28+ Cheque Book Request Letter Word Format, Templates, Tips

- Letter Format

- January 25, 2024

- Application Letters , Bank Letters , Formal Letters , Request Letters

Cheque Book Request Letter Word Format: A Cheque Book Request Letter Word Format is a formal Application letter written to a bank, requesting the bank to issue a new cheque book. It is an essential document for individuals who use cheques as a primary mode of payment. Writing a cheque book request letter word format in the correct format is crucial to ensure that the bank processes the request promptly. In this article, we will discuss the word format for a cheque book request letter.

Cheque Book Request Letter Word Format

Content in this article

The format of a Cheque Book Request Letter Word Format should be professional and formal. It should be addressed to the bank manager and include the following information:

- Date: The date on which the is being written.

- Bank’s Address: The address of the bank where the Letter is being sent.

- Subject: A brief subject line indicating the purpose of the Cheque Book Request Letter Word Format.

- Salutation: A formal greeting addressing the bank manager by name or designation.

- Introduction: A brief introduction to the account holder, stating the reason for writing the letter.

- Account Details: The account holder’s name, account number, and other relevant details should be mentioned.

- Request: This Cheque Book Request Letter Word Format is a clear and concise request for a new cheque book to be issued.

- Reason for Request: A brief explanation of the reason for the request, such as the old cheque book being exhausted or lost.

- Signature: The Cheque Book Request Letter Word Format should end with the account holder’s signature and full name.

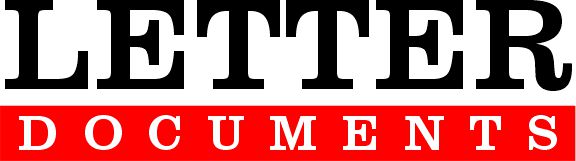

Cheque Book Request Letter Word Format – Sample format

Below is a sample format for a Cheque Book Request Letter Word Format:

[Your Full Name] [Your Address] [City, State, ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State, ZIP Code]

Subject: Cheque Book Request

Dear [Bank Manager’s Full Name],

I hope this letter finds you well. I am an account holder at [Bank Name], and I am writing to request a new cheque book for my account.

Account Details:

- Account Holder’s Name: [Your Full Name]

- Account Number: [Your Account Number]

- Type of Account: [Savings/Current/Other]

I have recently exhausted my current cheque book, and I require a new one to manage my financial transactions. I kindly request you to issue a new cheque book with [number of leaves, e.g., 50 leaves] leaves.

Additional Information:

- I would prefer the cheque book to be delivered to my registered address.

- If there are any fees associated with issuing a new cheque book, please deduct the charges from my account.

Please expedite the processing of this request, and I appreciate your prompt attention to this matter.

Thank you for your cooperation. If there are any forms or further documentation required, please let me know.

[Your Full Name] [Your Contact Number] [Your Email Address]

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book requests.

Cheque Book Request Letter Word Format – Sample Format

Cheque Book Request Letter Word Format – Example

Here’s an Example of Cheque Book Request Letter Word Format:

[Your Name] [Your Address] [City, State ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State ZIP Code]

Subject: Request for a New Cheque Book

Dear Sir/Madam,

I am writing this letter to request a new cheque book for my account [Account Number]. I have finished all the cheques from my previous cheque book and I need a new one to continue my transactions.

Please issue me a new cheque book with [Number of Cheques] cheques in it. I would be grateful if you could send the cheque book to my address mentioned above or I can collect it personally from your branch office.

Thank you for your prompt attention to this matter.

[Your Name]

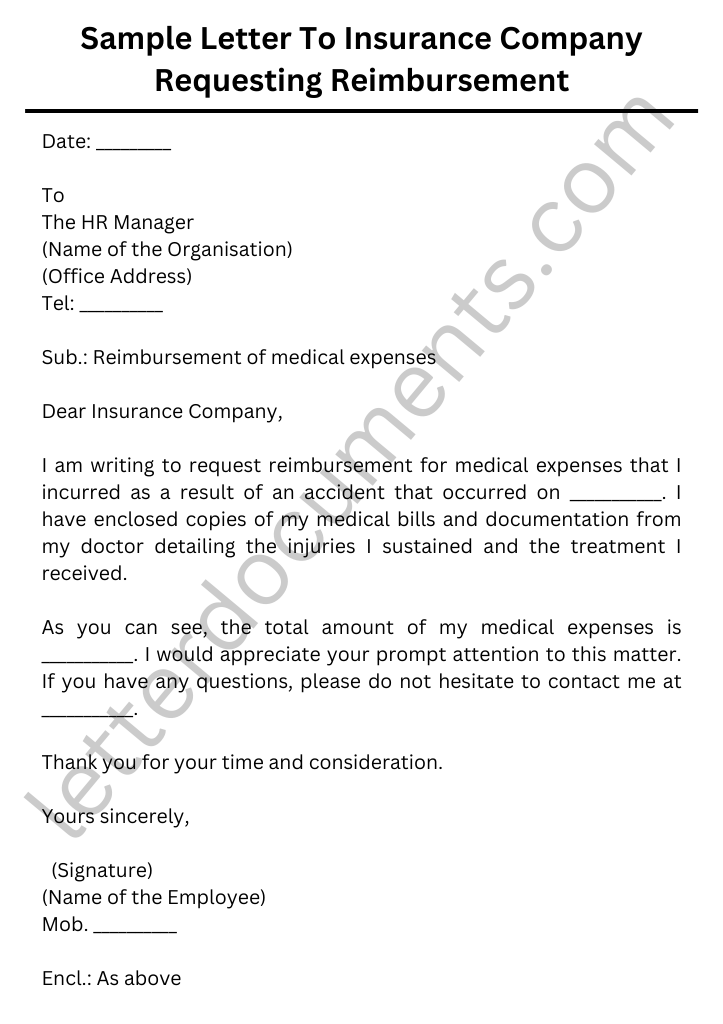

Cheque Book Application Letter Word Format

Below is a Cheque Book Application Letter in Word format:

[Your Full Name]

[Your Address]

[City, State, ZIP Code]

[Bank Name]

[Bank Address]

Subject: Cheque Book Application

I trust this letter finds you well. I am an account holder at [Bank Name], and I am writing to formally request a new cheque book for my account.

Cheque Book Requisition Letter Format Word

Below is a Cheque Book Requisition Letter in Word format:

Subject: Cheque Book Requisition

I hope this letter finds you in good health. I am writing to formally request the issuance of a new cheque book for my account at [Bank Name].

I have used all the leaves in my current cheque book, and I require a new one to facilitate my financial transactions.

Cheque Book Details:

- Number of Leaves: [Specify the number of leaves, e.g., 50 leaves]

I would appreciate it if you could arrange for the prompt issuance of the cheque book and have it delivered to my registered address.

If there are any fees associated with the issuance, please deduct the charges from my account, and provide me with the details.

Thank you for your attention to this matter. I trust that this request will be processed at your earliest convenience.

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book requisitions.

Cheque Book Request Letter Word Format – Template

Here’s a Template of Cheque Book Request Letter Word Format:

I am a customer of your bank and I have an account [Account Number] with your branch. I am writing this letter to request a new cheque book as my current cheque book is about to finish.

I would appreciate it if you could issue me a new cheque book with [Number of Cheques] cheques in it. I have enclosed a copy of my ID card for verification purposes.

Please let me know if you need any further information from me. I would be grateful if you could send the new cheque book to my address mentioned above.

Thank you for your assistance.

Cheque Book Issue Request Letter for Current Account

Here’s a sample format for a Cheque Book Issue Request Letter for a Current Account in Word format:

Subject: Request for Issuance of Cheque Book for Current Account

I trust this letter finds you well. I am writing to formally request the issuance of a new cheque book for my Current Account with [Bank Name].

- Account Number: [Your Current Account Number]

I have recently exhausted the last cheque leaf in my current cheque book and require a new one to manage my financial transactions.

I kindly request you to expedite the processing of this request and have the cheque book delivered to my registered address.

Thank you for your prompt attention to this matter. I trust that the new cheque book will be issued without any delays.

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book requests for current accounts.

Cheque Book Delivery Request Letter Word

Below is a Cheque Book Delivery Request Letter in Word format:

Subject: Request for Cheque Book Delivery

I trust this letter finds you well. I am writing to request the delivery of my new cheque book for the account held at [Bank Name].

I have recently submitted a request for a new cheque book, and I would appreciate it if you could arrange for the prompt delivery to my registered address:

Delivery Address: [Your Delivery Address]

If there are any fees associated with the delivery, please deduct the charges from my account, and provide me with the details.

I understand the importance of this request and kindly ask for your cooperation in ensuring a timely and secure delivery.

Thank you for your attention to this matter. I look forward to receiving the cheque book at the earliest convenience.

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book delivery requests.

Cheque Book Request Letter Format for Savings Account

Here’s a Cheque Book Request Letter for a Savings Account in Word format:

Subject: Cheque Book Request for Savings Account

I hope this letter finds you in good health. I am writing to formally request the issuance of a new cheque book for my Savings Account with [Bank Name].

