Corporate Governance Research Paper Topics

This guide provides a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on choosing a relevant and feasible topic, and tips on how to write a successful corporate governance research paper. Corporate governance is a critical aspect of modern business that has a significant impact on the success of organizations. As a result, students who study corporate governance are often assigned to write research papers that explore various aspects of the topic. In addition, iResearchNet offers custom writing services that provide expert degree-holding writers, customized solutions, and timely delivery. By using this guide and iResearchNet’s writing services, students can ensure that their corporate governance research papers meet the highest academic standards.

Corporate Governance Research

Corporate governance is a critical aspect of modern business that encompasses the practices, processes, and systems by which organizations are directed, controlled, and managed. As a result, students who study corporate governance are often assigned to write research papers that explore various aspects of the topic, ranging from board structures and executive compensation to shareholder activism and stakeholder engagement.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code.

In this guide, we provide a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on how to choose a relevant and feasible topic, and tips on how to write a successful corporate governance research paper. In addition, we offer custom writing services through iResearchNet that provide expert degree-holding writers, customized solutions, and timely delivery.

By using this guide and iResearchNet’s writing services, students can ensure that their corporate governance research papers are well-researched, well-written, and meet the highest academic standards.

100 Corporate Governance Research Paper Topics

Corporate governance is a broad and complex topic that encompasses a wide range of issues and challenges facing modern organizations. To help students choose a relevant and feasible corporate governance research paper topic, we have divided our comprehensive list of topics into 10 categories, each with 10 topics.

Board of Directors

- Board independence and effectiveness

- Board diversity and gender equality

- CEO duality and separation of roles

- Board composition and characteristics

- Board oversight and accountability

- Board nominations and elections

- Board leadership and culture

- Board committees and responsibilities

- Board evaluation and performance

- Board compensation and incentives

Executive Compensation

- Executive pay and performance

- Executive pay and firm performance

- Pay-for-performance and pay-for-skill

- CEO pay ratios and pay equity

- Stock options and equity-based compensation

- Executive severance and golden parachutes

- Executive perquisites and benefits

- Executive retirement and pensions

- Say-on-pay and shareholder activism

- Institutional investors and executive pay

Shareholder Activism

- Shareholder rights and activism

- Shareholder proposals and proxy access

- Shareholder engagement and communication

- Shareholder activism and corporate social responsibility

- Institutional investors and shareholder activism

- Hedge funds and shareholder activism

- Shareholder activism and executive compensation

- Shareholder activism and board independence

- Shareholder activism and corporate governance reforms

- Shareholder activism and CEO turnover

Stakeholder Engagement

- Stakeholder identification and analysis

- Stakeholder mapping and prioritization

- Stakeholder communication and dialogue

- Stakeholder participation and empowerment

- Stakeholder consultation and feedback

- Stakeholder engagement and corporate social responsibility

- Stakeholder engagement and sustainability reporting

- Stakeholder engagement and risk management

- Stakeholder engagement and corporate reputation

- Stakeholder engagement and value creation

Corporate Culture and Ethics

- Corporate values and ethics

- Ethical leadership and decision-making

- Corporate social responsibility and sustainability

- Business ethics and compliance

- Corporate citizenship and philanthropy

- Corporate culture and values alignment

- Corporate culture and employee behavior

- Corporate culture and organizational performance

- Corporate culture and innovation

- Corporate culture and risk management

Board-Shareholder Relations

- Board-shareholder communication and engagement

- Board-shareholder conflict resolution

- Board-shareholder cooperation and collaboration

- Board-shareholder activism and response

- Board-shareholder rights and responsibilities

- Board-shareholder agreements and charters

- Board-shareholder engagement and corporate social responsibility

- Board-shareholder relations and institutional investors

- Board-shareholder relations and minority shareholders

- Board-shareholder relations and corporate governance reforms

Regulatory and Legal Environment

- Corporate governance regulations and compliance

- Corporate governance laws and policies

- Corporate governance codes and standards

- Corporate governance enforcement and penalties

- Corporate governance and public policy

- Corporate governance and the role of regulators

- Corporate governance and antitrust laws

- Corporate governance and securities laws

- Corporate governance and data privacy laws

- Corporate governance and intellectual property laws

Risk Management and Disclosure

- Enterprise risk management and oversight

- Risk management and strategic planning

- Risk management and financial reporting

- Risk management and sustainability reporting

- Risk management and cybersecurity

- Risk management and climate change

- Risk management and supply chain management

- Risk management and crisis management

- Risk management and stakeholder engagement

- Risk management and disclosure requirements

International Corporate Governance

- Cross-border mergers and acquisitions and corporate governance

- Corporate governance and foreign direct investment

- Corporate governance and multinational corporations

- Corporate governance and global supply chains

- Corporate governance and global financial markets

- Corporate governance and emerging markets

- Corporate governance and corruption

- Corporate governance and cultural diversity

- Corporate governance and the United Nations Sustainable Development Goals

- Corporate governance and global challenges

Corporate Governance Reform

- Corporate governance failures and scandals

- Corporate governance reforms and their impact

- Corporate governance and shareholder activism

- Corporate governance and executive compensation reform

- Corporate governance and board independence reform

- Corporate governance and stakeholder engagement reform

- Corporate governance and diversity and inclusion reform

- Corporate governance and sustainability reform

- Corporate governance and regulatory reform

- Corporate governance and future trends

By organizing the corporate governance research paper topics into categories, students can easily identify areas of interest and develop research questions that align with their academic goals and interests. The categories cover a wide range of issues and challenges facing modern organizations, from board structures and executive compensation to stakeholder engagement and international corporate governance.

