To read this content please select one of the options below:

Please note you do not have access to teaching notes, blockchain technology in financial services: a comprehensive review of the literature.

Journal of Global Operations and Strategic Sourcing

ISSN : 2398-5364

Article publication date: 4 March 2021

Issue publication date: 15 July 2021

The purpose of this study is to thoroughly review studies that have used blockchain technology in financial services. This study will help provide a holistic framework that would highlight the current state and challenges of the blockchain in the financial services sector.

Design/methodology/approach

The objective of this study is to systematically examine and organize the current body of research literature that either quantitatively or qualitatively explored the use of blockchain technology in financial services. The study uses PRISMA-guided systematic review along with bibliometric analysis to achieve the purpose.

This study contributes to the existing literature by exploring and analyzing systematic studies available on blockchain with special reference to financial services sector. With blockchain based on five principles, namely, computational logic, peer-to-peer transmission, irreversibility of records, distributed database and transparency with pseudonym has immense potential to unleash and transform the financial service industry. With increasing blockchain-based operations of decentralized banking, insurance, trade finance, financial markets and cryptocurrency market, the subject is rapidly growing and seeking considerable contribution from scholars from around the world.

Research limitations/implications

This study uses systematic literature review approach, which has its own demerits. Like other studies based on Systematic Literature Review, this study also suffers from a certain bias such as sample selection bias, publication bias, data interpretation and the combination of quantitative and qualitative studies in the population. Further, the adoption and resultant benefits of blockchain have not been empirically tested.

Practical implications

This study can help policymakers and institutions in determining their future course of action, as it highlights the state of research in the area of blockchain technology and financial services.

Originality/value

Very few studies have done a comprehensive review of literature on blockchain in financial services.

- Qualitative

- Financial services

- Financial inclusion

Pal, A. , Tiwari, C.K. and Behl, A. (2021), "Blockchain technology in financial services: a comprehensive review of the literature", Journal of Global Operations and Strategic Sourcing , Vol. 14 No. 1, pp. 61-80. https://doi.org/10.1108/JGOSS-07-2020-0039

Emerald Publishing Limited

Copyright © 2020, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets

Posted 2021-02-05

The term decentralized finance (DeFi) refers to an alternative financial infrastructure built on top of the Ethereum blockchain. DeFi uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, and transparent way. This article highlights opportunities and potential risks of the DeFi ecosystem. I propose a multi-layered framework to analyze the implicit architecture and the various DeFi building blocks, including token standards, decentralized exchanges, decentralized debt markets, blockchain derivatives, and on-chain asset management protocols. I conclude that DeFi still is a niche market with certain risks but that it also has interesting properties in terms of efficiency, transparency, accessibility, and composability. As such, DeFi may potentially contribute to a more robust and transparent financial infrastructure.

Fabian Schär is a professor for distributed ledger technologies and fintech at the University of Basel and the managing director of the Center for Innovative Finance at the Faculty of Business and Economics, University of Basel. The author thanks two anonymous reviewers for their valuable comments and especially Florian Bitterli, Raphael Knechtli, and Tobias Wagner for their support with data collection and visualization and Emma Littlejohn and Amadeo Brands for proofreading.

INTRODUCTION

Decentralized finance (DeFi) is a blockchain-based financial infrastructure that has recently gained a lot of traction. The term generally refers to an open, permissionless, and highly interoperable protocol stack built on public smart contract platforms, such as the Ethereum blockchain (see Buterin, 2013). It replicates existing financial services in a more open and transparent way. In particular, DeFi does not rely on intermediaries and centralized institutions. Instead, it is based on open protocols and decentralized applications (DApps). Agreements are enforced by code, transactions are executed in a secure and verifiable way, and legitimate state changes persist on a public blockchain. Thus, this architecture can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians, central clearing houses, or escrow services, as most of these roles can be assumed by "smart contracts."

DeFi already offers a wide variety of applications. For example, one can buy U.S. dollar (USD)-pegged assets (so-called stablecoins) on decentralized exchanges, move these assets to an equally decentralized lending platform to earn interest, and subsequently add the interest-bearing instruments to a decentralized liquidity pool or an on-chain investment fund.

The backbone of all DeFi protocols and applications is smart contracts. Smart contracts generally refer to small applications stored on a blockchain and executed in parallel by a large set of validators. In the context of public blockchains, the network is designed so that each participant can be involved in and verify the correct execution of any operation. As a result, smart contracts are somewhat inefficient compared with traditional centralized computing. However, their advantage is a high level of security: Smart contracts will always be executed as specified and allow anyone to verify the resulting state changes independently. When implemented securely, smart contracts are highly transparent and minimize the risk of manipulation and arbitrary intervention.

To understand the novelty of smart contracts, we first must look at regular server-based web applications. When a user interacts with such an application, they cannot observe the application's internal logic. Moreover, the user is not in control of the execution environment. Either one (or both) could be manipulated. As a result, the user has to trust the application service provider. Smart contracts mitigate both problems and ensure that an application runs as expected. The contract code is stored on the underlying blockchain and can therefore be publicly scrutinized. The contract's behavior is deterministic, and function calls (in the form of transactions) are processed by thousands of network participants in parallel, ensuring the execution's legitimacy. When the execution leads to state changes, for example, the change of account balances, these changes are subject to the blockchain network's consensus rules and will be reflected in and protected by the blockchain's state tree.

Smart contracts have access to a rich instruction set and are therefore quite flexible. Additionally, they can store cryptoassets and thereby assume the role of a custodian, with entirely customizable criteria for how, when, and to whom these assets can be released. This allows for a large variety of novel applications and flourishing ecosystems.

The original concept of a smart contract was coined by Szabo (1994). Szabo (1997) used the example of a vending machine to describe the idea further and argued that many agreements could be "embedded in the hardware and software we deal with, in such a way as to make a breach of contract expensive…for the breacher." Buterin (2013) proposed a decentralized blockchain-based smart contract platform to solve any trust issues regarding the execution environment and to enable secure global states. Additionally, this platform allows the contracts to interact with and build on top of each other (composability). The concept was further formalized by Wood (2015) and implemented under the name Ethereum. Although there are many alternatives, Ethereum is the largest smart contract platform in terms of market cap, available applications, and development activity.

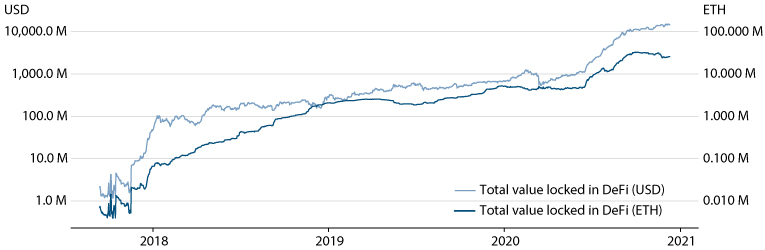

DeFi still is a niche market with relatively low volumes—however, these numbers are growing rapidly. The value of funds that are locked in DeFi-related smart contracts recently crossed 10 billion USD. It is essential to understand that these are not transaction volume or market cap numbers; the value refers to reserves locked in smart contracts for use in various ways that will be explained in the course of this paper. Figure 1 shows the Ether (ETH, the native cryptoasset of Ethereum) and USD values of the assets locked in DeFi applications.

Figure 1 Total Value Locked in DeFi Contracts (USD and ETH)

NOTE: M, million.

SOURCE: DeFi Pulse.

The spectacular growth of these assets alongside some truly innovative protocols suggests that DeFi may become relevant in a much broader context and has sparked interest among policymakers, researchers, and financial institutions. This article is targeted at individuals from these organizations with an economics or legal background and serves as a survey and an introduction to the topic. In particular, it identifies opportunities and risks and should be seen as a foundation for further research.

Read the full article .

Cite this article

Subscribe to Our Newsletter

Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. Louis Fed.

SUBSCRIBE TO THE RESEARCH DIVISION NEWSLETTER

Research division.

- Legal and Privacy

One Federal Reserve Bank Plaza St. Louis, MO 63102

Information for Visitors

Blockchain for Secure Payments: A Bibliometric Review

- First Online: 03 April 2024

Cite this chapter

- Vibhuti Jain 21 ,

- Ruchi Mehrotra 21 ,

- Jose Arturo Garza-Reyes 22 ,

- Rajesh Tiwari 21 &

- Khem Chand 23

Part of the book series: Contributions to Environmental Sciences & Innovative Business Technology ((CESIBT))

40 Accesses

Blockchain has gained the attention of stakeholders as a potential technology for peer-to-peer transactions. Traditional online financial transactions are susceptible to cyberattacks. The poor adoption of online payments has been a concern due to security issues. Blockchain offers a secure alternative for banks and non-bank entities engaged in the payment sector. The chapter explores the literature on blockchain for secure transactions. A bibliometric analysis was done on the Scopus database. 311 documents were used for the analysis. The VOS viewer software version 1.6.19 was used for the analysis. 187 documents were published in the Computer Science domain, 94 documents were published in the business and management domain, 86 documents in engineering, 58 in economics, econometrics, and finance, and 51 documents were published in the social science domain. The findings have implications for researchers as they explore major themes for research in secure payments using blockchain.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Ahmadisheykhsarmast S, Sonmez R (2020) Smart contract system for security of payment of construction contracts. Autom Constr 120:103401. https://doi.org/10.1016/j.autcon.2020.103401