- Account Number: [Your Savings Account Number]

I have recently used the last cheque leaf in my current cheque book and require a new one to facilitate my financial transactions.

I kindly request you to arrange for the prompt issuance of the cheque book and have it delivered to my registered address.

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book requests for savings accounts.

Email Ideas about Cheque Book Request Letter Word Format

Here’s a Cheque Book Request Letter Word Format with Email Ideas:

I hope this email finds you in good health. I am writing to request a new cheque book for my account [Account Number]. I have used up all the cheques from my previous cheque book, and I need a new one to continue with my transactions.

I would like to request a new cheque book with [Number of Cheques] cheques in it. I would appreciate it if you could process my request as soon as possible and send the new cheque book to my address mentioned in my account details. If necessary, I can personally come to the bank and collect the cheque book.

I have attached a copy of my ID card for verification purposes. Please let me know if you need any further information from me.

Formal Cheque Book Application Letter

Here’s a formal Cheque Book Application Letter in Word format:

Subject: Application for Cheque Book Issuance

I trust this letter finds you in good health. I am writing to formally request the issuance of a new cheque book for my account with [Bank Name].

I have recently utilized the last cheque leaf in my current cheque book and am in need of a new one to facilitate my financial transactions.

I kindly request you to process this application at your earliest convenience and deliver the cheque book to my registered address.

Thank you for your attention to this matter. I trust that this request will be processed promptly.

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book applications.

Cheque Book Request Letter for Educational Institution Transactions

Here’s a sample format for a Cheque Book Request Letter for Educational Institution Transactions in Word format:

Subject: Request for Cheque Book Issuance for Educational Transactions

I hope this letter finds you well. I am writing to formally request the issuance of a new cheque book for my account with [Bank Name]. The purpose of this cheque book is to facilitate transactions related to educational expenses and fees.

As a student of [Educational Institution Name], I often need to make transactions related to tuition fees, study materials, and other educational expenses. To streamline these transactions, I require a new cheque book.

I kindly request you to expedite the processing of this request and deliver the cheque book to my registered address.

Thank you for your prompt attention to this matter. I trust that the new cheque book will be issued without any delays, enabling me to manage my educational transactions efficiently.

Feel free to customize this format according to your specific details and the policies of your bank. Save it as a Word document before sending it to your bank. Always check with your bank for any specific procedures or requirements related to cheque book requests for educational transactions.

FAQS for Cheque Book Request Letter Word Format, Templates, Tips

Can i find a template for a cheque book request letter word format online.

Yes, you can find templates for Cheque Book Request Letter Word Format on various websites offering business letter templates or banking-related resources.

Are there specific tips to consider while drafting a Cheque Book Request Letter Word Format?

Yes, Cheque Book Request Letter Word Format some tips include clearly stating your account details, specifying the number of cheque leaves needed, providing accurate contact information, and requesting prompt processing and delivery.

How can I customize a Cheque Book Request Letter Word Format template to suit my needs?

You can personalize the template of Cheque Book Request Letter Word Format by inserting your name, address, account details, and any specific instructions or preferences you may have. Ensure the language remains formal and polite.

Are there any common mistakes to avoid when writing a Cheque Book Request Letter Word Format?

This Cheque Book Request Letter Word Format Avoiding common mistakes such as providing incorrect account details, not specifying the number of leaves needed, or using an informal tone is crucial. Double-check all information for accuracy.

Can I request a Cheque Book for different purposes, like educational transactions or business expenses?

Yes, you can customize the purpose of the cheque book request based on your needs. Specify the purpose in the letter to ensure the bank understands the intended use.

A Cheque Book Request Letter Word Format is an essential document that enables individuals to obtain a new cheque book from their bank . Writing the Cheque Book Request Letter Word Format in the correct format is crucial to ensure that the bank processes the request promptly . The sample of Cheque Book Request Letter Word Format provided above can be used as a reference while writing a Cheque Book Request Letter Word Format.

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

19+ Hand Fracture Leave Letter for Office – Format, Email Templates

24+ Car Parking Letter Format – How to Write, Email Templates

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

26+ Letter Writing to Principal for Certificates – Format & Samples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Authorization Letter To Collect Cheque Book

Cheque book collection authorization letter.

Authorization Letter to Collect Return Cheque from The Bank

Whenever a cheque doesn’t fulfill the payment will be returned, there are several reasons for the return of the cheque like insufficient funds, unavailability of funds, inoperative bank account, due to stop payment request or mismatch of signature, etc.

When the cheque gets return then the payor has to receive it, if the payor is not in a position to collect the cheque then they payor can send an authorized person to the bank to collect the returned cheque.

Here you can find some best sample authorization letters to collect the returned cheque from the bank.

Sample Format 1

The Branch Manager,

Sub: Authorization letter to collect the returned cheque

I here by authorize Mr ____________ , Id no________to collect the returned cheque of chque no___________ issued on _________ for the amount of __________(amount in words) on behalf of me.

I appreciate your support and for any clarification please contact me at ____________(your mobile number)

Thanking you.

________________.

Sample Format 2

To

The Branch Manager,

Sub: Authorization letter to collect the returned cheque

This is to authorize Mr______________ of employee Id_________ to collect my cheque on behalf of me. The following are the details of the returned cheque.

Cheque no:__________

Issued on: __________

For the amount: ___________(amount in words)

I hope you do the needful and for any concerns please contact me at ____________(your mobile number)

Regards,

_________.

Authorization letter to collect cheque on behalf of the company

To

The Branch Manager,

We, The XYZ pvt ltd are authorizing Mr______________ of employee Id_________ to collect the cheque on behalf of us. The cheque was issued on _____________(date) for the amount of _____________(amount in words) with cheque number ________.

We appreciate your support in this matter

Thanking you in advance.

For the XYZ pvt ltd.

Authorized Signatory.

- How to write one lakh on cheque

- Authorization letter to collect marks sheet from college

Leave a Comment Cancel reply

- Sample Authority Letter For Cheque Collection

An authority letter for cheque collection is a formal document that grants permission to a designated individual or representative to collect a cheque on behalf of the sender. Such letters are commonly used when the cheque recipient cannot personally be present for collection due to various reasons. To facilitate this process, we have prepared four templates for different scenarios where an authority letter may be required.Template 1 is designed for personal cheque collection, allowing the sender to authorize a trusted individual to collect their cheque from a bank or company. Template 2 is tailored for business entities, empowering an authorized representative to collect a cheque on behalf of the company. Template 3 addresses situations where a legal representative is authorized to collect a cheque for an individual, and Template 4 is suited for scenarios where an executor of an estate is granted authority to collect cheques on behalf of the estate.Each template serves as a formal authorization, clearly stating the details of the cheque, the authorized person's name, their responsibilities, and the necessary documentation required. By utilizing these templates, individuals and businesses can ensure a smooth and secure process for cheque collection in the absence of the cheque recipient.Please note that these templates should be customized to fit specific circumstances, including the relevant names, addresses, cheque details, and any additional instructions provided by the issuing authority. With these templates as a starting point, you can confidently issue an authority letter for cheque collection, streamlining the process and ensuring a valid and legal transaction.

Template Authority Letter for Cheque Collection - Personal Collection

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

[Authorized Person's Name] [Designation] [Bank/Company Name] [Bank/Company Address] [City, State, ZIP]

Dear [Authorized Person's Name],

I, [Your Name], hereby authorize [Authorized Person's Name] to collect a cheque on my behalf from [Bank/Company Name]. The cheque is for [mention the purpose of the cheque, e.g., salary, reimbursement, etc.] and bears cheque number [cheque number].

[Authorized Person's Name] has been granted full authority to sign all necessary documents and provide any identification required for the collection of the cheque. I trust [Authorized Person's Name] to handle this matter with utmost responsibility and integrity.

I request [Authorized Person's Name] to kindly collect the cheque and acknowledge receipt on my behalf. Once the cheque has been collected, please inform me immediately.

Thank you for your prompt attention to this matter, and I appreciate your cooperation in facilitating the cheque collection process.

[Your Name]

Template Authority Letter for Cheque Collection - Business Entity

[Your Company Name] [Your Company Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

This letter is to authorize [Authorized Person's Name] to collect a cheque on behalf of [Your Company Name] from [Bank/Company Name]. The cheque is issued to [mention the purpose of the cheque, e.g., vendor payment, refund, etc.] and has the cheque number [cheque number].

[Authorized Person's Name] has been granted full authority to act on behalf of [Your Company Name], and all necessary identification and documentation will be provided by [Authorized Person's Name].

We kindly request [Authorized Person's Name] to proceed with the cheque collection and ensure the completion of all required formalities. Upon successful collection, please notify us promptly.

We appreciate your cooperation and prompt attention to this matter.

[Your Name] [Your Designation - if applicable]

Template Authority Letter for Cheque Collection - Legal Representative

[Authorized Legal Representative's Name] [Legal Representative's Address] [City, State, ZIP]

Dear [Authorized Legal Representative's Name],

I, [Your Name], hereby authorize [Authorized Legal Representative's Name] to collect a cheque on my behalf from [Bank/Company Name]. The cheque is issued in my name and bears the cheque number [cheque number].

