Advantages and Disadvantages of Interview in Research

Approaching the Respondent- according to the Interviewer’s Manual, the introductory tasks of the interviewer are: tell the interviewer is and whom he or she represents; telling him about what the study is, in a way to stimulate his interest. The interviewer has also ensured at this stage that his answers are confidential; tell the respondent how he was chosen; use letters and clippings of surveys in order to show the importance of the study to the respondent. The interviewer must be adaptable, friendly, responsive, and should make the interviewer feel at ease to say anything, even if it is irrelevant.

Dealing with Refusal- there can be plenty of reasons for refusing for an interview, for example, a respondent may feel that surveys are a waste of time, or may express anti-government feeling. It is the interviewer’s job to determine the reason for the refusal of the interview and attempt to overcome it.

Conducting the Interview- the questions should be asked as worded for all respondents in order to avoid misinterpretation of the question. Clarification of the question should also be avoided for the same reason. However, the questions can be repeated in case of misunderstanding. The questions should be asked in the same order as mentioned in the questionnaire, as a particular question might not make sense if the questions before they are skipped. The interviewers must be very careful to be neutral before starting the interview so as not to lead the respondent, hence minimizing bias.

listing out the advantages of interview studies, which are noted below:

- It provides flexibility to the interviewers

- The interview has a better response rate than mailed questions, and the people who cannot read and write can also answer the questions.

- The interviewer can judge the non-verbal behavior of the respondent.

- The interviewer can decide the place for an interview in a private and silent place, unlike the ones conducted through emails which can have a completely different environment.

- The interviewer can control over the order of the question, as in the questionnaire, and can judge the spontaneity of the respondent as well.

There are certain disadvantages of interview studies as well which are:

- Conducting interview studies can be very costly as well as very time-consuming.

- An interview can cause biases. For example, the respondent’s answers can be affected by his reaction to the interviewer’s race, class, age or physical appearance.

- Interview studies provide less anonymity, which is a big concern for many respondents.

- There is a lack of accessibility to respondents (unlike conducting mailed questionnaire study) since the respondents can be in around any corner of the world or country.

INTERVIEW AS SOCIAL INTERACTION

The interview subjects to the same rules and regulations of other instances of social interaction. It is believed that conducting interview studies has possibilities for all sorts of bias, inconsistency, and inaccuracies and hence many researchers are critical of the surveys and interviews. T.R. William says that in certain societies there may be patterns of people saying one thing, but doing another. He also believes that the responses should be interpreted in context and two social contexts should not be compared to each other. Derek L. Phillips says that the survey method itself can manipulate the data, and show the results that actually does not exist in the population in real. Social research becomes very difficult due to the variability in human behavior and attitude. Other errors that can be caused in social research include-

- deliberate lying, because the respondent does not want to give a socially undesirable answer;

- unconscious mistakes, which mostly occurs when the respondent has socially undesirable traits that he does not want to accept;

- when the respondent accidentally misunderstands the question and responds incorrectly;

- when the respondent is unable to remember certain details.

Apart from the errors caused by the responder, there are also certain errors made by the interviewers that may include-

- errors made by altering the questionnaire, through changing some words or omitting certain questions;

- biased, irrelevant, inadequate or unnecessary probing;

- recording errors, or consciously making errors in recording.

Bailey, K. (1994). Interview Studies in Methods of social research. Simonand Schuster, 4th ed. The Free Press, New York NY 10020.Ch8. Pp.173-213.

Sociology Group

The Sociology Group is an organization dedicated to creating social awareness through thoughtful initiatives like "social stories" and the "Meet the Professor" insightful interview series. Recognized for our book reviews, author interviews, and social sciences articles, we also host annual social sciences writing competition. Interested in joining us? Email [email protected] . We are a dedicated team of social scientists on a mission to simplify complex theories, conduct enlightening interviews, and offer academic assistance, making Social Science accessible and practical for all curious minds.

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Qualitative Research Interviews

Try Qualtrics for free

How to carry out great interviews in qualitative research.

11 min read An interview is one of the most versatile methods used in qualitative research. Here’s what you need to know about conducting great qualitative interviews.

What is a qualitative research interview?

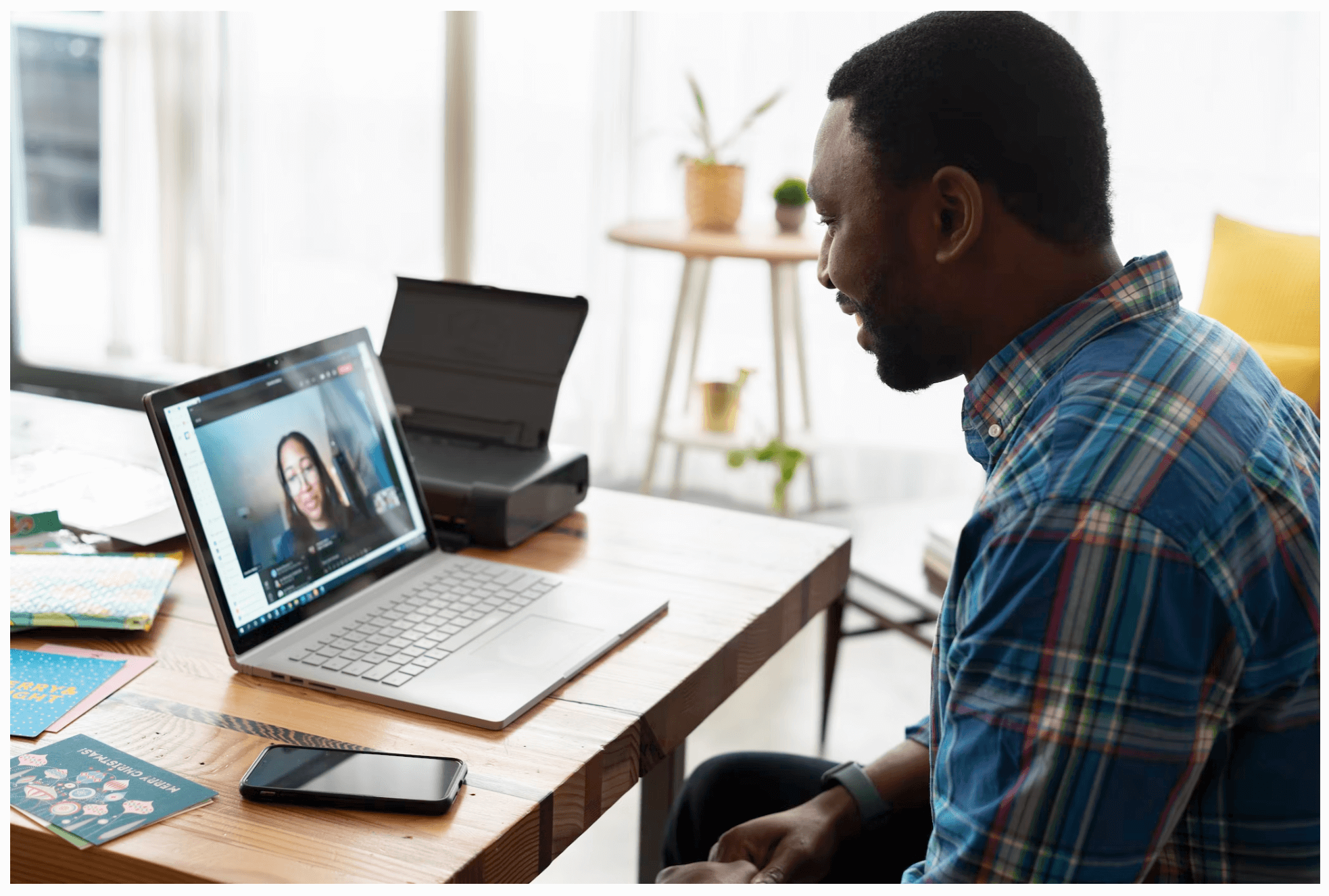

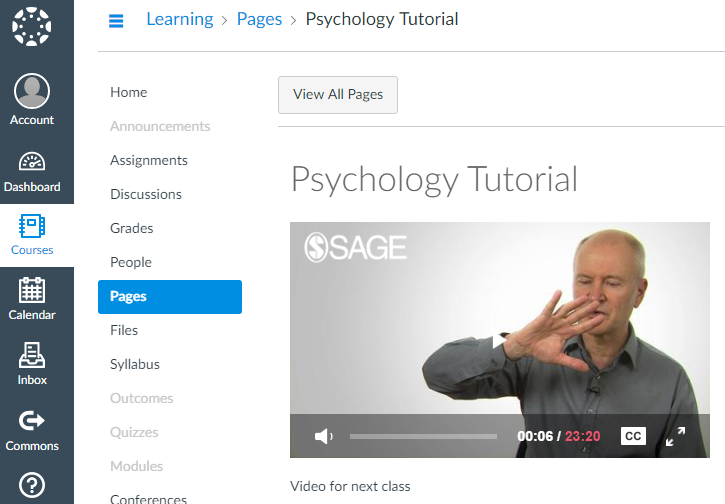

Qualitative research interviews are a mainstay among q ualitative research techniques, and have been in use for decades either as a primary data collection method or as an adjunct to a wider research process. A qualitative research interview is a one-to-one data collection session between a researcher and a participant. Interviews may be carried out face-to-face, over the phone or via video call using a service like Skype or Zoom.

There are three main types of qualitative research interview – structured, unstructured or semi-structured.

