How to Write a Letter to Bank to Unfreeze Your Bank Account – 9 Samples

If your bank account is frozen, to unfreeze the account, the bank manager will ask you to submit a request letter/application. Until you unfreeze your bank account you cannot withdraw funds using debit cards, cheques, UPI, and through internet banking,

Here you can find some of the best bank account unfreeze letter formats that you can submit to your bank manager. You can use any of the below formats that suit your requirements.

We will also guide you with FAQs and formatting tips to craft an effective “ application to unfreeze bank account”.

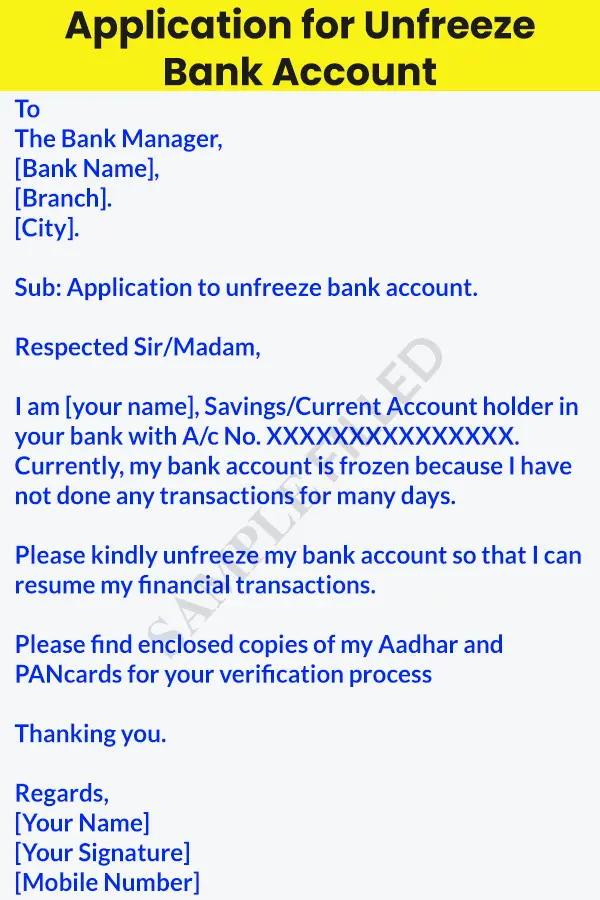

Application for Unfreeze Bank Account

To The Bank Manager, [Bank Name], [Branch]. [City].

Sub: Application to unfreeze bank account.

Respected Sir/Madam,

I am [your name], Savings/Current Account holder in your bank with A/c No. XXXXXXXXXXXXXXX. Currently, my bank account is frozen because I have not done any transactions for many days.

Please kindly unfreeze my bank account so that I can resume my financial transactions.

Please find enclosed copies of my Aadhar and PANcards for your verification process

Thanking you.

Regards, [Your Name] [Your Signature] [Mobile Number]

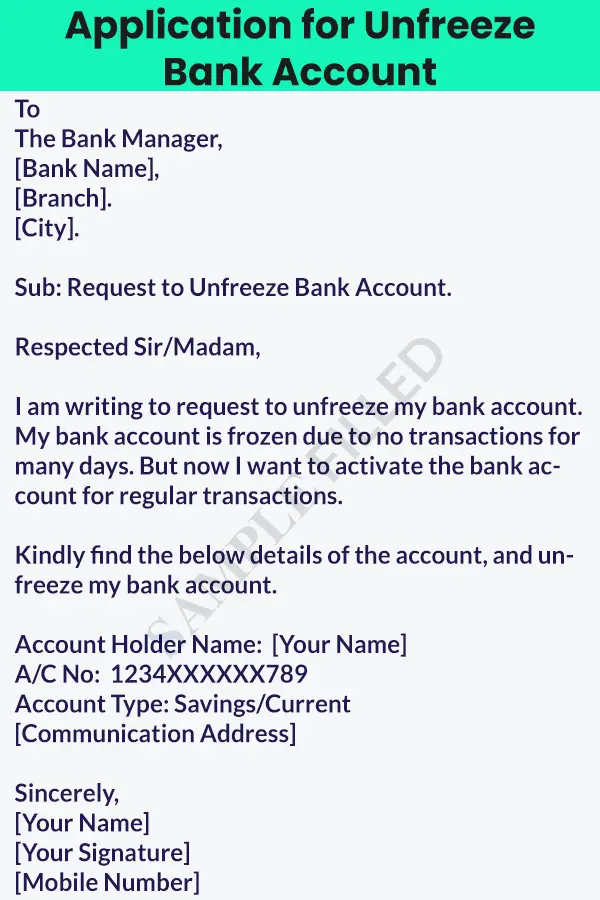

Simple Account Unfreeze Application

Sub: Request to Unfreeze Bank Account.

I am writing to request to unfreeze my bank account. My bank account is frozen due to no transactions for many days. But now I want to activate the bank account for regular transactions.

