How to Create a Profit and Loss Statement

By Andy Marker | March 18, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, you’ll learn about profit and loss statements and find tips on using an income statement for your financial strategy, including expert advice for small businesses. Plus, we’ll guide you through writing a P&L statement.

Included on this page, you’ll find the essentials of a profit and loss statement , step-by-step instructions for preparing a P&L statement with examples , free small business templates , and a helpful checklist .

What Is a Profit and Loss Statement?

A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. It captures how money flows in and out of your business.

A profit and loss statement is also called an income statement , a statement of profit , or a profit and loss report . Creating one is a standard way to compile historical data for your business to tell its financial story over time. Each monthly or quarterly reporting period, analyze the data vertically to see your business's monetary resource allocation. Over time, you will also analyze the data horizontally in context with other profit and loss statements to help you to make informed financial decisions and forecasts. You can also use the same technique to understand other businesses' finances.

Why Do You Need a Profit and Loss Statement?

You need a profit and loss statement to make the most informed choices for your business strategy. As an honest reflection of how your money works in your business, the statement shows what changes need to happen to increase profit.

Ivanka Menken, Managing Director and Co-founder of The Art of Service , emphasizes the importance of a P&L statement: “The numbers don't lie. [A profit and loss statement is] important to truly understand your business’s revenue and profit numbers to know if your revenue is helping or hurting your profitability. Many businesses go broke, especially when the focus is solely on revenue, [and not on] the cost of sales or the profitability of activities.”

A profit and loss statement helps you see exactly how money flows into your business, where you spend that revenue, and what adjustments you need to maximize profit. For example, you may discover that your cost of goods sold (COGS) is too high and needs to be reduced with a less expensive production option. By making changes to improve your margins, you can increase net revenue for the following months. Once you implement the new plan, you can measure its impact over time with the data from future P&L statements.

Additionally, a P&L statement is necessary to prove that your business is a trustworthy, solid investment. Financial backers or investors contributing capital to the business, banks at which you’re applying for a loan, or buyers interested in the business can use the document to determine your business’s capability to make a profit and view your financial trends over time. Essentially, the profit and loss statement showcases your ability to identify complex business problems and articulate how you solved them from a financial standpoint.

What Can a Profit and Loss Statement Tell You About Your Business?

Profit and loss statements show your business health over time. A reported loss signals that something isn’t functioning correctly within the business. After analyzing the document, you can pinpoint the cause of the loss and develop a stronger business strategy.

When comparing the statements in the context of other periods, you can clearly identify business areas that are performing well and those that need to be optimized.

Pam Prior, speaker, podcaster, and creator of Profit Concierge , shares an essential tip: “Do something with the information. Knowing history for history’s sake doesn’t do much for you.” Once you record, report, and analyze the information based on 12 months of history, you can use formulas to project the next 12 months. Your P&L statements are the basis of financial forecasting for the following year.

Your income statement is the most important financial statement for your business. Use it, along with one of our free small business budget templates , to simplify and strengthen your small business financial planning.

What Goes on a Profit and Loss Statement?

A profit and loss statement contains three basic elements: revenue, expenses, and net income. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Basic income statements contain the following elements:

- Gross Revenue: The amount of money you received as payment for your products or services (also called gross sales ).

- Cost of Goods Sold (COGS): Expenses for everything involved in creating your product, such as manufacturing materials, contractors, etc. Note that COGS does not include your operating expenses (i.e., salaries, facility rent).

- Net Revenue: The gross revenue minus COGS; also known as gross profit or gross income .

- Expenses: This refers to any fixed or operating expenses required to run the business, including salaried employees, rent, advertising and marketing expenses, utilities, and insurance. A basic statement accounts for interest, taxes, depreciation, and amortization as part of the total expenses. Use a small business expense template to easily itemize your expenses.

- Net Profit: Also called net income , this is the net revenue minus the total expenses. If the calculation is negative, it is called a loss or a net loss . Pro Tip: Menken advises that companies avoid getting too detailed and granular when creating a profit and loss statement, as doing so can defeat the document’s purpose. Use a small business profit and loss template if you are less familiar with spreadsheet software. As your company grows, so will the complexity of your profit and loss statement — in time, you can transition to more advanced profit and loss templates, which typically include more information, such as the following:

- Operating Profit: The profit before interest or taxes and after accounting for general costs. Subtract the operating expenses from the net revenue to calculate this figure.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): This line measures the business’s profitability and compares companies with each other. This figure is commonly used for corporations and large public companies. In some cases,, you may only calculate EBIT, meaning the operating profit plus depreciation and amortization.

- Additional Income: This includes anything not calculated in revenue, such as interest income, dividends, and donations. Pro Tip: As Prior shares, “Everything you need to create a basic profit and loss statement is already on your bank statement and credit card statement. As your business grows or for more complicated businesses, outsource to a bookkeeper as soon as you can afford one. You won’t have to clean up mistakes, saving money over the long run.”

How Do You Prepare a Profit and Loss Statement?

Preparing a profit and loss statement involves two multi-stage steps. First, find your gross profit by subtracting your COGS from your gross revenue. Then, subtract your total expenses from the gross profit to calculate the net income.

Before you start, gather the necessary documents. For a basic P&L statement, you only need your credit card and bank account statements. Supplement these documents with invoices, receipts, and other transactions not listed on your credit card or bank statements.