- Structured interviews Structured interviews are based around a schedule of predetermined questions and talking points that the researcher has developed. At their most rigid, structured interviews may have a precise wording and question order, meaning that they can be replicated across many different interviewers and participants with relatively consistent results.

- Unstructured interviews Unstructured interviews have no predetermined format, although that doesn’t mean they’re ad hoc or unplanned. An unstructured interview may outwardly resemble a normal conversation, but the interviewer will in fact be working carefully to make sure the right topics are addressed during the interaction while putting the participant at ease with a natural manner.

- Semi-structured interviews Semi-structured interviews are the most common type of qualitative research interview, combining the informality and rapport of an unstructured interview with the consistency and replicability of a structured interview. The researcher will come prepared with questions and topics, but will not need to stick to precise wording. This blended approach can work well for in-depth interviews.

Free eBook: The qualitative research design handbook

What are the pros and cons of interviews in qualitative research?

As a qualitative research method interviewing is hard to beat, with applications in social research, market research, and even basic and clinical pharmacy. But like any aspect of the research process, it’s not without its limitations. Before choosing qualitative interviewing as your research method, it’s worth weighing up the pros and cons.

Pros of qualitative interviews:

- provide in-depth information and context

- can be used effectively when their are low numbers of participants

- provide an opportunity to discuss and explain questions

- useful for complex topics

- rich in data – in the case of in-person or video interviews , the researcher can observe body language and facial expression as well as the answers to questions

Cons of qualitative interviews:

- can be time-consuming to carry out

- costly when compared to some other research methods

- because of time and cost constraints, they often limit you to a small number of participants

- difficult to standardize your data across different researchers and participants unless the interviews are very tightly structured

- As the Open University of Hong Kong notes, qualitative interviews may take an emotional toll on interviewers

Qualitative interview guides

Semi-structured interviews are based on a qualitative interview guide, which acts as a road map for the researcher. While conducting interviews, the researcher can use the interview guide to help them stay focused on their research questions and make sure they cover all the topics they intend to.

An interview guide may include a list of questions written out in full, or it may be a set of bullet points grouped around particular topics. It can prompt the interviewer to dig deeper and ask probing questions during the interview if appropriate.

Consider writing out the project’s research question at the top of your interview guide, ahead of the interview questions. This may help you steer the interview in the right direction if it threatens to head off on a tangent.

Avoid bias in qualitative research interviews

According to Duke University , bias can create significant problems in your qualitative interview.

- Acquiescence bias is common to many qualitative methods, including focus groups. It occurs when the participant feels obliged to say what they think the researcher wants to hear. This can be especially problematic when there is a perceived power imbalance between participant and interviewer. To counteract this, Duke University’s experts recommend emphasizing the participant’s expertise in the subject being discussed, and the value of their contributions.

- Interviewer bias is when the interviewer’s own feelings about the topic come to light through hand gestures, facial expressions or turns of phrase. Duke’s recommendation is to stick to scripted phrases where this is an issue, and to make sure researchers become very familiar with the interview guide or script before conducting interviews, so that they can hone their delivery.

What kinds of questions should you ask in a qualitative interview?

The interview questions you ask need to be carefully considered both before and during the data collection process. As well as considering the topics you’ll cover, you will need to think carefully about the way you ask questions.

Open-ended interview questions – which cannot be answered with a ‘yes’ ‘no’ or ‘maybe’ – are recommended by many researchers as a way to pursue in depth information.

An example of an open-ended question is “What made you want to move to the East Coast?” This will prompt the participant to consider different factors and select at least one. Having thought about it carefully, they may give you more detailed information about their reasoning.

A closed-ended question , such as “Would you recommend your neighborhood to a friend?” can be answered without too much deliberation, and without giving much information about personal thoughts, opinions and feelings.

Follow-up questions can be used to delve deeper into the research topic and to get more detail from open-ended questions. Examples of follow-up questions include:

- What makes you say that?

- What do you mean by that?

- Can you tell me more about X?

- What did/does that mean to you?

As well as avoiding closed-ended questions, be wary of leading questions. As with other qualitative research techniques such as surveys or focus groups, these can introduce bias in your data. Leading questions presume a certain point of view shared by the interviewer and participant, and may even suggest a foregone conclusion.

An example of a leading question might be: “You moved to New York in 1990, didn’t you?” In answering the question, the participant is much more likely to agree than disagree. This may be down to acquiescence bias or a belief that the interviewer has checked the information and already knows the correct answer.

Other leading questions involve adjectival phrases or other wording that introduces negative or positive connotations about a particular topic. An example of this kind of leading question is: “Many employees dislike wearing masks to work. How do you feel about this?” It presumes a positive opinion and the participant may be swayed by it, or not want to contradict the interviewer.

Harvard University’s guidelines for qualitative interview research add that you shouldn’t be afraid to ask embarrassing questions – “if you don’t ask, they won’t tell.” Bear in mind though that too much probing around sensitive topics may cause the interview participant to withdraw. The Harvard guidelines recommend leaving sensitive questions til the later stages of the interview when a rapport has been established.

More tips for conducting qualitative interviews

Observing a participant’s body language can give you important data about their thoughts and feelings. It can also help you decide when to broach a topic, and whether to use a follow-up question or return to the subject later in the interview.

Be conscious that the participant may regard you as the expert, not themselves. In order to make sure they express their opinions openly, use active listening skills like verbal encouragement and paraphrasing and clarifying their meaning to show how much you value what they are saying.

Remember that part of the goal is to leave the interview participant feeling good about volunteering their time and their thought process to your research. Aim to make them feel empowered , respected and heard.

Unstructured interviews can demand a lot of a researcher, both cognitively and emotionally. Be sure to leave time in between in-depth interviews when scheduling your data collection to make sure you maintain the quality of your data, as well as your own well-being .

Recording and transcribing interviews

Historically, recording qualitative research interviews and then transcribing the conversation manually would have represented a significant part of the cost and time involved in research projects that collect qualitative data.

Fortunately, researchers now have access to digital recording tools, and even speech-to-text technology that can automatically transcribe interview data using AI and machine learning. This type of tool can also be used to capture qualitative data from qualitative research (focus groups,ect.) making this kind of social research or market research much less time consuming.

Data analysis

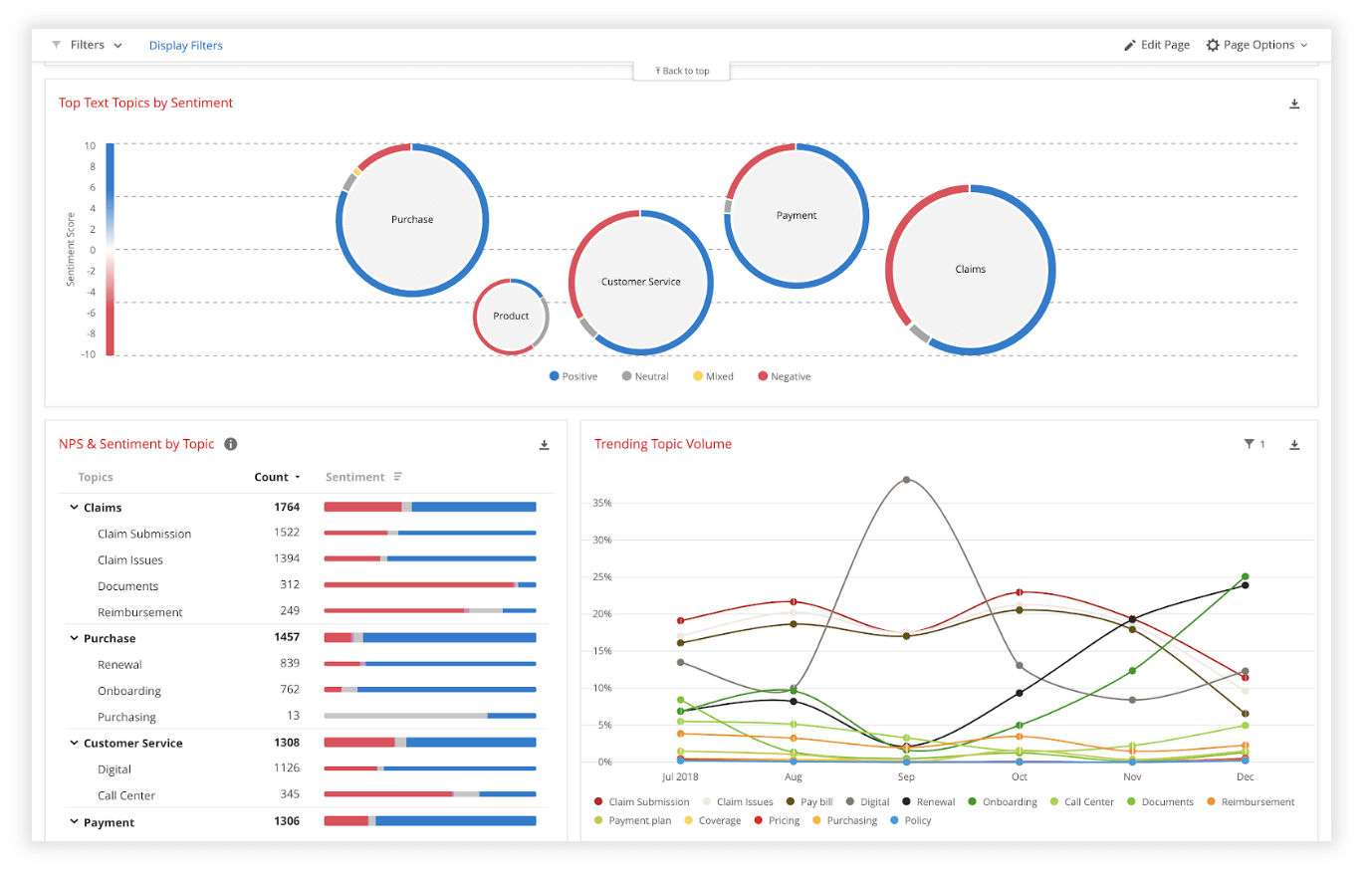

Qualitative interview data is unstructured, rich in content and difficult to analyze without the appropriate tools. Fortunately, machine learning and AI can once again make things faster and easier when you use qualitative methods like the research interview.