Kindly find the below details of the account, and unfreeze my bank account.

Account Holder Name: [Your Name] A/C No: 1234XXXXXX789 Account Type: Savings/Current [Communication Address]

Sincerely, [Your Name] [Your Signature] [Mobile Number]

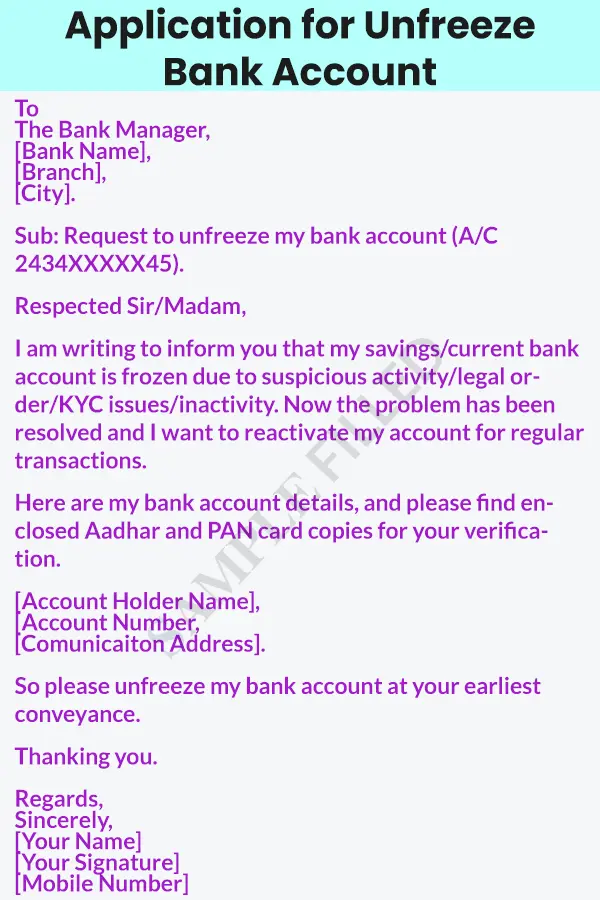

Unfreeze Bank Account Letter to Manager

To The Bank Manager, [Bank Name], [Branch], [City].

Sub: Request to unfreeze my bank account (A/C 2434XXXXX45).

I am writing to inform you that my savings/current bank account is frozen due to suspicious activity/legal order/KYC issues/inactivity. Now the problem has been resolved and I want to reactivate my account for regular transactions.

Here are my bank account details, and please find enclosed Aadhar and PAN card copies for your verification.

[Account Holder Name], [Account Number, [Comunicaiton Address].

So please unfreeze my bank account at your earliest conveyance.

Regards, Sincerely, [Your Name] [Your Signature] [Mobile Number]

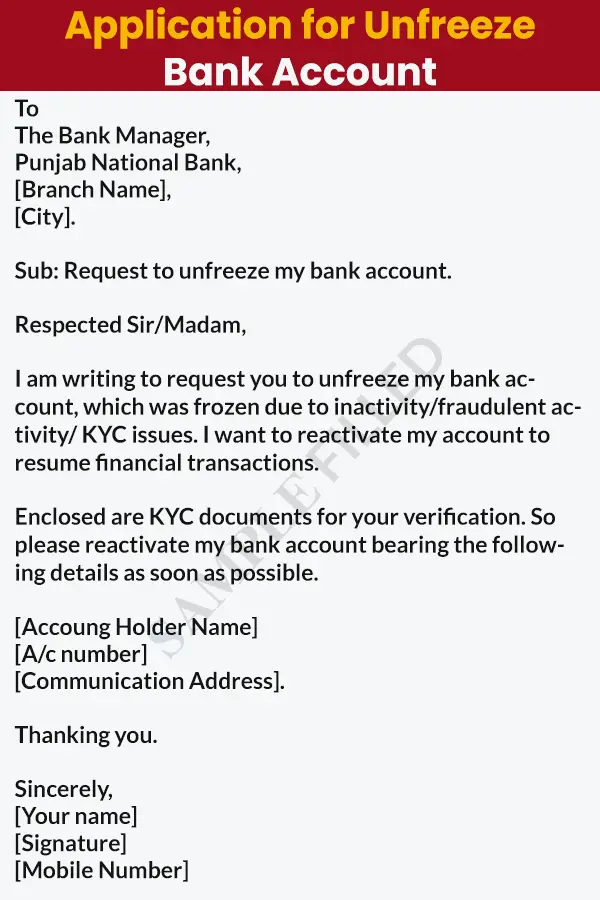

PNB Account Unfreeze Application

To The Bank Manager, Punjab National Bank, [Branch Name], [City].

Sub: Request to unfreeze my bank account.

I am writing to request you to unfreeze my bank account, which was frozen due to inactivity/fraudulent activity/ KYC issues. I want to reactivate my account to resume financial transactions.

Enclosed are KYC documents for your verification. So please reactivate my bank account bearing the following details as soon as possible.

