Do You Need a Business Plan? Scientific Research Says Yes

Noah Parsons

13 min. read

Updated November 20, 2023

Should you spend some time developing a plan for your business, or just dive in and start, figuring things out as you go? There has been plenty of debate on this topic, but no one has pulled together the scientific evidence to determine if planning is worthwhile—until now .

With the help of my friend Jeff, from the University of Oregon, I’ve been looking at academic research on business planning—the actual science around planning and how it impacts both startups and existing businesses.

But, before we dive into the data, why do we even need to look at research on business planning? It seems like most advice on starting a business includes writing a business plan as a necessary step in the startup process. If so many people encourage you to write one, business plans must add value, right?

Well, over the past few years, there’s been a lot of controversy about the value of business plans. People look at certain companies that have been very successful but haven’t written business plans and conclude that planning is a waste of time.

After all, taking the time to plan is a bit of a trade-off. The time you spend planning could be time spent building your company. Why not just “get going” and learn as you build your company, instead of taking the time to formulate a strategy and understand your assumptions about how your business might grow?

Well, the research shows that it’s really not a “write a plan” or “don’t write a plan” conversation. What really matters is what kind of planning you do and how much time you spend doing it.

- Planning can help companies grow 30 percent faster

One study (1) published in 2010 aggregated research on the business growth of 11,046 companies and found that planning improved business performance . Interestingly, this same study found that planning benefited existing companies even more than it benefited startups.

But, this study still doesn’t answer the question it raises:

Why would planning help a business that has a few years of history more than one that is just starting up?

The answer most likely lies in the fact that existing businesses know a bit more about their customers and what their needs are than a new startup does. For an existing business, planning involves fewer guesses or assumptions that need to be proven, so the strategies they develop are based on more information.

Another study (2) found that companies that plan grow 30 percent faster than those that don’t plan. This study found that plenty of businesses can find success without planning, but that businesses with a plan grew faster and were more successful than those that didn’t plan.

To reinforce the connection between planning and fast growth, yet another study (3) found that fast-growing companies—companies that had over 92 percent growth in sales from one year to the next—usually have business plans. In fact, 71 percent of fast-growing companies have plans . They create budgets, set sales goals, and document their marketing and sales strategies. These companies don’t always call their plans “business plans” but instead often refer to things like strategic plans, growth plans, and operational plans. Regardless of the name, it’s all forward-looking planning.

Action: Carve out some time to set goals and build a plan for your business. More importantly, re-visit your plan as you grow and revise it as you learn more about your business and your customers.

Business planning is not an activity you undertake only when you’re getting your business up and running. It should be something you return to, time and time again, to revise and improve upon based on new knowledge.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The quality of the plan matters

But, it’s not as simple as it might appear. Just having a plan doesn’t guarantee faster growth. It’s the kind of plan you have and how you use it that really matters .

It turns out that startups, especially ones building highly innovative businesses, should create shorter, less detailed plans (4). That’s because these innovative startups are learning new things about their product and customers at a very fast pace and their strategies change more frequently. Simpler plans get updated more frequently and are more helpful to these companies because they can review their strategy at a glance.

Meanwhile, more established companies know a lot more about their products and customers and can craft more detailed strategies that are less likely to change as quickly. For these companies, more detailed planning is generally more helpful.

And it’s not just the size of the plan that matters. What you include in your plan is important as well.

The same study we talked about above—the one that found that businesses grow faster with a plan—also found that companies that did a good job defining their value proposition do even better than companies that have a hard time defining their customers’ needs.

These researchers also found that having a plan is less about accurately predicting the future, and more about setting regular goals, tracking your actual progress toward those goals and making changes to your business as you learn more about your customers. Silicon Valley businesses like to call the act of changing strategic direction “pivoting.” All it really means is that you need to stay nimble, keep your eyes open, and be willing to make changes in your business as you compare your actual results to your goals and gather additional feedback from your customers.

Action: Skip the 40-page business plan and instead focus on simpler planning that defines your goals and documents your customers’ needs. Adjust your plan frequently as you learn more about your business.

Being prepared matters when you’re seeking funding

Over and over again, you hear venture capitalists talk about how much the team matters in a funding decision. Beyond just the team, you also hear them talk about passion—how much the entrepreneur believes in the idea.

But, it turns out that there is something that trumps passion when VCs make their decisions. Research shows (5) that how well an entrepreneur is prepared is much more important than how much passion they have.

This doesn’t mean that VCs will ask for a business plan. In fact, they probably won’t ask for one.

What it means is that entrepreneurs need to have done some planning, in some form, so that they can be prepared to talk intelligently about their idea, their target market, their sales and marketing strategies, and so on.

So, the formal 40-page business plan document may not be useful when you’re pitching VCs. But, you’d better have done some planning, so that you can communicate verbally or through a pitch deck what would normally have been found in that written document.

And, not only will business planning help you be more prepared, it will actually improve your chances of getting funded. A study at the University of Oregon (6) found that businesses with a plan were far more likely to get funding than those that didn’t have a plan .

Action: Know your business inside and out. Document your strategy in an internal document, but skip all the time and effort creating a well-crafted business plan document.

When you start planning is important—the earlier the better

So, if business planning increases your likelihood of success, and in fact helps you grow faster, when should you start working on a business plan?

Research shows (7) that entrepreneurs who started the business planning process early were better at what the scientists call “establishing legitimacy.” That’s a fancy way of saying that these entrepreneurs used business planning to start the process of talking with potential customers, working with business partners, starting to look for funding, and gathering other information they needed to start their business.

Entrepreneurs that did a good job of using their business plan to “establish legitimacy” early were more likely to succeed and their businesses tended to last longer.

Not only that, starting the planning process before starting marketing efforts and before talking to customers reduces the likelihood that a business will fail ( 8).

That said, planning should never take the place of talking to customers. An ongoing planning process—one in which the plan is constantly revised as new information is gathered—requires that you talk to your potential customers so that you can learn more about what they need, what they are willing to pay, and how you can best reach them.