Choosing a Topic in Corporate Governance

Choosing a relevant and feasible corporate governance research paper topic is critical for success in academia. The following are expert tips on how to choose a corporate governance research paper topic:

- Consider your interests : Choose a topic that you are interested in and passionate about. Your enthusiasm for the topic will help you stay motivated throughout the research and writing process.

- Identify a research gap : Choose a topic that fills a research gap or addresses a new research question. This will help you contribute new knowledge to the field and make a meaningful contribution to academic scholarship.

- Consult with your instructor : Discuss potential topics with your instructor and seek feedback on your ideas. Your instructor can help you refine your research question and suggest relevant literature and sources.

- Conduct a literature review : Conduct a literature review to identify gaps and areas of interest within the field. This will help you develop research questions and identify key concepts and themes.

- Consider feasibility : Choose a topic that is feasible given the time and resources available to you. Be realistic about your research scope and the data sources that are available to you.

- Stay current : Choose a topic that is current and relevant to the field. This will help you stay up-to-date on the latest trends and developments in corporate governance.

- Identify a manageable scope : Choose a topic that has a manageable scope. Narrow down your research question to a specific aspect of corporate governance that can be explored in-depth within the scope of a research paper.

- Brainstorm potential topics : Brainstorm a list of potential topics based on your interests, literature review, and discussions with your instructor. Evaluate each topic based on its relevance, feasibility, and potential impact.

By following these expert tips, students can choose a relevant and feasible corporate governance research paper topic that aligns with their academic interests and goals. In the next section, we provide tips on how to write a successful corporate governance research paper.

How to Write a Corporate Governance Research Paper

Writing a successful corporate governance research paper requires careful planning and attention to detail. The following are expert tips on how to write a corporate governance research paper:

- Develop a clear research question : Develop a clear and concise research question that addresses a gap or new research question within the field of corporate governance. The research question should be specific and focused to ensure a manageable scope for the research paper.

- Conduct a literature review : Conduct a comprehensive literature review to identify key concepts and themes within the field of corporate governance. This will help you develop a theoretical framework and provide a foundation for your research paper.

- Select appropriate research methods : Select appropriate research methods that align with your research question and objectives. This may include qualitative, quantitative, or mixed-methods research approaches.

- Collect and analyze data : Collect and analyze data using appropriate research methods. This may include conducting interviews, surveys, or analyzing financial data. Ensure that your data collection and analysis is rigorous and aligns with the research question and objectives.

- Develop a clear and structured outline : Develop a clear and structured outline for your research paper. This will help you organize your thoughts and ideas and ensure a logical flow of information.

- Write a clear and concise introduction : Write a clear and concise introduction that provides background information and context for the research question. The introduction should also clearly state the research question and objectives.

- Develop a comprehensive literature review : Develop a comprehensive literature review that provides a theoretical framework for the research question. The literature review should be organized thematically and include key concepts and themes within the field of corporate governance.

- Analyze and interpret findings : Analyze and interpret the findings of the research. Ensure that your analysis and interpretation aligns with the research question and objectives.

- Develop a clear and concise conclusion : Develop a clear and concise conclusion that summarizes the key findings of the research and provides implications for practice and future research.

- Ensure proper formatting and citation : Ensure that your research paper is properly formatted and cited. Follow the guidelines of the citation style required by your instructor, such as APA, MLA, or Chicago.

By following these expert tips, students can write a successful corporate governance research paper that contributes new knowledge to the field and makes a meaningful contribution to academic scholarship. In the next section, we provide information on how students can benefit from the iResearchNet writing services for corporate governance research papers.

iResearchNet Writing Services for Corporate Governance Research Papers

At iResearchNet, we understand the importance of producing high-quality corporate governance research papers that meet the academic standards of students. Our team of expert degree-holding writers can help students produce well-written and well-researched corporate governance research papers that meet the requirements of their instructors. Our writing services include the following features:

- Expert degree-holding writers : Our writers are experts in corporate governance with advanced degrees in the field. They have the knowledge and expertise to produce high-quality research papers that meet the academic standards of students.

- Custom written works : We provide custom written works that are tailored to the specific needs and requirements of each student. Our writers work closely with students to ensure that their research papers meet their expectations and academic standards.

- In-depth research : Our writers conduct in-depth research to ensure that the research papers are well-supported with relevant and reliable sources.

- Custom formatting : Our writers are well-versed in various citation styles, including APA, MLA, Chicago/Turabian, and Harvard. We ensure that the research papers are properly formatted and cited according to the required citation style.

- Top quality, customized solutions : We are committed to providing top-quality and customized solutions that meet the unique needs and requirements of each student.

- Flexible pricing : We offer flexible pricing options to ensure that our writing services are affordable for students.

- Short deadlines : We can accommodate short deadlines of up to 3 hours for urgent assignments.

- Timely delivery : We ensure timely delivery of research papers to ensure that students have enough time to review and submit their assignments.

- 24/7 support : We provide 24/7 support to answer any questions or concerns that students may have about their research papers.

- Absolute Privacy : We prioritize the privacy and confidentiality of our clients. We ensure that all client information is kept confidential and secure.

- Easy order tracking : We provide easy order tracking to enable students to track the progress of their research papers.

- Money-back guarantee : We offer a money-back guarantee to ensure that students are satisfied with the quality of their research papers.

By using iResearchNet writing services, students can benefit from the expertise of our writers and produce high-quality corporate governance research papers that meet the academic standards of their instructors.

Order Your Custom Research Paper Today!

Writing a successful corporate governance research paper requires careful planning and attention to detail. By choosing a relevant and feasible research paper topic, conducting a comprehensive literature review, and following the tips outlined in this article, students can produce high-quality research papers that make meaningful contributions to the field of corporate governance. Additionally, iResearchNet writing services offer students a valuable resource for producing high-quality research papers that meet the academic standards of their instructors. With expert degree-holding writers, customized solutions, and a range of support features, iResearchNet can help students achieve academic success and excel in their studies. Contact us today to learn more about our writing services and how we can assist you in your corporate governance research paper writing needs.