[Accoung Holder Name] [A/c number] [Communication Address].

Sincerely, [Your name] [Signature] [Mobile Number]

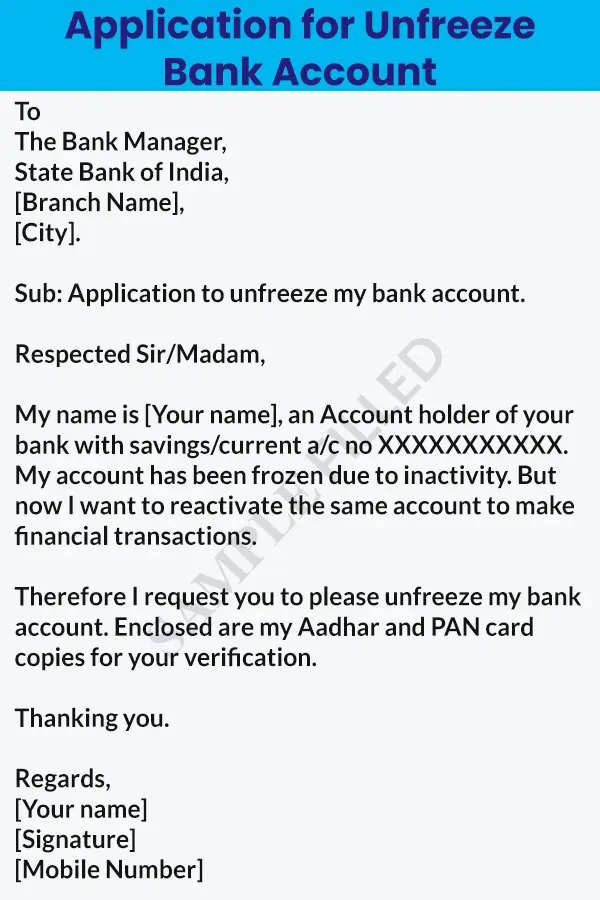

SBI Account Unfreeze Application

To The Bank Manager, State Bank of India, [Branch Name], [City].

Sub: Application to unfreeze my bank account.

My name is [Your name], an Account holder of your bank with savings/current a/c no XXXXXXXXXXX. My account has been frozen due to inactivity. But now I want to reactivate the same account to make financial transactions.

Therefore I request you to please unfreeze my bank account. Enclosed are my Aadhar and PAN card copies for your verification.

Regards, [Your name] [Signature] [Mobile Number]

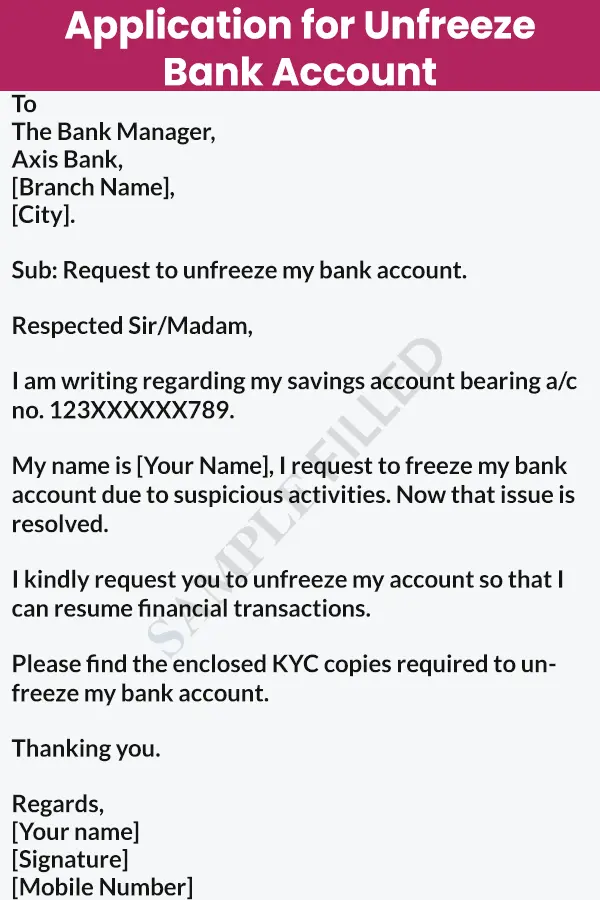

Axis Bank Account Unfreeze Application

To The Bank Manager, Axis Bank, [Branch Name], [City].

I am writing regarding my savings account bearing a/c no. 123XXXXXX789.

My name is [Your Name], I request to freeze my bank account due to suspicious activities. Now that issue is resolved.

I kindly request you to unfreeze my account so that I can resume financial transactions.

Please find the enclosed KYC copies required to unfreeze my bank account.