Article Google Scholar

Alabi K (2017) Digital blockchain networks appear to be following Metcalfe’s law. Electron Commer Res Appl 24:23–29

Baza M, Sherif A, Mahmoud MMEA, Bakiras S, Alasmary W, Abdallah M, Lin X (2021) Privacy-preserving blockchain-based energy trading schemes for electric vehicles. IEEE Trans Veh Technol 70(9):9369–9384. https://doi.org/10.1109/tvt.2021.3098188

Bodkhe U, Bhattacharya P, Tanwar S, Tyagi S, Kumar N, Obaidat MS (2019) BloHosT: blockchain enabled smart tourism and hospitality management. IEEE Xplore. https://doi.org/10.1109/CITS.2019.8862001

Chand K, Tiwari R, Sapna (2022) Effect of perception and satisfaction on preference for mobile wallet. FIIB Bus Rev 231971452210773. https://doi.org/10.1177/23197145221077365

Chand K, Jangra S, Singh PC, Tiwari RS, Tiwari R (2023) Sustainability of mobile wallets in the era of low-cost data usage in India. In: Data-driven approaches for effective managerial decision making. IGI Global, pp 102–126

Google Scholar

Chand K, Tiwari R, Bhardwaj K (2023) Impact of welfare measures on job satisfaction of employees in the industrial sector of Northern India. Financ India 37(2)

Chen PW, Jiang BS, Wang CH (2017) Blockchain-based payment collection supervision system using pervasive Bitcoin digital wallet. In: 2017 IEEE 13th international conference on wireless and mobile computing, networking and communications (WiMob). https://doi.org/10.1109/wimob.2017.8115844

Dashkevich N, Counsell S, Destefanis G (2020) Blockchain application for central banks: a systematic mapping study. IEEE Access 8:139918–139952. https://doi.org/10.1109/access.2020.3012295

Fan S, Zhang H, Zeng Y, Cai W (2020) Hybrid blockchain-based resource trading system for federated learning in edge computing. IEEE Internet Things J 1. https://doi.org/10.1109/jiot.2020.3028101

Giungato P, Rana R, Tarabella A, Tricase C (2017) Current trends in sustainability of bitcoins and related blockchain technology. Sustainability 9(12):2214. https://doi.org/10.3390/su9122214

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35(1):220–265

Guo Y, Liang C (2016) Blockchain application and outlook in the banking industry. Financ Innov 2:1–12

Hendershott T, Zhang X (Michael), Zhao JL, Zheng Z (Eric) (2021) FinTech as a game changer: overview of research frontiers. Inf Syst Res 32(1):1–17. https://doi.org/10.1287/isre.2021.0997

Hohne S, Tiberius V (2020) Powered by blockchain: forecasting blockchain use in the electricity market. Int J Energy Sector Manag (ahead-of-print). https://doi.org/10.1108/ijesm-10-2019-0002

Jamil F, Cheikhrouhou O, Jamil H, Koubaa A, Derhab A, Ferrag MA (2021) PetroBlock: a blockchain-based payment mechanism for fueling smart vehicles. Appl Sci 11(7):3055. https://doi.org/10.3390/app11073055

Article CAS Google Scholar

Karthick M, Somesh V, Gudadhe N, Boopathi B, Padmanabhan S, Tiwari R, Sharma A (2023) Structural analysis of motorcycle spokes design using finite element analysis with alloy materials. Mater Today: Proc

Kohli S, Srikavya BP, Dhapekar NK, Tiwari R, Kumar R, Yadav AS, Sharma N, Sharma A (2023) Impact of nano materials on engine performance run on biofuels. Mater Today: Proc

Li J, Greenwood D, Kassem M (2019a) Blockchain in the built environment and construction industry: a systematic review, conceptual models and practical use cases. Autom Constr 102:288–307

Li Z, Yang Z, Xie S, Chen W, Liu K (2019b) Credit-based payments for fast computing resource trading in edge-assisted internet of things. IEEE Internet Things J 6(4):6606–6617. https://doi.org/10.1109/jiot.2019.2908861

Liu J, Li X, Wang S (2020) What have we learnt from 10 years of fintech research? a scientometric analysis. Technol Forecast Soc Chang 155:120022. https://doi.org/10.1016/j.techfore.2020.120022

Lou AT, Li EY (2017) Integrating innovation diffusion theory and the technology acceptance model: the adoption of blockchain technology from business managers’ perspective

Milian EZ, Spinola MDM, Carvalho MMD (2019) Fintechs: a literature review and research agenda. Electron Commer Res Appl 34:100833. https://doi.org/10.1016/j.elerap.2019.100833

Nguyen QK (2016) Blockchain a financial technology for future sustainable development. In: 3rd international conference on green technology and sustainable development (GTSD). https://doi.org/10.1109/gtsd.2016.22

Oprea SV, Bara A, Andreescu AI (2020) Two novel blockchain-based market settlement mechanisms embedded into smart contracts for securely trading renewable energy. IEEE Access 8:212548–212556. https://doi.org/10.1109/access.2020.3040764

Padmalosan P, Vanitha S, Kumar VS, Anish M, Tiwari R, Dhapekar NK, Yadav AS (2023) An investigation on the use of waste materials from industrial processes in clay brick production. Mater Today: Proc

Prochazka D (2018) Accounting for bitcoin and other cryptocurrencies under IFRS: a comparison and assessment of competing models. Int J Digit Account Res 18:161–188. https://doi.org/10.4192/1577-8517-v18_7

Raikwar M, Mazumdar S, Ruj S, Sen Gupta S, Chattopadhyay A, Lam KY (2018) A blockchain framework for insurance processes. In: 2018 9th IFIP international conference on new technologies, mobility and security (NTMS). https://doi.org/10.1109/ntms.2018.8328731

Sun H, Mao H, Bai X, Chen Z, Hu K, Yu W (2017) Multi-blockchain model for central bank digital currency. IEEE Xplore. https://doi.org/10.1109/PDCAT.2017.00066

Swan M (2018) ‘Blockchain for business: next-generation enterprise artificial intelligence systems. Adv Comput 121–162. https://doi.org/10.1016/bs.adcom.2018.03.013

Tezel A, Febrero P, Papadonikolaki E, Yitmen I (2021) Insights into blockchain implementation in construction: models for supply chain management. J Manag Eng 37(4). https://doi.org/10.1061/(asce)me.1943-5479.0000939

Thakor AV (2019) Fintech and banking: what do we know? J Financ Intermediation 41:100833. https://doi.org/10.1016/j.jfi.2019.100833

Tiwari R, Chand K, Anjum B (2020) Crop insurance in India: a review of Pradhan Mantri Fasal Bima Yojana (PMFBY). FIIB Bus Rev 9(4):249–255. https://doi.org/10.1177/2319714520966084

Tiwari R, Chand K, Bhatt A, Anjum B, Thirunavukkarasu K (2021) Agriculture 5.0 in India: opportunities and challenges of technology adoption. A Step Towards Soc 5:179–198

Tiwari R, Agrawal P, Singh P, Bajaj S, Verma V, Chauhan AS (2023) Technology enabled integrated fusion teaching for enhancing learning outcomes in higher education. 18(7):243–249. https://doi.org/10.3991/ijet.v18i07.36799

Vasilievich Babkin A, Dmitrievna Burkaltseva D, Viktorovich Betskov A, Shapievich Kilyaskhanov H, Sergeevich Tyulin A, Vladimirovna Kurianova I (2018) Automation digitalization blockchain: trends and implementation problems. Int J Eng Technol 7(3.14):254. https://doi.org/10.14419/ijet.v7i3.14.16903

Wang X, Xu X, Feagan L, Huang S, Jiao L, Zhao W (2018) Inter-bank payment system on enterprise blockchain platform. IEEE Xplore. https://doi.org/10.1109/CLOUD.2018.0008

Wu T, Liang X (2017) Exploration and practice of inter-bank application based on blockchain. In: 2017 12th international conference on computer science and education (ICCSE). https://doi.org/10.1109/iccse.2017.8085492

Xiong W, Xiong L (2019) Smart contract based data trading mode using blockchain and machine learning. IEEE Access 7:102331–102344. https://doi.org/10.1109/access.2019.2928325

Zhang L, Xie Y, Zheng Y, Xue W, Zheng X, Xu X (2020) The challenges and countermeasures of blockchain in finance and economics. Syst Res Behav Sci 37(4):691–698. https://doi.org/10.1002/sres.2710

Download references

Author information

Authors and affiliations.

Department of Management Studies, Graphic Era (Deemed to Be University), Dehradun, India

Vibhuti Jain, Ruchi Mehrotra & Rajesh Tiwari

Head of Centre of Supply Chain Department, University of Derby, Derby, UK

Jose Arturo Garza-Reyes

Mittal School of Business, Lovely Professional University, Jalandhar-Delhi, G.T. Road, Phagwara, India

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Ruchi Mehrotra .

Editor information

Editors and affiliations.

