What Is Integrated Business Planning and Why Is It Important?

Think of modern integrated business planning, or IBP, as a mashup of supply chain optimization, financial planning and analysis (FP&A) and operational best practices, powered by a companywide culture that’s all about delivering the speed, savings and responsiveness today’s consumers demand while managing risk.

Note that IBP as a fuzzy, buzzword-laden process methodology has been around for years. It’s usually implemented by expensive consultants in sprawling, global corporations that know they need to unify siloed sales, supply, financial and operational resources — before more nimble competitors relegate them to the former Fortune 500 list.

We’re here to argue that IBP deserves a second look for any company that wants to maximize profits and minimize the risks associated with growth. No six-figure consultant required.

What Is Integrated Business Planning?

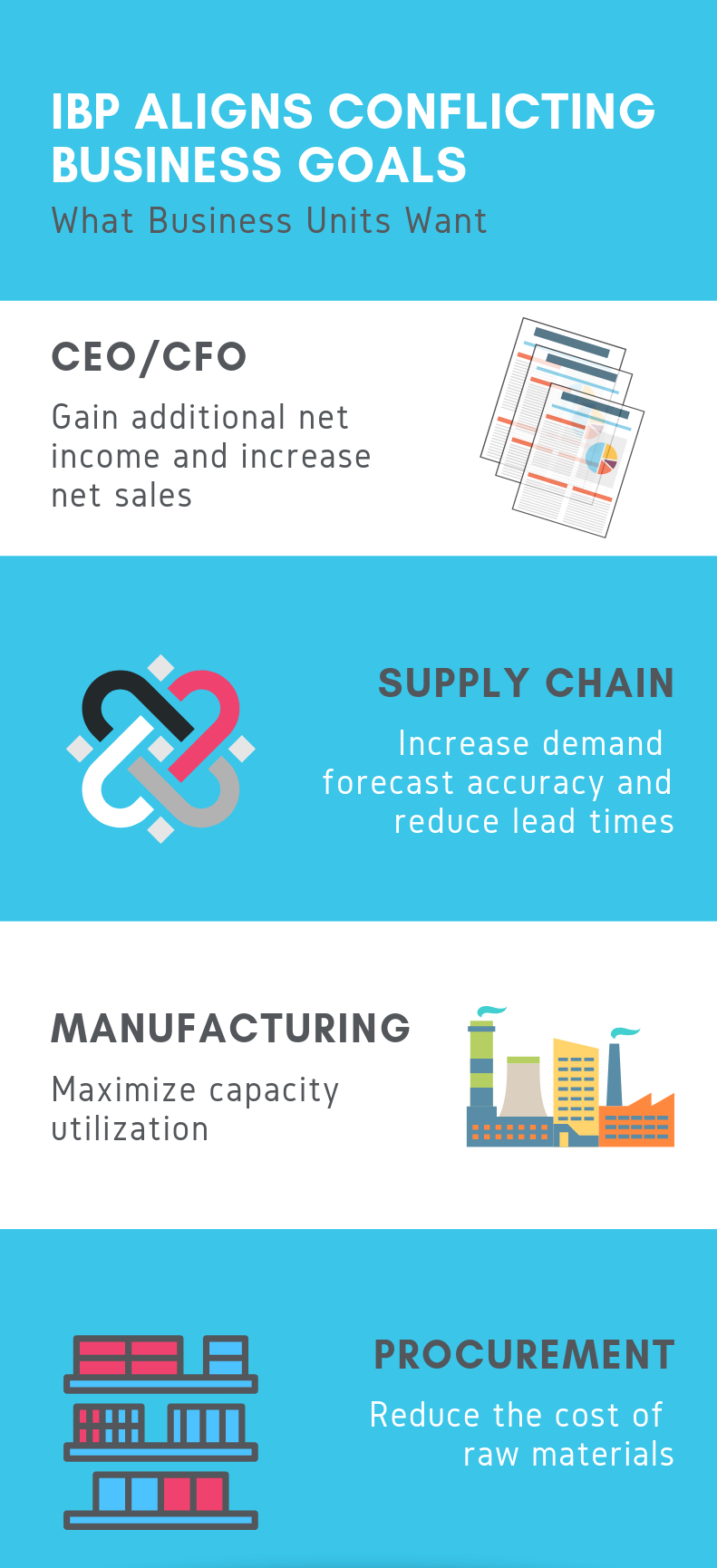

On paper, IBP is a process for aligning a company’s business goals with its finance, supply chain, product development, marketing and other operational functions. Think parts suppliers that work with automakers and need to constantly retool to accommodate design changes, or food producers operating on razor-thin margins that must manage both uncertain supply chains and fickle customer tastes.

Lag, and a competitor is standing by to take that business. Move quickly but in a disjointed manner and you may keep customers, but at the expense of higher cost of goods sold (COGS) and lower profitability.

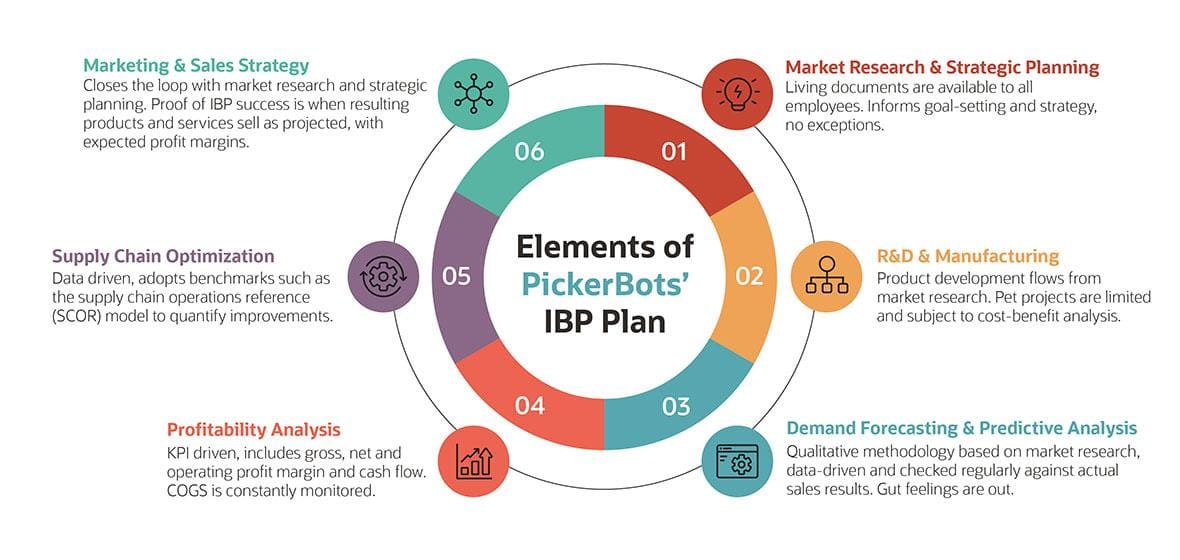

For example, consider PickerBots, a fictional maker of custom machinery for manufacturing and warehouse operations. When the company launched in 2017, it found a niche in restaurant supply, but when that business slowed significantly in 2020 the founders decided to retool. Rather than simply changing up its marketing, the firm set out to revamp its business strategy. A top-down scenario planning exercise led to realigning its R&D, demand forecasting, profitability and revenue analysis, supply chain planning and marketing and sales strategy.

The company culture was already strong on innovative thinking, but the founders realized that the link between strategic planning and day-to-day operations could use improvement. Enter a new COO with the chops to align operations with product demand planning and sales and marketing while weighing in on financial targets and budgets.

Key Takeaways

- In a company that embraces IBP, there’s a direct line from purchasing, production and inventory to sales and marketing to financial targets and budgets.

