- Go to our main website ⟶

Writing a Business Plan

Team sequoia.

When Brian, Joe and Nate founded Airbnb, they had an air mattress, entrepreneurial passion, and a vision for reinventing travel and hospitality, but no clear idea how to approach VCs or how to craft a pitch deck.

They came across Sequoia’s guide for how to write a business plan and the rest is history . They made a great deck.

But it wasn’t really the slides we liked—it was their ideas, the clarity of their thinking, and the scope of their ambition. We love partnering with founders hell-bent on bringing an idea to life that conventional wisdom deems impossible. And we love to partner early— when an idea is newly formed and has the maximal room to grow.

You can find our guide to pitching below (with a few refinements from years of use).

Company purpose Start here: define your company in a single declarative sentence. This is harder than it looks. It’s easy to get caught up listing features instead of communicating your mission.

Problem Describe the pain of your customer. How is this addressed today and what are the shortcomings to current solutions.

Solution Explain your eureka moment. Why is your value prop unique and compelling? Why will it endure? And where does it go from here?

Why now? The best companies almost always have a clear why now? Nature hates a vacuum—so why hasn’t your solution been built before now?

Market potential Identify your customer and your market. Some of the best companies invent their own markets.

Competition / alternatives Who are your direct and indirect competitors. Show that you have a plan to win.

Business model How do you intend to thrive?

Team Tell the story of your founders and key team members.

Financials If you have any, please include.

Vision If all goes well, what will you have built in five years?

Fundable VC Pitch Deck Examples (+How-to Tips & Templates)

Discover top VC pitch deck examples, learn the ideal VC pitch deck structure, and access customizable templates to craft your winning presentation.

9 minute read

helped business professionals at:

Short answer

What is a VC pitch deck?

A venture capital (VC) pitch deck is a presentation that startups use to explain their business to potential investors and venture capitalists (VCs).

It highlights the company's vision, team, market opportunity, and financials, aiming to secure investment by showcasing potential for growth and success.

You only have 15 seconds to convince VCs to look at your deck

So, you think you’ve got a vision that could make a real difference. But here's the thing - so does everyone else.

Your company is just one of thousands fighting for the attention of potential VCs, and having an innovative idea isn’t enough to succeed.

Your pitch deck is your voice before you even speak. It's what sets the stage for your story, and in a world where you’ve only got 15 seconds to make an impression, it needs to stand out. But how do you ensure your deck cuts through the noise?

I’m here to guide you through the art of crafting a VC pitch deck that makes VCs sit up and take notice.

From showcasing proven VC pitch deck examples to breaking down the ideal structure and providing you with customizable templates, I've got you covered.

Let's dive in and transform your pitch deck into your most powerful asset.

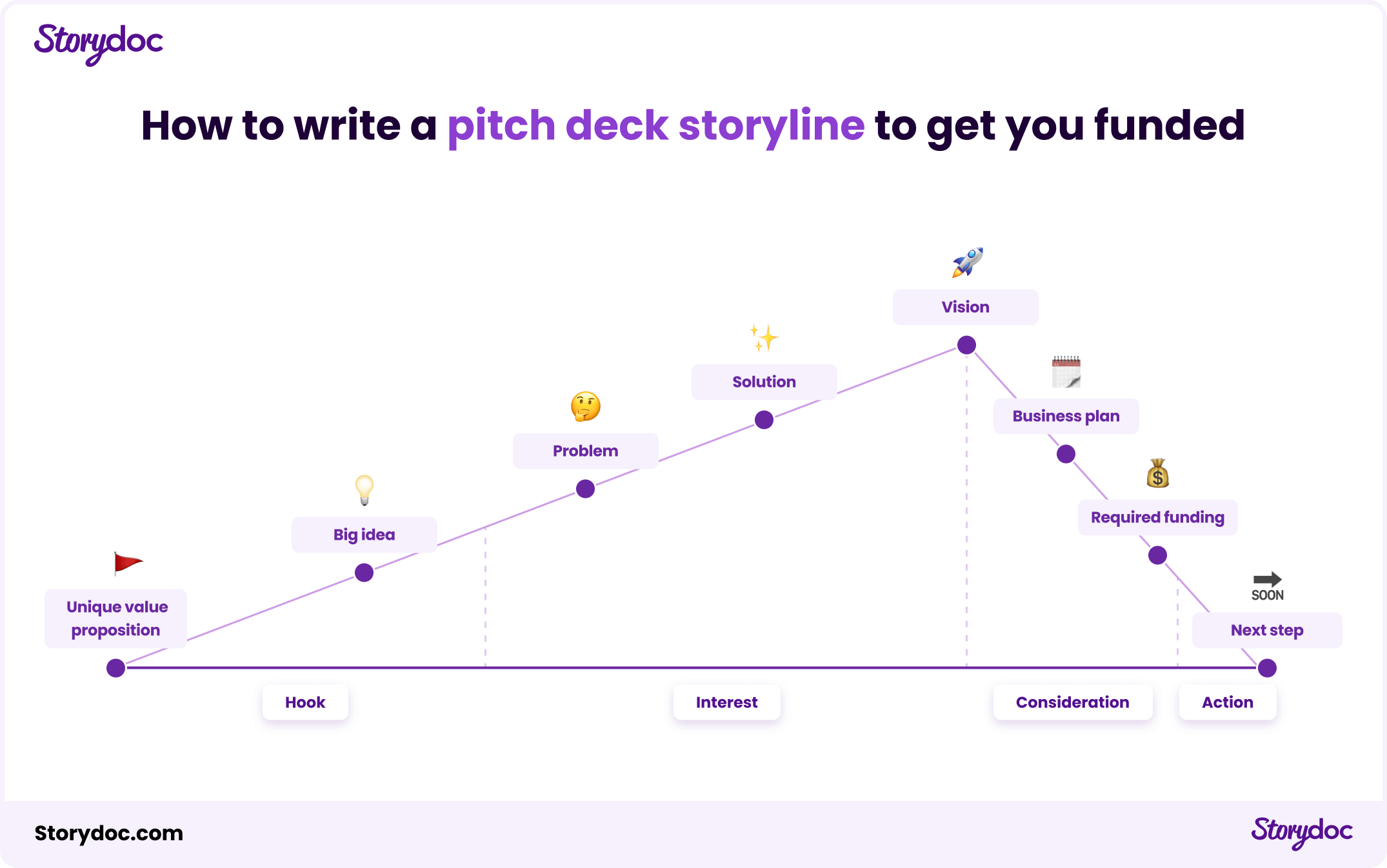

How do you structure a VC pitch deck?

A successful venture capital pitch deck should be structured as a narrative presentation .

Start by grabbing your investors' attention with what makes your solution special. Then, guide them through the journey of the problem you're tackling, how you're addressing it, and the brighter future your solution promises.

Wrap up by showing how their investment will play a crucial role in making this vision a reality. This narrative approach engages and connects with your audience on a deeper level.

Recommended VC pitch deck storyline format:

1) Unique Value Proposition

- What problem are you solving?

- Who are you solving it for?

- How does your solution stand out?

2) Big idea (elevator pitch)

- How does the world look before your solution?

- How does it change with your solution?

- Why is your team the one to make this happen?

- What struggles do potential customers face?

- What are the financial and emotional costs?

- Where do current solutions fall short?

4) Solution

- What is your approach to solving the problem?

- How does your solution ease the pain?

- What makes your solution uniquely valuable?

5) Market & Vision

- What does the competitive landscape look like?

- How do you plan to change the game?

- What are the numbers that back up your vision?

6) Business plan (hard numbers)

- How will you make money?

- What's your strategy for scaling?

- How will more funding improve your business?

7) Traction

- Do you already have customers?

- What revenue have you generated?

- How fast are you growing?

- How do you retain customers?

- What are your future projections based on data?

- What makes your team capable of succeeding?

- How well do you work together?

- Why is your team the best fit?

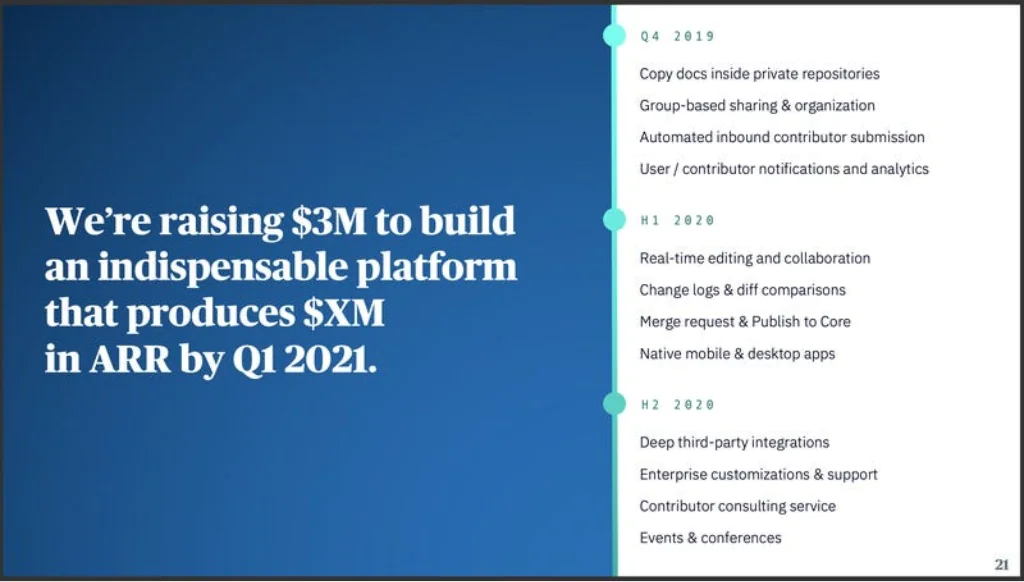

- How much funding do you need?

- Why is now the right time to invest?

- What will you do with the funding?

10) Next step

- What small commitment are you asking for?

- How can investors get involved?

- What are the consequences of not acting now?

What slides should be in a VC pitch deck?

When creating a venture capital pitch deck, you need to blend storytelling with strategic information to captivate potential investors.

The right slides can turn a good presentation into an unforgettable one, laying out your business case in a clear, compelling sequence.

11 essential slides of a VC deck:

Introduction: Set the stage with a compelling introduction that encapsulates who you are and what your company stands for.

The problem: Clearly define the problem you're solving, highlighting the need for a solution.

Your solution: Introduce your solution, focusing on how it addresses the problem uniquely and effectively.

Market size and opportunity: Demonstrate the potential market size and the opportunity it presents, underscoring the demand for your solution.

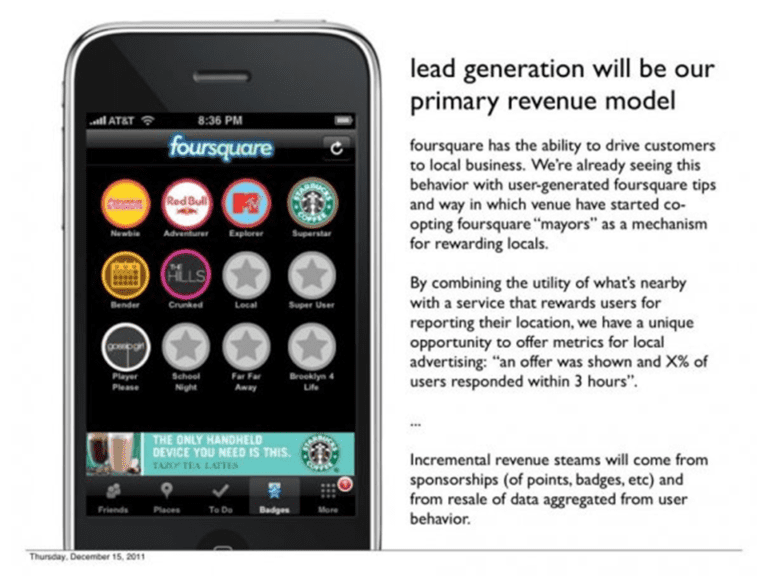

Business and revenue model: Explain how your business operates and how it makes money, detailing your revenue streams.

Traction and validation: Showcase any traction you've gained, such as customer feedback, sales figures, or growth metrics, to validate your business model.

Marketing strategy: Outline your strategy for attracting and retaining customers, including channels and tactics you use or plan to use.

Team: Highlight the strengths of your team, emphasizing the experience and skills that make you well-equipped to succeed.

Financials: Provide a snapshot of your current financial status and projections, giving investors a clear picture of your business's health and potential.

Investment and use of funds: Specify the amount of funding you're seeking and how you plan to use it to grow your business.

Next steps slide: Conclude with a clear call to action, outlining what you hope to achieve next and how investors can be part of your journey.

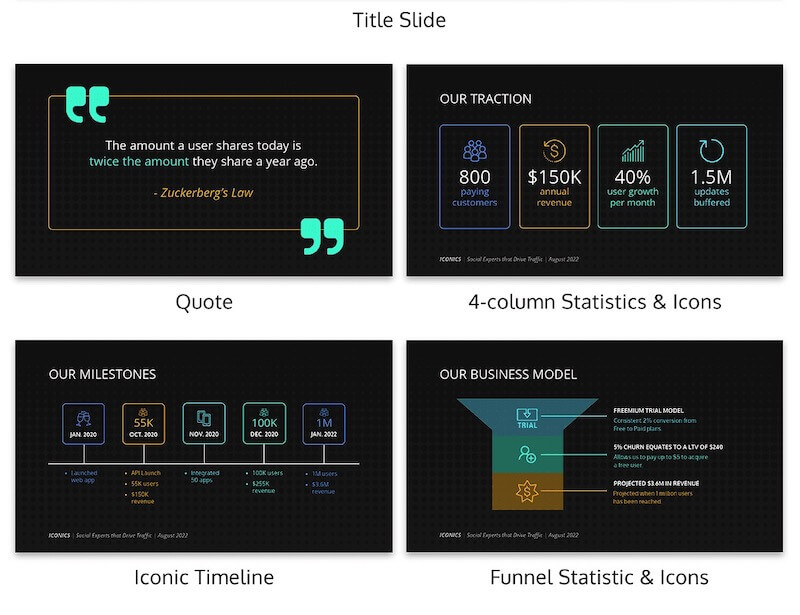

VC pitch deck examples that captivate potential investors

The most successful venture capital pitch decks share a common trait: they captivate potential investors from the first slide to the last.

It's not just about sharing facts and figures; it's about telling a story that makes people believe in your vision and want to be a part of it.

The VC pitch deck examples we're about to explore do exactly that. They mix the right ingredients—clear messaging, compelling visuals, and a strong narrative—to show just how powerful a great pitch can be.

Whether you're just starting out or gearing up to secure more funding, these examples are packed with lessons on how to make your fundable VC deck.

AI invest pitch deck

This VC pitch deck is a prime example of how to effectively communicate your startup's value proposition to potential investors. It skillfully combines narrative with interactive elements to create a dynamic and engaging presentation.

What makes this VC pitch deck great:

Average reading time on the cover: It immediately sets expectations for engagement, showing respect for the investor's time.

Easily customizable logo placeholders: The editor allows for quick customization to showcase competitive advantages in a visually appealing manner.

Interactive data visualization components: The deck engages viewers with interactive elements, making complex data easy to understand and memorable.

Professional startup deck

This deck exemplifies how to seamlessly blend interactive elements with a clear narrative to captivate venture capitalists.

By integrating multimedia right from the start and maintaining a focus on strategic storytelling throughout, it sets a new standard for pitch presentations.

What makes this VC deck great:

A video on the cover slide: It immediately captures the viewer's interest with a dynamic introduction, offering a memorable first impression that sets the stage for the story to unfold.

Clear go-to-market strategy: By providing a concise and coherent strategy, it allows investors to quickly grasp the startup's approach to market entry and expansion.

A narrator slide for the roadmap: This innovative feature personalizes the journey ahead, transforming the roadmap from a simple timeline into a compelling narrative that investors can envision themselves being a part of.

Vibrant VC deck

This venture capital deck stands out with a visually striking and interactive design that immediately draws in the viewer.

By cleverly integrating real-time data and a streamlined narrative structure, it not only presents the startup's story but also immerses the audience in a dynamic journey through its potential.

Running numbers for key metrics: It showcases the startup's achievements and potential with dynamically updating figures, making the data more engaging and easier to grasp.

Clear problem-solution framework: The deck clearly outlines the challenges faced by the target market and how the startup's solution addresses these issues, making the value proposition instantly clear.

Content segmented in tabs: This organization allows for a cleaner presentation and easier navigation through the deck, enabling investors to quickly find the information most relevant to them.

Tech industry VC deck

This VC deck effectively leverages digital tools to present a compelling case to potential investors. With a focus on clarity and engagement, it utilizes modern presentation elements to highlight the startup's strengths and future plans.

What makes this venture capital deck great:

Clear financial projections: It provides a transparent and detailed view of the startup's financial future, offering investors a clear understanding of growth potential.

Multiple image and video placeholders: These elements enrich the narrative with visual storytelling, making the presentation more engaging and informative.

An embedded calendar: This innovative feature facilitates immediate action by allowing potential investors to schedule meetings directly from the deck, enhancing interaction and follow-up.

Modern startup VC deck

This modern startup VC deck is a standout example of how to effectively use digital enhancements to personalize and elevate a pitch presentation. This deck is tailored to impress with its innovative features and clear, engaging layout.

Dynamic variables for personalization at scale: It allows for customization of the presentation to address each viewer directly, creating a more personal and impactful experience.

The use of highlight and grayed-out content to direct attention: This technique ensures that viewers' focus is drawn to key areas, enhancing the clarity and effectiveness of the message.

Data visualization components: Complex data is made accessible and engaging through well-designed visual elements, helping to convey the startup's achievements and projections clearly.

Creative VC pitch deck

By incorporating interactive elements, this VC deck delivers its message effectively and demonstrates the startup's innovative approach and attention to detail, making it a powerful tool in the fundraising process.

What makes this venture capital pitch deck great:

Clear unique value proposition: It articulates the startup's unique position in the market and its innovative solution to existing problems, making the investment opportunity clear and compelling.

Smart control measures: You can lock your deck with a password, ensuring that sensitive information remains secure and giving the presenter control over who can view the deck.

The option to extract branding from any website: This allows for a highly customized and relevant presentation, demonstrating the startup's ability to tailor its approach to different audiences and scenarios.

Crypto VC pitch deck

This VC pitch deck shines thanks to its sharp focus on innovation, a clear layout of problems and solutions, and an easy-to-navigate design, making a strong case for why it's a smart investment choice.

Ability to update after sending: This handy feature lets you make changes on the fly, keeping the deck fresh and accurate, which really helps in keeping trust and relevance high.

Easy branding integration: Pulling branding directly from any website makes customizing this presentation a breeze, ensuring your branding is on point from start to finish.

Built-in calendar: This makes it super easy for viewers to book meetings or follow-ups right from the pitch deck, making the step from interest to action quicker and smoother.

AI company VC pitch deck

This VC pitch deck masterfully introduces an AI startup, weaving a compelling story about tackling major industry issues with interactive and personalized touches.

Dynamic variables feature: This deck introduces dynamic variables, offering a tailored presentation journey for every viewer, which boosts both engagement and the feeling of relevance.

Solid problem-solution structure: It neatly lays out the big challenges facing the AI world and how the startup plans to solve them, showing a clear grasp of market needs and a practical approach to meet them.

Scroll-based layout: With its scroll-based design, the presentation allows for an easy, story-like walkthrough of AI concepts, making the advanced topic of AI interesting and accessible to everyone.

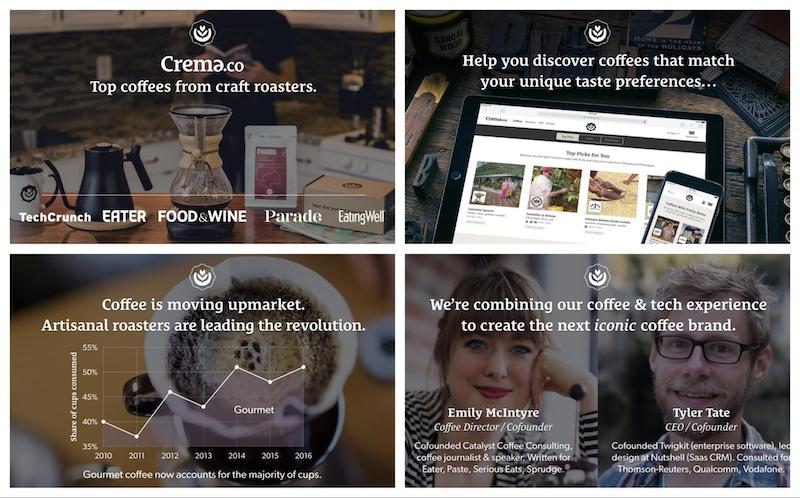

Consumer product VC pitch deck

This VC pitch deck captures attention with its sharp focus on consumer trends, innovative offerings, and deep market insights, crafting a persuasive argument for investment from.

What makes this VC pitch deck stand out:

Compelling value proposition: The presentation clearly outlines its strong value proposition, spotlighting the startup's dedication to sustainability, seamless technology integration, and affordability.

In-depth market research: It showcases extensive market research, pinpointing significant industry trends. This forms the backbone of the startup's strategic direction and highlights its potential for expansion.

Adaptive layout design: The pitch deck's design automatically adjusts to accommodate new content, ensuring that text, images, and graphs all integrate flawlessly. This keeps the presentation looking sharp and professional from start to finish.

Healthcare VC pitch deck

This VC pitch deck sets a new standard for presenting a healthcare startup, blending a clear problem-solution narrative with engaging interactive features and a clearly mapped out future journey.

Timeline slide: This deck features a timeline slide that charts the startup's growth trajectory, offering a glimpse into future innovations and key milestones, laying out a clear path forward.

Video embedding capability: By incorporating the ability to embed and play videos within the deck, it uses multimedia to showcase the startup's healthcare solutions and their transformative impact, making the presentation more dynamic and compelling.

Multiple smart CTAs: The presentation wraps up with cleverly positioned call-to-action buttons, designed to prompt potential investors to engage further, whether by seeking more information, booking a meeting, or delving deeper into what the startup has to offer.

B2B venture capital pitch deck

This B2B venture capital pitch deck serves as a standout example of how to succinctly and effectively present a complex B2B solution.

It achieves clarity in the problem-solution narrative, engages with interactive data visualizations to highlight growth, and clearly presents a robust business model, making it a benchmark for B2B startups looking to make an impact.

Strategic use of grayed-out content: The deck employs grayed-out content to subtly direct focus to the most crucial information, ensuring key points are immediately noticeable and easily understood.

Timeline slide: It features a timeline slide to present market analysis, showcasing the startup's grasp of industry trends and its potential for growth.

Transparent business model explanation: The presentation of the business model is marked by clarity and precision, with dynamic numbers that provide a clear picture of the startup's revenue streams and financial health.

Fintech VC pitch deck

This VC pitch deck weaves together a narrative that spotlights key problems, introduces innovative solutions, and is supported by compelling growth metrics.

Designed to grab the attention of potential investors, it positions the startup as a frontrunner in the fintech arena.

Real-time data integration: The ability to incorporate real-time data ensures the presentation remains fresh and engaging, allowing it to showcase the most recent successes and metrics.

Post-send edit capability: This feature adds incredible flexibility, permitting updates to the deck even after distribution. This ensures that every recipient has access to the latest, most accurate information about the startup.

Strategic smart CTAs: By embedding multiple smart call-to-action buttons, the deck effectively nudges readers towards meaningful engagement, whether it's to book a meeting, explore the website further, or initiate contact for more details.

Education VC pitch deck

This VC pitch deck introduces a forward-thinking solution to the pressing challenges in today's educational landscape.

It highlights the key issues faced by learners and educators alike and proposes an innovative solution aimed at transforming education for the next generation.

Customizable logo placeholders: Featuring easy-to-use placeholders for logos, this deck allows startups to swiftly personalize their presentations, maintaining brand consistency and recognition throughout.

Branding extraction feature: This functionality enables startups to pull branding elements directly from their website, ensuring the pitch deck seamlessly matches their online identity for a unified brand experience.

Multimedia placeholders: The inclusion of multiple placeholders for images and videos invites the use of rich multimedia content. This helps simplify complex educational topics, making the presentation more engaging and understandable for viewers.

General VC pitch deck

This general VC pitch deck shows how to succinctly and effectively communicate a startup's mission, pinpointing the problem being addressed, the proposed solution, and the compelling metrics that support its achievements.

Designed as a blueprint for creating pitches that are clear, engaging, and impactful, this deck is tailored to capture the focus of potential investors.

Interactive data visualization: By integrating dynamic charts and graphs, the deck vividly illustrates the startup's growth metrics, transforming raw data into a compelling narrative that's easy for the audience to grasp and appreciate.

Analytics panel access: The inclusion of an analytics panel offers a behind-the-scenes look at how viewers interact with the deck. This feedback loop is invaluable for identifying the most engaging parts of the pitch and areas that might need refining.

Responsive design: The deck guarantees a smooth and consistent viewing experience across various devices, ensuring that every potential investor can easily navigate and understand the startup's proposition, regardless of how they access the presentation.

What are VCs looking for in a pitch deck?

VCs sift through countless pitch decks, seeking signals of potential unicorn status within a concise presentation.

Understanding the key elements VCs look for can transform your pitch from just another deck to a compelling narrative that captures their imagination and investment interest.

1) The pitch deck’s purpose

The opening of your pitch deck should immediately clarify what your startup is about. Use the cover slide and tagline to succinctly convey your business's essence and the sector you're disrupting.

This isn't the place for vague aspirations; be specific and direct to anchor your audience's understanding from the get-go.

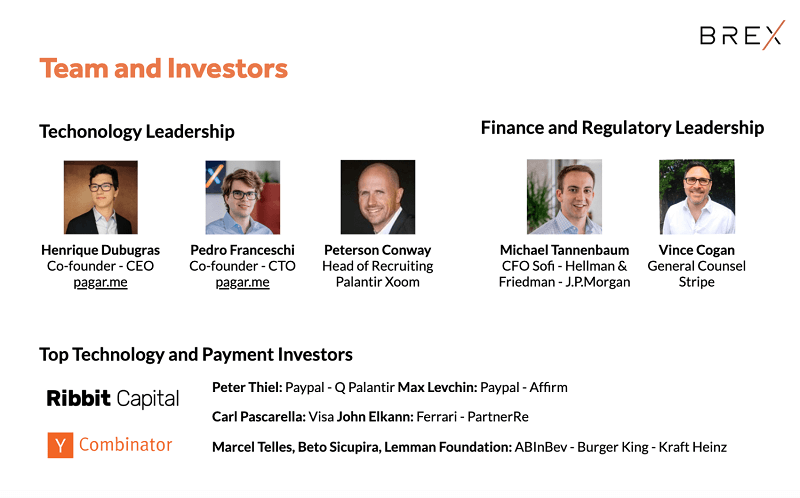

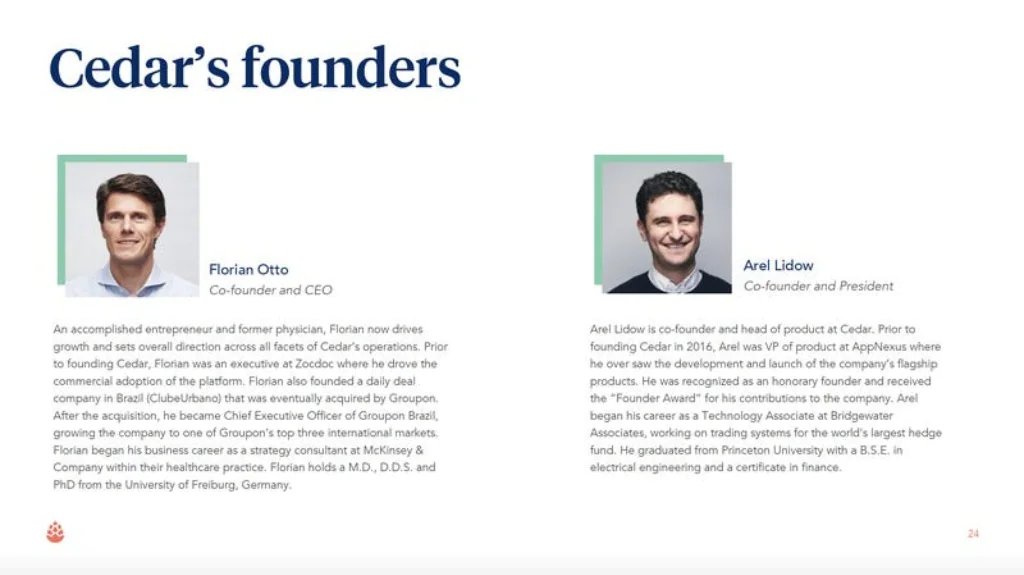

2) The team behind the vision

Early-stage investing is as much about betting on the jockey as it is on the horse. Highlight your team's expertise, experience, and unique qualifications early in the deck.

Show why your team, above all others, is equipped to turn this vision into a reality. Remember, a compelling team slide is not just a list of names but a narrative of capability and drive.

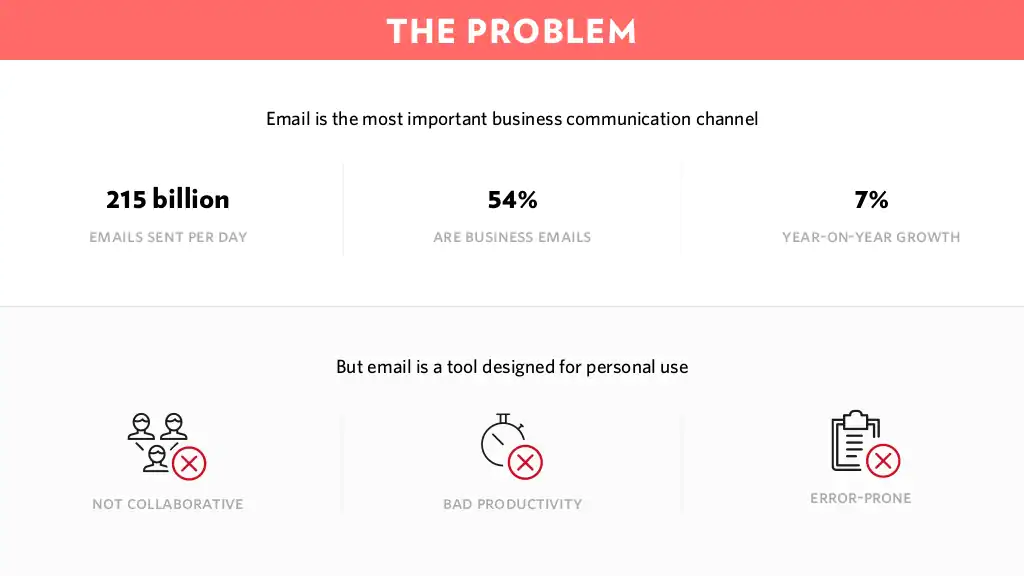

3) The significance of the problem

Articulate the problem you're solving in a way that resonates personally with VCs. This slide sets the stage for everything that follows, framing your startup as a solution to a significant, urgent problem.

Make the problem relatable, ensure it's a "hair-on-fire" issue for your target market, and demonstrate why it matters now.

Here's a great example of a problem slide:

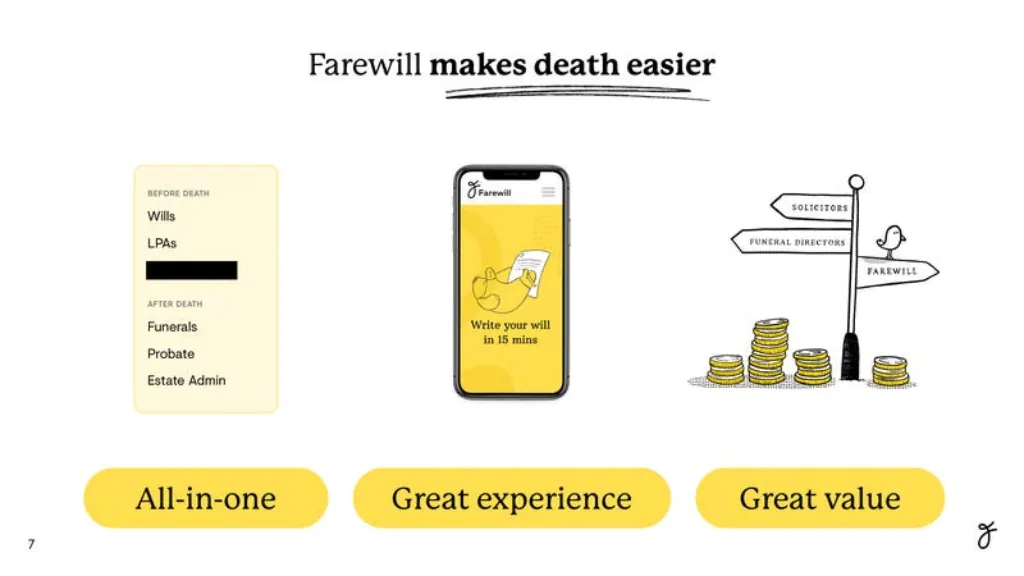

4) The solution’s impact

Present your solution as the inevitable answer to the outlined problem. This is where your product or service shines, showcasing its uniqueness and value proposition.

Be clear on how it addresses the problem better than anything else on the market, focusing on user benefits and potential for scale.

Here's what a good solution slide should look like:

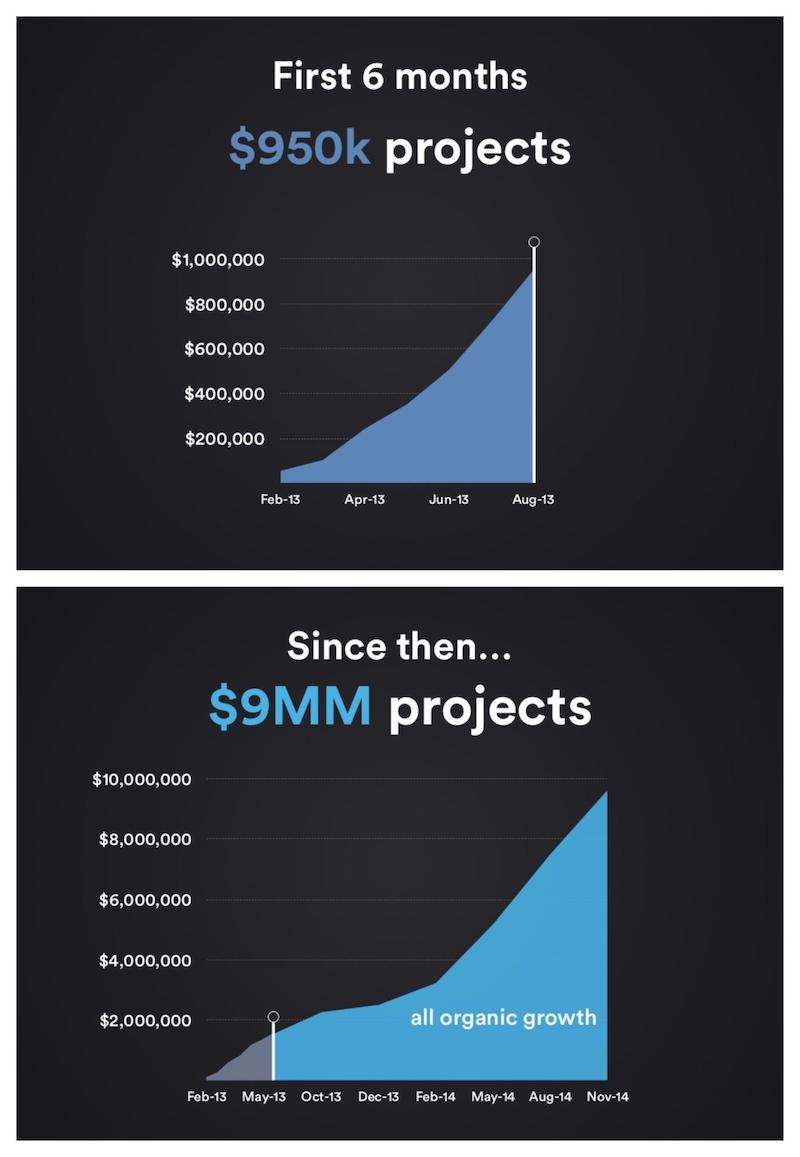

5) Proof of market traction

Traction is the proof that your solution has market fit. Include metrics that matter—revenue growth, user acquisition rates, notable partnerships, or customer testimonials.

This slide is your opportunity to show not just promise, but real-world impact and demand.

Here's an example of a traction slide:

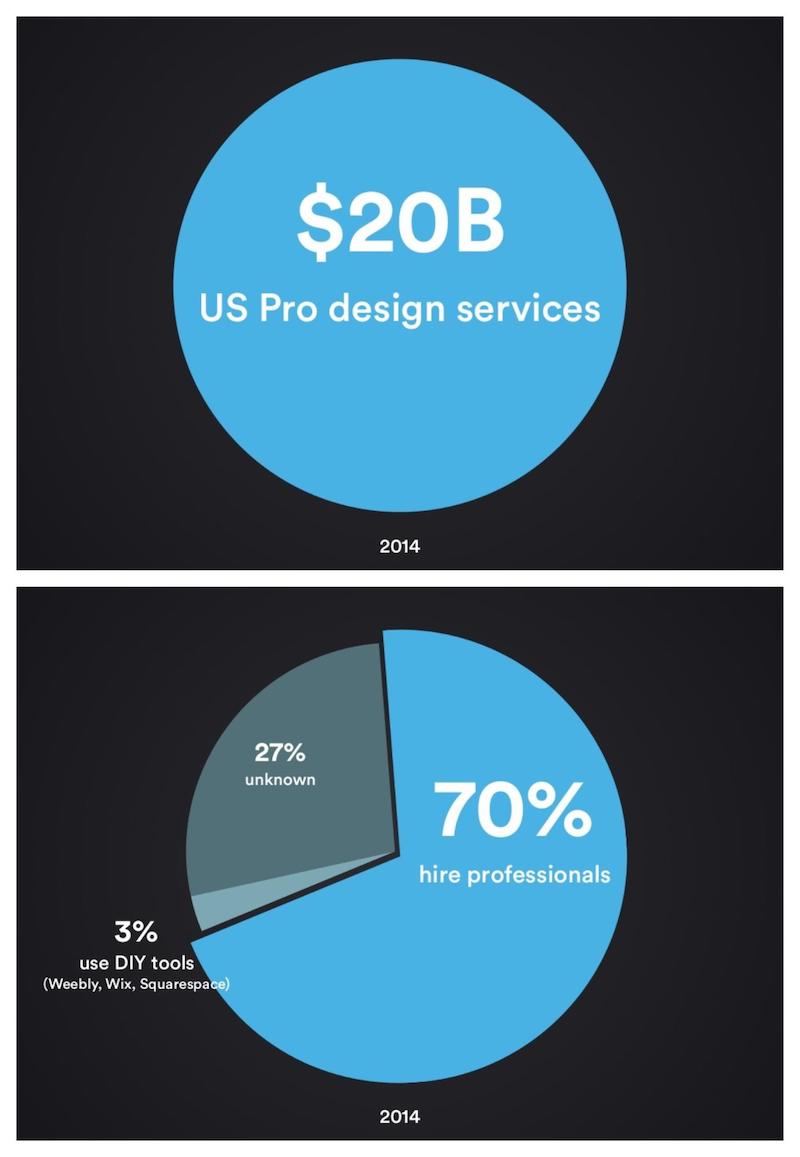

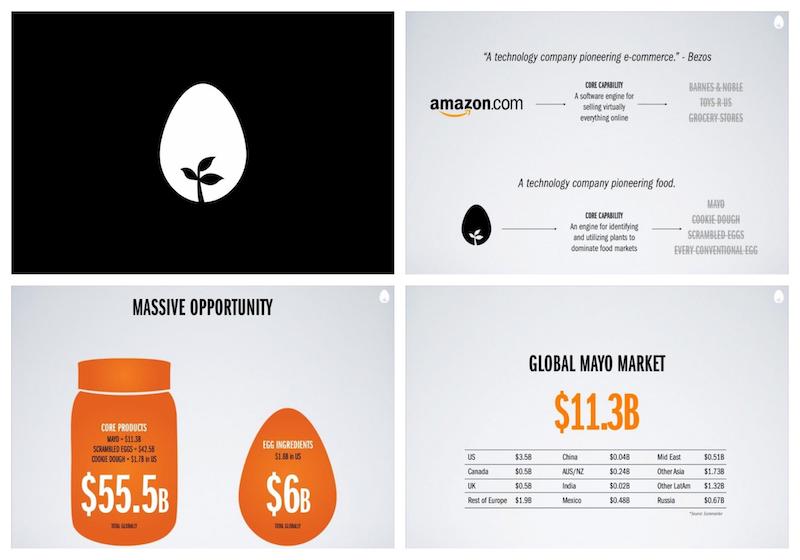

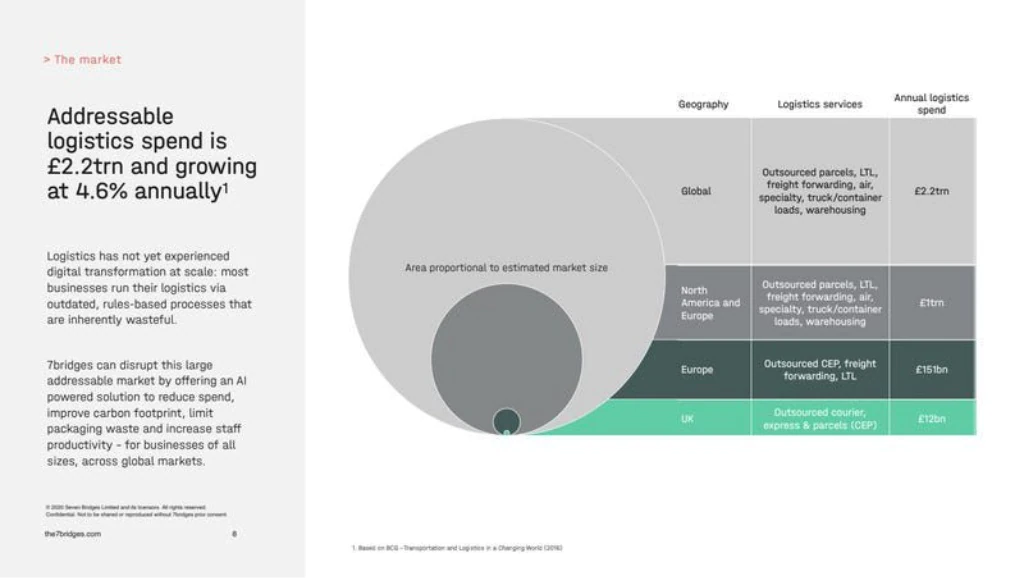

6) The market’s scope and potential

VCs are in the business of big wins. Detail your addressable market size and how you plan to capture a significant portion of it.

Use credible sources and logical assumptions to back your claims, showing a clear path to a large, scalable opportunity.

Here's what a market size slide should look like:

7) The strategy for market entry

Outline your plan to enter and capture the market. This should include your marketing and sales strategies, growth plans, and how you'll overcome initial barriers to entry.

It's about demonstrating a thoughtful, actionable roadmap to market dominance.

Here's an example of a go to market slide:

8) Competitive edge and customer appeal

Position your startup within the competitive landscape, highlighting what sets you apart.

This isn't just about who your competitors are but how your solution better meets customer needs. Differentiation is key; show how your approach is not just different, but better.

Here's an example of a competitive analysis slide:

9) The revenue generation strategy

Clearly articulate how your startup will generate revenue. Detail your pricing strategy, revenue streams, and the logic behind your business model. This slide reassures VCs that you have a viable, profitable path forward.

Here's an example of a revenue slide:

10) Potential for investor returns

Present realistic financial projections that outline your path to revenue and profitability. Show how investments will be used to fuel growth and what returns VCs can expect. This is about translating your business model into potential returns on investment.

Here's an example of a ROI slide:

11) Funding needs and allocation

Be transparent about how much funding you're seeking and how it will be used. This slide should align your funding request with your growth plans, showing how the investment will accelerate your path to key milestones and valuation increases.

Here's an example of an investment and use of funds slide:

12) The startup’s long-term vision

End with a compelling vision of what your company will become. This is your chance to inspire, showing the long-term impact and legacy your startup aims to achieve. Make it clear why your startup is not just a good investment, but a transformative one.

Understanding what VCs look for in a pitch deck and addressing these points thoughtfully can significantly increase your chances of making a memorable impact.

Remember, it's not just about answering these questions but weaving them into a narrative that tells a compelling story of opportunity, innovation, and growth.

How do you build a fundable VC pitch deck?

Creating a pitch deck that opens doors and secures funding is not just about showcasing your business; it's about crafting a story that resonates with VCs on a personal level.

Here's how you can build a VC pitch deck that stands out and positions your startup as an irresistible investment opportunity.

1) Personalize your pitch

Every VC brings a unique perspective, shaped by their experiences, interests, and investment thesis. Personalizing your pitch to reflect this can significantly increase your deck's impact.

Tools like Storydoc offer dynamic, interactive pitch decks that can be easily customized for different audiences.

By incorporating elements that speak directly to an individual VC's focus areas, you're not just presenting; you're engaging in a conversation.

Here's how you can easily personalize your deck with Storydoc:

2) Align with your funding stage

Your pitch deck should reflect the maturity of your startup. Early-stage companies should focus on vision, team, and market potential, emphasizing the problem and your innovative solution.

As you progress, the emphasis shifts towards traction, growth metrics, and financials. Understanding what VCs expect at each stage and tailoring your deck accordingly can make your pitch more compelling and relevant.

3) Adjust for different types of VC investors

VCs come in various flavors, from those specializing in early-stage startups to those focusing on specific sectors like tech, healthcare, or sustainability.

Researching and understanding the types of investments a VC firm makes can help you adjust your pitch to highlight the most relevant aspects of your business.

Whether it's your technology's groundbreaking nature or your business model's scalability, make sure your deck speaks their language.

4) Show, don’t tell

In a pitch deck, effective visuals can convey complex information quickly and memorably. Use charts, graphs, and images to illustrate your points, from market growth trends to user engagement metrics.

Interactive elements can bring your data to life, making your case more compelling without overwhelming your audience with text.

5) Leverage the power of storytelling

Your pitch deck should tell a story, one that takes VCs on a journey from identifying a pressing problem to presenting your solution as the inevitable answer. Use storytelling techniques to create a narrative arc that builds interest and culminates in a clear call to action.

Engage emotions and logic, weaving in customer testimonials or case studies to make your startup's impact tangible.

James Currier, Founding partner at NFX, says:

“"Each time you start to tell your story again, you’ve got to be able to judge the room and speak to what they’re interested in, only including the key details that are relevant for that audience.

You need to adjust your story so that they can understand from their perspective—using their language—what you are doing and why it’s interesting for them."

—James Currier, Founding partner at NFX

6) Highlight your Unique Value Proposition

In a sea of startups, your unique value proposition (UVP) is what sets you apart. Clearly articulate what makes your solution different and better than existing alternatives.

Whether it's a proprietary technology, a novel business model, or an untapped market opportunity, ensure your UVP shines through in your pitch deck.

7) Include a clear call to action

End your pitch deck with a clear call to action. Whether you're seeking a specific amount of funding, partnerships, or simply the opportunity for a follow-up meeting, be explicit about what you want from VCs.

A compelling CTA can be the difference between a pitch that fades into the background and one that moves forward.

Here's an example of an effective call to action:

If you want more specific advice, check out our in-depth guide on how to create fundable pitch decks as advised by VCs .

What are some key mistakes to avoid when making a VC pitch deck?

Making a pitch deck is a crucial step on the journey to securing venture capital, but common pitfalls can derail even the most promising presentations.

Steering clear of these mistakes can significantly enhance your pitch's effectiveness, ensuring your startup stands out for the right reasons.

10 common mistakes to avoid:

Overcomplicating your message: A complex or convoluted pitch can confuse potential investors. Ensure your message is clear, concise, and easily digestible.

Lacking a clear value proposition: Failing to articulate what sets your startup apart from competitors can leave VCs questioning your investment worthiness.

Ignoring the market size: Underestimating or not clearly defining the market size can make your business seem like a small opportunity. But, both extremes can turn off investors - so do not make unrealistic projections either.

Skimping on the business model: Not providing a clear business model or how the company will achieve profitability is a red flag for investors.

Underestimating the competition: Failing to acknowledge competitors or explain how your solution is better can undermine your credibility.

Overlooking the design: A poorly designed pitch deck can detract from your message. Ensure your deck is visually engaging and reflects your brand.

Being vague about the use of funds: Vague statements about how you'll use the investment can make VCs hesitant. Be specific about how funds will drive growth.

Neglecting the team slide: Investors invest in people. Not highlighting your team's expertise and roles can be a missed opportunity to build confidence.

Overloading with information: Cramming too much information into your pitch deck can overwhelm investors. Focus on what's most important.

Missing a clear call to action: Concluding without a clear call to action can leave potential investors unsure about the next steps.

If you want to learn more, check out this video on the top pitch deck fails:

Interactive VC pitch deck templates

Staring at a blank slide, knowing the future of your startup hinges on the presentation you're about to craft, can be overwhelming.

It's not just about filling the space with words and images; it's about weaving a narrative that captures the essence of your business, its potential for growth, and its appeal to investors.

With sections tailored to highlight your team, solution, market potential, and more, interactive VC pitch deck templates remove the guesswork from the equation.

Unlike static slides, interactive elements can engage investors on a deeper level, allowing them to explore data, dive into details, and truly connect with your proposition.

Just grab one and see for yourself.

Hi, I'm Dominika, Content Specialist at Storydoc. As a creative professional with experience in fashion, I'm here to show you how to amplify your brand message through the power of storytelling and eye-catching visuals.

Found this post useful?

Subscribe to our monthly newsletter.

Get notified as more awesome content goes live.

(No spam, no ads, opt-out whenever)

You've just joined an elite group of people that make the top performing 1% of sales and marketing collateral.

Create your best VC pitch deck to date.

Stop losing opportunities to ineffective presentations. Your new amazing deck is one click away!

Top 11 Venture Capital Pitch Decks

Healy Jones blends his venture capital experience with operational knowledge to support startup financial strategies. With a background in investing in over 50 startups and holding executive roles in VC-backed companies, Healy has been featured in major publications like the New York Times, Wall Street Journal, and TechCrunch. His efforts at Kruze have been crucial in helping startups collectively secure over $1 billion in VC funding, showcasing his ability to effectively navigate financial challenges and support startup growth.

A big part of my job at Kruze is to help our clients prepare to raise venture capital. So I’ve seen a lot of venture capital pitch decks recently. As a former VC who also has been an exec at a number of startups that have raised quite a few million in venture financing, I have some strong views on what information VCs want to see. And because Kruze clients raise over two billion dollars in venture funding annually , I get to see a lot of what works - and what doesn’t.

Since I’m regularly being asked for a template for a venture pitch deck, I thought that I’d compile the best templates available on the internet that I know about. Again, I’m strongly biased, as I’ve seen many companies successfully raise and some not. These are investor pitch deck examples that I think are working.

In addition to the example presentations below, I also lay out the standard slides that I’ve seen companies use to successfully raise venture funding. You can scroll down to also see a TechCrunch interview with a Kruze Client, DeepScribe, where the founder and their investor walk you through the deck they used to raise a $30M round. Finally, I’ve added in a dozen+ questions that VCs often ask founders during the pitch (I’ll probably create an entire article around VC questions and answers).

We’ve released our free startup pitch deck course ! It includes 2 free Google Presentation templates that are free to use, and one downloadable financial model template - plus over 8.5 hours describing what VCs look for on every slide in the deck.

Again, the pitch deck course has two free templates that are free to use. No email or registration or anything - just click the links, open the Google Slides and duplicate them into your own Google Drive. One of the free templates is a B2B example, the other is a B2C example. Haje Kamps, the well known TechCrunch writer who produces the pitch deck teardown series, helped me create those free templates - so get them!

Top 10 11 venture capital pitch deck templates on the internet right now

- Guy Kawasaki’s pitch template - https://guykawasaki.com/the-only-10-slides-you-need-in-your-pitch/ This is the OG demo pitch deck. Short and sweet. Starting to get a bit long in the tooth, but still the first one to check out because it will highlight how simple and short can be better (don’t make a 30 slide deck!!)

- Ycombinator’s slide template - https://blog.ycombinator.com/intro-to-the-yc-seed-deck/ The actual deck that YC links to (it’s a Google Slide file) has such poor design, I wouldn’t recommend using it. HOWEVER, the order of slides and the topics are 100% on, so it’s worth carefully reading the commentary in the actual post. I like the final slide, as it clearly outlines how much funding is needed and the use of the funds. A solid slide to end the conversation on.

- First Round Capital’s deck - https://www.beautiful.ai/blog/uber-vc-pitch-deck-presentation-template One of the top, East Coast VCs supposedly had a hand in creating this one, and the slide order/content is one of the best examples of what to put into your deck. I don’t know how you actually download this - it’s in some kind of a proprietary format, but if you are looking for a view on how to order and design a pitch deck, this is one you must check out.

- Series A pitch deck used by Front to raise their A - https://medium.com/@collinmathilde/front-series-a-deck-f2e2775a419b This founder very kindly shared their slides and fund raising experience. Great example of a competition slide in an industry that has a lot of legit competitors.

- Airbnb’s seed deck - https://www.alexanderjarvis.com/airbnb-seed-pitch-deck/ This is a classic (although the visual design did not age well). If you are looking for a consumer deck or one that talks about how to launch into a new(ish) industry, this is worth looking at.

We’ve also put links to six other examples below, like the Uber deck and the Mattermark slides. Scroll down to see more real-life examples, and dig into our commentary on slide order and content strategy.

Slides in an example Investor pitch deck

The professionals (like YC and Guy Kawasaki) are suggesting 10 slides in a standard pitch deck. I think the real point is that you should be able to deliver your pitch in 15 minutes or less - and if pressed, do a 5-minute pitch. That’s really short.

Why so short? Aren’t most VC meetings scheduled for 30 minutes? Well sure, but…

Assume that your VC is late to the meeting by 5 minutes (they will always say something like “something came up with a portfolio company’s acquisition, but the truth is probably that the barista messed up and gave them an almond milk latte instead of a soy milk one and they had to wait for the right beverage - kind of a joke.) The VC will probably then give you a few minute spiel around what makes their fund different. Then assume that you need to answer at least 5 minutes of questions if your pitch is not going well - and 10 minutes of questions or more if the investor is engaged. And you’ll need a 5-minute pitch, that isn’t rushed, if some important partner is running way late or misses the first 20 minutes of your 30-minute meeting.

The standard table of contents in a good pitch deck is:

Based on the $1 billion our clients raised last year in VC funding, we think you will want:

1. Cover/title slide - including the company name and the founder’s contact info

2. The industry’s or customers’ problem - the pain that your startup is solving

3. Your startup’s solution or value proposition - how your startup fixes the issue / the benefits you provide

The templates start to diverge, so a few different next slides are:

- Traction - metrics that show adoption or market validation or

- Product magic/product demo - showing off the offering

- Market size

- Business model / how you make money

6. Go to market/growth - explain how you are going to grow

7. Competition and or competitive analysis/advantages - all startups have some sort of competition, or there is at least a way that customers are currently dealing with the pain your startup is solving

9. Financial projections - include revenue growth, high-level spend, burn, and other KPIs like customer count (you can go deeper in an appendix or in a financial model). And if you are looking for a free downloadable model template, visit our financial modeling page .

10. Summary:

- How much you are raising

- Traction if you haven’t already done so

- Use of proceeds (what you do with the money)

- Current investors participation level (if any - strong investors who have already invested in previous rounds and who are participating in this one are a very good signal)

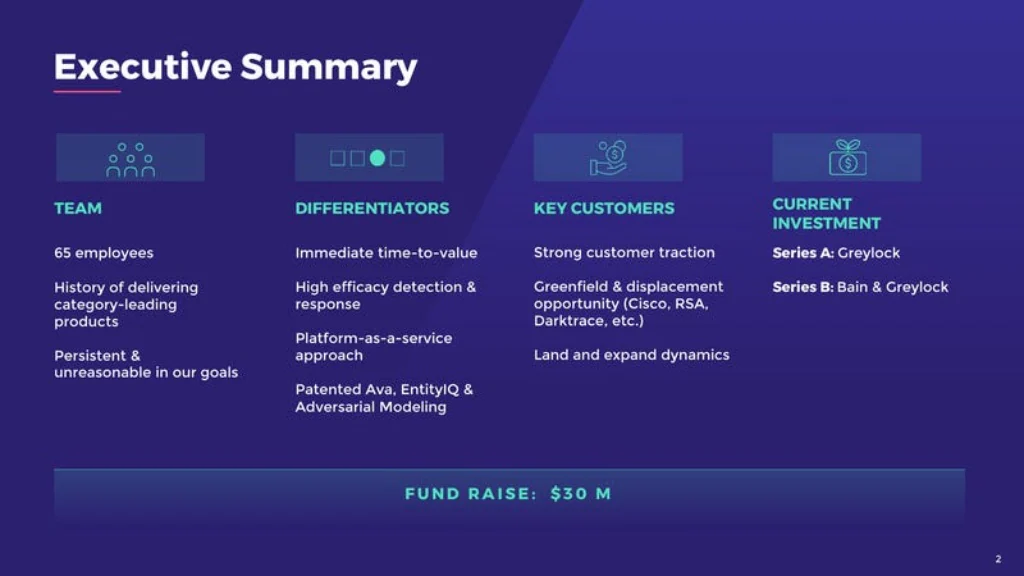

I am slightly older school - I usually like an “executive summary” after the cover page that goes over the company and round. I think this is probably a page that went out of style in 2015 or so, but I still like it because it quickly helps the VC see what your key metrics/sales points are, and how much you are raising. I usually recommend only four or five bullets on this slide:

- Disrupting the $x billion industry

- 1,500 customers using product [or] Marquee customers include McDonalds and Marriott

- ARR of X, growing 20% month over month

- Team has deep domain experience from XYZ

- Raising $8 to $10 million Series A

Given that YC and Guy Kawasaki seem to no longer (or maybe never) had an exec summary at the front of their venture capital pitch deck templates, you are probably OK ignoring my advice and just getting straight from the cover page to the problem statement.

Tips for your slides

Here are some of the slides that we mention above and some tips that founders we work with have found helpful:

- Problem Slide - Invite the investor into discussing / discovering the problem with you. Some problems are obvious - but that doesn’t mean that the VC has thought about them deeply before. Help the investor understand the issues from the eyes of the buyer/consumer. The best venture capital pitch decks have problem slides that are strong enough to make the investor really, really want to meet with you.

- Go to Market / Growth Slide - For companies that are already generating revenue and growing, show that you know who your customers are and where you can find them. For pre-revenue startups, use this slide to prove that the founders have 1) thought about how to sell the product and 2) have a plan on what you will try to prove vis a vis your sales and marketing with the capital you are raising.

Seed Pitch Deck Outline

Our COO, Scott Orn (also a former VC) has been assisting a number of seed and pre-seed companies during their fundraises, and has produced an outline/template for a seed pitch deck.

Pre-seed is sort of a new asset class. It’s essentially the first money in. That’s what seed used to be for everyone. So this is applicable to pre-seed and seed - basically, what to present when your company is more of an idea.

- Company’s slogan / 1 sentence elevator pitch - the first page or first slide should really just be the company’s name and slogan, or the one sentence, what you are doing. And just get the audience focused on that. Make sure to make an impression, deliver it with passion. You are in sell mode here. You’re pitching investors.

- Problem - what are your customers struggling with? A lot of investors like the problem-solution type of framework, so the next slide would be the problem. So talk about how your potential customers are suffering, what’s going on right now in the market, why it’s not working, and then the next page in the deck will be your solution.

- Solution - how are you going to make everyone’s life better? You can explain how you’re going to be better, how you’ll save your clients or customers a ton of time, a ton of money, etc. Better, faster, cheaper is a Silicon Valley slogan that people typically use when explaining their startup’s solution.

- Nothing is more powerful than a demo. That also shows that the company has actually built something and you can get a taste for it.

- Often you see a screenshot of the demo and often can click for video.

- Some people like more visual depictions of what you are doing. Regardless, in this section, something visual is pretty helpful. You want to get the conversation going, you want them to react to something, you want them to feel vested in what you’re doing. Get them to buy into the solution.

- This is kind of a “check the box” because it’s always hard to size the market.

- And many of the best companies look like they have a tiny market but turn it into something huge.

- But it’s a good exercise and tells investors where you are going. And, remember, venture capital is really just wanting to invest in big opportunities. VCs are okay with some losses, but when something works, they need it to be big. And so that’s why they really care about market size. This section helps prove to the seed investor that you are pointed at a big possible market, and that you are aiming to make a big company vs. a nice, small, lifestyle business.

- You would be surprised at how many small businesses, that never really anticipate getting bigger than a couple of million in revenue, try to raise seed financing. So the seed investors need to be able to weed out the entrepreneurs who are not focusing on big opportunities, and you do that in this part of your seed pitch deck.

- And if you’re willing to spend a bunch of your time, five, 10 years of your career on something, there better be some size to it!

- You want to identify competitors. If you pretend you don’t have competitors or bad mouth them, you’ll lose credibility. investors typically like you to acknowledge your competition. And oftentimes there’s a little bit of education, because you know this market really well, but the seed investor doesn’t, so here is where you teach them about the competition.

- Seed investors know that competitors aren’t the end of the world. In fact, the best venture capitalists actually LIKE successful competitors, because it helps validate that there is a market for the solution.

- This is a super important slide. Are you using a sales team? Partnerships? Online marketing? Events?

- Creativity, different approaches and things that investors have seen work are great.

- How much money do you need?

- How long will that get you?

- When do you think you’ll start to generate revenue.

- A visual is really good as part of this slide.

- It’s important to understand the seed investors mindset on this slide. They are doing the math, and they’re thinking, what does this company need to raise money from a series A venture capitalist? Because really, at every step of the venture capital game, people are putting money into your company and then hoping other people will step up down the road to fund the company. The seed investors that you are pitching only have so much capital. They are going to rely on your company doing well enough, and looking strong enough, to be able to get a VC to invest in your next round. And so, they’re doing that math and trying to figure out what is going to be that milestone that really brings other venture investors in the company?

- Some seed investors don’t want you to talk about a sale eventually. They are essentially saying “I don’t want to even hear that you’re thinking about selling the company in three years or four years, or how could you possibly know who’s gonna buy it?” Which is very fair. So you needed to kind of tread lightly on this. I think the way I typically like to do this is just point out the players in the market and make the point that if you get traction and you’re successful, these people or these companies are gonna have a real strong vested interest in acquiring you. And so that’s kind of enough.

- It’s enough to say that if we hit traction, there will be a lot of interested companies like X, Y Z.

- You don’t need to say like “I’m going to get bought for X number of dollars in year three” or something like that. Just talking about who could buy you or who would be interested is a delicate way of doing this.

- It’s always great when a founder says, “I’m taking this through IPO. I’m committed.”

- Note from Healy: While Scott may really like this slide, I don’t love it as much, because, as Scott mentions, it makes me afraid that the CEO is not in it for the long term. I usually prefer to discuss this on the competition slide, “here are other, very big companies, that don’t play in this solution but who have the same customer base as we want… they may get into our market. Who knows, they may acquire their way in once they realise the solution is being adopted.” I like that method better, as it doesn’t imply to the seed investors or the VCs that you are putting the cart before the horse, instead it says that you know who the heavy hitters are in the general market, and then the investor can do the mental math to think that they may want to buy their way in eventually.

- Team - some people like to put this way up in the front, right after the slogan and what they’re doing, because they have a team that has accomplished a lot and the team is backable just because they’re just so successful and so technically strong and know what they’re doing. But you can have it here at the end of the presentation, either way is fine. It’s good to get some bios up there, get some pictures so that people can identify. Also the nice thing about bios and your founding team in the slide is that oftentimes you can play the name game with venture capitalists or seed investors - they’re professional networkers, they know a lot of people. And so oftentimes, you can get to a point where they know someone that’s on your team or that you know, and that’s a really great background diligence channel. If they want to invest in you, they may actually call their friend who knows someone on the founding team or knows you and just check and see what kind of person you are or your team is just for diligence sake. It also can be very impressive if it’s a super strong technical team or a marketing team that’s gone to market in a really unique way. But, wherever you put it in the pitch deck, definitely have a team slide.

- Any examples of progress - this is huge. If you can say you already have clients, revenue, etc, it is much more convincing. All these signs that what you are doing is working, and that it’s legit and it’s something the seed investors want to be a part of, it’s a social proof type of thing if you know that from influence. And so showing your traction is probably the best thing you can do to sell the company. So don’t hesitate to do that. If you have a commitment from a lead investor, that’s great, always put that in this slide in your investor pitch deck because it’s a lot easier to follow on than be the lead and set the evaluation, write the check, that’s a lot of responsibility and sometimes people don’t want to do that. But that’s what you can end up with.

And then there’s a tiny little tip which is, oftentimes you get to the end of the presentation and that slide just sits up there for the remainder of the pitch discussion. If it’s going to sit there, just make it like something showing how awesome you are or helping you close the sale, maybe it’s pictures, maybe it’s graphs or your traction. Instead of having that boring, “questions” slide, do something that spices it up. And every time they kind of subconsciously look at the slide deck on the wall, or the presentation, even though you’re just talking after the presentation has been done, it can kind of help convince them in a small way. So just a little tip to help your investor pitch deck be a bit stronger at the end.

At the seed stage, you’re still living the dream and you’re convincing investors that they should come along. So it’s a little less finance, a little less metrics and more vision. But really this framework should work for any type of venture capital presentation.

How to write a pitch deck to raise funding

Ok, so you’ve now seen the VC and seed deck outlines above - but how so you actually start writing a presentation that will help you get funding? Here is how I have successfully written pitch decks when I was raising VC money:

- Understand WHY you’ll be able to raise funding - this could be your traction, the market, the team, the product strength. Find the one thing that will blow investors out of the water, and build your story around it.

- Now that you know what your biggest strength is, put together the outline of the deck.

- Decide what the one major takeaway is for each slide - this might be the slide title, or it might be a point driven by an image or chart. But you only have a handful of slides, so each one has to drive the vision forward; make each one count.

- Start from the strength slide; don’t get it perfect yet, just make sure it highlights the “wow.”

- Next, fill in the rest of the slides, remembering that you are selling your vision. Use data, market insights, customer quotes to support the conclusion that your company is going to be successful.

- Now, practice running through the deck. It sounds cheesy, but I recommend doing it out loud! Make improvements to the slides and flow based on how it sounds delivering it to yourself.

- You are ready to practice on some “friendlies” - either current investors, partners, mentors. Get their opinions, and then iterate the pitch deck until you feel confident that you’ve got the story down.

Tips for your fund raising presentation if time is running short

Ok, so as I outlined, it’s highly likely that your 30 minute conversation gets cut into a much shorter time frame. There are good ways to handle this and bad. The worst way that I’ve seen is when a CEO talks REALLY REALLY fast and blows through the preso. It’s hard for anyone to soak in the information, it can be hard to understand, and it usually doesn’t work. A better way is to have the 5 minute presentation ready to go, and then to just walk through that briskly. No demo, and try to answer the VC’s questions as quickly as possible.

Common mistakes founders make crafting their investor pitches

In the Kruze pitch deck course, I talked with renowned pitch deck consultant and author, Haje Kamps, about some of the most common mistakes we’ve seen founders make over and over when they present to potential investors. Here are some of those problems - and you can watch the entire video.

- Making the Team Slide Weak : We’ve noticed that many founders often inundate their team slide with unnecessary information, such as a full organizational chart, instead of focusing on key members and demonstrating their relevant skills for the specific startup. Don’t overload it; you don’t get points for lots of logos. Instead, figure out the most relevant or impressive items and

- Misunderstanding Market Size : The total addressable market and serviceable markets need to be sizeable enough to show potential for a venture-scale company. It’s fine to start in a niche, but you need to be able to create a company that’s worth at least a billion dollars, if not more. As you need to be attacking a big space.

- Unrealistic Projections : We’ve seen founders showcasing either slow, steady growth or overly aggressive, unrealistic growth - both extremes are unappealing to investors. Look at some of the templates we share on this slide - those projections are good! You aren’t going to go from founding to $100 million in revenue in a year. And if you are growing from $4 million to $4.5 million in revenue, congrats, you’ve got a great small business, but it’s not venture-scale.

- Failing to Accurately Represent Traction : A traction slide should provide substantial evidence of growth, often in the form of customers generating revenue or being in the sales funnel. Unfortunately, many founders include markers such as press coverage or vague “interest” that doesn’t translate into tangible growth.

- Lack of a Coherent Story : Haje really talks to this well. It’s essential for founders to weave a coherent story that sells not just the product, but the vision of the company and its future value. Many founders fail to communicate this effectively, resulting in a disconnected or confusing narrative. You want the partner who you just presented to to be able to walk off and talk about one of your main customer successes, and how that ties into your company’s vision and traction.

- Absence of a Competition Slide : Many founders overlook the importance of including a competition slide in their presentation. This is a major mistake, as not acknowledging competition can lead investors to think the founders are unaware of their market landscape. It’s one of my favorite slides. If you’ve got big competitors, great, you’ve just helped the VC understand who you might sell the company to in a few years!

That’s just a few of the top venture capital pitch deck fails we go over in the video - check it out. Being aware of these common mistakes and addressing them in your pitch deck can significantly enhance your chances of capturing a venture capitalist’s interest.

Common VC Pitch Deck Fails Video

Tips for the financial section of your pitch deck

As financial advisors to funded startups, we tend to overly index on the financial section of our client’s fundraising pitch decks. Note that this is our interest area (and how we get paid), so it may or may not be all that interesting or important for your startup’s presentation.

The financial detail that you go into in your VC deck will vary based on the stage of your business. So, let’s breakdown what you might need for a seed to Series C company.

- Seed stage - Your pitch deck only needs a brief description of what you are intending to do with the money. As Scott mentioned above, a visual can go a long way here. Since revenue is now often expected for an A, you should articulate some sort of an expectation in revenue before the money runs out (i.e. investors want to know if you’ll have the exit velocity you need to raise the next round).

- Series A - A 5-year view is ideal, as this gives you the chance to show / “prove” that you are going to create a venture scale business. An extrapolated income statement with include revenue growth, high-level spend, burn, and other KPIs like customer count. You ought to have an appendix with more detail - or just a piece of excel that you can share (probably better at this stage).

- Series B - You are still going to need the 5-year projections. But, at a B, you’ll have more financially minded investors. This means that you ought to have a real appendix section that gets into the drives and assumptions to your continued growth. SaaS companies are going to need to be able to explain how they calculate their LTV to CAC - so your pitch deck will have to address both parts of that calculation. You can still put the detail in the appendix, but have it organized so that you can go through all the financial part in an organized presentation if needed.

- Series C - Series C companies should have real financials that have been prepared by a professional accountant, either in house or as a consultant. While you’ll still want a single slide in the meat of the pitch deck that has your five year vision, your historical results will also matter - so that slide will have to do a lot. This may mean that you have to push your KPIs like customer count into a seperate slide(s). And the financial appendix should have historical statement - probably all three - and projections.

Finally, we’ve complied some other pitch deck examples that you may find helpful. Again, we think the best VC pitch decks templates/examples are the ones we highlighted at the top of this page, but here are some of the others that are floating around on the internet that you may like.

Five SIX More of the Best Pitch Deck Examples

- Uber ( pitch deck here ) - this is when they were still called “UberCab.” And it’s very early in the life of the company, so is product and market focused. You won’t find data about the company’s performance, since it’s so early. This deck may be helpful to pre-launched startups.

- Intercom ( seed pitch deck here ) - another example of a seed stage pitch deck, this one for when Intercom was raising $600k. This is a short deck - only 8 slides - and it focuses on the team, problem, solution and market. Note that the “progress” slide consists of a tweet from a user - pretty slight - you may not be able to get away with this lightweight of a presentation unless you have the clout of these founders. BUT if you are looking to talk about the market size and opportunity, this is a decent example.

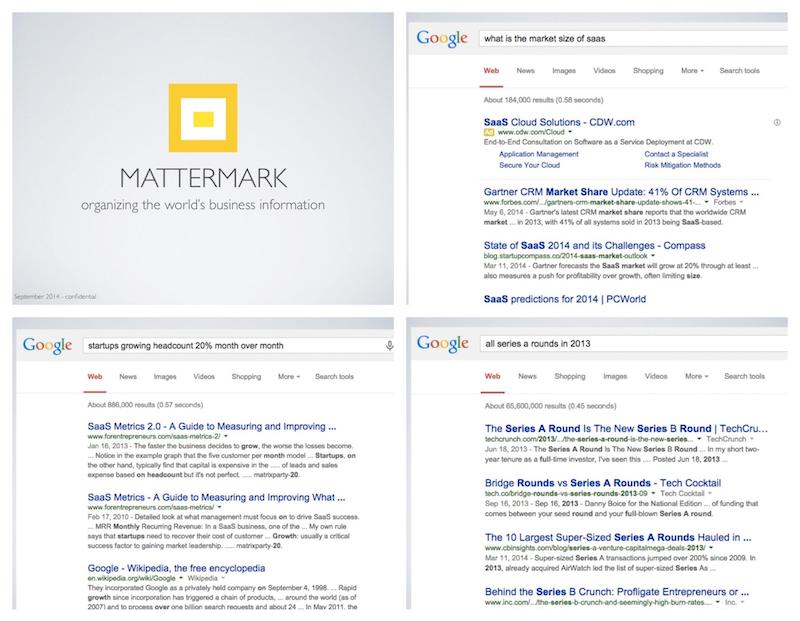

- Mattermark (deck here ) - data company Mattermark has real traction, and there are several examples of solid metrics/charting visuals in this deck. With $1.5M in ARR at the time of this pitch, they are probably around where many Series A’s are getting done in Silicon Valley. (I’ve even seen Series B’s happening at this level). This is a great pitch deck example if you are looking to impress the VCs’ with your traction. Check out slides 11, 12 and 13 for information on how to present historical revenue growth, projections and customer industry diversification.

- Mixpanel (deck on slideshare here ) - Mixpanel shared their deck as an example that other startup can use. This is the set of slides that Mixpanel used to raise a $65M round. The competition slide is particularly good for driving a disucssion with the VCs. The traction slide is also strong - one of the best in combining the visual “up and to the right” chart with some details on the company’s milestones. The slide that is close to the “what we do with your money / operating slide” is a good overview of what the company needs to do to grow, although it’s not as focused on financials as I’d like.

- Mint (seed pitch deck here ) - A great seed stage fundraising deck, with the whole enchilada: a good team slide, a great market size one, solid competition, user acquisition, and a financial slide that makes my inner accountant happy. Notice the flow on this slide, with the team slide right near the front. This could be the best template/example for companies with an experienced team.

- Orange (seed pitch deck template here ) - A great example of a hardware as a service deck. It gets into the problem, the market size, the solution and then makes a solid case for why this team is the one to solve it. One of the best parts of this one is the intro slide - it kicks off right at the front with a strong explanation of what the problem is, and the VC looking at it can immediately infer what the startup’s solution is.

So that makes 11 of the best pitch deck templates and examples that we’ve seen on the internet.

Pitch Deck Example from a Kruze Client

One of our clients, DeepScribe , was interviewed on TechCrunch Live about their Series A fundraising process. Akilesh Bapu, the CEO and co-Founder of DeepScribe, was interviewed along with Nina Achadjian, a VC and Partner at Index Ventures. Nina invested $30 million into the company, and was impressed with the founders and the story they explained during their pitch.