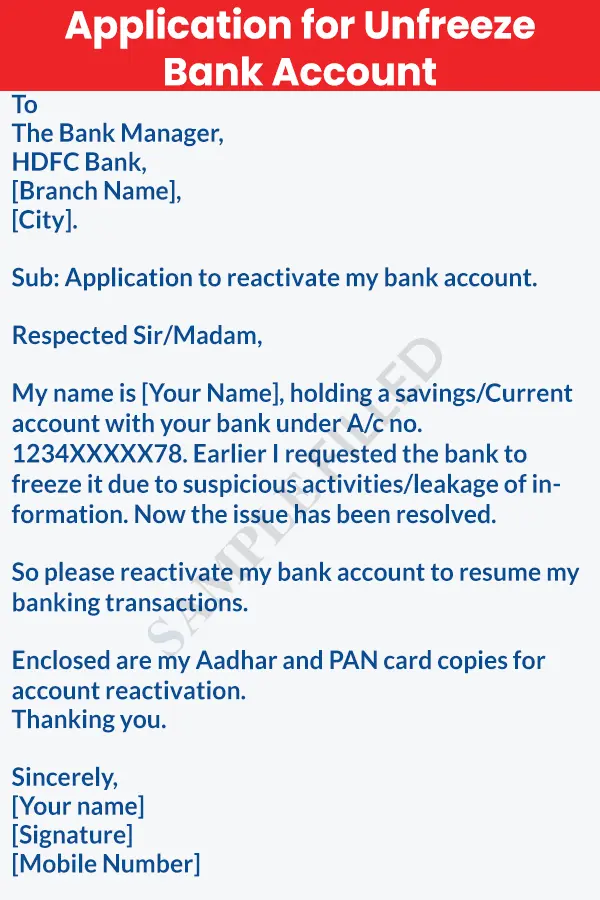

HDFC Account Unfreeze Application

To The Bank Manager, HDFC Bank, [Branch Name], [City].

Sub: Application to reactivate my bank account.

My name is [Your Name], holding a savings/Current account with your bank under A/c no. 1234XXXXX78. Earlier I requested the bank to freeze it due to suspicious activities/leakage of information. Now the issue has been resolved.

So please reactivate my bank account to resume my banking transactions.

Enclosed are my Aadhar and PAN card copies for account reactivation. Thanking you.

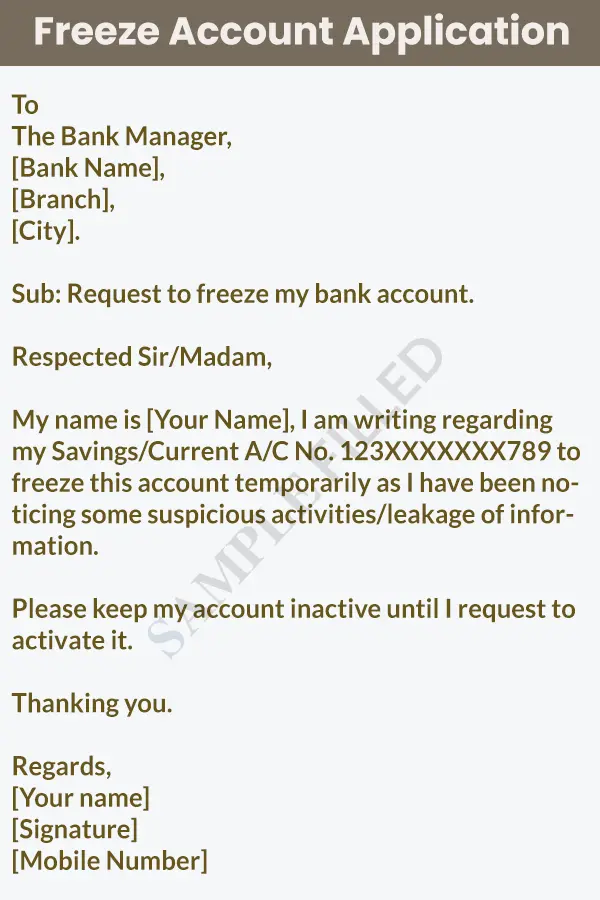

Freeze Account Application

Sub: Request to freeze my bank account.

My name is [Your Name], I am writing regarding my Savings/Current A/C No. 123XXXXXXX789 to freeze this account temporarily as I have been noticing some suspicious activities/leakage of information.

Please keep my account inactive until I request to activate it.

Components of a Good “Unfreeze Bank Account Application”

1. Recipient: Address the letter to the Bank manager, and include details like bank name, branch, and city.

2. Subject: use a simple subject line. Ex: Application to unfreeze my bank account (or) Request to unfreeze my bank account.

3. Salutation: Begin the letter with “Respected Sir/Madam”.

4. Introduction: Mention the purpose of the letter. Specify your identity as a Savings/Current account holder with the bank and also mention your Account number.

5. Explanation: Describe the reason for the account freeze such as inactivity/suspicious activities/fraudulent activities/ KYC issues etc.

6. Request: Request the bank manager to unfreeze the bank account so that you can resume your financial transactions.

7. Enclosures: Mention that you have enclosed required document copies such as Aadhar and PAN card for verification.

8. Thanking & Closure: Thank the bank manager for considering the request and close the letter with:

Regards, [Your Name] [Signture] [Mobile Number]

Tips to Write an Effective “ Unfreeze Bank Account Application”

1. Clear & Concise Subject Line: Use a clear and short subject line that informs the recipient about the purpose of the letter immediately.