- A key IBP benefit is that materials are bought at the right price, at the right time and in just the right quantity to fulfill market demand.

- Successful IBP delivers closer collaboration and more trust among departments, leading to improved decision-making.

- IBP may require significant cultural change and cannot be successful without unwavering commitment from the executive team.

Integrated Business Planning Explained

Many organizations mistake IBP for a supply-chain-centric exercise. While linking supply chain planning with other departments, from sales and operations through finance, is important, that’s just one element.

IBP aligns business g oals and financial t argets with decisions and execution across the entire business.

There is overlap with financial planning and analysis (FP&A). Because an IBP initiative gathers data from across the enterprise, companies get better at predictive analysis. Now, when purchasing forecasts a parts shortage, supply and operations can adjust before customers are affected.

It’s also not a one-and-done exercise. PickerBots’ new COO advises looking a minimum of 36 months out. Leaders will need to keep their eyes on that long-range plan while continually reviewing, revising and communicating financial and operating results. What supply chain gaps have opened up, and how can we close them? Do we need to update our scenario planning? Are we tracking the right financial KPIs?

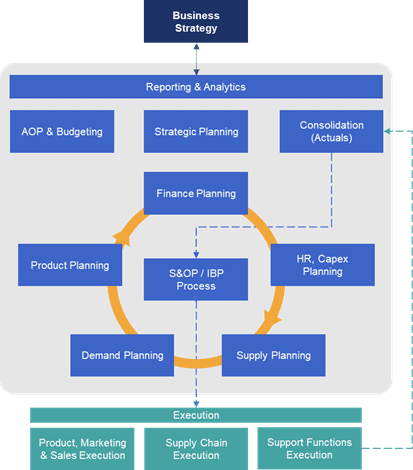

A crucial element of IBP is that it integrates financials with operations. Here’s a structure that PickerBots plans to follow.

Why Is Integrated Business Planning Important?

Companies that undertake IBP realize a number of practical benefits, including reduced holding costs, more responsive customer service and demand fulfillment, shorter time to market for new products and an improved correlation between demand planning and fulfillment.

After PickerBot’s scenario planning and strategy session, the company decided to jump into the emerging collaborative robot, or cobot, market. A collaborative robot is designed to safely interact with human workers. PickerBot’s leaders believe demand will increase for “pick and place” cobots with fine motor skills for use on manufacturing lines as well as in agricultural settings.

Now that the company has its strategic direction, the COO wants to focus on three higher-level concepts before delving into more practical areas, like financial planning and analysis and supply chain optimization. That’s because without goal-setting, PickerBots won’t be able to define success.

Alignment and accountability

All executives must agree on three things: What are our corporate goals? What does success look like for each? How will I and my team contribute and be accountable?

The company’s goals are grouped into four areas: industry-focused, operations and supply chain, financial and marketing and sales. The management team will review all goals to make sure they align with strategy and are both actionable and achievable.

Industry-focused goal: Offer the most innovative cobots on the market

What success looks like: Develop a product that can match or exceed a human worker in its ability to pick fragile crops without damage.

Who will execute: The R&D team

Financial goal: Diversify revenue streams

What success looks like: Minimize dependence on one market/industry. Add a services arm to generate recurring revenue from maintenance contracts, powered by sensors built in to all new products.

Who will execute: Cross-functional led by CEO and finance

Other goals might be “control costs at each step and deliver cobots to customers on time and to specifications” with an expectation to lower COGS by 10% and raise the company’s Net Promoter Score by 25% within one year. Or for sales, “find 10 new customers for the company’s agricultural cobots and bundle maintenance contracts with each sale.” That ties back to revenue diversification.

An important point: Every manager is accountable for every goal, not just those that lie within their purviews.

Informed decisions and actions

Planning across PickerBots’ supply chain was disjointed, with engineers purchasing materials direct and little central planning or cost control. As part of the IBP process, the company will adopt sales and operations planning (S&OP) principles to improve its supply chain and logistics.

Actionable goals here include building visibility into how each department is working and tying the impact of decisions to financial goals. For example, by having R&D build in sensors that can automatically collect and transmit data on a cobot’s operational status, PickerBots can proactively perform preventative maintenance so the devices are almost never down — an important selling point and a way to contribute to maintenance income.

Organizationwide, divisions need to focus less on their own needs and view actions through the lens of all goals. That means the company needs to collect a lot of timely data and use it to issue reports so managers can make better decisions, more quickly. That may require an investment in ERP and other software.

Transparency/visibility

All department heads will take part in a monthly business review, where the group will assess progress in achieving the company’s objectives. The strategic plan is also available to all staff members, and quarterly all-hands meetings will be held to gather ideas and insights and walk through KPIs.

Four success metrics for the IBP process include:

1. Getting all stakeholders to buy in to corporate goals so that everyone agrees and understands what the business wants to achieve and how it will get there. There are clear responsibilities for each function in the pursuit of goals.

2. Basing business decisions on data. The integration of finance into product, demand and supply functions is key here, as are selecting the right KPIs.

3. Tying decision-making to outcomes and improving accountability. Because every department is responsible for providing accurate numbers and projections, there’s less risk that the CFO and finance team are left holding the bag if revenues fall short.

4. Shifting the culture to embrace cross-functional collaboration. An IBP process encourages openness and trust, and as a result more deeply engages and empowers employees. As an action item, each R&D and manufacturing team member will spend a week annually accompanying sales reps on customer calls.

What Is the Difference Between S&OP and IBP?

The term “IBP” was coined by management consultancy Oliver Wight to describe the next iteration of the sales and operations planning (S&OP) process Wight developed in the early 1980s.

The big difference between IBP and S&OP is that the latter has become the domain of supply chain and logistics specialists, particularly those involved in supply-and-demand balancing and planning. S&OP is execution-focused and involves a traditional budgeting process.

In contrast, IBP takes a more cross-functional and holistic approach to weaving business goals through every function. As a result, in theory, supply chain management is proactive and optimized.

IBP includes S&OP processes but because it involves cultural change, without executive buy-in, IBP will not be successful.

Some major differences between S&OP and IBP are:

6 Steps in the Integrated Business Planning Process

Now that its goals are set, PickerBots can take the next steps in its IBP journey.

1. Determine what is holding the company back. Is it a lack or growth or profitability? Is the product portfolio too complex? Has the business lost competitiveness in its space? For our manufacturing firm, the main problem was overfocus on one niche market.

2. Engage and educate employees. Once leadership buys in to goals, that enthusiasm must trickle down through the ranks. Unless everyone is committed to integrated business planning, success will be elusive. The COO recognizes that a formal employee engagement program will keep workers invested in the success of the business and actively working to meet strategic goals.

3. Set up a tiger team. IBP success comes from tight coordination, constant communication and accountability for KPIs. It’s a cultural shift that will take time to propagate throughout the business. To jumpstart things, PickerBots identified engaged employees within each functional area and assigned them to a daily 20-minute standup call. Now, say a shipment of RFID readers needed by manufacturing will be two weeks late. The purchasing team member shares that information promptly so that sales can manage customer expectations and finance can account for delayed revenue. If the problem recurs, the company can seek out new suppliers. No more surprises.

4. Establish a project/product prioritization process. IBP takes discipline. Only projects that forward the company’s strategic goals get resources. Same for products. That might mean sunsetting a line that’s still selling but lacks growth potential. All managers who require resources or have a product or service launch idea fill out a cost-benefit analysis template that is tailored to reveal whether expected benefits and costs align with goals. Leadership prioritizes using this process. No more sacred cows.