Text analysis tools and natural language processing software can ‘read’ your transcripts and voice data and identify patterns and trends across large volumes of text or speech. They can also perform khttps://www.qualtrics.com/experience-management/research/sentiment-analysis/

which assesses overall trends in opinion and provides an unbiased overall summary of how participants are feeling.

Another feature of text analysis tools is their ability to categorize information by topic, sorting it into groupings that help you organize your data according to the topic discussed.

All in all, interviews are a valuable technique for qualitative research in business, yielding rich and detailed unstructured data. Historically, they have only been limited by the human capacity to interpret and communicate results and conclusions, which demands considerable time and skill.

When you combine this data with AI tools that can interpret it quickly and automatically, it becomes easy to analyze and structure, dovetailing perfectly with your other business data. An additional benefit of natural language analysis tools is that they are free of subjective biases, and can replicate the same approach across as much data as you choose. By combining human research skills with machine analysis, qualitative research methods such as interviews are more valuable than ever to your business.

Related resources

Market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, qualitative research questions 11 min read, qualitative research design 12 min read, primary vs secondary research 14 min read, request demo.

Ready to learn more about Qualtrics?

- Site Building

- Quick Reads

- About Academy

- Perspectives

- Using In-Depth Interviews and Focus Groups for Your Market Research

- Introduction to Market Research: What It Is and Why You Need It

- Introduction to Market Research: When and How to Start

- Conducting a Situation Analysis: The SWOT Analysis

- Using Your SWOT Analysis to Drive Your Market Research

- Conducting Competitor Research

- Resource List for Secondary Market Research

- Conducting Primary Market Research

- Creating a Killer Market Research Survey

- Best Practices for Moderating and Analyzing Interviews and Focus Groups

- Conducting Observational Research for Your Business

In the last section, we tackled the market research survey —that fixed set of questions you send out to a segment of your market for feedback on some aspect of your business. While surveys do pose qualitative (open-ended) questions, they’re used primarily for quantitative research. That is, they’re great for arriving at a consensus through loads of consumer data… but they won’t necessarily get you the deepest of insights.

Because let’s be honest: No one pours their heart out in a survey—no matter how many lines you offer them to fill in.

Enter the in-depth interview and the focus group for that information. Both market research techniques give you the opportunity to be in two-way communication with consumers—in a form unrestricted by question limits—and to establish a rapport with them. That sets the stage for deep and rewarding insights.

The Advantages of Direct Communication in Primary Market Research

“Direct contact” can mean many things, including conversations mediated by telephone, video conferencing , and chat platforms . Indeed, two great advantages of using these technologies for your market research are their expediency and their cost-effectiveness: You can cover a broad geographic area without anyone having to travel anywhere; and consecutive interviews can be conducted from the comfort of your own office. If you’re working within a budget, telephone interviews can be as insightful as in-person interviews… and the recommendations we offer below are just as applicable to that form of primary research.

Of course, in-person interviews and focus groups have their distinct advantages. In the first place, once you’ve got someone in a room, they can’t “hang up” on you: Both (or all) parties have signaled their commitment by arriving. What’s more, because you’re looking them directly in the eye, you’ll know your interviewees aren’t distracted by anything… and fully present participants are naturally going to give you the most sincere insights.

In the second place, when you get someone from your target market in a room, you have access to additional sources of information: body language, facial expressions, gestures, and so on. These non-verbal cues can sometimes reveal more about interviewees’ sentiments than they’d be willing to admit (or than they can even acknowledge to themselves ).

When the interviewer is adept at reading such non-verbal cues and putting interviewees at ease, these conversations lead to honest insights about emotions, opinions, and attitudes: Why did they really leave your business? How do they really use your product? What were they actually feeling when they moved through your purchasing funnel? What were the real psychic/emotional barriers?

As you can imagine, if you can get past the costs (travel, compensation, venue, moderator payment) and logistics of getting two or more people in a room for an hour or more, it’ll be well worth it. Not only will you get terrific qualitative insights to pair with your quantitative data; you’ll also gain a richer understanding of your customer personas , their journeys, motivations, and the language they use. (Of course, you’ll be looking out for “sticky” messages that you can use for future website or ad copy).

In-depth interviews and focus groups will fill in the emotional context for the numbers your surveys and secondary research give you. But remember that these are supplements —not substitutes —for those more quantitative research methods. While they’ll give you rich insights into unique individuals, be careful about generalizing from the information you get from these conversations. Your interviewees are representative of your target population, but they’re too small a sample size to draw statistical conclusions about your larger target market from. That’s what quantitative research is for.

But for now ? We’re talking quality over quantity.

In-Depth Interviews vs. Focus Groups: Which to Use?

In-depth interviews are often described as “focus groups of one,” and focus groups as “large-scale interviews.” In some ways, these are fair comparisons: Both methodologies revolve around semi-structured discussions whose core questions are designed to go deep , to help the business understand some problem. In both cases, respondents are respectfully treated as “experts” who can “teach” the business about its market’s feelings, perceptions, opinions, and hesitations.

But to state the obvious, dynamics change the moment a party of two becomes a party of three or more: Suddenly there are new interpersonal negotiations, sociocultural categorizings, hierarchies, and contentions. From a business perspective, you’ll have cost, time, and possibly location to account for. These may very well be factors in your decision, but so should the following:

When to use in-depth interviews

In-depth, one-on-one interviews can happen just about anywhere: at your business, at their home, or at a neutral location such as a rented venue. They can happen on the street while people are exiting a physical space—on their way out of a retail establishment, for example. They can happen in “captive audience” situations—during a conference, a workshop, or a public event.

This locational flexibility is one of the reasons in-depth interviews are among the most prevalent forms of primary research. Here are some of the reasons why you’d choose one over a focus group:

- When you’re gathering sensitive feedback . “Sensitive” might mean anything from disclosing personal information (finances or health issues) to more generally uncomfortable topics (birth control or personal hygiene products). If your research concerns topics that people might not feel comfortable discussing in a group, in-depth interviews should be your choice. (What’s more, if you’re looking for critique in a culture that tends to be more “polite” or less prone to debate, you might get more honest responses in a one-on-one inquiry.)

- When participants are competitors . Can you imagine hosting a focus group made up of competitors who are reluctant to share information for fear of losing whatever competitive advantage they might have? Unsurprisingly, these sorts of environments don’t foster open communication. You want participants who are willing to disclose information; so if they’re from the same vertical industry, you’d do best to meet with them separately.

- When you’re concerned about group hierarchy . Any time a focus group might present an inherent imbalance of power (bringing both workers and their supervisors into the same room, for example) you risk making some participants feel less at ease about sharing their views. Choose the one-on-one strategy for these situations.

- When you want feedback on isolated user experiences . Knowing how users perform individual activities, or what their individual experiences with products are, doesn’t require groupthink. Indeed, anytime you want to know anything about individual user experience (usability testing, decision processes, personal responses to ad campaigns, how much progress a client has made toward a goal, etc), one-on-one interviews are your best bet. They’ll get you honest, insightful feedback untainted by other participants’ responses.

When to use focus groups

There are plenty of advantages to getting a number of people (typically 6-10) together in a room so they can discuss a topic relevant to your business. More minds means more insight, information, and ideas. Memories get jogged; comments from one end of the table trigger ideas on the other end; solutions get fully developed through energetic collaboration. And since no one is required to answer every question, participants jump into the conversation spontaneously, when they have something insightful to say on that topic.

Here are some circumstances in which it makes sense to choose a focus group:

- When you need to brainstorm ideas . Focus groups are a terrific strategy for broad, exploratory topics, such as imagining new product features or working through ideas for your next ad campaign. Anytime you’re early on in the exploratory phase of a concept or topic (the what if…? phase), choose a focus group to assist with idea-generation and discovery.

- When you’re about to go live . This might mean just before you launch that ad campaign, or before that concept goes to market, or before you turn that prototype into The Real Deal and release it into the world. This is especially the case if you relied on secondary research to create that ad, concept, or prototype. The numbers might back you up… but you also want subjective, affective “data” describing why those numbers work. Refine before you release.

- When you want multiple perspectives, or to explore disparate views . You might be at a point in your decision-making process where two very different options seem feasible, and you want to hear representatives from your target market debate the pros and cons of each. Let your market generate the arguments for you. They might make a case for something you’d never considered before.

- When you want to better understand the complexities of your target market . While a single interviewee might give you great insights, they won’t be representative of your target market. Granted, focus groups won’t be either … but they will offer a broader range of representation. Collectively, the group can also help you understand the motivations behind more complex behaviors. Did your market say they wanted a product—but now they’re not buying? Focus groups can help you explore the apparent disconnect between declared desire and action.