[Authorized Legal Representative's Name] is granted full authority to act as my legal representative and is authorized to sign all necessary documents and provide identification on my behalf for the collection of the cheque.

I request [Authorized Legal Representative's Name] to collect the cheque and acknowledge receipt on my behalf. Once the cheque has been collected, please inform me immediately.

Thank you for your assistance in this matter. I trust [Authorized Legal Representative's Name] to handle this responsibility diligently and ethically.

Template Authority Letter for Cheque Collection - Executor of Estate

[Executor's Name] [Executor's Address] [City, State, ZIP]

Dear [Executor's Name],

I, [Your Name], being the beneficiary of the estate, hereby authorize [Executor's Name] to collect a cheque on my behalf from [Bank/Company Name]. The cheque is issued to the estate and has the cheque number [cheque number].

[Executor's Name] is entrusted with full authority to act as the executor of the estate and is authorized to sign all necessary documents and provide identification for the collection of the cheque.

I request [Executor's Name] to collect the cheque and acknowledge receipt on behalf of the estate. Please ensure that all required formalities are completed.

Thank you for your service as the executor of the estate, and I trust [Executor's Name] to carry out this responsibility faithfully.

We are delighted to extend our professional proofreading and writing services to cater to all your business and professional requirements, absolutely free of charge at Englishtemplates.com . Should you need any email, letter, or application templates, please do not hesitate to reach out to us at englishtemplates.com. Kindly leave a comment stating your request, and we will ensure to provide the necessary template at the earliest.

Posts in this Series

- Causes Of Corruption, And Their Solutions Letter To Editor

- Chair Request Letter For Office, Teacher, Employee

- Change of Address Letter For Customers

- Change of Engineer of Record Letter, Change Engineer of Record Florida

- Change of Residential Address Letter Sample

- Character Reference Letter From Mother To Judge

- Character Reference Letter Sample For Jobs

- Cheque Date Correction Letter Request Format

- Clarification Letter From Shipper On Mistake To Customs

- Closure Letter To Someone You Love

- Clothing Store Manager Cover Letter

- Company Address Change Letter To Bank

- Compensation Letter For Damages

- Complaint Letter About A Rude Staff

- Complaint Letter Against Father In Law

- Disability Insurance Recovery Letter

- Disappointment Letter To Boss On Appraisal

- Disappointment Letter To Client

- Disappointment Letter To My Wife

- Dishonoured Cheque Letter Before Action

- Diwali Holiday Announcement Email To Employees, Customers

- Donation Letter For Football Team

- Donation Request Letter For Laptop

- Donation Request Letter For Orphanage

- Donor Meeting Request Letter

- Down Payment Request Letter Sample

- Draft A Letter of Interest To Contract, Or Lent Cars To Government Departments, And Agencies

