AN INTERGOVERNMENTAL UNIVERSITY UNDER UNITED NATIONS TS 49006/7 — EUCLID RESPONSIVE SITE —

- Overview | Legal Status

- Memberships | Partnerships

- Accreditation | Recognition

- Officials | Administration

- Participating States

- EUCLID Institutes

- HQs and Offices

- History | Timeline

- Annual Reports

- Groups and Procedures

- General Public

- Government Officials

- Scholarship Programs

- Why choose EUCLID?

- ECOWAS Region Applicants

- Registrar’s Office

- Master’s Programs @ EUCLID

- PhD Programs @ EUCLID

- Tuition and Fees

- Pedagogical Approach

- Faculty Profiles

- Academic Standards

- Joint and Dual Degrees

- Online Programs @ EULER

- Alumni Profiles and Quotes

- Academic Journal IRPJ

- News & Events

- EUCLID Institutional and CMS

- EUCLID Treaty Site

- LinkedIn (Academic)

Online PhD in Islamic Finance and Economics

Quick access, program type, school / institute.

Online (Asynchonous)

USD 169 per credit hour

Scholarships

Full (officials of PS); 15% off (ECOWAS and IGOs)

The EUCLID online PhD in Islamic Finance and Economics is among the programs developed as part of a Joint Initiative between EUCLID (an intergovernmental treaty-based institution) and ICCI (now ICCIA , the Islamic Chamber of Commerce, Industry and Agriculture), starting 2008.

This PhD program represents a convergence of EUCLID’s expertise in global governance, international civil service, and interfaith studies. It is the only online graduate program in this important field of academic study and professional practice organized by a public intergovernmental organization and officially used by active civil servants over 4 continents. In this regards, it is an excellent choice for both Muslim and non-Muslim students alike.

Academic Presentation

EUCLID’s Doctorate in Islamic Finance and Economics represents 90 US credits (120 ECTS) of coursework beyond the Bachelor’s. In practice, students may enter the DIFE with a relevant Master’s degree, complete 30 to 35 US credits of core doctoral courses, followed by the actual writing of the dissertation in 5 phases. The resulting thesis should be a publishable book offering a clear contribution to the field and establishing the author as a subject-matter expert.

Among the suggested areas of focus are:

- Islamic Banking Sustainable development

- Islamic Microfinance

- Alternative Banking Models

- Comparative Economics

- Islamic Economics in Africa

- Sustainable Financial Systems

EUCLID = ISLAMIC FINANCE IN PRACTICE

Photo above: EUCLID’s Secretary-General Syed Zahid Ali with the President of the Islamic Development Bank (2008). EUCLID became an IsDB Partner in 2014.

MORE INFORMATION:

- Admissions Checklist

- Accreditation

- Admissions Group

- Alumni Profiles

Requirements

Featured video, program outline.

Note: to consult the current and official curriculum/list of courses from the EUCLID CMS database, please visit: EUCLID Available Degree Programs and follow the program link.

Employment Outlook

Why Study @ EUCLID?

EUCLID is the only intergovernmental, treaty-based university with a UN registered charter and recognized expertise in diplomacy. Join the alma mater of ambassadors and senior officials globally.

Note: if the PDF brochure is unavailable (or outdated by 2 years), please contact [email protected]

EUCLID AT WORK: RECENT NEWS AND ARTICLES

Gambia to Host OIC Summit

On the 04th and 05th of May 2024, the Republic...

EUCLID publishes 2023 Annual Report

The EUCLID Secretariat General is pleased to announce the release...

EUCLID Secretary-General Dookeran delivers UN ECLAC lecture

As part of the commemoration of the seventy-fifth anniversary of...

EUCLID Delegation at COP28

EUCLID (Euclid University) was officially approved as an intergovernmental observer...

The appropriate office and officials will reply within 2 business days. If calling a EUCLID office, make sure to call the correct location based on your profile.

The application review process takes 4-6 business days after receipt of documents.

EUCLID (Pôle Universitaire Euclide |Euclid University) A treaty-based organization with international liaison and representative offices in: New York, Washington DC, Montpellier (France)

Headquarters: Bangui, Central African Republic Commonwealth / ECOWAS Headquarters: Banjul, The Gambia

Studying with EUCLID

- Ph.D. / Doctorate

- Master's degrees

- Bachelor's degrees

- Habilitation and Post-Doc

- Specialized Certificates

Quick Access

- News and Events

Legal Protection Switzerland

About EUCLID

- Legal Status

- Offices and HQs

The EUCLID Charter in UNTS

EUCLID | WWW.EUCLID.INT: THE GLOBAL, INTER-DISCIPLINARY, TREATY-BASED UNIVERSITY

- Contact IIUM

- Researchers

- EN | MY | AR

- Search

- Staff Achievements

- Centres of Excellence

- Student Achievement

- Prominent Alumni

- Our Achievement

- Undergraduate

Postgraduate

- Short Courses

Ph.D in Islamic Banking and Finance / PIBF

Ph.D in Islamic Banking and Finance (PIBF) is awarded to graduates for a meaningful completion of doctoral research that advances the theory and principles of Islamic Banking and Finance from inter-disciplinary perspectives. Upon completion of a multi-disciplinary doctoral programme, the graduate is expected to undertake independent research and contribute to quality publications in their field of expertise

Programme Objectives

- To attract and train high potential talent in Islamic Banking and Finance

- To futher develop and enhance the theory and practice of Islamic Banking and Finance

- To meet the global demand for expertise in Islamic Banking and Finance industry

Programme and Mode of Structure

Candidates for Ph.D in Islamic Banking and Finance are required to take 3 special requirement courses as a coursework requirement. These three courses are to be completed within the first year of the programme. Candidates must pass all the special requirement courses before they can proceed to the thesis.

Two courses are compulsory and one is elective course. The courses for the Ph. D programme are:

Compulsory special requirement courses

Elective special requirement courses, research areas.

- Fiqh Muamalat in Islamic Banking and Finance

- Islamic Banking and Finance Law

- Performance and Efficiency of Islamic Banks and Takaful

- Economics Policy and Analysis of Islamic Banking and Finance

- Regulatory and Governance

- Takaful and Re-Takaful

- Investment Banking

- Islamic Wealth Management

- Islamic Capital Market

- Islamic Micro-Credit and Micro-Financing

- Corporate and Shari'ah Governance for Islamic Banking and Finance

- Risk Management

*Subject to availability of supervisors

Ph. D Thesis

Upon registration as doctoral student, the student is expected to prepare and submit thesis proposal for defense with the guidance of the thesis advisory committee within the prescribed period. Upon successful defense, the doctoral student is now a candidate to undertake and complete the research for final submission for viva voce' to be examined by both internal and external examiners.

Following the viva voce, one of the following recommendations will be made:

- Pass with minor revisions to be completed in six (6) months

- Pass with major revisions to be completed within the minimum period of six (6) to maximum period of twelve (12) months

- Resubmission with viva to be completed within the minimum period of twelve (12) to maximum period of eighteen (18) months

Fee Structure

Useful links.

- Admission Information

- Scholarships

Student Affair

CENTRE FOR POSTGRADUATE STUDIES

International Islamic University Malaysia,

P.O. Box 10, 50728 Kuala Lumpur, MALAYSIA

Any inquiry related to admission, please send e-mail to :

International Admission : [email protected]

Local Admission : [email protected]

per semester

International

Interested in ph.d in islamic banking and finance / pibf .