School of Computer Science, University of Petroleum and Energy Studies, Dehradun, Uttarakhand, India

Adarsh Kumar

Neelu Jyothi Ahuja

Keshav Kaushik

Department of Computer Science and Engineering, Maulana Azad National Institute of Technology, Bhopal, Madhya Pradesh, India

Deepak Singh Tomar

School of Science, Engineering and Environment, University of Salford, Manchester, UK

Surbhi Bhatia Khan

Rights and permissions

Reprints and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Jain, V., Mehrotra, R., Garza-Reyes, J.A., Tiwari, R., Chand, K. (2024). Blockchain for Secure Payments: A Bibliometric Review. In: Kumar, A., Ahuja, N.J., Kaushik, K., Tomar, D.S., Khan, S.B. (eds) Sustainable Security Practices Using Blockchain, Quantum and Post-Quantum Technologies for Real Time Applications. Contributions to Environmental Sciences & Innovative Business Technology. Springer, Singapore. https://doi.org/10.1007/978-981-97-0088-2_14

Download citation

DOI : https://doi.org/10.1007/978-981-97-0088-2_14

Published : 03 April 2024

Publisher Name : Springer, Singapore

Print ISBN : 978-981-97-0087-5

Online ISBN : 978-981-97-0088-2

eBook Packages : Earth and Environmental Science Earth and Environmental Science (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Open access

- Published: 10 March 2023

Blockchain technology-based FinTech banking sector involvement using adaptive neuro-fuzzy-based K-nearest neighbors algorithm

- Husam Rjoub 1 , 2 ,

- Tomiwa Sunday Adebayo ORCID: orcid.org/0000-0003-0094-1778 3 &

- Dervis Kirikkaleli ORCID: orcid.org/0000-0001-5733-5045 4

Financial Innovation volume 9 , Article number: 65 ( 2023 ) Cite this article

5407 Accesses

9 Citations

Metrics details

The study aims to investigate the financial technology (FinTech) factors influencing Chinese banking performance. Financial expectations and global realities may be changed by FinTech’s multidimensional scope, which is lacking in the traditional financial sector. The use of technology to automate financial services is becoming more important for economic organizations and industries because the digital age has seen a period of transition in terms of consumers and personalization. The future of FinTech will be shaped by technologies like the Internet of Things, blockchain, and artificial intelligence. The involvement of these platforms in financial services is a major concern for global business growth. FinTech is becoming more popular with customers because of such benefits. FinTech has driven a fundamental change within the financial services industry, placing the client at the center of everything. Protection has become a primary focus since data are a component of FinTech transactions. The task of consolidating research reports for consensus is very manual, as there is no standardized format. Although existing research has proposed certain methods, they have certain drawbacks in FinTech payment systems (including cryptocurrencies), credit markets (including peer-to-peer lending), and insurance systems. This paper implements blockchain-based financial technology for the banking sector to overcome these transition issues. In this study, we have proposed an adaptive neuro-fuzzy-based K-nearest neighbors’ algorithm. The chaotic improved foraging optimization algorithm is used to optimize the proposed method. The rolling window autoregressive lag modeling approach analyzes FinTech growth. The proposed algorithm is compared with existing approaches to demonstrate its efficiency. The findings showed that it achieved 91% accuracy, 90% privacy, 96% robustness, and 25% cyber-risk performance. Compared with traditional approaches, the recommended strategy will be more convenient, safe, and effective in the transition period.

Introduction

Today’s modern service expectations necessitate 24-h availability and international accessibility for all kinds of work. FinTech refers to the use of technology in global business structures to deliver better financial services to clients. However, the phrase itself is still a subject of debate. In actuality, FinTech is a blanket term encompassing several different technologies that constantly communicate in a common infrastructure (Xu et al. 2019 ). Traditional banks are under increasing pressure to update their core business operations and services as technology-driven enterprises that provide financial services become more prevalent (Bazarbash 2019 ; Fang et al. 2022 ). Many banks are now addressing digitalization concerns by partnering with startups that provide innovative banking services and unique service bundles (FinTech). Banking, traditionally one of the most conservative and traditional areas of the economy, has recently been challenged by potentially disruptive technology-driven innovations and Web solutions (Athari et al. 2022 ; Ayhan et al. 2022 ). By creating new information technology (IT)-enabled service models, new startup industries and worldwide technology companies in many contexts have created more customer-oriented and user-friendly automated processes in the banking industry, contributing to increased digital service innovation of financial products. FinTech companies have also played a role in the creation of many of these new banking products. Several of the latest technological advances can alter or potentially destroy the business operations of some of the more traditional institutions. As a result of digitalization and platform-enabled FinTech, banks have been compelled to review their organizational building and increase their accessibility to market interactions (Sebastião and Godinho 2021 ; Stojanović et al. 2021 ).

FinTech offers identical services to banks, perhaps more effectively as a result of technology improvements, but in a distinct, and unbundled way. For example, crowdfunding platforms transform funds into lending in the same manner as banks. Unlike banks, however, they employ big data instead of long-term connections; access to care is only dispersed via online networks, risk and trust conversion are not conducted, and borrowers, and lenders, along with investors and investment possibilities, are immediately matched. These are all FinTech-related endeavors. However, the scope of these unmetered FinTech activities is limited. For example, platforms struggle to provide a diverse range of investment options to their customers without taking on some risk (Stojanović et al. 2021 ). Figure 1 shows a general representation of financial technology (FinTech).

General representation of financial technology (FinTech)

FinTech payment systems have had a huge impact on the financial services industry. Payment systems or credit contracts are transitions that, unlike cars, or other purchases, generally do not involve any physical components. Another reason is that, apart from some physical involvement, such as customer assistance, many activities, such as payment processing or trading industries, are largely carried out without any actual touch (Claessens et al. 2018 ). The ongoing economic growth and development process is causing a substantial reorganization of the financial advisory production chain, including technological advances such as robo-advisors and new competitors entering the industry because of recent technological advancements, such as those of Apple. “Financial technology,” or “FinTech,” reflects growth induced by IT transformation (Li et al. 2022 ; Navaretti et al. 2018 ).

Cryptocurrencies are decentralized digital assets that enable safe electronic payments. The notion of cryptocurrency emerged as a division of the digital cash phenomenon, but it was only with the introduction of Bitcoin that it gained widespread acceptance. FinTech has witnessed several significant advancements over the last decade, with Bitcoin at the forefront. Furthermore, the worldwide business, and economic development crisis—which corresponds to the financial collapse that started in the US financial sector in 2007–2008—has reduced public trust in banking organizations, which has enabled cryptocurrencies to become available. Since then, the sector has grown rapidly, propelled by rising acceptability, increased media attention, steady inflows, the initial coin offering mania, and improved transition capacity. Cryptocurrency has the potential to open up new FinTech marketplaces. Cryptocurrency improves the efficiency of money transfers. FinTech benefits from cryptocurrency since it helps prevent fraud (Degerli 2019 ; Kou et al. 2021 ).

FinTech credit is a credit activity that is made possible by electronic platforms. Borrowers are normally connected directly with investors; however, other platforms lend straight from their financial sheets. FinTech engagement in the credit market and online credit use promote sales and transaction growth for global-level businesses. These factors show the extent of credit market frictions and the advantages of new credit technology in strengthening credit markets (Hau et al. 2019 ). A peer-to-peer (P2P) market is a networked model in which two individuals engage directly with one another to buy products and services or to jointly develop products and services without the need for a middleman or a commercial business. P2P lending platforms lure customers who have limited or no access to conventional banks' credit capabilities. Although many banks and financial institutions offer online loan application services, only a small number of them verify the applications (Najaf et al. 2022 ).

FinTech involves the new use of knowledge to solve the extensive catalog of transition issues that the insurance business is now experiencing. It incorporates the use of technology to enhance CRM, pricing consolidation, Omni channel marketing acquisition, the Digital Claims Process, and online policy purchase in customer interactions. In the case of blockchain, the use of car telemetry, sensor data, traceability, asset trading, and home security may help insurers generate new income streams. Wearable tech, genetic information, chronic disease management, and preventive healthcare may all change the way insurance companies serve their customers (Yang et al. 2021 ).

Several existing approaches to FinTech transaction, credit, and insurance systems have flaws. Some experts feel that the FinTech revolution is a double-edged sword: on the one hand, it reduces banking costs, while on the other, it adds costs for infrastructure that must be constructed to accommodate FinTech growth. According to Hinson et al. ( 2019 ), nonperforming loan risk has increased dramatically with growth in FinTech lending. The explosion in FinTech lending is a direct result of the FinTech revolution. It has increased the likelihood that people and families can obtain loans at reasonable rates. According to Claessens et al. ( 2018 ), the low collateral requirements, and insufficient legal backing in FinTech are to blame for the rise in nonperforming loans. However, Lee and Shin ( 2018 ) stated that due to the short-term nature of these loans and their focus on the retail rather than the business sector, FinTech loan default risk is lower than that of a traditional commercial bank loan. Some studies have shown that the banking industry has become more vulnerable to competitive pressures because of the rising impact of FinTech. For instance, FinTech expansion has been shown to decrease bank market share, increase banking regulations, and lower bank profit margins, among other negative effects.

This paper introduces a blockchain-based finance solution for tackling various transition challenges within the banking sector. First, payment, credit, and insurance are gathered for the dataset. The dataset is then denoised for outliers/noises through the normalization approach. These normalized data are stored in the blockchain through smart contracts to prevent cheats. Due to the limitations of existing approaches, the rolling window autoregressive lag (RARDL) modeling approach is suggested in this research to examine economic improvement. The study contributes to the ongoing literature because blockchain technology is anticipated to improve data protection, help accelerate resolution, and automate processes to reduce expenditures. Open banking may leverage payment systems enabled by blockchain. However, if properly used and controlled, the self-governing capabilities of blockchain might result in systemic changes. Higher hardware prices and computer power requirements could hinder its deployment.