Action: Start the planning process early. Even if all you do is build out a simple elevator pitch to try your idea on for size, it will help you begin the conversation with potential customers and kick-start your business.

- Planning makes you more likely to start your business

If you’re like me, and like most entrepreneurs, you like to dream up new business ideas. You constantly think of new ways to improve existing businesses and solve new problems.

But, most of those dreams never become a reality. They live on as ideas in your head while other entrepreneurs see the same opportunity and find a way to make it happen.

It turns out that there’s a way to turn more of your ideas into a viable business. A study published in Small Business Economics found that entrepreneurs that take the time to create a plan for their business idea are 152 percent more likely to start their business ( 9). Not only that, those entrepreneurs with a plan are 129 percent more likely to push forward with their business beyond the initial startup phase and grow it. These findings are confirmed by another study that found that entrepreneurs with a plan are 260 percent more likely to start their businesses (10).

Interestingly, these same entrepreneurs who build plans are 271 percent more likely to close down a business . This seems counterintuitive to the stats above, but when you think about it a bit more, it makes a lot of sense.

Entrepreneurs with plans are tracking their performance on a regular basis. They know when things aren’t going to plan—when sales aren’t meeting projections and when marketing strategies are failing. They know when it’s time to walk away and try a different idea instead of riding the business into the ground, which could have disastrous results.

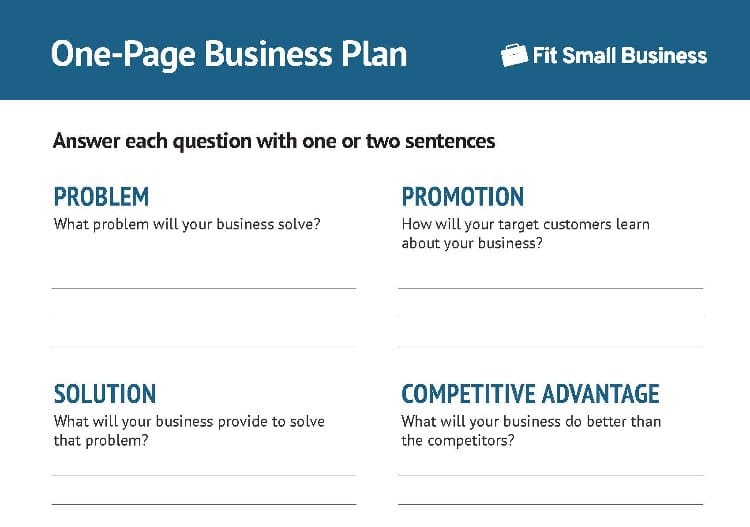

Action: If you really want to start a business, start committing your goals and strategy to paper. Even if it’s just a simple one-page business plan, that will help you get started faster. And, once you do start, track your performance so you know when to change direction and try something different.

You’re less likely to fail if you have a plan

Nothing can absolutely prevent your company from failing, but it turns out that having a plan can help reduce your risks.

Yet another study of 223 companies found that having a plan reduced the likelihood that a business would fail. Having a plan didn’t guarantee success, unfortunately. But, those companies with a plan had better chances of success than those that skipped the planning process.

Having a plan and updating it regularly means that you are tracking your performance and making adjustments as you go. If things aren’t working, you know it. And, if things are going well, you know what to do more of.

Action: Build a plan, but don’t just stick it in a drawer. Track your performance as you go so you can see if you’re reaching your goals. Your plan will help you discover what’s working so you can build your business.

- Your success depends on the type of planning you do

In the end, creating a business plan seems like common sense. You wouldn’t set out on a trip without a destination and a map, would you?

It’s great to see research back up these common-sense assumptions. The research also validates the idea that the value of business planning really depends on how you approach it.

It’s not a question of whether you should plan or not plan—it’s what kind of planning you do. The best planning is iterative; it’s kept alive and it adapts.

It’s not about predicting the future as if you’re a fortune teller at a carnival. Instead, it’s a tool that you use to refine and adapt your strategy as you go, continuing to understand your market as it changes and refining your business to the ever-changing needs of your customers.

I recommend starting with a one-page plan. It’s a simpler form of planning where you can start by documenting your business concept on a single page. From there, iterate, gather feedback, and adjust your plan as needed. If you need some inspiration, check out our gallery of over 550 free sample business plans .

Finally, a big “thank you” to Jeff Gish at the University of Oregon , who was immensely helpful in gathering and analyzing the research mentioned in this article.

What has your experience with business planning been like? Will you approach the planning process differently in the future? Tell me on Twitter @noahparsons.

References:

1 Brinckmann, J., Grichnik, D., & Kapsa, D. (2010). Should entrepreneurs plan or just storm the castle? A meta-analysis on contextual factors impacting the business planning–performance relationship in small firms. Journal of Business Venturing, 25(1), 24-40. doi: 10.1016/j.jbusvent.2008.10.007

2 Burke, A., Fraser, S., & Greene, F. J. (2010). The multiple effects of business planning on new venture performance. Journal of Management Studies, 47(3), 391-415.

3 Upton, N., Teal, E. J., & Felan, J. T. (2001). Strategic and business planning practices of fast growth family firms. Journal of Small Business Management, 39(1), 60-72.

4 Gruber, M. (2007). Uncovering the value of planning in new venture creation: A process and contingency perspective. Journal of Business Venturing, 22(6), 782-807. doi: 10.1016/j.jbusvent.2006.07.001

5 Chen, X.-P., Yao, X., & Kotha, S. (2009). Entrepreneur passion and preparedness in business plan presentations: A persuasion analysis of venture capitalists’ funding decisions. Academy of Management Journal, 52(1), 199-214.

6 Ding, E., & Hursey, T. (2010). Evaluation of the effectiveness of business planning using Palo Alto’s Business Plan Pro. Department of Economics. University of Oregon.