2. Polite & Respectful Tone: Begin the letter with a courteous salutation “Respected Sir/Madam”, which shows politeness and respect towards the recipient.

3. Brief and to the Point: Clearly state the account holder’s name, account type, account number, and reason for the account being frozen.

4. Specific Request: Request the bank manager to unfreeze your bank account to resume your financial transactions.

5. Enclosure of Required Documents: Mention that you have enclosed copies of your Aadhar and PAN card to make the verification process smoother.

It takes 7-10 days, but the final duration depends on the bank’s policies and the reason for the freeze.

You receive notifications from the bank, and you will face problems in making financial transactions and accessing funds.

You should contact your bank directly and provide the required information and documentation to unfreeze your bank account.

There are several reasons to block a bank account inactivity/ suspicious activities/fraudulent activities/KYC issues/ court orders etc..

When a bank account remains inactive for a long period without any transactions or activity then it will become a dormant bank account. It levies fees and restrictions on using the account.

A frozen bank account can receive the money, but you can’t withdraw or transfer money.

You can withdraw or transfer the money only after unfreezing the account by the bank officials. For that, you have to resolve the issues causing the account freeze.

Yes, you can open a new bank account in the new bank, however, you will face difficulties if you want to open a new account in the same bank until you resolve the freezing issue.

Yes, banks can freeze your account for KYC (Know Your Customer) compliance reasons, such as not submitting Aadhar, PAN and identity details, etc.

It depends on the freezing reason. If you temporarily freeze your account then you can request the bank’s customer care to activate it. If the bank itself freezes your account then you have to visit the bank to activate it.

Recommended:

- 5+ Joint account to single account applications in English.

- Minor to major account applications to the bank manager .

Leave a Comment Cancel reply

Unfreeze Account Application Request (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional unfreeze account application request.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Application for Unfreezing an Account

First, find the sample template for unfreeze account application request below.

To, The Branch Manager, [Bank Name], [Branch Name & Address],

Subject: Request to Unfreeze Account

Respected Sir/Madam,

I, [Your Name], am writing this letter to inform you that my account number [Account Number] with [Bank Name] at your branch has been frozen due to some unknown reasons. I came to know about this situation when I was not able to withdraw money from the ATM on [Date].

I kindly request you to look into this matter urgently as I am unable to carry out necessary transactions. I assure you that if there are any discrepancies from my end, they are unintentional and I am ready to provide all the necessary information or documents required for this process.

I am hoping for a quick resolution to this issue as it is causing me a lot of inconvenience. I have been a loyal customer of your bank for [number of years] years and I have always complied with the necessary rules and regulations.

I would like to bring to your notice that I have not received any prior notice or warning regarding any irregularities in my account activities. Therefore, I was taken aback by this sudden action.

I kindly request you to unfreeze my account at the earliest and also provide me with information about the cause of this issue, so that I can prevent such situations in the future.

Thanking you in anticipation of your prompt action.

Yours faithfully,

[Your Name] [Your Address] [Your Contact Number] [Your Email Address]

Below I have listed 5 different sample applications for “unfreeze account application request” that you will certainly find useful for specific scenarios:

Application for Unfreezing Bank Account due to Identity Theft

To, The Branch Manager, [Your Bank’s Name], [Your Bank’s Address],

Subject: Application for Unfreezing Bank Account due to Identity Theft

I, [Your Full Name], holding the account number [Your Account Number] at your esteemed bank, write this letter to bring a serious issue to your attention. Recently, I became a victim of identity theft, and as a safety measure, my account was frozen by the bank, a decision I fully understand and appreciate.

However, I have since taken stringent actions to rectify this situation. I have filed a complaint with the local police station and the cybercrime cell, and they are currently investigating the matter. I have also taken measures to secure my personal information to prevent any such incident in the future.

I hereby request you to unfreeze my bank account, as I am facing difficulties in performing my day-to-day financial transactions. I assure you that all necessary steps have been taken to prevent any further unauthorized access to my account. I have attached the copies of the police complaint and the acknowledgement from the cybercrime cell for your perusal.

I kindly urge you to expedite this process as it is causing me significant inconvenience. I am willing to visit the branch and provide any further information or undergo any process that you may deem necessary.

Thank you for your understanding and cooperation. I trust that my request will be processed at the earliest.

Yours faithfully, [Your Full Name] [Your Contact Number] [Your Email Address] [Date]

Attachments: Copy of Police Complaint, Cybercrime Cell Acknowledgement

Application for Reactivating Dormant Account

To, The Branch Manager, [Bank’s Name], [Bank’s Branch Address],

Subject: Application for Reactivation of Dormant Account

Dear Sir/Madam,

I, [Your Name], an account holder in your esteemed bank with the account number [Account Number], am writing this letter to inform you that my above-mentioned account has unfortunately become dormant due to a long period of inactivity.