To get started, you’ll need to know the basic formulas. Use our quick-reference guide below until you are familiar with the formulas. We’ve also indicated when to use each formula in our step-by-step instructions for preparing a basic profit and loss statement.

1. Calculate Gross Profit

You can calculate your gross profit by taking the sum of the gross revenue and subtracting the COGS. These figures are pre-tax amounts. Use the following formula to find the gross profit:

Gross Profit = Gross Revenue - COGS

- Total your gross revenue from sales and other pre-tax income and create a line item for the total amount.

- Total your COGS and create a line item for this figure. Pro Tip: Menken recommends that businesses look at the income and expense lines and consider if they are a cost of sales or an expense. Understanding the difference will help you know where you can save money (by lowering your expenses) and where you need to increase investments to increase revenue. The difference between costs and expenses is as follows: A cost refers to a payment made toward the production of the goods you sell, and an expense refers to a fixed monthly cost that is necessary for business operations, such as rent, salaries, and utilities. Generally, expenses are recurring payments and costs are one-time payments.

- Subtract COGS from the gross revenue to find your gross profit. If the number is negative, your business has incurred a loss for this period.

2. Total All Expenses

In this example, since we are preparing a basic small business profit and loss statement, we will simplify the expenses by including the operating and non-operating expenses.

- Itemize your operating expenses (salaried employees, facilities, marketing, etc.) and non-operating expenses (interest, depreciation, taxes, amortization).

- Total all expenses as a separate line item. Note: As your business grows and becomes more complex, so will your financial documents. You may wish to expand your income statement to itemize the EBIT or EBITDA separately as a way to compare your business profit with competitors. Pro Tip: Prior advises statement preparers to use itemized categories (i.e., contractor payments, travel, software, marketing) to help you see how they perform over time and how the money spent generates more net profit.

3. Calculate Net Income

The final step is to calculate the net income (also called net earnings ) using the following formula:

Net Income = Gross Profit – Total Expenses

- Subtract your total expenses from the gross profit to find your net income.

- List this figure on a separate line. Pro Tip: Menken advises, “If you feel overwhelmed by all these numbers, then make it simple. Take the aggregate numbers for your income, cost of sales, and expenses. You’ll then have a five-line overview of your business. From there, you can drill down into more detail when you are ready for more information. ”You can use any spreadsheet tool to create a profit and loss statement that automatically performs calculations. You can also use a template that contains built-in calculations. To get started, visit our step-by-step tutorial on how to create a profit and loss statement in Excel.

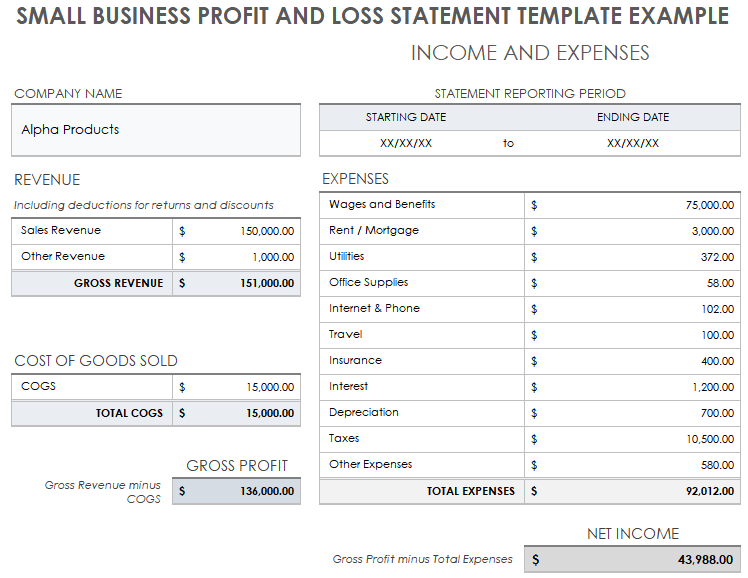

Profit and Loss Statement Template Example

Download Profit and Loss Template Example — Microsoft Excel

To help you create a profit and loss statement, we’ve filled out a free small business profit and loss statement as an example. Download the fully customizable example template to see how the numbers work and fill in your own figures.

You can also visit our profit and loss templates page to find the free template that best meets your needs.

How Often Do You Prepare a Profit and Loss Statement?

Businesses routinely prepare a profit and loss statement each month, quarter, or year. As a standard, many organizations prepare the statement monthly to line up with bank cycles.

Pam Prior highly recommends monthly statements: “The standard is monthly because banks tend to cycle each month. Essentially, you’re taking the info from the bank and credit card statements and putting it into a format to see what you made and what you spent. When you do this monthly, you have 12 data points over the course of a year, versus four quarterly or one annual report. Since data informs decisions, 12 points of data provide the most clarity.”

Startups and new businesses that do not have a financial history use a pro forma financial statement instead of a profit and loss statement. The pro forma is a projection of finances and is necessary when you are applying for business financial backing.

How to Read a Profit and Loss Statement

To read a profit and loss statement, you must first identify the preparation method: accrual or cash basis. Next, scan the document to review the finances during a single period. Then, analyze the trends over time by comparing data from other P&L statements.

Preparers typically use one of two primary reporting methods on the income statement:

- Accrual Basis: In this method, you report income and expenses on the income statement as they occur. For example, you would record the sale of a single product upon delivery to a customer who promises to pay in the future.

