is relevant and representative of the target market.

- This could involve administering surveys, conducting interviews, or employing observational techniques. The collected data then undergoes analysis and interpretation, turning raw information into actionable insights.

- This step is critical in extracting meaningful patterns and trends that can guide decision-making.

- Ensuring that decision-makers understand and can act upon the insights gained is crucial for the successful integrating of market research into the product management strategy.

Competitive analysis is an indispensable aspect of market research, focusing on a comprehensive understanding of competitors and the broader competitive landscape. This involves evaluating competitors’ products, market share, pricing strategies, and overall marketing can identify areas where their products can outperform competitors and formulate strategies to gain a competitive edge.

Here are the differences between Market Research and Competitive Analysis:

You’ll want to look into three key components of market research for product Management: the overall market landscape, competitive analysis, and customer research.

Market Landscape: An examination of the market as a whole is a good place to begin. This type of market research typically focuses on macro-level industry characteristics and customer behavior. The factors to consider when researching the market landscape are listed below.

Competitive Analysis: Investigating competitors entails looking at established market players as well as alternative solutions used by prospective customers. You can learn how to differentiate your product by analyzing your competitors’ strengths and weaknesses.

Customer Research: Customer research drives product innovation by allowing you to gain direct insights from your target audience. This assists product teams in developing empathy for the problems that customers want to solve. It can also reveal the true feelings of your customers toward your product.

There are several methods employed in market research, each serving specific purposes.

- Surveys and questionnaires are common for gathering quantitative data on customer preferences.

- Interviews focuses groups offer qualitative insights into customer opinions and motivations.

- Observational research involves studying consumer behavior in real-world settings.

- Additionally, social media monitoring and web analytics provide valuable data on sentiment and online trends.

How to do Market Research as a Product Manager:

The complexity of the market research process will vary depending on the scope and extent of your plans. Launching a brand new offering frequently necessitates a thorough examination of the entire market; in other cases, such as improving existing products, a cursory examination of the current competition may suffice.

However, there are four critical steps to conducting successful market research:

- Establish your goals: To collect the appropriate data, you must first determine what you are attempting to learn. Clarify the scope of your market research by making a list of the questions you have about a problem or opportunity, then distilling this into a goal statement.

- Plan and carry out research: Identifying where to look for the information you require. You can use a combination of primary and secondary sources, with primary sources including interviews, surveys, and focus groups and secondary sources including industry publications, trade associations, and market reports.

- Analyze the data and share its results: Once you’ve gathered your data, go over it carefully to look for trends and other insights. Make your findings accessible to your team by summarizing them. You could even make a presentation to show off what you learned.

- Plan your next steps: Market research should be used to guide action. Use your newfound knowledge to create customer personas, develop a comprehensive product strategy, or prioritize product decisions that will add more value to the market.

- Market research is useful in addressing a variety of product management challenges.

- For starters, it aids in the understanding of customer preferences and needs, allowing the development of products that are appealing to the target audience.

- Market research also aids in identifying market gaps and opportunities, lowering the risk of product failure.

- It also aids in the optimization of pricing strategies, ensuring that products are competitively positioned in the market.

- Market research can also be used to assess the effectiveness of marketing campaigns, allowing for changes to improve customer engagement and brand perception.

To summarize, market research is a problem-solving tool that reduces uncertainty and provides a solid foundation for strategic decision-making.

Market research is a vital compass that helps product managers navigate the complexities of the business landscape. It is more than just data collection; it is a strategic initiative that enables decision-making. Product managers can navigate uncertainties and make informed decisions by understanding customer needs, identifying market opportunities, and conducting thorough competitive analysis. this components, which include both primary and secondary research, provide a comprehensive view of the market landscape.

Please Login to comment...

Similar reads.

- Geeks Premier League 2023

- Geeks Premier League

- Product Management

- What are Tiktok AI Avatars?