- When you want to know more about your brand perception . Focus groups are great for brand insights. After all, it’s consumers who create your brand perception through shared experience (what they imagine about your business and how they speak about it); it’s not something your business makes . So go directly to the source for this intelligence.

- When you want to evaluate reactions . Have a new campaign ad to run by consumers? A new food product to test? These aren’t the “isolated user experiences” we discussed above; and the feedback is best collected through group discussion.

If you’re still unsure which method is best for your market research question, ask yourself: “How (or what ) will group dynamics contribute to my findings?”

Preparing for Your In-Depth Interview or Focus Group

Whichever method you choose, the event will take some pre-planning. Here’s what to consider:

Clarify your goal and structure

Never go into market research without a clear idea of your question, and what its answer will mean for your business. A SWOT analysis can help you home in on your business’s strengths, weaknesses, opportunities, and threats so you can narrow down your research to a single topic. Remember: You’re going for depth—not breadth—here. What’s the problem you’re gathering information on? The clearer your answer, the more useful your questions will ultimately be.

Your goal will also help you decide whether a structured or unstructured interview will be more effective. Granted, if you’re hosting a focus group, your “interviewer” will be more a moderator than anything: They’re there to get participants discussing amongst themselves, rather than to adhere to a predefined list of questions. Focus groups are, by nature, more unstructured.

With in-depth interviews, however, you’ll make a conscious choice between these two types. In unstructured interviews, the interviewer arrives with a series of well-thought-out issues to address; but the questions take shape during the conversation. Structured interviews, on the other hand, are a bit like verbal surveys. Standardizing the Q&A in this way—asking the same questions in the same order, every time—ensures more consistent data between interviews.

Choose an appropriate location and time

You’ve got a nearly unlimited range of possibilities (including online “locations”) here. Consider your needs: A facility with access to cameras so you can record the interview? One-way mirrors for observers? The location you choose should be easy to get to, easy to park near, and the room should feel intimate and provide as few distractions as possible. If you’re hosting a focus group, all participants should be able to sit facing each other.

Then consider your participants. If you’re a B2B company, you might hold your focus group at a downtown location during work hours, setting the space up board-room style. If you’re hosting consumers, evening may work best, you may choose a more suburban venue, and the setup might look less formal. If your demographic involves consumers of a lower socio-economic status, consider a venue along public transportation routes. Consider religious holidays. You get the point. You know your personas better than we do. Imagine the venue they’d want.

Plan your documentation strategy

Tape recording? Video recording? Note-taking by the moderator or a third-party observer? Each of these strategies will affect the dynamics of the conversation differently, and will give you access to different information after the fact. (For instance, a tape recording won’t help you recall who said what, or what their facial expression was when they said it. But it will get you a full transcript.) Of course, you’ll need all participants’ permission before hitting a “Record” button of any kind.

While we’d recommend digital recording, note-taking is a useful backup plan in case of malfunction, dead batteries, or static on the recording. If your interviewer is your note-taker, ensure that they can take notes and listen simultaneously, and record in a low-key manner. Participants who see moderators jumping to the notebook and writing furiously might be influenced to answer subsequent questions similarly (or very differently!)

Select your interviewer or moderator

Of course, anyone in theory could take on this role: the business owner, an associate, or someone else in your organization. But remember that the best interviewer is an unbiased one; and the more that’s at stake for your interviewer in the outcome, the less impartial they’re likely to be. This will affect group dynamics, and it won’t get you the data you need. The same goes for a moderator who knows the participants: Where there’s an established relationship, participants are less likely to be critical.

That said, you might decide to hire an experienced moderator—for example, someone trained in psychology who can better observe and understand complex behaviors. Trained moderators can quickly create a permissive and nurturing environment and keep an active conversation going for the time allotted (typically 30 minutes to an hour for an in-depth interview, and 1-2 hours for a focus group), with the study’s objectives always at the forefront. Which isn’t quite as easy as it sounds.

Well-seasoned moderators can monitor the conversation and change course on the fly. They can recognize when participants are speaking out of a psychological pressure to respond in a particular way. They’re trained in drawing quieter participants out of their shells, giving time to slower thinkers, tamping down heated discussions, and tactfully curbing participants who are monopolizing the conversation. They can visualize how key pieces of information fit together, clearly identify when a topic has been sufficiently covered, and know when to skip questions that earlier comments have suggested are irrelevant to the person or group at hand. They can interpret body language, gestures, hesitations, and facial expressions. And they can do all this without being an expert on the subject.

If you have this person in your organization, that’s remarkable: Use them ! If not, you can find trained moderators through an online search, referrals, or by posting a query in an industry forum.

Select your participants

Your sample size will be a matter of how clear a picture you want of your target market. Naturally, the more participants you have, the stronger your sense of the segment will be. You’ll probably want to conduct more than one in-depth interview, and you may also want to hold more than one focus group to ensure consistency across gatherings. At some point, you’ll see common themes emerging in responses. That’s when you’ll know you’re moving toward sounder conclusions.

At the risk of stating the obvious, the participants you select should be in a position to answer all of your questions. Remember, they’re the “experts”: maybe because they fit a persona with particular buying habits, or because they have relevant experience with a product (“new mothers in their ’30s who live in Western Massachusetts” or “males between the ages of 18-25 who play at least 15 hours of video games a week”).

Due to their commonality of experience, your focus groups will necessarily have some degree of homogeneity. That said, consider that first example: If you’re looking to target all new mothers, maybe you’d split your groups by income (new mothers who make less than and more than $100k), education (new mothers with and without a college degree), or relationship status (single mothers versus partnered mothers). Different demographics may provide different responses. If you foresee this, split your groups along these lines.

Participants may already be your customers or followers, in which case you can contact them through your CRM or by putting a call out on social media platforms. You can also find them through Facebook groups, advertisements, social events that your target audience attends, or market research companies who can find focus groups that match the target demographic you want to reach.

If you want to ensure that these prospects really do meet your criteria, set up a screening process before you officially invite them as an interviewee or focus group member. Try to ensure that participants aren’t familiar with each other. (Familiarity affects group dynamics.) Finally, recruit more participants than you need: You’ll almost inevitably get “no-shows.”

Standardize your proceedings

There are a few other things you’ll want to determine early on to ensure uniformity across interviews. Decide whether participants will be told who’s sponsoring the study, what the purpose of the interview or focus group is, and how the data will be used to make decisions after the fact. Choosing to offer this information to one group or participant and not to another may lead to different responses and variations in data.

You’ll should also create a guide—or at least a list of questions—that the interviewer or moderator will use to guide the discussion and ensure all topics are covered. (We’ve got some recommendations on the questions and the structure of the interview or focus group in the next section.) If you’re hosting a focus group, establish clear session guidelines in writing. You’ll share these with participants so they know what’s expected of them.

And before The Big Day, you might even consider running a pilot test to ensure your guide is a viable support.

You’ve got your interviewee or focus group in the room… now what? In the next section, we cover best practices for these forms of primary research to follow on the day itself.

Lauren Shufran

Sign up for our newsletter to get more quality content

- Market Research Techniques

- Quantitative Research

- Qualitative Research

- Ethnographic Research

- Depth Interviews

- Focus Group Research

- Market Research Surveys

- Face-to-Face Research

Spark Life 360

Spark flexi-track.

- Spark S-Factor

In-Depth Interviews – Advantages & Disadvantages

In-depth interviews are one of the most effective ways to learn more about your consumers. They are a qualitative research method, with the aim to explore each participant’s feelings, perspectives and points of view. They can be used as a standalone research method or in conjunction with others, depending on the type of project.

One to one interviews are ideal for research projects that may cover sensitive or divisive topics, or where it would be logistically difficult to get multiple participants in the same space for a focus group. They are also of great value when we need to truly understand the differences across different customer types on a granular level, which methods like focus groups do not deliver on.

Whether face to face or digitally the most important factor is that the researcher builds a rapport with the participant. The style of the interview itself will depend on the researcher, but the best ones will make sure the participant feels relaxed enough to give honest and open answers. You’d be surprised how open people are once they feel comfortable to share their feelings.

At Spark our team are experts at conducting in-depth interviews, and work with brands across all different industries. We are naturally curious, and maybe a little nosey, which means we love finding out how people interact with brands, products and services, whether that be a bank, a supermarket or a food / drinks outlet.

We have worked with all types of people, from age 6 to 86, across all different backgrounds, to provide insight that can help take your brand to the next level. Find out more about our in-depth interviews here .

The different types of in-depth interviews

Conducting interviews takes a lot of planning, and there are a variety of formats they can be in depending on what your ultimate objectives are.

In- depth interviews are not always one to one. In some instances, there may be the need to conduct a paired depth – such as an interview with a couple or a friendship pair

Sometimes all that we need is just to sit with people for 45-60 minutes to uncover a wealth of information that helps brands grow. Other types of interviews are:

How we get the best out of our in-depth interviews

Warm up: We always start broad and get our participants in a relaxed and comfortable state of mind before probing on more detailed views. It’s important to build rapport and trust.

Flexible: We use a semi structured guide to keep us on topic, but our expert team know when something ‘off topic’ is worth exploring.

Iterative and Interactive: The iterative process is the practice of building, refining, and improving a project, product, or initiative . We learn and adapt according to our cumulative learnings. Even within each interview we must think two steps ahead to inspire further questions and exploration.

Deep: We have ways of making you talk!! We have lots of what we in the industry call ‘projective or enabling techniques’ that help our participants articulate their feelings. This might be as simple as projecting on to a third person, or object to remove the personal nature of a question.