- Early Payment Discount Letter Sample

- Early Retirement Letter Due To Illness

- Early Retirement Request Letter For Teachers

- Eid Greetings Letter From Company To Staff Members, Employees And Students

- Electrical Engineer Experience Letter Sample

- Employee Encouragement Letter Sample

- Employee Not Returning Uniforms

- Employee Recognition Letters Sample

- Employee Warning Letter Sample For Employers

- Best Thank You Letter After Interview 2023

- Beautiful Apology Letter To Girlfriend

- Babysitter Cover Letter No Experience

- Babysitter Letter of Payment

- Babysitting Letter To Parents

- Back To School Letter From Principal In Florida

- Balance Confirmation Letter Format For Banks And Companies

- Bank Account Maintenance Certificate Request Letter

- Bank Balance Confirmation Letter Sample

- Bank Internship Letter Format, And Sample

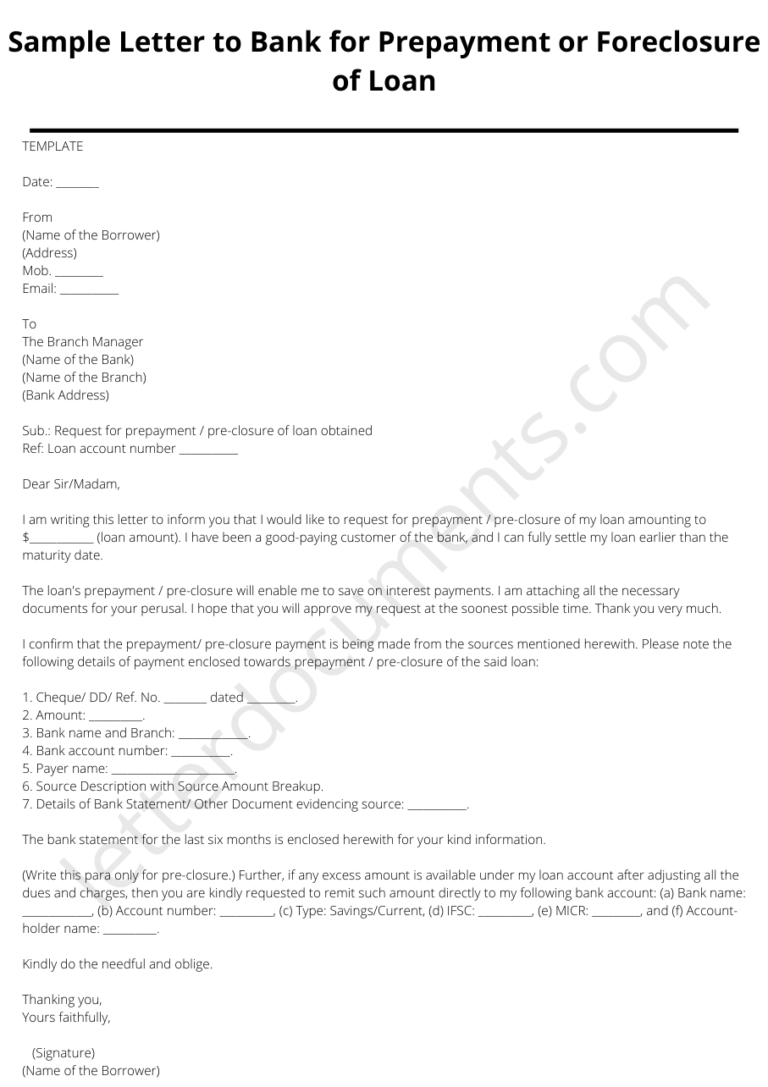

- Bank Loan Repayment Letter Format

- Authorization Letter To Collect Money On My Behalf

- Authorized Signatory Letter Format For Bank

- Aviation Management Cover Letter Example

- Attestation Letter For Employee

- Attestation Letter of A Good Character

- Audit Document Request Letter

- Authority Letter For Degree Attestation Sample

- Authority Letter For Issuing Degree

- Authority Letter For Receiving Degree

- Authority Letter To Collect Documents

- Authority Letter To Collect Passport

- Authorization Letter For Air Ticket Refund

- Authorization Letter For Car Insurance Claim

- Authorization Letter For Driver License Renewal

- Authorization Letter For Getting Driver License

- Authorization Letter For Student Driver License

- Authorization Letter For Tree Cutting Permit

- Ask Permission From My Boss For Straight Afternoon

- Asking For Compensation In A Complaint Letter Example

- Appointment Letter With Probation Period

- Appreciation Letter For Good Performance On Duty

- Appreciation Letter For Hosting An Event

- Appreciation Letter For Manager

- Appreciation Letter From Hotel To Guest

- Appreciation Letter To Employee For Good Performance

- Apprenticeship Result Letter By Principal

- Approval Letter For Job Transfer

- Approval Letter For Laptop

- Approval Request To Govt Authorities For Sports Shop Approval

- Ask For A Letter of Recommendation Taxas

- Apply For Government Contracts Letter

- Appointment Letter Daily Wages

- Appointment Letter For A Medical Representative Job

- Appointment Letter For Job In Word Free Download

- Appointment Letter For Patient

- Credit Card Address Change Request Letter To Hdfc Bank

- Customer Request Letter For Insurance Policy Pending

- Data Collection Application Letter Request From University

- Dealership Cancellation Request Letter

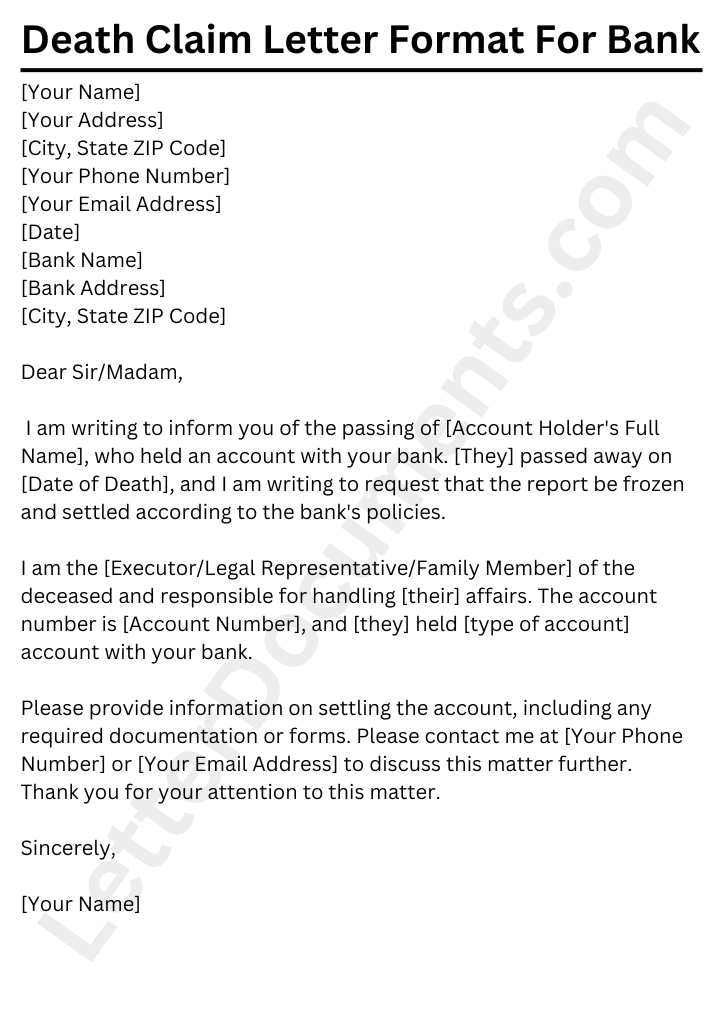

- Death Intimation Letter Format To Bank

- Debit Card Cancellation Letter Format

- Demand For Assurance Letter

- Demand Letter For Attorney Fees

- Demand Letter For Mortgage Payment

- Demand Letter For Property Return

- Demand Letter For Return of Items

- Demanding Letter For The Competition Exams Books For Your College Library

- Denial Letter For Insurance Claim

- Compliment Letter To Hotel Staff

- Compromise Agreement Sample Letter

- Compromise Letter For The Reason of Disturbance

- Compromise Letter To Police Station

- Computer Repair, And Replacement Complaining Letter

- Condolence Letter For Death Of Friend

- Condolence Letter For Death of Mother

- Condolence Letter For Loss of Child

- Condolence Letter For The Death of Father, Mother, Or Someone Else

- Condolence Letter On Death Of Father In English

- Condolence Letter To A Friend Who Lost His Brother

- Condolence To My Player Lost A Parent

- Condolences Letter On Loss Of Wife

- Confessional Letter To Church

- Confirm Meeting Appointment Letter Sample

- Confirmation Letter For Airport Pick Up

- Confirmation Letter For Appointment In Email

- Confirmation Letter For Bank Account

- Confirmation Letter For Completion of Training

- Confirmation Letter For Teacher After Completion of 1 Year of Probation With Necessary Terms, And Conditions

- Conflict Resolution Letter For Employees

- Congratulation Letter After Job Interview

- Congratulation Letter Business Success

- Congratulation Letter For Passing Board Exam

- Congratulation Letter For Promotion

- Congratulations Letter Receiving Award

- Consent Letter For Children Travelling Abroad

- Consent Letter For Guarantor

- Construction Contract Approval Letter

- Construction Delay Claim Letter Sample

- Contract Approval Letter Example

- Contract Extension Approval Letter

- Contract Renewal Letter To Manager

- Contract Termination Letter Due To Poor Performance

- Contract Termination Letter To Vendor

- Contractor Recommendation Letter Format

- Convert Residential To Commercial Property

- Courtesy Call Letter Sample

- Work From Home After Accident Letter Format

- Uniform Exemption Letter For Workers, Students, Employees

- Thanks Letter For Visitors Free Download

- Thanks Letter To Chief Guest And Guest Of Honor

- Apology For Resignation Letter

- Apply For Funds For Ngo Dealing With Disabled People, We Have A Land, And Want To Build The Proper Shelter

- Allow Vehicles For Lifting Auction Material Letter Format

- Address Change Request Letter For Credit Card

- Address Proof Letter Format

- Admission Confirmation Letter Format

- Admission Rejection Letter Samples

- Accreditation Letter For School

- Accreditation Letter For Travel Agency

- Accountant Letter For Visa

- Accreditation Letter For Organization

- Absence Excuse Letter For Professor-Lecturer

- Acceptance Letter By Auditor

- A Letter Of Support For A Graduation

- School Timing Change Notice

- Thank You Letter For Sponsoring An Event

- Sample Letter of Data Collection, And Research Work

- Sample Letter of Request For Borrowing Materials

- Sample Letter Of Thank You For Participation

- Sample Letter To Bank Manager For Unblock Atm Card

- Sample Letter To Claim Car Insurance

- Sample Letter To Close Bank Account of Company

- Sample Letter To Parents About Fee Increase

- Sample Letter To Parents For School Fees Submission

- Sample Letter To Return Products, Or Ordered Items Or Replacement

- Sample Nomination Letter To Attend Training

- Sample Notice For Parent Teacher Meeting (Ptm)

- Sample Experience Letter For Hotel Chef Or Cook

- Sample Experience Letter For Nurses

- Sample Holiday Notification Letter Format For Office

- Sample Invitation Letter To Chief Guest

- Sample Letter Asking Permission To Conduct Seminar

- Sample Letter For Acknowledging Delivery Of Goods, Or Services

- Sample Letter For Leave Without Permission

- Sample Letter For Requesting Quotations

- Sample Letter For Urgent Visa Request

- Salary Deduction Letter To Employee

- Request Letter For Any Suitable Job - Covering Letter Format

- Request Letter For Change of Name In School Records

- Reply To Employment Verification Letter

- Request Application Letter To The College Principal -Vice-Chancellor -Admission Office For Taking Admission

- Request Final Payment Settlement After The Resignation

- Request For Fuel Allowance To Company-Employer

- Request For Meeting Appointment With Seniors - Other Employees-Clients Sample Letter

- Request For Office Supplies Templates

- Request Letter For Accommodation In University

- Request Letter For An Online Interview

- Notice On Cleanliness In Your Office Compound

- Office Closing Reason For Business Loss Letter Format

- One Hour Leave Application Request Letter

- Permission Letter For Blood Donation Camp

- Promotion Request Letter And Application Format

- Proposal Letter For School Events And Activities

- Quotation Approval Request Letter With Advance Payment

- Recommendation Letter For Visa Application From Employer

- Remaining Payment Request Letter Sample For Clients, Customers

- New Email Address Change Notification Letter

- Letter To Principal For Change of School Bus Route

- Letter To Principal From Teacher About Misbehavior of a Student

- Letter To Remove Name From Joint Bank Account

- Letter To Renew Employment Contract Sample

- Letter To Subcontractor For Work Delay By The Contractor

- Letter To Your Friend About An Exhibition You Have Seen Recently

- Loan Cancellation Letter Sample

- Marriage Leave Extension Letter To Office-Manager Or Company

- Letter of Introduction From A Company To An Employee For Visa

- Letter of Recommendation For Further Studies By Employer

- Letter Regarding Visa Delay To Embassy

- Letter Requesting School Principal To Issue A New Student Identity Card

- Letter Requesting Sponsorship For Education From Ngo-Spouse-Court

- Letter To Airline For Refund Due To Illness, Death, Or Medical Grounds

- Letter To Cancel The Approved Leave of Employee Due To Work In Office

- Letter To Customs Officer To Release Goods-Cargo

- Letter To Friend Telling About Your New School

- Letter To Friend Thanking Him For The Books He Lent To You

- Letter To Increase PF(Provident Fund) Contribution

- Letter To Inform Change Of Bank Account

- Letter To Insurance Company For Change Of Address

- Letter To Municipal Commissioner For Street Lights

- Letter To Municipal Corporation For Road Repair

- Letter To Parents Asking For Money

- Email Letter to Request Travelling Allowance

- 10 Examples of Letters of Recommendations

- Letter Writing

- Formal Letter Writing In English

- Cheque Book Request Letter

Cheque Book Request Letter - Things to Keep in Mind and Sample Letters

A cheque book is a book with a number of cheques that are used to make payments or purchases. A cheque is issued to a beneficiary instead of cash so that the beneficiary can collect the said money in cash from the nearest bank. When making a payment by cheque, it is saved in the bank records. It is always safer to make huge payments by cheque but make sure you provide a valid cheque.

If you have run out of cheque leaves and are wondering how to write a formal letter requesting the issuance of a cheque book, this article is for you. Read through the article to find out how to write a cheque book request letter and go through the sample request letters to understand better. Also, check out the article on Letter Writing for more sample letters.

Table of Contents

Writing a cheque book request letter, application for cheque book issue, cheque book request letter to bank, application for new cheque book.

- FAQs on Cheque Book Request Letter Format

A cheque book request letter is written as an official request to your bank to provide you with a cheque book with the required number of cheque leaves. There are cheque books with a minimum of 25 cheque leaves and a maximum of 100 cheque leaves. Make sure you mention the number of cheque leaves you will require when you write a cheque book request letter.

