14 Reasons Why You Need a Business Plan

10 min. read

Updated April 19, 2024

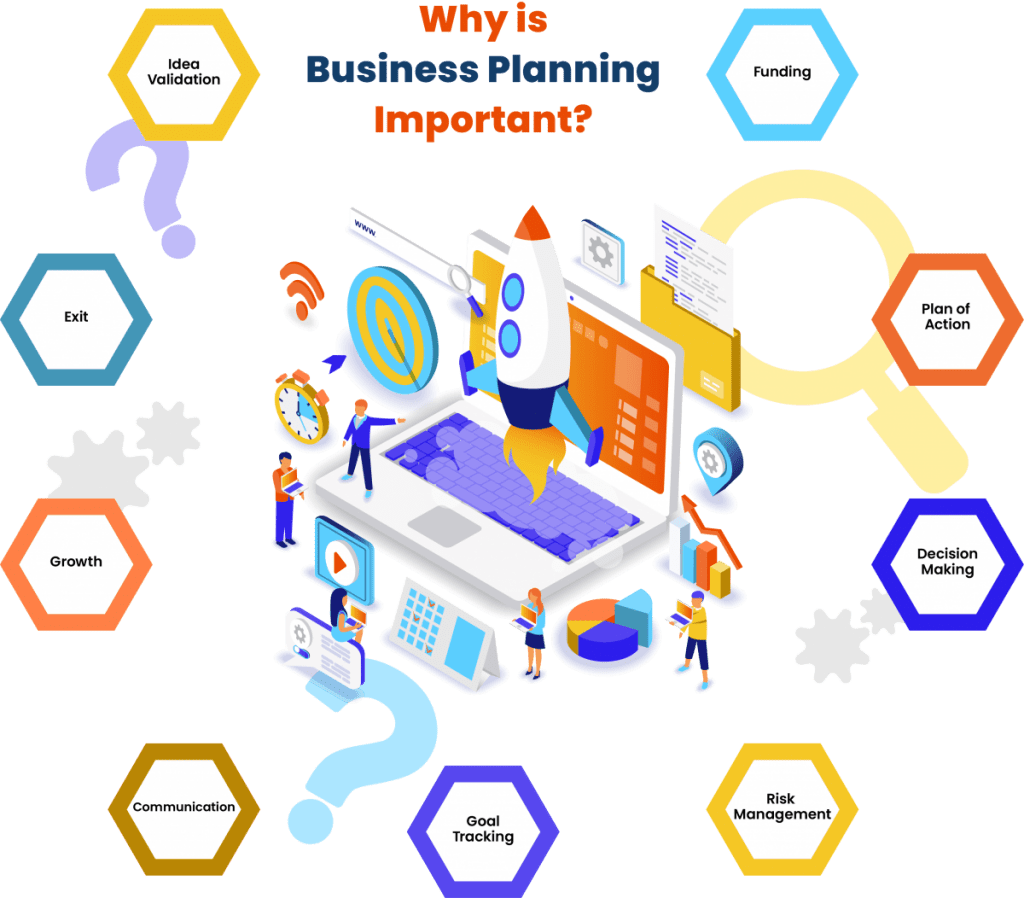

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

Further Reading: 5 fundamental principles of business planning

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

6 Min. Read

Business Plan vs Business Model Canvas Explained

3 Min. Read

How Long Should a Business Plan Be?

12 Min. Read

Do You Need a Business Plan? Scientific Research Says Yes

11 Key Components of a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

The importance of business plan: 5 key reasons.

A key part of any business is its business plan. They can help define the goals of your business and help it reach success. A good business plan can also help you develop an adequate marketing strategy. There are a number of reasons all business owners need business plans, keep reading to learn more!

Here’s What We’ll Cover:

What Is a Business Plan?

5 reasons you need a well-written business plan, how do i make a business plan, key takeaways.