7 Delmar, F., & Shane, S. (2004). Legitimating first: Organizing activities and the survival of new ventures. Journal of Business Venturing, 19(3), 385-410. doi: 10.1016/s0883-9026(03)00037-5

8 Shane, S., & Delmar, F. (2004). Planning for the market: Business planning before marketing and the continuation of organizing efforts. Journal of Business Venturing, 19(6), 767-785. doi: 10.1016/j.jbusvent.2003.11.001

9 Hechavarria, D. M., Renko, M., & Matthews, C. H. (2011). The nascent entrepreneurship hub: Goals, entrepreneurial self-efficacy and start-up outcomes. Small Business Economics, 39(3), 685-701. doi: 10.1007/s11187-011-9355-2

10 Liao, J., & Gartner, W. B. (2006). The effects of pre-venture plan timing and perceived environmental uncertainty on the persistence of emerging firms. Small Business Economics, 27(1), 23-40. doi: 10.1007/s11187-006-0020-0

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Being prepared matters when you’re seeking funding

- When you start planning is important—the earlier the better

- You’re less likely to fail if you have a plan

Related Articles

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

10 Min. Read

Use This Simple Business Plan Outline to Organize Your Plan

14 Reasons Why You Need a Business Plan

3 Min. Read

How Long Should a Business Plan Be?

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

Do You Really Need a Business Plan?

The art of storytelling, from net margin to sales.

Why is a business plan important?

- Who will the reader be?

- What do you want their response to be?

Four Reasons to Write a Business Plan

1. To raise money for your business

2. To make sound decisions

3. To help you identify any potential weaknesses

4. To communicate your ideas with stakeholders

More by this contributor:

- Challenges Become Opportunities

- Discontinuing Healthy Workplace Consultancy

- Financial Planning for the Pandemic

Comments (0)

You may like.

How to Write a Business Plan for Your Small Business

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Training and Development

- Beginner Guides

Blog Business

Small Business Owners: How to Write Your Business Plan [+ Editable Templates]

By Krystle Wong , Apr 03, 2023

As a small business owner, it can be tempting to jump right into launching your business and skip the step of creating a business plan. However, having a well-written business plan is essential to the success and growth of your business.

A business plan serves as a roadmap for your business, outlining your goals, strategies, and action plans. It helps you stay on track and focused, ensuring that every decision you make is aligned with your overall business objectives.

While creating a business plan may seem daunting, it’s worth the time and effort to ensure the long-term success of your business. In this article, I’ll dive into the insights on how a business plan can help your small business thrive and how to create one that stands out.

Ready to get started with creating a business plan to win over your investors? Pick from Venngage’s 10,000+ professional templates to customize your own for free!

Click to jump ahead:, why is having a business plan important for small businesses, what are the 3cs for writing a successful small business plan, what are the 7 steps of creating a winning business plan, how to make my small business plan stand out.

Nevertheless, you may be wondering – is it really necessary to go the extra mile and build a business plan even as a small business?

For many business owners, it’s easy to get caught up in the day-to-day operations of running your business. However, it’s essential to take a step back and create a solid business plan – especially if you’re looking to:

1. Clarify your vision and goals

Whether you’re trying to start a new business or expand your existing business, it’s important to know what your goals are. The plan will serve as a blueprint for how you plan to grow and sustain your business over time.

2. Secure Funding

Another reason for writing a business plan is to seek out investors for your business. A compelling business plan demonstrates the potential for growth and profitability of your business and increases your chances of securing funding. Partnering with a reliable invoice finance provider can offer a flexible solution to manage cash flow and support growth, especially when navigating the financial complexities of expanding a small business.

3. Identify potential challenges

From financial obstacles to operational and staffing challenges, having a business plan forces you to think critically about your business. From there, you can develop strategies to address these challenges more effectively.

4. Attract and retain customers

Having an exciting product or service is simply not enough. You need to think about how you can get customers to keep coming back to sustain in the long run. With a business plan, you can develop a strategy that resonates with your customers and stand out from the competition.

5. Measure performance

Your should include your financial projections and key performance indicators to measure your achievements. By regularly reviewing and updating your business plan, you can also ensure that your business is on track to meet its goals.

Ready to put your ideas down on paper? Here are 15+ business plan templates you can use for strategic planning .

As an entrepreneur, you’d know that running a successful business goes beyond just your day-to-day operations. Therefore, having a detailed business plan can help you take a closer look at your business — starting by analyzing your 3Cs.

By focusing on these three key areas, you can develop a plan that effectively communicates your business concept, identifies your target customer, and positions your business to compete in the market.

The first ‘C’ refers to the concept of your business. Look for gaps in the market you’re in and how your product or service solves a problem for your target market. Focus on what is your competitive advantage and how it sets you apart from your competitors.

Your business plan should also include information about your company’s history, business structure and mission statement. Having a solid understanding of your business will also come in handy when writing your company description and earn you extra first impression points.

2. Customers

The second ‘C’ is all about understanding your target markets and potential customers. Before you dive deep into your business plan, you should first conduct market research. This would help you identify your ideal customer profile, including their demographics, behaviors and preferences.

Additionally, you should explain how you plan to reach and acquire these customers with a detailed marketing and sales strategy plan. Creating a user persona guide helps you understand your target market and how they use your product or service. Here’s an example that you can use:

Visualize your customers with Venngage’s User Persona Guide tool today. It’s free and most importantly — no design experience is required.

3. competitors.

Your final “C” in writing an effective business plan is no other than your competitors. Competitor analysis is critical in positioning your business for success. You should definitely research and evaluate your competitors, analyzing their strengths and weaknesses, market position, and pricing strategy.

At the same time, you should also outline your strengths and weaknesses and explain how you plan to overcome them. You can always conduct a SWOT analysis on both your and your competitors’ business. This SWOT competitor analysis template is a good example of how it’s done:

Check out this article to learn everything about utilizing infographics to create an effective business plan .

If you’ve read this blog on how to create a business plan , you’d know that a professional plan typically has the following sections:

- Table of Contents

- Executive summary

- Company description

- Market analysis

- Organization and management

- Service or product line

- Marketing and sales

- Funding request

- Financial projections

- An appendix

This may seem overwhelming for many small business owners and you’re probably thinking of backing out at this point. Therefore, creating your bus i ness plan outline before you go into the details can ensure that you don’t leave any essential information out of your plan.

