Thermal Material Trends Driven by SiC Adoption in EV Power Electronics

Membrane Materials for PEM Fuel Cells in the Post-PFAS World

Here's Why the SDV Market Will Be Worth US$700 Billion by 2034

Upcoming Webinar on Hydrogen and Solar Charged Electric Vehicles

Safety in Electric Vehicles - Exploring Fire Protection Materials

Upcoming Webinar on eVTOLs and Urban Air Mobility

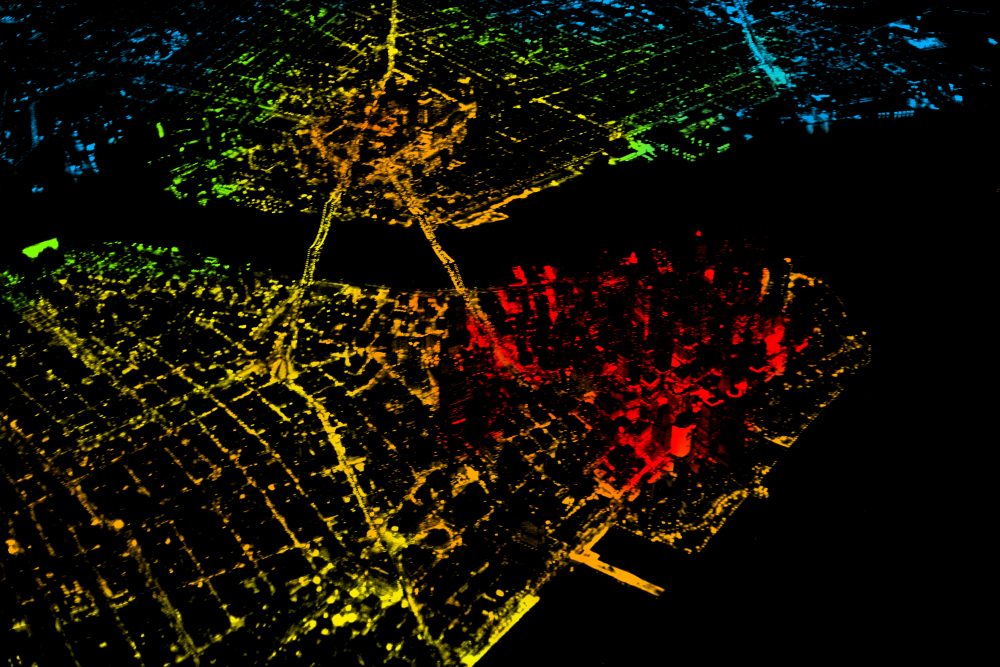

Unlocking Tomorrow's Vision: Exploring Lidar Technology Trends in 2024

Upcoming Webinar - What's Next for the Quantum Computing Market?

EV Charging Beyond the Utility Grid: A US$16Billion Market by 2034

IDTechEx Release Thermal Management for EV Power Electronics Report

Webinar - Insights into Future Lidars for Automotive Applications

Taxiing For Takeoff: The Promise of eVTOLs

The Sustainability of Electric Vehicle Fire Protection Materials

IDTechEx Release New Global eVTOL Aircraft Market Report

EVs Will Make Mining Cleaner, Cheaper, and More Productive

Webinar on the Evolution & Opportunities in Automotive HUD Technology

Which High-Tech Industries Need to Find Alternatives for PFAS?

Integration of DMS & OMS Offers Advancements for In-Cabin Monitoring

The Opportunities & Barriers Facing 3D Printing for Electric Vehicles

Metal vs Graphite Bipolar Plates: A Key PEM Fuel Cells Debate

- Search Menu

- Browse content in A - General Economics and Teaching

- Browse content in A1 - General Economics

- A10 - General

- A11 - Role of Economics; Role of Economists; Market for Economists

- A12 - Relation of Economics to Other Disciplines

- A13 - Relation of Economics to Social Values

- A14 - Sociology of Economics

- Browse content in A2 - Economic Education and Teaching of Economics

- A20 - General

- A29 - Other

- A3 - Collective Works

- Browse content in B - History of Economic Thought, Methodology, and Heterodox Approaches

- Browse content in B0 - General

- B00 - General

- Browse content in B1 - History of Economic Thought through 1925

- B10 - General

- B11 - Preclassical (Ancient, Medieval, Mercantilist, Physiocratic)

- B12 - Classical (includes Adam Smith)

- B13 - Neoclassical through 1925 (Austrian, Marshallian, Walrasian, Stockholm School)

- B14 - Socialist; Marxist

- B15 - Historical; Institutional; Evolutionary

- B16 - History of Economic Thought: Quantitative and Mathematical

- B17 - International Trade and Finance

- B19 - Other

- Browse content in B2 - History of Economic Thought since 1925

- B20 - General

- B21 - Microeconomics

- B22 - Macroeconomics

- B23 - Econometrics; Quantitative and Mathematical Studies

- B24 - Socialist; Marxist; Sraffian

- B25 - Historical; Institutional; Evolutionary; Austrian

- B26 - Financial Economics

- B27 - International Trade and Finance

- B29 - Other

- Browse content in B3 - History of Economic Thought: Individuals

- B30 - General

- B31 - Individuals

- Browse content in B4 - Economic Methodology

- B40 - General

- B41 - Economic Methodology

- B49 - Other

- Browse content in B5 - Current Heterodox Approaches

- B50 - General

- B51 - Socialist; Marxian; Sraffian

- B52 - Institutional; Evolutionary

- B53 - Austrian

- B54 - Feminist Economics

- B55 - Social Economics

- B59 - Other

- Browse content in C - Mathematical and Quantitative Methods

- Browse content in C0 - General

- C00 - General

- C02 - Mathematical Methods

- Browse content in C1 - Econometric and Statistical Methods and Methodology: General

- C10 - General

- C12 - Hypothesis Testing: General

- C13 - Estimation: General

- C14 - Semiparametric and Nonparametric Methods: General

- C18 - Methodological Issues: General

- C19 - Other

- Browse content in C2 - Single Equation Models; Single Variables

- C20 - General

- C21 - Cross-Sectional Models; Spatial Models; Treatment Effect Models; Quantile Regressions

- C22 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes

- C23 - Panel Data Models; Spatio-temporal Models

- C25 - Discrete Regression and Qualitative Choice Models; Discrete Regressors; Proportions; Probabilities

- Browse content in C3 - Multiple or Simultaneous Equation Models; Multiple Variables

- C30 - General

- C32 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes; State Space Models

- C34 - Truncated and Censored Models; Switching Regression Models

- C38 - Classification Methods; Cluster Analysis; Principal Components; Factor Models

- Browse content in C4 - Econometric and Statistical Methods: Special Topics

- C43 - Index Numbers and Aggregation

- C44 - Operations Research; Statistical Decision Theory

- Browse content in C5 - Econometric Modeling

- C50 - General

- Browse content in C6 - Mathematical Methods; Programming Models; Mathematical and Simulation Modeling

- C60 - General

- C61 - Optimization Techniques; Programming Models; Dynamic Analysis

- C62 - Existence and Stability Conditions of Equilibrium

- C63 - Computational Techniques; Simulation Modeling

- C65 - Miscellaneous Mathematical Tools

- C67 - Input-Output Models

- Browse content in C8 - Data Collection and Data Estimation Methodology; Computer Programs

- C82 - Methodology for Collecting, Estimating, and Organizing Macroeconomic Data; Data Access

- C89 - Other

- Browse content in C9 - Design of Experiments

- C90 - General

- C91 - Laboratory, Individual Behavior

- C92 - Laboratory, Group Behavior

- C93 - Field Experiments

- Browse content in D - Microeconomics

- Browse content in D0 - General

- D01 - Microeconomic Behavior: Underlying Principles

- D02 - Institutions: Design, Formation, Operations, and Impact

- D03 - Behavioral Microeconomics: Underlying Principles

- Browse content in D1 - Household Behavior and Family Economics

- D10 - General

- D11 - Consumer Economics: Theory

- D12 - Consumer Economics: Empirical Analysis

- D13 - Household Production and Intrahousehold Allocation

- D14 - Household Saving; Personal Finance

- Browse content in D2 - Production and Organizations

- D20 - General

- D21 - Firm Behavior: Theory

- D22 - Firm Behavior: Empirical Analysis

- D23 - Organizational Behavior; Transaction Costs; Property Rights

- D24 - Production; Cost; Capital; Capital, Total Factor, and Multifactor Productivity; Capacity

- D25 - Intertemporal Firm Choice: Investment, Capacity, and Financing

- Browse content in D3 - Distribution

- D30 - General

- D31 - Personal Income, Wealth, and Their Distributions

- D33 - Factor Income Distribution

- D39 - Other

- Browse content in D4 - Market Structure, Pricing, and Design

- D40 - General

- D41 - Perfect Competition

- D42 - Monopoly

- D43 - Oligopoly and Other Forms of Market Imperfection

- D46 - Value Theory

- Browse content in D5 - General Equilibrium and Disequilibrium

- D50 - General

- D51 - Exchange and Production Economies

- D57 - Input-Output Tables and Analysis

- D58 - Computable and Other Applied General Equilibrium Models

- Browse content in D6 - Welfare Economics

- D60 - General

- D61 - Allocative Efficiency; Cost-Benefit Analysis

- D62 - Externalities

- D63 - Equity, Justice, Inequality, and Other Normative Criteria and Measurement

- D64 - Altruism; Philanthropy

- D69 - Other

- Browse content in D7 - Analysis of Collective Decision-Making

- D71 - Social Choice; Clubs; Committees; Associations

- D72 - Political Processes: Rent-seeking, Lobbying, Elections, Legislatures, and Voting Behavior

- D73 - Bureaucracy; Administrative Processes in Public Organizations; Corruption