A business plan contains detailed information that can help determine its success. Some of this information can include the following:

- Market analysis

- Cash flow projection

- Competitive analysis

- Financial statements and financial projections

- An operating plan

A solid business plan is a good way to attract potential investors. It can also help you display to business partners that you have a successful business growing. In a competitive landscape, a formal business plan is your key to success.

Check out all of the biggest reasons you need a good business plan below.

1. To Secure Funding

Whether you’re seeking funding from a venture capitalist or a bank, you’ll need a business plan. Business plans are the foundation of a business. They tell the parties that you’re seeking funding from whether or not you’re worth investing in. If you need any sort of outside financing, you’ll need a good business plan to secure it.

2. Set and Communicate Goals

A business plan gives you a tangible way of reviewing your business goals. Business plans revolve around the present and the future. When you establish your goals and put them in writing, you’re more likely to reach them. A strong business plan includes these goals, and allows you to communicate them to investors and employees alike.

3. Prove Viability in the Market

While many businesses are born from passion, not many will last without an effective business plan. While a business concept may seem sound, things may change once the specifics are written down. Often, people who attempt to start a business without a plan will fail. This is because they don’t take into account all of the planning and funds needed to get a business off of the ground.

Market research is a large part of the business planning process. It lets you review your potential customers, as well as the competition, in your field. By understanding both you can set price points for products or services. Sometimes, it may not make sense to start a business based on the existing competition. Other times, market research can guide you to effective marketing strategies that others lack. To have a successful business, it has to be viable. A business plan will help you determine that.

4. They Help Owners Avoid Failure

Far too often, small businesses fail. Many times, this is due to the lack of a strong business plan. There are many reasons that small businesses fail, most of which can be avoided by developing a business plan. Some of them are listed below, which can be avoided by having a business plan:

- The market doesn’t need the business’s product or service

- The business didn’t take into account the amount of capital needed

- The market is oversaturated

- The prices set by the business are too high, pushing potential customers away

Any good business plan includes information to help business owners avoid these issues.

5. Business Plans Reduce Risk

Related to the last reason, business plans help reduce risk. A well-thought-out business plan helps reduce risky decisions. They help business owners make informed decisions based on the research they conduct. Any business owner can tell you that the most important part of their job is making critical decisions. A business plan that factors in all possible situations helps make those decisions.

Luckily, there are plenty of tools available to help you create a business plan. A simple search can lead you to helpful tools, like a business plan template . These are helpful, as they let you fill in the information as you go. Many of them provide basic instructions on how to create the business plan, as well.

If you plan on starting a business, you’ll need a business plan. They’re good for a vast number of things. Business plans help owners make informed decisions, as well as set goals and secure funding. Don’t put off putting together your business plan!

If you’re in the planning stages of your business, be sure to check out our resource hub . We have plenty of valuable resources and articles for you when you’re just getting started. Check it out today!