- Poe Introduces A Price-per-message Revenue Model For AI Bot Creators

- Truecaller For Web Now Available For Android Users In India

- Google Introduces New AI-powered Vids App

- 30 OOPs Interview Questions and Answers (2024)

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

- Integrations

- Learning Center

The Best Ways for Product Managers to Research their Competitors

Competition is healthy. If your product doesn’t have any competitors, it won’t have too many customers, either. An attractive market opportunity always entices many parties to take a crack at it. But how to product managers research competitors, how do they keep up?

Product managers view competitors as a double-edged sword. Yes, they are likely going to grab some of your potential market shares and make it harder to close as many deals. But, competition pushes your product to reach its potential. They inspire new features and enhancements you may not have thought of, and bring out the best in you and your colleagues.

Regardless of how much time and energy you spend tracking and analyzing the competition, they will continue to innovate. Their functionality, messaging, pricing, and product positioning will evolve constantly. Your customers and prospects will hear those pitches and entertain the pros and cons of each solution available to them. So it’s best to keep a close watch on what they’re all up to and figure out how to share and potentially act on what you’re seeing. Product Managers research competitors not only to keep up on the landscape but also as an inspiration to push their team forward.

How Product Managers Keep Tabs on Competitors

You can’t make informed strategic decisions on your product if you don’t know what’s happening. That’s why product managers researching competitors need a consistent approach to monitoring what everyone else is up to.

This begins by determining who should be considered a competitor at all. Sometimes it’s obvious. Especially in more mature markets where established providers of similar solutions exist.

For example, auto manufacturers know they’ve got to track what the likes of Toyota, Ford, Fiat, and Honda are up to. That club’s membership rarely changes much. However, upstarts do emerge. Such as Tesla establishing a new beachhead with luxury electric vehicles. Or Korean brands such as Hyundai and Kia entering the U.S. market 30 years ago.

There’s indirect competition from alternative solutions to the same problem. This includes motorcycles, scooters, on-demand rentals such as Zipcar, ride-sharing services like Uber and Lyft, or even public transportation. They’ll all get you from Point A to Point B, which is the primary reason people buy cars.

For technology companies, understanding current markets requires customer research . Plenty of startups who found their problem-solving apps were no match for workarounds prospects had devised.

1. Keep Up on Competitive Product Research

After compiling your list of competitors, product teams must ensure they’re getting a steady stream of intelligence on what they’re up to. You could set a bunch of calendar reminders to check their websites once a week. However, a more automated, passive system is more prudent for a product manager researching competitors with other tasks on their plate.

To ensure you’re not missing out on what’s new and exciting, you’ll need to act like a superfan of these products:

- Subscribe to their newsletters

- Follow them on social media

- Read their blog posts

- Watch their webinars

- Set up Google Alerts for their products

- Follow relevant industry analysts

- Track product reviews

You might want to use alternative social media handles and email addresses. In order to not make it too obvious what you’re up to. Getting bombarded by their messaging will not only give you a heads up on what they’re working on, but you’ll also see how they position their offering. An added benefit can be seeing what their customers are saying when they comment on posts or “@” them on Twitter.

3 steps to keep track of product competitor research

All that information is great. But with no organized strategy for dealing with it all, it can become overwhelming and useless. Don’t think you can remember it all and come up with a plan to manage the inflow and do something useful with what you’re learning.

1. Divide and conquer.

Assuming you have the luxury of product team, product managers research competition by splitting up which companies you’re each going to track. This is a better approach than divvying things up based on channel. This way individuals will get a holistic view of what a given competitor is up to.

You can each become mini-subject matter experts on your assigned rivals. When a new alternative appears on the horizon, they can be assigned to someone specific for tracking.

2. Define what you’re tracking.

You don’t need to know everything about your competitors, only the important stuff. To create a consistent competitive analysis approach, figure out what key elements you should note and what to skip.

Your top topics might be:

- Major new features

- Third-party integrations and partnerships

- New marketing campaign themes

- Major new customer announcements

- Pricing and packaging changes

- Financial news (new funding announcements, earnings reports, sales figures, etc.)

- Key hires and departures

3. Organize your insights.

What is important for product managers researching competitors is consistency. It doesn’t matter if you opt for a competitive intelligence dashboard or a shared Google Doc. You need to find the relevant information you’ve gleaned from your research so if someone asks you what’s new with Company X or the value proposition of Product Y quickly.