Fun: This must be an enjoyable process, so where appropriate we will sprinkle in some fun questions or gamify the process a little to keep the energy high.

The advantages of in-depth interviews

There are many reasons why in-depth interviews are an excellent way to find out more about your target market.

Work alongside other methods

In-depth interviews can work well as a pre cursor to measuring opinions. All the information gathered means we can really hone the questionnaire into a more relevant set of questions and test hypothesis emerging from the Qual.

Deeper understanding of participants

Interviewers can gain incredibly deep insights due to the one-on-one nature of interviews. It allows for the exploration of topics that may not be explored in quantitative methods of data collection. It can also help build clear customer segments for our clients, which can then be measured.

Observing the unsaid as well as the said

If taking place face to face (or visually online), the interviewer can pick up on non-verbal cues from the participant and construe their emotions on different topics.

The disadvantages of in-depth interviews

As with every method of data collection, in-depth interviews have their own disadvantages which need to be considered.

Time intensive

In-depth interviews are one of the most time-consuming ways of collecting data, as they require a large amount of preparation beforehand. The interviews themselves take time, in addition to then transcribing them and analysing the results after the fact.

Trained interviewer

To be able to conduct effective research, interviewers need to be well-trained. This will allow them to gather rich and detailed information from each participant. They also need to be able to utilise the latest interview techniques and be personable so they can allow the participants to feel comfortable and give honest answers.

Lack of idea generation

In depths are not as useful when trying to generate new ideas or create new concepts. This is where a focus group format is usually preferred where participants can spark ideas off one another.

What is the purpose of in-depth interviews?

In-depth interviews allow brands to understand their target market, from their likes and dislikes to their behaviours. They can also really bring to light the highs and lows of a customer journey. This allows brands to make well-informed decisions for things such as marketing strategies, product launches, store placement and customer service.

Businesses can also gain a better understanding of product demand and can design products that have higher potential for being accepted into the market. It’s fair to say that in-depth interviews have both advantages and disadvantages but can be an incredibly useful tool to help you achieve your brand goals.

Spark’s in-depth interviews

In-depth interviews are one of our favourite research methods! We like to keep them informal and friendly and call them ‘Chit Chats’. Time and time again they have proved fertile ground for potential for new marketing campaigns and can take your brand in new and exciting directions.

Our trained research experts are fantastic at diving under the surface and assigning meaning to even the most complex perceptions, behaviours, and experiences. Our focus is always on really moving beyond the ‘reported story’ to uncover the ‘real one’, that sometimes even the participants themselves are surprised at!

Spark Market Research is an award-winning company and we have worked with a variety of prestigious brands in a whole range of industries. Our core value is using innovative ways to gain meaningful consumer insights for our clients. We collaborate with our clients every step of the way in order to gain fruitful results that drive incredible marketing strategies. Find out more about In- Depth Interviews here .

Share This:

Market research solutions.

Ever wanted to be a fly on the wall as your consumer uses your or…

What is Spark Glow? Its Contagious! As a strategy research agency we often hear the…

Brand Tracking Research for Business Success Market Research is the bridge between your brand and…

What is Spark Clan? Spark clan is how we segment large samples of consumers in…

Have A Project In Mind?

Recent posts.

Raising the bar in stakeholder workshops

Come on feel the noise! Landing community insights with impact

You’d better watch out – Three pitfalls of online qual research and how to handle them

So you think you’re a Trendsetter?

Start for free

Market Research Interviews: 7 Strategies for Success

Julia Kolomiiets

Aug 29, 2023

Customers are a valuable source of knowledge for any marketer. To learn what they think, how they feel, and how they behave, we can use Market Research Interviews. This tool of market research can help you collect valuable quantitative or qualitative information about your potential or existing customers.

Market research interviews are helpful for making right marketing decisions on expanding to new markets, launching new products, or changing the way a product or service is promoted.

Marketing research process identifies a set of practices used by a company to study its target market.

Market research process can help you with the following activities:

Study your competitors

Understand your current customers

Identify and study potential customers

Learn about new niches or markets

Keeping up with trends

Developing and introducing new products/services

Rebranding & changing marketing strategies

Altering the existing products/services

Creating or changing your positioning

Transform Your Market Research with Noty.ai

Discover the next level of efficiency in your market research interviews. Utilize Noty.ai to capture and analyze insights like never before. Say goodbye to manual note-taking and hello to enhanced productivity.

Start using Noty.ai AI meeting notes today!

Types of market research, primary market research.

A business studies market, its trends, and TA, using surveys, interviews, etc. It requires a large budget, time and dedicated specialists.

Secondary market research

A business uses existing market research (from several sources) to compile one document. It is usually conducted when the budget for research is tight.

Methods of market research

Roundtables

Focus Groups

Observation

Goals of marketing research process

Make marketing decisions, like launching a new product, targeting a new market, etc.

Identify new opportunities for business

Provide information for potential investors

Mitigate business risks and avoid mistakes

Benefits of marketing research process

Data-driven marketing

Better understanding of your competitors, products, and TA.

The ability to cater your marketing activities to meet the customer needs.

Better planning and ability to improve ROI of marketing activities.

Steps in marketing research process

Outline the subject you’re going to research. For example, we need to study the features that the competing tools provide.

Develop the playbook for your research. It will contain the subject of research and the type of data you need to gather, the methods (e.g., interview), the necessary resources (time, budget), the timeline, and the step-by-step plan.

Approve the plan with top management and allocate the necessary resources.

Implement the research plan and gather the data.

Analyze the data and develop your recommendations for the business.

Present the marketing research to the management.

Market research interview is one of the tools of market research that enables you to learn the feelings, opinions, and behavioral patterns of your chosen target audience.

Types of market research interviews:

Market research interviews are categorized in several ways.

By the level of interviewee’s personal involvement:

Face-to-face

The interviewee and the interviewer have a face-to-face appointment in real life. It’s a great method as it enables the researcher to build rapport and analyze the non-verbal cues. The main disadvantages is the budget, the location limitations, and general unwillingness of people to go somewhere to participate in an interview.

Online video conferencing

This method has most of the advantages of a face-to-face appointment. However, it’s cheaper. You’re not limited by geography and your participants are more willing as they do not need to spend their time on the trip to your office and back. Similar to the previous method, it’s perfect for open-ended questions and qualitative research.

Telephone interviews are a relatively cheap and fast method. However, the possibilities for building rapport and listening to non-verbal cues are limited. It’s best for close-ended questions.

Form fill-out

The interviewee fills out a questionnaire and submits it to the interviewer. This method requires least time and engagement from the interviewee. It’s the cheapest method. And it’s generally good for quantitative research.

However, there’s no opportunity to build a rapport with the interviewee, and no space for insights. Sometimes this method is categorized as a separate method of market research process.

By the data:

Qualitative - you learn how interviewee feel and what they think (e.g., which services people consider the most important).

Quantitative - you only learn data in numbers (e.g., how many times per week a person uses the application).

Mixed - you learn moth qualitative and quantitative data

By organization:

Structured - all questions are premeditated and close-ended.

Unstructured - questions are open-ended and the interview relies on spontaneity.

Semi-structured - the middle ground between unstructured and structured interviews.

Elevate Your Research Insights with Noty.ai

Make your market research interviews more impactful with Noty.ai. Experience the ease of automated transcriptions and recordings. Don't miss out on valuable information - let Noty.ai be your assistant.

Try meeting transcriptions now!

Pros and cons of market research interviews.

Interview as a method of market research has several benefits:

1. It enables you to obtain in-depth information about your target audience, their feelings, ideas, and behaviors.

2. It can give you unexpected insights into your product/service or separate features, especially if you have one-on-one interviews and use semi-structured or unstructured surveys.

3. You can ask the interviewee to test the product /service right on spot.

4. You can observe non-verbal cues if you conduct face-to-face or video interviews.

5. You can build rapport and turn an occasional customer into a loyal one.

The disadvantages of an interview as a method of market research include:

It provides subjective data

The interviews are self-reporting surveys. And we know from psychological research that the results of a self-reporting survey can change with time and is influenced by multiple factors that researchers cannot control.

To mitigate this risk, try to create a neutral environment for your interviewees and build a rapport with them. If you have a team of researchers, try to find the researcher that fits the target group. For example, ask a teammate with children to conduct interviews if you specifically research parents.

The obtained data might not be relevant to your target group

To obtain correct data, the researchers must form the researched group according to certain rules (e.g., have a certain age representation). To provide a statistically correct result you need at least 100 participants.

Obviously, many business researchers are limited in their resources and 100 participants is an unattainable number. It might happen so that most of the research participants turn out to be uncommon to your TA.

For example, you want to research the users of XBox consoles. According to this research , most users are 25-44 years old and do not own Playstation 4. However, the participants of your research are predominantly 44 years-old owners of both competing consoles. As you can see, your group is not representative of your target audience unless you want to find out how to make more owners of Playstation 4 buy your console.

To mitigate this risk, analyze your demographics and come up with different incentives for participation. You should also try to word your request differently for every group.

Interviewer’s bias and interpretation error

Many researchers have their hypotheses and expectations. And sometimes it’s hard to abandon them even if the data proves you’re wrong. When you’re in a position of power, the temptation of breaking rules and tweaking the results is great. To the point when we can do it subconsciously.

This is especially critical for open-ended questions and qualitative research, when the answer is subject to wide interpretation. To minimize the bias we suggest recording and transcribing the interviews. We also suggest asking an opinion of other team members.