A cheque book request letter is written in the format of a formal letter . Ensure to provide your account number accurately and other identifying information so that there are no problems or confusion for your bank to issue the cheque book at the earliest.

Sample Cheque Book Request Letter

Here are some sample cheque book request letters for your reference.

3/27, Monte Vue Apartments

P N Palayam

Coimbatore – 641049

11 th January, 2022

The Bank Manager

South Indian Bank

P N Palayam Branch

Coimbatore – 641044

Subject: Request for cheque book

Respected Sir/Ma’am,

I am Nandhini Balasubramaniam, and I am a savings account holder (mention your account number) in your bank. I am in need of a single cheque book of 100 leaves or two cheque books of 50 leaves each.

I have enclosed copies of my identification and address proof for your reference along with this letter.

Kindly consider my request and do the needful.

Thanking you.

Yours sincerely,

Signature of the account holder

NANDHINI BALASUBRAMANIAM

108 V, B B Street

Mumbai – 400051

Central Bank of India

Bandra East Branch

I hold a premium account with the account number (mention your account number) at your bank. I am in urgent need of a cheque book to make payments to some of my third party vendors who are demanding pay by cheque only. I have to make the payments latest by the 7 th of January, 2022.

I request you to kindly understand my situation and issue me a cheque book of 50 leaves at the earliest. I have enclosed herewith a self-attested copy of my PAN card and my Aadhaar card as proof for your reference.

Thank you for your time and consideration.

SANDRA RHEA

Flat No. 152, Golden Flats

Ambattur O T

Chennai – 600053

January 3, 2022

Union Branch of India

Ambattur Branch

Subject: Application for new cheque book

I hold a savings account at your bank with the account number (mention your account number). I require a new cheque book to submit as a supporting document to apply for my vehicle loan. I have been asked to submit it by January 9, 2022.

I have attached along with this letter my address and identification proof for your kind perusal. I request you to kindly provide me with a cheque book as soon as possible so that the process of verification can be initiated.

PRABHA SEKHAR

Attached documents:

Address proof: Self-attested copy of Aadhaar card

Identity proof: Self-attested copy of PAN card

Frequently Asked Questions on Cheque Book Request Letter

How do i request a cheque book.

You can approach the bank in person or write a letter to your bank requesting the issue of a new cheque book. When you write a cheque book request letter, ensure that you mention the number of cheque leaves you require, and also the reason why you require a new cheque book.

What is a cheque book?

A cheque book is a book that contains 25 -100 cheques that can be used to make huge payments. A cheque allows the bank to provide the beneficiary with the said amount when the cheque is submitted to the bank with appropriate proof.

Why do I require a cheque book?

Cheque books are useful to make payments. There are some parties who insist on receiving payment by cheque only. Payments by cheque are considered to be safer and preferred by many people, so it is advisable to have a cheque book and make good use of it.

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

Request Letters

Cheque Book Request Letter (Format and Samples)

A cheque is an essential document that allows you to make payments to an organization or individual either as an advance for payment due or gift. Thanks to a cheque, you don’t have to deal with the risk of having to carry along cash with you. Therefore, you should always make sure to have a steady stock of checkbooks to guarantee all your payments are made on time and in no rush.

However, if you want a new checkbook and can’t head to the bank and collect it yourself, then it becomes necessary to write a cheque book request letter. You should address this letter to the appropriate bank and stating the urgency of the cheque being delivered on time. So, where do you start when writing a cheque book request letter? Here is a detailed guide on the steps you need to follow.

Tips on Writing a Cheque Book Request Letter

- Politely Request for The Cheque Book. When writing the cheque book request letter, it is vital to maintain a polite tone. This shows appreciation for the efforts being put by the bank attendants in making sure your needs get attended to promptly.

- State Why You Urgently Need the Cheque Book. It would be best if you mentioned how soon the cheque book needs to be delivered. This is vital as it allows the bank on their part to make sure that you get the cheque book on time, thereby ensuring there’s no interference.

- Explain The Reason You Want the Cheque Book. While drafting the cheque book letter, you should also mention the reason why you need the cheque book as soon as possible. For instance, you may need the cheque book to pay your employees or to pay for services rendered to your businesses.

- State The Number of Leaves to Be on The Cheque Book. Some people make more payments with by cheque hence necessitate more leaves on their cheque books. Therefore, you should first assess your needs to have a better estimate of the ideal number of leaves to be found in your cheque book.

- Give Thanks to the Reader for Their Effort. One thing that some people overlook when writing a cheque book letter is the need to thank the reader for their services. However, you shouldn’t do the same and should instead show appreciation for handling your matter.

- Make Sure the Letter is Relevant and Concise. You should go straight to the point when drafting a cheque book request letter. While you do this, make sure to include all the relevant details such as the desired number of leaves on your cheque book.

- Be Formal. When writing this letter, make sure to use a formal tone. This is vital because it shows you are someone to be taken seriously, therefore whoever is attending to your request will be diligent when processing your request.

Sample of Cheque Book Request Letter

(Account Holder’s Name)

(Full address)

(Mobile Number)

Branch Manager.

(Name of Branch)

(Name of Bank)

Sub: Request for A New Cheque Book

I have been an account holder in your bank for the last ten years and am requesting for the issuance of a new cheque book. Typically, I use my credit or debit card to make payments, but I misplaced it several days ago. As a result, it has become increasingly difficult for me to perform my business transactions. Because of this, I hereby submit this request to be issued with three new cheque books with 50 leaves each.

I kindly request if this matter could be completed as soon as possible and I know I’ve delayed sending out this request, but I had travelled out of town for business. I apologize for any inconvenience caused and hope you will be able to address the matter as soon as possible.

Please debit all the charged from my account and enclosed are copies of identification and proof of address that are needed for verification reasons.

Kindly attend to this matter with urgency and do what is necessary as soon as you can. I am looking forward to getting the cheque book soon.

Thank you in advance.

Yours faithfully,

(signature)

(Name of Account Holder)

Cheque Book Request Letter (Word Format)

If you prefer making payments using cheque, a cheque book is thus essential to ensure the smooth operation of your business. Reading through this article has provided you with useful tips on the steps to follow when writing a cheque book letter once your old cheque book is finished. This means learning the importance to use polite language, format content while still expressing the urgency of the matter being address swiftly.

How did our templates helped you today?

Opps what went wrong, related posts.

How to Write a Request Letter (Format and Samples)

Request for Approval: Template & Samples

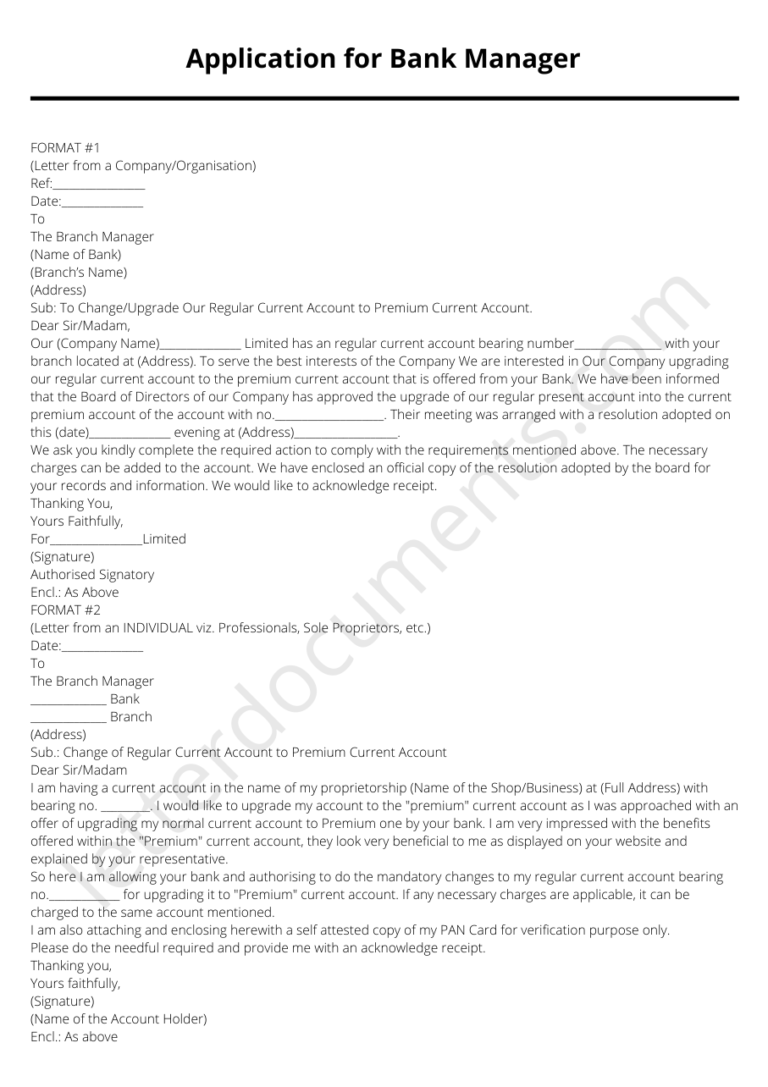

Request Letter to Bank for Opening a Bank Account

Leave Application Cancellation Letter

Request Letter: Format, Template and Examples | (Word | PDF)

Permission Request Letter to Principal for Tour

Permission Request Letter to Principal for Late Payment of Fees

Leave Permission Request Letter to Principal

Thank you for your feedback.