Likewise, if you’ve taken the divide and conquer approach, you should each be using the same format and criteria.

2. Create a Comparison Matrix

With your competitors identified and your information collected, there’s no better way to see how everyone stacks up than via a matrix. At a glance, you should be able to make a comparison. This should include features, platform compatibility, integrations, industries, verticals, key customers, and pricing.

This isn’t going to include every detail and nuance. The ability to see a snapshot is a handy resource. Anyone trying to get a feel for the marketplace can see the key differences between solutions.

3. Build Out Your Battle Cards

Product managers researching competitors need a strategy on how to win . Battle cards are a tried-and-true tool for visualizing the competitive landscape. There are a few different versions. They’re all a take on one-pagers that creates a visual template for putting competitive intelligence into action.

Each competitor can have its own battle card. These should spell out everything from pricing to their strengths and weaknesses. It’s a quick reference for the latest take on what they have to offer.

You can also create comparison battle cards. Line up your current product offering and a competitor’s. This allows you to compare how you differ, where you overlap, and which variances are opportunities or weak points in the juxtaposition between the two.

Battle cards can play multiple roles for your organization. For the product team, it can serve as another tool to spot opportunities where you can shore up your product offering or areas where you’re currently leading and may want to build on.

But the sales and marketing teams can also benefit from them. They provide a concise reference for competitors. They can also be “played” during sales training and prep work to create a unique selling proposition .

For example, let’s say a salesperson is calling on a prospect that currently uses a competitor’s product. Using battle cards, they’ll be able to know in advance which areas your own offering is better at, as well as the things your competitor does better. This will allow the salesperson to better prepare their pitch and not be surprised when things come up during the meeting.

In some cases, marketing might even produce battle cards. These cards can highlight the areas where your product is superior to prospects. These can also be used defensively if a current customer is considering a switch to an alternative.

4. Share Competitive Intelligence Updates

It can be really tempting to fire off emails the second you find a juicy tidbit about your competitors. You want to be seen as someone who’s on top of the news and don’t want anyone else to steal your thunder.

Stakeholders aren’t looking to product management as a source of gossip or to be a news aggregator. They’re looking for actionable information, and that includes analysis and context beyond the headline. This is why it’s so important for product managers to research competition.

Come up with a manageable cadence for updating stakeholders on noteworthy news and stick to it. This could be daily, weekly, or monthly given how active your particular industry is, but less is often more in these cases.

When you do deliver these updates, be sure you’re providing more than just a bunch of links. Briefly describe what you’ve learned, why it’s important, and if there’s any recommended action, including how this may impact the cost of delay .

Competitors will launch new features, sign new customers, and create news about themselves all the time. That’s how they stay relevant and top-of-mind, and your marketing department is likely doing the same thing. So be sure you’re adding value by curating carefully and providing substantive analysis. This is a handy tool to go with what you do choose to share and to help avoid stakeholders succumbing to shiny object syndrome .

Of course, there may be exceptions to the rule. When Google acquires a competitor or Amazon announces they’re entering your market you shouldn’t wait for your scheduled update. But keep those “urgent alerts” to a minimum to preserve your credibility and make sure you’re not tuned out by busy executives.

Regular reviews and overviews

Beyond breaking news, it’s always a good idea to take a step back and holistically review your overall assessment of each major competitor. Whether it’s monthly or quarterly, go back and review their current messaging and offering compared to what’s in your matrix and battle cards.

This “forest versus trees” analysis might uncover a trend you’d missed. Plus it’s just a good exercise to renew your familiarity with whom your product is up against.

5. Turn Competitive Intelligence Into Action

Compiling, organizing, and sharing all this data is pointless if it’s not going to inform the actions of your team and your organization. Be sure a competitive analysis is always an initial part of any decision-making or prioritization activity. And while competition shouldn’t be the only driver for what makes it onto the roadmap, it can’t be ignored either .

Understanding what else is out there is crucial to figuring out what differentiates your product versus what it is sorely lacking. Addressing the latter will let buyers focus on the former instead of fixating on what your product doesn’t do.