ORDER HIGH QUALITY CUSTOM PAPER

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

- Faculty Recruiting

- See All Jobs

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Subscribe to Corporate Governance Emails

CGRI Journal Articles

Research papers authored by Stanford GSB faculty and published in leading peer-reviewed journals that provide rigorous empirical analysis of concepts and theories in corporate governance.

Shall We Talk? The Role of Interactive Investor Platforms in Corporate Communication

Between 2010 and 2017, Chinese investors used an investor interactive platform (IIP) to ask public companies around 2.5 million questions, the vast majority of which received a reply within two weeks. We analyze these IIP dialogues…

How Much Should We Trust Staggered Difference-In-Differences Estimates?

We explain when and how staggered difference-in-differences regression estimators, commonly applied to assess the impact of policy changes, are biased. These biases are likely to be relevant for a large portion of research settings in finance,…

Political Connections and the Informativeness of Insider Trades

We analyze the trading of corporate insiders at leading financial institutions during the 2007 to 2009 financial crisis. We find strong evidence of a relation between political connections and informed trading during the period in which Troubled…

Long-Term Economic Consequences of Hedge Fund Activist Interventions

We examine the long-term effects of interventions by activist hedge funds. Research documents positive equal-weighted long-term returns and operating performance improvements following activist interventions, and typically conclude that activism…

Causal Inference in Accounting Research

This paper examines the approaches accounting researchers adopt to draw causal inferences using observational (or nonexperimental) data. The vast majority of accounting research papers draw causal inferences notwithstanding the well-known…

See also Corporate Governance

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Annual Alumni Dinner

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Career Support and Resources

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Program Contacts

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- RKMA Market Research Handbook Series

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

A Guide to the Big Ideas and Debates in Corporate Governance

by Lynn S. Paine and Suraj Srinivasan

Summary .

Corporate governance has become a topic of broad public interest as the power of institutional investors has increased and the impact of corporations on society has grown. Yet ideas about how corporations should be governed vary widely. People disagree, for example, on such basic matters as the purpose of the corporation, the role of corporate boards of directors, the rights of shareholders, and the proper way to measure corporate performance. The issue of whose interests should be considered in corporate decision making is particularly contentious, with some authorities giving primacy to shareholders’ interest in maximizing their financial returns and others arguing that shareholders’ other interests — in corporate strategy, executive compensation, and environmental policies, for example — and the interests of other parties must be respected as well.

Partner Center

Open Access is an initiative that aims to make scientific research freely available to all. To date our community has made over 100 million downloads. It’s based on principles of collaboration, unobstructed discovery, and, most importantly, scientific progression. As PhD students, we found it difficult to access the research we needed, so we decided to create a new Open Access publisher that levels the playing field for scientists across the world. How? By making research easy to access, and puts the academic needs of the researchers before the business interests of publishers.

We are a community of more than 103,000 authors and editors from 3,291 institutions spanning 160 countries, including Nobel Prize winners and some of the world’s most-cited researchers. Publishing on IntechOpen allows authors to earn citations and find new collaborators, meaning more people see your work not only from your own field of study, but from other related fields too.

Brief introduction to this section that descibes Open Access especially from an IntechOpen perspective

Want to get in touch? Contact our London head office or media team here

Our team is growing all the time, so we’re always on the lookout for smart people who want to help us reshape the world of scientific publishing.

Home > Books > Customer Relationship Management - Contemporary Concepts and Strategies

Introductory Chapter: Corporate Governance – A Modern Perspective

Submitted: 16 January 2024 Reviewed: 30 January 2024 Published: 30 October 2024

DOI: 10.5772/intechopen.114251

Cite this chapter

There are two ways to cite this chapter:

From the Edited Volume

Customer Relationship Management - Contemporary Concepts and Strategies

Edited by Tahir Mumtaz Awan

To purchase hard copies of this book, please contact the representative in India: CBS Publishers & Distributors Pvt. Ltd. www.cbspd.com | [email protected]

Chapter metrics overview

11 Chapter Downloads

Impact of this chapter

Total Chapter Downloads on intechopen.com

Total Chapter Views on intechopen.com

Author Information

Tahir mumtaz awan *.

- Department of Management Sciences, COMSATS University, Islamabad, Pakistan

- School of Business Sciences, University of the Witwatersrand, Johannesburg, South Africa

- The Center of Ethnology and Anthropology, Hunan Normal University, Changsha City, Hunan Province, Peoples Republic of China

*Address all correspondence to: [email protected]

1. Introduction to corporate governance

In the early 2000s, the business world witnessed a seismic shift in the realm of corporate governance, epitomized by the fall of the Enron Corporation. Once a titan in the energy sector, Enron’s collapse sent shockwaves across global markets, unveiling a startling tale of fraudulent accounting practices and corporate malfeasance. This scandal, marked by its dramatic unraveling, showcased the catastrophic consequences of poor corporate governance. Enron’s deceptive financial reporting, facilitated by a complicit board of directors and a lack of transparency, not only led to its own downfall but also eroded public trust in corporate institutions at large. The Enron debacle became a textbook example underscoring the necessity of robust, ethical governance in the corporate world. The evolution of corporate governance has been a journey marked by such significant milestones. Initially, the concept centered primarily on financial accountability, particularly toward shareholders [ 1 ]. This paradigm stemmed from the early twentieth-century business landscape, dominated by family-owned firms where owners and managers were often the same individuals. However, as corporations grew and ownership became more dispersed, a gap emerged between owners and managers, leading to a need for more structured governance mechanisms.