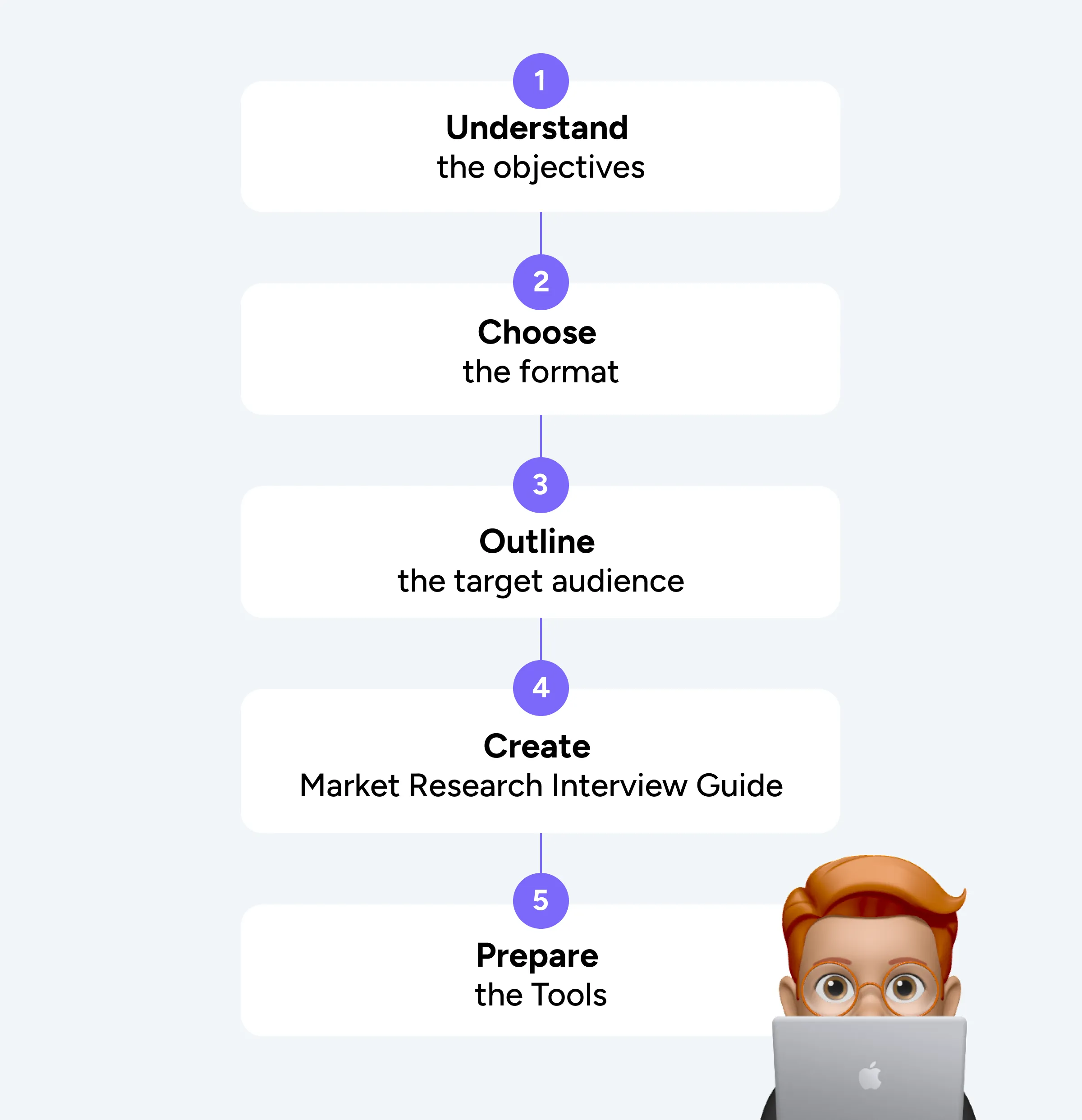

Preparation for the market research interview is a critical step in the market research process.

Identifying the market research objectives

This step will create a solid foundation for your market research interview. You will use it for all the next steps in the process. It will impact the format of the interview, the audience, the guide and the tools you will use.

The objective of the research is the answer to one or several questions about your customers, product, service or brand.

For example, a company is launching a new product. They need to understand how to promote it in their target market. The questions can be: “What are the three criteria for choosing the product?” “What do you use this product for” “What associations do you have with this product?”

Streamline Your Market Analysis with Noty.ai

Dive deeper into your market research interviews with Noty.ai's advanced to-do lists generated from the interview. Get accurate, real-time tasks and uncover hidden insights. Make every interview count.

Embrace the power of to-do lists today!

Choose the format of your market research interview.

At this stage you choose the type of interview you want to conduct. Will it be one-on-one meeting in real life or an online call or will a survey be enough? What types of questions do you want to ask, close-ended or open-ended?

The format also will depend on the available budget that you have.

Outline the market research target audience

As mentioned above, the target audience (TA) for your research is critical to get a correct result and correct predictions.

First, identify the demographics of your TA (age, gender, income, geography, etc.). You might have more than one homogeneous group.

Second, identify how many people you can interview. It will depend on the format of interview you chose. The reply rate for the request to participate in marketing research is quite low.

You need to remember that you’ll have to request at least 10 times as many potential participants. Generate a list of potential participants to whom you will send the request. Compile the request message that you will use to ask people to participate in your market research process.

Enhance Interview Accuracy with Noty.ai

Let Noty.ai revolutionize the way you conduct market research interviews. Experience the accuracy and detail of automated transcription and analysis. Capture every nuance and detail effortlessly.

Upgrade to meeting summaries now!

Create market research interview guide.

You know how they say that the best improvisation is the one prepared and rehearsed in advance. You might be a natural communicator. Still it’s best to have a clear plan and understand what to say and when.

That’s why you need a Market Research Interview Guide. Think of it as your playbook for conducting the interview. If you have a truly interesting interlocutor, bright and knowledgeable, the guide will help you not to get carried away and achieve your points. If you have a bad day and your memory plays tricks, it will remind you of the next question. All in all, it’s a must have for a good market researcher.

The Market Research Interview usually consists of four parts:

1. Intro & Warm up

This is the part where you build rapport with your interviewee. Generally, you present yourself, thank them for their time and effort and remind them of the reward. You need to explain shortly how the interview will go. Next, you ask some neutral questions about themselves. This way they will feel valued and seen. The questions will also make them more open up and relax.

2. General Questions

Once you feel that your interviewee feels comfortable and at ease around you, you can start asking questions relative to your market research. Remember these are not the questions that serve your objective.

Examples of general questions are “Do you know the brand ABC?” “Which brands of this product do you know?”

We suggest preparing 10-20 of these questions. It’s not necessary to ask all of them. Usually, you’ll be able to ask up to 6. But sometimes you’ll need more to get a person to talk. These questions can be unique to each of the subgroups that you have.

3. Core Questions

The core questions are the questions that serve the objective of your marketing research. It’s critical to ask all of them to each interviewee. The number of core questions should be limited to up to 5.

It’s important to end the interview on a positive note. Ask them what they think about the topic of the interview. Ask if they have anything else to add to what has already been said. Give them a reward if it is immediately available or explain how the reward will be delivered (ask address or other relative information if necessary).

Thank them for the interview and express hope (e.g., that they will continue to use your product).