But let me assure you that you’ll be well on your way to creating a successful business plan that can help you achieve your goals by following these steps:

Step 1: Define your business idea

Every business idea should be born out of a problem that needs solving. To find a good business idea , start by identifying a problem or a need in the market that is not adequately addressed. For example, if you notice members in your community Facebook group are often looking for cleaners in the area with little success, that’s a market you can tap into by starting a cleaning business .

You also should clearly define your business idea and what you plan to offer. Don’t forget to also consider your business’s cost, feasibility, scalability, and profitability.

For example, this candle business highlights that handmade candles are made from 100% beeswax to ensure product safety and quality:

Once you have that figured out, it’ll be easy as pie for you to come up with your company description. Your company description should include details such as your business location, business resources, management team and more.

Step 2: Conduct your market research

Conducting thorough market research builds a strong foundation for your market analysis. What’s more, it provides insights into the viability of your business idea and helps you develop a winning strategy.

You can conduct primary market research with:

- Customer interviews

- Online surveys or questionnaires

- In-person focus groups

- Purchasing a competitor product to study packaging and delivery experience

Or secondary market research by:

- Reading company records

- Examining the current economic conditions

- Researching relevant technological developments

This market overview template will help you look into industry trends and your target audience and collect vital data for your marketing strategy:

Step 3: Analyze your competitors

A competitive analysis report outlines the strengths and weaknesses of your competitors compared to those of your own business.

Start by creating a competitor profile for each of your competitors which typically includes:

- The company’s revenue and market share

- The company’s size and management team

- A SWOT analysis

- An overview of how the brand is perceived by customers

In addition to specific product features, here are some attributes that you might want to look into:

- Product quality

- Number of features

- Ease of use

- Customer support

- Brand/style/image

Use this competitor analysis report template to dive deeper into your competitor data and inform your marketing and business strategies:

Step 4: Develop a marketing strategy

Your marketing strategy can be brief, covering a single campaign, or it can be long-term, detailing your marketing plans for an entire year.

An effective marketing plan revolves around your target market and finding ways to reach them effectively. This may include branding, advertising, and social media .

While different marketing tactics are used to achieve different goals, they should always be in sync with the overall goals of your business.

Use a mindmap to organize your marketing goals and strategies to make sure that they are in line with your business goals.

If you’re running a small business, you may have limited funds to allocate toward marketing efforts. Some commonly used marketing strategies for small businesses include:

- Social media marketing

- Content marketing

- Work with local influencers

- Word-of-mouth

- Customer referral programs

- Customer loyalty plans

This Japanese restaurant business plan details both their online and offline marketing strategies. They’re also keen to capitalize on the steady stream of tourists coming into the city by catering to groups with large orders.

You can also use a timeline infographic like this one here to keep you on track with your marketing goals:

Don’t know where to start? This article will give you a crash course on how to make your marketing plan .

Step 5: identify your key performance indicators (kpi).

With all those marketing strategies in line, the next step is to identify the key metrics you’ll use to measure your business’s success. So, what is your KPI going to be? Is it revenue, profit margin, customer acquisition cost or customer retention rate?

KPIs give you a clear understanding of how well your business is doing and provide valuable insights that help make informed decisions. Without identifying KPIs, it can be difficult to gauge the effectiveness of your efforts.

Step 6: Develop a Financial Plan

We’ve finally reached the core of your business strategy, which is the section that your potential investors are most interested in – your financial plan.

Having your business plan lined out can help you understand the financial viability of your business and prepare for potential challenges. It can also persuade investors and get the funding you need.

Some of the important details that you’d want to include in your financial plan are your:

- Income statement

- Cash flow statement

- Balance sheet

- Sales forecast

- Break-even analysis

- Financial health

- Financial forecasts

Planning to start your own gym ? Use this template to project your revenues and expenses:

Step 7: Determine your funding needs

Now that you have your financial plans worked out, you’ll have a clearer picture of how much funding you’ll need to start and grow your business .

There are several types of funding options available for small businesses seeking financing, including:

- Self-funding or bootstrapping

- Family and friend loans

- Crowdfunding

- Angel investors

- Venture capital

- Business loans

For example, this non-profit business plan template details the fundraising activities they have to generate operational funds.

Start customizing your business plan with these 15+ templates that would help you win over your investors, lenders, or partners .

As new business owners, having a strong business plan is essential for securing funding and laying the foundation for your company’s success. However, with so many business plans vying for investors’ attention, it can be challenging to make yours stand out.

In summary, the following tips can help you write a business plan that captures the attention of investors:

Focus on your competitive advantages

Furthermore, show customers and investors why they should choose you over others. Highlight what sets your business apart from your competitors and how your product or service can serve as a solution.

Show a deep understanding of your target market

Visualize your ideal customers and their needs with a user persona and analyze your competitors. This will help you explain how your business can meet those needs better than your competitors.

Provide a clear and concise executive summary

Start with a short, punchy summary that gives investors or lenders an overview of your business. Your executive summary should also include your plans, its value proposition, and the opportunities it presents to attract funding.

Provide solid financial projections

Investors and lenders want to see that your business has a foreseeable future. Make sure to detail your business financials such as cash flow statement, income statement, break-even analysis and balance sheet.

Be specific about your goals and milestones

Lay out achievable goals and milestones that you aim to reach in the short and long term. This will give investors a clear sense of your vision and your commitment to achieving it.

Show your passion

Finally, don’t be afraid to let your passion for your business shine through. Investors and lenders want to see that you are committed to your business and that you believe in its potential for success.

Elevate your small business with an exceptional business plan that sets you apart from the competition

Having a well-thought-out business plan can really max out your business’s potential and win over your investors. But as an entrepreneur, growing a business requires a lot of time and effort and you might not have the extra time to spend on designing your business plan.

But don’t you worry – Venngage has got it covered for you. Designing a business plan requires little to no effort with Venngage’s customizable professional templates. Most importantly, no design experience is required.