- D74 - Conflict; Conflict Resolution; Alliances; Revolutions

- Browse content in D8 - Information, Knowledge, and Uncertainty

- D80 - General

- D81 - Criteria for Decision-Making under Risk and Uncertainty

- D82 - Asymmetric and Private Information; Mechanism Design

- D83 - Search; Learning; Information and Knowledge; Communication; Belief; Unawareness

- D84 - Expectations; Speculations

- D85 - Network Formation and Analysis: Theory

- D86 - Economics of Contract: Theory

- D87 - Neuroeconomics

- Browse content in D9 - Micro-Based Behavioral Economics

- D91 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making

- Browse content in E - Macroeconomics and Monetary Economics

- Browse content in E0 - General

- E00 - General

- E01 - Measurement and Data on National Income and Product Accounts and Wealth; Environmental Accounts

- E02 - Institutions and the Macroeconomy

- Browse content in E1 - General Aggregative Models

- E10 - General

- E11 - Marxian; Sraffian; Kaleckian

- E12 - Keynes; Keynesian; Post-Keynesian

- E13 - Neoclassical

- E16 - Social Accounting Matrix

- E17 - Forecasting and Simulation: Models and Applications

- Browse content in E2 - Consumption, Saving, Production, Investment, Labor Markets, and Informal Economy

- E20 - General

- E21 - Consumption; Saving; Wealth

- E22 - Investment; Capital; Intangible Capital; Capacity

- E23 - Production

- E24 - Employment; Unemployment; Wages; Intergenerational Income Distribution; Aggregate Human Capital; Aggregate Labor Productivity

- E25 - Aggregate Factor Income Distribution

- E26 - Informal Economy; Underground Economy

- E27 - Forecasting and Simulation: Models and Applications

- Browse content in E3 - Prices, Business Fluctuations, and Cycles

- E30 - General

- E31 - Price Level; Inflation; Deflation

- E32 - Business Fluctuations; Cycles

- E37 - Forecasting and Simulation: Models and Applications

- Browse content in E4 - Money and Interest Rates

- E40 - General

- E41 - Demand for Money

- E42 - Monetary Systems; Standards; Regimes; Government and the Monetary System; Payment Systems

- E43 - Interest Rates: Determination, Term Structure, and Effects

- E44 - Financial Markets and the Macroeconomy

- E49 - Other

- Browse content in E5 - Monetary Policy, Central Banking, and the Supply of Money and Credit

- E50 - General

- E51 - Money Supply; Credit; Money Multipliers

- E52 - Monetary Policy

- E58 - Central Banks and Their Policies

- Browse content in E6 - Macroeconomic Policy, Macroeconomic Aspects of Public Finance, and General Outlook

- E60 - General

- E61 - Policy Objectives; Policy Designs and Consistency; Policy Coordination

- E62 - Fiscal Policy

- E63 - Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization; Treasury Policy

- E64 - Incomes Policy; Price Policy

- E65 - Studies of Particular Policy Episodes

- Browse content in F - International Economics

- Browse content in F0 - General

- F00 - General

- F01 - Global Outlook

- F02 - International Economic Order and Integration

- Browse content in F1 - Trade

- F10 - General

- F11 - Neoclassical Models of Trade

- F12 - Models of Trade with Imperfect Competition and Scale Economies; Fragmentation

- F13 - Trade Policy; International Trade Organizations

- F14 - Empirical Studies of Trade

- F15 - Economic Integration

- F16 - Trade and Labor Market Interactions

- F17 - Trade Forecasting and Simulation

- F18 - Trade and Environment

- Browse content in F2 - International Factor Movements and International Business

- F20 - General

- F21 - International Investment; Long-Term Capital Movements

- F22 - International Migration

- F23 - Multinational Firms; International Business

- Browse content in F3 - International Finance

- F30 - General

- F31 - Foreign Exchange

- F32 - Current Account Adjustment; Short-Term Capital Movements

- F33 - International Monetary Arrangements and Institutions

- F34 - International Lending and Debt Problems

- F35 - Foreign Aid

- F36 - Financial Aspects of Economic Integration

- F37 - International Finance Forecasting and Simulation: Models and Applications

- F39 - Other

- Browse content in F4 - Macroeconomic Aspects of International Trade and Finance

- F40 - General

- F41 - Open Economy Macroeconomics

- F42 - International Policy Coordination and Transmission

- F43 - Economic Growth of Open Economies

- F44 - International Business Cycles

- F45 - Macroeconomic Issues of Monetary Unions

- F47 - Forecasting and Simulation: Models and Applications

- Browse content in F5 - International Relations, National Security, and International Political Economy

- F50 - General

- F51 - International Conflicts; Negotiations; Sanctions

- F53 - International Agreements and Observance; International Organizations

- F54 - Colonialism; Imperialism; Postcolonialism

- F55 - International Institutional Arrangements

- F59 - Other

- Browse content in F6 - Economic Impacts of Globalization

- F60 - General

- F61 - Microeconomic Impacts

- F62 - Macroeconomic Impacts

- F63 - Economic Development

- F64 - Environment

- F65 - Finance

- Browse content in G - Financial Economics

- Browse content in G0 - General

- G00 - General

- G01 - Financial Crises

- Browse content in G1 - General Financial Markets

- G10 - General

- G11 - Portfolio Choice; Investment Decisions

- G12 - Asset Pricing; Trading volume; Bond Interest Rates

- G13 - Contingent Pricing; Futures Pricing

- G14 - Information and Market Efficiency; Event Studies; Insider Trading

- G15 - International Financial Markets

- G18 - Government Policy and Regulation

- G19 - Other

- Browse content in G2 - Financial Institutions and Services

- G20 - General

- G21 - Banks; Depository Institutions; Micro Finance Institutions; Mortgages

- G22 - Insurance; Insurance Companies; Actuarial Studies

- G23 - Non-bank Financial Institutions; Financial Instruments; Institutional Investors

- G24 - Investment Banking; Venture Capital; Brokerage; Ratings and Ratings Agencies

- G28 - Government Policy and Regulation

- Browse content in G3 - Corporate Finance and Governance

- G30 - General

- G32 - Financing Policy; Financial Risk and Risk Management; Capital and Ownership Structure; Value of Firms; Goodwill

- G33 - Bankruptcy; Liquidation

- G34 - Mergers; Acquisitions; Restructuring; Corporate Governance

- G35 - Payout Policy

- G38 - Government Policy and Regulation

- Browse content in G5 - Household Finance

- G51 - Household Saving, Borrowing, Debt, and Wealth

- Browse content in H - Public Economics

- Browse content in H1 - Structure and Scope of Government

- H10 - General

- H11 - Structure, Scope, and Performance of Government

- H12 - Crisis Management

- Browse content in H2 - Taxation, Subsidies, and Revenue

- H20 - General

- H22 - Incidence

- H23 - Externalities; Redistributive Effects; Environmental Taxes and Subsidies

- H25 - Business Taxes and Subsidies

- H26 - Tax Evasion and Avoidance

- Browse content in H3 - Fiscal Policies and Behavior of Economic Agents

- Browse content in H4 - Publicly Provided Goods

- H40 - General

- H41 - Public Goods

- Browse content in H5 - National Government Expenditures and Related Policies

- H50 - General

- H53 - Government Expenditures and Welfare Programs

- H55 - Social Security and Public Pensions

- H56 - National Security and War

- Browse content in H6 - National Budget, Deficit, and Debt

- H60 - General

- H62 - Deficit; Surplus

- H63 - Debt; Debt Management; Sovereign Debt

- H68 - Forecasts of Budgets, Deficits, and Debt

- Browse content in H7 - State and Local Government; Intergovernmental Relations

- H70 - General

- H74 - State and Local Borrowing

- H77 - Intergovernmental Relations; Federalism; Secession

- Browse content in I - Health, Education, and Welfare

- Browse content in I0 - General

- I00 - General

- Browse content in I1 - Health

- I10 - General

- I12 - Health Behavior

- I14 - Health and Inequality

- I15 - Health and Economic Development

- Browse content in I2 - Education and Research Institutions

- I20 - General

- I21 - Analysis of Education

- I23 - Higher Education; Research Institutions

- I24 - Education and Inequality

- I26 - Returns to Education

- Browse content in I3 - Welfare, Well-Being, and Poverty

- I30 - General

- I31 - General Welfare

- I32 - Measurement and Analysis of Poverty

- I38 - Government Policy; Provision and Effects of Welfare Programs

- Browse content in J - Labor and Demographic Economics

- Browse content in J0 - General

- J00 - General

- J01 - Labor Economics: General

- J08 - Labor Economics Policies

- Browse content in J1 - Demographic Economics

- J10 - General

- J13 - Fertility; Family Planning; Child Care; Children; Youth

- J15 - Economics of Minorities, Races, Indigenous Peoples, and Immigrants; Non-labor Discrimination

- J16 - Economics of Gender; Non-labor Discrimination

- J18 - Public Policy

- Browse content in J2 - Demand and Supply of Labor

- J20 - General

- J21 - Labor Force and Employment, Size, and Structure

- J22 - Time Allocation and Labor Supply

- J23 - Labor Demand

- J24 - Human Capital; Skills; Occupational Choice; Labor Productivity

- J26 - Retirement; Retirement Policies

- J28 - Safety; Job Satisfaction; Related Public Policy

- J29 - Other

- Browse content in J3 - Wages, Compensation, and Labor Costs

- J30 - General

- J31 - Wage Level and Structure; Wage Differentials

- J32 - Nonwage Labor Costs and Benefits; Retirement Plans; Private Pensions

- J33 - Compensation Packages; Payment Methods

- J38 - Public Policy

- Browse content in J4 - Particular Labor Markets

- J40 - General

- J41 - Labor Contracts

- J42 - Monopsony; Segmented Labor Markets

- J44 - Professional Labor Markets; Occupational Licensing

- J45 - Public Sector Labor Markets

- J46 - Informal Labor Markets

- J48 - Public Policy

- J49 - Other

- Browse content in J5 - Labor-Management Relations, Trade Unions, and Collective Bargaining