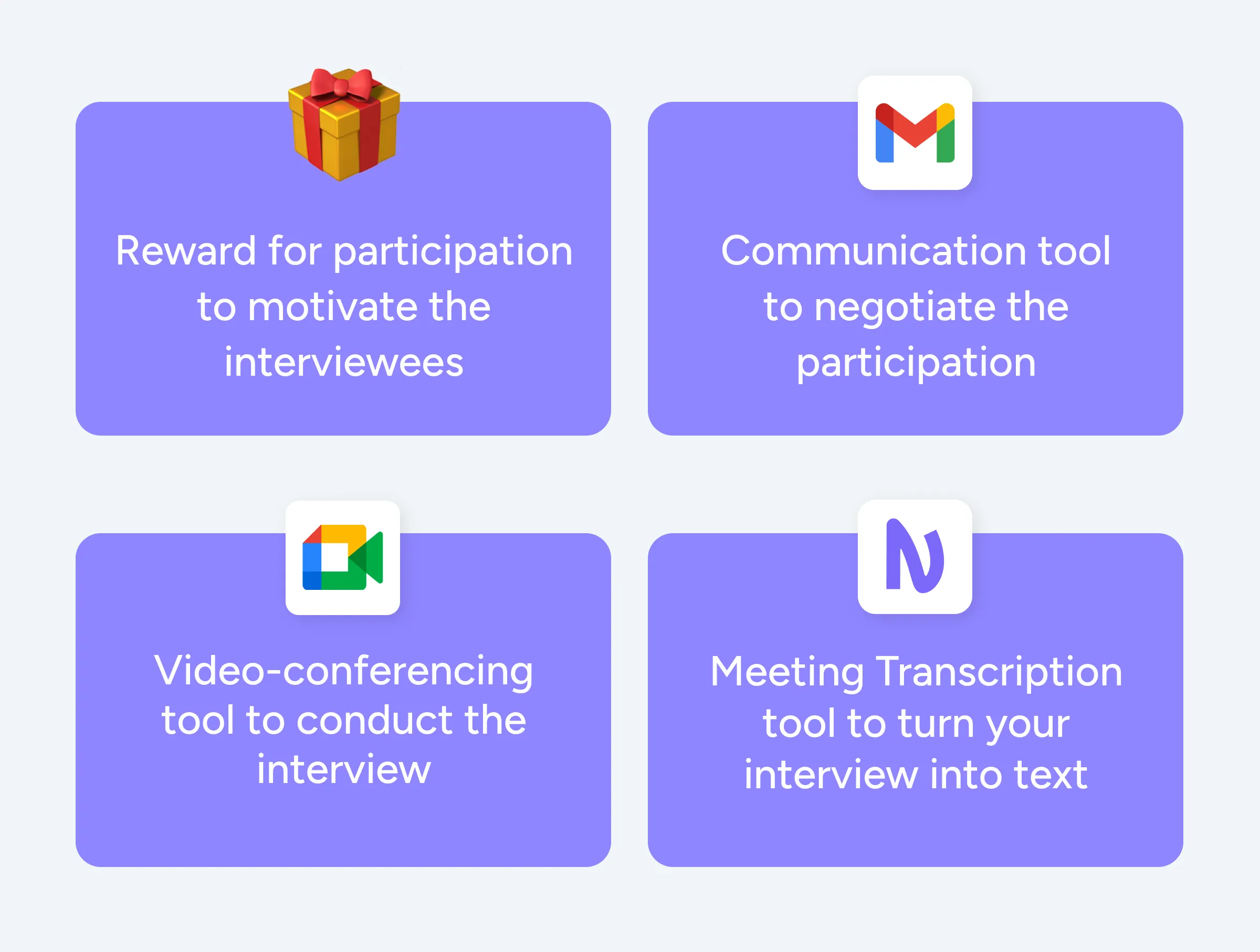

Prepare the Tools

Many market researchers omit this step or do not pay enough attention. In the end, lack of good toolkit can harm your market research overall. Let’s take a quick look at the tools that can help you in your work.

General tools for market research interview

First thing first, the reward for participating in the survey is your major interview tool. Many people would only participate in hope of getting something in return. You need to communicate it clearly. You also need to think about the ways to deliver the reward to the participants.

It is also critical to get management’s approval for the award beforehand. Finally, you need to understand if the award is deliverable at all. This is especially critical for IT companies. Marketers love to come up with ideas on how to lure potential customers with freemium. However, in practice the development team is not able to implement all of their ideas.

Next, you will need the printed-out survey for one-on-one interviews and working pens. You will have to prepare at least two copies per person just in case (e.g., a coffee spills over). Remember that some people tend to take the pens they used for writing with them. They do not do it on purpose. But by the end of the day you might find yourself without a critical tool.

You will also need the online communication solutions, if you conduct a survey online. Most likely it will be email. However, you can also reach out to people via LinkedIn or Facebook, or via messengers.

If you plan a mass send out with a request to participate in your marketing research interview, make sure you use appropriate tools. For example, CRMs will spread out your emails in time so that email providers do not mark them as spam.

If you don’t have or do not want to use a CRM, no worries. In 2023, Gmail launched functionality for mass send outs. It enables you to send the same email to multiple people and they won’t see other senders. Gmail will automatically insert their names in the necessary slots in your email.

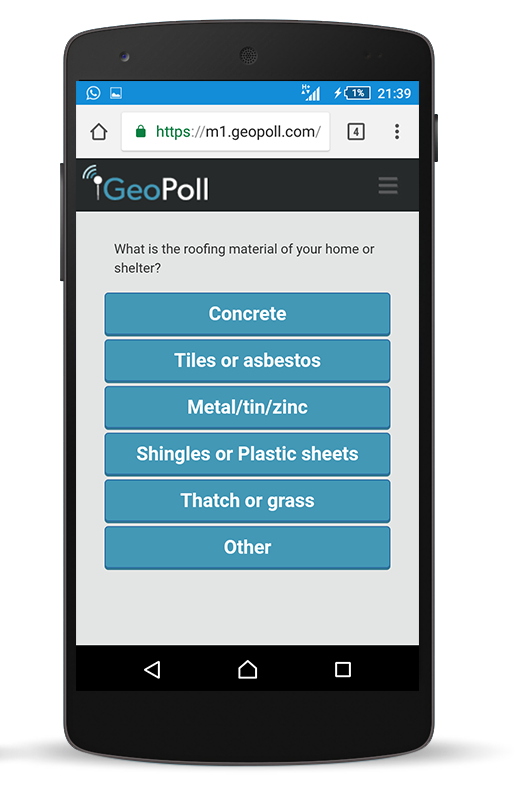

Quantitative market research

Quantitative market research requires several additional tools:

1. The online survey form. Most quantitative surveys have closed questions with several answer options to choose from. Tools like Google Forms enable you to automate your survey with drop-down lists, check boxes, etc. It will ease the market research process both for your interviewee (easy fill-out) and for you (easy data gathering).

2. The tool for processing the data. Depending on the research it can be Google Sheets / Excel or more complex SAS.

Qualitative market research

The additional tools for quantitative market research are:

1. Recording device and text-to-speech program for offline interviews. You’ll need a recording device to capture the interview information precisely. Simple note-taking can change the meaning of the original speech. As a result, you might come to the wrong conclusions and it can cost a lot for your company.

The text to speech program will help you transcribe your recorded interview. We suggest using it because text format has multiple advantages over audio recording. First, you can easily find any piece of information you like using the search function or just scanning the text with your eyes. Second, you can copy the key phrases to a separate document or highlight them in the text. And you won’t need to return to the audio recording and listen to them over and over. Third, most people perceive visual information better than audio.

2. Video-conferencing tools for online interviews. When choosing a video-conferencing tool, several aspects need to be considered:

The ability to record the call

The limitations (e.g., 40-minute limit in Zoom free version).

The possibility to add a person who isn’t registered in the application (without the necessity to do it).

3. Meeting transcription tool for online surveys. Tools like Noty integrate with video-conferencing tools and enable you to transcribe your interviews in real time. As a result you get a full transcription of your interview with speakers and time-stamps along with all the benefits of a text over audio recording.

Furthermore, you can pin important parts of your interview and type quick notes right in the Noty widget in Google Meet.

Additionally, they have AI capabilities to summarize the call. You can use custom prompts to get the data you need from the interview in a couple of seconds.

Unleash the Potential of Your Market Research with Noty.ai

Maximize the effectiveness of your market research interviews with Noty.ai. From transcription to analysis, let Noty.ai do the heavy lifting. Discover trends and insights faster and more accurately.

Transform your research process with Noty.ai today!

What is the first step in the marketing research process.

The first step in the marketing research process is outlining the subject of your research.

What type of interview is commonly used for market research?

Most common type of interview used for market research is semi-structures, open-end question online interview.

How do I prepare for a market research interview?

You need to understand the key objective of the research, choose the interview format, outline target audience, create the Market Research Interview Guide, and prepare the tools.

What to expect in a market research interview?

You can expect that your hypothesis might be wrong and you need to accept it. You can expect that an interviewee can be interrupted or the conversation will go into the wrong direction. You need to prepare for these scenarios in order to mitigate the risks.

How can I improve my market research skills?

It depends on the skills you need to improve. Market research process requires strong analytical and strong communication skills as well as a profound knowledge of data analysis tools. Not all people have both. One of the great ways to boost your communication skills is to take theater classes. They teach you how to read non-verbal cues, how to interact with a partner as one, and how to control your body language, facial expressions, and voice. Analytical skills can be boosted through solving logic puzzles and mathematical problems. You can also take courses in marketing analysis. Finally, to get a good grip of data analysis tools you can either take online courses or use YouTube videos.

What are the main questions in a market research interview?

There are three types of questions you will need to ask during the market research interview. Start with icebreaker questions that will help you establish your rapport with the interviewee. Next, ask general questions related to the market, their experience with brands and products, etc. Finally, ask the core questions related to the market research objectives.

Related articles

Gemini in Google Workspace App: How to Use

Mar 22, 2024

Enhancing Your Google Meet Experience: Google Meet Effects

Mar 18, 2024

Google BARD or Gemini: Making Sense of Google AI

Mar 7, 2024

Home • Knowledge hub • Choosing the Right Approach: Qualitative vs. Quantitative Market Research.

Choosing the Right Approach: Qualitative vs. Quantitative Market Research.