In addition to giving Kruze Consulting a shout-out for our help on his accounting diligence (thanks Akilesh!) he also walks through part of his VC pitch deck. It’s one of the better examples that we’ve seen of a live pitch deck presentation. You can watch on Youtube or see below.

What Questions do VCs ask During a Pitch?

Questions during a pitch are a GREAT sign - that means that the venture capitalist is paying attention. I strongly recommend founders use their venture capital pitch deck as a crutch, jumping to the right slide to answer the specific question , then going back to the original presentation order to make sure all important topics are hit. Again, I’ve seen partners reject a company because “the founder didn’t talk about go to market.” Yeah, they didn’t have time to talk about it because of all of your questions!

Here are some of the trickier questions investors might ask during a presentation. Think about which slide you might be able to use to answer these questions. Resist the temptation to argue with a VC if they ask difficult questions; saying you don’t know but then laying out your plan to figure it out is a great response to many questions.

Questions VCs Ask

- What’s the backstory?

- Tell me about yourself

- How did you meet your cofounder?

- Tell me about the team? How did you find your first hires?

- What is the specific problem you are solving?

- What’s the key insight about your user that led you to build this business?

- What’s the ideal outcome for your customer?

- How are customers currently solving this problem, before your product/solution existed?

- What differentiates your solution from alternatives?

- What have your biggest learnings been so far?

- How are you planning to acquire customers?

- What would your customers say about your solution, and how would they react if it went away (i.e. you went out of business)?

- Why now? What has changed in technology or the market that makes this possible only now?

- What do you think has to go right for this to be a massive outcome?

- How much do you want to raise, and what milestones do you hit with that capital?

VC Pitch Deck FAQ

Because Google says people are asking questions.

What is a VC pitch deck?

A VC pitch deck is a presentation (typically in Powerpoint, Google Sheets or PDF) used to explain a startup idea to potential venture capital investors. A pitch deck contains information on the business, the market and the company’s traction/financials.

What is a pitch deck used for?

These presentations are used to 1) convince venture capitalists to take a 1st meeting with the founder(s); 2) begin investment due diligence and 3) convince the venture firm’s partnership to want to invest in a startup.

Will a deck help you get a meeting with a VC?

A great venture capital pitch deck may help you get a meeting with a venture capitalist. VC firm NFX reminds startup founders that investors are looking for the following 12 data points before taking a meeting with a startup:

- Company description

- Market opportunity

- Business model (how you make $ + your financial projections)

- Geography (less important post COVID)

- Team size (FTEs)

- Timing of the fundraise

- Company traction

- Fundraising history

- Fit for the specific VC

- Referrer - who introduced you to the fund

Does your venture capital presentation have to be PowerPoint?

VCs typically expect a slide deck; these days usually a PowerPoint, Google Slides or a PDF of one of those formats. I’ve been with companies that have used designers to create an incredibly slick venture capital presentation, which they presented as a PDF - no idea which tool was used to actually design the presentation, but it was likely an Adobe product. The most important thing is making the presentation be in 1) slides and 2) something they can share and access from their computer.

Is it OK to share your venture capital presentation by DocSend or a presentation sharing platform instead of as an email attachment?

These days more and more VCs are Ok getting the presentation as a DocSend or other presentation sharing platform that asks for their email address or asks to verify that they are someone you to share the document with. However, you’ll occasionally find the grump VC who wants their presentation the old school way. Often these investors write up their dislike of sharing tools on their blog or Twitter.

How do you modify your pitch deck for the final, all-hands VC partner pitch?

The final step to getting a term sheet, at many venture capital firms, is to pitch the partnership one final time. This is after you’ve already gotten one of the partners to support your investment internally as the champion. In the final meeting, you’ll have the full range of understanding of your company - from the partner who is supporting you and who knows a ton to partners who know close to nothing.

It’s not safe to assume knowledge on your industry or problem. Invite all the partners into the fold by explaining and building excitement around what you are doing. Don’t gloss over the market size or competition!

Hope this helps you find a good pitch deck template for your fundraise!

Contact Us for a Free Consultation

Get the information you need

Startup CEO Salary Calculator

US Based Companies that have raised under $125M

Top Articles

Pre-Seed Funding + Top 20 Funds

eCommerce Accounting

Accounts Receivable Loans

What is the 2% and 20% VC fee structure?

How much does a 409A valuation cost?

What are Your VC’s Return Expectations Depending on the Stage of Investment?

Fractional CFOS

How much can your startup save in payroll taxes?

Estimate your R&D tax credit using our free calculator.

Signup for our newsletter

Popular pages

SaaS accounting 101

Best accounting software

Top banks for startups

How to account for convertible note

Average CEO Pay

Startup Tax Returns

Best VC Pitch Decks

Venture Capital Angel Investors Seed Funds

How are Startup Employee Strike Prices Set?

Venture Capital Seed Funds Angel Investors

How do venture capital firms make money?

How Do Venture Capitalists Make Decisions?

Kruze is a leader in accounting services for startups

With over $10 billion in funding raised by our clients, Kruze is a leader in helping funded startups with accounting, tax, finance and HR strategies.

Your request has been submitted. We will contact you shortly.

Important Tax Dates for Startups

- C-Corp Tax Deadlines

- Atlanta Tax Deadlines

- Austin Tax Deadlines

- Boston Tax Deadlines

- Chicago Tax Deadlines

- Dallas Tax Deadlines

- Miami Tax Deadlines

- Mountain View Tax Deadlines

- New York City Tax Deadlines

- Palo Alto Tax Deadlines

- Salt Lake City Tax Deadlines

- San Francisco Tax Deadlines

- San Jose Tax Deadlines

- Santa Monica Tax Deadlines

- Seattle Tax Deadlines

- Washington DC Tax Deadlines

Is the content on this page useful?

Your feedback is very important.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Template Lists

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Graphic Design 30+ Best Pitch Deck Examples, Tips & Templates

30+ Best Pitch Deck Examples, Tips & Templates

Written by: Ryan McCready Jul 04, 2023

A startup is, by definition, a fast-growing company. And to grow you need funding.

Enter the pitch deck.

In this post, we’ll look at the best startup pitch deck templates from heavy-hitters such as Guy Kawasaki, Airbnb, Uber and Facebook. We’ll also uncover the secrets of their successful startup pitch decks, and how you can leverage them to attract investor dollars, bring on new business partners and win new client contracts.

Haven’t created a winning pitch deck before? Then, use Venngage’s Presentation Maker to easily edit the templates — no technical expertise required.

Table of contents (click to jump ahead):

- What is a pitch deck?

30 pitch deck examples for businesses

What makes a good pitch deck, what is the difference between a pitch deck vs business plan, pitch deck faq, create a pitch deck in 4 easy steps, what is a pitch deck .

A pitch deck is a presentation created to raise venture capital for your business. In order to gain buy-in and drum up financial support from potential investors, these presentations outline everything from why your business exists, to your business model, progress or milestones , your team, and a call-to-action.

The best startup pitch decks can help you:

- Prove the value of your business

- Simplify complex ideas so your audience can understand them (and get on board)

- Differentiate your business from competitors

- Tell the story behind your company to your target audience (and make that story exciting)

What is a pitch deck presentation?

A pitch deck presentation is a slideshow that introduces a business idea, product, or service to investors. Typically consisting of 10–20 slides, a pitch deck is used to persuade potential investors to provide funding for a business. It serves as a comprehensive overview of your company, outlining your business model, the problem you solve, the market opportunity you address, your key team members, and your financial projections.

1. Buffer pitch deck

Industry: Social Media Management

Business model: Subscription-based SaaS (Software as a Service)

Amount raised: $500k, according to Buffer’s co-founder Leo Widrich .

Location: San Francisco, California, USA

Website: Buffer.com

Key takeaway : The traction slide was key for Buffer: it showed they had a great product/market fit. If you have great traction, it’s much easier to raise funding.

What’s interesting about Buffer’s pitching process was the issue of competition, as that’s where many talks stalled. Investors became confused, since the social media landscape looked crowded and no one was sure how Buffer differed.

Eventually, they created this slide to clear the air:

To be frank, I’m still confused by this addition to the Buffer pitch deck, but perhaps their presentation would have cleared things up.

In any case, we’ve recreated Buffer’s pitch deck with its own traction, timeline and competitor slides, plus a clean new layout and some easy-to-customize icons:

Design tip : don’t forget to add a contact slide at the end of your pitch deck, like in the business pitch example below.

Because sometimes you’re going to pitch to a small room of investors. Other times, it will be to an auditorium full of random people in your industry. And I can guarantee that not everyone is going to know your brand off the top of their head.

You should make it extremely easy for people to find out more info or contact your team with any questions. I would recommend adding this to the last slide, as shown below.

Alternatively, you could add it to the slide that will be seen the longest in your pitch deck, like the title slide. This will help anyone interested write down your information as event organizers get things ready.

Related: Creating a Pitch Deck? 5 Ways to Design a Winner

2. Airbnb pitch deck

Industry: Hospitality, Travel, and Technology

Business model: Online marketplace (peer-to-peer) for lodging and travel experiences

Amount raised: $20k at three months and $600k at eight months (seed), according to Vator .

Website: airbnb.com

Key takeaway: A large marketplace, impressive rate of traction and a market ready for a new competitor are the factors which made Airbnb stand out early on, says Fast Company. The organization’s slide deck clearly demonstrates these points.

Your pitch deck should explain the core information in your business plan in a simple and straightforward way. Few startups have done this as well as Airbnb.

We’ve re-designed Airbnb’s famous deck as two light and airy sample pitch deck templates. The focus here is on engaging visuals, with minimal text used.

Airbnb fundraising slide deck

This type of deck is also called a demo day presentation . Since its going to be viewed from a distance by investors while you present, you don’t need lots of text to get your message across. The point is to complement your speech, not distract from it.

Another great thing about Airbnb’s fundraising slide deck format is that every slide has a maximum of three sections of information:

As one of the most popular presentation layouts , the rule of three design principle has been drilled into my head. And for good reason!

Here’s one of the slides that demonstrates why this pitch deck design tip works:

VIDEO TUTORIAL: Learn how to customize this pitch deck template by watching this quick 8-minute video.

Minimalist Airbnb pitch deck template

This simple sample pitch deck template is clean and incredibly easy to customize, making it perfect for presentation newbies.

Don’t forget to insert your own tagline instead of the famous “Book rooms with locals, rather than hotels” slogan. Hint: your tagline should similarly convey what your business offers. Airbnb’s pitch deck offers up tantalizing benefits: cost savings, an insider’s perspective on a location and new possibilities.

Design tip : Click the text boxes in our online editor and add your own words to the pitch decks. Duplicate slides you like, or delete the ones you don’t.

Related: How to Create an Effective Pitch Deck Design [+Examples]

3. Uber pitch deck

Industry: Transportation, Technology, and Logistics