- J50 - General

- J51 - Trade Unions: Objectives, Structure, and Effects

- J52 - Dispute Resolution: Strikes, Arbitration, and Mediation; Collective Bargaining

- J53 - Labor-Management Relations; Industrial Jurisprudence

- J54 - Producer Cooperatives; Labor Managed Firms; Employee Ownership

- J58 - Public Policy

- Browse content in J6 - Mobility, Unemployment, Vacancies, and Immigrant Workers

- J60 - General

- J61 - Geographic Labor Mobility; Immigrant Workers

- J62 - Job, Occupational, and Intergenerational Mobility

- J63 - Turnover; Vacancies; Layoffs

- J64 - Unemployment: Models, Duration, Incidence, and Job Search

- J65 - Unemployment Insurance; Severance Pay; Plant Closings

- J68 - Public Policy

- J69 - Other

- Browse content in J7 - Labor Discrimination

- J71 - Discrimination

- J78 - Public Policy

- Browse content in J8 - Labor Standards: National and International

- J80 - General

- J81 - Working Conditions

- J83 - Workers' Rights

- J88 - Public Policy

- Browse content in K - Law and Economics

- Browse content in K0 - General

- K00 - General

- Browse content in K1 - Basic Areas of Law

- K11 - Property Law

- K12 - Contract Law

- K13 - Tort Law and Product Liability; Forensic Economics

- Browse content in K2 - Regulation and Business Law

- K20 - General

- K21 - Antitrust Law

- K22 - Business and Securities Law

- K23 - Regulated Industries and Administrative Law

- K25 - Real Estate Law

- Browse content in K3 - Other Substantive Areas of Law

- K31 - Labor Law

- K39 - Other

- Browse content in K4 - Legal Procedure, the Legal System, and Illegal Behavior

- K40 - General

- K41 - Litigation Process

- K42 - Illegal Behavior and the Enforcement of Law

- Browse content in L - Industrial Organization

- Browse content in L0 - General

- L00 - General

- Browse content in L1 - Market Structure, Firm Strategy, and Market Performance

- L10 - General

- L11 - Production, Pricing, and Market Structure; Size Distribution of Firms

- L12 - Monopoly; Monopolization Strategies

- L13 - Oligopoly and Other Imperfect Markets

- L14 - Transactional Relationships; Contracts and Reputation; Networks

- L16 - Industrial Organization and Macroeconomics: Industrial Structure and Structural Change; Industrial Price Indices

- Browse content in L2 - Firm Objectives, Organization, and Behavior

- L20 - General

- L21 - Business Objectives of the Firm

- L22 - Firm Organization and Market Structure

- L23 - Organization of Production

- L24 - Contracting Out; Joint Ventures; Technology Licensing

- L25 - Firm Performance: Size, Diversification, and Scope

- L26 - Entrepreneurship

- L29 - Other

- Browse content in L3 - Nonprofit Organizations and Public Enterprise

- L30 - General

- L31 - Nonprofit Institutions; NGOs; Social Entrepreneurship

- L32 - Public Enterprises; Public-Private Enterprises

- L33 - Comparison of Public and Private Enterprises and Nonprofit Institutions; Privatization; Contracting Out

- L39 - Other

- Browse content in L4 - Antitrust Issues and Policies

- L40 - General

- L41 - Monopolization; Horizontal Anticompetitive Practices

- L44 - Antitrust Policy and Public Enterprises, Nonprofit Institutions, and Professional Organizations

- Browse content in L5 - Regulation and Industrial Policy

- L50 - General

- L52 - Industrial Policy; Sectoral Planning Methods

- Browse content in L6 - Industry Studies: Manufacturing

- L60 - General

- L61 - Metals and Metal Products; Cement; Glass; Ceramics

- L66 - Food; Beverages; Cosmetics; Tobacco; Wine and Spirits

- L67 - Other Consumer Nondurables: Clothing, Textiles, Shoes, and Leather Goods; Household Goods; Sports Equipment

- Browse content in L7 - Industry Studies: Primary Products and Construction

- L78 - Government Policy

- Browse content in L8 - Industry Studies: Services

- L80 - General

- L82 - Entertainment; Media

- Browse content in L9 - Industry Studies: Transportation and Utilities

- L97 - Utilities: General

- L98 - Government Policy

- Browse content in M - Business Administration and Business Economics; Marketing; Accounting; Personnel Economics

- Browse content in M0 - General

- M00 - General

- Browse content in M1 - Business Administration

- M10 - General

- M12 - Personnel Management; Executives; Executive Compensation

- M13 - New Firms; Startups

- M16 - International Business Administration

- Browse content in M2 - Business Economics

- M21 - Business Economics

- Browse content in M3 - Marketing and Advertising

- M37 - Advertising

- Browse content in M4 - Accounting and Auditing

- M41 - Accounting

- M49 - Other

- Browse content in M5 - Personnel Economics

- M51 - Firm Employment Decisions; Promotions

- M52 - Compensation and Compensation Methods and Their Effects

- M54 - Labor Management

- M55 - Labor Contracting Devices

- Browse content in N - Economic History

- Browse content in N0 - General

- N00 - General

- N01 - Development of the Discipline: Historiographical; Sources and Methods

- Browse content in N1 - Macroeconomics and Monetary Economics; Industrial Structure; Growth; Fluctuations

- N10 - General, International, or Comparative

- N11 - U.S.; Canada: Pre-1913

- N12 - U.S.; Canada: 1913-

- N13 - Europe: Pre-1913

- N14 - Europe: 1913-

- N15 - Asia including Middle East

- N17 - Africa; Oceania

- Browse content in N2 - Financial Markets and Institutions

- N20 - General, International, or Comparative

- N23 - Europe: Pre-1913

- N24 - Europe: 1913-

- N25 - Asia including Middle East

- N26 - Latin America; Caribbean

- Browse content in N3 - Labor and Consumers, Demography, Education, Health, Welfare, Income, Wealth, Religion, and Philanthropy

- N30 - General, International, or Comparative

- N32 - U.S.; Canada: 1913-

- N34 - Europe: 1913-

- Browse content in N4 - Government, War, Law, International Relations, and Regulation

- N43 - Europe: Pre-1913

- Browse content in N5 - Agriculture, Natural Resources, Environment, and Extractive Industries

- N50 - General, International, or Comparative

- N51 - U.S.; Canada: Pre-1913

- N52 - U.S.; Canada: 1913-

- N55 - Asia including Middle East

- N7 - Transport, Trade, Energy, Technology, and Other Services

- Browse content in N8 - Micro-Business History

- N80 - General, International, or Comparative

- Browse content in O - Economic Development, Innovation, Technological Change, and Growth

- Browse content in O1 - Economic Development

- O10 - General

- O11 - Macroeconomic Analyses of Economic Development

- O12 - Microeconomic Analyses of Economic Development

- O13 - Agriculture; Natural Resources; Energy; Environment; Other Primary Products

- O14 - Industrialization; Manufacturing and Service Industries; Choice of Technology

- O15 - Human Resources; Human Development; Income Distribution; Migration

- O16 - Financial Markets; Saving and Capital Investment; Corporate Finance and Governance

- O17 - Formal and Informal Sectors; Shadow Economy; Institutional Arrangements

- O18 - Urban, Rural, Regional, and Transportation Analysis; Housing; Infrastructure

- O19 - International Linkages to Development; Role of International Organizations

- Browse content in O2 - Development Planning and Policy

- O20 - General

- O23 - Fiscal and Monetary Policy in Development

- O24 - Trade Policy; Factor Movement Policy; Foreign Exchange Policy

- O25 - Industrial Policy

- Browse content in O3 - Innovation; Research and Development; Technological Change; Intellectual Property Rights

- O30 - General

- O31 - Innovation and Invention: Processes and Incentives

- O32 - Management of Technological Innovation and R&D

- O33 - Technological Change: Choices and Consequences; Diffusion Processes

- O34 - Intellectual Property and Intellectual Capital

- O35 - Social Innovation

- O38 - Government Policy

- O39 - Other

- Browse content in O4 - Economic Growth and Aggregate Productivity

- O40 - General

- O41 - One, Two, and Multisector Growth Models

- O43 - Institutions and Growth

- O44 - Environment and Growth

- O47 - Empirical Studies of Economic Growth; Aggregate Productivity; Cross-Country Output Convergence

- Browse content in O5 - Economywide Country Studies

- O50 - General

- O51 - U.S.; Canada

- O52 - Europe

- O53 - Asia including Middle East

- O54 - Latin America; Caribbean

- O55 - Africa

- Browse content in P - Economic Systems

- Browse content in P0 - General

- P00 - General

- Browse content in P1 - Capitalist Systems

- P10 - General

- P11 - Planning, Coordination, and Reform

- P12 - Capitalist Enterprises

- P13 - Cooperative Enterprises

- P14 - Property Rights

- P16 - Political Economy

- P17 - Performance and Prospects

- Browse content in P2 - Socialist Systems and Transitional Economies

- P20 - General

- P21 - Planning, Coordination, and Reform

- P25 - Urban, Rural, and Regional Economics

- Browse content in P3 - Socialist Institutions and Their Transitions

- P30 - General

- P31 - Socialist Enterprises and Their Transitions

- P35 - Public Economics

- P36 - Consumer Economics; Health; Education and Training; Welfare, Income, Wealth, and Poverty

- P37 - Legal Institutions; Illegal Behavior

- Browse content in P4 - Other Economic Systems

- P40 - General

- P41 - Planning, Coordination, and Reform

- P46 - Consumer Economics; Health; Education and Training; Welfare, Income, Wealth, and Poverty

- P48 - Political Economy; Legal Institutions; Property Rights; Natural Resources; Energy; Environment; Regional Studies