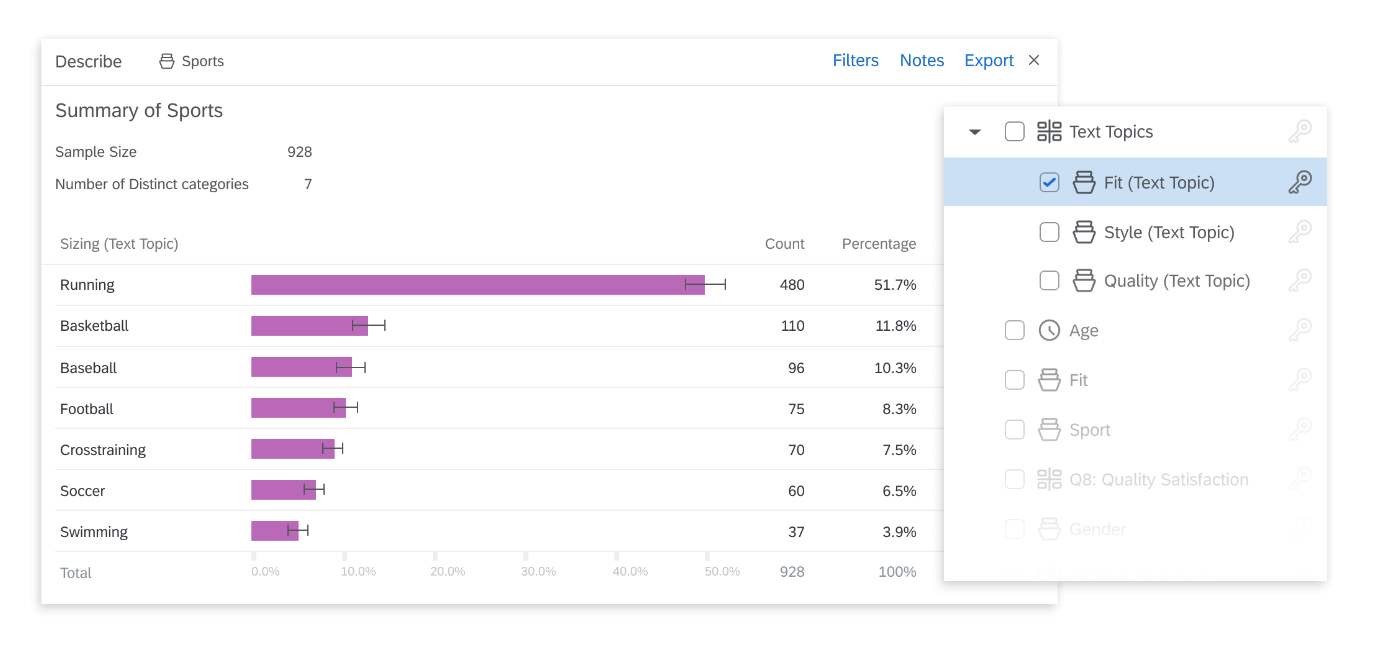

Imagine this scenario: you’re the Product Marketing Manager at Stellar Sneakers, a thriving company known for its innovative and stylish footwear. Your team is poised to launch a new line of eco-friendly shoes, but before you do, you want to gather valuable insights to ensure the product’s success. There’s a budget set aside for market research, but you’re faced with a crucial decision: should you go for a qualitative approach, diving into the deep and nuanced attitudes of your target audience? Or should you lean on quantitative research , capturing broad trends and measurable consumer preferences?

These choices are commonplace for marketing professionals. Market research is instrumental in developing successful products and campaigns, helping you understand your target audience, gauge customer preferences, and assess market trends. However, deciding between qualitative and quantitative methodologies can often seem like a labyrinth.

In this article, we will navigate this maze together. We’ll delve into the strengths and weaknesses of both qualitative and quantitative research, providing a practical guide for marketing executives like yourself wrestling with this choice. Our goal is to equip you with a more profound understanding, enabling you to select the most effective research methodology for your marketing objectives.

Understanding Qualitative Research

Qualitative research can be likened to a deep, exploratory dive. Instead of skimming the ocean’s surface to understand what lies beneath, qualitative research immerses itself in the depths to explore the unseen. In other words, it involves gathering subjective, non-numerical data to uncover your target audience’s thoughts, feelings, and motivations.

Imagine conducting in-depth interviews or focus groups with your prospective customers. You might ask them open-ended questions like, “How important is sustainability in your footwear choices?” or “What would make you choose our new eco-friendly shoes over traditional options?” Such questions do not restrict respondents to choosing from pre-determined answers; instead, they allow them to express their unique thoughts and emotions.

Similarly, other qualitative methods, like observations or ethnography, enable researchers to study people in their natural settings. For instance, observing customers in a retail store can offer valuable insights into shopping habits and behaviors that would be difficult to capture through structured surveys.

In a nutshell, qualitative research is all about understanding the “why” behind consumer behavior. It delves into the intricacies of consumer attitudes, beliefs, and experiences, providing a rich, nuanced understanding of your target audience. But like all methodologies, qualitative research has its strengths and drawbacks.

Pros of Qualitative Research

Now that we understand what qualitative research entails let’s dive into its advantages. For you, as the Product Marketing Manager of Stellar Sneakers, these pros can guide your understanding of what consumers feel and why they behave the way they do.

In-depth Understanding: The primary strength of qualitative research lies in its depth of understanding. By allowing consumers to express their thoughts and feelings in their own words, you can gain a holistic and nuanced understanding of their attitudes, beliefs, and experiences. You might discover, for example, that your target audience highly values sustainable practices not just because of environmental concerns but due to an underlying desire to contribute positively to society. This insight goes beyond basic preferences and can help guide your product development and marketing strategies.

Flexibility: Qualitative research is adaptable, allowing exploring unexpected avenues that emerge during the research process. Let’s say during your focus group discussions, a participant brings up an unanticipated point about the aesthetics of eco-friendly shoes. This can lead the conversation down a new path, offering insights you hadn’t considered initially. This adaptability makes qualitative research a powerful tool for discovery.

Contextual Understanding: This research method provides context to your findings. Instead of just knowing that a certain percentage of your audience prefers eco-friendly shoes, you get to understand why they prefer them. Are they driven by concerns about climate change, peer influence, or simply a desire for unique, innovative products? This contextual understanding can help you craft more effective marketing messages.

Cons of Qualitative Research

While the strengths of qualitative research are many, it has limitations. Understanding these drawbacks is crucial for a balanced approach to your market research.

Limited Generalizability: Qualitative research typically involves smaller, more targeted sample sizes due to the time and resources required for in-depth interviews, focus groups, or observations. This means that while the insights you gather will be rich and detailed, they may not represent the views and experiences of your entire target population. For instance, the customers who participate in your focus groups might have particularly strong feelings about sustainability, which might not be as prevalent in the broader customer base.

Subjectivity: Unlike its quantitative counterpart, qualitative research relies heavily on interpretation and analysis. The findings are often expressed in words and narratives, making them susceptible to researcher bias. For example, two researchers might interpret a participant’s responses in a focus group differently, leading to different conclusions. Therefore, ensuring rigor and objectivity during the analysis phase is critical.

Time and Resource-Intensive: Conducting and analyzing qualitative research can be quite labor-intensive. Transcribing interviews, analyzing focus group discussions, and reviewing observational data require skilled moderators, transcription services, and a significant amount of time. Additionally, the need for specially trained researchers to conduct interviews or focus groups can add to the cost of the research.

These cons do not diminish the value of qualitative research; instead, they highlight the need for careful planning and thoughtful interpretation of the data gathered. By understanding this approach’s strengths and limitations, you can maximize its benefits and make informed decisions.

Understanding Quantitative Research

As we leave the deep-diving world of qualitative research, we surface to the realm of quantitative research, where the breadth of understanding is the key. Think of it as casting a wide net into the sea, gathering as many fish (or, in our case, data points) as possible to analyze and identify patterns or trends.

In contrast to qualitative research, quantitative research involves gathering measurable, numerical data. This can be accomplished through various methods, such as online surveys , questionnaires, or structured observations. The questions in this type of research are often closed-ended, offering a set of predefined responses for the participants to choose from. For instance, you might ask your customers to rate on a scale of 1-5 how likely they are to buy your new eco-friendly shoes or to select from a list of options their primary reason for purchasing such shoes.

The essence of quantitative research is the ability to quantify consumer behavior and attitudes. Rather than focusing on individual narratives, it provides a statistical representation of a large group’s feelings or behaviors. For instance, it might tell you that 65% of your target market is willing to pay a premium for eco-friendly footwear.

Quantitative research, like its qualitative counterpart, has a unique set of pros and cons, which can significantly impact your research results and, consequently, your business decisions.

Pros of Quantitative Research

Quantitative research provides a measurable, objective lens to view your market. Here are some of the key advantages it offers:

Generalizability: With its focus on large sample sizes, quantitative research enables you to gather data statistically representative of your target population. For instance, if your survey reveals that a significant percentage of respondents are willing to pay more for eco-friendly shoes, you can confidently infer this trend extends to your broader target market.

Measurable and Objective: Quantitative data can be precisely measured and easily analyzed using statistical methods. The responses you gather can be quantified, compared, and tracked over time, offering you valuable insights. For example, you can measure changes in consumer attitudes toward eco-friendly products over several years.

Efficiency: Given that quantitative research often employs online or paper surveys, you can collect data from a large number of respondents simultaneously. This method can be cost-effective and time-efficient, especially when compared to conducting numerous in-depth interviews or focus groups.

Cons of Quantitative Research

Despite the significant advantages of quantitative research, it’s essential to be mindful of its limitations to ensure a balanced approach to your market research.

Lack of Depth: While quantitative research excels in measuring and quantifying consumer behaviors and attitudes, it often doesn’t capture the nuances and underlying reasons for those behaviors. For example, although you might know from a survey that a substantial percentage of your target market prefers eco-friendly shoes, you won’t necessarily understand the specific motivations, emotions, or experiences behind this preference.

Limited Context: Quantitative research provides statistical data but often lacks the rich, detailed context of qualitative research. It tells you “what” the trends are but often falls short of explaining “why” those trends exist. For instance, your survey might reveal that younger customers are more likely to buy eco-friendly shoes, but without further qualitative investigation, the reasons for this demographic preference may remain unclear.

Potential for Survey Bias: The design of your quantitative surveys can significantly influence the accuracy of your results. Poorly constructed questions, leading prompts, or a lack of diverse response options can introduce bias, resulting in skewed data. For example, if your survey questions are biased towards positive responses about eco-friendly products, you may end up with an inflated perception of your target market’s interest in such products.