Sample Letter for Cheque Book Request

With extensive experience in writing cheque book request letters, I offer a step-by-step guide and template to ensure your request is effective, whether you’re new or seeking a refresher.

Cheque Book Request Letter Generator

Disclaimer: This tool is intended to help you create a basic cheque book request letter. Please review and edit the letter according to your specific needs and bank’s requirements.

Key Takeaways

- Understand the Purpose: Learn why a well-written cheque book request letter is crucial.

- Gather Necessary Information: Know what details to include for a successful request.

- Step-by-Step Guide: Follow clear steps to craft your letter.

- Free Template: Use the provided template to easily structure your request.

- Personal Experience Tips: Benefit from real-life examples and tips from an experienced letter writer.

- FAQs Answered: Get answers to commonly asked questions about cheque book request letters.

Understanding the Purpose of the Letter

A cheque book request letter is more than just a formality; it’s a professional way of communicating with your bank. This letter helps in maintaining a record of your request and ensures that your needs are met accurately.

Gathering Necessary Information

Before you start writing, gather the following details:

- Your Bank Account Information: This includes your account number, account type, and branch details.

- Personal Identification: Your full name as per bank records and contact details.

- Cheque Book Details: Specify the number of leaves you need and any other preferences.

Step-by-Step Guide to Writing Your Letter

Step 1: start with your details.

Begin by mentioning your name, address, account number, and the date at the top left corner of the letter.

Step 2: Add Bank Details

Trending now: find out why.

Address the letter to your bank manager or the relevant authority. Include the bank’s name and branch.

Step 3: Write the Subject Line

Clearly state the purpose of your letter. For example, “Subject: Request for Issuance of New Cheque Book.”

Step 4: Compose the Body

Explain your request in a concise and polite manner. Mention the type of account and any specific requirements for the cheque book.

Step 5: Conclude and Sign Off

Thank your reader for considering your request. End with a complimentary close and your signature.

Cheque Book Request Letter Template

[Your Name] [Your Address] [Account Number] [Date]

[Bank Manager’s Name] [Bank’s Name] [Branch Address]

Subject: Request for New Cheque Book

Dear [Bank Manager’s Name],

I am writing to request a new cheque book for my account [Your Account Number]. I have recently used the last cheque from my current book and require a new one for ongoing transactions.

I hold a [Type of Account] account with your branch and would like to request a cheque book with [Number of Leaves] leaves.

Thank you for attending to this matter promptly. Please let me know if you need any further information or documentation from my side.

Yours sincerely,

[Your Signature] [Your Name]

Tips from Personal Experience

- Be Precise: Keep your letter concise and to the point.

- Proofread: Ensure there are no spelling or grammatical errors.

- Follow Up: If you don’t receive a response, follow up with your bank.

Writing a cheque book request letter is a straightforward task when you know the right steps. By following this guide and using the provided template, you can ensure that your request is clearly understood and promptly processed by your bank.

I’d love to hear from you! If you have any further questions or need more insights on writing a cheque book request letter, feel free to leave a comment below. Your feedback and experiences are valuable to me and our readers

Frequently Asked Questions (FAQs)

Q: What is a cheque book request letter?

Answer : A cheque book request letter is a formal letter written by an individual or an account holder to their bank, requesting the issuance of a new cheque book.

This letter serves as a formal communication to the bank, indicating the account holder’s need for a new set of cheques to carry out financial transactions.

Q: How should I begin a cheque book request letter?

Answer : When writing a cheque book request letter, it is important to start with a polite and professional salutation, such as “Dear [Bank Name] Customer Service” or “To Whom It May Concern.” This sets a respectful tone for your letter.

Q: What information should I include in a cheque book request letter?

Answer : In a cheque book request letter, you should include your full name, address, contact information, and your bank account number.

Additionally, it is essential to clearly state that you are requesting a new cheque book and mention any specific requirements, such as the number of cheques or any customization options.

Q: How can I explain the reason for my cheque book request in the letter?

Avoid going into unnecessary detail, as the main purpose of the letter is to request a new cheque book.

Q: Should I mention any specific instructions or preferences in the cheque book request letter?

For example, if you would like personalized cheques with your name or if you require a certain number of leaves in the cheque book, clearly state your requirements to ensure they are addressed by the bank.

Q: How should I conclude a cheque book request letter?

Use a polite closing, such as “Thank you for your prompt attention to this matter” or “I appreciate your help in issuing the new cheque book.” Sign off with your full name and any additional contact information if necessary.

Q: How should I format a cheque book request letter?

Use a professional tone throughout the letter and maintain a clear and concise structure. Ensure that you proofread the letter for any grammatical or spelling errors before sending it to the bank.

Q: How should I deliver the cheque book request letter to the bank?

Alternatively, you may choose to send the letter through postal mail or submit it electronically via email, if your bank allows such communication. Check with your bank regarding their preferred method of receiving such requests.

Q: How long does it usually take for the bank to process a cheque book request?

It is advisable to contact your bank to inquire about their specific timeline for processing cheque book requests.

MORE FOR YOU

Ultimate loan repayment letter template.

Discover a free sample loan repayment letter template to help you craft a compelling and effective repayment plan.

Read More »

Sample Letter to Bank for Name Change after Marriage

Changing your name after marriage is a significant life event, and one of the essential steps is to update your name with various institutions, including…

Urgent Request Letter to Stop Auto Debit (Free Sample)

If you’ve ever found yourself in a situation where auto-debits have unexpectedly drained your account, you’re not alone. Over the years, I have helped numerous…

Sample Letter Informing Change of Email Address to Bank: Free & Effective

As someone who has written numerous letters to banks about updating email addresses, I understand the nuances of this seemingly simple task. In this article,…

Sample Letter to Creditors Unable to Pay Due to Death

Through this article, I aim to guide you step-by-step in crafting a compassionate yet effective letter to your creditors, sharing proven templates and personal tips…

Sample Letter to Close Current Bank Account and Transfer Funds

I’ll share my personal experiences and tips to help you navigate this process effortlessly. Plus, there’s a handy template at the end to get you…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Sample letter to bank for Cheque return

- Topics >>

- Letter samples >>

- Banking Correspondence Sample Letters - Format and Templates -02/27/14

- « Previous

- Next »

- RE: Sample letter to bank for Cheque return -Lubna Lakdawala (03/13/14)

Related Content

- Sample letter to bank for Waiving bank charges

- Sample letter to bank for Refund

- Sample letter to bank for Lowering interest rate

- Sample letter to bank for Death of account holder

- Sample letter to bank for Credit card limit increase

- Sample letter to bank for Change of name

- Sample letter to bank to Warn a customer about credit suspen...

- Sample letter to bank to Cancel, Suspend, or Restrict a Cred...

- Sample letter to bank for Credit card renewal

- Sample letter to bank for Credit Card dispute

- Sample letter to bank for Credit card settlement

- Sample letter to bank for Credit card replacement

- Sample letter to bank for Credit card lost

- Sample letter to bank for Credit card cancellation

- Sample letter to bank for Ratification of charges

- CareerRide on YOUTUBE

- CareerRide on INSTAGRAM

Related Topics

- Information Letter Samples - format and templates

- Sample Letters to Editors - format and templates

- Disciplinary Letter Samples - format and template

- Goodbye Letter Samples - format and templates

- Welcome Letter Samples - format and templates

- Response Letter Samples - format and templates

- Cheque Book Request Letter

Banks usually issue 2 types of cheque books. The first is personalized, and the second is non-personalized. Hence, you must write a cheque book request letter if you need one. However, in today’s world, credit cards and net banking have surpassed cheque books. In fact, the biggest drawback of a cheque is that it requires a few days to be cleared. On the other hand, the plus point is, cheques help you to track and document payments. Additionally, Cheques do not have processing fees. Therefore, many individuals still prefer cheques. Hence, in today’s article, we will shed some light on how to write a cheque book request letter. Moreover, I have added a few examples for your reference.

How To Write A Cheque Book Request Letter?

A cheque book request letter is an official letter to your bank. It is a request letter to provide you with a cheque book. Moreover, you can get a cheque book with 25 to 100 cheque leaves. However, you must write it in a formal tone. Also, mention the number of cheque leaves you need in the cheque book request letter.

Additionally, provide your account number and ID proof. This is to mitigate future problems when issuing the cheque book.

In fact, your role ends here. Further, the bank will send the cheque book to your address in 3-4 working days.

Therefore, wait for your cheque book patiently.

Guideline For Writing A Cheque Book Request Letter

1. Initially, you have to address the letter to the head of the bank. Furthermore, you must also include details like

- Account number

- Branch name

2. Also, make sure to write it in a formal tone. Moreover, use formal greetings and salutations like:

- Greetings of the day

3. Simultaneously mention the number of cheque leaves you need.

4. Lastly, give a short reason for the need for cheque book.

5. Additionally, always cross-check your account number and other details.

6. Furthermore, do not mention sensitive details like CVV, ATM pin, or other credentials.

Format of Cheque Book Request Letter

Address –

You must include your and your bank’s address without fail. Afterwards, cross-check it.