- Browse content in P5 - Comparative Economic Systems

- P50 - General

- P51 - Comparative Analysis of Economic Systems

- P52 - Comparative Studies of Particular Economies

- Browse content in Q - Agricultural and Natural Resource Economics; Environmental and Ecological Economics

- Browse content in Q0 - General

- Q00 - General

- Q01 - Sustainable Development

- Browse content in Q1 - Agriculture

- Q15 - Land Ownership and Tenure; Land Reform; Land Use; Irrigation; Agriculture and Environment

- Q18 - Agricultural Policy; Food Policy

- Browse content in Q3 - Nonrenewable Resources and Conservation

- Q30 - General

- Browse content in Q4 - Energy

- Q41 - Demand and Supply; Prices

- Q42 - Alternative Energy Sources

- Q48 - Government Policy

- Browse content in Q5 - Environmental Economics

- Q50 - General

- Q54 - Climate; Natural Disasters; Global Warming

- Q56 - Environment and Development; Environment and Trade; Sustainability; Environmental Accounts and Accounting; Environmental Equity; Population Growth

- Q57 - Ecological Economics: Ecosystem Services; Biodiversity Conservation; Bioeconomics; Industrial Ecology

- Browse content in R - Urban, Rural, Regional, Real Estate, and Transportation Economics

- Browse content in R0 - General

- R00 - General

- Browse content in R1 - General Regional Economics

- R10 - General

- R11 - Regional Economic Activity: Growth, Development, Environmental Issues, and Changes

- R12 - Size and Spatial Distributions of Regional Economic Activity

- R15 - Econometric and Input-Output Models; Other Models

- Browse content in R2 - Household Analysis

- R20 - General

- Browse content in R3 - Real Estate Markets, Spatial Production Analysis, and Firm Location

- R30 - General

- R31 - Housing Supply and Markets

- R4 - Transportation Economics

- Browse content in R5 - Regional Government Analysis

- R51 - Finance in Urban and Rural Economies

- R58 - Regional Development Planning and Policy

- Browse content in Y - Miscellaneous Categories

- Browse content in Y1 - Data: Tables and Charts

- Y10 - Data: Tables and Charts

- Browse content in Y3 - Book Reviews (unclassified)

- Y30 - Book Reviews (unclassified)

- Browse content in Y8 - Related Disciplines

- Y80 - Related Disciplines

- Browse content in Z - Other Special Topics

- Browse content in Z0 - General

- Z00 - General

- Browse content in Z1 - Cultural Economics; Economic Sociology; Economic Anthropology

- Z10 - General

- Z11 - Economics of the Arts and Literature

- Z12 - Religion

- Z13 - Economic Sociology; Economic Anthropology; Social and Economic Stratification

- Z18 - Public Policy

- Browse content in Z2 - Sports Economics

- Z29 - Other

- Advance articles

- Editor's Choice

- Author Guidelines

- Submission Site

- Open Access

- About Cambridge Journal of Economics

- About the Cambridge Political Economy Society

- Editorial Board

- Advertising and Corporate Services

- Self-Archiving Policy

- Dispatch Dates

- Terms and Conditions

- Journals on Oxford Academic

- Books on Oxford Academic

Article Contents

1. introduction, 2. paris purposes and the future we made, 3. the problem of unmaking, 4. conclusion: unmaking and is paris possible, conflict of interest statement, bibliography.

- < Previous

Electric vehicles: the future we made and the problem of unmaking it

- Article contents

- Figures & tables

- Supplementary Data

Jamie Morgan, Electric vehicles: the future we made and the problem of unmaking it, Cambridge Journal of Economics , Volume 44, Issue 4, July 2020, Pages 953–977, https://doi.org/10.1093/cje/beaa022

- Permissions Icon Permissions

The uptake of battery electric vehicles (BEVs), subject to bottlenecks, seems to have reached a tipping point in the UK and this mirrors a general trend globally. BEVs are being positioned as one significant strand in the web of policy intended to translate the good intentions of Article 2 of the Conference of the Parties 21 Paris Agreement into reality. Governments and municipalities are anticipating that a widespread shift to BEVs will significantly reduce transport-related carbon emissions and, therefore, augment their nationally determined contributions to emissions reduction within the Paris Agreement. However, matters are more complicated than they may appear. There is a difference between thinking we can just keep relying on human ingenuity to solve problems after they emerge and engaging in fundamental social redesign to prevent the trajectories of harm. BEVs illustrate this. The contribution to emissions reduction per vehicle unit may be less than the public initially perceive since the important issue here is the lifecycle of the BEV and this is in no sense zero-emission. Furthermore, even though one can make the case that BEVs are a superior alternative to the fossil fuel-powered internal combustion engine, the transition to BEVs may actually facilitate exceeding the carbon budget on which the Paris Agreement ultimately rests. Whether in fact it does depends on the nature of the policy that shapes the transition. If the transition is a form of substitution that conforms to rather than shifts against current global scales and trends in private transportation, then it is highly likely that BEVs will be a successful failure. For this not to be the case, then the transition to BEVs must be coordinated with a transformation of the current scales and trends in private transportation. That is, a significant reduction in dependence on and individual ownership of powered vehicles, a radical reimagining of the nature of private conveyance and of public transportation.