Pick from one of the templates above or browse for more Business Plan Templates and start customizing your own today!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Starting a Business | How To

How to Start a Small Business: An Ultimate Guide

Published October 9, 2023

Published Oct 9, 2023

WRITTEN BY: Agatha Aviso

Get Your Free Ebook

Your Privacy is important to us.

This article is part of a larger series on Starting a Business .

Starting A Business?

- 1. Come Up With a Business Idea

- 2. Test Your Business Idea

- 3. Write a Business Plan

- 4. Acquire Funding

- 5. Choose Structure & Register

- 6. Get Business Insured

- 7. Build Team

- 8. Set Up Systems & Software

Bottom Line

Whether you’re starting a part-time business or quitting your corporate job to create your dream biz, you’ll find information in this guide to help you succeed. Throughout this article, you’ll learn how to start a small business from experts in finance, legal, marketing, human resources, software, insurance, as well as expert advice from former small business consultants.

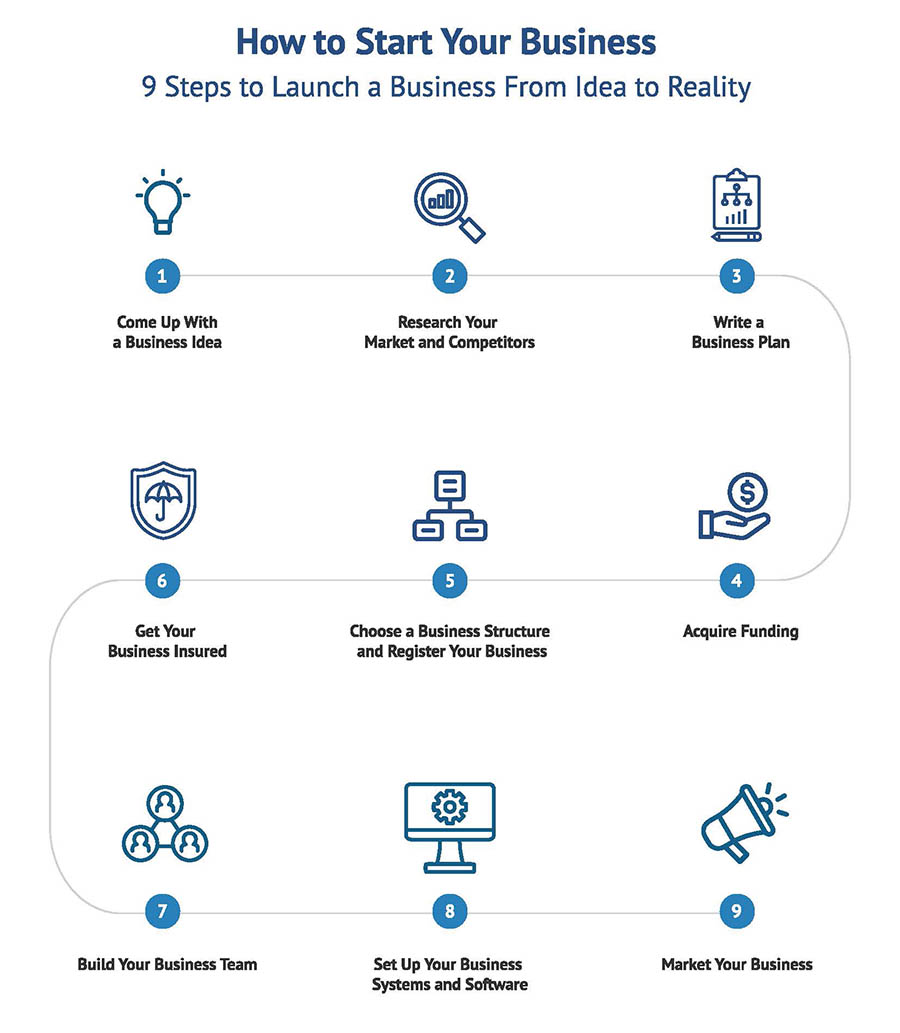

Starting a small business involves coming up with a business idea, testing the idea, writing a business plan, acquiring funding, choosing a business structure, registering the business, getting it insured, making key hires, setting up systems, and finally, marketing and promoting it.

Download Your Free “How To Start A Business” E-book

FILE TO DOWNLOAD OR INTEGRATE

How To Start A Business

Thank you for downloading!