Global trends have also significantly influenced corporate governance practices, necessitating adaptability and foresight from businesses worldwide. The increasing emphasis on corporate social responsibility (CSR) and sustainability has led companies to integrate environmental, social, and governance (ESG) criteria into their business strategies. Further, technological advancements are another key trend reshaping corporate governance. Technologies like blockchain and artificial intelligence (AI) are not only transforming business operations but also how companies are governed [ 2 , 3 ]. Blockchain technology, for instance, offers unprecedented transparency and security in transactions, which can significantly enhance trust in shareholder voting processes and financial reporting. Moreover, the global business environment has become increasingly interconnected, necessitating a global perspective in governance practices. This globalization has led to the harmonization of corporate governance standards across borders, as evidenced by the widespread adoption of the OECD Principles of Corporate Governance by many countries. Such harmonization ensures that multinational corporations maintain consistent governance standards in different jurisdictions, fostering global trust and cooperation [ 4 , 5 ]. Corporate governance is a fundamental framework that regulates how companies are directed and controlled. It encompasses a set of principles, practices, and processes designed to ensure that a company operates efficiently, ethically, and in the best interests of its stakeholders, including shareholders, employees, customers, and the wider community.

2. Defining the concept of corporate governance

At its core, corporate governance is about achieving a balance between the interests of a company’s various stakeholders, particularly its shareholders and management. It aims to prevent conflicts of interest and promote transparency, accountability, and responsible decision-making within the organization. One crucial aspect of corporate governance is the relationship between a company’s board of directors and its management team. The board of directors, elected by shareholders, is responsible for overseeing the company’s strategic direction, while the management team is responsible for implementing that strategy on a day-to-day basis [ 5 ]. This separation of ownership (shareholders) and control (management) is a defining characteristic of modern corporations.

3. Elements and principles of corporate governance

To understand corporate governance fully, it is essential to explore its key elements and principles:

Shareholder Rights and Equitable Treatment: Shareholders are the owners of the company, and their rights must be respected. This includes the right to vote, receive dividends, and access relevant information. Equitable treatment ensures that all shareholders are treated fairly, regardless of their size or influence.

Board of Directors: The board plays a pivotal role in corporate governance. It is responsible for setting the company’s strategic direction, appointing and overseeing the management team, and ensuring that the company operates ethically and responsibly.

Transparency and Disclosure: Companies must provide timely and accurate information about their financial performance, operations, and risks to shareholders and the public. Transparency builds trust and confidence among stakeholders.

Accountability and Responsibility: Management is accountable to the board, which, in turn, is accountable to shareholders. Corporate leaders must act in the best interests of the company and its stakeholders, making responsible decisions that align with the company’s long-term objectives.

Ethical Behavior and Corporate Citizenship: Companies should operate ethically, complying with laws and regulations while also considering broader social and environmental responsibilities.

Risk Management: Effective risk management is crucial for corporate governance. Companies must identify, assess, and manage risks to ensure their long-term sustainability.

Stakeholder Engagement : Beyond shareholders, companies should consider the interests of other stakeholders, such as employees, customers, suppliers, and the communities in which they operate.

4. The modern business landscape

In the tapestry of today’s society, corporations stand as central figures, deeply intertwined with the economy, communities, and a broad range of stakeholders. Their impact stretches far beyond simple financial metrics, influencing social norms, environmental sustainability, and technological advancements. As businesses navigate through an ever-changing landscape, corporate governance has become a cornerstone in ensuring ethical, sustainable, and efficient operations. The evolution of corporate governance mirrors the shifts in the business environment [ 6 ]. Traditionally, governance focused primarily on shareholder interests. However, in recent years, this view has expanded to include a wider range of stakeholders, including employees, customers, and the community at large. This change is partly a response to the growing awareness of corporate social responsibility and the realization that long-term success is tied to more than just financial performance.

Globalization and technological advancements have further reshaped the business world. The rise of digital technologies, for instance, has created new opportunities and challenges, requiring corporations to adapt their governance structures. Companies like Apple and Amazon, which have effectively harnessed technology and globalization, serve as prime examples of how dynamic governance can facilitate unprecedented growth and market dominance. Regulatory changes also play a crucial role [ 1 , 7 ]. Post-2008 financial crisis reforms, such as the Dodd-Frank Act in the United States, have brought about more stringent rules, compelling companies to enhance transparency and accountability. Such regulatory environments underscore the necessity for robust governance practices, enabling organizations to not only comply with legal requirements but also to gain the trust of stakeholders and the public. Effective governance is pivotal in guiding organizations through challenges and uncertainties. Good governance practices, such as clear decision-making processes, accountability, and transparency, are crucial for managing risks and maintaining corporate integrity. As businesses confront complex issues like climate change, social inequality, and ethical conduct, strong governance frameworks can provide the strategic direction and ethical compass necessary for sustainable growth.

5. Challenges and evolutions

Corporate governance, in its contemporary form, navigates a landscape rife with multifaceted challenges, each demanding innovative and nuanced responses. Among these challenges, cybersecurity stands out as a critical concern in the digital era. High-profile incidents, such as the Facebook data breach, have shed light on the severe vulnerabilities and consequences that lapses in governance can precipitate. These breaches not only lead to immediate financial losses but also long-term damage to reputation and stakeholder trust. In response, there is a growing emphasis on incorporating robust cybersecurity measures into governance frameworks, making it an integral part of risk management strategies. Furthermore, sustainability has ascended to the forefront of corporate governance concerns. Environmental and social consciousness is no longer peripheral but central to corporate strategy [ 8 ]. Companies like Unilever and Patagonia are trailblazers in this regard, embedding sustainability into their core business philosophies. This shift is not just about corporate image but is also driven by the recognition that long-term business success is inextricably linked to environmental stewardship and social responsibility. These companies demonstrate how sustainable practices can be aligned with profitability, challenging the traditional view that environmental and social goals are secondary to financial objectives [ 9 ].