The remaining parts of this paper are the (1) literature review and problem statement, (2) proposed work, (3) performance analysis, and (4) conclusion.

Synopsis of past studies

Le et al. ( 2021 ) review the linkages between the expansion of FinTech loans and the efficacy of financial institutions. According to the study, they appear to have a two-way connection. Consistent with a negative relationship between bank profitability and FinTech credit, FinTech credit is more developed in countries with less efficient banking systems. Meanwhile, the positive impact of FinTech credit on banking system efficiency suggests that FinTech credit might be a wake-up call for the banking system. Thus, governments worldwide should promote FinTech credit. Moreover, Najaf et al. ( 2022 ) examine recent advances within the FinTech industry and the resulting transition issues. They draw on current BIS work, including recent FSI research on national and global policy measures to adapt existing financial regulations to new activities and participants. Payment, investment management, fundraising, borrowing, equity markets, and insurance services are the six FinTech marketing strategies employed by a growing number of FinTech companies. FinTech refers to a broad set of technological advances facilitated through technological advances in the delivery of services to the authorized customer, economic organization technicians' internal manufacturing operations, and the layout of market enterprises without installing extra potential configurations of intersectional activities at risk (Hinson et al. 2019 ).

In addition, Hernández et al. ( 2019 ) demonstrated that FinTech has shown its importance as an innovation-driven field in the modern financial industry and is capable of transforming traditional financial marketing, providing a basic overview of FinTech and its growth in Vietnam. The research also includes a survey of expert opinions on the roadblocks to establishing FinTech programs to modernize Vietnam's banking and finance sector. Moreover, Bhasin and Rajesh ( 2021 ) explain the dramatically changing Indian banking system, which is moving away from traditional banking toward the e-collaboration of digital bank services and FinTech enterprises. The new structures are generating financial disruptions and changing the payment system structure. On the other hand, FinTech firms, while technologically advanced, must create client confidence for new digital and FinTech products to be adopted. The many problems and possibilities that the Indian banking industry faces in cooperation and coinvention with FinTech startups are detailed in this study report.

Thakor ( 2019 ) examines FinTech and its relationship with banking. The study begins with a description of FinTech, then examines various figures and stylized facts, and finally reviews conjectural, and experimental journalism. Hinson et al. ( 2019 ) analyze poor nations, finding that to fully profit from FinTech's promise within this environment, significant restrictions, and hazards must be overcome. Massive infrastructure expenditures and large-scale capacity growth are two mitigating variables. Appropriate policy recommendations require a thorough study of the financial stability and cost-effectiveness of emerging models for FinTech. The study reported that increases in green financing activity positively affect environmental and economic growth.

Williams ( 2021 ) examines the threat FinTech poses to traditional financial institutions and the advantages and hazards of financial democratization. Because analyzing the impact that FinTech has on market structures is difficult because of a lack of established data, the second section of this chapter combines relevant data from various sources with theoretical model predictions and evidence-based and questionnaire evidence to shine a light on how marketplaces are developing and group members are behaving. A study by Degerli ( 2019 ) reported that companies, regardless of industry, reconfigure their services in today's environment, with competitive circumstances continually changing.

Moreover, Pinshi ( 2021 ) examined the probable impact of FinTech on the financial system during the dark period of COVID-19. The study outcome shows that in that time of financial turmoil, FinTech seemed to see itself optimistically as a rebalancing mechanism for the global business financial system and the greatest tool for enhancing economic growth and development program adaptability and reacting to the emergency by ensuring system functionality while complying with countermeasures and trying to prevent the virus from spreading. Furthermore, Sheikh et al. ( 2019 ) discussed the financial sector's progress, prospects, and problems in China resulting from new technology. This chapter examines the possibilities arising from a large population, high penetration, and access to the most up-to-date and cheap technology, as well as government rules and regulations. The study findings show unrealized FinTech potential in China. The reality is that the financial system develops new features, attributes, and components as a result of globalization, technological development, and innovations as new financial instruments and inventions enter the financial environment and demand evolves.

Navaretti et al. ( 2018 ) provide a study agenda to predict future services research into the digitization of financial advice systems through FinTech—novel products developed by new rivals that threaten the existence of established financial institutions. This study introduces a use-inspired research program that integrates management challenges connected to FinTech with services marketing literature to provide intellectual and institutionally relevant research choices. The microlevel intricacy of digitized financial advisory networks, the microcoordination of value cocreation with FinTech, and the evolution of elastic structures, models, and markets are all on the table.

The Financial Services Authority (OJK) is responsible for safeguarding the public from fraudulent online FinTech loan networks (P2P lending) through public administration. Online loans have become more common as the COVID-19 epidemic has progressed, and OJK plays a critical role in preventing and safeguarding the public from illicit online loans through public administration. OJK promotes education and socialization so consumers can make better-informed decisions about online loans (Aziz and Nur’aisyah 2021 ). Similarly, Sheikh et al. ( 2019 ) stated that FinTech innovation is a hot issue globally. FinTech startups include lenders, cryptocurrencies, payments, and personal financial management, to name a few. Here, we review certain academic research before classifying well-known Iranian FinTech firms.

Due to the potential consequences of continued use of this new tech, blockchain technology is presently one of the most relevant subjects for academics and business (Fernandez-Vazquez et al. 2022 ). FinTech firm adoption of this method represents the next stage in ensuring blockchain longevity and growth. A paper by Tsai et al. ( 2016 ) presented the super-large ledger (SLL), a novel trade-clearing structure that may be deployed among exchangers, bankers, and authorities. As demand grows, the SLL will be divided and distributed across other computers to make the process more efficient. Carta et al. ( 2020 ) offered a generic approach to the well-established technical trading investment strategy using various logistic regression and dynamic asset choices. The overall resource evaluation uses a quality control method to determine whether a function carrying equities has shown subpar prediction performance before using it as an entry in the exchange process.

Likewise, Chen and Liao ( 2021 ) investigate the state of progress, future possibilities, and planning processes for finance and Internet technologies. FinTech employs several technical advancements, including big data, and cloud computing, to enable technology to support the finance sector and significantly improve production efficiency. To achieve knowledge transfer, the Internet of Things links everything to machinery. Hernández et al. ( 2019 ) analysed recent developments in this field and data security implementation in financial planning systems. Due to the high degree of protection that FinTech demands, the study also evaluates information security growth within that industry. Additionally, it reviews data storage difficulties in the cloud and encryption technologies for guaranteeing information security.

The banking industry has sizable revenue, earnings, and volume, posing both possibilities, and problems. In the digital age, it has experienced a period of transition in consumer and personalization terms. Additionally, the key participants are the consumers. For sustained development, their contentment is crucial. FinTech development has encountered several difficulties despite early enthusiasm about it. Due to the risk of hacking and concerns about the disclosure of private consumer financial information, data security is a major barrier for FinTech organizations. The hefty startup costs for financial businesses are another area of difficulty. We thus designed an adaptive neuro-fuzzy-based K-nearest neighbors algorithm (ANF-K-nearest neighbors (KNN) to identify the mismatch and successfully integrate it with banking to evaluate the impact on customer satisfaction as a means of resolving this problem.

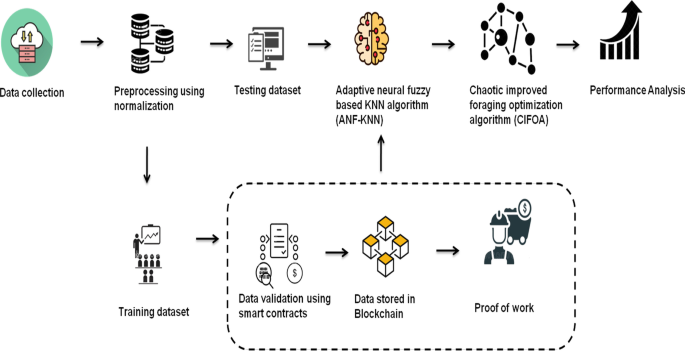

Proposed work

This paper provides a new method to overcome transition issues with the existing methods used for FinTech payment systems, credit markets, and insurance systems. The suggested technique often shows better performance with continuous data than that of the genetic and particle swarm algorithms. The suggested technique references previously collected data to classify a network. The proposed method will be more comfortable, secure, and effective than the genetic and particle swarm algorithms. Blockchain-based FinTech is proposed for predicting attacks within the banking sector. The ANF-K-nearest neighbors (KNN) is presented in this study. We have also proposed a chaotic improved foraging optimization algorithm (CIFOA). Figure 2 provides an overall representation of the proposed work.

Overall representation of the proposed work

Data collection

Using a dataset of 28 Chinese banks from 2009 to 2018, both “linear and nonlinear” associations between corporate social performance and banking performance were found. Payment-focused FinTech firms can recruit clients rapidly and at a reduced cost, and they are among the most innovative and quick in adapting to new payment services. Consumer and retail payments and wholesale payments are the two marketplaces for FinTech payment data. A broad range of credit market services, including investing, foreign currency, trading, regulatory compliance, and research, influence FinTech firm models. Capital markets trading is a potential FinTech area. Trading FinTech allows traders and investors to connect in real time to consider and share information, buy and sell items and securities, and manage risks. A further capital markets idea for FinTech marketing is foreign currency transition. In FinTech insurance business strategies, FinTech aims to allow for more direct engagement between the insurer and the customer. As the pool of potential clients develops, consumers are offered solutions that meet their needs. They evaluate and correlate risks using data analytics.