I was unable to operate this account for a considerable duration because [provide reason if comfortable]. Now, I wish to reactivate the same as it is beneficial for my financial transactions.

I understand that I have to submit my recent KYC documents for the reactivation process. Therefore, I am enclosing my updated KYC documents, which include my Aadhaar Card and PAN Card, with this letter.

I humbly request you to process my application at the earliest and reactivate my account. I assure you that I will maintain the required minimum balance and will be regular in my transactions henceforth.

Looking forward to your prompt assistance in this matter.

Thank you for your cooperation.

Yours sincerely, [Your Name] [Your Address] [Your Contact Number] [Your Email ID]

Request Application for Unfreezing Account after False Fraud Alert

To, The Branch Manager, [Your Bank’s Name], [Your Branch’s Address],

Subject: Request for Unfreezing Account following False Fraud Alert

I, [Your Full Name], am a savings account holder with your esteemed bank, holding account number [Your Account Number]. I am writing this letter to bring to your attention an issue that has arisen with my account.

Recently, I received a notification from your bank stating that my account has been frozen due to a suspected fraudulent activity. I understand that such measures are necessary to ensure the security of my account and I appreciate the bank’s vigilance towards protecting my funds.

However, I believe that this is a case of a false alarm. The transactions deemed suspicious were authorized by me and there has been no unauthorized access to my account.

I kindly request you to review my case and take necessary actions to unfreeze my account. I am ready to provide any further information or complete any formalities that may be required for this process. I assure you that all transactions from my account are legitimate and I will be more careful about notifying the bank about any large or unusual transactions in the future.

I apologize for any inconvenience caused and appreciate your immediate attention to this matter. I hope for a quick resolution so that I can continue to utilize your banking services without any hindrances.

Yours sincerely, [Your Full Name] [Your Contact Number] [Your Email Address]

Application for Account Unfreezing after Resolving Compliance Issues

To, The Branch Manager, [Bank’s Name], [Branch’s Address]

Subject: Application for Unfreezing of Account

I, [Your Full Name], am holding a savings/current account (Account Number: [Your Account Number]) in your reputed bank at the [Branch’s Name]. My account was frozen due to some compliance issues which I have now duly resolved.

I deeply regret the inconvenience caused due to the non-compliance earlier. However, I have now ensured that all necessary compliance as per the rules and regulations of our bank and the Reserve Bank of India are met.

The documents verifying the resolution of these issues are attached with this application for your perusal. I request you to kindly review the attached documents and consider my request for unfreezing my account.

I understand the importance of abiding by the rules set by the bank and assure you that I will adhere to them in the future. I am hopeful that you will understand my situation and assist me in this regard.

I appreciate your prompt attention to this matter. If you require any additional information or clarification, please feel free to contact me at [Your Contact Number] or [Your Email Address].

Thank you for your understanding and support.

Yours faithfully, [Your Full Name] [Your Contact Number] [Your Email Address] [Your Address]

Attachments: [List all the documents that you are attaching]

Request for Business Account Unfreezing Application after Audit Completion

To, The Branch Manager, [Bank Name], [Branch Address], [City Name], [State Name], [Postal Code]

Subject: Request for Unfreezing Business Account After Audit Completion

I, [Your Name], the proprietor of [Your Company Name], am writing this letter to bring your attention to an urgent matter regarding our business account no. [Account Number].

Our account was frozen on [Date when the account was frozen] due to an ongoing audit process. I am glad to inform you that the audit has now been completed successfully without any discrepancies identified. All the necessary documents and reports supporting the completion of the audit have been duly compiled and are ready for your scrutiny.

In light of this, I kindly request you to initiate the process of unfreezing our business account at the earliest. The non-operation of this account has been causing significant inconvenience in our day-to-day business transactions and operations. The lifting of the freeze will enable us to resume our normal course of business.

I am ready to provide any additional documents or information required for this process. Please feel free to contact me at [Your Contact Number] or [Your Email Address] if there are any further inquiries or clarifications needed.

I look forward to your prompt action regarding this matter. Thank you for your understanding and cooperation.

[Your Full Name] [Your Position in the Company] [Your Company Name] [Your Contact Number] [Your Email Address]

Date: [Current Date] Place: [Your Location]

How to Write Unfreeze Account Application Request

Some writing tips to help you craft a better application:

- Start with your name, account number, and contact information.

- Use a clear subject line like ‘Request to Unfreeze Account’.

- Explain when and why your account was frozen if known.

- Assure the bank you have resolved any issues that caused the freeze.

- Provide any supporting documents to back up your claim.

- Politely request them to unfreeze your account.

- Offer to provide additional information if required.

- Thank them for their time and consideration.

- End the letter with your signature and date.

Related Topics:

- Request for Account Renewal Application

- Account Reactivation Request Application

- Application for Account Name Correction

View all topics →

I am sure you will get some insights from here on how to write “unfreeze account application request”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Urgent Letter To Unfreeze Bank Account (Free Sample)

In this article, I’m here to share my knowledge and provide you with a step-by-step guide, including a customizable template , to help you navigate this frustrating scenario.