The emphasis on diversity and inclusion reflects another significant evolution in corporate governance. A diverse array of perspectives in leadership and workforce is increasingly seen as a key driver of innovation and resilience. The push for diversity is not just about gender but also encompasses race, ethnicity, age, and different life experiences. Initiatives like the Women on Boards movement, aiming to increase female representation in boardrooms, have gained considerable momentum. These initiatives are supported by a growing body of research suggesting that diverse boards and leadership teams can lead to better decision-making and financial performance [ 5 , 10 ]. The approach to corporate governance also varies widely across different regions, influenced by cultural, legal, and economic factors. In countries like Japan and South Korea, governance structures are often marked by a focus on consensus and long-term relationships, reflecting deeper cultural inclinations toward collectivism. This stands in contrast to the more individualistic and shareholder-focused approaches prevalent in the United States and Europe. These regional differences highlight the need for a flexible and context-specific approach to corporate governance.

Global standards and initiatives, such as the OECD Principles of Corporate Governance, play a crucial role in shaping these varied practices. They offer a blueprint for effective governance that balances the interests of various stakeholders while promoting transparency and accountability. These principles are not just theoretical constructs but have been instrumental in guiding reforms and shaping governance practices worldwide. They demonstrate the growing recognition of the need for a cohesive global approach to governance, one that can adapt to the unique challenges and dynamics of the modern business world. The current state of corporate governance is one of dynamic evolutions, responding to the challenges posed by digitalization, environmental concerns, and the increasing importance of diversity and inclusion. As governance practices continue to evolve, they must remain agile and responsive, capable of addressing the unique demands of an ever-changing global business environment [ 10 ].

6. Why corporate governance matters

Implementing effective corporate governance holds immense advantages, key among them being enhanced financial performance. Good governance structures enable better decision-making and risk management, factors that directly contribute to a company’s financial health. This robust performance fosters investor confidence and strengthens stakeholder trust, both of which are essential for sustained success in a competitive business environment. For instance, Johnson & Johnson’s enduring market presence and financial stability can be attributed in part to its strong governance principles, which have fostered a reputation for reliability and ethical conduct. Additionally, good corporate governance promotes transparency and accountability, which are vital in today’s market where information is readily available and public scrutiny is high [ 11 ]. Companies like Google and Salesforce have thrived in part due to their transparent business practices and accountable leadership. This transparency not only builds trust with stakeholders but also ensures that potential issues are identified and addressed promptly, thereby averting crises.

Another significant advantage of effective governance is the ability to attract and retain top talent. A company known for its ethical practices and good governance is more likely to attract employees who value integrity and accountability. This, in turn, fosters a positive corporate culture that contributes to employee satisfaction and retention. For example, Adobe has been recognized for its corporate culture, which is deeply rooted in strong governance and ethical practices, contributing to its high employee retention rates and consistent innovation. On the other hand, poor corporate governance can lead to severe negative outcomes, as evidenced by numerous corporate scandals. The downfall of Enron, one of the most infamous corporate collapses, stemmed largely from governance failures such as fraudulent accounting practices and lack of oversight. This not only led to the company’s financial ruin but also caused significant harm to its employees, shareholders, and the wider economy [ 12 ].

More recently, Wells Fargo faced a crisis following revelations of fraudulent customer account practices, highlighting the consequences of poor internal controls and unethical behavior. Such governance failures damage the company’s reputation, erode public trust, and can lead to significant legal and financial penalties. Moreover, these incidents often result in a loss of consumer and investor confidence, which can have long-lasting effects on the company’s market position and financial stability. The importance of corporate governance in today’s business landscape cannot be overstated. Effective governance practices lead to improved financial performance, increased transparency and accountability, and a stronger corporate reputation, all of which are crucial for long-term success. Conversely, neglecting governance can result in significant financial, legal, and reputational damage. As the corporate world continues to evolve, the need for robust and adaptable governance frameworks becomes increasingly critical [ 13 ].

Thus, as corporations navigate an increasingly complex and dynamic business environment, the role of corporate governance becomes ever more critical. The challenges of cybersecurity, sustainability, and diversity demand innovative and adaptive governance approaches. Good corporate governance is no longer a luxury but a necessity, pivotal for ensuring long-term success and sustainability in today’s global economy.

- 1. Monks RA, Minow N. Corporate Governance. United States of America: John Wiley & Sons; 2011

- 2. Kavadis N, Thomsen S. Sustainable corporate governance: A review of research on long-term corporate ownership and sustainability. Corporate Governance: An International Review. 2023; 31 (1):198-226

- 3. Brennan NM, Subramaniam N, Van Staden CJ. Corporate Governance Implications of Disruptive Technology: An Overview. United Kingdom: Elsevier; 2019. p. 100860

- 4. Fenwick M, Vermeulen EP. Technology and corporate governance: Blockchain, crypto, and artificial intelligence. The Texas Journal of Business Law. 2019; 48 :1

- 5. Cheffins BR. The History of Corporate Governance. Belgium: European Corporate Governance Institute; 2013

- 6. Grant GH. The evolution of corporate governance and its impact on modern corporate America. Management Decision. 2003; 41 (9):923-934

- 7. Khan H. A literature review of corporate governance. In: International Conference on E-Business, Management and Economics. Singapore: IACSIT Press; 2011

- 8. Williamson OE. On the governance of the modern corporation. Hofstra Law Review. 1979; 8 :63

- 9. Mees B. Corporate governance as a reform movement. Journal of Management History. 2015; 21 (2):194-209

- 10. Ha TTH. Modern corporate governance standards and role of auditing-cases in some Western European countries after financial crisis, corporate scandals and manipulation. International Journal of Entrepreneurship. 2019; 23 :1-10

- 11. Báez AB et al. Gender diversity, corporate governance and firm behavior: The challenge of emotional management. European Research on Management and Business Economics. 2018; 24 (3):121-129

- 12. Solomon J. Corporate Governance and Accountability. United States of America: John Wiley & Sons; 2020

- 13. Vanishvili M, Shanava Z. Challenges and perspectives of corporate governance in Georgia. American Research Journal of Humanities & Social Science (ARJHSS) R. 2022; 5 (4):118-127

© 2024 The Author(s). Licensee IntechOpen. This chapter is distributed under the terms of the Creative Commons Attribution 3.0 License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Continue reading from the same book

Customer relationship management.