Data preprocessing using normalization

Data preprocessing entails the preparation and transformation of collected data into an appropriate format. Preprocessing data seeks to minimize data size, establish data relationships, normalize data, eliminate outliers, and extract data characteristics. Data cleansing, integration, transformation, and minimization are some of the strategies used. The primary goal of data normalization is to reduce or eliminate redundant data. Min-mix normalization is a method for performing linear transformations on a set of data. This is a technique for keeping the original data connected. Min–max normalization is a simple method for fitting data inside a predefined boundary:

Here \(U^{,}\) are the min–max normalized data, [V, D] is a predefined boundary, and U is the original data range.

F-score normalization is a method that uses concepts like quantitative variables to obtain normalized values or sets of information from unstructured data. As a result, the F-score parameter may be used to normalize unstructured data, as presented in the following equation:

\(g_{i}^{^{\prime}}\) —F-score normalized one’s value, \(g_{i}\) —the value of row \(\overline{J}\) .

The technique that gives a scale from − 1 to 1 is known as decimal scaling. From the decimal scaling procedure, as a consequence,

\(g^{i}\) -scaled value, \(g\) -range of values, n-smallest integer Max ( \(\left| {g^{i} } \right|\) ) < 1.

Using min–max normalization, the original data are converted linearly. Assume that min n and max n are the lowest and maximum values for variable P . By computing [new-min n , new-max n , a value e of P is transferred to p' within the range through min–max normalization [new-min n , new-max n ].

The values for variable P are normalized using the mean and standard deviation of P in w-score normalization. P-value e of P is normalized to pʹ using the following formula:

where p and \(\sigma_{N}\) are the mean and standard deviation of variable e, respectively. When the real minimum and maximum of variable e are unknown, this approach of normalizing is beneficial.

The decimal point of values of variable p is moved during normalization using decimal scaling. The number of decimal points shifted is determined by an absolute maximum value. A value p of P is normalized to pʹ using the following formula:

where i is the smallest integer such that Max( \(\left| {p\prime } \right|\) ) < 1.

The preprocessed data is called the training data set. These data are validated using smart contractors. Then it will store in the blockchain. Testing data set is directly tested through the proposed algorithm.

Adaptive neuro-fuzzy-based K-nearest neighbors algorithm

The ANF-KNN is a data categorization method that calculates the probability that a data point belongs to one of two groups based on determining to which group the data points closest to it belong. The KNN method does not create a framework using the training set until the data set is queried.

The ANF-KNN gives a more accurate membership vector for the objects, as well as taking into consideration the intensity of object membership. When using this strategy, a group of objects is assigned to the most common group based on its KNNs. The ANF-KNN assigns sample fuzzy memberships and aids decision-makers in making fuzzy judgments.

The ANF-KNN divides (clusters) the example vectors Y = {y1, y2,..., y m } S m into k(1 < k < m) fuzzy subsets. The fuzzy membership matrix is illustrated as A for p = 1, 2,..., kand q = 1, 2,..., m, where U pq represents the fuzzy membership degree of yq in class p. In a nonfuzzy variant of the procedure, the q th item is assigned to the i th class with the biggest A pq with respect to the degree of adaptive neuro-fuzzy membership of all the other classes. The restrictions on matrix A are as follows:

The initial requirement in Eq. ( 9 ) guarantees that all entity degrees of membership are attained across all groups p = 1,2,…,k, and that the sum of all degrees of membership is one.

A few of the entities' fuzzy degrees of membership are in the region of comparability of more than zero to less than one, as shown in Eq. ( 10 ). The two conditions show that if an object belongs to a group with A = 1, it has a membership degree of zero in all other classes.

In the ANF-KNN, each vector is given a fuzzy degree of membership depending on the ranges of their KNN membership, as follows:

where K is a fixed variable and m is a specified number of closest neighbors. The option m defines the degree of each nearest neighbor in the calculation of the fuzzification value.

However, the Nash–Sutcliffe model efficiency coefficient ( E NS ) may be used to determine how reliable prediction models are in practice. The Nash–Sutcliffe coefficient is defined as follows:

This coefficient ranges from − ∞ to 1, with a value near 1 denoting greater accuracy, a value of exactly 0 denoting that the forecasting algorithm is as accurate as the observed data mean, and any negative sign identifying that the predictive model outcome is less accurate than even the observed data mean. This coefficient is a widely used statistic in research to determine the efficacy of a prediction model.

In the validation step of the models, five evaluation metrics are used to test the performance of the proposed ANF-KNN model: RMSRE, RMRE, CC, bias, and SI. The following are the definitions of these statistical measures:

where the observed and assessed pth are g i and g i *, respectively, and m is the number of observations in the validating set of data. In the validation data set, G and G* represent the average observed and assessed, respectively.

Chaotic improved foraging optimization algorithm

Rolling window autoregressive lag modeling

Besides autoregressive distributed lag (ARDL), major rolling window mechanisms have been used in many kinds of research. The ARDL assumption implies that the lagged vector and parameters remain constant throughout the time series. However, if this is not the case, ARDL modeling could cause us to reach an absurd conclusion. The assumption of consistent cointegrating vectors and variable stability must be loosened to reflect the underlying nature of the connection. RARDL can help with this since it relaxes the assumption; even if the assumption is correct, it also provides strong proof. RARDL modeling is used to analyze economic growth.

Let the size of the rolling window be K s for a sample population of K. The following steps are used to perform the RARDL bounds test:

Step 1 For k = 1, 2,…, K s , the ARDL bounds test is performed on the first K s samples of A k and B k . D stat, q-value, and other statistics of importance are reported.

Step 2 An ARDL bounds test is performed by removing the initial observations and adding observation, i.e., the (K s + 1)th of K s and B k . That is, for k = 2, 3,…, K s + 1 samples of A k and B k , the ARDL bounds test is approximated. D stat, q-value, and other relevant statistics are mentioned once again.

Step 3 Step 2 is performed until all of the remaining observations T have been accounted for. As a result, (K-K s + 1) ARDL limits serial correlation tests, and their comparative statistical data will exist.

Performance analysis

This paper provides recommendations for improving FinTech within the banking sector, including payment systems (cryptocurrencies), credit markets (P2P lending), and insurance systems. This article discusses using FinTech within the banking sector based on an ANF-KNN employing blockchain technology. We review FinTech involvement within the banking sector in terms of investment range, transaction speed, credit market development, insurer satisfaction, and accuracy. These parameters of the proposed method are evaluated and compared with existing optimization methods such as the K-means clustering algorithm (K-CA), multiple criteria decision-making method (MCDM), greedy algorithm (GA), and decision tree algorithm (DTA).

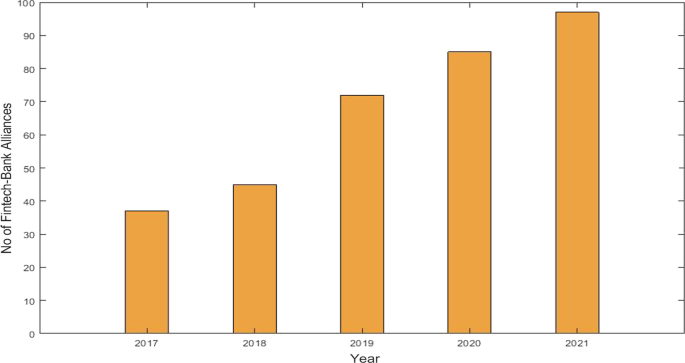

Growth in FinTech—bank alliances

FinTech—bank alliances involvement in recent years is growing higher because of making transactions with convenience. Bank customers will have the opportunity to transact through cutting-edge technology, saving time, effort, and money. High transaction volumes with minimal operational costs in a short period will also benefit banks and FinTech. Figure 3 depicts the growth in FinTech—bank alliances from 2017 to 2021.

Growth of FinTech in banking

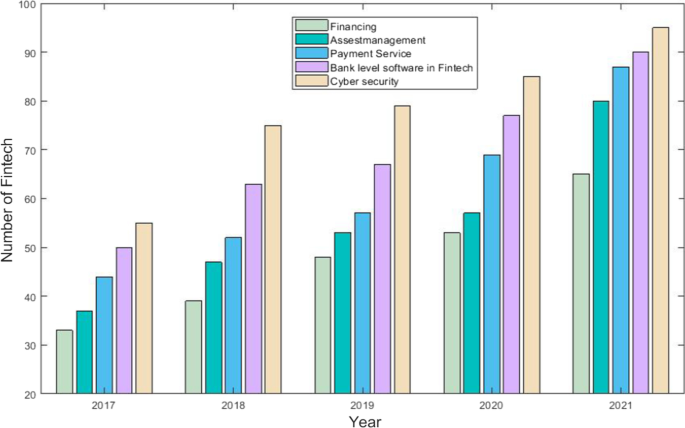

FinTech growth in the banking sector

FinTech involvement in the banking sector adds to the financial services and security of transactional activities. The five key banking activities seeing growth due to FinTech involvement are financing, asset management, payment services, bank-level FinTech software, and cybersecurity. Figure 4 shows the growth in these FinTech-related activities, with FinTech involvement at banks rising rapidly from 2017 to 2021.