Letter to Unfreeze Bank Account Generator

Your letter:.

Disclaimer: This is a general template and should be customized to your specific situation. Please seek legal advice if necessary.

Key Takeaways Purpose : A step-by-step guide on writing a request letter to unfreeze a bank account. Audience : Bank account holders facing account freeze issues. Free Template : Utilize the provided template to simplify the process.

Understanding the Need for a Request Letter

A bank may freeze an account for various reasons – suspected fraudulent activity, unpaid debts linked to the account, or failure to comply with banking regulations, to name a few.

A request letter to unfreeze your account is a formal way of communicating with your bank, explaining your situation, and requesting them to lift the freeze.

Step-by-Step Guide to Writing the Letter

1. gather necessary information.

Before drafting your letter, ensure you have all relevant details: your account number, the date you noticed the account was frozen, and any related incident or reference numbers.

2. Start with Basic Formal Letter Format

Trending now: find out why.

Use a formal letter format starting with your contact information, date, and the bank’s details. Address the letter to the specific department or individual if known.

3. Clearly State the Purpose of the Letter

In the opening paragraph, clearly state that you are writing to request the unfreezing of your bank account. Mention your account number and any relevant details.

4. Explain Your Situation

Provide a clear and honest explanation of the circumstances leading to the account freeze, if known. Be concise and factual.

5. Request for Specific Action

Politely request the bank to unfreeze your account. If there are any steps you need to take, mention your willingness to cooperate.

6. Attach Necessary Documentation

If applicable, attach copies of any documents that support your case (e.g., proof of identity, legal documents).

7. Conclude with a Thank You

End the letter with a polite thank you, expressing appreciation for their time and assistance.

8. Proofread and Send

Finally, proofread your letter for any errors and send it through the appropriate channel (mail, email, or in-person).

Template for Request Letter to Unfreeze Bank Account

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date]

[Bank’s Name] [Bank’s Address] [City, State, Zip Code]

Dear [Bank Manager’s Name/Bank’s Department],

I am writing to request the unfreezing of my bank account [Your Account Number]. I noticed the account was frozen on [Date], and I believe this may be due to [Your Reason/Incident Reference Number, if applicable].

I understand that accounts may be frozen for various reasons, and I am eager to resolve any issues that may have led to this action. [Explain your situation briefly and factually].

I kindly request your assistance in unfreezing my account. I am willing to provide any additional information or documentation required for this process.

Thank you for your time and attention to this matter. I appreciate your prompt response and assistance.

Sincerely, [Your Name]

Tips for Writing the Request Letter

- Clarity: Ensure that the letter is clear, concise, and to the point.

- Professional Tone: Maintain a professional tone throughout the letter.

- Correct Addressee: Address the letter to the appropriate authority for effective communication.

- Detailed Information: Provide all necessary details to avoid any delays due to lack of information.

- Follow-Up: Express your availability for any required follow-up or additional information.

By adhering to these guidelines and utilizing the provided sample, you can craft a compelling request letter to expedite the unfreezing of your bank account and regain access to your funds.

Unfreezing Process Timeline Calculator

Related posts.

- Sample Letter to Unfreeze Bank Account due to Inactivity

- Sample Letter to Unfreeze Bank Account due to Legal Action

- Sample Letter to Unfreeze Bank Account due to Suspicious Activity

- Sample Letter to Unfreeze Bank Account due to Error

- Sample Letter to Unfreeze Bank Account due to Technical Issues

Frequently Asked Questions (FAQs)

Q1: How can I write a letter to unfreeze my bank account?

Answer: In my experience, it’s crucial to clearly state your full name, account number, and the date when the account was frozen. I always recommend asking directly for the account to be unfrozen and explaining any misunderstandings that led to the freeze.

Q2: What information do I need to include in a letter to unfreeze my bank account?

Answer: When I write these letters, I ensure to include identification details, account information, any supporting documents like proof of identity or transaction receipts, and a concise explanation of why the freeze may have been a mistake.

Q3: How long does it typically take for a bank to unfreeze an account after they receive the letter?

Answer: Based on my interactions, it typically takes about 7 to 10 business days for a bank to process the unfreeze request after they receive the letter, depending on the bank’s internal procedures.

Q4: Can I email a letter to unfreeze my bank account, or does it need to be mailed?

Answer: I’ve successfully used both methods, but I find emailing faster and more efficient. However, some banks may require a hard copy for their records.

Q5: Who should I address the letter to when requesting to unfreeze my bank account?

Answer: From my past experiences, it’s most effective to address the letter directly to the branch manager of your bank or the customer service department.

Q6: What tone should I use in writing a letter to unfreeze my bank account?

Answer: I always use a polite and professional tone, as being courteous can facilitate a smoother interaction and potentially quicker resolution.

Q7: Should I mention my previous communications with the bank in the letter to unfreeze my account?