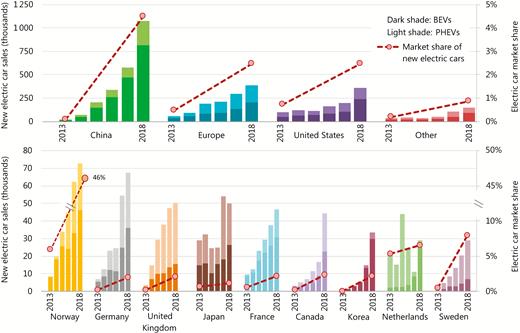

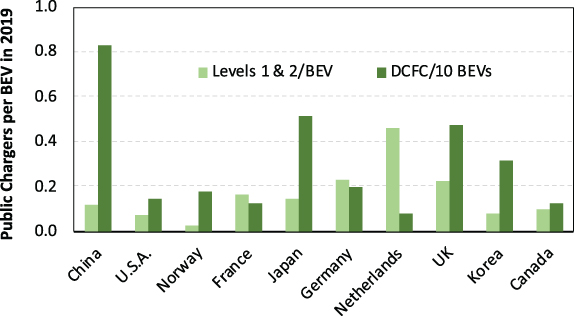

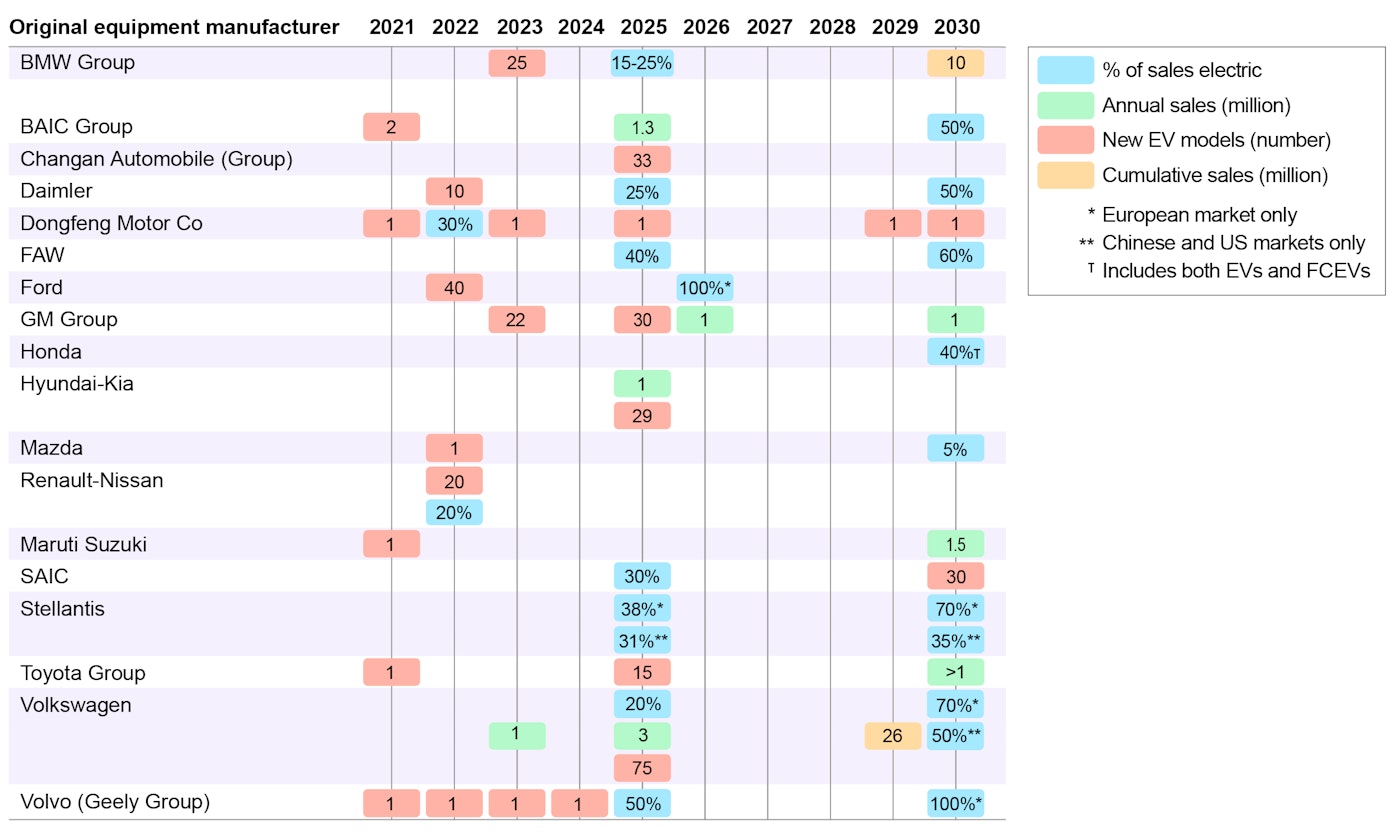

According to the UK Society of Motor Manufacturers and Traders (SMMT), the Tesla Model 3 sold 2,685 units in December 2019, making it the 9th best-selling car in the country in that month (by new registrations; in August, a typically slow month for sales, it had been 3rd with 2,082 units sold; Lea, 2019; SMMT, 2019 ). As of early 2020, battery electric vehicles (BEVs) such as the new Hyundai Electric Kona had a two-year waiting list for delivery and the Kia e-Niro a one-year wait. The uptake of electric vehicles, subject to bottlenecks, seems to have reached a tipping point in the UK and this transcends the popularity of any given model. This possible tipping point mirrors a general trend globally (however, see later for quite what this means). At the regional, national and municipal scale, public health and environmentally informed legislation are encouraging vehicle manufacturers to invest heavily in alternative fuel vehicles and, in particular, BEVs and plug-in hybrid vehicles (PHEVs), which are jointly categorised within ‘ultra-low emission vehicles’ (ULEVs). 1 According to a report by Deloitte, more than 20 major cities worldwide announced plans in 2017–18 to ban petrol and diesel cars by 2030 or sooner ( Deloitte, 2018 , p. 5). All the major manufacturers have or are launching BEV models, and so vehicles are becoming available across the status and income spectrum that has in the past determined market segmentation. According to the consultancy Frost & Sullivan (2019) , there were 207 models (143 BEVs, 64 PHEVs) available globally in 2018 compared with 165 in 2017.

In 2018, the UK government published its Road to Zero policy commitment and introduced the Automated and Electric Vehicles Act 2018 , which empowers future governments to regulate regarding the required infrastructure. Road to Zero announced an ‘expectation’ that between 50% and 70% of new cars and vans will be electric by 2030 and the intention to ‘end the sale of new conventional petrol and diesel cars and vans by 2040’, with the ‘ambition’ that by 2050 almost all vehicles on the road will be ‘zero-emission’ at the point of use ( Department for Transport, 2018 ). Progress towards these goals was to be reviewed 2025. 2 However, on 4 February 2020, Prime Minister Boris Johnson announced that in the run-up to Conference of the Parties (COP)26 in Glasgow (now postponed), Britain would bring forward its 2040 goal to 2035. The UK is a member of the Clean Energy Ministerial Campaign (CEM), which launched the EV30@30 initiative in 2017, and its Road to Zero policy commitments broadly align with those of many European countries. 3 Norway has longstanding generous incentives for BEVs ( Holtsmark and Skonhoft, 2014 ) and 31% of all cars sold in 2018 and just under 50% in the first half of 2019 in Norway were BEVs. According to the International Energy Agency (IEA), Norway is the per capita global leader in electric vehicle uptake ( IEA, 2019A ). 4

BEVs, then, are being positioned as one significant strand in the web of policy intended to translate the good intentions of Article 2 of the COP 21 Paris Agreement into reality (see Morgan, 2016 ; IEA, 2019A , pp. 11–2). Clearly, governments and municipalities are anticipating that a widespread shift to electric vehicles will significantly reduce transport-related carbon emissions and, therefore, augment their nationally determined contributions (NDCs) to emissions reduction within the Paris Agreement. And, since the BEV trend is global, the impacts potentially also apply to countries whose relation to Paris is more problematic, including the USA (for Trump and his context, see Gills et al. , 2019 ). However, matters are more complicated than they may appear. Clearly, innovation and technological change are important components in our response to the challenge of climate change. However, there is a difference between thinking we can just keep relying on human ingenuity to solve problems after they emerge and engaging in fundamental social redesign to prevent the trajectories of harm. BEVs illustrate this. In what follows we explore the issues.

The aim of this paper, then, is to argue that it is a mistake to claim, assert or assume that BEVs are necessarily a panacea for the emissions problem. To do so would be an instance of what ecological economists refer to as ‘technocentrism’, as though simply substituting BEVs for existing internal combustion engine (ICE) vehicles was sufficient. The literature on this is, of course, vast, if one consults specialist journals or recent monographs (e.g. Chapman, 2007 ; Bailey and Wilson, 2009 ; Williamson et al. , 2018 ), but remains relatively under-explored in general political economy circles at a time of ‘Climate Emergency’, and so warrants discussion in introductory and indicative fashion, setting out, however incompletely, the range of issues at stake. To be clear, the very fact that there is a range is itself important. BEVs are technology, technologies have social contexts and social contexts include systemic features and related attitudes and behaviours. Technocentrism distracts from appropriate recognition of this. At its worse, technocentrism fails to address and so works to reproduce a counter-productive ecological modernisation: the technological focus facilitates socio-economic trends, which are part of the broader problem rather than solutions to it. In the case of BEVs, key areas to consider and points to make include:

Transport is now one of, if not, the major source of carbon emissions in the UK and in many other countries. Transport emissions stubbornly resist reduction. The UK, like many other countries, exhibits contradictory trends and policy claims regarding future carbon emissions reductions. As such, it is an error to simply assume prior emissions reduction trends will necessarily continue into the future, and the new net-zero goal highlights the short time line and urgency of the problem.

Whilst BEVs are, from an emissions point of view, a superior technology to ICE vehicles, this is less than an ordinary member of the public might think. ‘Embodied emissions’, ‘energy mix’ and ‘life cycle’ analysis all matter.

There is a difference between ‘superior technology’ and ‘superior choice’, the latter must also take account of the scale of and general trend growth in vehicle ownership and use. It is this that creates a meaningful context for what substitution can be reasonably expected to achieve.

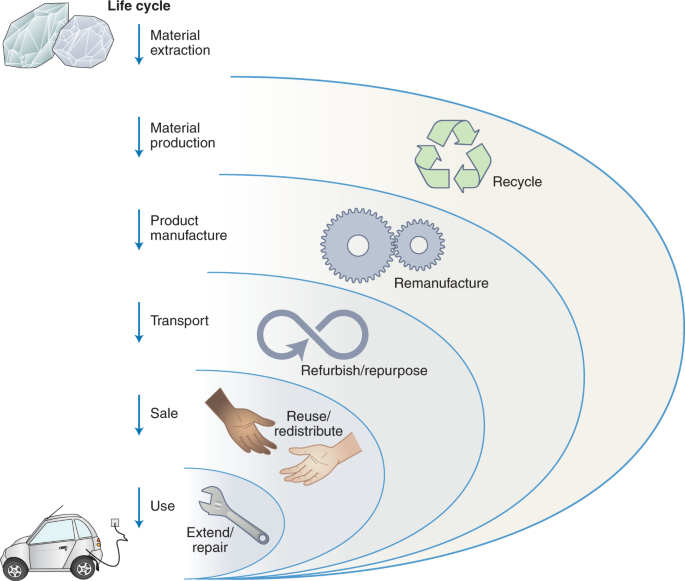

A 1:1 substitution of BEVs for ICE vehicles and general growth in the number of vehicles potentially violates the Precautionary Principle. It creates a problem that did not need to exist, e.g. since there is net growth, it involves ‘emission reductions’ within new emissions sources and this is reckless. Inter alia , a host of fallacies and other risks inherent to the socio-economy of BEVs and resource extraction/dependence also apply.

As such, it makes more sense to resist rather than facilitate techno-political lock-in or path-dependence on private transportation and instead to coordinate any transition to BEVs with a more fundamental social redesign of public transport and transport options.

This systematic statement should be kept in mind whilst reading the following. Cumulatively, the points stated facilitate appropriate consideration of the question: What kind of solution are BEVs to what kind of problem? And we return to this in the conclusion. It is also worth bearing in mind, though it is not core to the explicit argument pursued, that an economy is a complex evolving open system and economics has not only struggled to adequately address this in general, it has particularly done so in terms of ecological issues (for relevant critique, see especially the work of Clive Spash and collected, Fullbrook and Morgan, 2019 ). 5 Since we assume limited prior knowledge on the part of the reader, we begin by briefly setting out the road to the current carbon budget problem.

The United Nations Framework Convention on Climate Change (UNFCCC) was created in 1992. Article 2 of the Convention states its goal as, the ‘stabilization of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system’ ( UNFCCC, 1992 , p. 4; Gills and Morgan, 2019 ). Emissions are cumulative because emitted CO 2 can stay in the atmosphere for well over one hundred years (other greenhouse gases [GHGs] tend to be of shorter duration). Our climate future is made now. The Intergovernmental Panel on Climate Change (IPCC) collates existent models to produce a forecast range and has typically used atmospheric CO 2 of 450 ppm as a level likely to trigger a 2°C average warming. This has translated into a ‘carbon budget’ restricting total cumulative emissions to the lower end of 3,000+ Gigatonnes of CO 2 (GtCO 2 ). In the last few years, climate scientists have begun to argue that positive feedback loops with adverse warming and other climatological and ecological effects may be underestimated in prior models (see Hansen et al. , 2017 ; Steffen et al. , 2018 ). Such concerns are one reason why Article 2 of the UNFCCC COP 21 Paris Agreement included a goal of at least trying to do better than the 2°C target—restricting warming to 1.5°C. This further restricts the available carbon budget. However, current Paris Agreement country commitments stated as NDCs look set to exceed the 3,000+ target in a matter of a few short years ( UNFCCC, 2015 ; Morgan, 2016 , 2017 ).