Financial technology (FinTech) banking sector activities

Credit market development

FinTech credit activity is made possible by the online platform. Borrowers are normally connected directly with investors; however, other platforms lend using their balance sheets. FinTech platforms provide a variety of credit types, including consumer, and commercial lending, real estate loaning, and trade finance. Due to the benefits for credit markets, FinTech use is increasing. Figure 5 shows the comparison of the credit system for the proposed method and the traditional method. The figure shows that compared with a traditional credit system, the proposed credit system developed with FinTech grew rapidly from 2017 to 2021.

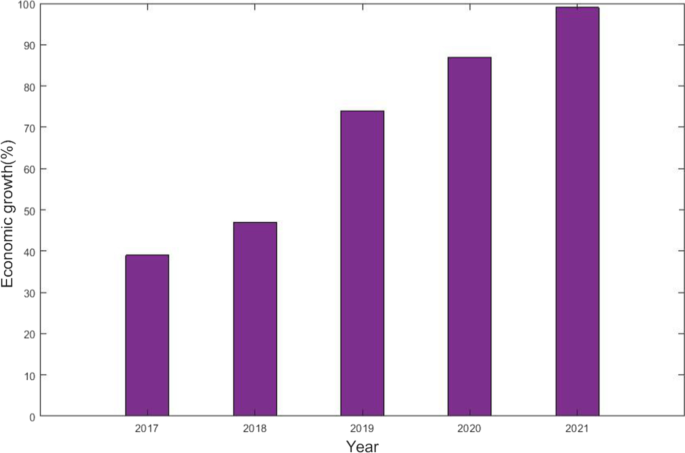

- Economic growth

By increasing the gross domestic product generated by the financial industry and indirectly boosting e-commerce sales and real estate financing, specifically by decreasing loan rates for all enterprises, FinTech advancement contributes to the economic development sector, as well as indirectly enhancing e-commerce turnover and real-sector finance, particularly by reducing lending rates for all companies. Figure 6 shows the economic growth from FinTech. The figure clearly shows that the economy was growing rapidly from 2017 to 2021 due to FinTech advancement.

Economic growth (%)

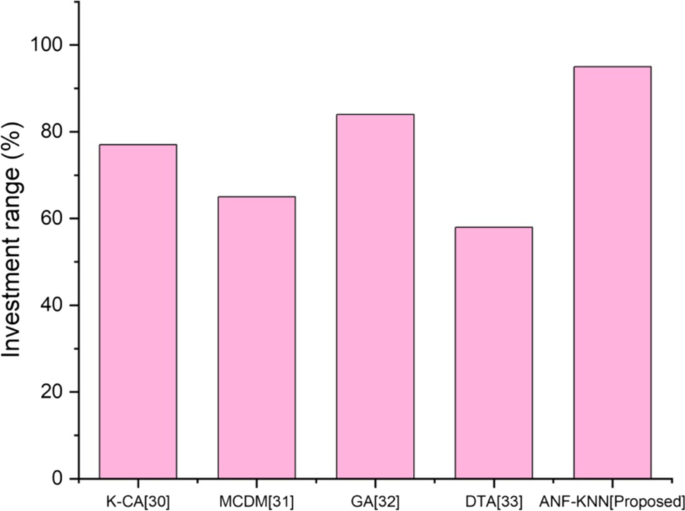

Investment range

The proposed method will change the landscape of investment management. Because of the technologies provided in blockchain-based FinTech, involvement is used to assess investment possibilities, portfolio optimization, and risk mitigation. Figure 7 shows the comparative analysis of the proposed method's investment range with existing methods. The figure shows that the amount invested in implementing the proposed method is higher than with traditional methods.

Scalability

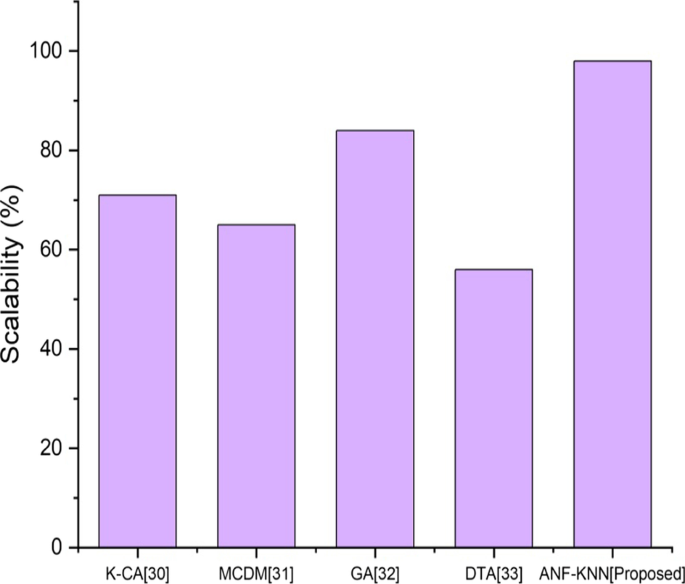

Scalability in financial markets refers to a financial institution's capacity to manage rising market demands. In the corporate world, a scalable corporation can maintain or enhance profit margins as sales volume grows. In a comparative analysis, the proposed method provides more scalability than other existing methods. Figure 8 shows a comparative analysis of the proposed and existing methods. The figure shows that the scalability of the proposed method is superior to that of conventional approaches.

Scalability comparison of existing and proposed method

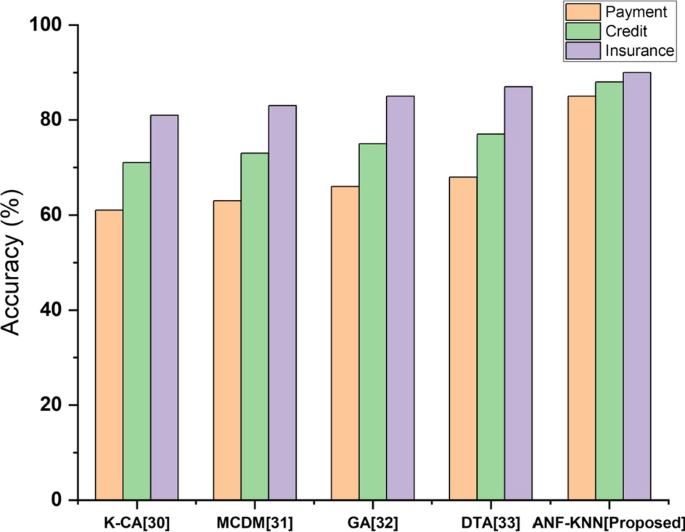

The proposed method of FinTech involvement within the banking sector must be more accurate for payment systems, credit markets, and insurance systems. For these three platforms, the process will be safer, more efficient, and more convenient. Figure 9 shows a comparative analysis of the accuracy of the process involving FinTech. The figure shows that the accuracy of the proposed method is higher than that of the existing method.

Accuracy comparison of existing and proposed method

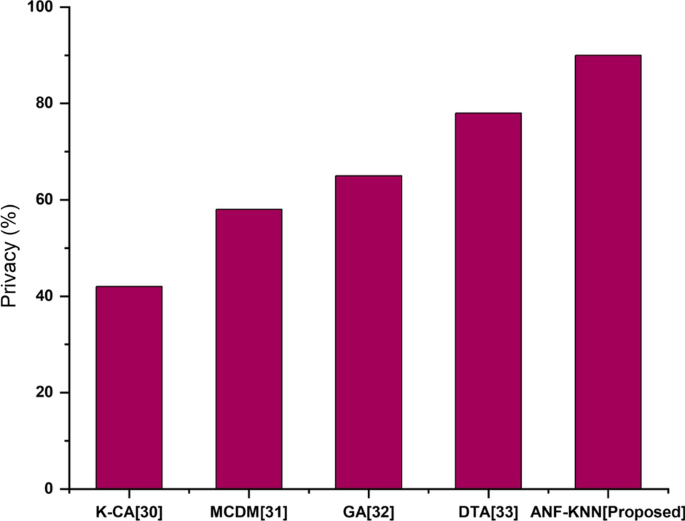

Customers require that their personal information and financial transaction history are kept private. Customer identifying information, such as credit information, payment history, bank account authentication information, and Social Security numbers, are kept private much more efficiently with the proposed technology than with others. FinTech companies reduce risk in the digital environment by using proactive cybersecurity services. Figure 10 shows a comparative analysis of privacy for a proposed method and existing method. The figure shows that the privacy of the proposed method is superior to the existing method.