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

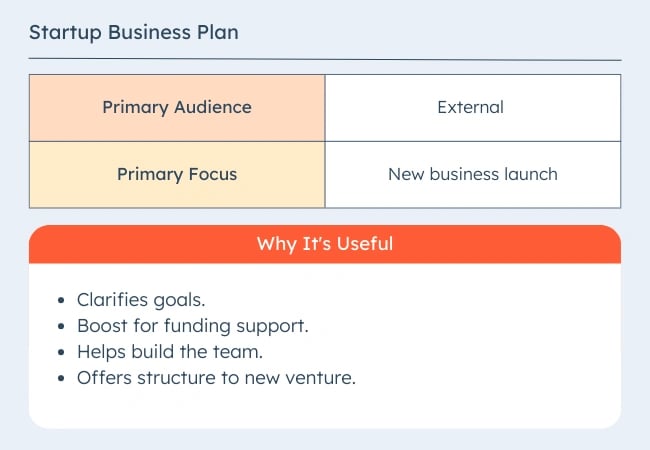

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

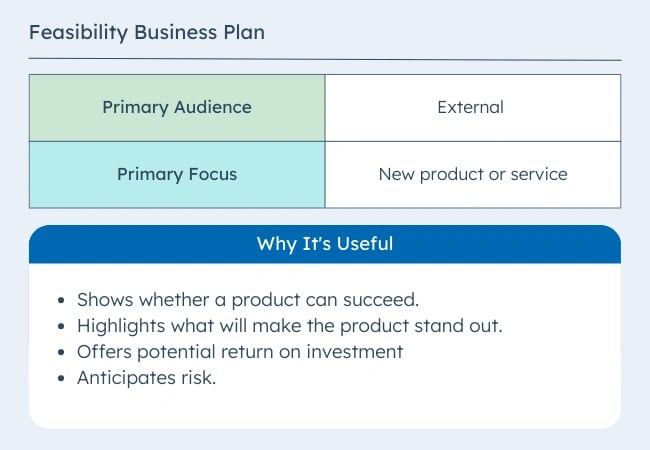

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

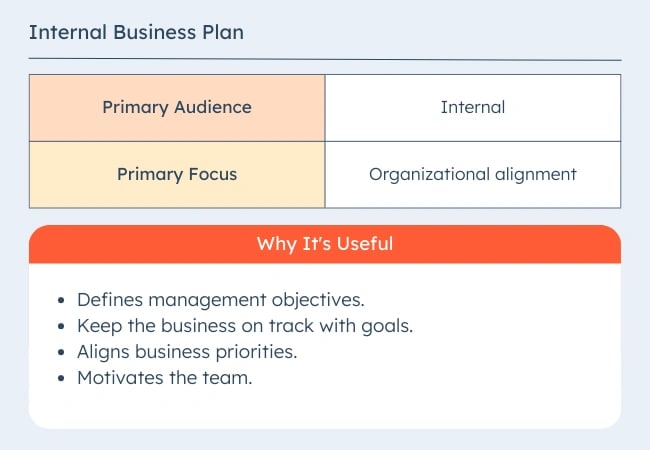

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

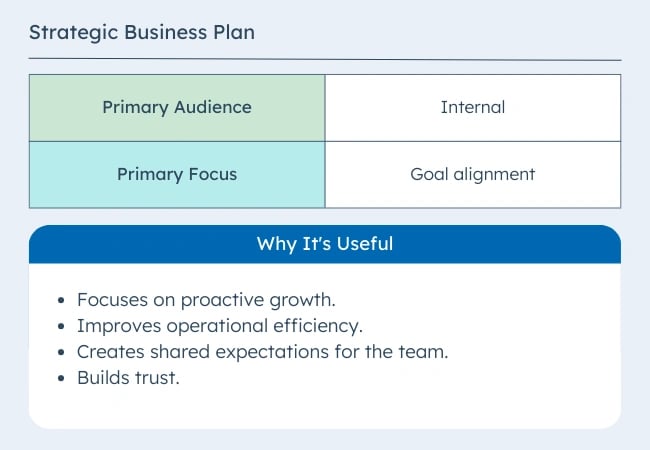

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

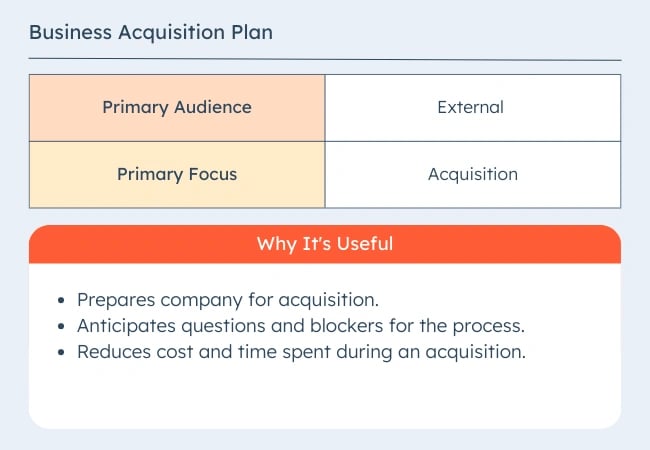

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![what is the importance of making business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![what is the importance of making business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what is the importance of making business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.