Published: 30 October 2024

By Francisco J. Quevedo

115 downloads

By Zohaib Riaz Pitafi and Tahir Mumtaz Awan

55 downloads

By Gerard Loosschilder and Diana Garoseanu

62 downloads

IntechOpen Author/Editor? To get your discount, log in .

Discounts available on purchase of multiple copies. View rates

Local taxes (VAT) are calculated in later steps, if applicable.

Support: [email protected]

Advertisement

Corporate governance and sustainability: a review of the existing literature

- Published: 03 January 2021

- Volume 26 , pages 55–74, ( 2022 )

Cite this article

- Valeria Naciti 1 ,

- Fabrizio Cesaroni ORCID: orcid.org/0000-0002-2345-6225 1 &

- Luisa Pulejo 1

13k Accesses

8 Altmetric

Explore all metrics

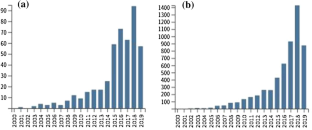

Over the last 2 decades, the literature on corporate governance and sustainability has increased substantially. In this study, we analyze 468 research studies published between 1999 and 2019 by employing three clustering analysis visualization techniques, namely keyword network clustering, co-citation network clustering, and overlay visualization. In addition, we provide a brief review of each cluster. We find that the number of published items that fall under our search criteria has grown over the years, having surged at various times including 2014. We identified three main thematic clusters, which we have called (1) corporate social responsibility and reporting, (2) corporate governance strategies, and (3) board composition. The weighted average years that major keywords appear in the literature published over the last 2 decades fall into a period of 4 years between 2014 and 2017. This is due to the massive increase in the number of publications on corporate governance and sustainability in recent years. By means of chronological analysis, we observe a transition from more abstract concepts—such as ‘society,’ ‘ethics,’ and ‘responsibility’—to more tangible and actionable terms such as ‘female director,’ ‘board size,’ and ‘independent director.’ Our review suggests that corporate governance and sustainability literature is evolving from quite a conceptual approach to rather more strategic and practical studies, while its theoretical roots can be traced back to a number of foundational studies in stakeholder theory, agency theory and socio-political theories of voluntary disclosure.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

A systematic literature review on the relationship between corporate governance and corporate sustainability

Uncovering the sustainability reporting: bibliometric analysis and future research directions

Thirty years of sustainability reporting research: a scientometric analysis

Adams, B. (2008). Green development: Environment and sustainability in a developing world . New York: Routledge.

Book Google Scholar

Aguilera, R. V., Filatotchev, I., Gospel, H., & Jackson, G. (2008). An organizational approach to comparative corporate governance: Costs, contingencies, and complementarities. Organization Science, 19 (3), 475–492.

Article Google Scholar

Amran, A., Lee, S. P., & Devi, S. S. (2014). The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Business Strategy and the Environment, 23 (4), 217–235.

Aoki, M. (1984). The co-operative game theory of the firm . New York: Oxford University Press.

Google Scholar

Aras, G., & Crowther, D. (2009). Corporate sustainability reporting: A study in disingenuity? Journal of Business Ethics, 87 (1), 279.

Barnett, M. L., Henriques, I., & Husted, B. W. (2018). Governing the void between stakeholder management and sustainability. In S. Dorobantu, R. V. Aguilera, J. Luo, & F. J. Milliken (Eds.), Sustainability, stakeholder governance, and corporate social responsibility (pp. 121–143). Bingley, UK: Emerald Publishing Limited.

Chapter Google Scholar

Burke, R. J., & Mattis, M. C. (Eds.). (2013). Womenoncorporateboardsofdirectors:International challenges and opportunities (Vol. 14). Dordrecht, NL: Springer Science & Business Media.

Brundtland, G. H., Khalid, M., Agnelli, S., Al-Athel, S., & Chidzero, B. J. N. Y. (1987). Our common future (p. 8). New York. https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf .

Carroll, A. B. (1991). The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Business Horizons, 34 (4), 39–48.

Carter, D. A., D’Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review, 18 (5), 396–414.

Cetinkaya, B., Cuthbertson, R., Ewer, G., Klaas-Wissing, T., Piotrowicz, W., & Tyssen, C. (2011). Sustainable supply chain management: Practical ideas for moving towards best practice . Berlin, Heidelberg: Springer Science & Business Media.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33 (4–5), 303–327.

Cox, T. H., & Blake, S. (1991). Managing cultural diversity: Implications for organizational competitiveness. Academy of Management Perspectives, 5 (3), 45–56.

Davidson, F. (1996). Planning for performance: Requirements for sustainable development. Habitat international, 20 (3), 445–462.

Demirag, I. (Ed.). (2018). Corporate social responsibility, accountability and governance: Global perspectives . New York: Routledge.

Di Maggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48 (2), 147–160. https://www.jstor.org/stable/2095101 . Accessed 6 Dec 2020.

Du Plessis, J. J., Hargovan, A., & Harris, J. (2018). Principles of contemporary corporate governance . Port Melbourne: Cambridge University Press.

Epstein, M. J. (2018). Making sustainability work: Best practices in managing and measuring corporate social, environmental and economic impacts . Oxford: Routledge.