(Your address)

(Recipient’s address)

Date –

The date is one of the most crucial details while writing the request letter.

Salutation –

Keep the solution formal.

- Hello Sir/Madam

- Respected Madam/Sir

Subject –

Describe the objective of the letter in one sentence.

Main body –

- Firstly, the body must be succinct.

- Now, introduce yourself and explain the reason for writing the letter.

- Then, ask the recipient to provide the cheque book.

- Also, mention the number of Cheque leaves.

- At last, state that you have included the required document.

- Afterwards, thank the recipient.

- Yours faithfully

- Yours truly

Write your name beneath.

Samples Of Cheque Book Request Letter

Following are some common examples of cheque book request letters.

Sample 1 –

R/8, Laxmi Nagar

Nagpur – 440001

The Bank Manager

Shivaji Nagar branch

Nagpur – 440023

Subject: Request for Cheque Book

Respected Sir/Ma’am,

I am Tushar Pillay, and my account no. is 0198xxxxxxxxxx88. To sum up, I urgently need a cheque book of 100 leaves. Recently, my customer has asked me to pay through cheque. However, I don’t have a cheque book. Therefore, I request you to please issue my cheque book.

Also, I have attached ID and address proof for your reference.

Kindly accept my request.

Thanking you

Yours sincerely,

Tushar Pillay

Attachments:

- Address proof

Sample 2 –

202, Shewalkar Tower

Gandhi Nagar

Nagpur – 440011

Kotak Mahindra Bank

Bajaj Nagar

Nagpur – 440035

I, Snehal Rajora, a savings account holder in your bank. Furthermore, my account number is 01276xxxxxxxx0099. I urgently need a cheque book to make some payments before 20th august 2022. Therefore, I request you to please issue me with a cheque book of 50 leaves.

Also, it would be helpful if you issue it before 20th august.

Moreover, I have attached a self-attested copy of my ID proof and address proof.

Thank you for your time and consideration.

Snehal Rajora

Explore More Sample Letters

- Leave Letter

- Letter to Uncle Thanking him for Birthday Gift

- Joining Letter After Leave

- Invitation Letter for Chief Guest

- Letter to Editor Format

- Consent Letter

- Complaint Letter Format

- Authorization Letter

- Application for Bank Statement

- Apology Letter Format

- Paternity Leave Application

- Salary Increment Letter

- Permission Letter Format

- Enquiry Letter

- Application For Character Certificate

- Name Change Request Letter Sample

- Internship Request Letter

- Application For Migration Certificate

- NOC Application Format

- Application For ATM Card

- DD Cancellation Letter

Sample 3 –

5th lane, Shivaji Nagar

Nagpur – 440002

Bank of Baroda

Laxmi Nagar

I am Rajiv Dhoot, and my account number is 05543xxxxxxxx0156. To sum up, I need a cheque book as my old cheque book is about to end. Therefore, I request you to please issue me with a cheque book as soon as possible.

Moreover, I have attached my self-attested Aadhar card copy and PAN card for your reference.

Rajiv Dhoot

- Aadhar card

Frequently Asked Questions

Q1. How do I request a Cheque book?

Answer: Send a cheque book request letter to your bank. Also, ensure you provide details like account number, branch, ID proof, and address proof.

Q2. What are the types of cheque books available for the customer?

Answer: There are two types of cheque books viz., Personalized and Non-personalized. They are similar in terms of values. However, the former carries your name, and the latter does not. Moreover, you can get the non-personalized cheque book immediately. Therefore, if you urgently need a cheque book, you can go for the non-personalized one.

Q3. What is a cheque book?

Answer: A cheque book contains 25 to 100 cheques. It is usually used to make big amounts of payments.

Q4. Why do I require a cheque book?

Answer: You can make payments with cheques. For instance, some people insist on getting payment by cheque. Also, it is a safer option for transactions of huge payments. Therefore, you must have a cheque book with you.

Customize your course in 30 seconds

Which class are you in.

Letter Writing

- Letter to School Principal from Parent

- ATM Card Missing Letter Format

- Application for Quarter Allotment

- Change of Address Letter to Bank

- Name Change Letter to Bank

- Application for School Teacher Job

- Parents Teacher Meeting Format

- Application to Branch Manager

- Request Letter for School Admission

- No Due Certificate From Bank

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

MYCOMPANYWALA

- +91 7703833927

- Register | Login

- OPEN YOUR COMPANY

- PRIVATE LIMITED COMPANY

- LIMITED LIABILITY PARTNERSHIP

- ONE PERSON COMPANY

- PUBLIC LIMITED COMPANY REGISTRATION

- NIDHI COMPANY OR SECTION 8 COMPANY

- SOLE PROPERTIORSHIP REGISTRATION

- PATNERSHIP REGISTRATION

- INDIAN SUBSIDIARY REGISTRATION

- RESGISTRATION

- EMPLOYEE STATE INSURANCE REGISTRAION

- FSSAI REGISTRAION

- PROVIDENT FUND REGISTARTION

- IMPORT EXPORT CODE

- SHOP AND ESTABLISHMENT ACT REGISTRATION

- EMPLOYEE PROVIDENT FUND REGISTRATION

- TRADE LICENSE

- RERA REGISTRATION

- CONVERSION OF COMPANY

- PRIVATE LIMITED TO PUBLIC LIMITED

- OPC TO PVT LTD AND PUBLIC LTD

- PUBLIC TO PRIVATE LIMITED

- PRIVATE LIMITED TO OPC

- PARTNERSHIP TO LLP OR PVT LTD

- SOLE PROPRIETORSHIP TO PVT LTD

- FSSAI & EATING LICENSE

- FSSAI LICENCE

- FSSAI STATE LICENSE

- CENTRAL FSSAI LICENSE

- FSSAI ANNUAL RETURN

- TRADEMARK SERVICES

- TRADEMARK REGISTRATION

- TRADEMARK OBJECTION

- TRADEMARK ASSIGNMENT

- TRADEMARK OPPOSITION

- TRADEMARK RENEWAL

- TRADEMARK RESTORATION

- TRADEMARK HEARING

- TRADEMARK INFRINGEMENT

- COPYRIGHT REGISTRATION

- ANNUAL COMPLIANCES

- ANNUAL COMPLIANCES FOR PRIVATE LIMITED

- ANNUAL COMPLIANCES FOR SECTION 8

- ANNUAL COMPLIANCES FOR PRODUCER COMPANY

- ANNUAL COMPLIANCES OF LLP

- ANNUAL COMPLIANCES OF OPC

- ROC ANNUAL FILING

- DIRECTOR DISQULAIFICATION

- REVIVAL OF COMPANY

- INCOME TAX RETURN

- XBRL FILINGS

- SECTION 12A AND SECTION 80 G REGISTARTION

- INCOME TAX COMPLIANCES

- Section 12A and Section 80 G

- CHANGE IN BUSINESS

- COMPANY NAME CHANGE

- CHANGE ADDRESS OF COMPANY

- INCREASE IN AUTHORISED CAPITAL

- CHANGE IN OBJECT CLAUSE

- APPOINTMENT & RESIGNATION OF DIRECTORS

- CHANGE IN LLP AGREEMENT

- ONE PERSON COMPANY CLOSURE

- PVT. LTD. COMPANY CLOSURE

- LLP CLOSURE

- PUBLIC LTD COMPANY CLOSURE

- SECTION 8 DEMAND NOTICE

- SECTION 9 PETITION

- Replacement of Power of Attorney

- Property will Affidavit

- relative visa affidavit format

- sworn affidavit

- surety affidavit

- affidavit of single parent guardianship

- transfer of filed suit affidavit

- date of birth proof for passport affidavit format

- no address proof pan card affidavit

- borrower affidavit format

- labour amount recovery affidavit

- gap year affidavit

- deponent rendition of accounts affidavit

- refund of caution money affidavit

- accident death claim affidavit

- children custody affidavit

- cheque deposit affidavit

- declaration for change of signature

- bill affidavit

- bail affidavit

- bail affidavit format

- agriculture land affidavit

- applications

- application for claim of wrong statement

- witness application

- sewer connection application undertaking

- application for complaining against mobile tower installation

- application for releasing vehicle on superdari to the applicant

- legal notice for dues recovery or application for recovery of dues

- industrial dispute claim application

- application for inspection of the case file

- application for permission to open the premises after breaking the lock

- application for early hearing of the case

- application for divorce petition

- criminal appeal transfer application

- vehicle application consumer protection act

- application for list of witness which the applicant wants to examine in his evidence