- Cash Basis: Here, you report income and expenses on the income statement at the time of the transaction. For example, you would record the sale of a single product or service only when money for that product has exchanged hands.

The accrual method is most common in publicly traded companies and is more accurate in reporting the overall health of the company. The cash method is common for personal finances and small businesses and is much simpler, especially when you’re starting out.

Pro Tip: Prior urges new businesses to start preparing income statements using the cash basis method.

To determine the profit margin, we’ve detailed the common formulas and how to use them with your income statement data below:

Vertical (Common-Size) Analysis

A vertical or common-size analysis is a financial tool analysts use to interpret financial documents like a profit and loss statement. The method calculates major line items (gross profit, operating profit, and net profit) from your income statement as a percentage of its base line item (gross revenue). These percentages are called margins . Analyzing the document using profit margins allows you to understand the impact of each reporting period for your business, and also produces relative terms to accurately compare your company’s finances to other companies, regardless of their scale.

- Scan the Document: Look at the big picture by reviewing the net revenue, expenses, and net income. Note if anything looks surprising, and then scan the statement line by line to gain a general understanding of how finances performed for that particular period.

- Gross Revenue: $20,000

- Cost of Goods Sold: $15,000

- Operating Expenses: $1,000

- *Non-operating Expenses: $500

- *Non-operating expenses include interest, taxes, depreciation, and amortization. They should be itemized individually on the statement.

- Gross Profit Margin: This is the profit your business made relative to what it costs to produce them. Remember that gross profit equals gross revenue minus COGS. The formula to find your gross profit margin is as follows: Gross Profit Margin = (Gross profitGross revenue) x 100

- Gross Profit Margin Example: If you paid $15,000 for goods and sold them at $20,000, your gross profit will be $5,000. To find the gross profit margin, divide the gross profit ($5,000) by the gross revenue ($20,000) and multiply that number by 100 to get the percentage. Your gross profit margin for this example is 25 percent.

- Operating Profit Margin: The percentage of expenditures it takes to operate your business (i.e., marketing and PR costs, salaries, taxes, interest, supplies, vendor and contractor payment, professional fees, such as accountants and lawyers) in relation to the revenue. Your operating profit does not include non-operating expenses (interest, taxes, depreciation, and amortization) and only uses the EBITDA to determine this margin. Remember that operating profit equals gross revenue minus (COGS + operating expenses). The formula to find the operating profit margin is as follows: Operating Profit Margin = (Operating profitGross revenue) x 100

- Operating Profit Margin Example: If your operating costs were an additional $1,000 on top of the COGS ($15,000) and you subtract it from your gross revenue ($20,000), your operating profit is $4,000. Divide your operating profit ($4,000) by the gross revenue ($20,000) and multiply it by 100. Your operating profit margin in this example is 20 percent.

- Net Profit Margin: This formula calculates all expenses from revenue, including COGS, operating expenses, taxes, interest, depreciation, and amortization in relation to the total revenue. Remember that net profit equals gross revenue minus total expenses. The formula is as follows: Net Profit Margin = (Net profitGross revenue) x 100

- Net Profit Margin Example: Using the same figures from the previous examples and assuming that your taxes, interest, depreciation, and amortization were $500 in addition to the $1,000 operating expenses, we’ll input the numbers into the calculation for net profit: Net Profit = [(Gross Revenue – COGS) - (operating expenses + taxes, interest, depreciation, amortization)] [($20,000 - $15,000) – ($1,000 + $500)] = $3,500 Divide your net profit ($3,500) by the gross revenue ($20,000) and multiply it by 100. Your net profit margin is 17.5 percent.

- Analyze the Profit Margins: Look closely at individual lines in each section (gross revenue/sales, COGS, net profit, expenses, and net income). What needs to happen to increase your margins? Can you lower COGS or operating expenses without compromising your product or company values? What needs to happen to increase sales? Did something go particularly well for this month? Try to replicate it for the following month. Compare the line items to determine where to strategically adjust.

Horizontal (Serial) Analysis

After analyzing the document vertically, compare the statements month to month (or quarter to quarter or year to year) horizontally to see the story of where the money is going. Place your net profit margins on a graph to see the information in context. You’ll discover big-picture insights, general business trends, and increasing or decreasing profit margins. You can use this information to forecast your business direction and compare it with other companies’ public financial statements.

Financial expert Prior says, “The really cool thing is when you see a profit and loss statement in columns that show each month. This system shows your financial story over time. This way, you can see if the money you’re spending is working for you and generating revenue — profit is the whole point of business. Once you have this piece in place, you can make informed decisions on what to do next. You’ve got the data to interpret, develop a strategy, and measure its impact.”

Beyond the basic steps of reading and analyzing a P&L statement, it is important to keep outside factors in mind to develop insights for your strategy. Read your profit and loss statement like you would a story. Ask questions when something isn’t adding up as expected. As you read the statement, consider in your strategy the following factors:

- Seasonality: The time of year impacts a number of areas on your statement. Items may be more expensive during a specific period, thereby increasing the COGS. Holidays can increase sales with demand. By including seasonality, you can interpret dramatic changes and develop creative solutions to create more income during off seasons.