5. Expand the finance team’s influence. Finance needs to sit in on product planning, supply chain optimization and sales strategy meetings. Specifically, choose a finance team member well-versed in FP&A functions. FP&A professionals inform major decisions made by the executive team and collect and analyze financial data from across the organization to create reports that reveal whether goals are being met — and if not, why not? How do we fix the problem? Like many smaller firms, PickerBots doesn’t have a dedicated FP&A staffer, so the head of finance assigns an accounting team member who knows the business and has an aptitude for data collection and number crunching.

6. Adopt technology and tools to support IBP. If the forecasting process is seen as a quarterly or annual exercise imposed by finance and yielding little benefit to departments, IBP can’t succeed. Companies with static, point-in-time budgets need to adopt rolling forecasts to make sure the business stays on track. And, finance teams need to be able to easily access the data they need from each operational area. Both rolling forecasts and better use of data require technology and a commitment to transparency. You can’t manage what you can’t measure.

Traditional vs. Rolling Forecasts

5 tips to succeed at integrated business planning.

Some ways the COO plans to set PickerBots up for success include:

1. Sell IBP as a way to bring order from chaos. For example, large companies, especially those that have engaged in a number of mergers and acquisitions, may have thousands of SKUs and product codes. One big manufacturer Oliver Wight worked with used IBP to whittle 120,000 item numbers down to about 10,000 and reduce inventories by 50% while improving on-time, in-full delivery by up to 20%. For a smaller company, IBP can prevent ever getting in a situation where it needs to slash 90% of SKUs.

2. Adopt a continuous improvement mindset. All parts of any production or service system, particularly people, are interconnected, inform one another and are mutually dependent on generating successful outcomes. This practice’s origin comes from Kaizen, a Japanese term meaning “change for the better.” Originating in Japan, the business philosophy looks to continuously improve operations and involve all employees, from assembly line workers to the CEO. It’s a way to reinforce IBP.

3. Get buy-in from the CIO. PickerBots’ CIO came up through the ranks of manufacturing IT and is familiar with the concept of Total Quality Management (TQM), which has overlap with IBP. That went a long way in communicating the benefits of IBP and freeing up budget for technologies that can make IBP work, like ERP, enterprise performance management (EPM), supply chain management and real-time-capable accounting and finance software — especially important to realize the “one set of numbers” value proposition.

4. Apply risk management principles. Disasters large and small happen. While the zen of IBP skews toward positive and upbeat, make sure department heads are doing scenario planning and what-if analyses to model operational risk — like overdependence on one market. Consider assigning your tiger team a secondary function as a crisis management strike force.

5. Don’t forget HR. Labor is likely your company’s biggest operating expense, so ensure that it’s working for your IBP effort, not against it. A human resources professional can identify traits in applicants — like team players who are data driven and comfortable with transparency — that predict whether they will be contributors to IBP success.

Benefits of Integrated Business Planning

Research shows that the main benefit of implementing IBP is increased revenue, followed by forecast accuracy and improved Perfect Order Delivery rates.

Three additional key benefits:

Real-time insights: Once companies have instituted rolling forecasts, for example, finance can more quickly and accurately answer questions on spending and cash flow. Expect more accurate KPIs across the board.

Ownership: The flip side of accountability is that in a company fully embracing IBP, all employees assume responsibility for meeting all goals. So you’d better make sure that authority to make decisions is decentralized and tied to responsibility for outcomes, because there are few bigger morale killers than accountability without the power to effect success. Companies can further nurture a culture of ownership by tying rewards to meeting or exceeding goals.

Improved customer satisfaction: While more on-time, in-full deliveries make customers happy, that’s not the only way IBP improves Net Promoter Scores. Better planning yields better insights into what customers want, and a strong company culture often leads to improved customer empathy and its associated benefits.

Integrated Business Planning Adoption Challenges

Where a business starts with IBP depends on its maturity. Companies with dog-eat-dog cultures and highly siloed processes have a lot of work to do. These tend to be firms with traditional top-down management structures, static annual budgeting with little ability to generate forward-looking projections and dated business plans that are misaligned with current customer needs.

While all are thorny structural challenges, a leadership team that’s averse to placing trust and decision-making authority at lower levels of the organization is in even worse shape. Companies with autocratic, command-and-control styles must be willing to decentralize authority if they hope to realize IPB’s benefits.

Even businesses with mature, integrated processes and egalitarian cultures often get tripped up by “top down” versus “bottom up” KPI reporting and budgeting. IBP requires businesses to focus less on finance developing a top-line budget and then handing departmental budgets down from on high. Rather, they need to become comfortable with a bottom-up process, where departments start with a plan of what they want to achieve, calculate what it will cost and then feed a number up to the finance team, which uses that input to calculate the total budget.

Companies not already using at least a somewhat flexible budgeting process are likely to find this shift difficult. One way to jump-start the transformation might be a modern form of zero-based budgeting.

Steps of Zero-Based Budgeting for 2021

- Create a strategic vision for ZBB: Identify cost targets, relevant KPIs and goals.

- Evaluate business units to select ZBB candidates (also referred to as “decision units,” or any organ of the business that operates independently with its own budget).

- Start selected budgets from scratch (i.e., from zero).

- Each decision unit provides “decision packages,” which break down each activity in terms of its objective, funding needs, justification in the context of company goals, technical viability and alternative courses of action.

- Evaluate each proposed item to determine its value-add to the company and whether the entire cost is justified. What does the expenditure bring back to the company?

- Prioritize costs based on company goals. Reduce or cut expenses in areas that no longer produce significant value.

- Allocate funds among areas that are productive and aligned with the business’s growth drivers.

Elements of Integrated Business Planning

Integrated business planning takes place at a regular cadence; every month is most common, so we’ll use that in our example.

These steps are standard for IBP consultants, adaptable to most industries and bake in the PickerBots COO’s virtuous cycle of market research and strategic planning, R&D and manufacturing, demand forecasting and predictive analysis, profitability analysis, supply chain optimization and marketing and sales strategy.

1. Product management review. This includes all elements of product portfolio management. A cross-functional team meets monthly to review the overall status of all of product-related projects: Are they on track? Have we identified new risks and opportunities? Are the most high-value products or services prioritized? The goal is aligning the product portfolio with business goals and making sure needed raw materials and manufacturing floor capacity are lined up. Product managers revise as needed and publish an updated master plan, along with the resources it’ll take to deliver any changes.

2. Demand planning picks it up. This is a cross-functional process that helps businesses meet customer demand for products while minimizing excess inventory and avoiding supply chain disruptions. Demand planning can increase profitability and customer satisfaction and lead to efficiency gains. This team brings together members of sales, marketing and finance to determine whether they’re targeting the right markets, the right way. They work up an optimized demand plan. Relevant KPIs include sales forecast accuracy, inventory turns, fill rates and order fulfillment lead times.

3. Then, the ball goes to the supply planning team. These supply chain experts work out the optimal way to meet projected demand in a cost-effective way. The key is to have visibility into complex supply chains; a formal supply chain visibility (SCV) project helps spot and fix weaknesses, such as inventory shortfalls or order fulfillment issues, before they become major problems. Lower cost of goods sold (COGS) is the North star.

4. The integrated reconciliation team pulls together the initial product, demand and supply plans and consolidates them into one holistic business plan based on a 24- or 36-month projection; for iterative updates, teams highlight material changes. Decisions that could not be made by individual teams are prepared for executive review.

5. The executive team resolves conflicts and rolls the updated plan out to the entire company.

Integrated Business Planning Components

The components of integrated business planning comprise three buckets: Plan, execute and monitor and adjust.

Specific actions falling into each bucket vary depending on the consultancy or technology supplier. Some are more aligned with supply chain planning, while others center on S&OP or financial planning with plug-ins to other functional areas. Others are very industry-specific.