Erhardt, N. L., Werbel, J. D., & Shrader, C. B. (2003). Board of director diversity and firm financial performance. Corporate Governance: An International Review, 11 (2), 102–111.

Fernando, Y., Jabbour, C. J. C., & Wah, W. X. (2019). Pursuing green growth in technology firms through the connections between environmental innovation and sustainable business performance: Does service capability matter? Resources, Conservation and Recycling, 141, 8–20.

Figge, F., Hahn, T., Schaltegger, S., & Wagner, M. (2002). The sustainability balanced scorecard—Linking sustainability management to business strategy. Business Strategy and the Environment, 11 (5), 269–284.

Filatotchev, I., & Wright, M. (2005). The life cycle of corporate governance . Cheltenham: Edward Elgar Publishing.

Freeman, R. E. (1984). Strategic management: A stakeholder approach . Boston: Pitman.

Freeman, R. E., & Werhane, P. H. (2005). Corporate responsibility. In R. G. Frey & C. Heath Wellman (Eds.), A Companion to Applied Ethics (pp. 552–569). Oxford, UK: Blackwell Publishing.

Friedman, M. (1970). A theoretical framework for monetary analysis. Journal of Political Economy, 78 (2), 193–238.

Giddings, B., Hopwood, B., & O’brien, G. (2002). Environment,economyandsociety:Fittingthem together into sustainable development. Sustainable Development, 10 (4), 187–196.

Gray, R., Owen, D., & Maunders, K. (1988). Corporate social reporting: Emerging trends in accountability and the social contract. Accounting, Auditing & Accountability Journal, 1 (1), 6–20.

Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal, 8 (2), 47–77.

Hall, R. (1993). A framework linking intangible resources and capabiliites to sustainable competitive advantage. Strategic Management Journal, 14 (8), 607–618.

Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24 (5), 391–430.

Hart, S. L., & Ahuja, G. (1996). Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Business Strategy and the Environment, 5 (1), 30–37.

Hildebrand, P. & Deese, B. (2019). Il futuro degli investimenti è sostenibile. Il sole 24ore.

Hill, C. W., & Jones, T. M. (1992). Stakeholder-agency theory. Journal of Management Studies, 29 (2), 131–154.

Iansiti, M., & Levien, R. (2004). Strategy as ecology. Harvard Business Review, 82 (3), 68–81.

Invernizzi, G., Milano, M., & Milano, E. G. E. A. (2004). Strategia e politica aziendale . Milan, IT: Mc Graw-Hill.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3 (4), 305–360.

John, K., & Senbet, L. W. (1998). Corporate governance and board effectiveness. Journal of Banking & Finance, 22 (4), 371–403.

Kang, H., Cheng, M., & Gray, S. J. (2007). Corporate governance and board composition: Diversity and independence of Australian boards. Corporate Governance: An International Review, 15 (2), 194–207.

Kemp, R. (1997). Environmental policy and technical change . Cheltenham, UK: Edward Elgar Publishing.

Kolk, A. (2003). Trends in sustainability reporting by the Fortune Global 250. Business Strategy and the Environment, 12 (5), 279–291.

Kolk, A. (2008). Sustainability, accountability and corporate governance: Exploring multinationals’ reporting practices. Business Strategy and the Environment, 17 (1), 1–15.

Kolk, A., & Pinkse, J. (2008). A perspective on multinational enterprises and climate change: learning from “an inconvenient truth”? Journal of International Business Studies , 39 (8), 1359–1378.

Kotabe, M., & Murray, J. Y. (2004). Global sourcing strategy and sustainable competitive advantage. Industrial Marketing Management, 33 (1), 7–14.

Lankoski, L. (2006). Environmental performance and economic performance: The basic links. In S. Schaltegger & M. Wagner (Eds.), Managing the business case for sustainability: The integration of social, environmental and economic performance (pp. 32–46). Sheffield, UK: Greenleaf Publishing.

Lazzeretti, L., Capone, F., & Innocenti, N. (2017). Exploring the intellectual structure of creative economy research and local economic development: A co-citation analysis. European Planning Studies, 25 (10), 1693–1713.

Lee, S. Y. (2012). Corporate carbon strategies in responding to climate change. Business Strategy and the Environment, 21 (1), 33–48.

Maignan, I. (2001). Consumers’ perceptions of corporate social responsibilities: A cross-cultural comparison. Journal of Business Ethics, 30 (1), 57–72.

Marcus, A., & Geffen, D. (1998). The dialectics of competency acquisition: Pollution prevention in electric generation. Strategic Management Journal, 19 (12), 1145–1168.

Michelon, G., & Parbonetti, A. (2012). The effect of corporate governance on sustainability disclosure. Journal of Management & Governance, 16 (3), 477–509.

Milne, M. J. (1996). On sustainability; the environment and management accounting. Management Accounting Research, 7 (1), 135–161.

Morhardt, J. E. (2010). Corporate social responsibility and sustainability reporting on the internet. Business Strategy and the Environment, 19 (7), 436–452.

Naciti, V. (2019). Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. Journal of Cleaner Production, 237, 117727.

Pelled, L. H. (1996). Demographic diversity, conflict, and work group outcomes: An intervening process theory. Organization Science, 7 (6), 615–631.

Poddar, A., Narula, S. A., & Zutshi, A. (2019). A study of corporate social responsibility practices of the top Bombay Stock Exchange 500 companies in India and their alignment with the Sustainable Development Goal s. Corporate Social Responsibility and Environmental Management, 26 (6), 1184–1205.

Rao, K., & Tilt, C. (2016). Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. Journal of Business Ethics, 138 (2), 327–347.

Roberts, D. J., & Van den Steen, E. (2000). Shareholder interests, human capital investment and corporate governance. Stanford GSB Working. https://doi.org/10.2139/ssrn.230019 .