- Income Sources and New Offerings: If your business has expanded its offerings, are they worth the resources you’re putting into them? Are the profit margins high enough to keep the offerings? Do you need to shift more money to market the product and increase sales? Your profit and loss statement helps guide the best choices about how well your new product performs.

- Bottom Line: Typically, the COGS increases with revenue. If you see that the COGS exceeds revenue, you need to make immediate decisions to change a loss into a profit. To increase your bottom line, ask if there’s any way you can reduce these expenses without jeopardizing the quality of product or company values.

- Big Picture: Look at your net income as the big picture. For example, it is cost-effective to purchase items in bulk for the year. Still, it will appear negative on the income statement for a particular month. Ultimately, you’ll recoup the money over time for higher margins, but you need to keep an eye on the big picture to see this in the income statement.

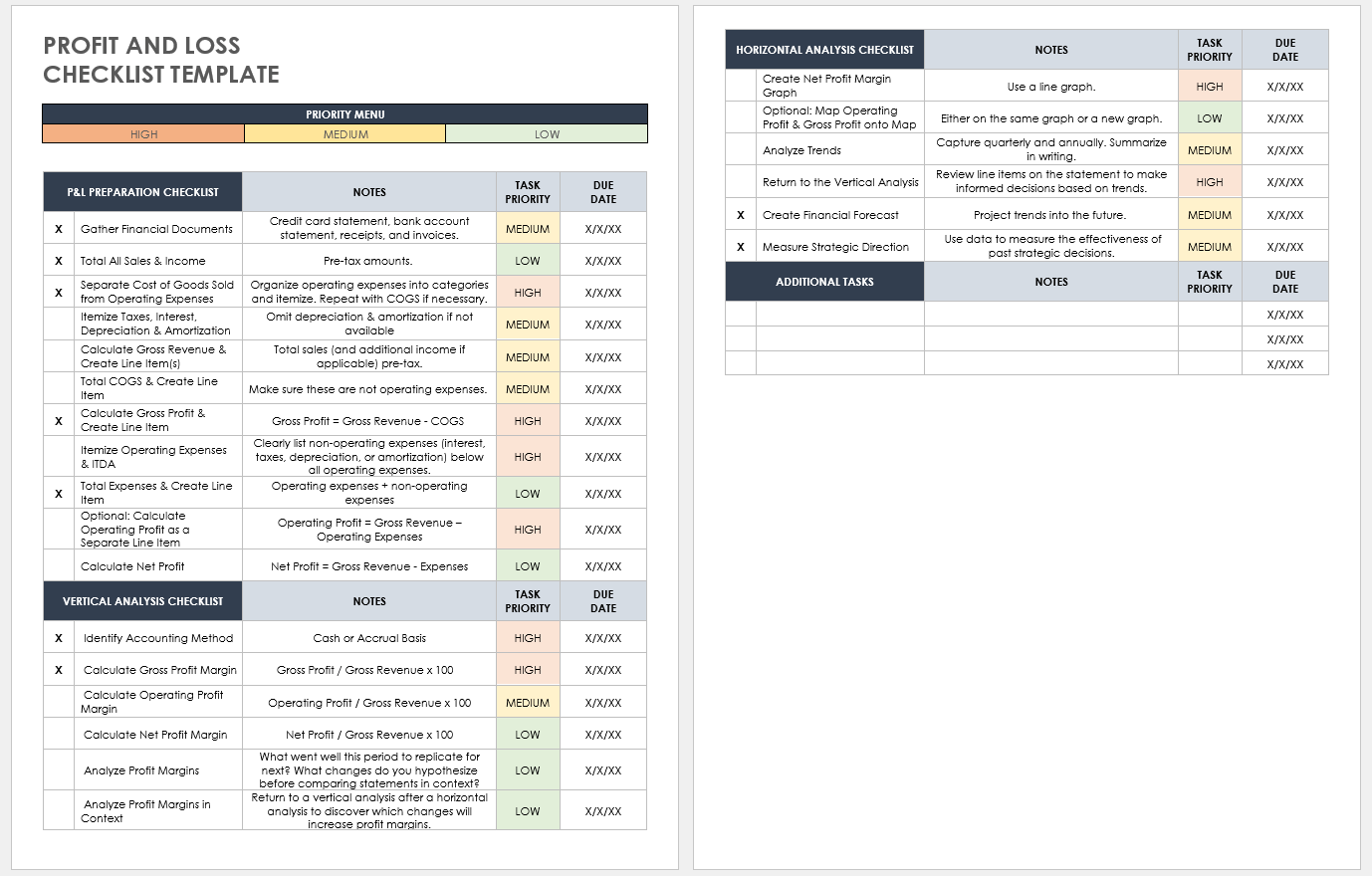

Profit and Loss Statement Checklist

Download Free Profit & Loss Statement Checklist Microsoft Word | Adobe PDF | Google Docs

Whether you are just beginning to prepare your profit and loss statement or are analyzing profit and loss statements vertically or horizontally, use our quick reference checklist to ensure you don’t miss a step. This complete checklist includes quick reference income statements and profit margin formulas to help you cover all your bases.

Balance Sheet vs. Profit and Loss Statement

A balance sheet is different from a profit and loss statement. It captures a snapshot of the business’s assets, debts, and equity in a single moment, whereas a P&L statement demonstrates the performance of the overall business.