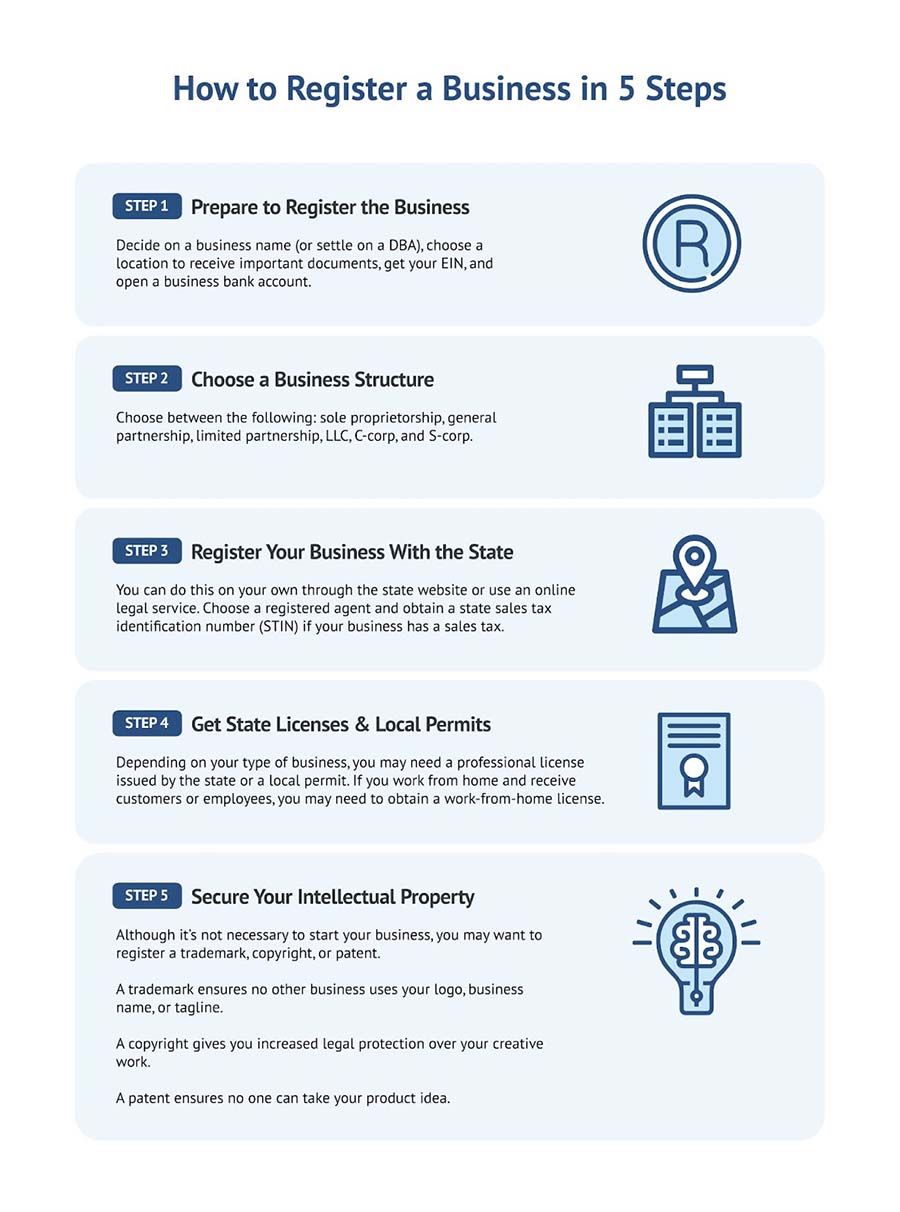

As you’re starting your business, it’s wise to register it as a legal entity, like an LLC. Doing this will protect your personal assets if a lawsuit were to occur against the business. You can register your business as an LLC through an online legal service.

IncFile is an online service that handles and files the paperwork so your business can become an LLC quickly.

Start your business today with IncFile for as little as $0 plus state fees with no contracts and no hidden fees.

Should you start a business? Before coming up with a business, it’s crucial to determine if you’re ready to become a business owner and there are many things to consider. Examine the main points to consider by reading our guide on determining if you should start a business .

“Starting a business is not for everyone. Generally, starting a business, I’d say, No. 1 is to have a high pain threshold. When you first start a company, there’s lots of optimism and things are great. Happiness at first is high, then you encounter all sorts of issues and happiness will steadily decline, and then you will go through a whole world of hurt, and then eventually, if you succeed—and in most cases, you will not succeed—if you succeed then, after a long time, you will finally get back to happiness.” – Elon Musk

Step 1: Come Up With a Business Idea

All businesses start with the same first step— coming up with a business idea . When coming up with an idea for your business, consider your own skills and experiences, as well as business trends and problems or pain points your business could help address.

As you go through your day, you should write down any ideas you have. Look for problems you’re having in your own life. Can you solve that problem yourself and turn the solution into a business?

It’s also important to consider your personality when choosing a business idea:

- Would you like to work at home in silence or talk with customers in a store?

- Would you like to have a lifestyle business, which caps your income, or an eight-figure business with employees?

- Would you like to start from scratch or purchase an existing businesslike a franchise?

- Would you like to work 80-hour weeks and grow a business fast or keep a more balanced life and grow the business slowly?

- Would you like to create products and have other people sell them or sell products that other people have created?

Think about these questions to help you begin with the end in mind. Another personality-based test is to notice your energy levels when doing tasks at work and home. What tasks give you energy, and what depletes your energy? Running a business that gives you energy will be much more likely to succeed.

Business Idea Examples

Browse our list of business ideas for inspiration:

- Best Business Ideas to Make Money

- Best Business to Start

- Best Businesses to Start With Less Than $500

- Mompreneur Business Ideas

- Home-based Business Ideas

- Small Farm Business Ideas

- Low-cost Franchises

- Creative Business Ideas Started During the Pandemic

Additionally, you may want to browse “how to start a business” guides to learn more about a specific business idea:

- Restaurant or catering business

- Cleaning business

- Clothing boutique or a consignment store

- Coffee shop

- Dropshipping business

- FedEx routes

- Ghost kitchen

- Lifestyle blog

- Online store

- Online T-shirt business

- Personal training

- Retail store

Starting From Scratch vs Buying Existing vs a Franchise

One question you may have is if you should start your small business from scratch, buy an existing business, or purchase a franchise? Two things to consider are your business experience and available funds.

If you have no experience running a business or in a particular industry, buying into a franchise can increase your odds of success. When you buy into a franchise , you’re mostly learning how to run the business. If you follow the franchise formula in a well-populated area, you’re likely to succeed.

The same line of thinking applies to an existing business. Purchase an existing business, and you’ll learn how to run the business—plus receive previous customers. This combination makes the likelihood of success higher than you’d have for a brand-new franchise.

The challenge with buying a franchise or an existing business is cost. The high cost is one of the main reasons most new entrepreneurs start their business from scratch. However, keep in mind that there are dozens of franchises that cost under $25,000 .

- Buying a Franchise: How to Buy a Franchise in 8 Steps

- Financing a Franchise: 7 Best Loan Options

- 11 Franchise Marketing Tips to Grow Your Business

- 19 Best Franchises Under 10K

How Much Money Do You Need to Start?

It’s essential to know the answer to this question before starting your business. I’ve met with several people who never got their business off the ground because it required too much money. Remember, if you don’t have the capital available: Dream big, but start small.

To start some businesses, such as residential cleaning or power washing, you may only need $1,000. Use these funds to register the business, purchase supplies, get your first customers, and then, you’ll be in business.