International Islamic University Malaysia

P.O. Box 10, 50728 Kuala Lumpur

Phone : (+603) 6421 6421 Fax : (+603) 6421 4053 Email : [email protected]

Students & Parents

- Academic Calendars

- Student Resources

- Scholarship & Financial Assistance

Researchers, Lecturers & Alumni

- Research Centre

- Thesis, Journal & Papers

- List of Expertise

- IIUM Repository

- E-Bookstore

- Alumni Chapters

- About Alumni Society

- Staff Email

Business, Government & Related Links

- IIUM Holdings Sdn. Bhd.

- Vendor Portal

- Job Opportunities

- MyIIUM Portal

- List of Mobile Apps

- Give to IIUM

- IIUM News Bulletin

- Disclaimers

- Corporate Identity Manual

- 35th Convocation

- How to Contact Us

- Library & Collections

- Business School

- Things To Do

/prod01/prodbucket01/media/durham-university/research-/doctoral-training-centres/durham-doctoral-training-centre-in-islamic-finance/52790-1-1920X290.jpg)

PhD by Research

DCIEF has a large PhD community, with over 60 students from across the world.

We offer specialised research degrees in most areas of Islamic economics, banking and finance. As part of the degree programme students normally attend a module on Islamic economics and Shari'ah compliant finance. There are also weekly Research Support Workshops.

Our Islamic Finance research degrees are recognised by the Saudi Ministry of Higher Education, the Central Bank of Bahrain and Bank Negara, the Central Bank of Malaysia.

The Islamic Finance programme and the Summer School places one in a highly advantageous position to enter the Islamic Finance Industry.

Current PhD research areas

- An Empirical Investigation of Operational Risk Management in Islamic Banks: An Integrated Approach

- Performance Measurement and Profitability of Islamic Banks in Sudan

- The Merits in Applying AAOIFI Accounting Standards in the Islamic Banking Sector in Saudi Arabia

- A Study of the Investment Policies of Takaful Companies and the Factors Influencing their Investment Decisions

- Modelling Risk Management for Islamic Financial Products in Malaysia

- Comparative Analysis on Capital Adequacy and Risk-Taking Behaviour among Financial Institutions across Select Middle East Countries and Malaysia

- Institutional Dimensions of Economic Stagnation in the Muslim World: An Islamic Political Economy Approach

- Social Dimensions of Islamic Investment in Malaysia

- Service Quality Measurement in Islamic Banks in the UAE

- Measuring the Performance of Islamic Mutual Funds

- Developing Sukuk Structure Beyond the Traditional Models: Overcoming Risk Implications

- Religious Determinants of Economic Behaviour: The Case of Algerian Youth

- Evaluating Islamic Home Financing in Malaysia

- Islamic Home Financing in Kuwait

- Islamic Corporate Social Governance and Ethical Investment in Turkey

- Developing Financing for SME's in Saudi Arabia

- Exploring the Potential for Islamic Finance in Libya

- Evaluating the Demand for Islamic Mortgages in the UK

Islamic finance research degrees

An overview of our postgraduate research in Islamic finance and entry requirements for PhDs and other research degrees.

Aims and vision

We aim to undertake world-class research in Islamic political and moral economy, finance and banking. All research projects will be inspired both theoretically and methodologically by humanities and social sciences subject areas, including political and moral economy, economics, development, philanthropy, and Islamic commercial law.

The University recognises that excellent research is firmly rooted within core intellectual disciplines and the abilities of individual researchers to contribute at the highest level.

The vision is for our Islamic Finance PhD programme to become the home for some of the best Islamic finance researchers in the world.

We will grow and support a vibrant culture and community of research students and staff.

We will ensure all students and staff uphold higher education's values of quality, diversity and partnership. While in the pursuit of new insights and understanding of the subject matter.

Our Islamic Finance PhD programme is run in partnership with Al Maktoum College .

Staff profiles

These members of staff are our colleagues from Al Maktoum College, who support teaching this degree.

- Alija Avdukic is the Deputy Programme Director and course lecturer.

- Dr Ata Rahmani is course lecturer

Areas of research

While research in Islamic finance has expanded quickly, general research in Islamic economics, which began in the 1970s and 1980s, has grown more slowly. The areas of research that we focus on include all broad areas of Islamic economics and finance (for example, Islamic political/moral economy, Islamic banking and finance, Islamic insurance, Islamic capital markets, Islamic commercial law) by developing the theoretical, empirical and law-oriented studies in these areas.

The main areas of research within the PhD programme are:

Islamic economic theory

- the micro and macro foundations of Islamic economics

- formation of Islamic political economy

- formulating Islamic moral economy

- the theory of maqāsid al Shari’ahand its implications for Islamic economic theory

- the development of Shariah based products (in contrast with Shariah compliant products). Newly developed products should not be a mere innovation but rather an 'invention'. This will develop synergies in a wide range of areas of Islamic finance and Islamic sustainable development

Empirical Islamic finance

- Islamic banking and finance and sustainable development

- Islamic moral economy and the performance of Islamic banking and finance

- Islamic capital markets (sukuk markets)

- Maqasid al-Shari’ah performance of Islamic banks, Islamic stocks and other Islamic institutions

- Islamic charitable giving behaviour and maqāsid al-Shari’ah performance of Islamic charities

Islamic commercial law

- Islamic financial contracts and transactions

- investigation into corporate law for Islamic finance

- the impact of government legislation on Islamic finance

- arbitration in Islamic law

- how Islamic law complies with intentional law

Key research projects

This is only some of the possible key research projects:

Islamic economic theory

- aspects of the microeconomics foundations of Islamic economics

- aspects of the foundations of economic welfare in Islamic economics

- macroeconomic policy in Islamic economics (including monetary and fiscal policy, and the associated monetary and fiscal instruments)

- Islamic political economy

- Islamic moral economy vs Islamic economics

- methodological aspects of Islamic economic theory including Islamisation vs Authentication in Islamic economics and epistemological approaches to Islamic economics including conventional/Islamic methodological frameworks

- the Islamic economic conceptualisation of Islamic finance

- the philosophical debate on the making of Islamic economics

- ethics and the formation of Islamic economics

- Islamic financial institutions and banks (their operational aspects)

- Islamic finance without and before banking (the form vs substance debate in Islamic finance and banking, and the direction of change in Islamic finance and banking)

- evaluating the performance of the emergent non-banking Islamic finance institutions which is shaping the nature and process of the future direction of Islamic finance and banking

- socially responsible Islamic investment and finance: corporate social responsibility and Islamic finance, green Sukuk, social banking etc.

- in-depth analysis of the challenges facing the regulatory structure of the Islamic finance industry.