Let’s look at Oracle’s IBPX (Integrated Business Planning and Execution) for Manufacturing solution as an example. Key components include:

- Top-down and bottom-up, driver-based planning and forecasting

- Risk modeling for M&A and strategic initiatives

- Full financial statement structure for strategic and operational planning

- Predictive and prescriptive analytics and planning

- A preseeded S&OP process

- Near-real-time demand and supply balancing

- Real-time backlog management

- Automation of predictions and correction actions based on actuals

- AI-enabled operational planning, such as for sales territories and quotas

- IoT and sensor data flows integrated with automated decisions

Items like backlog management and enhanced support for IoT and sensor data are important to manufacturers like PickerBots. A retailer might be more interested in advanced inventory management. What’s important is that any solution, whether purchased as a suite or pulled together by an integrator or in-house team, supports the ability to do long- and medium-range and short-term planning based on a single, up-to-date data set that’s accessible to all authorized stakeholders.

Also look for the ability to easily model “what-if” scenarios, robust budgeting and costing and a roadmap to advanced technologies like AI and predictive analytics.

Integrated Business Planning Examples

We mentioned the Oliver Wight customer that whittled 120,000 SKUs down to about 10,000. That firm, Uponor Group, looked to IBP after a string of acquisitions left it with swelling inventories, an extremely complex portfolio and a lack of communication between siloed functions and far-flung locations. The Finnish company sells products for drinking water delivery as well as radiant heating and cooling equipment and has 3,900 employees in 30 countries. Uponor had a hard time getting a singular view of financial information across its subsidiaries, and each unit had its own practices for inventory management. Small events, such as holidays, would drive some sites to build up “just in case” inventory, and double-stocking in warehouses was common. Subsidiaries in different countries had different SKUs for the same items, and R&D was localized, with no collaboration across the company.

Upinor focused first on its supply chain and implemented S&OP processes, then advanced to IBP the following year. The results have been an increase in net sales of $1.1 billion euros, a 30% improvement in on-time in-full deliveries, a 50% reduction in inventories and increased visibility.

U.S.-based technology provider Juniper Networks also undertook an IBP project focused on implementing a digital supply chain with IBP, where the business planning process would extend S&OP throughout the supply chain, product and customer portfolios, customer demand and strategic planning.

Since undertaking the project, Juniper’s lead-time attainment is up 55%. and its inventory costs are down by 15%, allowing it to realize a positive ROI on the IBC project.

History of Integrated Business Planning

Oliver Wight developed S&OP in the 1980s as a methodology for a client that wanted to balance supply-and-demand volume. In the years since, the process evolved to integrate financials, inventory and new-product introductions.

The consultancy renamed S&OP as integrated business planning in the late 1990s to reflect the process of integrating all functions of the business behind one optimized plan. Since then, a newer term, “enterprise integrated business planning,” has emerged. EIBP includes scenario planning and extended supply chain collaboration and discusses how large companies will adopt new technologies, such as AI, big data and advanced analytics.

#1 Cloud ERP Software

Applications of Integrated Business Planning

IBP makes planning and operations much more transparent, so it’s ideal for companies moving to “just in time” manufacturing. It’s also predictive, once a company builds up some data. That can help with customer satisfaction.

PickerBots, as an example, found that it typically sees constrained supply chain capacity for motherboards in Q3. With that insight, sales and marketing can work to encourage customers to take delivery of systems in Q2 or Q4, manufacturing can prebuild products and supply chain leaders can work on alternate sources for parts that pose challenges.

Looking ahead to the future of IBP, we expect it to help companies:

- Work on ever-longer-range strategy planning, modeling and M&A activities with a higher degree of confidence.

- Detect and notify stakeholders of unanticipated events before they impact the business by using advanced technologies, including real-time sensor information and machine learning (ML) pattern recognition.

As companies build comfort with automation, advanced IBP systems can be set to take action based on analysis without human intervention. Consider a chain of bakeries; a system plugged into a long-range weather forecast system might detect a tropical storm that could raise the price of vanilla and automatically order extra.

Cloud-based technology such as ERP underpins all these advances. For example, PickerBots always set its sales goals monthly. But often these plans were delayed to let the executive team review and approve any changes, meaning operations was caught unawares. A tool like NetSuite Planning and Budgeting automates planning processes and centralizes company financial and operational data, so finance teams can disseminate updates quickly.

The next frontier? Expending IBP to business partners and suppliers, even customers. But first, companies need to get their own cultural and technology houses in order.

Business Strategy

Business Process Automation: Ultimate Guide

A well-run business is always analyzing business processes and finding ways to make them more efficient. It also searches for ways to review, update, change, replace or eliminate its processes on a regular basis in order to…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Imagine a symphony orchestra where each musician plays their own tune without listening to others. The result would be chaotic and dissonant, right? Similarly, in the business world, when decision-making happens in silos and planning processes are disconnected, it’s like having a group of individuals playing their own instruments without any coordination. The harmony is lost, and the organization becomes inefficient, misses opportunities, and struggles to keep up with the fast-paced market.

Integrated Business Planning (IBP) addresses these challenges by providing a comprehensive framework that integrates strategic, operational and financial planning, analysis, and reporting to drive better business outcomes. A retail company experiences a sudden surge in online sales due to a viral social media campaign. Integrated planning incorporates supply chain planning, demand planning, and demand forecasts so the company can quickly assess the impact on inventory levels, supply chain logistics, production plans, and customer service capacity. By having real-time data at their fingertips, decision-makers can adjust their strategies, allocate resources accordingly, and capitalize on the unexpected spike in demand, ensuring customer satisfaction while maximizing revenue. This blog explores the significance of IBP in today’s modern business landscape and highlights its key benefits and implementation considerations.

Integrated business planning framework

Integrated Business Planning (IBP) is a holistic approach that integrates strategic planning, operational planning, and financial planning within an organization. IBP brings together various functions, including sales, marketing, finance, supply chain, human resources, IT and beyond to collaborate across business units and make informed decisions that drive overall business success. The term ‘IBP’ was introduced by the management consulting firm Oliver Wight to describe an evolved version of the sales and operations planning (S&OP process) they originally developed in the early 1980s.

Making up the Integrated Business Planning framework are six key pillars:

1. strategic planning.

Integrated Business Planning starts with strategic planning. The management team defines the organization’s long-term goals and objectives. This includes analyzing market trends, competitive forces, and customer demands to identify opportunities and threats. Strategic planning sets the direction for the entire organization and establishes the foundation for subsequent planning roadmap.

2. Operational planning

Operational planning focuses on translating strategic goals into actionable plans at the operational level. This involves breaking down the strategic objectives into specific targets and initiatives that different departments and functions need to execute.

For example, the sales department might develop a plan to enter new markets or launch new products, while the supply chain department focuses on inventory optimization and ensuring efficient logistics. The key is to align operational plans with the broader strategic objectives to ensure consistency and coherence throughout the organization.

3. Financial planning

Financial planning ensures that the organization’s strategic and operational plans are financially viable. It involves developing detailed financial projections, including revenue forecasts, expense budgets, and cash flow forecasts. By integrating financial planning with strategic and operational planning, organizations can evaluate financial profitability, identify potential gaps or risks, and make necessary adjustments to achieve financial targets.

4. Cross-functional collaboration

A fundamental aspect of IBP is the collaboration and involvement of various functions and departments within the organization. Rather than working in isolation, departments such as sales, marketing, finance, supply chain, human resources, and IT come together to share information, align objectives, and make coordinated decisions.

5. Data integration and analytics

IBP relies on the integration of data from different sources and systems. This may involve consolidating data from enterprise resource planning (ERP) systems, customer relationship management (CRM) systems, supply chain management systems, and other relevant sources. Advanced analytics and business intelligence tools are utilized to analyze and interpret the data, uncovering insights and trends that drive informed decision-making.