Privacy comparison of existing and proposed method

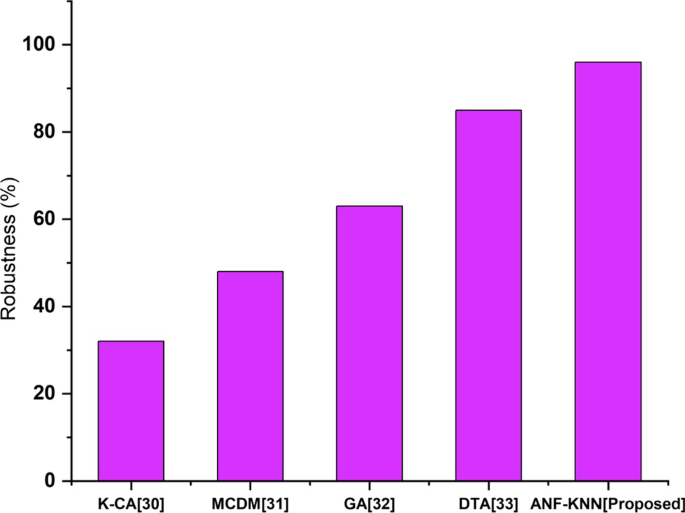

Robustness is a property that describes a model’s, test’s, or system’s capacity to work well when its parameters or hypotheses are changed in the investing world. A solid notion will work without fail and deliver great outcomes in many situations. The proposed FinTech system technology is highly robust compared with other existing FinTech systems. Figure 11 shows a comparative analysis of the robustness of the proposed and existing methods. The figure shows that the proposed method has higher robustness than the existing method.

Robustness comparison of existing and proposed method

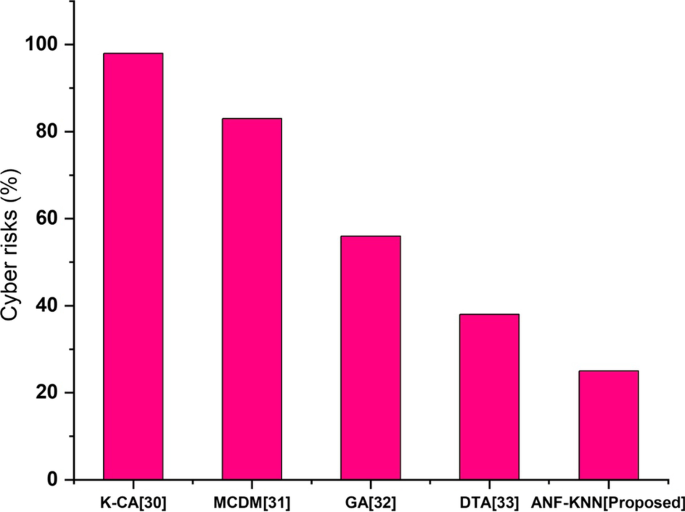

Cyber-risks

Vulnerable to unauthorized access, intimidation, denial of service attacks, and credit card fraud have all become common financial cyber-risks. These cyberattacks have the potential to put the financial system in danger. The proposed method will deny these types of cyberattacks in FinTech. Figure 12 shows the comparative analysis of cyber-risks for a proposed method with existing methods. The figure shows that the proposed method has more risk than the existing method.

Cyber-risk comparison of existing and proposed method

Blockchain is a decentralized network ecosystem with a digital ledger in which transactions are easy for the customer. It offers protection, safety, accessibility, and identity via a set of instructions and cryptographic methods. The proposed blockchain-based ANF-KNN and CIFOA focus on the challenges of FinTech involvement within the banking sector, such as investment range, scalability, accuracy, privacy, robustness, and cyber-risks. This paper has compared these challenges with four other existing technologies, namely K-CA, MCDM, GA, and DTA.

Investment in the FinTech-based banking sector is mainly based on trust and the advancement of technology in financial activities. The investment banking sector has struggled to adapt to legacy technology, but as the digital revolution sweeps across finance, the moment to modernize is now. FinTech will change investment banking in several ways, including using sophisticated technology. Investment institutions must adapt and embrace these technological advancements to stay competitive. Figure 7 shows the high-level investment range of FinTech using the proposed method. One of the most significant issues with existing methods is scalability. Today, increasing network size is seen as a changing objective rather than a goal. A key goal of cryptocurrencies is to achieve a per-second transaction rate comparable to that of a centralized system while holding the underlying technology constant. There is a need to establish a blockchain that can handle scalability and develop a network of computers that can confirm each transaction. Figure 8 shows the higher scalability of the proposed method compared with existing methods. Accuracy is defined as the efficiency and effectiveness of the process using FinTech. The existing system poses some issues for FinTech. The proposed method will be more effective for all financial transactions and other activities that involve FinTech.

Figure 9 compares the accuracy of the proposed and existing methods. Privacy is the most serious challenge for existing financial activities, and existing methods experience more issues in maintaining customer data privacy. The transparency of financial activities, one of the technology's core strengths, could become an enormous challenge. Due to economic and client privacy implications, two firms dealing with each may be hesitant to have this information monitored by a third party. All customer personal data can be protected from hackers safely through the proposed method. The privacy level of comparative analysis for the proposed and existing methods is shown in Fig. 10 .

When the proposed technology exhibits features comparable to those of existing economic networks after overcoming the aforementioned problems, the system has achieved resilience. Nonetheless, today's technology is confronted with issues that must be solved. Robustness is measured by increased availability, which means no downtime, and transaction services that are continuously available. Based on comparison analysis, Fig. 11 shows the robustness of the proposed method. Banks and other financial institutions all around the globe have been the subject of cyber-risks.

Cybersecurity concerns influence practically every aspect of the financial industry. They might put financial institutions that employ technology, FinTech companies, and financial clients in the FinTech ecosystem at risk. Additionally, technology engineers must be aware of possible cybersecurity threats that might exploit vulnerabilities and weaknesses in the proposed technology. Malware, data breaches, interruption of service, cybercrime, and hacking are just some of the cyber-risks to which existing FinTech has been exposed. The two most prevalent cyberattacks documented regularly in the chronology of cyber-hazards and threats on FinTech worldwide are unauthorized access and distributed denial of service. The proposed method protects against these cyber-risks in financial activities, as shown in Fig. 12 .

Conclusions

In conclusion, conventional transition methods, qualifying for and receiving a loan from a finance business, and insurance terms, and policies are significant obstacles to contemporary technology and could affect future economic growth and development. This research provides a novel insight into the appropriate functioning of the AFN-KNN algorithm, which is based on blockchain technology. To enhance all transactional, lending, and insurance processes securely, and effectively, we have suggested the CIFOA. This enhancement would promote the expansion of economic organizations and industries. The suggested technique achieves 91% accuracy, 90% privacy, 96% robustness, and 25% cyber-risk. The digitalized FinTech-based process will provide people the chance to transact while making use of the newest technologies and saving time, effort, and money. As a result, the suggested solution will also benefit FinTech, since it will quickly result in a high transaction volume with low operating expenses.

Because it has changed how businesses function, FinTech is presently well liked. Consumers may now transfer money online much more easily due to this industry. FinTech companies were created in response to the need for a more effective financial system with real-time applications. Furthermore, due to the impact of the pandemic, many firms were better able to understand the significance of FinTech and are now able to advise their customers about how to satisfy their financial needs as technology advances. We believe that the number of FinTech-related patent applications will continue to increase due to the importance of applying FinTech to develop digital finance within the financial sector.

In future research, investigators may collect more FinTech datasets to examine the impact of FinTech in more detail. They could further subdivide the data into subsamples depending on financial region, size, ownership, and other factors. Future FinTech development could also focus on several diverse sectors, such as risk management, precise financial distribution, loan management, and client maintenance, and services. The findings suggest that to improve performance, the financial sector should exert greater effort when filing for FinTech patents. However, there are limitations to this research. First, the study was limited to the financial and banking industry within China. Second, because of the small sample size, several methodological issues with the study might limit the validity of the empirical findings.

Availability of data and materials

The data that support the findings of this study are available from World Bank.

Abbreviations

Internet of things

Artificial intelligence

- Adaptive neural fuzzy based KNN algorithm

Decision tree algorithm

Distributed denial of service

Greedy algorithm

Information technology

K-means clustering algorithm

Multiple criteria decision-making method

Non-performing loans

Peer-to-peer

Super-large ledger

Athari SA, Kirikkaleli D, Adebayo TS (2022) World pandemic uncertainty and German stock market: evidence from Markov regime-switching and Fourier based approaches. Qual Quant. https://doi.org/10.1007/s11135-022-01435-4

Article Google Scholar

Ayhan F, Kartal MT, Adebayo TS, Kirikkaleli D (2022) Nexus between economic risk and political risk in the United Kingdom: evidence from wavelet coherence and quantile-on-quantile approaches. Bull Econ Res. https://doi.org/10.1111/boer.12371

Aziz A, Nur’aisyah I (2021) Role of the financial services authority (OJK) to protect the community on illegal FinTech online loan platforms (SSRN Scholarly Paper No. 3912984). https://papers.ssrn.com/abstract=3912984

Bazarbash M (2019) FinTech in financial inclusion: machine learning applications in assessing credit risk. IMF Work Pap. https://doi.org/10.5089/9781498314428.001.A001

Bhasin NK, Rajesh A (2021) Impact of E-collaboration between Indian Banks and Fintech companies for digital banking and new emerging technologies. Int J E-Collab (IJeC) 17(1):15–35. https://doi.org/10.4018/IJeC.2021010102

Carta S, Recupero DR, Saia R, Stanciu MM (2020) A general approach for risk controlled trading based on machine learning and statistical arbitrage. In: Nicosia G, Ojha V, La Malfa E, Jansen G, Sciacca V, Pardalos P, Giuffrida G, Umeton R (eds) Machine learning, optimization, and data science. Springer International Publishing, Cham, pp 489–503. https://doi.org/10.1007/978-3-030-64583-0_44