Since the industrial revolution began, we have already produced more than 2,000 GtCO 2 . Total annual emissions have increased rather than decreased over the period in which the problem has been recognised. The United Nations Environment Program (UNEP) publishes periodic ‘emissions gap’ reports. Its recent 10-year summary report notes that emissions grew at an average 1.6% per year from 2008 to 2017 and ‘show no signs of peaking’ ( Christensen and Olhoff, 2019 , p. 3). In 2018, the 9th Report stated that annual emissions in 2017 stood at a record of 53.5 Gigatonnes of CO 2 and equivalents (GtCO 2e ) ( UNEP, 2018 , p. xv). This compares to less than 25 GtCO 2 in 2000 and far exceeds on a global basis the level in the Kyoto Protocol benchmark year of 1990. According to the 9th Emissions Gap Report, 184 parties to the Paris Agreement had so far provided NDCs. If these NDCs are achieved, annual emissions in 2030 are projected to still be 53 GtCO 2e . However, if the current ‘implementation deficit’ continues global annual emissions could increase by about 10% to 59 GtCO 2e . This is because current emissions policy is not sufficient to offset the ‘key drivers’ of ‘economic growth and population growth’ ( Christensen and Olhoff, 2019 , p. 3). By sharp contrast, the IPCC Global Warming of 1.5 ° C report states that annual global emissions must fall by 45% from the 2017 figure by 2030 and become net zero by mid-century in order to achieve the Paris target ( IPCC, 2018 ). According to the subsequent 10th Emissions Gap Report, emissions increased yet again to 55.3 GtCO 2e in 2018 and, as a result of this adverse trend, emissions need to fall by 7.6% per year from 2020 to 2030 to achieve the IPCC goal, and this contrasts with less than 4% had reductions begun in 2010 and 15% if they are delayed until 2025 ( UNEP 2019A ). Current emissions trends mean that we will achieve an additional 500 GtCO 2 quickly and imply an average warming of 3 to 4°C over the rest of the century and into the next. We are thus on track for the ‘dangerous anthropogenic interference with the climate system’ that the COP process is intended to prevent ( UNFCCC, 1992 , p. 4). According to the 10th Emissions Gap Report, 78% of all emissions derive from the G-20 nations, and whilst many countries had recognised the need for net zero, only 5 countries of the G-20 had committed to this and none had yet submitted formal strategies. COP 25, December 2019, meanwhile, resulted in no overall progress other than on measurement and finance (for detailed analysis, see Newell and Taylor, 2020 ). As such, the situation is urgent and becoming more so.

Problems, moreover, have already begun to manifest ( UNEP 2019B , 2019B ; IPCC 2019A , 2019B ). Climate change does not respect borders, some countries may be more adversely affected sooner than others, but there is no reason to assume that cumulative effects will be localised. Moreover, there is no reason to assume that they will be manageable based on our current designs for life. In November 2019, several prominent systems and climate scientists published a survey essay in Nature highlighting nine critical climate tipping points that we are either imminently approaching or may have already exceeded ( Lenton et al. , 2018 ). In that same month, more than 11,250 scientists from 153 countries (the Alliance of World Scientists) signed a letter published in BioScience concurring that we now face a genuine existential ‘Climate Emergency’ and warning of ‘ecocide’ if ‘major transformations’ are not forthcoming ( Ripple et al. , 2019 ). We live in incredibly complex interconnected societies based on long supply chains and just in time delivery–few of us (including nations) are self-sufficient. Global human civilisation is extremely vulnerable and the carbon emission problem is only one of several conjoint problems created by our expansionary industrialised-consumption system. Appropriate and timely policy solutions are, therefore, imperative. Cambridge now has a Centre for the Study of Existential Risk and Oxford a Future of Humanity Institute (see also Servigne and Stevens, 2015 ). This is serious research, not millenarian cultishness. The Covid-19 outbreak only serves to underscore the fragility of our systems. As Michael Marmot, Professor of epidemiology has commented, the outbreak reveals not only how political decisions can make systems more vulnerable, but also how governments can, when sufficiently motivated, take immediate and radical action (Harvey, 2020). To reiterate, however, according to both the IPCC and UNEP, emissions must fall drastically. 6

Policy design and implementation are mainly national (domestic). As such, an initial focus on the UK provides a useful point of departure to contextualise what the transition to BEVs might be expected to achieve.

The UK is a Kyoto and Paris signatory. It is a member of the European Emissions Trading Scheme (ETS). The UK Climate Change Act 2008 was the world’s first long-term legally binding national framework for targeted statutory reductions in emissions. The Act required the UK to reduce its emissions by at least 80% by 2050 (below the 1990 baseline; this has been broadly in line with subsequent EU policy on the subject). 7 The Act put in place a system of five yearly ‘carbon budgets’ to keep the UK on an emissions reduction pathway to 2050. The subsequent carbon budgets have been produced with input from the Committee on Climate Change (CCC), an independent body created by the 2008 Act to advise the government. In November 2015, the CCC recommended a target of 57% below 1990 levels by the early 2030s (the fifth carbon budget). 8 Following the Paris Agreement’s new target of 1.5°C and the IPCC and UNEP reports late 2018, the CCC published the report Net Zero: The UK’s contribution to stopping global warming ( CCC, 2019 ). 9 The CCC report recognises that Paris creates additional responsibility for the UK to augment and accelerate its targets within the new bottom-up Paris NDC procedure. The CCC recommended an enhanced UK net-zero GHG emissions target (formally defined in terms of long-term and short-term GHGs) by 2050. This included emissions from aviation and shipping and with no use of strategies that offset or swap real emissions. In June 2019, Theresa May, then UK Prime Minister, committed to adopt the recommendation using secondary legislation (absorbed into the 2008 Act—but without the offset commitment). So, the UK is one of the few G-20 countries to, so far, provide a formal commitment on net zero, though as the UNEP notes, a commitment is not itself necessarily indicative of a realisable strategy. The CCC responded to the government announcement:

This is just the first step. The target must now be reinforced by credible UK policies, across government, inspiring a strong response from business, industry and society as a whole. The government has not yet moved formally to include international aviation and shipping within the target , but they have acknowledged that these sectors must be part of the whole economy strategy for net zero. We will assist by providing further analysis of how emissions reductions can be delivered in these sectors through domestic and international frameworks. 10

The development of policy is currently in flux during the Covid-19 lockdown and whilst Brexit reaches some kind of resolution. As noted in the Introduction section, however, May’s replacement, Boris Johnson has signalled his government’s commitment to achieving its statutory commitments. However, this has been met with some scepticism, not least because it has not been clear what new powers administrative bodies would have and over and above this many of the Cabinet are from the far right of the Conservative Party, and are on record as climate change sceptics or have a voting record of opposing environmentally focussed investment, taxes, subsidies and prohibitions (including the new Environment Secretary, George Eustice, formerly of UKIP). The policy may and hopefully will change, becoming more concrete, but it is still instructive to assess context and general trends.

The UK has one of the best records in the world on reducing emissions. However, given full context, this is not necessarily a cause for congratulation or confidence. It would be a mistake to think that emissions reduction exhibits a definite rate that can be projected from the past into the future. 11 This applies both nationally and globally. Some sources of relative reduction that are local or national have different significance on a global basis (they are partial transfers) and overall the closer one approaches net zero the more resistant or difficult it is likely to become to achieve reductions. The CCC has already begun to signal that the UK is now failing to meet its existent budgets. This follows periods of successive emissions reductions. According to the CCC, the UK has reduced its GHG emissions by approximately one-third since 1990. ‘Per capita emissions are now close to the global average at 7–8 tCO 2 e/person, having been over 50% above in 2008’ ( CCC, 2019 , p. 46). Other analyses are even more positive. According to Carbon Brief, emissions have fallen in seven consecutive years from 2013 to 2019 and by 40% compared with the 1990 benchmark. Carbon Brief claim that since 2010 the UK has the fastest rate of emissions reduction of any major economy. However, it concurs with the CCC that future likely reductions are less than the UK’s carbon budgets and that the new net-zero commitment requires: amounting to only an additional 10% reduction over the next decade to 2030. 12

Moreover, all analyses agree that the reduction has mainly been achieved by reducing coal output for use in electricity generation (switching to natural gas) and by relative deindustrialisation as the UK economy has continued to grow—manufacturing is a smaller part of a larger service-based economy. 13 And , the data are based on a production focussed accounting system. The accounting system does not include all emissions sources. It does not include those that the UK ‘imports’ based on consumption. UK consumption-based emissions per year are estimated to be about 70% greater than the production measure (for different methods, see DECC, 2015 ). 14 If consumption is included, the main estimates for falling emissions change to around a 10% reduction since 1990. Moreover, much of this has been achieved by relatively invisible historic transitions as the economy has evolved in lock-step with globalisation. That is, reductions have been ones that did not require the population to confront behaviours as they have developed. No onerous interventions have been imposed, as yet . 15 However, it does not follow that this can continue, since future reductions are likely to be more challenging. The UK cannot deindustrialise again (nor can the global economy, as is, simply deindustrialise in aggregate if final consumption remains the primary goal), and the UK has already mainly switched from coal energy production. Emissions from electricity generation may fall but it also matters what the electricity is being used to power. In any case, future emissions reductions, in general, require more effective changes in other sectors, and this necessarily seems to require everyone to question their socio-economic practices. Transport is a key issue.