Pam continues, “A profit and loss statement tells you what happens over a period of time. A balance sheet is a record or a snapshot in time as of a certain date, of the values of the things in the business. It’s critical to know if something belongs on a balance sheet or a profit and loss statement.”

All balance sheets calculate the owner’s (or shareholder) equity by assessing the company assets against its liabilities:

- Assets: What your business owns, including tangible items like cash, investments, and owned property, as well as prepaid expenses known as accounts receivable .

- Liabilities: These are items that your business owes, including any loans, accrued expenses, accounts payable, etc.

- Owner’s Equity: This is the amount that the owner of a private company has after subtracting liabilities from assets. This is called shareholder equity for public companies.

The balance sheet is also a supporting document when creating a cash flow statement . The cash flow statement is another financial document that monitors cash flow in and out of the business, sufficient funds for bills, and how well the business generates money.

Get the Most Out of Your Profit and Loss Statements with Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today .

Connect your people, processes, and tools with one simple, easy-to-use platform.

Home > Finance > Accounting

How to Prepare a Profit and Loss Statement

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Your goal as a business owner is to keep your business financially solvent, and to do that, you absolutely must know how much you're making and how much you're losing. A profit and loss (P&L) statement, otherwise called an income statement , breaks down your profit and loss line by line so you can determine your net income and make wise decisions about business opportunities.

Since an income statement gives you a close look at your total profits, liabilities, and expenses, it's one of the most important financial documents in your roster. Because P&L statements are so important, even the most basic accounting software programs generate them for you at the click of a button. But if you want to draw up your own P&L statements (or if you want to understand exactly what goes into generating income statements), we have a short guide below.

How to prepare an income statement in 7 steps

- Choose an income statement format

- Decide on a time period to calculate net income

- List your revenue

- Calculate your direct costs

- Calculate your gross profit

- Calculate your operating and non-operating expenses

- Determine your net income

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option.

What is an income statement?

Before we start creating income statements, let's talk a bit more about why understanding profit and loss is essential to running a successful business.

Profit obviously refers to the amount of money your business is making—and yes, it's critical to know what your income is at any given moment. But revenue alone doesn't accurately represent your business's profits. After all, expenses like rent, employee paychecks, damaged inventory, bank fees, and a host of other expenses and liabilities come out of your bottom line.

To accurately understand your business's fiscal position, then, you need to calculate both profit and loss to find your total net income. And that's exactly what the profit and loss sheet does for you: lists your total revenue, total expenses, and total equity line by line to show how much cash your business is really bringing in.

P&L statements are also important for banks, lenders, and other investors. Lenders will almost always look at your income statement before deciding if your business is profitable enough to invest in. P&L sheets also demonstrate your own financial know-how—if you as a business owner don't have a good understanding of how to effectively manage profit and loss, lenders will be less likely to trust that your business can give them a good return on investment.

Again, you don’t have to prepare a P&L statement on your own. Plenty of accounting software will do it for you. And if you want more information on how to create an income statement specific to your business, we always recommend talking to your financial advisor. Virtual accountants and bookkeepers can help, as can business bankers, CPAs, or other trusted financial professionals.

1. Choose an income statement format

If you're creating an income statement by hand, using a spreadsheet program like Excel or Google Sheets will help you keep the process simple. Depending on the product you use, you can find an easy template instead of building a document from the ground up. For instance, Microsoft Office offers a series of Excel templates for P&L statements.

The U.S. Small Business Association also offers a simple income statement template you can easily download, print, and fill out.

Your accountant can also show you how they draw up a profit and loss statement. And, again, most accounting or bookkeeping software can automatically create a P&L statement for you or provide you with a template for you to fill in.

2. Decide on a time period to calculate net income

Most businesses calculate their profits and losses on a monthly, quarterly, or annual basis. If a lender or investor asks you for a P&L statement, they should specify the time period they need to see. Otherwise, just make sure to choose a time frame that shows you a general trend without overwhelming you with too much data; less than a month is probably too little time to reveal trends, while more than a year is probably too much.

By signing up I agree to the Terms of Use and Privacy Policy .

3. List your revenue

For most product-based small businesses, revenue equals sales, or the amount goods sold—such as the amount of hair products sold by your salon, the number of baked goods sold by your cafe, or the number of printouts sold by your copy shop. But depending on the business, revenue could also include things like rent money, tax returns, or licensing agreements.

List each revenue source as its own line on your profit and loss statement. Then, once you’ve listed each source, total the amount to find your gross revenue.

4. Calculate your direct costs

After adding up your revenue, it's time to add up your direct costs, or costs related directly to producing the products or services you sell. If you sell a physical product, direct costs can also be called COGS, or cost of goods sold .

Not sure what expenses count as COGS? Let’s say you sell holiday-themed oven mitts on Etsy. To make your goods, you have to buy fabric, thread, a sewing machine, scissors, pins, patterns, and a host of other materials. The money you spend purchasing those items is your direct cost.

What if your business provides a service instead of goods? Since you don’t sell a physical product, you don’t have COGS, but you do still have direct costs. For instance, if you’re a psychologist, your office space is essential to the service you provide: without an office, you can’t offer services. So in this case, the money you pay for the office would be one of your primary direct costs.

Direct costs can also include the costs of the labor that goes directly into your product or service. Let’s imagine you’re the owner of a small lawn mowing company. Purchasing a lawn mower isn’t your only direct cost—the amount of money you pay an employee to push the lawn mower is also a direct cost.