6. Continuous monitoring and performance management

The Integrated Business Planning process requires continuous monitoring of performance against plans and targets. Key performance indicators (KPIs) are established to measure progress and enable proactive management. Regular performance reviews and reporting enable organizations to identify deviations, take corrective actions, and continuously improve their planning processes.

What are the benefits of Integrated Business Planning?

By integrating strategic, operational, and financial planning organizations can unlock the full potential of IBP and drive business success and achieve their goals.

Enhanced decision-making

IBP facilitates data-driven decision-making by providing real-time insights into various aspects of the business. By bringing together data from various departments, organizations can develop a holistic view of their operations, enabling them to make better-informed decisions.

Improved alignment

By aligning strategic objectives with operational plans and financial goals, IBP ensures that every department and employee is working towards a common vision. This alignment fosters synergy and drives cross-functional collaboration.

Agility and responsiveness

In the rapidly changing business landscape, agility is crucial. IBP allows organizations to quickly adapt to market shifts, demand fluctuations, and emerging opportunities. By continuously monitoring and adjusting plans, businesses can remain responsive and seize competitive advantages.

Optimal resource allocation

Integrated Business Planning enables organizations to optimize resource allocation across different functions. It helps identify bottlenecks, allocate resources effectively, and prioritize initiatives that yield the highest returns, leading to improved efficiency and cost savings.

Risk management

IBP facilitates proactive risk management by considering various scenarios and identifying potential risks and opportunities. By analyzing data and conducting what-if analyses, companies can develop contingency plans and mitigate risks before they materialize.

Essential steps for implementing Integrated Business Planning

Implementing an effective IBP process requires careful planning and execution that may require substantial effort and a change of management, but the rewards are well worth it. Here are some essential strategic steps to consider:

1. Executive sponsorship

Establish leadership buy-in; gain support from top-level executives who understand the value of Integrated Business Planning and can drive the necessary organizational changes. Leadership commitment, led by CFO, is crucial for successful implementation.

2. Continuous improvement

Continuously monitor and adjust; implement mechanisms to monitor performance against plans and targets. Regularly review key performance indicators (KPIs), conduct performance analysis, and generate timely reports and dashboards. Identify deviations, take corrective actions, and continuously improve the planning processes based on feedback and insights.

3. Integration of people and technology

To foster cross-functional collaboration, the organization must identify key stakeholders, break down silos, and encourage open communication among departments. Creating a collaborative culture that values information sharing and collective decision-making is essential.

Simultaneously, implementing a robust data integration system, encompassing ERP, CRM, and supply chain management systems, ensures seamless data flow and real-time updates. User-friendly interfaces, data governance, and training provide the necessary technological support. Combining these efforts cultivates an environment of collaboration and data-driven decision-making, boosting operational efficiency and competitiveness.

4. Technology

Implement advanced analytics and business intelligence solutions to streamline and automate the planning process and assist decision-making capabilities. These solutions provide comprehensive functionality, data integration capabilities, scenario planning and modeling, and real-time reporting.

Integrated Business Planning software

From a tech perspective, organizations need advanced software solutions and systems that facilitate seamless data integration and collaboration to support IBP. Here are some key components that contribute to the success of integrated business planning:

1. Corporate performance management

A platform that serves as the backbone of integrated business planning by integrating data from different departments and functions. It enables a centralized repository of information and provides real-time visibility into the entire business.

2. Business intelligence (BI) tools

Business intelligence tools play a vital role in analyzing and visualizing integrated data from multiple sources. These tools provide comprehensive insights into key metrics and help identify trends, patterns, and opportunities. By leveraging BI tools, decision-makers can quickly evaluate financial performance, make data-driven business decisions and increase forecast accuracy.

3. Collaborative planning and forecasting solutions

Collaborative planning and forecasting solutions enable cross-functional teams to work together in creating and refining plans. These planning solutions facilitate real-time collaboration, allowing stakeholders to contribute their expertise and insights. With end-to-end visibility, organizations can ensure that plans are comprehensive, accurate, and aligned with business strategy.

4. Data integration and automation

To ensure seamless data integration, organizations need to invest in data integration and automation tools. These tools enable the extraction, transformation, and loading (ETL) of data from various sources. Automation streamlines data processes reduces manual effort and minimizes the risk of errors or data discrepancies.

5. Cloud-based solutions

Cloud computing offers scalability, flexibility, and accessibility, making it an ideal choice for integrated business planning. Cloud-based solutions provide a centralized platform where teams can access data, collaborate, and make real-time updates from anywhere, at any time. The cloud also offers data security, disaster recovery, and cost efficiencies compared to on-premises infrastructure.

6. Data governance and security

As organizations integrate data from multiple sources, maintaining data governance and security becomes crucial. Establishing data governance policies and ensuring compliance with data protection regulations are vital steps in maintaining data integrity and safeguarding sensitive information. Implementing robust data security measures, such as encryption and access controls, helps protect against data breaches and unauthorized access.

IBM Planning Analytics for Integrated Business Planning

IBM Planning Analytics is a highly scalable and flexible solution for Integrated Business Planning. It supports and strengthens the five pillars discussed above, empowering organizations to achieve their strategic goals and make better data-driven decisions. With its AI- infused advanced analytics and modeling capabilities, IBM Planning Analytics allows organizations to integrate strategic, operational, and financial planning seamlessly. The solution enables cross-functional collaboration by providing a centralized platform where teams from various departments can collaborate, share insights, and align their plans. IBM Planning Analytics also offers powerful data integration capabilities, allowing organizations to consolidate data from multiple sources and systems, providing a holistic view of the business. The solutions’s robust embedded AI predictive analytics uses internal and external data and machine learning to provide accurate demand forecasts. IBM Planning Analytics supports continuous monitoring and performance management by providing real-time reporting, dashboards, and key performance indicators (KPIs) that enable organizations to track progress and take proactive actions. As the business landscape continues to evolve, embracing Integrated Business Planning is no longer an option but a necessity for organizations. To succeed in this dynamic environment, businesses need an integrated approach to planning that brings all the departments and data together, creating a symphony of collaboration and coordination.

More from Artificial intelligence

The power of remote engine execution for etl/elt data pipelines.

5 min read - Business leaders risk compromising their competitive edge if they do not proactively implement generative AI (gen AI). However, businesses scaling AI face entry barriers. Organizations require reliable data for robust AI models and accurate insights, yet the current technology landscape presents unparalleled data quality challenges. According to International Data Corporation (IDC), stored data is set to increase by 250% by 2025, with data rapidly propagating on-premises and across clouds, applications and locations with compromised quality. This situation will exacerbate data silos, increase costs…

Where to begin: 3 IBM leaders offer guidance to newly appointed chief AI officers

4 min read - The number of chief artificial intelligence officers (CAIOs) has almost tripled in the last 5 years, according to LinkedIn. Companies across industries are realizing the need to integrate artificial intelligence (AI) into their core strategies from the top to avoid falling behind. These AI leaders are responsible for developing a blueprint for AI adoption and oversight both in companies and the federal government. Following a recent executive order by the Biden administration and a meteoric rise in AI adoption across…

Scaling generative AI with flexible model choices

5 min read - This blog series demystifies enterprise generative AI (gen AI) for business and technology leaders. It provides simple frameworks and guiding principles for your transformative artificial intelligence (AI) journey. In the previous blog, we discussed the differentiated approach by IBM to delivering enterprise-grade models. In this blog, we delve into why foundation model choices matter and how they empower businesses to scale gen AI with confidence. Why are model choices important? In the dynamic world of gen AI, one-size-fits-all approaches are…

IBM Newsletters

A better way to drive your business

Managing the availability of supply to meet volatile demand has never been easy. Even before the unprecedented challenges created by the COVID-19 pandemic and the war in Ukraine, synchronizing supply and demand was a perennial struggle for most businesses. In a survey of 54 senior executives, only about one in four believed that the processes of their companies balanced cross-functional trade-offs effectively or facilitated decision making to help the P&L of the full business.