As a ‘satellite’ of its National Accounts, the UK Office for National Statistics (ONS) publishes Environmental Accounts and these data are used to measure progress. Much of the data refer to the prior year or earlier. In 2017, UK GHG emissions were reported to be 566 million tonnes CO 2 e (2% less than 2016 and, as already noted about one-third of the 1990 level; ONS, 2019 ). The headline accounts break this down into four categories (for which further subdivisions are produced by various sources) and we can usefully contrast 1990 and recent data ( ONS, 2019 , p. 4):

The Environmental Accounts’ figures indicate some shifting in the relative sources of emissions over the last 30 years. As we have intimated, electricity generation and manufacturing have experienced reduced emissions, though they are far from zero; household and transport, meanwhile, have remained stubbornly high. Moreover, the accounts are also slightly misleading for the uninitiated, since transport refers to the industry and not all transport. Domestic car ownership and use are part of the household sector, and it is the continued dependence on car ownership that provides, along with heating and insulation issues, one of the major sources of the persistently high level of household emissions. The UK Department for Business, Energy and Industrial Strategy (DBEIS) provides differently organised statistics and attributes cars to its transport category and uses a subsequent residential category rather than household category. The Department’s statistical release in 2018 thus attributes a higher 140 MtCO 2 e to transport for 2016, whilst the residential category is a correspondingly lower figure of approximately 106 MtCO 2 e. The 140 MtCO 2 e is just slightly less than the equivalent figure for 1990, although transport achieved a peak of about 156 MtCO 2 e in 2005 ( DBEIS, 2018 , pp. 8–9). As of 2016, transport becomes the largest source of emissions based on DBEIS data (exceeding energy supply) whilst households become the largest in the Environmental Accounts. In any case, looking across both sets of accounts, the important point here is that since 1990 transport as a source of emissions has remained stubbornly high. Transport emissions have been rising as an industrial sector in the Environmental Accounts or relatively consistent and recently rising in its total contribution in the DBEIS data. The CCC Net Zero report draws particular attention to this. Drawing on the DBEIS data, it states that ‘Transport is now the largest source of UK GHG emissions (23% of the total) and saw emissions rise from 2013 to 2017’ ( CCC, 2019 , p. 48). More generally, the report states that despite some progress in terms of the UK carbon budgets, ‘policy success and progress in reducing emissions has been far from universal’ ( CCC, 2019 , p. 48). The report recommends ( CCC, 2019 , pp. 23–6, 34):

A fourfold increase by 2050 in low carbon (renewables) electricity

Developing energy storage (to enhance the use of renewables such as wind)

Energy-efficient buildings and a shift from gas central heating and cooking

Halting the accumulation of biodegradable waste in landfills

Developing carbon capture technology

Reducing agricultural emissions (mainly dairy but also fertiliser use)

Encouraging low or no meat diets

Land management to increase carbon retention/absorption

Rapid transition to electric vehicles and public transport

As we noted in the Introduction section, the UK Department for Transport Road To Zero document stated a goal of ending the sale of conventional diesel- and petrol-powered ICE vehicles by 2040. The CCC suggested improving on this:

Electric vehicles. By 2035 at the latest all new cars and vans should be electric (or use a low-carbon alternative such as hydrogen). If possible, an earlier switchover (e.g. 2030) would be desirable, reducing costs for motorists and improving air quality. This could help position the UK to take advantage of shifts in global markets. The Government must continue to support strengthening of the charging infrastructure, including for drivers without access to off-street parking. ( CCC, 2019 , p. 34)

The UK government’s response to these and other similar suggestions has been to bring the target date forward to 2035 and to propose that the prohibition will also apply to hybrids. However, the whole is set to go out to consultation and no detail has so far (early 2020) been forthcoming. In its 11 March 2020 Budget, the government also committed £1 billion to ‘green transport solutions’, including £500 million to support the rollout of the electric vehicle charging infrastructure, whilst extending the current grant/subsidy scheme for new electric vehicles (albeit at a reduced rate of £3000 from £3500 per new registration). It has also signalled that it may tighten the timeline for sales prohibition further to 2030. 16 As a policy, much of this is, ostensibly at least, positive, but there is a range of issues that need to be considered regarding what is being achieved. The context of transition matters and this may transcend the specifics of current policy.

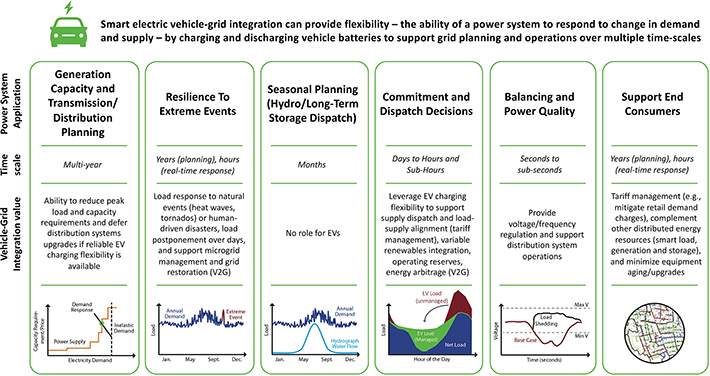

3.1 BEV transition: life cycles?

The CCC is confident that a transition to electric vehicles can be a constructive contribution to achieving net-zero emissions by mid-century. However, the point is not unequivocal. The previously quoted CCC communique following the UK government’s commitment to implement Net Zero uses the phrase ‘credible UK policies, across government, inspiring a strong response from business, industry and society as a whole’, and the CCC report places an emphasis on BEVs and a transition to public transport. The relative dependence between these two matters (and see Conclusion). BEVs are potentially (almost) zero emissions in use. But they are not zero emissions in practice. Given this, then the substitution of BEVs for current carbon-powered ICEs is potentially problematic, depending on trends in ownership of and use of powered vehicles (private transportation). These points will become clearer as we proceed.

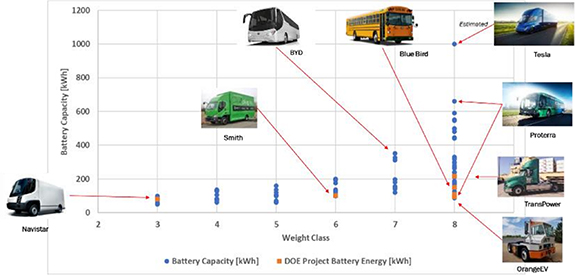

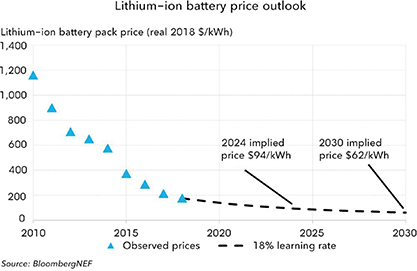

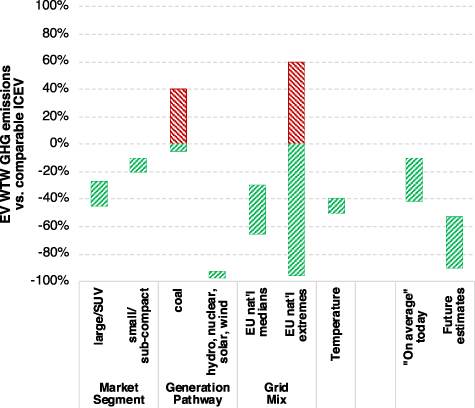

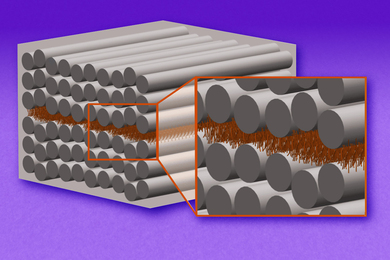

BEVs are not zero emission in context and based on the life cycle. This is for two basic reasons. First, a BEV is a powered vehicle and so the source of power can be from carbon-based energy supply sources (and this varies with the ‘energy mix’ of electricity production in different countries; IEA, 2019A , p. 8). Second, each new vehicle is a material product. Each vehicle is made of metals, plastics, rubber and so forth. Just the cabling in a car can be 60 kg of metals. All the materials must be mined and processed, or synthesised, the parts must be manufactured, transported and assembled, transported again for sale and then delivered. For example, according to the SMMT in 2016, only 12% of cars sold in the UK were built in the UK and 80% of those built in the UK were exported in that year. Some components (such as a steering column) enter and exit the UK multiple times whilst being built and modified and before final assembly. Vehicle manufacture is a global business in terms of procuring materials and a mainly regional (in the international sense) business in terms of component manufacture for assembly and final sales. Power is used throughout this process and many miles are travelled. Moreover, each vehicle must be maintained and serviced thereafter, which compounds this utilisation of resources. BEVs are a subcategory of vehicles and production locations are currently more concentrated than for vehicles in general (Tesla being the extreme). 17 In any case, producing a BEV is an economic activity and it is not environmentally costless. As Georgescu-Roegen (1971) noted long ago and ecologically minded economists continue to highlight (see Spash, 2017 ; Holt et al. , 2009 ), production cannot evade thermodynamic consequences. In terms of BEVs, the primary focus of analysis in this second sense of manufacturing as a source of contributory emissions has been the carbon emissions resulting from battery production. Based on current technology, batteries are heavy (a significant proportion of the weight of the final vehicle) and energy intensive to produce.

Comparative estimates regarding the relative life cycle emissions of BEVs with equivalent fossil fuel-powered vehicles are not new. 18 Over the last decade, the number of life cycle studies has steadily risen as the interest in and uptake of BEVs have increased. Clearly, there is great scope for variation in findings, since the energy mix for electricity supply varies by country and the assumptions applied to manufacturing can vary between studies. At the same time, the general trend over the last decade has been for the energy mix in many countries to include more renewables and for manufacturing to become more energy efficient. This is partly reflected in metrics based on emissions per $GDP, which in conjunction with relative expansion in service sectors are used to establish ‘relative decoupling’. So, given that both the energy mix of power production and the emissions derived from production can improve, then one might expect a general trend of improved emissions claims for BEVs in recent years and this seems to be the case.

For example, if we go back to 2010, the UK Royal Academy of Engineering found that technology would likely favour PHEVs over BEVs in the near future because the current energy mix and state of battery technology indicated that emissions deriving from charging were typically higher for BEVs than an average ordinary car’s fuel consumption—providing a reason to persist with ICE vehicles or, more responsibly, choose hybrids over pure electric ( Royal Academy of Engineering, 2010 ). Using data up to 2013, but drawing on the previous decade, Holtsmark and Skonhoft (2014) come to similar conclusions based on the most advanced BEV market—Norway. Focussing mainly on energy mix (with acknowledgement that a full life cycle needs to be assessed) they are deeply sceptical that BEVs are a significant net reduction in carbon emissions ( Holtsmark and Skonhoft, 2014 , pp. 161, 164). Neither the Academy nor Holtsmark and Skonhoft are merely sceptical. The overall point of the latter was that more needed to be done to accelerate the use of low or no carbon renewables for power infrastructure (a point the CCC continues to make). This, of course, has happened in many places, including the UK. That is, acceleration of the use of renewables, though it is by no means the case government can take direct credit for this in the UK (and there is also evidence on a global level that a transition to clean energy from fossil fuel forms is much slower than some data sources indicate; see Smil, 2017A , 2017B ). 19 In terms of BEVs, however, recent analyses are considerably more optimistic regarding emissions potential per BEV (e.g. Hoekstra, 2019 ; Regett et al. , 2019 ). Research by Staffell et al. (2019) at Imperial for the power corporation, Drax, provides some interesting insights and contemporary metrics.