- empirically investigate the role of Shari’ah boards in shaping the changing nature of (i) Islamic finance, (ii) the Shari’ah boards and their fatwa, and (iii) how the re-defined Shari’ah auditing is shaping authentic Islamic banking operations

- capital requirements, credit risk weighting of assets (standardized and internal rating based approaches), treatment of leases, micro finance, project finance, operational risks, market risks, securitisation and Islamic banking and market disciplines, and the implications of supervisory review process

- systemic risks, credit risks, market risks, operational risks, and liquidity risks, particularly stemming from the unique asset and liability structures of Islamic banks due to Shari'ah compliance, perception of banks and regulators regarding these risks, and various risk exposures underlying Sukuk structures

- factors effecting financial stability, the role of Islamic finance and regulatory institutions in ensuring financial stability, empirical work on the stability of Islamic banks in comparison with traditional banks during financial distress, the effect of Islamic financial instruments on financial market stability, and early warning systems of financial distress

- the underlying principle of Islamic banks and financial institutions is the Islamic legal codes (Fiqh) to achieve Shari’ah compliance that are based on profit-and-loss sharing, risk sharing, and the prevention of debt financing in the society.

- fiqh appraisal of risk management instruments and alternatives developed to treat defaults, operating financial leases, asset securitization, plus the importance of managing bank capital and its implications for business risk etc.

- comparing the regulatory frameworks of Islamic banking and traditional banking and the implications for whether there is a level playing field, cross-sector consolidation of activities cross-sector risk transmission, and the implications for banking supervision.

- Islamic banking regulation and supervision including Shariah compliance as a matter of regulation or market discipline, the application of risk assessment tools, the risk weighting of the assets of Islamic banks, the treatment of investment and current accounts, sources of capital, disclosure and transparency requirements, applications of international standards, financial reporting and disclosures, and compliance with core principles.

- arbitration (Tahkim) for Islamic finance which may include a comparative approach and convergences with international law and other jurisdictions; methods of disputes resolution for Islamic finance, and semi-secular arbitrations for Shariah compliant finance.

Propose your own PhD topic

If you want to propose your PhD topic, you can use the contact details below to contact a staff member to discuss your proposal.

Entry requirements

You should have an honours degree at 2.1 or above, and/or a Masters degree in a relevant discipline.

English language requirements

We also accept other English language qualifications

You do not need to prove your knowledge of English if you are a national of certain countries .

Don't meet the English language requirements?

English language programmes.

Prepare for university study and benefit from extra English tuition with an English language programme .

Islamic finance PhD tuition fees

Tuition fee per year of study (subject to a 3% annual increase for Scottish/Rest of UK students and a 5% annual increase for International students).

Part time study, where available, is charged on a pro-rata basis.

Scottish/Rest of UK fee status annual increase

Each year, UKRI sets a recommended fee and stipend level for Scottish/Rest of UK students, which we use as the basis for fees charged to this group.

UKRI usually increases its fee and stipend levels in line with inflation, based on the Treasury GDP deflator.

Therefore, the Scottish/Rest of UK fees detailed in this table for 2025/26 (and beyond) can only be estimated according to the typical increase.

The fee charged to you may differ, though only slightly, from the figure given.

Your research proposal

Learn about writing a research proposal for postgraduate research in Islamic finance

Apply for a research degree

You can apply for a PhD or other postgraduate research degree using our Direct Application System.

We have three start dates per academic year.

PhD Islamic Finance (3 years)

- Apply to start in May 2024

- Apply to start in September 2024

- Apply to start in January 2025

- Apply to start in May 2025

PhD Islamic Finance (4 years)

The University of Dundee welcomes applications from disabled students.

- Information for applicants declaring a disability

Please direct your enquiries to the below, or email [email protected]

+44 (0)1382 384845

Professor, Associate Dean International and Student Admissions

+44 (0)1382 385165

PhD Islamic Finance - Research Based

Uk accredited and globally recognized online islamic finance phd, phd in islamic banking and finance.

In an era where Islamic banking and finance is witnessing significant growth and acceptance globally, our PhD in Islamic banking and finance stands as an opportunity to delve deeper into this dynamic field. Our Islamic Finance PhD offers unparalleled flexibility, allowing individuals to balance their studies with professional and personal commitments. The PhD in Islamic finance and banking enables students to cultivate a deep understanding of the complexities of Islamic finance. They gain expertise that is sought after internationally, marking the beginning of a promising career in Islamic banking and finance. The research-based online PhD Islamic finance program is available part-time or full-time, and you may research across a wide range of areas in Islamic finance.

Reach the Milestone of Your Career

Integrate education to deal with the larger problems.

Link education research to Islamic finance policy and practice.

Become the Islamic finance scholar of global standing.

Islamic Finance PhD: At a Glance

Islamic finance programs.

- Certified Islamic Banker (CIB)

- Certified Islamic Finance Expert (CIFE)

- Diploma in Islamic Finacne (MDIF)

- MBA Islamic Banking and Finance Degree

- PhD (Doctorate) in Islamic Finance and Banking

How to Achieve Your PhD in Islamic Banking and Finance with AIMS?

Our Islamic finance PhD UK program offers self-paced learning, and it may be completed in 2 years. You are required to work 10-12 hours a week. Prospective students will need to do their research and find the right fit for their academic and career goals.

Our Student Say!

“I gained a lot from studying Islamic finance at AIMS, and it greatly benefited both me and my company. Through my experience working with Islamic banks, I noticed that many senior officials tend to handle Islamic products, services, and situations in a conventional way. By specializing in Islamic finance at AIMS, I was able to provide valuable advice to my company’s management on how to operate in a Shariah-compliant manner by developing an analytical approach. My studies have truly made a difference for us”.

T. Chouhan, Mohammad.

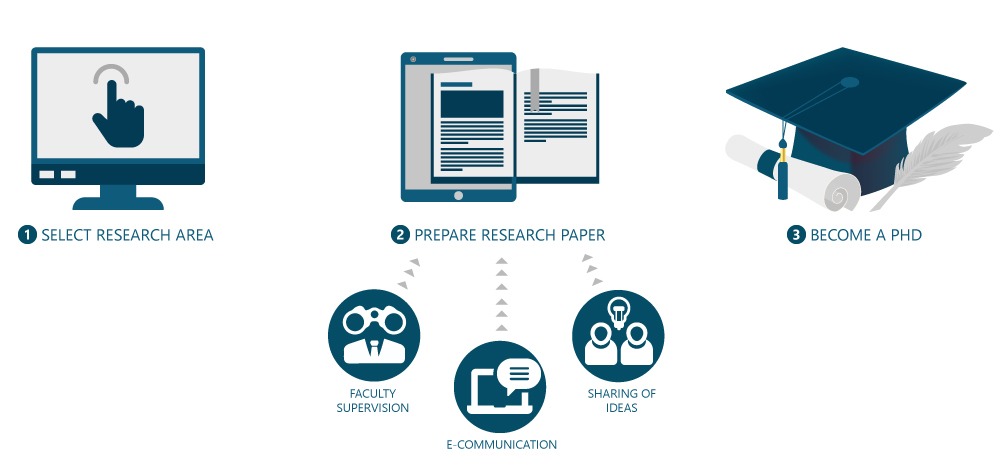

Steps for Completion

Step-1: Admission Approval & Registration:

Firstly, you must email us a scanned copy of your master’s degree and your resume. If your master’s degree major was not Islamic finance, you must also provide proof of a formal qualification in Islamic finance. If you do not have a formal qualification, the Certified Islamic Finance Expert ( CIFE is the best Islamic finance certification course offered online ) may fulfill the PhD in Islamic Finance prerequisite requirements. You may register and pay online if you meet the eligibility criteria. Admission processing time is 4-5 working days.