Here's the basic formula for calculating your cost of goods sold:

Cost of goods sold = beginning inventory + purchases – ending inventory

For a more detailed breakdown of the COGS formula, check out our page on calculating COGS .

Consider using an accounting software

5. calculate your gross profit.

So now you know what your direct costs are. But do they outweigh what you charge customers for your products or services? Let’s find out: subtract your direct costs from your total revenue to get your gross profit . Hopefully, you’re left with a positive number that shows how much your business is making.

Once you've calculated your gross profit, you can also calculate your gross margin, which represents your gross profit as a percentage. Just subtract your direct costs from your gross revenue, and then divide that number by the gross revenue. Then simply multiply that number by 100.

Hint: a higher gross margin indicates higher efficiency, which is excellent for any small business.

Here's a simplified equation for calculating gross profit:

Gross profit = Gross revenue – direct costs

And if you want to turn that number into a percentage, here's how to calculate your gross margin:

Gross margin = { [Gross revenue – direct costs] / gross revenue } x 100

6. Calculate your operating and non-operating expenses

Operating expenses (OPEX) are any expenses necessary to your business that aren’t direct costs. In other words, these expenses refer to any money that doesn’t go directly into creating goods or supplying services, which is why you'll also see operating expenses referred to as indirect expenses.

Depending on the type of business you run, these could include monthly utilities, business internet and phone plans, hardware and equipment, marketing costs, office supplies, building maintenance, and equipment repairs and maintenance.

Basically, anything that impacts your day-to-day business operations should be listed as an operating expense on your income statement.

Since there are so many types of operating expenses, most income statements break down your OPEX by category. Here are a few of the most common.

Administrative expenses

Administrative expenses, also called general expenses, are any expenses you incur in the general administration of your business. You can also think of administrative expenses as costs you'd pay even if you weren't producing goods or selling services—for instance, even on a day you don't sell a single product, you're still paying for inventory storage space.

Overhead expenses

Overheads can refer to the fixed costs of running a business that don’t vary from month to month (in contrast with operating costs, which can fluctuate). If you pay the same monthly fee for your accounting software, that would count as a fixed cost , or overhead.

Depending on your business and type of income statement, overhead costs can also encompass all indirect labor and production costs. This contrasts with operating costs, which can mean the costs of actually running a business. Your accountant can help you understand more about what overheads look like at your unique business.

Additional operating costs

A few other main OPEX categories include payroll expenses, marketing costs, and sales costs. Once again, we recommend asking an accountant for personalized recommendations about how to break down your operating expenses on an income statement.

SG&A stands for selling, general, and administrative expense, and it's yet another term you might see used as a synonym for OPEX. Basically, the term encompasses everything except for COGS, direct costs, research and development expenses, and interest on business loans.

Non-operating expenses

Non-operating expenses are (hopefully) one-time expenses like legal fees, tax penalties, or interest on a business loan. Once you've calculated your operating expenses, make sure to include your non-operating expenses on your P&L statement as well.

7. Determine your net income

It’s time for the moment of truth: is your business profitable or not? Steel yourself, take a deep breath, and subtract your total expenses from your gross profit to get your net profit.

Is your net profit positive? Nice! You’re on track for financial health. Is it low, zero, or in the negatives? It’s time to reevaluate some business practices. That could mean cutting down your OPEX (operating expenses), downsizing departments, or switching raw materials manufacturers to reduce your COGS (cost of goods sold).

Other considerations: EBIT, EBT, and EBITDA

The steps above show you how to create a simple, straightforward income statement. You won’t need any more data than what we’ve listed here to fill out the U.S. Small Business Association’s template.

But maybe you’re doing in-depth business forecasting, or maybe your bank asked for more info before approving your loan. In that case, you want a longer, more detailed, and more accurate P&L statement, which means getting familiar with these abbreviations:

- Earnings before interest and taxes (EBIT): The total of your business’s net income without accounting for income taxes and loan interest.

- Earnings before tax (EBT): The total of your business’s net income plus the taxes you expect to pay (based on your business’s projected tax liabilities).

- Earnings before interest, taxes, depreciation, and amortization (EBITDA): The total of your business’s net income without accounting for income taxes, loan interest, or depreciation and amortization.

Depreciation refers to the constantly lowering value of your business’s physical assets, like a company car or office building. The more you drive the car, the more its value depreciates.

Amortization refers to the constantly lowering value of your business’s non-physical (or intangible) assets, like patents, copyrights, and trademarks.

Compare the year's best accounting software

Data as of 3/9/23. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue beneath $50K USD **Current offer: 90% off for 3 mos. or 30-day free trial †Current offer: 50% off for three months or 30-day free trial ‡Current offer: 75% off for 3 mos. Available for new customers only

The takeaway

With the right financial documents on hand and sheer confidence in your Excel formula skills, creating a simple profit and loss statement is totally doable. Once you have the process down, feel free to pull data for a P&L statement whenever you need to—it’s the best, fastest, and cheapest way to quickly evaluate your small business’s financial health.

Want to learn more about how calculating profit and loss can help you grow your business? Check out our piece on how to effectively manage your company’s profit and loss .