Opening a store with a location is more costly. You’ll need at least $50,000 in funding—possibly several hundred thousand dollars. For a very small retail store, you should plan on earning at least $100,000 a year to cover overhead costs and make a nice profit.

If you need substantial debt to open your first business—over $20,000—you should seriously think about that decision. What’s the worst-case scenario? And how long will it take you to get out of debt? If possible, start part time with the business and acquire the necessary entrepreneurship skills. Or consider waiting. Save up cash, and take on as little debt as possible.

Learn More: How to Choose a Business to Start

Now that you’ve settled on an idea, it is time to really dive into the market.

Step 2: Research Your Market and Competitors

Once you have chosen your business idea, you need to test the idea to determine the likelihood that it will work. The majority of new business owners skip this step—that’s why 20–22% of small businesses fail within the first year according to the Bureau of Labor Statistics .

Don’t skip this step! You may learn valuable information that alters the type of business you start or how you implement it. All the information you collect will go into your business plan (step No. 3).

Validate Your Business Idea

Validating your business idea involves making efforts to ensure the solution you want to sell is something customers will pay for. True validation comes when someone spends their money on your product or service. However, you may not be able to figure out with certainty how well your product will do in the market until it’s created, or your business is open.

This is where research becomes crucial. Consider creating a few focus groups and surveys to gather feedback. Building an audience online is a great way to elicit feedback for your idea. Additionally, starting a crowdfunding campaign is one of the best ways to ensure your business idea is a good one.

- Evaluate your competitors. Consider your top five potential competitors and list their strengths and weaknesses. What strengths do your competitors have that you cannot beat? What weaknesses do they have that you can improve upon? If you have no competitors, that is not always a good sign. Ask yourself why there are no competitors in your area. There may be a reason. For example, the market may be too small to support your idea or people are not willing to pay for your product or service.

- Identify your target demographic. Customer research is key in deciding whether or not the business will work. There must be people willing to pay for your product or service in your area. To narrow down your customers, consider creating customer profiles for each type of customer you will have. Once you are clear on your customers, you want to determine how many of them are in your area. ReferenceUSA is a database you can use to do this research. ReferenceUSA is a powerful tool that allows you to research customers based on demographics. Tens of thousands of local libraries provide free access to ReferenceUSA.

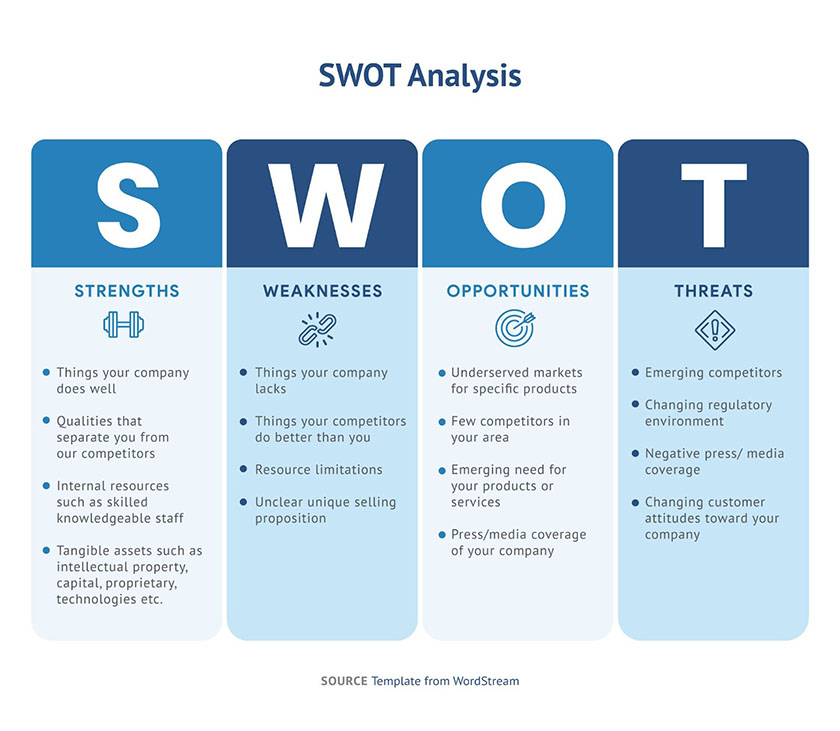

Perform a SWOT Analysis

A SWOT (strengths, weaknesses, opportunities, threats) analysis is an exercise that helps you think critically about your business idea. SWOT analysis may reveal certain aspects of your business you have not considered—both positive and negative.

Go through each section below and list your ideas:

- Strengths: What will the business do well?

- Weaknesses: What may the business not do well?

- Opportunities: What external market opportunities are there—such as less competition and underserved segments?

- Threats: What external factors may make success difficult—such as regulations?

- Identify your competitive advantages. A SWOT analysis helps you identify your own competitive advantages. A question to ask yourself is: “What is my advantage that the competition will struggle to match? ” Is it your quality of product or service, customer service, or knowledge? This question will help you determine if you can be the best at something. Being the best in a certain area of a business makes it more likely that the business will succeed.

Research a Location

If you’re considering an office or storefront, start your research into the location now. You want to start early to make sure you can afford it. Look into potential locations to develop a rough estimate of the build-out cost (renovations) and monthly rent. The information you collect will go into your business plan and financial projections.

Once you have validated your idea, performed in-depth research, identified target demographics and possible locations, and performed competitive analysis, you are ready for the next step. So far, you have put together informal pieces of a business plan. Now, it’s time to write down information in a document as part of a formal business plan.

Step 3: Write a Business Plan

When you’re just starting your business, a business plan, along with a solid business philosophy , can help you plot your future. Additionally, a business plan is an opportunity to show why and how your business will become a success. All businesses need to create a business plan or a strategic roadmap to guide their business decisions.

The business plan contains several elements, including market analysis, competitor analysis, and financial projections. If you’re seeking funding from a bank or investor, you will need a business plan. The plan shows on paper how you will start your own business. After you open, the document keeps you focused and on track with your goals.