Step-2: Approval of PhD Dissertation Title:

Prior to proposing your research topic for the phd thesis in Islamic banking and finance, make sure that your research area fits your career goals, style, and experience. You have the opportunity to achieve this by engaging in conversations with our program representatives. The PhD Committee will review it, and when approved, you may begin your dissertation.

Step-3: Writing the PhD Islamic Finance Thesis:

Utilize your skills and potential to create a research proposal with assistance from our academic support team. During your studies, you will receive guidance from the faculty and support from the PhD Islamic Finance Committee. Emails and WhatsApp are among the means of communication that we offer.

Step-4: Evaluation and Doctorate Award:

After completing the PhD thesis in Islamic banking and finance, it will undergo evaluation by the academic support team and the PhD committee. The defense can be conducted online or in person within the United Kingdom. Those who pass will be awarded a PhD in Islamic Banking and Finance.

Accreditation!

AIMS is a formally acknowledged institution accredited by CPD and registered with the UKRLP in the United Kingdom. The online Doctorate in Islamic Banking and Finance provided by AIMS complies with the directives specified by the Ofqual Regulated Qualifications Framework (RQF) for Level-8 Ph.D. Degree, as well as adhering to the Shariah Standards established by AAOIFI .

Strategic Goals

Contribute to the development and advancement of Islamic banking and finance both in theory and practice.

Produce Islamic banking and finance scholars, who are competent to work in a variety of areas in Islamic finance.

A research-based program that can help you secure a high position at top-tier organizations.

Achieve your career goals through a globally recognized and accredited research-based doctoral degree.

Prominent Features of Our PhD Islamic Finance

Internationally accreditation & recognition.

This online PhD in Islamic banking and finance has international accreditation, ensuring it meets high academic standards and is globally recognized. With this degree, graduates can confidently pursue their career aspirations anywhere in the world, knowing that their qualifications will be acknowledged and respected. The international accreditation emphasizes AIMS UK’s commitment to providing an educational experience of the highest quality, aligning with the best practices in the field of Islamic finance. Our PhD in Islamic Finance degree is highly esteemed among Islamic financial institutions around the globe. Its comprehensive and rigorous curriculum, ensures graduates are well-prepared to lead and innovate in the field of Islamic finance.

Ideal Candidates for PhD in Islamic Finance?

PhD in Islamic Banking and Finance is an excellent choice for professionals, based on their career goals, and professional background.

- Professionals in Islamic Finance who are already working in the Islamic finance sector who wish to deepen their understanding and contribute new knowledge to the field.

- Academics and Educator s who are interested in researching, teaching, or contributing to the academic literature on Islamic finance.

- Banking and Finance Professionals from conventional banking and finance sectors aim to diversify their expertise or transition to Islamic finance.

- Regulatory Authorities and Policy Makers , involved in regulatory affairs or policy-making related to Islamic finance could enhance their ability to develop effective and informed policies.

- Research Scholars interested in exploring the intricacies and potential of Islamic finance could deepen their research capabilities and make significant contributions to the field.

- Consultants working with financial institutions or individuals who want to provide advice on Islamic banking and finance.

Flexible and Globally Accessible Education

The online PhD in Islamic banking and finance program offers a unique blend of flexibility and convenience, allowing you to complete your studies according to a timeline that suits your personal and professional commitments. This distance learning format eliminates the need for physical attendance, enabling you to study from anywhere in the world, at any time that is convenient for you. Throughout your Islamic Finance PhD journey, you can expect to receive consistent and comprehensive supervision to guide your research. Communication with supervisors is facilitated through a variety of means, including emails and video conferences, to ensure you receive the support and guidance you need to excel in your studies.

Career Opportunities and Salary Prospects

- President of an Islamic Financial Institution makes high-level decisions, develops business strategies, and builds relationships with key stakeholders. Salary $360,000.

- Head of the Islamic Bank oversees the bank’s operations, ensuring adherence to Islamic principles and maintaining a profitable banking structure. Salary $300,000.

- Head of Shariah provides crucial guidance on all matters pertaining to Islamic law. Salary $240,000.

- Finance Director/Chief Financial Officer is responsible for the financial health of an organization. Salary $210,000.

- Academic Professor contributes to their fields by teaching students, conducting research, and publishing their findings. Salary $110,000.

- Finance Consultant advise clients on financial planning, investments, insurance, pension plans, and other financial matters. Salary $185,000.

- Policy Makers in financial regulatory authorities can influence the direction of Islamic finance through the creation of effective policies. Salary $150,000.

- Corporate Lawyer ensures the legality of commercial transactions, advising corporations on their legal rights and duties. Salary $250,000.

Why is Getting a PhD in Islamic Finance Worth It?

Embarking on a PhD in Islamic Finance is undoubtedly a significant investment of time and energy, but the rewards are commensurate with the effort.

- This doctorate in Islamic finance equips you with the tools and knowledge to shape the future of the industry.

- It presents a unique opportunity to delve deep into research, question established norms, and challenge existing assumptions within the field.

- The Islamic Finance PhD fosters an environment that encourages you to explore your passions and push the boundaries of the Islamic banking and finance industry.

- The PhD in Islamic Finance carries with it substantial career benefits. It enhances your salary potential and opens up opportunities for leadership roles in top-tier organizations.

- Whether you aim to work in multinational corporations, or government agencies, or even aspire to teach in world-class universities, the PhD in Islamic finance marks a significant milestone on your journey to these lofty goals.

Thus, far from being just a degree, the PhD in Islamic Banking and Finance is a catalyst that propels your career onto a path paved with opportunities for growth and influence.

What are the Scholarships and Research Preferences at AIMS?

At AIMS, we actively support a diverse student body, offering the chance for you to delve into research topics that resonate with your unique interests and passions. In addition to enhancing the quality of our education, AIMS also provides fee scholarships, considerably easing the financial strain typically associated with pursuing an advanced degree. Therefore, our Islamic finance PhD program stands as a compelling choice for those who weigh financial implications against their academic endeavors. As a result, our students can shift their focus toward their research, reducing the financial stress commonly linked with higher education.

How to Choose the Right Research Topic for Your PhD Islamic Finance?

It is a crucial decision that shapes the trajectory of your academic journey. Here are a few steps to guide you through this process:

1. IDENTIFY YOUR AREAS OF INTEREST

The first step is to recognize your areas of interest within the broad field of Islamic Finance. It could be Islamic Banking Practices, Islamic Investment, Takaful (Islamic Insurance) , or Sukuk (Islamic Bonds). Your passion for the area of study will keep you motivated during the challenging times of your Islamic Finance PhD.

2. SCAN THE LITERATURE

Browse through existing literature in your chosen area of interest. Identify gaps in the research that you could potentially fill with your study. It’s important to ensure your research contributes to the overall body of knowledge in Islamic Finance.

3. FEASIBILITY OF THE STUDY

Consider the feasibility of your PhD Islamic Finance research topic. Do you have access to the resources, data, and methodology required to undertake the research? If not, you may need to refine your topic.

4. CONSULT WITH ADVISORS

Discuss your chosen topic with our advisors. They can provide valuable feedback and guide you toward a topic that is academically significant and practical for you to research.

5. ALIGN WITH CAREER GOALS

Lastly, consider how your chosen topic aligns with your future career goals. A PhD Islamic Finance research topic closely related to your career aspirations can open doors for opportunities in the future.