Related reading

- The 6 Most Useful Financial Documents for Small Businesses

- The Best Tools for Creating a Financial Statement

- How to Calculate Net Operating Income (NOI)

- The Difference between Bookkeeping and Accounting

P&L statement FAQ

The answer largely depends on the size of your business, but P&L statement generation is one key aspect of most accounting job descriptions. Whether you have an in-house accountant, have a CPA on retainer, or pay a local accountant by the hour, the accountant you work with should be able to handily throw together an income statement in no time.

We always recommend meeting with an accountant or other financial advisor at least once when you first start creating financial documents for your business. From there, you can create your own P&L statements if you'd like to. Accounting software, including free accounting software , can draw up income statements for you with little effort on your part.

There’s a lot of financial data for you to include in your P&L statement. Like, a lot . Finding a starting point can be intimidating, but it’s much less so if you already have a great bookkeeping system in place. If you do, you should have easy access to your company’s receipts, invoices, pay stubs, credit card payments, tax data, accrued interest, and more so you can sit down and start running the numbers.

If you don’t have a great bookkeeping system in place yet, cut yourself some slack—and then get right on creating one now. (Literally now. Right now. Step away from this page and get thee to a bookkeeper.)

If you do cash transactions, start keeping receipts and storing them in a logical, orderly way. Organize your general ledger. Hire a part-time bookkeeper for a small fee or invest in bookkeeping software that keeps all your data in the same place.

Getting organized—including entering all your information into new accounting software—can be a steep learning curve. But apart from creating excellent products and services and hiring fantastic employees, there’s next to nothing more important to your business than accurate, detailed financial records, profit and loss statements included.

Are there multiple types of income statements?

Yes. There’s the typical P&L statement detailed above, and there’s a pro forma P&L, which is an income statement you fill out when you first start a business. How do you figure out revenue for a business that only just started? Well, to put it frankly, you give it your best guess—that makes it a projected profit and loss sheet, not a record of current profit and loss.

If this is your first P&L (or pro forma P&L), make sure to lowball your revenue and highball your expenses. This is a great time to detail all of your expenses in full, from the electricity bill to the replacement staplers you just bought. Having a full list of expenses can help you moderate overheads and operating costs, which helps you build frugal business practices into your company right from the start.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

Fall in love with FreshBooks 🍂 50% o ff for 6 months. Buy Now & Save

50% off for 6 months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

What Is a Profit and Loss Statement?

A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue. The profit and loss statement, also called an income statement , details a company’s financial performance for a specific period of time.

Here are the topics you’ll need to cover to prepare a profit and loss statement:

What Does a Profit and Loss Statement Tell You?

What do i need to prepare a profit and loss statement, how to prepare a profit and loss statement, why is a profit and loss statement useful for business.

A profit and loss statement is a financial report summarizing the revenues, costs and expenses a company incurs for a specific period. Usually, the profit and loss account is prepared monthly, quarterly or annually.

The profit and loss statement demonstrates your business’s ability to generate profits. It shows the sales you’re earning and how you’re managing your expenses.

To create a profit and loss report , you’ll need the following financial information related to your business:

Banking Transactions

To create a profit and loss statement, you’ll need your banking records, including listings of all the transactions related to your business bank accounts and credit card records outlining your business purchases.

Cash Transactions

Before preparing your profit and loss statement, you’ll need to gather all receipts related to cash purchases for your business. Include petty cash transactions, as well, if it applies to your company.

Income Listings

To create a profit and loss statement, you’ll need an account of all your income sources, including cash, check, credit and online payments your clients have made to your business.

To prepare a profit and loss statement, you’ll essentially be solving the basic equation for calculating profit:

Profit = Revenues – Expenses

Here are the steps to prepare an accurate profit and loss statement for your small business using the equation above, in greater detail:

Show Net Income

Show the net income generated by your business, typically titled “Sales”. If it’s helpful, you can then further break down your income into subsections, to show your different income sources.

Itemize Expenses

Itemize all your business expenses for the period you’re reporting on. You’ll want to show your expenses as a percentage of Sales.

Calculate EBITDA

Calculate your earnings before interest, taxes depreciation and amortization, commonly shortened to EBITDA. This will show the difference between Sales and Expenses As Earnings.

Account for Interest

If you have any business debt, you’ll need to account for your interest payments as part of the profit and loss statement. To do so, subtract your business debt for the year from your EBITDA.

Next, you’ll need to list your taxes on net income, and subtract it from your revenue.

Show Depreciation

Show the total depreciation and amortization for your business for the year, and subtract that from your revenue.

Calculate Profit

After the above calculations, you’ll be left with your net earnings or the profits generated by your business. Hopefully, you’ll report a profit, not a loss.

Profit and loss statement is also known as an Income statement in Accounting terms. If you need more guidance preparing your profit and loss statement? Visit our Guide on How to Make an Income Statement .

A profit and loss statement is useful for small businesses because it shows the profit (or loss) generated by the company for a specific period of time. The profit and loss statement is one of the fundamental financial statements for accounting, along with the balance sheet and cash flow statement. Together, forecasts of the three financial statements serve as a foundation for a new company’s business plan.

A profit and loss statement is a useful business document because it can help you analyze the financial health of your business. It compares the money going out of your business to the money coming into it, and so it can show you areas where you can cut back costs to increase your profits.

Profit and loss statements can help you or your accountant prepare your taxes. By preparing a profit and loss statement for the full fiscal year , you’ll have a useful document that will help you compile your income and expenses for your tax filing.