A typical business plan may contain over 40 pages of info about your business. You should plan on spending at least 30 hours creating a well-researched business plan. In addition to writing the plan, you will also spend time doing market research and creating financial projections.

Planning to launch a very small business such as a side business? Creating a one-page business plan might be better. With this plan, you’ll write a couple of sentences for important business concepts. It should include items such as the business model (how will it make money?) and competitive advantage (what will it do better than competitors?).

You should plan on spending around an hour to write out a one-page business plan. The simplified financial projections will be the most challenging and time-consuming. You most likely will need to do research online to get accurate income and expense estimates.

Download our one-page business plan template to start your business planning today.

Most business owners can easily do the research and write the plan. Where most have difficulty are the financial projections, which require creating several financial documents. If you don’t have a financial analysis background or interest, it’s a wise strategy to purchase business plan software that walks you through the financial projection process.

Related: 4 Types Of Business Plans (Plus Software & Writing Services)

Here are nine sections to include in your traditional business plan:

- Opening Organizational and Legal Pages: Cover page, nondisclosure agreement, and a table of contents

- Executive Summary: A summary of the entire business plan in fewer than two pages; Complete this section last

- Company Summary: Basics of the company, such as its history, location, facilities, company ownership, and competitive advantage

- Products and Services: How your business makes money (business model), the products or services it provides, and future products or services

- Market and Industry Analysis: Analysis of potential customers and industry. Include any data here about your current (or ideal) customers, business industry, and competitors

- Marketing Strategy and Implementation Summary: Discussion of marketing, sales, and pricing strategies

- Management and Organization Summary: Business ownership and operation. (If your business isn’t open yet, give a compelling reason why your background will make it a success. Include information on any managers in the business as well.)

- Financial Data and Analysis: Financial projections such as a profit and loss statement, projected cash flow, and business ratios

- Appendix: Any documents or information that doesn’t fit in the above categories goes in the appendix. You may want to include documents such as a floor plan, trademark, or marketing materials.

This might be a big undertaking for some, so there are business plan writing services you can seek help from. Alternatively, Here are some industry-specific business plan templates that can help:

- How To Write an SBA Business Plan [+Free Template]

- 4 Free Retail & Online Store Business Plans

- How to Write a Real Estate Business Plan (+ Free Template)

Learn More: How to Write a Business Plan

Step 4: Acquire Funding

Obtaining financing for your startup business may be the biggest challenge you face in your company’s infancy.

If you don’t have sufficient personal funds to start your business, you’ll need to secure additional funds. There are several funding options available for soon-to-be business owners, including several types of loans, investors, and crowdfunding.

No matter which type of startup financing your business applies for, you can increase the chances of getting a small business loan by preparing a solid business plan, improving your personal credit score , saving up personal capital, building your business’ customer base, and maintaining updated financial projections .

Family & Friends

A popular saying that many in startup financing like to say is, “You should always look to family, friends, and fools for funding before an investor or loan.” The reason is that family and friends (and fools) are the cheapest sources of capital.

The main downside of securing capital from family and friends is the potential for a damaged relationship. To avoid this, draw up an agreement that states how and when you need to pay back the funds.

A loan is a sum of money that needs to be paid back with interest. Business loan amounts can range anywhere from under $1,000 to over $1,000,000.

Just because you may qualify for a loan doesn’t mean you should use it. Start your small business with as little debt as possible. Remember, if your business were to fail, you would still need to pay off the debt you incurred, which could take several years.

Here are several different types of loans to fund your business:

- 10 Best Business Credit Cards for Startups

- 10 Best Sole Proprietorship Business Credit Cards

- 6 Best Instant Approval Business Credit Cards

- 6 Best Credit Cards for New Businesses With No Credit History

- 8 Best LLC Credit Cards

- 13 Best Small Business Credit Cards

- 6 Best Personal Loans for Business Funding

- Business Loans vs Personal Loans: Which Is Best for Your Small Business

See also: 7 Best Rollover for Business Startups (ROBS) Providers

- Home equity loan or line of credit : These loans pull equity out of your home for a loan. They are appealing because of their low-interest rate.

See also: SBA Microloans: What They Are & How to Apply

- SBA Loan Requirements

- How to Get an SBA Loan in 4 Steps

- How to Get an SBA Startup Loan in 6 Steps

- SBA Community Advantage Loan: What It Is & How to Apply

- Understanding the SBA Guarantee Fee

See also: How to Get Unsecured Startup Business Loans in 6 Steps

Find an Angel Investor

An angel investor is typically a wealthy individual who funds early-stage businesses. Investors usually want equity ownership in businesses they invest their money in. Having ownership means they will collect a percent of your profits in exchange for their investment. Read more about the pros and cons of angel investments .

Crowdfunding

Crowdfunding a small business is when you get customers to pre-order products or services. It’s a great way to raise funds before opening your business or creating a product.

Kickstarter and Indiegogo are crowdfunding platforms that assist with raising the money for your business. The cost to use the platforms is 5% of the final price raised plus payment processing fees, which are around 3%.

- Pros and Cons of Business Crowdfunding

- 11 Best Crowdfunding Sites for Small Businesses

Apply for Business Grants

Business grants are funds given to start a business that doesn’t have to be repaid. Federal, state, and local governments are common sources of grants. Many new business owners seek them, but they are hard to find.

A business grant is typically reserved for a particular type of business, such as a research-based business. Grants may also come in forms other than money, such as reduced rent to open a business in a disadvantaged area designated by a city.

- 8 Best Small Business Grants

- 8 Great Minority Small Business Grants

- 13 Best Small Business Grants for Women

Apply for Venture Capital Funding

Venture capital is private equity designed to help startups with long-term growth potential scale. In this arrangement, groups of investors pool money to fund a startup in exchange for equity. Typically, venture capitalist firms also shape the strategies of the companies, provide expertise, and make introductions. Read more about the disadvantages and advantages of venture capital funding .

Learn More: Startup Business Loans: The 7 Best Ways to Fund Your Startup