Answer: Absolutely, referencing previous communications provides context and shows your proactive approach in resolving the issue. I find this often speeds up the process.

Q8: What documents are commonly required to support a letter to unfreeze a bank account?

Answer: Typically, you might need to include a copy of your ID, any relevant transaction receipts, and possibly a police report if the freeze was due to fraudulent activity.

Q9: How should I follow up after sending a letter to unfreeze my bank account?

Answer: I recommend following up with a phone call or an email after a week if you haven’t received any response; it shows your urgency and commitment to resolving the matter.

Q10: Can freezing of my bank account affect my credit score?

Answer: Based on what I’ve learned, the freezing of your account itself doesn’t affect your credit score; however, it can indirectly affect financial activities that might impact your score.

Q11: What are common reasons banks freeze accounts?

Answer: From my dealings, common reasons include suspected fraudulent activities, discrepancies in personal information, or significant changes in banking behavior that trigger security protocols.

Q12: Is there a fee to unfreeze a bank account?

Answer: In my experience, there usually isn’t a fee for unfreezing an account, but this can vary depending on the bank’s policy.

Q13: What if the bank refuses to unfreeze my account even after sending a letter?

Answer: If this happens, I advise contacting higher authorities within the bank or seeking legal advice to explore further options.

Q14: Can I access other bank services while my account is frozen?

Answer: While your account is frozen, access to funds is restricted, but you might still be able to access some other services. It’s best to check with your bank directly.

Q15: Should I visit the bank in person if my account doesn’t get unfrozen after the letter?

Answer: I have found that visiting the bank in person can often lead to quicker resolutions and clearer communication.

Q16: How can I prevent my bank account from being frozen again in the future?

Answer: Keeping your contact information up to date, monitoring your account regularly, and notifying your bank of unusual activities are practices I follow to prevent future freezes.

Q17: What impact does a frozen account have on pending transactions?

Answer: From my experience, pending transactions may not be processed, which can lead to non-sufficient funds (NSF) fees if not managed promptly.

Q18: Can a bank freeze an account without notifying the account holder?

Answer: Yes, banks can freeze accounts without prior notification, especially if they suspect fraudulent or illegal activities.

Q19: What rights do I have if my bank account is unjustly frozen?

Answer: You have the right to be informed about the reasons for the freeze and to appeal the decision through proper channels, which I have exercised in the past.

Q20: How do I craft an effective appeal against a bank account freeze?

Answer: An effective appeal should be factual, include any supporting documents, and clearly state your case as to why the freeze is unjustified, which has worked for me previously.

Q21: Are there any specific regulations that banks need to follow when freezing accounts?

Answer: Yes, banks are required to comply with legal standards and regulations, such as providing reasons for the account freeze and following due process.

Q22: How can I find out the exact reason my account was frozen?

Answer: You should directly contact your bank’s customer service; I’ve found they can provide specific details regarding the freeze.

Q23: What legal actions can I take if a bank wrongly freezes my account?

Answer: Consulting with a legal expert to explore options like filing a complaint with the banking ombudsman has been my approach when needed.

Q24: Can I open a new bank account if my current one is frozen?

Answer: Yes, you can open a new account unless the freeze is due to a legal investigation that might influence other financial institutions.

Q25: Will closing a frozen account resolve the issues?

Answer: Closing a frozen account does not necessarily resolve underlying issues and may impact your relationship with future bankers, based on my experiences.

MORE FOR YOU

Ultimate loan repayment letter template.

Discover a free sample loan repayment letter template to help you craft a compelling and effective repayment plan.

Read More »

Sample Letter to Bank for Name Change after Marriage

Changing your name after marriage is a significant life event, and one of the essential steps is to update your name with various institutions, including…

Urgent Request Letter to Stop Auto Debit (Free Sample)

If you’ve ever found yourself in a situation where auto-debits have unexpectedly drained your account, you’re not alone. Over the years, I have helped numerous…

Sample Letter Informing Change of Email Address to Bank: Free & Effective

As someone who has written numerous letters to banks about updating email addresses, I understand the nuances of this seemingly simple task. In this article,…

Sample Letter for Cheque Book Request

With extensive experience in writing cheque book request letters, I offer a step-by-step guide and template to ensure your request is effective, whether you’re new…

Sample Letter to Creditors Unable to Pay Due to Death

Through this article, I aim to guide you step-by-step in crafting a compassionate yet effective letter to your creditors, sharing proven templates and personal tips…

3 thoughts on “Urgent Letter To Unfreeze Bank Account (Free Sample)”

How to withdraw money from a frozen account?

From what I’ve dealt with, the first thing you gotta do is figure out why your account got frozen in the first place. This usually means getting in touch with your bank or whoever put the freeze on.

After that, it’s all about sorting out whatever the problem is, like handing over any paperwork they need or fixing any issues with your account. That’s how you get your hands back on your money.

I’ve been struggling to unfreeze my account for weeks. This letter gives me hope—thanks for such a detailed template!

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *