- Peterborough

How to Write a Policy Assignment

What is a policy assignment, policy critique.

- Policy Brief/Briefing Note

Reading and Analyzing Policy

Writing policy assignments, research and writing process.

Understanding, evaluating, and writing policy documents are important competencies to develop as undergraduate students in a wide range of fields, spanning from Health Care to Environmental Science to Education. Policy is informed by strong research and accurate evidence, often compiled and presented by government and non-governmental organizations. Public policies include formal legislation, official plans, and regulations created by various levels of government. Each of these can act as guiding principles for governmental decision making and program delivery. Non-governmental and para-governmental organizations publish policy briefs, commission reports, and fact sheets to inform policy makers and recommend policy change.

Course instructors often ask students to analyze policy documents to better understand issues and policy alternatives, and students in many disciplines must write policy documents, including critiques and briefs or briefing notes. This guide offers steps to reading policy and keys for effective policy writing.

Types of Policy Assignments

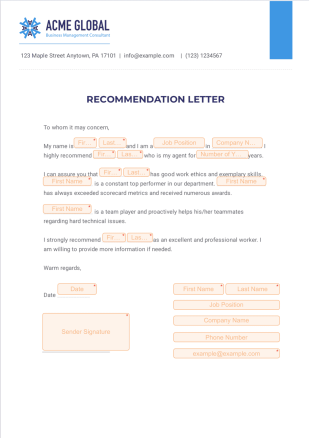

In a policy critique, students are expected to read and critically analyze one or more policy documents that address a common issue. The goal of this assignment is to present an overall assessment of current or proposed policies and their efficacy or potential considering both scholarly theory and real-world, practical application with consideration of environmental, social, or economic contexts.

Proposed structure

- Issue: what is the policy in question?

- Background: where did it emerge? What problem does it try to address?

- Application: so far, based on evidence, how effective has it been?

- Limits: what are limits with the policy? How has it been adapted? What questions remain?

- Evaluation/potential: based on concepts and theories from course materials, what is the potential for this policy to address particular issue/problem?

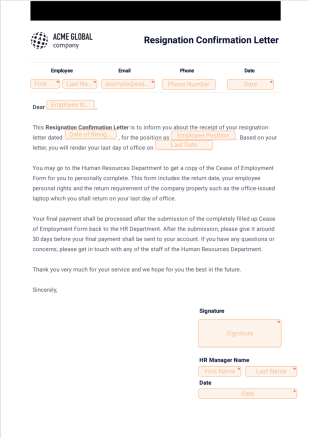

Policy Brief (Briefing Note)

Policy briefs or briefing notes are documents written by governmental and non-governmental organizations to propose evidence-based policy solutions to a well-defined social, environmental, or economic issue. Briefs present findings from academic and grey literature to demonstrate the scope of an issue and to analyze its context and background. The brief is organized with clear headings and short sections, which are supported by figures or tables.

- Executive Summary: similar to an abstract, briefly explains the goal, findings, and recommendations. Although it is placed first in the document, it is written last.

- Issue Definition: identify and explain the key issue and its scope and significance.

- Policy Background: synthesize evidence to explain the context of the issue – its origins, key stakeholders, overlapping issues, and potential barriers – and any existing policy.

- Best Practices: describe relevant policies from other jurisdictions and introduce specific examples of policy and best practices that reinforce the argument your briefing note presents.

- Policy Options: synthesize your research to present a few policy options; for each option, describe the approach and present advantages, challenges, and potential barriers. Present one policy recommendation from these options.

- References: divide references into sections (e.g., academic sources, grey literature, policy documents etc.)

Each policy document is focused on a specific issue and establishes particular goals; when you read any policy document, you are working to understand and analyze the issue and how the policy addresses the issue. These messages are often presented in different ways. Policy briefs are, well, brief, but other policy documents or commissioned reports can be quite lengthy, so it is important to develop a reading strategy for each new document. Generally, it is best to follow this process: preview, plan, read and take notes, and assess within course context.

Because policy documents vary significantly in form and purpose, it is essential to preview the document prior to reading it: identify its author, its purpose, and its form. Take time to read the executive summary, which presents a short explanation of the issue and purpose of the document. Understand its authorship and the interests of the individual or organizational author.

Make a plan

Identify your goal in reading the document: do you wish to better understand the issue, to identify policy alternatives, to appreciate broader context, or to determine efficacy of policy? How will this document inform your understanding of the issue you are studying? What sections will be most useful or relevant?

Read and take notes

Your preview and plan can direct your reading and notetaking. Read closely to understand the policy or issue, its context, and the evidence used to support it. Identify stakeholders and their interests, the goals of the policy and how those goals are measurable and actionable. You may find it helpful to refer to the table of contents or index (or to use the ‘find’ tool in your browser) to seek out sections that contain relevant keywords in documents spanning more than 100 pages.

Assess policy within course context

Refer to theories, frameworks, and indices that you have discussed in class to assess a policy. Consider whether it follows a particular conceptual framework or achieves particular numerical targets. Compare it to other policies in similar contexts and analyze its parts to assess its adaptability to different contexts. Evaluate its fit to the specific issue and its relevance for various stakeholder needs or values.

Reading an Official Plan

An official plan is often a lengthy document that covers many topics and issues within a set of overarching goals for an organization, like a university, hospital, or municipality. Your aim should be to understand the overarching goals of the plan and its broader context, which are likely laid out in the executive summary and introductory sections. Then you may need to seek out references to a particular topic, issue, or stakeholder; the index, table of contents, or “find” tool can be helpful for this.

Reading a Policy Brief

The goal of a policy brief is to inform and persuade policy makers, so your aim should be to understand the issue the brief identifies and to analyze the policy it proposes. The structure and design of the policy brief will guide your reading. Take time to understand the context of the issue and the policy: who are the stakeholders, what are the goals, what is the process, and what are the barriers? Analyze the policy within the disciplinary concepts you’re learning in class; how does the policy fit particular frameworks, theories, or indices you’ve discussed? What is unique about this policy? How can this policy be adapted to different contexts? What is its potential to address the issue?

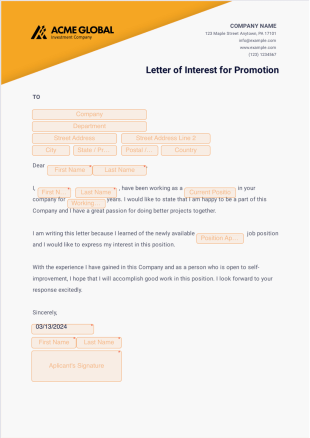

Successful policy assignments are focused, well-researched, analytical, organized, and concise. Therefore, it is important to take time to define the issue, understand the context of the issue, and seek out policy alternatives prior to identifying a recommended course of action.

- Focused Issue

- Using Research

- Demonstrating Analysis

- Organized, Concise, and Clear Writing

Focused issue

It is essential that you present a focused and clear issue, and that issue must be at the scale of policy action. For example, policy briefs can address ER wait times or agricultural pesticide use, but issues such as access to health care or the sustainability of food production are too complex for you to address in a short policy assignment. Often, course material and core concepts provide useful direction for you to narrow your issue.

In policy assignments, an issue is clearly defined and contextualized with evidence from scholarly and grey literature. It is important for you to explain how scholars, governments, or NGOs have discussed the issue, and numerical data or figures can demonstrate the scale of an issue or its projected trajectory. Provide details about the issue in its context: be specific about place, time, and stakeholders, and acknowledge any overlapping economic, environmental, or social issues.

Example: Effective issue definition 1

Age-friendly municipalities foster solidarity among generations within communities and reach out to older people at risk of isolation by making them feel socially included and involved (WHO, 2007). It is well documented that these trends are happening across Canada, and evidence suggests that local governments have a key role in enabling older people to live longer. It is unclear to what degree Aurora’s municipal government is prepared to support its expanding ageing population. It is essential to continue to examine new approaches to housing and transportation infrastructure within Aurora in order to improve public policy matters in regards to their ageing population.

- Issue is grounded by focused concept and evidence; writer demonstrates value of municipal policy to address the issue

- Writer precisely identifies the issue to be discussed in brief and the goals of the report

Example: Ineffective issue definition 1

In addition to the infrastructure issue in Peterborough, there is also an issue regarding how spread out the community is. The city is too big for residents to be able to walk the entire city. Amenities are also very spread out; it is unlikely that pedestrians would be able to access the required amenities within walking distance from their house. Ultimately, the main issues surrounding the walkability in the City of Peterborough are the lack of infrastructure and maintenance, as well as the lack of available activities near to peoples’ residences.

- Not grounded in conceptual framework or theory; writer needs to explain why walkability is an issue that a municipality should address

- Lack of precision or evidence to support claims about the size of the city or accessibility to amenities

Using research

Policy is informed by evidence from scholarly literature, government data, and research by various stakeholder organizations. Effective policy assignments synthesize evidence from academic and grey literature to create an accurate account of the issue and policy options. Common forms of evidence in policy writing include numerical and financial data, figures such as graphs and maps, excerpts from existing policies, recommendations from NGOs, and conceptual frameworks.

In policy writing, your goal is to present research both accurately and accessibly, as decision-makers in government and business may not be familiar with terminology or concepts presented by scholars. Make efforts to paraphrase the evidence you use and be sure to include citations in the form requested by your professor (footnotes or author-date systems are common).

One of the key factors in Municipal Cultural Planning is increasing cross-sectoral strategies by building new partnerships “…between the municipality and its community and business partners” (Municipal Cultural Plan, toolkit, 2011, p.21) for long term sustainability. Therefore, municipal cultural planning “…does not look at policy sectorally” (Gollmitzer, 2008, p.18), but instead strengthens and integrates “…cultural resources across all facets of government planning and decision making” (Municipal Cultural Plan Toolkit, 2011, p.21). Building new networks are supported by leveraging the sense of place within a community. Adopting a place-based planning approach allows “…government, community organizations and citizens to explore, measure and asses the values, resources and assets of the community” (Huhtala, 2016, p.66), in order to leverage them for economic prosperity.

- Writer synthesizes academic and grey literature to demonstrate how concepts are applied in policy.

- Writer also demonstrates analysis of evidence and its relevance to the brief’s focused issue.

- Use of direct quotation can feature the language of a policy if the writer wishes to analyze discourse; however, this excerpt relies too heavily on direct quotation, and it would be stronger if this evidence was paraphrased.

Demonstrating analysis

The quality of your policy assignment is closely tied to your analysis of the issue and the policy options you present. It is important to evaluate policy options as you research and to critically analyze how those options address the issue within its particular context. Take time to examine specific factors and parties involved in an issue and consider how these factors may facilitate or challenge each policy option; furthermore, you should also assess the advantages and disadvantages of each policy option and its impacts on these factors or parties.

You may find it valuable to consider theories, concepts, or frameworks from your course to develop your argument and to establish coherence throughout your assignment. If you assess all policy options through the same critical lens or theory, then your message will be clear and consistent throughout your document.

Integrating senior housing into the fabric of the inner core communities could make housing developments viable and situate seniors in settings where they can access these services by foot or nearby transit (Fang, 2013). This concept can allow seniors, who may be considering downsizing, to remain within their community where they can keep active, live within easy access to medical and community services, and stay close to their support network that they have spent their lives establishing. However, the growing demand for these developments could put major pressure on the municipality. City officials would have to amend current zoning by-laws to allow commercial and residential uses to be a part of mixed-use development and appropriate provisions need to be provided to ensure compatibility and to minimize potential negative impacts.

- Writer presents both advantages and challenges of policy option within common concept of healthy aging communities.

- Writer also includes potential impacts and barriers of policy option, which demonstrates their consideration of the issue and its context.

Organized, concise, and clear writing

Policy writing should be well-organized and easy to follow. Use headings and subheadings to create structure and to support your reader. It is common to number sections and subsections to further clarify the order of your ideas. In addition, good paragraph structure also supports organization and clarity, so we encourage you to use specific topic sentences to introduce the main idea of a paragraph.

Well-written policy assignments employ a formal writing style and use third-person voice (e.g., they) rather than first-person (e.g., I, we) or second-person (e.g., you) voice. Further, they avoid jargon, but use specific and clear language. When you revise your draft, take time to consider each sentence and remove repetitive or redundant phrases and words.

Finally, it is important to pay attention to the details. Label any figures or tables in your document; make reference to these figures or tables in the text of your work (e.g., see Figure 1). Also be sure to follow assignment instructions for referencing evidence in your text (e.g., footnotes or author-date system) and in your list of sources, which is often categorized by type of source (e.g., academic, government, NGOs).

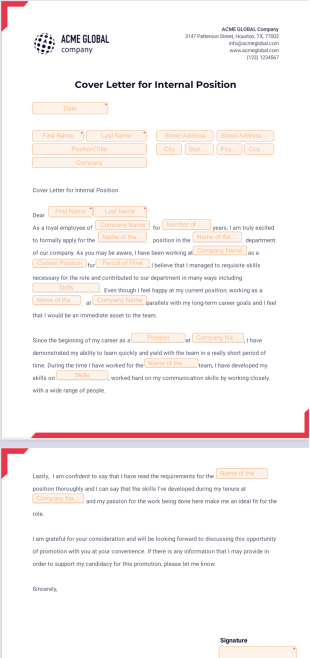

There are many ways to approach a policy assignment, but it is important to take time to research and analyze issues and policy options thoroughly prior to writing. Consider the following steps to complete your policy assignment:

- Read assignment instructions closely

- Preliminary research: review course materials, brainstorm, conduct environmental scan or site visit, consider current issues relevant to course concepts

- Define issue: consider questions and frameworks

- Research issue and context

- Research and evaluate policy alternatives in other places

- Analyze policy alternatives and consider fit for current issue and context; select policy options to present

- Outline sections: what evidence goes where? How does evidence work together?

- Write sections (leave Executive Summary until last)

- Revise for organization, analysis, and use of evidence. See Strategies for Revision and Proofreading.

- Edit for clarity, concision, and grammar

- Complete final proof of document

- These examples are not to be reproduced in whole or part. Use of the ideas or words in this example is an act of plagiarism, which is subject to academic integrity policy at Trent University and other academic institutions.

The Economic Times daily newspaper is available online now.

All you need to know about assigning life insurance policy.

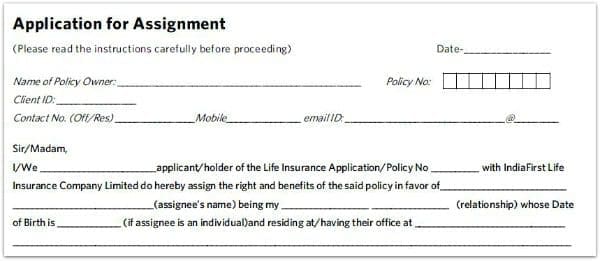

The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer.

- Conditional assignment: This is done when the insured wishes to pass benefits of the policy to a relative in case of early death or certain conditions. The rights of the policyholder are restored once the conditions are fulfilled.

- Absolute assignment: This is done as a part of consideration for a loan in favour of the lender/bank/lending institution. In such an assignment, the insured loses his rights in the policy and the absolute assignee can deal with it independently.

- Proof of income.

- Self attested copy of photo ID and address proof .

- Self attested copy of PAN card.

Read More News on

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

3x return in a year: How far can a PSU shipbuilder sail?

UBL needs its latest brews to cure a four-year revenue hangover

Is Elon Musk’s Starlink a dream too pricey for Bharat?

What Girish Mathrubootham’s exit reveals about Freshworks

This summer, there is one air-cooling company the market is showing no love for

Stock Radar: IGL on verge of a breakout from Triangle pattern; should you buy?

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

Please enable javascript to view this site.

SRD Law Notes

Law Notes for Law students. study materials for BSL,LLB, LLM, and Various Diploma courses.

Assignment of Marine Insurance Policy | Insurance Law

Marine insurance - , what police you must specify- , contract must be embodied in policy- , assignment of policy - , assured who has no interest cannot assign- , double insurance -, 24 comments:.

As a law student, I found your source quite educational and informational. I have read about marine insurance acts today in As a law student, I found your source quite educational and informational. I have read about marine insurance acts today in custom writing paper service class and I was not able to understand it but your easy notes made it easier for me to understand it. class and I was not able to understand it but your easy notes made it easier for me to understand it.

You can also stick to just those daters who are in the same country you are. Projectsdeal.co.uk Review

It is an incredible site.. The Design looks great.. Continue working that way!. auto insurance

Some marine hardware or rebate marine items accompany sound players where you can tune in to music, book recordings, whatever you like. watersports supplier

Recently, I used to be with an outdoors concert and festival on the beach. It was well attended by humans, dogs and birds. Fishing Reel Tips

Your writing is fine and gives food for thought. I hope that I’ll have more time to read your articles . Regards. I wish you that you frequently publish new texts and invite you to greet me https://helpmewithmyessay.com/write-my-essay/

Analyze the topics: Analyze the topic and theme of the Assignment and Fastest PhD Thesis Writing Service do a self estimation to determine your strength for that topic. Discuss with friends about the topics in which you feel you are not strong.

In the event that your youngster's school has no uncommon assignment book, he can put to the side a segment at the front of a multi-subject fastener to record all assignments. cause and effect essay

Thank you because you have been willing to share information with us. we will always appreciate all you have done here because I know you are very concerned with our. Class 9 Assignment

Global Studies solution. The Class 9 English Assignment along with other two subject will be published in later week. class 9 assignment 2021 answer

It is significant that staff perceive the difficult that is being tended to through the policy execution. reinsurance in Missouri & Kansas

Wow! Such an amazing and helpful post this is. I really really love it. It's so good and so awesome. I am just amazed. I hope that you continue to do your work like this in the future also Assignment Answer

Great article Lot's of information to Read...Great Man Keep Posting and update to People..Thanks Class 8 Assignment Answer

Some of the time it turns out to be hard to deal with every one of your tasks in school. Understudies don't get a lot of time to comprehend the topic of the task and complete them inside the given time. Custom Assignment Writing Service

Rather than goggling information, our experts plan copyright infringement free assignments with unique substance utilizing class modules, address slides, notes, introductions, and examination work Assignment Help UK

Nice to be visiting your blog again, it has been months for me. Well this article that i’ve been waited for so long. I need this article to complete my assignment in the college, and it has same topic with your article. Thanks, great share. 代写作业

Your blog provided us with valuable information to work with. Each & every tips of your post are awesome. Thanks a lot for sharing. Keep blogging.. 毕业论文代写

Thanks for taking the time to discuss this, I feel strongly about it and love learning more on this topic. If possible, as you gain expertise, would you mind updating your blog with extra information? It is extremely helpful for me. 论文代写

Nice blog and absolutely outstanding. You can do something much better but i still say this perfect.Keep trying for the best. 多伦多代写

This is my first time i visit here. I found so many interesting stuff in your blog especially its discussion. From the tons of comments on your articles, I guess I am not the only one having all the enjoyment here keep up the good work 论文代写

Nowadays many students are scared of their assignments of collage because they get very less time to complete them. Online assignment help is like a boon for them. You can avail online assignment help and get best assistance to complete your assignment. Assignment Help

I invite you to the page where see how much we have in common. Assignment Help UK

We provide the largest Bangladeshi job circular and job education-related websites. you can get education information, job circular, results, notices, and job tips regularly here. Check it for Bangladesh Bank Exam Result 2022

"Understanding the time window for returns is essential. Some stores have shorter return periods for electronics or seasonal items." Walmart return policy without receipt

- Objective Questions with Answers on Law Of Contracts - 19 1) Consider the following statements : A) Every promise is an agreement. B) Every agreement is a contract. C) A contrac...

- Objective Questions with Answers on Law Of Contracts - 18 1) Which one of the following element is not necessary for a contract ? A) Competent parties B) Reasonable terms and condition...

- Objective Questions with Answers on Law Of Contracts - 17 1) Give correct answer : A) Void agreements are always illegal. B) Illegal agreements are always voidable . C) Illegal a...

- The importance of a Computerized Accounting System Computer is an important part of an accounting system. Computerized accounting systems are important to business in various...

- Advantages of Law Advantages of Law - There are many Advantages of law... some of the them are as follows : 1) Uniformity and Certainty: ...

Assignment of Life Insurance Policy

The person who assigns the policy, i.e. transfers the rights, is called the Assignor and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee.

Assignment of a Life Insurance Policy simply means transfer of rights from one person to another. The policyholder can transfer the rights of his insurance policy to another for various reasons and this process is called Assignment.

The person who assigns the policy, i.e. transfers the rights, is called the Assignor and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee. Once the rights have been transferred to the Assignee, the rights of the Assignor stands cancelled and the Assignee becomes the owner of the policy.

here are 2 types of Assignment:

- Absolute Assignment – This means complete Transfer of Rights from the Assignor to the Assignee, without any further conditions applicable.

- Conditional Assignment – This means that the Transfer of Rights will happen from the Assignor to the Assignee subject to certain conditions. If the conditions are fulfilled then only the Policy will get transferred from the Assignor to the Assignee.

Let’s take an example:

Rahul owns 2 Life Insurance policies of value Rs 2 lakhs and Rs 5 lakhs respectively. He would like to gift one policy of Rs 2 lakhs to his best friend Ajay. In that case, he would like to absolutely assign the policy in his name such that the death or maturity proceeds are directly paid to him. Thus, after the assignment, Ajay becomes the absolute owner of the policy. If he wishes, he may again transfer it to someone else for any other reason. This type of Assignment is called Absolute Assignment.

Now, Rahul needed to take a loan for Rs 5 lakhs. So, he thought of doing so against the other policy that he owned for Rs 5 lakhs. To take a loan from ABC bank, he needed to conditionally assign the policy to that Bank and then the bank would be able to pay out the loan money to him. If Rahul failed to repay the loan, then the bank would surrender the policy and get their money back.

Once Rahul’s loan is completely repaid, then the policy would again come back to him. In case, Rahul died before completely repaying the loan, then also the bank can surrender the policy to get their money back. This type of Assignment is called Conditional Assignment.

Sachin Telawane is a Content Manager and writes on various aspects of the Insurance industry. His enlightening insights on the insurance industry has guided the readers to make informed decisions in the course of purchasing insurance plans.

Assignment in Insurance Policy | Meaning | Explanation | Types

Table of Contents

- 1 What is Assignment in an Insurance Policy?

- 2 Who can make an assignment?

- 3 What happens to the ownership of the policy upon Assignment?

- 4 Can assignment be changed or cancelled?

- 5 What happens if the assignment dies?

- 6 What is the procedure to make an assignment?

- 7 Is it necessary to Inform the insurer about assignment?

- 8 Can a policy be assigned to a minor person?

- 9 Who pays premium when a policy is assigned?

- 10.1 1. Conditional Assignment

- 10.2 2. Absolute Assignment

What is Assignment in an Insurance Policy?

Assignment means a complete transfer of the ownership of the policy to some other person. Usually assignment is done for the purpose of raising a loan from a bank or a financial institution .

Assignment is governed by Section 38 of the Insurance Act 1938 in India. Assignment can also be done in favour of a close relative when the policyholder wishes to give a gift to that relative. Such an assignment is done for “natural love and affection”. An example, a policyholder may assign his policy to his sister who is handicapped.

Who can make an assignment?

A policyholder who has policy on his own life can assign the policy to another person. However, a person to whom a policy has been assigned can reassign the policy to the policyholder or assign it to any other person. A nominee cannot make an assignment of the policy. Similarly, an assignee cannot make a nomination on the policy which is assigned to him.

What happens to the ownership of the policy upon Assignment?

When a policyholder assign a policy, he loses all control on the policy. It is no longer his property. It is now the assignee’s property whether the policyholder is alive or dead, the assignee alone will get the policy money from the insurance company.

If the assignee dies, then his (assignee’s) legal heirs will be entitled to the policy money.

Can assignment be changed or cancelled?

An assignment cannot be changed or cancelled. The assignee can of course, reassign the policy to the policyholder who assigned it to him. He can also assign the policy to any other person because it is now his property. We can think of a bank reassigning the policy to the policyholder when their loan is repaid.

What happens if the assignment dies?

If the assignee dies, the assignment does not get cancelled. The legal heirs of the assignee become entitled to the policy money. Assignment is a legal transfer of all the interests the policyholder has in the policy to the assignee.

What is the procedure to make an assignment?

Assignment can be made only after issue of the policy bond. The policyholder can either write out the wording on the policy bond (endorsement) or write it on a separate paper and get it stamped. (Stamp value is the same, as the stamp required for the policy — Twenty paise per one thousand sum assured). When assignment is made by an endorsement on the policy bond, there is no need for stamp because the policy is already stamped.

Is it necessary to Inform the insurer about assignment?

Yes, it is necessary to give information about assignment to the insurance company. The insurer will register the assignment in its records and from then on recognize the assignee as the owner of the policy. If someone has made more than one assignment, then the date of the notice will decide which assignment has priority. In the case of reassignment also, notice is necessary.

Can a policy be assigned to a minor person?

Assignment can be made in favour of a minor person. But it would be advisable to appoint a guardian to receive the policy money if it becomes due during the minority of the assignee.

Who pays premium when a policy is assigned?

When a policy is assigned normally, the assignee should pay the premium, because the policy is now his property. In practice, however, premium is paid by the assignor (policyholder) himself. When a bank gives a loan and takes the assignment of a policy a security, it will ask the assignor himself to pay the premium and keep it in force. In the case of an assignment as a gift, the assignor would like to pay the premium because he has gifted the policy.

Types of assignment

Assignment may take two forms:

- Conditional Assignment.

- Absolute Assignment.

1. Conditional Assignment

It would be useful where the policyholder desires the benefit of the policy to go to a near relative in the event of his earlier death. It is usually effected for consideration of natural love and affection. It generally provides for the right to revert the policyholder in the event of the assignee predeceasing the policyholder or the policyholder surviving to the date of maturity.

2. Absolute Assignment

This assignment is generally made for valuable consideration. It has the effect of passing the title in the policy absolutely to the assignee and the policyholder in no way retains any interest in the policy. The absolute assignee can deal with the policy in any manner he likes and may assign or transfer his interest to another person.

Related Posts

- Privacy Policy

Assignment under Insurance Policies

By J Mandakini, NUALS

Editor’s Note: This paper attempts to explore the concept of assignment under Indian law especially Contract Act, Insurance Act and Transfer of Property Act. It seeks to appreciate why the assignment is made use of for securities of a facility sanctioned by ICICI Bank. Also, it explains how ICICI Bank faces certain problems in executing the same.

INTRODUCTION

For any facility sanctioned by a lender, collateral is always deposited to secure the same. Such mere deposition will not suffice, the borrower has to explicitly permit the lender to recover from the borrower, such securities in case of his default.

This is done by the concept of assignment, dealt with adequately in Indian law. Assignment of obligations is always a tricky matter and needs to be dealt with carefully. The Bank should not fall short of any legally permitted lengths to ensure the same. This is why ambiguity in its security documents have to be rectified.

This paper attempts to explore the concept of assignment in contract law. It seeks to appreciate why the assignment is made use of for securities of a facility sanctioned by ICICI Bank. The next section will deal with how ICICI Bank faces certain problems in executing the same. The following sections will talk about possible risks involved, as well as defenses and solutions to the same.

WHAT IS ASSIGNMENT?

Assignment refers to the transfer of certain or all (depending on the agreement) rights to another party. The party which transfers its rights is called an assignor, and the party to whom such rights are transferred is called an assignee. Assignment only takes place after the original contract has been made. As a general rule, assignment of rights and benefits under a contract may be done freely, but the assignment of liabilities and obligations may not be done without the consent of the original contracting party.

The liability on a contract cannot be transferred so as to discharge the person or estate of the original contractor unless the creditor agrees to accept the liability of another person instead of the first. [i]

Illustration

P agrees to sell his car to Q for Rs. 100. P assigns the right to receive the Rs. 100 to S. This may be done without the consent of Q. This is because Q is receiving his car, and it does not particularly matter to him, to whom the Rs. 100 is being handed as long as he is being absolved of his liability under the contract. However, notice may still be required to be given. Without such notice, Q would pay P, in spite of the fact that such right has been assigned to S. S would be a sufferer in such case.

In this case, that condition is being fulfilled since P has assigned his right to S. However, P may not assign S to be the seller. P cannot just transfer his duties under the contract to another. This is because Q has no guarantee as to the condition of S’s car. P entered into the contract with Q on the basis of the merits of P’s car, or any other personal qualifications of P. Such assignment may be done with the consent of all three parties – P, Q, S, and by doing this, P is absolved of his liabilities under the contract.

1.1. Effect of Assignment

Immediately on the execution of an assignment of an insurance policy, the assignor forgoes all his rights, title and interest in the policy to the assignee. The premium or loan interest notices etc. in such cases will be sent to the assignee. [ii] However, the existence of obligations must not be assumed, when it comes to the assignment. It must be accompanied by evidence of the same. The party asserting such a personal obligation must prove the existence of an express assumption by clear and unequivocal proof. [iii]

Assignment of a contract to a third party destroys the privity of contract between the initial contracting parties. New privity is created between the assignee and the original contracting party. In the illustration mentioned above, the original contracting parties were P and Q. After the assignment, the new contracting parties are Q and S.

1.2. Revocation of Assignment

Assignment, once validly executed, can neither be revoked nor canceled at the option of the assignor. To do so, the insurance policy will have to be reassigned to the original assignor (the insured).

1.3. Exceptions to Assignment

There are some instances where the contract cannot be assigned to another.

- Express provisions in the contract as to its non-assignability – Some contracts may include a specific clause prohibiting assignment. If that is so, then such a contract cannot be assigned. Assignability is the rule and the contrary is an exception. [iv]

Pensions, PFs, military benefits etc. Illustration

1.4. enforcing a contract of assignment.

From the day on which notice is given to the insurer, the assignee becomes the beneficiary of the policy even though the assignment is not registered immediately. It does not wait until the giving of notice of the transfer to the insurer. [vi] However, no claims may lie against the insurer until and unless notice of such assignment is delivered to the insurer.

If notice of assignment is not provided to the obligor, he is discharged if he pays to the assignor. Assignee would have to recover from the assignor. However, if the obligor pays the assignor in spite of the notice provided to him, he would still be liable to the assignee.

The following two illustrations make the point amply clear:

Illustrations

1. Seller A assigns its right to payment from buyer X to bank B. Neither A nor B gives notice to X. When payment is due, X pays A. This payment is fully valid and X is discharged. It will be up to B to recover it from A

2. Seller A assigns to bank B its right to payment from buyer X. B immediately gives notice of the assignment to X. When payment is due, X still pays A. X is not discharged and B is entitled to oblige X to pay a second time.

An assignee doesn’t stand in better shoes than those of his assignor. Thus, if there is any breach of contract by the obligor to the assignee, the latter can recover from the former only the same amount as restricted by counter claims, set offs or liens of the assignor to the obligor.

The acknowledgment of notice of assignment is conclusive proof of, and evidence enough to entertain a suit against an assignor and the insurer respectively who haven’t honoured the contract of assignment.

1.5. Assignment under various laws in India

There is no separate law in India which deals with the concept of assignment. Instead, several laws have codified it under different laws. Some of them have been discussed as follows:

1.5.1. Under the Indian Contract Act

There is no express provision for the assignment of contracts under the Indian Contract Act. Section 37 of the Act provides for the duty of parties of a contract to honour such contract (unless the need for the same has been done away with). This is how the Act attempts to introduce the concept of assignment into Indian commercial law. It lays down a general responsibility on the “representatives” of any parties to a contract that may have expired before the completion of the contract. (Illustrations to Section 37 in the Act).

An exception to this may be found from the contract, e.g. contracts of a personal nature. Representatives of a deceased party to a contract cannot claim privity to that contract while refusing to honour such contract. Under this Section, “representatives” would also include within its ambit, transferees and assignees. [vii]

Section 41 of the Indian Contract Act applies to cases where a contract is performed by a third party and not the original parties to the contract. It applies to cases of assignment. [viii] A promisee accepting performance of the promise from a third person cannot afterwards enforce it against the promisor. [ix] He cannot attain double satisfaction of its claim, i.e., from the promisor as well as the third party which performed the contract. An essential condition for the invocation of this Section is that there must be actual performance of the contract and not of a substituted promise.

1.5.2. Under the Insurance Act

The creation of assignment of life insurance policies is provided for, under Section 38 of the Insurance Act, 1938.

- When the insurer receives the endorsement or notice, the fact of assignment shall be recorded with all details (date of receipt of notice – also used to prioritise simultaneous claims, the name of assignee etc). Upon request, and for a fee of an amount not exceeding Re. 1, the insurer shall grant a written acknowledgment of the receipt of such assignment, thereby conclusively proving the fact of his receipt of the notice or endorsement. Now, the insurer shall recognize only the assignee as the legally valid party entitled to the insurance policy.

1.5.3. Under the Transfer of Property Act

Indian law as to assignment of life policies before the Insurance Act, 1938 was governed by Sections 130, 131, 132 and 135 of the Transfer of Property Act 1882 under Chapter VIII of the Act – Of Transfers of Actionable Claims. Section 130 of the Transfer of Property Act states that nothing contained in that Section is to affect Section 38 of the Insurance Act.

I) Section 130 of the Transfer of Property Act

An actionable claim may be transferred only by fulfilling the following steps:

- Signed by a transferor (or his authorized agent)

The transfer will be complete and effectual as soon as such an instrument is executed. No particular form or language has been prescribed for the transfer. It does not depend on giving notice to the debtor.

The proviso in the section protects a debtor (or other person), who, without knowledge of the transfer pays his creditor instead of the assignee. As long as such payment was without knowledge of the transfer, such payment will be a valid discharge against the transferee. When the transfer of any actionable claim is validly complete, all rights and remedies of transferor would vest now in the transferee. Existence of an instrument in writing is a sine qua non of a valid transfer of an actionable claim. [x]

II) Section 131 of the Transfer Of Property Act

This Section requires the notice of transfer of actionable claim, as sent to the debtor, to be signed by the transferor (or by his authorized agent), and if he refuses to sign it, a signature by the transferee (or by his authorized agent). Such notice must state both the name and address of the transferee. This Section is intended to protect the transferee, to receive from the debtor. The transfer does not bind a debtor unless the transferor (or transferee, if transferor refuses) sends him an express notice, in accordance with the provisions of this Section.

III) Section 132 of the Transfer Of Property Act

This Section addresses the issue as to who should undertake the obligations under the transfer, i.e., who will discharge the liabilities of the transferor when the transfer has been made complete – would it be the transferor himself or the transferee, to whom the rest of the surviving contract, so to speak, has been transferred.

This Section stipulates, that the transferee himself would fulfill such obligations. However, where an actionable claim is transferred with the stipulation in the contract that transferor himself should discharge the liability, then such a provision in the contract will supersede Ss 130 and 132 of this Act. Where the insured hypothecates his life insurance policies and stipulates that he himself would pay the premiums, the transferee is not bound to pay the premiums. [xi]

FACILITIES SECURED BY INSURANCE POLICIES – HOW ASSIGNMENT COMES INTO THE PICTURE

Many banks require the borrower to take out or deposit an insurance policy as security when they request a personal loan or a business loan from that institution. The policy is used as a way of securing the loan, ensuring that the bank will have the facility repaid in the event of either the borrower’s death or his deviations from the terms of the facility agreement.

Along with the deposit of the insurance policy, the policyholder will also have to assign the benefits of the policy to the financial institution from which he proposes to avail a facility. The mere deposit, without writing, or passing of any document of title to such a claim, does not create any equitable charge. [xii]

ETHICS OF ASSIGNING LIFE INSURANCE POLICY TO LENDERS

The purpose of taking out a life insurance policy on oneself, is that in the event of an untimely death, near and dear ones of the deceased are not left high and dry, and that they would have something to fall back on during such traumatic times. Depositing and assigning the rights under such policy document to another, would mean that there is a high chance that benefits of life insurance would vest in such other, in the event of unfortunate death and the family members are prioritized only second. These are not desirable circumstances where the family would be forced to cope with the death of their loved one coupled with the financial crisis.

Thus, there is a need to examine the ethics of:

- The bank accepting such assignment

The customer should be cautious before assigning his rights under life insurance policies. By “cautious”, it is only meant that he and his dependents and/or legal heirs should be aware of the repercussions of the act of assigning his life insurance policy. It is conceded that no law prohibits the assignment of life insurance policies.

In fact, Section 38 of the Insurance Act, 1938 , provides for such assignments. Judicial cases have held life insurance policies as property more than a social welfare measure. [xiii] Further, the bank has no personal relationship with any customer and thus has no moral obligation to not accept such assignments of life insurance.

However, the writer is of the opinion that, in dealing with the assignment of life insurance policies, utmost care and caution must be taken by the insured when assigning his life insurance policy to anyone else.

CURRENT STAND OF ICICI REGARDING FACILITIES SECURED BY INSURANCE POLICY, WITH SPECIFIC REFERENCE TO ASSIGNMENT OF OBLIGATIONS

This Section seeks to address and highlight the manner in which ICICI Bank drafts its security documents with regard to the assignment of obligations. The texts placed in quotes in the subsequent paragraphs are verbatim extracts from the security document as mentioned.

Composite Document for Corporate and Realty Funding

“ 8 . CHARGING CLAUSE

The Mortgagor doth hereby:

iii) Assign and transfer unto the Mortgagee all the Bank Accounts and all rights, title, interest, benefits, claims and demands whatsoever of the Mortgagor in, to, under and in respect of the Bank Accounts and all monies including all cash flows and receivables and all proceeds arising from Projects and Other Projects_______________, insurance proceeds, which have been deposited / credited / lying in the Bank Accounts, all records, investments, assets, instruments and securities which represent all amounts in the Bank Accounts, both present and future (the “Account Assets”, which expression shall, as the context may permit or require, mean any or each of such Account Assets) to have and hold the same unto and to the use of the Mortgagee absolutely and subject to the powers and provisions herein contained and subject also to the proviso for redemption hereinafter mentioned;

(v) Assign and transfer unto the Mortgagee all right, title, interest, benefit, claims and demands whatsoever of the Mortgagors, in, to, under and/or in respect of the Project Documents (including insurance policies) including, without limitation, the right to compel performance thereunder, and to substitute, or to be substituted for, the Mortgagor thereunder, and to commence and conduct either in the name of the Mortgagor or in their own names or otherwise any proceedings against any persons in respect of any breach of, the Project Documents and, including without limitation, rights and benefits to all amounts owing to, or received by, the Mortgagor and all claims thereunder and all other claims of the Mortgagor under or in any proceedings against all or any such persons and together with the right to further assign any of the Project Documents, both present and future, to have and to hold all and singular the aforesaid assets, rights, properties, etc. unto and to the use of the Mortgagee absolutely and subject to the powers and provisions contained herein and subject also to the proviso for redemption hereinafter mentioned.”

ICICI Bank’s Standard Terms and Conditions Governing Consumer Durable Loans

“ insurance.

The Borrower further agrees that upon any monies becoming due under the policy, the same shall be paid by the Insurance Company to ICICI Bank without any reference / notice to the Borrower, but not exceeding the principal amount outstanding under the Insurance Policy. The Borrower specifically acknowledges that in all cases of claim, the Insurance Company will be solely liable for settlement of the claim, and he/she will not hold ICICI Bank responsible in any manner whether for compensation, recovery of compensation, processing of claims or for any reason whatsoever.

Reference has been made only to assignment of assets, rights, benefits, interests, properties etc. No specific reference has been made to the assignment of obligations of the assignor under such insurance contract.

THE ISSUE FACED BY ICICI BANK

Where ICICI Bank accepts insurance policy documents of customers as security for a loan, in the light of the fact that the documents are silent about the question of assignment of obligations, are they assigned to ICICI Bank? Where there is hypothecation of a life insurance policy, with a stipulation that the mortgagor (assignor) should pay the premiums, and that the mortgagee (assignee) is not bound to pay the same, Sections 130 and 132 do not apply to such cases. [xiv] With rectification of this issue, ICICI Bank can concretize its hold over the securities with no reservations about its legality.

RISKS INVOLVED

This section of the paper attempts to explore the many risks that ICICI Bank is exposed to, or other factors which worsen the situation, due to the omission of a clause detailing the assignment of obligations by ICICI Bank.

Practices of Other Companies

The practices of other companies could be a risk factor for ICICI Bank in the light of the fact that some of them expressly exclude assignment of obligations in their security documents.

There are some companies whose notice of assignment forms contain an exclusive clause dealing with the assignment of obligations. It states that while rights and benefits accruing out of the insurance policy are to be assigned to the bank, obligations which arise out of such policy documents will not be liable to be performed by the bank. Thus, they explicitly provide for the only assignment of rights and benefits and never the assignment of obligations.

Possible Obligation to Insurance Companies

By not clearing up this issue, ICICI Bank could be held to be obligated to the insurance company from whom the assignor took the policy, for example, with respect to insurance premiums which were required to be paid by the assignor. This is not a desirable scenario for ICICI Bank. In case of default by the assignor in the terms of the contract, the right of ICICI Bank over the security deposited (insurance policy in question) could be fraught in the legal dispute.

Possible litigation

Numerous suits may be instituted against ICICI Bank alleging a violation of the Indian Contract Act. Some examples include allegations of concealment of fact, fraud etc. These could be enough to render the existing contract of assignment voidable or even void.

Contra Proferentem

This doctrine applies in a situation when a provision in the contract can be interpreted in more than one way, thereby creating ambiguities. It attempts to provide a solution to interpreting vague terms by laying down, that a party which drafts and imposes an ambiguous term should not benefit from that ambiguity. Where there is any doubt or ambiguity in the words of an exclusion clause, the words are construed more forcibly against the party putting forth the document, and in favour of the other party. [xv]

The doctrine of contra proferentem attempts to protect the layman from the legally knowledgeable companies which draft standard forms of contracts, in which the former stands on a much weaker footing with regard to bargaining power with the latter. This doctrine has been used in interpreting insurance contracts in India. [xvi]

If litigation ensues as a result of this uncertainty, there are high chances that the Courts will tend to favour the assignor and not the drafter of the documents.

POSSIBLE DEFENSES AGAINST DISPUTES FOR THE SECURITY DOCUMENTS AS THEY ARE NOW

This section of the paper attempts to give defences which the Bank may raise in case of any disputes arising out of silence on the matter of assignability of obligations.

Interpretation of the Security Documents

UNIDROIT principles expressly provide a method for interpretation of contracts. [xvii] The method consists of utilizing the following factors:

This defence relates to the concept of estoppel embodied in Section 115 of the Indian Evidence Act, 1872. According to the Section, when one person has, by his declaration, act or omission, intentionally caused or permitted another person to believe a thing to be true and to act upon such belief, neither he nor his representative shall be allowed, in any suit or proceeding between himself and such person or his representatives, to deny the truth of that thing.

If a man either by words or by conduct has intimated that he consents to an act which has been done and that he will not offer any opposition to it, and he thereby induces others to do that which they otherwise might have abstained from, he cannot question legality of the act he had sanctioned to the prejudice of those who have so given faith to his words or to the fair inference to be drawn from his conduct. [xviii] Subsequent conduct may be relevant to show that the contract exists, or to show variation in the terms of the contract, or waiver, or estoppel. [xix]

Where the meaning of the instrument is ambiguous, a statement subsequently interpreting such instrument is admissible. [xx] In the present case, where the borrower has never raised any claims with regard to non assignability of obligations on him, and has consented to the present conditions and relations with ICICI Bank, he cannot he cannot be allowed to raise any claims with respect to the same.

Internationally, the doctrine of post contractual conduct is invoked for such disputes. It refers to the acts of parties to a contract after the commencement of the contract. It stipulates that where a party has behaved in a particular manner, so as to induce the other party to discharge its obligations, even if there has been a variation from the terms of the contract, the first party cannot cite such variation as a reason for its breach of the contract.

Where the parties to a contract are both under a common mistake as to the meaning or effect of it, and therefore embark on a course of dealing on the footing of that mistake, thereby replacing the original terms of the contract by a conventional basis on which they both conduct their affairs, then the original contract is replaced by the conventional basis. The parties are bound by the conventional basis. Either party can sue or be sued upon it just as if it had been expressly agreed between them. [xxi]

The importance of consensus ad idem has been concretized by various case laws in India. Further, if the stipulations and terms are uncertain and the parties are not ad idem there can be no specific performance, for there was no contract at all. [xxii]

In the present case, the minds of the assignor and assignee can be said to have not met while entering into the assignment. The assignee never had any intention of undertaking any obligations of the assignor. In Hartog v Colin & Shields, [xxiii] the defendants made an offer to the plaintiffs to sell hare skins, offering to a pay a price per pound instead of per piece.

AVOIDING THESE RISKS

To concretize ICICI Bank’s stand on the assignment of obligations in the matter of loans secured by insurance policies, the relevant security documents could be amended to include such a clause.

For instances where loans are secured by life insurance policies, a standard set by the American Banker’s Association (ABA) has been followed by many Indian commercial institutions as well. [xxvi] The ABA is a trade association in the USA representing banks ranging from the smallest community bank to the largest bank holding companies. ABA’s principal activities include lobbying, professional development for member institutions, maintenance of best practices and industry standards, consumer education, and distribution of products and services. [xxvii]

There are several ICICI security documents which have included clauses denying any assignment of obligations to it. An extract of the deed of hypothecation for vehicle loan has been reproduced below:

“ 3. In further pursuance of the Loan Terms and for the consideration aforesaid, the Hypothecator hereby further agrees, confirms, declares and undertakes with the Bank as follows:

(i)(a) The Hypothecator shall at its expenses keep the Assets in good and marketable condition and, if stipulated by the Bank under the Loan Terms, insure such of the Assets which are of insurable nature, in the joint names of the Hypothecator and the Bank against any loss or damage by theft, fire, lightning, earthquake, explosion, riot, strike, civil commotion, storm, tempest, flood, erection risk, war risk and such other risks as may be determined by the Bank and including wherever applicable, all marine, transit and other hazards incidental to the acquisition, transportation and delivery of the relevant Assets to the place of use or installation. The Hypothecator shall deliver to the Bank the relevant policies of insurance and maintain such insurance throughout the continuance of the security of these presents and deliver to the Bank the renewal receipts / endorsements / renewed policies therefore and till such insurance policies / renewal policies / endorsements are delivered to the Bank, the same shall be held by the Hypothecator in trust for the Bank. The Hypothecator shall duly and punctually pay all premia and shall not do or suffer to be done or omit to do or be done any act, which may invalidate or avoid such insurance. In default, the Bank may (but shall not be bound to) keep in good condition and render marketable the relevant Assets and take out / renew such insurance. Any premium paid by the Bank and any costs, charges and expenses incurred by the Bank shall forthwith on receipt of a notice of demand from the Bank be reimbursed by the Hypothecator and/or Borrower to the Bank together with interest thereon at the rate for further interest as specified under the Loan Terms, from the date of payment till reimbursement thereof and until such reimbursement, the same shall be a charge on the Assets…”

The inclusion of such a clause in all security documents of the Bank can avoid the problem of assignability of obligations in insurance policies used as security for any facility sanctioned by it.

An assignment of securities is of utmost importance to any lender to secure the facility, without which the lender will not be entitled to any interest in the securities so deposited.

In this paper, one has seen the need for assignment of securities of a facility. Risks involved in not having a separate clause dealing with non assignability of obligations have been discussed. Certain defences which ICICI Bank may raise in case of the dispute have also been enumerated along with solutions to the same.

Formatted by March 2nd, 2019.

BIBLIOGRAPHY

[i] J.H. Tod v. Lakhmidas , 16 Bom 441, 449

[ii] http://www.licindia.in/policy_conditions.htm#12, last visited 30 th June, 2014

[iii] Headwaters Construction Co. Ltd. v National City Mortgage Co. Ltd., 720 F. Supp. 2d 1182 (D. Idaho 2010)

[iv] Indian Contract Act and Specific Relief Act, Mulla, Vol. I, 13 th Edn., Reprint 2010, p 968

[v] Khardah Co. Ltd. v. Raymond & Co ., AIR 1962 SC 1810: (1963) 3 SCR 183

[vi] Principles of Insurance Law, M.N. Srinivasan, 8 th Edn., 2006, p. 857

[vii] Ram Baran v Ram Mohit , AIR 1967 SC 744: (1967) 1 SCR 293

[viii] Sri Sarada Mills Ltd. v Union of India, AIR 1973 SC 281

[ix] Lala Kapurchand Godha v Mir Nawah Himayatali Khan, [1963] 2 SCR 168

[x] Velayudhan v Pillaiyar, 9 Mad LT 102 (Mad)

[xi] Hindustan Ideal Insurance Co. Ltd. v Satteya, AIR 1961 AP 183

[xii] Mulraj Khatau v Vishwanath, 40 IA 24 – Respondent based his claim on a mere deposit of the policy and not under a written transfer and claimed that a charge had thus been created on the policy.

[xiii] Insure Policy Plus Services (India) Pvt. Ltd. v The Life Insurance Corporation of India, 2007(109)BOMLR559

[xiv] Transfer of Property Act, Sanjiva Row, 7 th Edn., 2011, Vol II, Universal Law Publishing Company, New Delhi

[xv] Ghaziabad Development Authority v Union of India, AIR 2000 SC 2003

[xvi] United India Insurance Co. Ltd. v M/s. Pushpalaya Printers, [2004] 3 SCR 631, General Assurance Society Ltd. v Chandumull Jain & Anr., [1966 (3) SCR 500]

[xvii] UNIDROIT Principles, Art 4.3

[xviii] B.L.Sreedhar & Ors. v K.M. Munireddy & Ors., 2002 (9) SCALE 183

[xix] James Miller & Partners Ltd. v Whitworth Street Estates (Manchester) Ltd., [1970] 1 All ER 796 (HL)

[xx] Godhra Electricity Co. Ltd. v State of Gujarat, AIR 1975 SC 32

[xxi] Amalgamated Investment & Property Co. Ltd. v Texas Commerce International Bank Ltd., [1981] 1 All ER 923

[xxii] Smt. Mayawanti v Smt. Kaushalya Devi, 1990 SCR (2) 350

[xxiii] [1939] 3 All ER 566

[xxiv] Terrell v Alexandria Auto Co., 12 La.App. 625

[xxv] http://www.uncitral.org/pdf/english/CISG25/Pamboukis.pdf, last visited on 30 th June, 2014

[xxvi] https://www.phoenixwm.phl.com/shared/eforms/getdoc.jsp?DocId=525.pdf, last visited on 30 th June, 2014

[xxvii] http://www.aba.com/About/Pages/default.aspx, last visited on 30 th June, 2014

Related Posts:

Leave a Comment Cancel reply

Give it a try, you can unsubscribe anytime :)

Thanks, I’m not interested

- 1800 102 2355

- Download the APP

- 1800 102 2355 [9:30AM-6:30PM]

- Branch Locator

- Customer Portal Login

- Advisor Portal Login

What is Assignment and Nomination in Life Insurance?

‘Assignment’ and ‘Nomination’ are two most common terms used in a life insurance policy document. Let us understand the importance of these two terms in-detail.

By Future Generali. Updated On Oct 06, 2022

Your life insurance policy is a contract between you (insured) and the insurance company (insurer). The contract is filled with jargon. To the extent possible, we must understand all the terms mentioned in the policy bond (certificate). ‘Assignment’ and ‘Nomination’ are two most common terms used in the insurance world.

For instance, in the event that you plan to apply for a home loan, your home loan provider will surely use these terms. Hence, it is best to be sure and understand exactly what the terms mean before you make a decision to buy the policy.

What is assignment in life insurance?

A life insurance policy can be assigned when rights of one person are transferred to another. The rights to your insurance policy can be transferred to someone else for various reasons. The process is known as assignment.

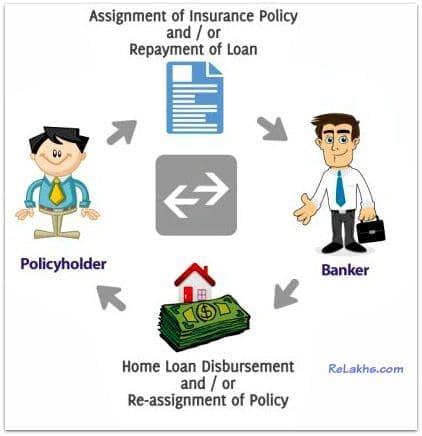

An “assignor” (policyholder) is the person who assigns the insurance policy. An “assignee” is the person to whom the policy rights have been transferred, i.e. the person to whom the policy has been assigned.

In the event rights are transferred from an Assignor to an Assignee, the rights of the policyholder are canceled, and the Assignee becomes the owner of the insurance policy.

People often assign their life insurance policies to banks. A bank becomes the policy owner in this case, while the original policyholder continues to be the life assured whose death may be claimed by either the bank or the policy owner.

Types of Assignment

There are two ways to assign an insurance policy. They are as follows:

1. Absolute Assignment

During this process, the rights of the assignor (policyholder) will be completely transferred to the assignee (person to whom the policy rights have been transferred). It is not subject to any conditions.

As an example, Mr. Rajiv Tripathi owns a Rs 1 Crore life insurance policy. Mr. Tripathi wants to gift his wife this policy. Specifically, he wants to make “absolute assignment” of the policy in his wife's name, so that the death benefit (or maturity proceeds) can be paid directly to her. After the absolute assignment has been made, Mrs. Tripathi will own this policy, and she will be able to transfer it to someone else again.

2. Conditional Assignment

As part of this type of assignment, certain conditions must be met before the transfer of rights occurs from the Assignor to the Assignee. The Policy will only be transferred to the Assignee if all conditions are met.

For instance, a term insurance policy of Rs 50 Lakh is owned by Mr. Dinesh Pujari. Mr. Pujari is applying for a home loan of Rs 50 Lakh. For the loan, the banker asked him to assign the term policy in their name. To acquire a home loan, Mr. Pujari can assign the insurance policy to the home loan company. In the event of Mr. Pujari’s death (during the loan tenure), the bank can collect the death benefit and get their money back from the insurance company.

Mr. Pujari can get back his term insurance policy if he repays the entire amount of his home loan. As soon as the loan is repaid, the policy will be transferred to Mr. Pujari.