Remember, the journey towards a PhD in Islamic Finance is a marathon, not a sprint. Choosing the right topic can make this journey a rewarding one, leading to professional growth and meaningful contributions to the field of Islamic Finance.

ISLAMIC FINANCE BLOG

COMPARE PROGRAMS

FREE LECTURES

FAQ’s

- On Campus & Online Education Courses Millions of people learning!

- Student login

American International Theism University is an accredited online distant learning institution that is based in Florida. The Department of Education Commission on Independent Education of the State of Florida has granted us the right to award Master’s Degrees and Doctorate Degrees under Section 1005.06(1)(f).

(941) 841-0682, 1460 s mccall road suite 5 englewood, florida 34223, [email protected].

American International Theism University

AITU offers qualifying degrees in Religious Studies, Islamic Finance, Business and Psychology.

Accreditation

We are more confident than ever that our graduates will feel a sense of pride and excellence as graduates of AITU.

Learn More about Grief Counseling, Business Administration, Islamic Banking & Finance and Education

- Qualified Instructors

- High Academic Standards

- Outstanding higher education courses

- High graduation rates

- Dynamic course interface

- Self-paced courses featured

Dr. Ronald D. Fite

American International Theism University is a Religious institution that meets the requirements found in Section 1005.06(1)(f), Florida Statutes and Rule 6E-5.001, Florida Administrative Code are not under the jurisdiction or purview of the Commission for Independent Education and are not required to obtain licensure.

The title of AITU-issued degrees incorporates a religious modifier inside any of the accompanying degrees to consent to the Florida Department of Education, Commission for Independent Education Section 1006.06 ((1) (F): For instance, Associate of Arts, Associate of Science, Bachelor of Arts, Bachelor of Science, Master of Arts, Master of Science, Doctor of Philosophy, and Doctor of Education.

AITU offers educational programs that prepare students for religious vocations as ministers, professionals, or laypersons in ministry. Our programs include counseling, theism, education, administration, music, fine arts, media communications, or social work.

There are a variety of educational programs available at American International Theism University for students to join. These programs are designed to prepare students in their fields of choice. The majors available include Islamic Studies, counseling, social work, education, banking, finance, or business management. Students can choose to major in Grief Counseling, Education, Islamic Finance, or Business Administration for their degree programs.

American International Theism University is one of the few independent universities in Florida to offer Master’s Degrees and Doctorate Degrees online. By providing such advanced degree programs over the internet, it keeps our overhead costs to a minimum. That way, we can offer our students a much more significant discount on their tuition and other related educational products and services

Employers and future educators will want to make sure your degree is accredited before accepting you into their organization. The Accreditation Service for International Schools, Colleges, and Universities has granted accreditation to American International Theism University. As a result, our degrees include an official accreditation along with them. Once you show a potential employer your degree from American International Theism University, they can verify its accreditation and the value of the knowledge that you have received from our school.

AITU agreement with Hodmas University

American International Theism University is excited to formally announce a significant collaboration with Accord University, a prestigious institution of higher learning Hodmas University College www.hodmas.edu.so This partnership marks a pivotal moment in the journey of both universities, offering our students a wealth of new opportunities to accomplish their academic and professional objectives.

Hodmas University College distinguished reputation, coupled with its official licensing and approval by the Ministry of Education, Culture, and Higher Education in Somalia, underscores the credibility and quality of education that it offers. It’s worth noting that the Ministry of Education, Culture, and Higher Education holds the distinction of being recognized by the prestigious Council of Higher Education Accreditation (CHEA) www.chea.org

AITU agreement with UNIMY

AITU is delighted to announce an exciting partnership with University Malaysia Of Computer Science & Engineering (UNIMY) a prestigious institution in Malaysia for our Dual Degree Programs. This collaboration marks a significant milestone in our commitment to providing exceptional education and expanding global opportunities for our students. Through this monumental partnership, we aim to create an environment of academic excellence and innovation, empowering our students to thrive in today’s ever-evolving world. Our joint efforts will enable us to deliver an unparalleled educational experience that prepares our graduates for successful careers and a future filled with possibilities.

Ethereal Masters & Ethereal Doctorate Degree Programs

Our accelerated degree programs.

American International Theism University has something for everyone. Now with our Accelerated Degree Programs, you can complete your Master’s or Doctorate Degrees in up to three years. Each course offers six credit hours and lasts for six weeks. Let your hard work and dedication pay off by achieving your degree in half the time. Enrollment is open, and students may begin the program at any time. All courses take place in classrooms, with a faculty member that provides one-to-one mentoring. Students also have free access to our comprehensive Study Tactics and Resources Center, which offers links to subject-related websites, libraries, articles, and research assistance

Ethereal Master in Business Administration

Accelerated Ethereal Doctorate in Business Administration

Accelerated Ethereal Master of Psychology in Grief Counseling

Ethereal Doctor of Psychology in Grief Counseling

Accelerated Master in Islamic Finance and Banking

Accelerated Ethereal Master in Theology

Doctor of Islamic Finance and Banking

Ethereal Doctorate Degree in Education

Ethereal Doctorate in Education

You can learn it, popular courses.

BUS 702 – Research Methods

EDUD 870 – Globalization & Education

GRFM 525 – Psychotherapy Overview Theory and Practice II

MMP 500 : Genesis, Exodus, Leviticus, Numbers …

TMBA 628 – Strategic Management

GEDB 803 Clinical Dimensions of Anticipatory Mourning

DMGT 890 – Dissertation Research and Data Collections

GEDT 702 Counseling the Terminaly Ill

GEM 410 Treatment Planning

MMP 700 : Thesis Project in Ministerial Studies

GRFD 1101 – Psychotherapy Overview: Theory and Practice I

IFN 701 – Advanced Islamic Banking; Products and Services

Certificates & Accreditation

Memberships.

Don’t hesitate, View our Programs OR Enroll Now OR Pay Now

AITU Graduation Ceremony 2024

“Hello everyone! Today is a special day for AITU, and it’s all because of you. We work hard to see the joy and success on your faces. It’s a privilege to be a part of your journey. Your passion and determination make our jobs easier and motivate us to help you grow.

I wish each one of you the very best in your academic and personal life. Let’s not forget our dedicated doctors and professors who’ve made this day possible.

As we start this celebration, remember this day as a symbol of your hard work and a bright future ahead. Congratulations, Class of 2024!”

American International Theism University (AITU) is one the 10 Best Distance-Learning Institutes in 2022

With advancements in technology, the education system has witnessed incredible changes and updates in its teaching patterns. International institutes are offering online education to students globally. While this change towards online education has been embraced by almost all facets of the education sector, some are doing it exceptionally well.

There are a variety of educational programs available at American International Theism University for students to join. These programs are designed to prepare students for real-life job experiences in their fields of choice. The majors available include Islamic Studies, counseling, social work, education, banking, finance, or business management. Students can choose to major in Grief Counseling, Education, Islamic Finance, or Business Administration for their degree programs.

AITU with Florida Department of Education

Florida Department of Education Official Website

[American International Theism University] holds International Accreditation from ASIC (Accreditation Service for International Schools, Colleges, and Universities) with Premier Status for its commendable Areas of Operation.