Robinson, N. A. (1998). Comparative environmental law perspectives on legal regimes for sustainable development. Widener Law Symposium Journal, 3, 247–278.

Robinson, G., & Dechant, K. (1997). Building a business case for diversity. Academy of Management Perspectives, 11 (3), 21–31.

Rogelj, J., Den Elzen, M., Höhne, N., Fransen, T., Fekete, H., Winkler, H., et al. (2016). Paris Agreement climate proposals need a boost to keep warming well below 2 C. Nature, 534 (7609), 631.

Schaltegger, S., & Wagner, M. (2006). Integrative management of sustainability performance, measurement and reporting. International Journal of Accounting, Auditing and Performance Evaluation, 3 (1), 1–19.

Scherer, A. G., Rasche, A., Palazzo, G., & Spicer, A. (2016). Managing for political corporate social responsibility: New challenges and directions for PCSR 2.0. Journal of Management Studies, 53 (3), 273–298.

Seelos, C., & Mair, J. (2005). Entrepreneurs in service of the poor: Models for business contributions to sustainable development. Business Horizons, 48 (3), 241–246.

Testa, S., Massa, S., Martini, A., & Appio, F. P. (2020). Social media-based innovation: A review of trends and a research agenda. Information & Management, 57 (3), 103196.

Trujillo, C. M., & Long, T. M. (2018). Document co-citation analysis to enhance transdisciplinary research. Science Advances, 4 (1), e1701130.

Uhlaner, L., Wright, M., & Huse, M. (2007). Private firms and corporate governance: An integrated economic and management perspective. Small Business Economics, 29 (3), 225–241.

United Nations (UN). (2015). Countries reach historic agreement to generate financing for new sustainable development agenda. http://www.un.org/esa/ffd/ffd3/press-release/countries-reach-historic-agreement.html .

United Nations Framework Convention on Climate Change (UNFCC). (2008). Kyoto protocol reference manual on accounting of emissions and assigned amount . Germany: UNFCC.

Useem, M. (1986). The inner circle: Large corporations and the rise of business political activity in the US and UK . New York: Oxford University Press.

Van Eck, N. J., & Waltman, L. (2007). VOS: A new method for visualizing similarities between objects. In R. Decker & H. J. Lenz (Eds.), Advances in data analysis (pp. 299–306). Berlin, Heidelberg: Springer.

Van Eck, N., & Waltman, L. (2009). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84 (2), 523–538.

Van Eck, N. J., & Waltman, L. (2017). Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics, 111 (2), 1053–1070.

Van Eck, N. J., Waltman, L., Dekker, R., & van den Berg, J. (2010). A comparison of two techniques for bibliometric mapping: Multidimensional scaling and VOS. Journal of the American Society for Information Science and Technology, 61 (12), 2405–2416.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance–financial performance link. Strategic Management Journal, 18 (4), 303–319.

Waltman, L., Van Eck, N. J., & Noyons, E. C. (2010). A unified approach to mapping and clustering of bibliometric networks. Journal of Informetrics, 4 (4), 629–635.

Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting . New York: Free Press.

Zadek, S. (2001). Third generation corporate citizenship . London: The Foreign Policy Centre.

Download references

Author information

Authors and affiliations.

Department of Economics, University of Messina, Piazza Pugliatti, 1, 98122, Messina, Italy

Valeria Naciti, Fabrizio Cesaroni & Luisa Pulejo

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Fabrizio Cesaroni .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Naciti, V., Cesaroni, F. & Pulejo, L. Corporate governance and sustainability: a review of the existing literature. J Manag Gov 26 , 55–74 (2022). https://doi.org/10.1007/s10997-020-09554-6

Download citation

Accepted : 26 November 2020

Published : 03 January 2021

Issue Date : March 2022

DOI : https://doi.org/10.1007/s10997-020-09554-6

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Corporate governance

- Sustainability

- Corporate social responsibility

- Board of Directors

- Sustainability reporting

- Clustering analysis

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO

COMMENTS

The following is a comprehensive list of 200 corporate governance thesis topics, divided into 10 categories. These topics cover current issues, recent trends, and future directions in corporate governance, giving students a broad range of ideas to explore in their academic research.

In this guide, we provide a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on how to choose a relevant and feasible topic, and tips on how to write a successful corporate governance research paper.

Learn about corporate accountability and social responsibility, and the operational structures of corporations in Insights by Stanford Business. Research papers authored by Stanford GSB faculty and published in leading peer-reviewed journals on corporate governance concepts.

Corporate governance research has been driven by underlying assumptions and perspectives that are predominantly based on our understanding of US publicly listed companies and US capital market constituents with an emphasis on shareholder value maximization.

New research on corporate governance from Harvard Business School faculty on issues including the structure of board committees, the consequences of mandatory corporate sustainability reporting, and a cure of Enron-style audit failures.

Sep 2024. Shahbaz Sheikh. This study empirically examines the effect of corporate governance on the relation between CEO power and firm leverage. Results from OLS and industry fixed effects...

Corporate governance has become a topic of broad public interest as the power of institutional investors has increased and the impact of corporations on society has grown. Yet ideas about how...

Using a content analysis of 165 articles published in top journals from accounting, finance, management, and organization disciplines, we explore research on institutions, corporate governance, and firm outcomes.

It encompasses a set of principles, practices, and processes designed to ensure that a company operates efficiently, ethically, and in the best interests of its stakeholders, including shareholders, employees, customers, and the wider community. Advertisement. 2. Defining the concept of corporate governance. At its core, corporate governance is ...

In this study, we analyze 468 research studies published between 1999 and 2019 by employing three clustering analysis visualization techniques, namely keyword network clustering, co-citation network clustering, and overlay visualization. In addition, we provide a brief review of each cluster.