In the event that the insurer receives a death benefit that exceeds the outstanding loan balance, the bank will be paid from the difference between the death benefit and the loan and the balance will be paid directly to the nominee. In the above example, the remaining amount (if any) will be paid to Mr. Pujari’s beneficiaries (legal heirs/nominee).

Key Points to know Note About Assignment

In regards to the assignment, the following points should be noted:

- A policy assignment transfers/changes only the ownership, not the risk associated with it. The person assured thus becomes the insured.

- The assignment may lead to cancellation of the nomination in the policy only when it is done in favour of the insurance company due to a policy loan.

- Assignment for all insurance plans except for the pension plan and the Married Women's Property Act (MWP), can be done.

- A policy contract endorsement is required to effect the assignment.

What is nomination in life insurance?

Upon the death of the life assured, the nominee/ beneficiary (generally a close relative) receives the benefits. Policyholders appoint nominees to receive benefits. Under the Insurance Act, 1938, Section 39 governs the nomination process.

Types of Nominees

In a life insurance policy, the policyholder names someone who will receive the benefits in the event of the life assured's death. Here are a few types of nominees:

1. Beneficial Nominees

In accordance with the law, the beneficiary of the claimed benefits will be any immediate family member nominated by the policyholder (like a spouse, children, or parents). Beneficiary nominees are limited to immediate family members of the beneficiary.

2. Minor Nominees

It is common for individuals to name their children as beneficiaries of their life insurance policies. Minor nominees (under the age of 18) are not allowed to handle claim amounts. Hence, the policyholder needs to designate a custodian or appointee. Payments are made to the appointee until the minor reaches the age of 18.

3. Non-family Nominees

Nominees can include distant relatives or even friends as beneficiaries of a life insurance policy.

4. Changing Nominees

It is okay for policyholders to change their nominees as often as they wish, but the latest nominee should take priority over all previous ones.

Key Points to Note About Nomination

In regards to the nomination, the following points should be noted:

- In order to nominate, the policyholder and life assured must be the same.

- In the case of a different policyholder and life assured, the claim benefits will be paid to the policyholder.

- Nominations cannot be changed or modified.

- The policy can have more than one nominee.

- As part of successive nominations, if the life assured appoints person “A” as the first person to receive benefits. Now, in the event of the life assured’s death after person “A” dies, the claim benefits will be given to person “B”. The benefits will be available to Nominee “C” if Nominee “A” and Nominee “B” have passed away.

What is the difference between nomination and assignment?

Let's talk about the differences between assignment and nomination.

Nomination and Assignment serve different purposes. The nomination protects the interests of the insured as well as an insurer in offering claim benefits under the life insurance policy. On the other hand, assignment protects the interests of an assignee in availing the monetary benefits under the policy. The policyholder should be aware of both of them before buying life insurance.

Connect with our trusted financial advisors right away!

Fill in below details to get a call back

One of our associate will connect with you soon.

Latest Articles

Life Insurance 4 min What is Investment? A Complete guide to start your investment journey.

By Future Generali. Dec 06, 2023

Life Insurance 5 min Endowment Policy: Returns, Benefits & Requirement

By Future Generali. Sep 06, 2023

Life Insurance 4 min Understanding Sum Assured: Significance & Calculation

By Future Generali. Jul 28, 2023

Couldn't find what you are looking for? TRY SEARCH

ARN No.: Comp-April-2022_534.

- Submit Post

- Union Budget 2024

- Corporate Law

Assignment of Marine Insurance Policies

As you are aware that a contract of marine insurance is an agreement whereby the insurer undertakes to indemnify the insured, in the manner and to the extent thereby agreed, against transit losses, that is to say losses incidental to transit.

A contract of marine insurance may by its express terms or by usage of trade be extended so as to protect the insured against losses on inland waters or any land risk which may be incidental to any sea voyage.

In simple words the marine insurance includes;

A. CARGO INSURANCE which provides insurance cover in respect of loss of or damage to goods during transit by rail, road, sea or air.

Thus cargo insurance concerns the following :

(i) export and import shipments by ocean-going vessels of all types,

(ii) coastal shipments by steamers, sailing vessels, mechanized boats, etc.,

(iii) shipments by inland vessels or country craft, and

(iv) Consignments by rail, road, or air and articles sent by post.

B. HULL INSURANCE which is concerned with the insurance of ships (hull, machinery, etc.).

INSURABLE INTEREST

For effecting marine insurance like any other insurance, the assured must have an insurable interest. If there is no such interest, the policy would be a wagering contract and thus it will be void. Any person does have an insurable interest who is interested in a marine journey or who can get affected due to the losses and damages caused in the marine journey or adventure. The interest must subsist either at the time of effecting the insurance or at the time of loss. Any interest which is defeasible or contingent or partial can be insured. A lender under a bottomry bond or respondentia bond has insurable interest as well as master’s and seamen’s wages, advance freight are insurable, a mortgagee has also insurable interest.

The term “ Transfer” or “ Assignment” of policies of insurance are governed by the provisions of the Transfer of Property Act,1882 as amended from time to time. Please note that provisions of Section 38 of the Insurance Act,1938 only deals with transfer or assignment of Life Insurance Polices and the provisions of TP Act,1882 deal with other types of insurance policies.

“ Actionable Claim”-Section 3 of TP Act,1882 defines as – a claim to any debt, other than a debt secured by mortgage of immoveable property or by hypothecation or pledge of moveable property, or to any beneficial interest in moveable property not in the possession, either actual or constructive, of the claimant, which the Civil Courts recognise as affording grounds for relief, whether such debt or beneficial interest be existent, accruing, conditional or contingent. The claim under a policy was regarded as property and is treated as an actionable claim under TP Act,1882 and the rules relating a transfer of actionable claim were held to apply to assignment of policies till specific statute laid down some specific rules for such assignments.

Section 6( e) of the Transfer of Property Act,1882 lays down that a mere right to sue cannot be transferred.

From above we find that an actionable claim means a claim to a debt. In its primary sense a debt is a liquidated money obligation and it is an essential feature of an action for debt that it should be for a liquidated debt or certain sum of money. The right to recover an ascertained and definite debt is not a mere right to sue and is not transferable. It is an actionable claim.

It means if a certain sum of money is due from any person , that sum is recoverable on assignment , and it is not mere right to sue to offend against the provisions of Section 6( e) of TP act,1882. As you know that in case of an actionable claim, there is a surety that there is some amount ,which can be recovered and same as in an Insurance Policy. The Sum Insured is the amount ,which will be recoverable at the time of loss or after assignment of insurance policy by the assignee. A policy of insurance is a present contract in the hand of an insured of which he has present right to the benefit although the fruits are to be enjoyed in future.

A policy on a man’s life expressed to be payable to his executors or administrators is a reversionary interest certain to fall in on the assured’s death or attainment of the stipulated age. A policy of insurance is a choose in action. A policy of life insurance represents money which is due and owned to the assured at his death and in the part of his estate. He has unlettered discretion to sell or charge it, to bequeath it or even to give it away.

“ASSIGNMENT” means- Transfer of interest from one to another is called assignment. In insurance also when rights and obligation under the contract are transferred from one to another, the same is called assignment of the policy. There can be another assignment in insurance which is assignment of benefits under the policies. Assignment of policy and assignment of benefits are quite distinct. Whereas in the former all the rights and obligations are transferred, in the latter only benefits (i.e. money due under the policy etc) are transferred. In insurance the assignment means assignment of rights under the contract. An assignee for all purposes becomes the owner of the policy and enjoys all rights thereunder. However, by assignment no change is made in the subject matter insured by the policy and it remains unaltered.”

ASSIGNMENT OF A CONTRACT OF INSURANCE AND ASSIGNMENT OF THE SUBJECT MATTER OF INSURANCE.

Assignment for the purpose of law o insurance may either be;

(a) The assignment of the subject matter of insurance ;or

(b) The assignment of the policy.

Please note that:- the question of the assignment of the subject matter of insurance in case of life and personal accident insurances does not arise, for the subject -matter in such cases is from its very nature unassignable.