RELATED ARTICLES

How to Prepare a Profit and Loss (P&L) Statement for Your Startup

| Written by

Monitoring your startup’s finances is an integral part of knowing how to sustain and grow your business. A profit and loss (P&L) statement is one key element to measuring the health of your startup’s finances.

This guide walks you through what a P&L statement is, why your company needs it, and how to prepare a profit and loss statement for your startup.

P&L Statements for Startups

Tracking a company’s profit and loss provides entrepreneurs with insight into their startup’s financial wellness and performance over a period of time, allowing them to make better decisions for their business.

While it is possible to prepare a P&L statement using financial management software such as QuickBooks , knowing how to manually issue one can be valuable for entrepreneurs. Especially if they are looking to deeply familiarize themselves with their company’s financial position.

What Is a Profit and Loss statement?

A profit and loss (P&L) statement, commonly referred to as an income statement , is a summary of the net profit and loss of a company over a period of time. This is one of three financial reports businesses are required to prepare annually and quarterly, along with a cash flow statement and balance sheet .

The P&L statement, specifically, indicates whether a business is profitable or not, how much profit is being made, and helps when filing taxes.

Why Do I Need a P&L Statement for My Startup?

As mentioned above, P&L statements are one of the three reports businesses are required to issue. However, these statements also provide value for entrepreneurs and their teams to better their company’s financial position.

Tax Preparation

Not only is a P&L used by startup founders to gauge the financial performance of their company, but the Internal Revenue Service (IRS) uses these statements to make tax assessments as well.

Generates Feedback

The amount of profit versus expenses may help you better understand how your product or service is performing. This feedback may help you troubleshoot and adapt to better reach your target market.

How to Create a P&L statement

Many businesses choose to use software to track their finances that can easily issue a profit and loss statement. However, if you’d rather prepare one manually, here are six easy steps to create a P&L statement for your startup.

1. Choose Your Time Period

Whether you’re issuing an annual, quarterly, or monthly P&L sheet, your first step is to determine the reporting period you’re calculating for. Then, gather all of the information required to calculate revenue, expenses, and any other financial information from that period to create your statement.

2. Calculate Revenue

Next, calculate your company’s revenue for your reporting period. This will include any money you gain from the sale of your company’s profits or services.

It is helpful to keep these sales documented and organized as they occur.

3. Calculate Expenses

After you have determined the amount of money you have coming in, you need to calculate the money your company is spending, otherwise known as expenses or costs of goods sold .

This, however, does not include salaries, leases, or any other fixed expenses.

4. Find the Gross Profit

Your next step is to determine your gross profit by subtracting your operating expenses (Step 2) from your revenue (Step 3) listed above.

5. Add In Overhead Costs

Then, add your overhead costs . These are the fixed expenses that typically don’t change based on your revenue, such as salaries, rent, insurance, and other continuous expenses.

Subtract the total of your overhead costs from your gross profits to determine your operating income.

Keep in mind that if you have any non-operational expenses or revenue, such as interest or dividends, these will need to be added or subtracted from your operating income.

6. Assess the Net Profit

Once you have your operating income , you will know your net profit. This is how much profit or loss your company had over the reporting period after revenue and expenses.

You can use this number to assess the financial health of your company and make changes if needed to avoid losses in the future.

P&L Statement Tools for Startups

While it is possible to issue profit and loss statements manually, using financial management or accounting software makes the process easier and faster. Here are some great options for startup profit and loss statement tools.

1. QuickBooks

With QuickBooks ’ suite of accounting software tools, startups can easily manage their finances as well as prepare profit and loss statements with ease.

If you’re looking for a free P&L template as well as additional resources, Lili offers a variety of information. Plus, if you utilize Lili’s accounting software, profit and loss statements are automatically generated for you.

Lili is a financial technology company, not a bank. Banking services provided by Sunrise Banks N.A., Member FDIC.

3. FreshBooks

Finally, FreshBooks offers a free downloadable P&L template that is compatible with Google Sheets, Google Docs, PDFs, and more.

Further Reading

- Best Financial Tools to Track Startup Growth September 12, 2024

- Guide to Financial Modeling for Startups July 25, 2024

- Startup Costs Entrepreneurs Should Know July 25, 2024

Topics to Explore

- Startup Ideas

- Startup Basics

- Startup Leadership

- Startup Marketing

- Startup Funding

Browse Tags

COMMENTS

Step 1: Calculate revenue. The first step in creating a profit and loss statement is to calculate all the revenue your business has received. You can obtain current account balances from...

Preparing a profit and loss statement involves two multi-stage steps. First, find your gross profit by subtracting your COGS from your gross revenue. Then, subtract your total expenses from the gross profit to calculate the net income. Before you start, gather the necessary documents.

A profit and loss (P&L) statement, otherwise called an income statement, breaks down your profit and loss line by line so you can determine your net income and make wise decisions about business opportunities.

To take it from there to a more formal projected Profit and Loss is a matter of collecting forecasts from the lean plan. The sales and costs of sales go at the top, then operating expenses. Calculating net profit is simple math.

A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue. The profit and loss statement, also called an income statement, details a company’s financial performance for a specific period of time.

A profit and loss (P&L) statement is one key element to measuring the health of your startup’s finances. This guide walks you through what a P&L statement is, why your company needs it, and how to prepare a profit and loss statement for your startup.