That’s not because of a lack of effort. Most companies have made strides to strengthen their planning capabilities in recent years. Many have replaced their processes for sales and operations planning (S&OP) with the more sophisticated approach of integrated business planning (IBP), which shows great promise, a conclusion based on an in-depth view of the processes used by many leading companies around the world (see sidebar “Understanding IBP”). Assessments of more than 170 companies, collected over five years, provide insights into the value created by IBP implementations that work well—and the reasons many IBP implementations don’t.

Understanding IBP

Integrated business planning is a powerful process that could become central to how a company runs its business. It is one generation beyond sales and operations planning. Three essential differentiators add up to a unique business-steering capability:

- Full business scope. Beyond balancing sales and operations planning, integrated business planning (IBP) synchronizes all of a company’s mid- and long-term plans, including the management of revenues, product pipelines and portfolios, strategic projects and capital investments, inventory policies and deployment, procurement strategies, and joint capacity plans with external partners. It does this in all relevant parts of the organization, from the site level through regions and business units and often up to a corporate-level plan for the full business.

- Risk management, alongside strategy and performance reviews. Best-practice IBP uses scenario planning to drive decisions. In every stage of the process, there are varying degrees of confidence about how the future will play out—how much revenue is reasonably certain as a result of consistent consumption patterns, how much additional demand might emerge if certain events happen, and how much unusual or extreme occurrences might affect that additional demand. These layers are assessed against business targets, and options for mitigating actions and potential gap closures are evaluated and chosen.

- Real-time financials. To ensure consistency between volume-based planning and financial projections (that is, value-based planning), IBP promotes strong links between operational and financial planning. This helps to eliminate surprises that may otherwise become apparent only in quarterly or year-end reviews.

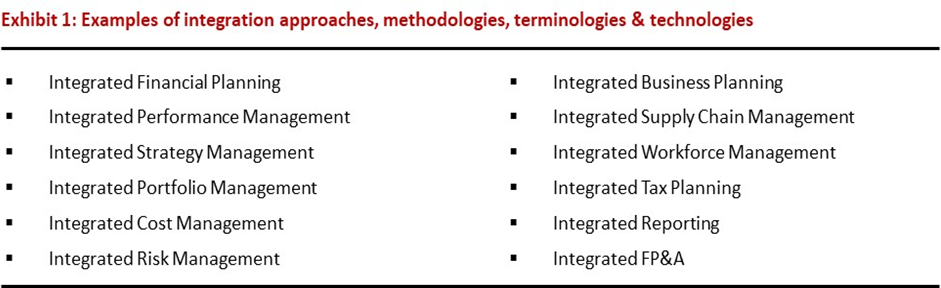

An effective IBP process consists of five essential building blocks: a business-backed design; high-quality process management, including inputs and outputs; accountability and performance management; the effective use of data, analytics, and technology; and specialized organizational roles and capabilities (Exhibit 1). Our research finds that mature IBP processes can significantly improve coordination and reduce the number of surprises. Compared with companies that lack a well-functioning IBP process, the average mature IBP practitioner realizes one or two additional percentage points in EBIT. Service levels are five to 20 percentage points higher. Freight costs and capital intensity are 10 to 15 percent lower—and customer delivery penalties and missed sales are 40 to 50 percent lower. IBP technology and process discipline can also make planners 10 to 20 percent more productive.

When IBP processes are set up correctly, they help companies to make and execute plans and to monitor, simulate, and adapt their strategic assumptions and choices to succeed in their markets. However, leaders must treat IBP not just as a planning-process upgrade but also as a company-wide business initiative (see sidebar “IBP in action” for a best-in-class example).

IBP in action

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function. Beyond S&OP, the sales function forecast demand in aggregate dollar value at the category level and over short time horizons. Finance did its own projections of the quarterly P&L, and data from day-by-day execution fed back into S&OP only at the start of a new monthly cycle.

The CEO endorsed a new way of running regional P&Ls and rolling up plans to the global level. The company designed its IBP process so that all regional general managers owned the regional IBP by sponsoring the integrated decision cycles (following a global design) and by ensuring functional ownership of the decision meetings. At the global level, the COO served as tiebreaker whenever decisions—such as procurement strategies for global commodities, investments in new facilities for global product launches, or the reconfiguration of a product’s supply chain—cut across regional interests.

To enable IBP to deliver its impact, the company conducted a structured process assessment to evaluate the maturity of all inputs into IBP. It then set out to redesign, in detail, its processes for planning demand and supply, inventory strategies, parametrization, and target setting, so that IBP would work with best-practice inputs. To encourage collaboration, leaders also started to redefine the performance management system so that it included clear accountability for not only the metrics that each function controlled but also shared metrics. Finally, digital dashboards were developed to track and monitor the realization of benefits for individual functions, regional leaders, and the global IBP team.

A critical component of the IBP rollout was creating a company-wide awareness of its benefits and the leaders’ expectations for the quality of managers’ contributions and decision-making discipline. To educate and show commitment from the CEO down, this information was rolled out in a campaign of town halls and media communications to all employees. The company also set up a formal capability-building program for the leaders and participants in the IBP decision cycle.

Rolled out in every region, the new training helps people learn how to run an effective IBP cycle, to recognize the signs of good process management, and to internalize decision authority, thresholds, and escalation paths. Within a few months, the new process, led by a confident and motivated leadership team, enabled closer company-wide collaboration during tumultuous market conditions. That offset price inflation for materials (which adversely affected peers) and maintained the company’s EBITDA performance.

Our research shows that these high-maturity IBP examples are in the minority. In practice, few companies use the IBP process to support effective decision making (Exhibit 2). For two-thirds of the organizations in our data set, IBP meetings are periodic business reviews rather than an integral part of the continuous cycle of decisions and adjustments needed to keep organizations aligned with their strategic and tactical goals. Some companies delegate IBP to junior staff. The frequency of meetings averages one a month. That can make these processes especially ineffective—lacking either the senior-level participation for making consequential strategic decisions or the frequency for timely operational reactions.

Finally, most companies struggle to turn their plans into effective actions: critical metrics and responsibilities are not aligned across functions, so it’s hard to steer the business in a collaborative way. Who is responsible for the accuracy of forecasts? What steps will be taken to improve it? How about adherence to the plan? Are functions incentivized to hold excess inventory? Less than 10 percent of all companies have a performance management system that encourages the right behavior across the organization.

By contrast, at the most effective organizations, IBP meetings are all about decisions and their impact on the P&L—an impact enabled by focused metrics and incentives for collaboration. Relevant inputs (data, insights, and decision scenarios) are diligently prepared and syndicated before meetings to help decision makers make the right choices quickly and effectively. These companies support IBP by managing their short-term planning decisions prescriptively, specifying thresholds to distinguish changes immediately integrated into existing plans from day-to-day noise. Within such boundaries, real-time daily decisions are made in accordance with the objectives of the entire business, not siloed frontline functions. This responsive execution is tightly linked with the IBP process, so that the fact base is always up-to-date for the next planning iteration.

A better plan for IBP

In our experience, integrated business planning can help a business succeed in a sustainable way if three conditions are met. First, the process must be designed for the P&L owner, not individual functions in the business. Second, processes are built for purpose, not from generic best-practice templates. Finally, the people involved in the process have the authority, skills, and confidence to make relevant, consequential decisions.

Design for the P&L owner

IBP gives leaders a systematic opportunity to unlock P&L performance by coordinating strategies and tactics across traditional business functions. This doesn’t mean that IBP won’t function as a business review process, but it is more effective when focused on decisions in the interest of the whole business. An IBP process designed to help P&L owners make effective decisions as they run the company creates requirements different from those of a process owned by individual functions, such as supply chain or manufacturing.

One fundamental requirement is senior-level participation from all stakeholder functions and business areas, so that decisions can be made in every meeting. The design of the IBP cycle, including preparatory work preceding decision-making meetings, should help leaders make general decisions or resolve minor issues outside of formal milestone meetings. It should also focus the attention of P&L leaders on the most important and pressing issues. These goals can be achieved with disciplined approaches to evaluating the impact of decisions and with financial thresholds that determine what is brought to the attention of the P&L leader.

The aggregated output of the IBP process would be a full, risk-evaluated business plan covering a midterm planning horizon. This plan then becomes the only accepted and executed plan across the organization. The objective isn’t a single hard number. It is an accepted, unified view of which new products will come online and when, and how they will affect the performance of the overall portfolio. The plan will also take into account the variabilities and uncertainties of the business: demand expectations, how the company will respond to supply constraints, and so on. Layered risks and opportunities and aligned actions across stakeholders indicate how to execute the plan.

Would you like to learn more about our Operations Practice ?

Trade-offs arising from risks and opportunities in realizing revenues, margins, or cost objectives are determined by the P&L owner at the level where those trade-offs arise—local for local, global for global. To make this possible, data visible in real time and support for decision making in meetings are essential. This approach works best in companies with strong data governance processes and tools, which increase confidence in the objectivity of the IBP process and support for implementing the resulting decisions. In addition, senior leaders can demonstrate their commitment to the value and the standards of IBP by participating in the process, sponsoring capability-building efforts for the teams that contribute inputs to the IBP, and owning decisions and outcomes.

Fit-for-purpose process design and frequency

To make IBP a value-adding capability, the business will probably need to redesign its planning processes from a clean sheet.

First, clean sheeting IBP means that it should be considered and designed from the decision maker’s perspective. What information does a P&L owner need to make a decision on a given topic? What possible scenarios should that leader consider, and what would be their monetary and nonmonetary impact? The IBP process can standardize this information—for example, by summarizing it in templates so that the responsible parties know, up front, which data, analytics, and impact information to provide.

Second, essential inputs into IBP determine its quality. These inputs include consistency in the way planners use data, methods, and systems to make accurate forecasts, manage constraints, simulate scenarios, and close the loop from planning to the production shopfloor by optimizing schedules, monitoring adherence, and using incentives to manufacture according to plan.

Determining the frequency of the IBP cycle, and its timely integration with tactical execution processes, would also be part of this redesign. Big items—such as capacity investments and divestments, new-product introductions, and line extensions—should be reviewed regularly. Monthly reviews are typical, but a quarterly cadence may also be appropriate in situations with less frequent changes. Weekly iterations then optimize the plan in response to confirmed orders, short-term capacity constraints, or other unpredictable events. The bidirectional link between planning and execution must be strong, and investments in technology may be required to better connect them, so that they use the same data repository and have continuous-feedback loops.

Authorize consequential decision making

Finally, every IBP process step needs autonomous decision making for the problems in its scope, as well as a clear path to escalate, if necessary. The design of the process must therefore include decision-type authority, decision thresholds, and escalation paths. Capability-building interventions should support teams to ensure disciplined and effective decision making—and that means enforcing participation discipline, as well. The failure of a few key stakeholders to prioritize participation can undermine the whole process.

Decision-making autonomy is also relevant for short-term planning and execution. Success in tactical execution depends on how early a problem is identified and how quickly and effectively it is resolved. A good execution framework includes, for example, a classification of possible events, along with resolution guidelines based on root cause methodology. It should also specify the thresholds, in scope and scale of impact, for operational decision making and the escalation path if those thresholds are met.

Transforming supply chains: Do you have the skills to accelerate your capabilities?

In addition to guidelines for decision making, the cross-functional team in charge of executing the plan needs autonomy to decide on a course of action for events outside the original plan, as well as the authority to see those actions implemented. Clear integration points between tactical execution and the IBP process protect the latter’s focus on midterm decision making and help tactical teams execute in response to immediate market needs.

An opportunity, but no ‘silver bullet’

With all the elements described above, IBP has a solid foundation to create value for a business. But IBP is no silver bullet. To achieve a top-performing supply chain combining timely and complete customer service with optimal cost and capital expenditures, companies also need mature planning and fulfillment processes using advanced systems and tools. That would include robust planning discipline and a collaboration culture covering all time horizons with appropriate processes while integrating commercial, planning, manufacturing, logistics, and sourcing organizations at all relevant levels.

As more companies implement advanced planning systems and nerve centers , the typical monthly IBP frequency might no longer be appropriate. Some companies may need to spend more time on short-term execution by increasing the frequency of planning and replanning. Others may be able to retain a quarterly IBP process, along with a robust autonomous-planning or exception engine. Already, advanced planning systems not only direct the valuable time of experts to the most critical demand and supply imbalances but also aggregate and disaggregate large volumes of data on the back end. These targeted reactions are part of a critical learning mechanism for the supply chain.

Over time, with root cause analyses and cross-functional collaboration on systemic fixes, the supply chain’s nerve center can get smarter at executing plans, separating noise from real issues, and proactively managing deviations. All this can eventually shorten IBP cycles, without the risk of overreacting to noise, and give P&L owners real-time transparency into how their decisions might affect performance.

P&L owners thinking about upgrading their S&OP or IBP processes can’t rely on textbook checklists. Instead, they can assume leadership of IBP and help their organizations turn strategies and plans into effective actions. To do so, they must sponsor IBP as a cross-functional driver of business decisions, fed by thoughtfully designed processes and aligned decision rights, as well as a performance management and capability-building system that encourages the right behavior and learning mechanisms across the organization. As integrated planning matures, supported by appropriate technology and maturing supply chain–management practices, it could shorten decision times and accelerate its impact on the business.

Elena Dumitrescu is a senior knowledge expert in McKinsey’s Toronto office, Matt Jochim is a partner in the London office, and Ali Sankur is a senior expert and associate partner in the Chicago office, where Ketan Shah is a partner.

Explore a career with us

Related articles.

To improve your supply chain, modernize your supply-chain IT

Supply-chain resilience: Is there a holy grail?

- Webinar Replays

- News & Press

- User Groups

- Brand Ambassadors

- OneStream Press

- Solution Exchange

- PartnerStream

- Financial Close & Consolidation

- Financial Signaling

- Reporting & Analytics

- Financial Data Quality

- Account Reconciliations

- Transaction Matching

- Compliance Solutions

- Tax Provision

- ESG Reporting & Planning

- Planning, Budgeting & Forecasting

- AI Financial Forecasting

- People Planning

- Capital Planning

- Sales Planning

- Profitability Analysis

- Manufacturing

- Financial Services

- Public Sector

- Higher Education

- Oracle Hyperion Conversion

- SAP ERP Customers

- Consulting Services

- Certification Program

- ONECommunity

- Customer Success

- News & Press

What is Integrated Business Planning and What Are The Benefits?

If there is one thing any business analyst can forecast is this: sustained uncertainty. And organizations can’t do much to change this. What organizations can do though, is to prepare to deal with market variability by addressing the business challenges internal organizations may have: disconnected and lengthy planning processes, an insane amount of time collating data, siloed decision-making, lack of forecasting accuracy, poor sight into operational assumptions and what is driving margin. That’s what Integrated Business Planning is aiming for.