ASIC Accreditation is a leading, globally recognised quality standard in international education. Institutions undergo an impartial and independent external assessment process to confirm their provision meets rigorous internationally accepted standards, covering the whole spectrum of its administration, governance, and educational offering. Achieving ASIC Accreditation demonstrates to students and stakeholders that an institution is a high-quality education provider that delivers safe and rewarding educational experiences and is committed to continuous improvement throughout its operation.

About ASIC: One of the largest international accreditation agencies operating in 70+ countries, ASIC is recognised in the UK by UKVI – UK Visas and Immigration (part of the Home Office of the UK Government), is ISO 9001:2015 (Quality Management Systems) Accredited and is a Full Member of The International Network for Quality Assurance Agencies in Higher Education (INQAAHE), a member of the BQF (British Quality Foundation), a member of the International Schools Association (ISA), and an institutional member of EDEN (European Distance and E-Learning Network).

AITU Scientific Research Journal

AITU Scientific Research Journal invites researchers, scholars, and academicians to submit their original research for consideration. By contributing to our journal, you have the opportunity to contribute to the advancement of knowledge, drive innovation, and make a lasting impact on your field. Together, let us embark on a journey of discovery, pushing the boundaries of scientific research, and shaping the future of academia.

Request More Information

AITU is authorized to award Associate, Bachelor, Master and Doctorate Degrees

You Can Learn

Our course workflow.

Application Filling

Registering for Course

Make a Tuition

Catch your Dream

Just fill the next form and we will contact you to make your dream come true

Select Your Country Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antigua and Barbuda Argentina Armenia Armenia Aruba Australia Austria Azerbaijan Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bonaire Bosnia and Herzegovina Botswana Bouvet Island (Bouvetoya) Brazil British Indian Ocean Territory (Chagos Archipelago) British Virgin Islands Brunei Darussalam Bulgaria Burkina Faso Burundi Canada Cambodia Cameroon Cape Verde Cayman Islands Central African Republic Chad Chile China Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Congo Cook Islands Costa Rica Cote d'Ivoire Croatia Cuba Curaçao Cyprus Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (Malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guernsey Guinea Guinea-Bissau Guyana Haiti Heard Island and McDonald Islands Holy See (Vatican City State) Honduras Hong Kong Hungary Iceland India Indonesia Iran Iraq Ireland Isle of Man Israel Italy Jamaica Japan Jersey Jordan Kazakhstan Kazakhstan Kenya Kiribati Korea Korea Kuwait Kyrgyz Republic Lao People's Democratic Republic Latvia Lebanon Lesotho Liberia Libyan Arab Jamahiriya Liechtenstein Lithuania Luxembourg Macao Macedonia Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia Moldova Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands Netherlands Antilles New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestinian Territory Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Islands Poland Portugal Puerto Rico Qatar Reunion Romania Russian Federation Rwanda Saint Barthelemy Saint Helena Saint Kitts and Nevis Saint Lucia Saint Martin Saint Pierre and Miquelon Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Sint Maarten (Netherlands) Slovakia (Slovak Republic) Slovenia Solomon Islands Somalia South Africa South Georgia & S. Sandwich Islands Spain Sri Lanka Sudan Suriname Svalbard & Jan Mayen Islands Swaziland Sweden Switzerland Syrian Arab Republic Taiwan Tajikistan Tanzania Thailand Timor-Leste Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkey Turkmenistan Turks and Caicos Islands Tuvalu U.S. Virgin Islands U.S. Minor Outlying Islands Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Venezuela Vietnam Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe

Select Program Master in Business Administration Doctorate in Business Administration Master in Grief Counseling Ethereal Doctor of Psychology in Grief Counseling Master in Islamic Banking and Finance Doctorate in Islamic Banking and Finance Master in Theology Doctorate in Theology Master in Education Doctorate in Education ماجيستير الدراسات الاسلاميه دكتورا في الدراسات الاسلاميه

Explore our Programs Now

AITU offers various programs with qualifying degrees in Religious Studies, Islamic Finance, Business, and Psychology.

our articles

Latest news & blog.

A comprehensive summary of the day’s most trending blog posts & news articles from the best Education websites on the web.

Doctorate of Islamic Banking and Investment Stability

Islamic finance

Finish your Doctorate in Education in One year

Accelerated Degree in Education

One-year Doctorate Degree in Education

Doctorate in Grief Counseling in One year

Accelerated Degree in Grief Counseling

- Oxford Centre for Islamic Studies

Islamic Finance

Research into the theory and practice of Islamic finance is being carried out in conjunction with a number of international financial institutions, policymakers and regulatory bodies, notably the Securities Commission Malaysia. This activity also ties in closely with the Centre’s work on the economic and human development of Muslim societies. The aims are threefold:

- to create an international platform for debate, dialogue, study, research and publication on contemporary issues and challenges faced by Islamic finance;

- to strengthen the understanding of Islamic finance in the UK and Europe as an alternative mode of financing;

- to support the development of new ideas that will have the potential to contribute to an enhanced role for Islamic finance in business and society.

These aims are achieved by:

- Research and publication : The Centre welcomes visiting scholars (supported through the Centre’s visiting fellowships and Chevening schemes) to conduct research and contribute to the publication output on Islamic finance. A Visiting Fellowship in Islamic Finance programme which supports one or two scholars per year to undertake research on the topic has been running since 2012. Applicants must be specialists in Islamic finance and/or a closely related discipline. (Click for further details.) In 2018, the Mahathir Mohamad Research Fellow, Mohammad Meki, submitted his doctoral thesis on the topic on the effect of equity-like (musharakah-based) microfinance contracts.

- Seminars : S eminars and workshops are regularly organised by the Centre on a range of topics relating to Islamic finance. This has included a seminar series run with Fajr Capital on Islamic finance which covered topics such as the history and evolution of Islamic finance, concepts, products and structures in Islamic finance, how Keynesian monetary theory and policy could embed a Qur'anic model of finance and the role of public policy in enabling Islamic finance.

- Conferences and roundtables : These include the annual Securities Commission Malaysia – Oxford Centre for Islamic Studies Roundtable on Islamic Finance (running since 2010). Over the years topics have included Islamic endowments ( waqf ), solutions for liquidity, the Islamic financial system cycle and the role of Islamic finance in transformational change. The roundtables bring industry practitioners, policy-makers, regulators and scholars who are leading international specialists in their field. In 2018 the ninth annual SC – OCIS Roundtable on Islamic finance was held in Malaysia and focused on ‘Enhancing the Value of Islamic Capital Market through Social and Impact Investment.’ (See ‘Roundtables’ for more information.)

- Prizes : The Sultan Hassanal Bolkiah Prize in Islamic Finance considered nominations of eminent figures in Islamic finance from around the world. The prize was awarded jointly to the Islamic Development Bank and its founding President, HE Dr Ahmad Mohamed Ali Al-Madani and in 2018. (Click for details.)

The Centre continues to seek further collaborative engagements with international partners on the subject.

Click to view the Centre’s 2023 Annual Report entry on Islamic finance.

- GET 7 FREE LESSONS NOW

- CERTIFICATION

- Testimonials

- Download Brochure

- Training and Certification Capabilities (PDF)

- Best of Weekly Mailshots

- Press Releases

- Become an Ethica Affiliate or Reseller

- Contribute to the ‘Train-a-Scholar’ Program

- User Safety Guidelines

“Ethica’s CIFE™ has already opened doors for me…“ Boyd Ruff, CIFE™ Graduate, Esq., USA

Trusted by more professionals for islamic finance certification, ethica has trained over 15,000 paying professionals, now working in over 160 financial institutions in 65 countries around the world., celebrating 20 years of islamic finance excellence.