- caveator application

- application for advance remittance against imports

- application for issuance of foreign demand draft or foreign outward remittance

- appication for surrender of the accused applicant

- applilcation for regular bail

- rti application form right to information act form

- Suit For Declaration

- application form for marriage registration

- declaration form for new gas connection

- police clearance certificate form pcc

- legal notice for snatching and accident

- public notice for name change after marriage

- performance seller legal notice

- marriage divorce legal notice

- criminal complaint after legal notice

- legal notice to bank loan

- Suit for Declaration Agriculture Land

- personal loan

- house declaration

- objection execution affidavit format

- affidavit for noc of property for construction

- medical reimbursement

- covering letter for data

- rent agreement

- evidence claim

- for grant of anticipatory bail in case under section of electricity act police station

- consequential relief permanent injunction

- declaration for physical fitness for driving license

- consumer evidence

- protest petition format

- civil appeal report

- certificate for non re marriage

- atm proposal letter format

- special power of attorney

- sealing of commercial shop affidavit

- Other Legal Documents

- BOARD RESOLUTIONS

- Company Name Change

- Notice of EGM

- Appointment of First Auditor

- Appointment of Director

- Appointment of Company Secretary

- Increase in Authorised Share Capital

- Partnership Resignation Letter Format

- vehicle 4 wheelers

- FORMATS & FORMS

- Trademark Forms

- MOA/AOA Formats

- Name Availability Guidelines

- Cheque Bounce Notice Format

- Breach of Contract Notice Format

- Legal Notice For Dues Recovery

- Security deposit refund legal notice

- Delay of possession legal notice

- Managing Business/Employment

- No Objection Certificate

- Resignation Letter Format

- Appointment Letter Format

- Auditor Consent & Certificate

- Auditor Appointment Letter

- partnership deed

- trade license affidavit

- loan agreement with bank application

- Business Registration

- LLP Agreement

- Applying Import Export Code

- Rent/Lease Agreement

- View All Legal Docs

Cheque Return Letter Format

[Date, Month, Year]

[Cheque Issuer Name]

[Address line 1]

[City, State, Pin Code]

Sub: Request for payment

Dear Sir/Madam

I regret to inform you that your cheque no. __________________ in favour of _________________________ for the amount of Rs. ________________ was presented for payment this day through (name of the bank) and payment has been unfortunately refused by the Drawee Bank with the endorsement – " [Funds not sufficient] " vide [Returning Memo No. ] on [Cheque Return Date] .

In these circumstances, I request you to pay me the above mentioned amount of Rs. [Cheque Amount] at the earliest.

Your Truly,

For XYZ Private Limited

Any Question? Call us on +91-77038-33927

Submit your detail and download this form, submit your detail, related post by mycompanywala.

Annual Compliance for Private Limited Company

Annual Compliance for Private Limited CompanyA Private Company is a corporate held under private ownership which requires regular filing with the Ministry of Corporate Affairs. For every organization it is obligatory to file an yearly return and audited financial statements including profit and loss...... Read More

Annual Compliance for One Person Company

Annual Compliance for One Person CompanyIn countries like India where entrepreneurship is highly encouraged. One Person Company is one of the most leading forms of business for entrepreneurs whose business lies in an early stage with an intention to grow in future. A One Person Company comprises one...... Read More

Annual Compliances for LLP

Annual Compliances for LLP A Limited Liability Partnership is a separate legal entity. In order to preserve active status and to avoid default status. A regular filing with MCA is required to be taken care by all Limited Liability partnerships. Annual Compliance for any LLP is obligatory...... Read More

How much times involved in strike of company name from the register of companies?

Once an application is filed for striking off of company with the respective Registrar of Companies (ROC) after verifying the documents the RoC will strike off the name of company and this procedure normally takes 3-4 month. However, if any objection is received from ROC this process might take extra time or even reject the application. Disclaimer: – The above article is prepared keeping all the significant and fundamental inquiry which comes at the top of the pri...... Read More

What are the documents which are required for closure of the Company?

Certified true copy of board resolution for authorisation given for filing this application.Registered Digital Signature Certificate of director for signing the form.Memorandum of association of the CompanyArticle of Association of the Company.Proof of identity (PAN Card/Aadhar Card/Voter ID card).Residence proof (Passport/Driving License/Voter ID Card)Statement of account duly certified by a chartered accountant.Affidavit in Form STK-4 and Indemnity bond in Form STK-3 duly notarised...... Read More

What is the procedure to strike of company in case of voluntary striking off of company?

The procedure is extremely easy and is completed step wise:- 1. Call a board meeting in accordance with the Secretarial standards and Companies Act 20132. Convene Board meetingto pass the following resolutions:-To take note of statement of accountsTo authorise directors to sign the Indemnity Bond and Affidavits as per Form STK-3 and Form STK-4 respectively.To authorise a director to digitally sign the application in e-Form STK-2.To fix the day, date, time and venue...... Read More

What are the fees for e-form MGT-14 and e-form STK-2?

MGT-14 has normal associated fees in accordance with the authorized share Capital of the Company. STK-2:- INR 10,000/-......

Which forms required to be filed for strike off Company?

Two e-forms are required for striking off of company:- a) MGT-14 b) STK-2......

Whether members approval is required for striking off Company ?

Yes. Member’s approval is required through Special resolution for striking off company ......

When Company cannot make an application for striking off?

has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded;has engaged in any activitythe company at any time in the previous 3 months:- has changed its name or shifted its registered office from one State to another; ...... Read More

What are the main checklists needs to be considering before closing of the Company?

The company has filed its upto date all the financial statements and annual return with the Registrar of Companies.The company does not have any management disputes or there is no litigation pending with regard to management or shareholding of the company.No order is in operation staying filing of the documents by a court or tribunal or any other competent authority.the company is not a company incorporated for charitable purposes under section 8 of the Companies Act, 2013 or section 25 ...... Read More

What are the ways for close the Company?

A company can get strike off in two ways:- Suo-moto (Voluntary Striking off)By Registrar of Companies ......

Which Company can get close in Strike off?

Any company can get strike off whether it’s a Private companyOne-person companyPublic company ......

What is meaning of striking off of company name?

Striking off of company suggests that closing of a non profitable venture company. In different words it's the quickest and easiest method to shut an organization.......

PROCEDURE FOR STRIKING OFF OF NAME OF A COMPANY

Each organization is begun with a dream to keep up its business continuously, but not all businesses square measure effective since quite an whereas past run. As we have a tendency to as of currently recognize, that there's positive technique to consolidate a company, run a company, in like manner, there's an exact system to shut a company. As on date, there square measure 2 alternative ways to shut a company:- Strike off companyWinding up of company ...... Read More

DETAILED NOTE ON BONUS ISSUE DEFINITION

An issue of bonus shares is referred to as a bonus share issue or bonus issue. A bonus issue is usually based upon the number of shares that shareholders already own. While the issue of bonus shares increases the total number of shares issued and owned, it does not change the value of the company. 1) The source out...... Read More

ISSUE OF SHARES THROUGH RIGHT ISSUE

DEFINITIONOF RIGHT ISSUE ‘Right Issue’ means offering shares to existing members in proportion to their existing shareholding. The object is, of course, to ensure equitable distribution of Shares and the proportion of voting rights is not affected by issue of Fresh shares. A rights issue is an invitation to existing shareholders to purchase additional new shares in the company. This type of issue gives existing shareholders securities called rights. ...... Read More

PROCEDURE FOR REMOVAL OF DIRECTOR

1. Ensure that a special notice for the removal of a director is furnished by number of members in accordance with the section 115 of Companies Act, 2013 to the company at least 14 days before the meeting at which it is to be moved. 2. (a) Ensure that the notice for removal of a director is for a director other than a director appointed by the Tribunal under section 242 of the Companies Act, 2013. &n...... Read More

ISSUUANCE OF EQUITY SHARES THROUGH SWEAT EQUITY

Introduction- What is sweat equity shares? Sweat equity shares refers to equity shares given to the company’s employees on favorable terms, in recognition of their work. Sweat equity shares is one of the modes of making share based payments to employees of the company. The issue of sweat equity shares allows the company to retain the employees by rewarding them for their services. Sweat equity shares rewards the beneficiaries by giving them incentives in lieu of their contribution tow...... Read More

PROCEDURE FOR ISSUE OF SHARES THROUGH PRIVATE PLACEMENT

INTRODUCTION Private placement can be explained as a means of raising capital by the companies without going for public issues. Public Issues like Initial Public Offering and Further Public Opening are means of raising capital by the companies. DEFINITION A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. It is an alternative to an initial public offering (IPO) for a compan...... Read More

OPC has to convert into Private or public limited company within 6 months

.jpg)

OPC shall be required to convert itself, within six months of the date on which its paid up share capital is increased beyond fifty lakh rupees and the last day of the relevant period during which its average annual turnover exceeds two crore rupees as the case may be, into either a private co...... Read More

Mandatory Conversion of One Person Company into Private Limited or Public Company

.jpg)

Rule 6 of the Companies (Incorporation) Rules, 2014 as amended vide the Companies (Incorporation) Amendment Rules, 2015, w.e.f. 1-5-2015 provides that where the paid up share capital of an OPC exceeds fifty lakh rupees and its average annual turnover during the relevant period exceeds two crore rupe...... Read More