Chapter Google Scholar

Chen C-C, Liao C-C (2021) Research on the development of Fintech combined with AIoT. In: 2021 IEEE international conference on consumer electronics-Taiwan (ICCE-TW), pp. 1–2. https://doi.org/10.1109/ICCE-TW52618.2021.9602952

Claessens S, Frost J, Turner G, Zhu F (2018) Fintech credit markets around the world: size, drivers and policy issues (SSRN Scholarly Paper No. 3288096). https://papers.ssrn.com/abstract=3288096

Degerli K (2019) Regulatory challenges and solutions for FinTech in Turkey. Procedia Comput Sci 158:929–937. https://doi.org/10.1016/j.procs.2019.09.133

Fang F, Ventre C, Basios M, Kanthan L, Martinez-Rego D, Wu F, Li L (2022) Cryptocurrency trading: a comprehensive survey. Financ Innov 8(1):13. https://doi.org/10.1186/s40854-021-00321-6

Fernandez-Vazquez S, Rosillo R, de la Fuente D, Puente J (2022) Blockchain in sustainable supply chain management: an application of the analytical hierarchical process (AHP) methodology. Bus Process Manag J 28(5/6):1277–1300. https://doi.org/10.1108/BPMJ-11-2021-0750

Hau H, Huang Y, Shan H, Sheng Z (2019) How FinTech enters China’s credit market. AEA Pap Proc 109:60–64. https://doi.org/10.1257/pandp.20191012

Hernández E, Öztürk M, Sittón I, Rodríguez S (2019) Data protection on FinTech platforms. In: De La Prieta F, González-Briones A, Pawleski P, Calvaresi D, Del Val E, Lopes F, Julian V, Osaba E, Sánchez-Iborra R (eds) Highlights of practical applications of survivable agents and multi-agent systems. The PAAMS collection. Springer International Publishing, Cham, pp 223–2334. https://doi.org/10.1007/978-3-030-24299-2_19

Hinson R, Lensink R, Mueller A (2019) Transforming agribusiness in developing countries: SDGs and the role of FinTech. Curr Opin Environ Sustain 41:1–9. https://doi.org/10.1016/j.cosust.2019.07.002

Kou G, Olgu Akdeniz Ö, Dinçer H, Yüksel S (2021) Fintech investments in European banks: a hybrid IT2 fuzzy multidimensional decision-making approach. Financ Innov 7(1):39. https://doi.org/10.1186/s40854-021-00256-y

Le TDQ, Ho TH, Nguyen DT, Ngo T (2021) FinTech credit and bank efficiency: international evidence. Int J Financ Stud. https://doi.org/10.3390/ijfs9030044

Lee I, Shin YJ (2018) Fintech: ecosystem, business models, investment decisions, and challenges. Bus Horiz 61(1):35–46. https://doi.org/10.1016/j.bushor.2017.09.003

Li G, Kou G, Peng Y (2022) Heterogeneous large-scale group decision making using fuzzy cluster analysis and its application to emergency response plan selection. IEEE Trans Syst Man Cybern Syst 52(6):3391–3403. https://doi.org/10.1109/TSMC.2021.3068759

Najaf K, Subramaniam RK, Atayah OF (2022) Understanding the implications of FinTech peer-to-peer (P2P) lending during the COVID-19 pandemic. J Sustain Finance Invest 12(1):87–102. https://doi.org/10.1080/20430795.2021.1917225

Navaretti GB, Calzolari G, Mansilla-Fernandez JM, Pozzolo AF (2018) Fintech and Banking. Friends or Foes? (SSRN Scholarly Paper No. 3099337). https://doi.org/10.2139/ssrn.3099337

Pinshi CP (2021) Exploring the usefulness of FinTech in the dark era of COVID-19. J Adv Stud Finance (JASF) XII(23):40–50

Google Scholar

Sebastião H, Godinho P (2021) Forecasting and trading cryptocurrencies with machine learning under changing market conditions. Financ Innov 7(1):3. https://doi.org/10.1186/s40854-020-00217-x

Sheikh A, Ghanbarpour T, Gholamiangonabadi D (2019) A preliminary study of FinTech industry: a two-stage clustering analysis for customer segmentation in the B2B setting. J Bus Bus Mark 26(2):197–207. https://doi.org/10.1080/1051712X.2019.1603420

Stojanović B, Božić J, Hofer-Schmitz K, Nahrgang K, Weber A, Badii A, Sundaram M, Jordan E, Runevic J (2021) Follow the trail: machine learning for fraud detection in FinTech applications. Sensors. https://doi.org/10.3390/s21051594

Thakor AV (2019) Fintech and Banking (SSRN Scholarly Paper No. 3332550). https://doi.org/10.2139/ssrn.3332550

Tsai B-H, Chang C-J, Chang C-H (2016) Elucidating the consumption and CO 2 emissions of fossil fuels and low-carbon energy in the United States using Lotka-Volterra models. Energy 100:416–424. https://doi.org/10.1016/j.energy.2015.12.045

Williams J (2021) Conclusion: FinTech—a perfect day or walk on the wild side? In: King T, Stentella Lopes FS, Srivastav A, Williams J (eds) Disruptive technology in banking and finance: an international perspective on FinTech. Springer International Publishing, Cham, pp 283–313. https://doi.org/10.1007/978-3-030-81835-7_11

Xu M, Chen X, Kou G (2019) A systematic review of blockchain. Financ Innov 5(1):27. https://doi.org/10.1186/s40854-019-0147-z

Yang Y, Su X, Yao S (2021) Nexus between green finance, FinTech, and high-quality economic development: empirical evidence from China. Resour Policy 74:102445. https://doi.org/10.1016/j.resourpol.2021.102445

Download references

Acknowledgements

Not applicable.

We also confirmed that this research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and affiliations.

Department of Accounting and Finance, Palestine Polytechnic University-PPU, Hebron, Palestine

Husam Rjoub

Department of Banking and Finance, Faculty of Economics, Administrative and Social Sciences, Bahçeşehir Cyprus University, 99010, Alayköy, Nicosia, Turkey

Department of Economics, Faculty of Economics and Administrative Science, Cyprus International University, Northern Cyprus, 10, Mersin, Nicosia, Turkey

Tomiwa Sunday Adebayo

Department of Banking and Finance, Faculty of Economics and Administrative Sciences, European University of Lefke, Lefke, Northern Cyprus, 10, Mersin, Turkey

Dervis Kirikkaleli

You can also search for this author in PubMed Google Scholar

Contributions

TSA and HR designed the experiment and collect the dataset. The introduction and literature review sections are written by HR. DK constructed the methodology section and empirical outcomes in the study. TSA contributed to the interpretation of the outcomes. All the authors read and approved the final manuscript.

Corresponding author

Correspondence to Dervis Kirikkaleli .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Rjoub, H., Adebayo, T.S. & Kirikkaleli, D. Blockchain technology-based FinTech banking sector involvement using adaptive neuro-fuzzy-based K-nearest neighbors algorithm. Financ Innov 9 , 65 (2023). https://doi.org/10.1186/s40854-023-00469-3

Download citation

Received : 05 May 2022

Accepted : 19 February 2023

Published : 10 March 2023

DOI : https://doi.org/10.1186/s40854-023-00469-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Blockchain technology

- Rolling window autoregressive lag modelling

- Weekly Blockchain Blog - May 2024

Fintech and Crypto Firms Announce New Cryptocurrency Products

By Robert A. Musiala Jr.

According to recent reports, a major U.S. fintech firm will begin letting its users accept payments in USDC. The fintech firm’s head of crypto reportedly said, “We’re excited about empowering … users to accept stablecoin payments, helping them expand their global reach and give their customers access to easy, fast, and trustworthy transactions even if they don’t have a bank account or credit card.” In a separate press release, smart contracts platform Avalanche announced an integration with the same fintech company that will allow retail users to “purchase AVAX directly through the fintech firm, “removing the need to go through an exchange.”

Another major U.S. fintech firm recently announced that it has completed development of a new custom bitcoin mining chip. According to a press release, the fintech firm’s mining chip “will utilize the most advanced semiconductor process currently available and will deliver the performance required for mining operators of all types to survive and thrive in the fifth mining epoch (the period following the recent 4th halving of the block subsidy) and beyond.”

In another recent development, a major U.S. cryptocurrency exchange announced that it is “rolling out support for the Lightning Network enabling instant, low-cost bitcoin transfers.” According to a blog post by the crypto exchange, “Users will have the option to choose between using Lightning for faster and cheaper bitcoin transactions, or processing their transaction on the traditional Bitcoin network.” The new offering is available through an integration with startup Lightspark.

In a final notable item, a major U.S. blockchain and fintech firm recently announced “a strategic partnership with HashKey DX, the Tokyo-based specialized consulting company of the HashKey Group, to introduce XRP Ledger (XRPL)-powered enterprise solutions to the Japanese market.” According to a blog post by the fintech firm, the initiative will introduce supply chain finance solutions “built on the XRPL, a decentralized layer 1 blockchain renowned for its decade-long reliability and stability in tokenizing and exchanging crypto-native and real-world assets.”

For more information, please refer to the following links:

- Payments Giant Stripe Reenters Crypto With USDC on Ethereum, Solana and Polygon

- Avalanche Integrates with Stripe for Crypto Onramping

- Latest updates: 3nm chip headed to the foundry, our new mining system, and more

- Coinbase integrates Bitcoin’s Lightning Network in partnership with Lightspark