• Official recognition from AAOIFI, the world’s leading standard-setting body for Islamic finance • 15,000 paying professionals in 65 countries from over 160 institutions • +$350,000 given in financial aid • +100 countries and thousands receive free courses and ebooks • Ranked #1 on Google for “Best Islamic Finance Certification” regularly • 69 industry awards

Compare Ethica with the Competition

Ask yourself these 3 questions when comparing Ethica with the competition...

Ethica's Recent Awards

- 2024 Best Islamic Finance Qualification—Global (Corporate America Today Annual Awards New York, US)

- 2024 Best Islamic Finance Qualification—Global (Global 100 Awards, UK)

- 2024 Best Islamic Finance Qualification—Global (M&A Today Global Awards, UK)

- 2023 Outstanding Finance Education Provider—Dubai (Gazet International, Singapore)

- 2023 Best Training Institution—Dubai (Gazet International, Singapore)

- 2023 Best Islamic Finance Qualification—Global (Global 100 Awards, UK)

Pay in Easy Monthly Instalments

CIFE™ and ACIFE™ programs starting at only $149.5/month

Officially AAOIFI Recognized

Officially recognized by aaoifi (pronounced “a-yo-fee”), the world’s leading standard-setting body in islamic finance, ethica's award-winning certified islamic finance executive (cife) and advanced cife (acife) earn you continuing professional development (cpd) credit, access your free 2,000+ page e-book.

• Mufti Taqi Usmani’s “Introduction to Islamic Finance“ • AAOIFI’s Shariah Standards • Sample Islamic finance contracts • CIFE™ Study Notes • Recommended reading lists • Over 1,000 Islamic finance Q&As

Financial Aid for Students, Scholars, and Islamic Finance Graduates

Our graduates perform better because Ethica's courses find their roots in the cut-and-thrust of on-the-ground execution. Recruiters know that you'll bring more Islamic finance know-how to the job than most around.

The Fastest Way to Learn Islamic Finance. Guaranteed.

Ethica's CIFE™ and ACIFE™ give you only the most essential, practical Islamic finance knowledge distilled into an accelerated program.

Ethica’s CIFE™ Now Earns You 20 CPD Credits

Ethica’s CIFE™ is now NASBA-compliant. That means you earn 20 CPD credits right away once you complete your CIFE™

ETHICA CERTIFICATES: 3 MONTHS OR LESS ONLINE

Certified islamic finance executive (cife).

Practical Islamic finance training, taking newcomers to an advanced level of knowledge rapidly.

ADVANCED CIFE (ACIFE) FINANCIAL ANALYSIS

Learn to perform the most commonly used Islamic financial calculations in the industry.

ADVANCED CIFE (ACIFE) ACCOUNTING

AAOIFI’s accounting standards distilled into an accelerated certificate.

Couriered to your doorstep at no extra charge, your framed certificate will handsomely adorn your office or study for years to come. Custom-mounted and framed by hand, this beautiful certificate was designed by classically-trained Islamic artists and third-party accredited to comply with AAOIFI, the world’s leading Islamic finance standard.

Officially recognized by AAOIFI (pronounced “a-yo-fee”), the world’s leading standard-setting body in Islamic finance, Ethica's award-winning Certified Islamic Finance Executive (CIFE) and Advanced CIFE (ACIFE) earn you continuing professional development (CPD) credits

“The role Ethica has played in promoting the cause of standardization of best practices in Islamic finance, especially in the fields of Shari'ah and accounting, that too for the last two decades, is indeed praiseworthy. They have always put AAOIFI standards at the heart of all their certification and training programs for which we are grateful.”

Omar Mustafa Ansari Secretary General, AAOIFI

START YOUR CIFE NOW…FIRST 7 DAYS FREE

Please enter your details below to start receiving your lessons instantly!

We value your privacy. We will never rent, sell, or spam email addresses.

Welcome to the Certified Islamic Finance Executive (CIFE) program, trusted by more professionals for Islamic finance, with 15,000+ learners now working in over 160 financial institutions in 65 countries around the world.

Why Islamic Finance? (PLAY VIDEO NOW)

In Your Interest (PDF)

Please sign up using the form to start your CIFE now

Understanding ijarah 1 - islamic leasing (video).

Understanding Ijarah 2 - Islamic Leasing (VIDEO)

How to Calculate an Ijarah Schedule 1 (ADVANCED VIDEO)

How to Calculate an Ijarah Schedule 2 (ADVANCED VIDEO)

Riba & Mortgages — 20 Commonly Asked Questions (PDF)

ETHICA’S ALUMNI WORK EVERYWHERE

Are you a bank? Get 20 complimentary licenses and experience the CIFE™ first hand!

We offer 20 complimentary, full-access, 1 month, training licenses to any financial institution that would like to get first-hand experience of our award-winning CIFE™ program.

BANKS — 7 Day Full-Access Corporate Trial

Please enter your details to get started with your trial account.

From individuals to entire banks. anytime, anywhere.

- Individuals

- Universities

"I chose Ethica for its excellent market reputation. And now I understand why..."

Daniel Rasqui, CIFE Graduate Director, SIX Financial, Luxembourg

Ethica's Handbook of Islamic Finance (2,000+ Page E-book)

Mufti Taqi Usmani’s “Introduction to Islamic Finance”

AAOIFI’s Shariah Standards

Sample Islamic finance contracts

CIFE™ Study Notes

Recommended reading lists

1,000+ Islamic finance Q&As

Download Now

This award-winning video demonstrates the quality and depth of Ethica’s training methodology. We decipher AAOIFI’s cryptic standards for you.

Why Islamic Finance?

The Problem with Artificial Wealth Creation

How is Islamic Finance Different?

3 Real-World Examples

How Does Islamic Finance Make Money?

ETHICA’S AWARDS & RECOGNITION

Best Research and Education Company Dubai, UAE

Best Islamic Finance Training Institution MENA Best Islamic Finance Education Provider MENA Best Online Islamic Finance Program MENA London, UK

Best Online Islamic Finance Program London, UK

Best Islamic Finance Qualification London, UK

Education Leadership Award Dubai, UAE

Islamic Finance Education Provider of the Year London, UK

Best Global Online Islamic Finance Education Provider London, UK

Islamic Finance Education Provider of the Year – Gold Award Islamic Finance Forum of South Asia, Sri Lanka

Best Islamic Finance Training Provider of the Year MEA Markets UK

What people are saying about Ethica

Marwa El Messidi, CIFE Graduate

Economic Development Professional, Richmond, USA

"I first became interested in Islamic finance as a graduate student at UC Davis. Ethica's CIFE was the first course I have taken completely online and I loved it! I learnt a great deal regarding the practical application, benefits, and risks involved. The course was an excellent mix of theory and practice. Highly recommended"

Waqas Zafar, CIFE Graduate

Senior Associate, KPMG, UAE

"Ethica's tutorials are an absolute game changer. Through excellent examples they explain how Islamic banking gets done inside an Islamic bank. The personnel at Ethica are devoted, professional and above all extremely helpful. My job entails dealing with the mergers and acquisitions sector and with Ethica’s CIFE I was able to accomplish what I had set out to achieve."