Staffell et al. split BEVs into three categories based on conjoint battery and vehicle size: a 30–45 kWh battery car, equivalent to a mid-range or standard car; a heavier, longer-range, 90–100 kWh battery car, equivalent to a luxury or SUV model; and a 30–40 kWh battery light van. They observe that a 40-litre tank of petrol releases 90–100 kgCO 2 when burnt and the ‘embodied’ emissions represented by the manufacture of a standard lithium-ion battery are estimated at 75–125 kgCO 2 per kWh. They infer that every kWh of power embodied in the manufacture of a battery is, therefore, approximately equivalent to using a full tank of petrol. For example, a 30 kWh battery embodies thirty 40-litre petrol tank’s worth of emissions. The BEV’s are also a source of emissions based on the energy mix used to charge the battery for use. The in-use emissions for the BEV are a consequence of the energy consumed per km and this depends on the weight of car and efficiency of the battery. 20 They estimate 33 gCO 2 per km for standard BEVs, 44–54 gCO 2 for luxury and SUVs and 40 gCO 2 for vans. In all cases, this is significantly less than an equivalent fossil-fuel vehicle.

The insight that the estimates and comparisons are leading towards is that the battery embodies an ‘upfront carbon cost’ which can be gradually ‘repaid’ by the saving on emissions represented by driving a BEV compared with driving an equivalent fossil fuel-powered vehicle. That is, the environmental value of opting for BEVs increases over time. Moreover, if the energy mix is gradually becoming less carbon based, this effect is likely to improve further. Based on these considerations, Staffell et al. estimate that it may take 2–4 years to repay the embodied emissions in the battery for a standard BEV and 5 to 6 for the luxury or SUV models. Fundamentally, assuming 15 years to be typical for the on-the-road life expectancy of a vehicle, they find lifetime emissions for each BEV category are lower than equivalent fossil-fuel vehicles.

Still, the implication is that BEVs are not zero emission. Moreover, the degree to which this is so is likely to be significantly greater than a focus on the battery alone indicates. Romare and Dahlöff (2017) , assess the life-cycle of battery production (not use), and in regard of the stages of battery production find that the manufacturing stages account for about 50% of the emissions and the mining and processing stages about the same. They infer that there is significant scope for further emissions reductions as manufacturing processes improve and the Drax study seems to confirm this. However, whilst the battery may be the major component, as we have already noted, vehicle manufacture is a major process in terms of all components and in terms of distance travelled in production and distribution. It is also worth noting that the weight of batteries creates strong incentives to opt for lighter materials for other parts of the vehicle. Most current vehicles are steel based. An aluminium vehicle is lighter, but the production of aluminium is more carbon intensive than steel, so there are also further hidden trade-offs that the positive narrative for BEVs must consider. 21

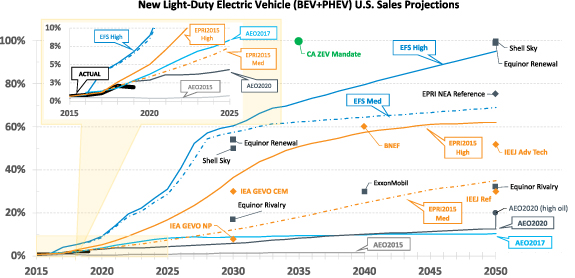

The general point worth emphasising here is that there is basic uncertainty built into the complex evolving process of transition and change. There is a basic ontology issue here familiar in economic critique: there is no simple way to model the changes with confidence, and in broader context confidence in modelling may itself be a problem here when translated into policy, since it invites complacency. 22 That said, the likely direction of travel is towards further improvements in the energy mix and improvements in battery technology. Both these may be incremental or transformational depending on future technologies (fusion for energy mix and organics and solid-state technologies for batteries perhaps). 23 But one must still consider time frames and ultimate context. 24 The context is a carbon budget and the need for radical reductions in emissions by 2030 and net zero by mid-century. Consider: if just the battery of a car requires four years to be paid back then there is no significant difference in the contribution to emissions from the vehicle into the mid 2020s. For larger vehicles, this becomes the later 2020s, and each year of delay in transition for the individual owner is another year closer to 2030. Since transport is (stubbornly) the major source of emissions in the UK and a major source in the world, this is not irrelevant. BEVs can readily be a successful failure in Paris terms. This brings us to the issue of trends in vehicle ownership and substitutions. This also matters for what we mean by transition.

3.2 Substitutions and transformations: successful failure?

There are many ways to consider the problem of transition. Consider the ‘Precautionary Principle’. This is Principle 15 of the 1992 Rio Declaration: ‘In order to protect the environment, the precautionary principle shall be widely applied by the States [UN members] according to their capabilities. Where there are threats of serious or irreversible damage, lack of full scientific certainty shall not be used as a reason for postponing cost-effective measures to prevent environmental degradation’ (UNCED). Assuming we can simply depend on unrealised technology potentially violates the Principle. Why is this so? If BEVs are a source of net emissions, then each new vehicle continues to contribute to overall emissions. The current number of vehicles to be replaced, therefore, is a serious consideration, as is any growth trend. Here, social redesign rather than merely adopting new technology is surely more in accordance with the Precautionary Principle. BEVs may be sources of lower emissions than fossil fuel-powered vehicles, but it does not follow that we are constrained to choose between just these two options or that it makes sense to do so in aggregate, given the objective of radical and rapid reduction in emissions. If time is short and numbers of vehicles are large and growing then the implication is that substitution of BEVs should (from a precautionary point of view) occur in a context that is oppositional to this growing trend. That is, the goal should be one of reducing private car ownership and use, and increasing the availability, pervasiveness and use of public transport (and alternatives to private vehicle ownership). This is an issue compounded by the finding that there is an upfront carbon cost from BEVs. Some consideration of current vehicle numbers and trends in the UK and globally serve to reinforce the point.

The UK Department for Transport publishes annual statistics for vehicle licensing. According to the 2019 statistical release for 2018 data, there were 38.2 million licensed vehicles in Britain and 39.4 million including Northern Ireland ( Department for Transport, 2019 ). Vehicles are categorised into cars, light goods vehicles, heavy goods vehicles, motorcycles and buses and coaches. Cars comprised 31.5 million of the total (82%) and the total represented a 1.2% increase in the year 2017. There is, furthermore, a long-term year-on-year trend increase in vehicles since World War II and over the last 20 years that growth (the net change as new vehicles are licensed and old vehicles taken off the road) has averaged 630,000 vehicles per year ( Department for Transport, 2019 , p. 7). This is partly accounted for not only by population growth, and business growth, but also by an increase in the number of vehicles per household. According to the statistical release, 2.9 million new vehicles were registered in 2018, and though this was about 5% fewer than 2017 the figure remained broadly consistent with long-term trends in numbers and still represented growth (contributing to the stated 1.2% increase). 25 Of the total new registrations in 2018, 2.3 million were cars and 360,000 were light goods vehicles. Around 2 million has been typical for cars.

The point to take from these metrics is that numbers are large and context matters. Cars represent 31.5 million emission sources and there are 39.4 million vehicles in the UK. Replacing these 1:1 reproduces an emissions problem. Replacing them in conjunction with an ownership growth trend exacerbates the emissions problem that then has to be resolved. If around 2 million new cars are registered per year then the point at which the BEVs amongst these new registrations can be assumed to begin payback for embodied emissions prior to the point at which they become net sources of reduced (and not zero ) emissions is staggered over future years based on the rate of switching. There are then also net new vehicles. Given there are 31.5 million cars to be replaced over time (plus net growth), there is a high likelihood of significant transport emissions up to and beyond 2030. The problem, of course, is implicit in the Department for Transport policy commitment to end sales of petrol and diesel vehicles by 2035 and ensure all vehicles are zero-emission in use by 2050. Knowingly committing to this ingrained emission problem, given we have already recognised the urgency and challenge of the carbon budget and the ‘stubbornness’ of transport emissions, is not prudent, if alternatives exist . It is producing a problem that need not exist purely because enabling car ownership and use is a line of least resistance in policy terms (it requires the least change in behaviour and thus provokes limited opposition). It is also worth noting that the UK, like most countries, has an ‘integrated’ transport policy. However, the phrasing disguises the relative levels of investment between different modes of transport. Austerity politics may have resulted in declining road quality in the UK but, in general terms, the UK is still committed to heavy investment in and expansion of its road system. 26 This infrastructure investment not only seems ‘economically rational’, but it is also a matter of relative emphasis and ‘lock-in’. The future policy is predicated on the dominance of road use and thus vehicle use.

The crux of the matter here is how we view political expedience. Surely this hinges on the consequences of policy failure. That is, the failure to implement an effective policy given the genuine problem expressed in the goal of 1.5 or 2°C. ‘Alternatives’ may seem unrealistic, but this is a matter of will and policy—of rational social design rather than impossibility. The IPCC and other sources suggest that achieving the Paris goals requires mobilisation of a kind not previously seen outside of wartime. Policy can pivot on this quite quickly, even if perhaps this can seem unlikely in 2020. Climate events may make this necessary and popular pressure and opinion may be transformed. This is currently uncertain. Positions on this may yet move quite quickly.