Pradeep Varma

Director, Pennant Technologies, India

"Ethica’s training and certification programs have benefited Pennant's Islamic banking product engineering and implementation staff — tremendously"

Read all Testimonials

ASK AN ISLAMIC FINANCE QUESTION

Each question is reviewed by an Islamic finance expert and approved by a scholar.

SEARCH ISLAMIC FINANCE Q&As

Browse one of the world's largest database of Islamic finance Q&As available online.

View details »

What’s New at Ethica

Press releases, live events, book recommendations, discount offers, and more

College of Islamic Studies CIS Hamad Bin Khalifa University Hamad Bin Khalifa University

Master of Science in Islamic Finance

- --> --> --> -->

The Master of Science (MS) in Islamic Finance is a specialized program that teaches qualitative and quantitative methods of analysis in both Islamic and conventional finance.

This innovative program has been developed to offer students a unique opportunity to enjoy a strong multidisciplinary and interdisciplinary graduate education across a range of core subjects. It also enables participants to pursue a specialization in one of several important areas, including Islamic Finance and Sustainable Finance.

The mixed philosophy of the program enables graduates to attain the skills needed to understand the global financial system, and proposes viable alternatives to existing models, by blending guidance from Shari’a with modern scientific knowledge and the techniques of economics and finance.

This popular master’s program is one of an extremely limited number of top-tier specialized Islamic finance programs globally. By emphasizing practical as well as theoretical aspects of Islamic finance, students are better able to address global opportunities and participate effectively in business and financial sectors.

Program Focus

Islamic banking in Qatar constitutes approximately 25 percent of local banking activity. The MS in Islamic Finance program is focused on giving graduate students a greater understanding of the practical business applications of Shari’a.

Furthermore, the engagement of our faculty members in leading financial scholarship in global academia as well as their close partnership with the industry and government ensures that the program directly speaks to current affairs and developments in the financial and economic sectors.

A 36-credit degree program taught over two years in English that includes:

Four core courses (12 credits).

- Islamic Financial Contracts

- Islamic Banking and Financial Markets

- Islamic Corporate Finance and Financial Engineering

- Research Methods

A choice of two concentrations (6 credits)

- Islamic Asset, Funds and Portfolio Management

- Analysis of Financial Statements with Applications to Islamic Banks

- Sustainable Finance and Impact Investing

- Islamic Economics and Sustainable Development

A choice of three electives out of nine options (9 credits)

- Applied Quantitative Methods

- Behavioral Islamic Economics and Finance

- Fintech and its Islamic Finance Applications

- Legal, Regulatory and Institutional Aspects of Islamic Finance

- Principles and Objectives of Islamic Law

- Strategic Management in Islamic Finance

- Independent Studies

- A course from the PhD catalog*

*Students can select an elective from the courses offered within the PhD program.

Thesis (9 credits)

- Admission Requirements

- Research at CIS

IMAGES

VIDEO

COMMENTS

The EUCLID online PhD in Islamic Finance and Economics is among the programs developed as part of a Joint Initiative between EUCLID (an intergovernmental treaty-based institution) and ICCI (now ICCIA, the Islamic Chamber of Commerce, Industry and Agriculture), starting 2008.. This PhD program represents a convergence of EUCLID's expertise in global governance, international civil service ...

Ph.D in Islamic Banking and Finance (PIBF) is awarded to graduates for a meaningful completion of doctoral research that advances the theory and principles of Islamic Banking and Finance from inter-disciplinary perspectives. Upon completion of a multi-disciplinary doctoral programme, the graduate is expected to undertake independent research ...

Islamic Finance and Economy A key motivation for the PhD program is to develop unique and innovative approaches for the continuous transformation of economies to be more responsible, inclusive, and resilient. The policy relevance for Islamic finance continues to increase, alongside the need to understand and integrate

At the end of PhD in Islamic Finance programme, graduates should be able to: Synthesize and develop new concepts/theories contributing to the body of knowledge in Islamic finance through independent research. Demonstrate in-depth knowledge spanning across key areas in Islamic finance. Evaluate and enhance the current practices in Islamic finance.

PhD by Research. DCIEF has a large PhD community, with over 60 students from across the world. A long tradition of research at the University underpins the Durham Centre for Islamic Economics and Finance (DCIEF), which offers postgraduate training to equip people with the necessary knowledge and skills to succeed in this dynamic and expanding ...

[email protected]. +44 (0)1382 384845. Professor Bill Russell. Professor, Associate Dean International and Student Admissions. [email protected]. +44 (0)1382 385165. An overview of our postgraduate research in Islamic finance and entry requirements for PhDs and other research degrees.

The Doctor of Philosophy (PhD) in Islamic Finance and Economy is an innovative multidisciplinary program that provides students with the required analytical and research skills to understand, analyze, and interpret the workings of the rapidly expanding Islamic financial services and market sectors, and to tackle their emerging challenges and opportunities.

The online PhD in Islamic banking and finance program offers a unique blend of flexibility and convenience, allowing you to complete your studies according to a timeline that suits your personal and professional commitments. This distance learning format eliminates the need for physical attendance, enabling you to study from anywhere in the ...

The vision is for our Islamic Finance PhD programme at the University of Dundee to become the home for some of the best Islamic finance researchers in the world. Visit the Visit programme website for more information. University of Dundee. Dundee , Scotland , United Kingdom. Top 2% worldwide.

Earn your online PhD, Doctorate, Graduate Program in Islamic Studies & educational leadership from AITU. we can offer our students a much more significant discount on their tuition and other related educational products and services. ... work, education, banking, finance, or business management. Students can choose to major in Grief Counseling ...

Conferences and roundtables: These include the annual Securities Commission Malaysia-Oxford Centre for Islamic Studies Roundtable on Islamic Finance (running since 2010). Over the years topics have included Islamic endowments (waqf), solutions for liquidity, the Islamic financial system cycle and the role of Islamic finance in ...

ALIM has developed a plan to offer a PhD in Islamic studies online after graduating in the MA program. The PhD Doctorate degree will require 45 credits of course completion and 15 credits for dissertation presentation up to 100-200 pages research project with evidence and defenses. There will be an oral exam and interview on defense and ...

An Islamic finance graduate certificate offers that. Explore how corporations in the Muslim world raise capital in accordance with Sharia, or Islamic law. Discover an alternative way to banking that relies on community problem-solving and sustainable development. You can become an asset for organizations that require this increasingly important ...

About. The PhD in Islamic Finance and Economy at Hamad Bin Khalifa University is an innovative multidisciplinary program that provides students with the required analytical and research skills to understand, analyze, and interpret the workings of the rapidly expanding Islamic financial services and market sectors, and to tackle their emerging ...

"I first became interested in Islamic finance as a graduate student at UC Davis. Ethica's CIFE was the first course I have taken completely online and I loved it! I learnt a great deal regarding the practical application, benefits, and risks involved. The course was an excellent mix of theory and practice.

The MS in Islamic Finance program is focused on giving graduate students a greater understanding of the practical business applications of Shari'a. Furthermore, the engagement of our faculty members in leading financial scholarship in global academia as well as their close partnership with the industry and government ensures that the program ...