What is Integrated Business Planning (IBP)?

Integrated Business Planning aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one version of the numbers. A trusted, common view of the numbers provides a robust baseline for agile decision-making and keeps all teams together, collectively trying to achieve the same corporate objectives while staying focused on specific KPIs. In other words, the different teams maintain their independence while working in unison to achieve corporate success by leveraging the same trusted and governed data.

The bottom line is that IBP is about aligning strategy intent, unifying planning processes and bringing the organization together.

IBP Process: How Does it Work

The Integrated Business Planning process is a framework to address the C-suite needs and help them implement the business strategy and manage uncertainty to improve decision-making. The secret sauce of IBP is a collaboration between the different teams under a single view of the numbers that must unequivocally be tied to financial performance, that’s how the C-suite gets value from it. Consequently, finance plays a central role within IBP.

IBP typically focuses on 24- 60 months horizons, as opposed to short term: that’s Integrated Tactical Planning or Sales and Operations Planning and Execution. The process must be fully integrated, so it should remove the departmental silos and it must adapt to the organizational construct of every business (it is not a one size fits all type of process).

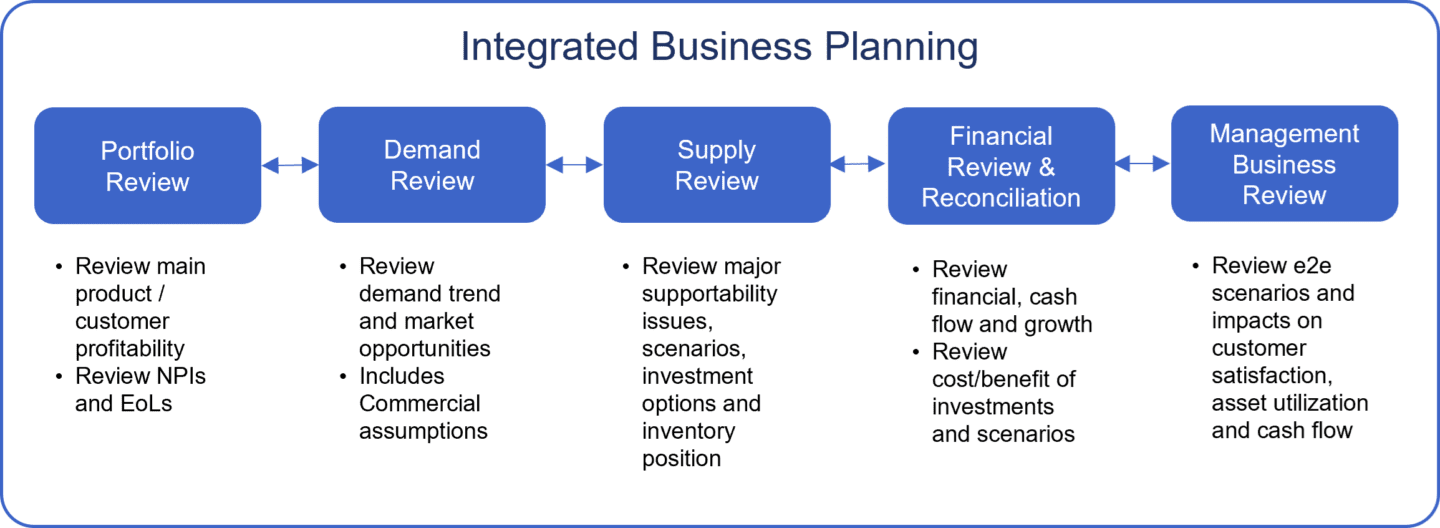

Figure 1 outlines the five core elements of the IBP cycle with its responsibilities:

The most efficient way to foster this collaboration is by having a unified solution and data model that caters the needs of the various agents involved on each review. Figure 2 shows how one solution gathering all the capabilities in the greyed area under a unified data model is the most efficient approach to IBP.

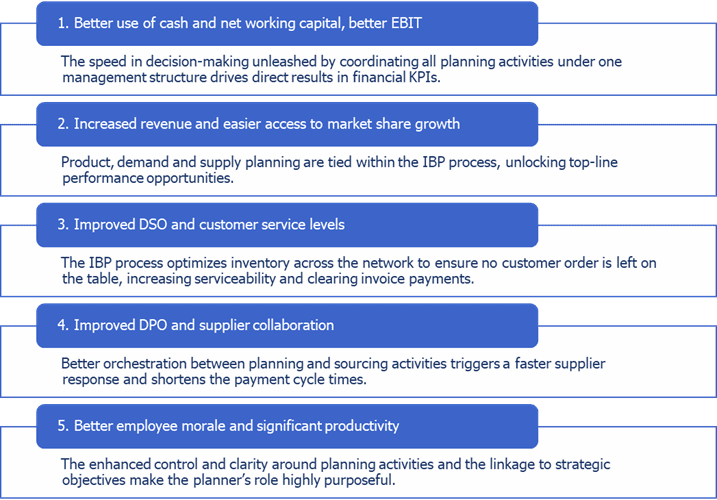

IBP Business Benefits

The benefits an organization can expect from an IBP implementation are diverse. In the big picture, IBP can certainly improve financial and business performance. Figure 3 outlines some of the most remarkable KPI improvements.

Want to learn how you can maximize the benefits of your IBP process and get your CEO onboard, read our blog on the 5 Considerations to Help Your CEO Trust the IBP Process .

Get Started With a Personal Demo

Streamline Financial Processes

- my. Inchainge

- Integrated Business Planning

What is Integrated Business Planning (IBP)? And what are the similarities, but also differences when compared to S&OP? In this article, Inchainge discusses everything you need to know about IBP.

What is integrated business planning (IBP)?

Integrated Business Planning (IBP) is the business planning process that extends the principles of Sales and Operations Planning (S&OP) throughout the value chain . It is to create a bridge between strategy and execution. IBP is a next step for companies that already have an S&OP process in place. It is a next step because it integrates the Financial Planning Cycle. The financial function will become part of this cross-functional process. In most companies the business owner of this process will change as well.

Similarities between IBP and S&OP

Integrated Business Planning and Sales and Operations Planning have several similarities between them. These are as follows:

- Monthly process

- Cross-functional approach

- Driven by business strategy

- Tactical planning at an aggregated level

Differences between IBP and S&OP

However, Integrated Business Planning includes content on top of Sales and Operations Planning:

- Financial function involved

- Integration financial planning cycle, like financial budget and forecast

- From volume planning to volume and value planning

- It drives the overall business performance

How does the IBP process work?

Companies have an annual budget cycle, based on their strategic plans and targets. The annual budget projects planned revenues and costs for the year.

In traditional S&OP companies go through a monthly process during which they project for the next 6 to 24 months where demand will go, and what resources need to be available to meet that demand. When gaps are discovered between expected demand and available resources looking this far ahead into the future, this often provides ample time to balance supply and demand, so that by the time real customer orders are submitted, demand can be met.

Suppose that during this monthly S&OP cycle, one would also look 6 to 24 months into the future where expected revenues and costs will go. And how these financial figures would look compared to the annually budgeted revenues and cost. Most likely gaps will occur here as well between the annually budgeted numbers and the monthly updated numbers. Actions could then be taken to address these gaps. Integrating a financial view. When this happens, we actually practice IBP. In IBP the relationship with the financial performance management cycle is very important. Budget and financial forecasting must be aligned and integrated with the steps from the original S&OP cycle.

The challenges of IBP

IBP is a next step in maturity after companies have implemented a proper S&OP process. Integrating finance sounds simple but is not easy at all. People from the physical supply chain side of the business, often speak a different language than people who operate on the financial side. Supply chain people often speak about units, products, and product families, whereas financial people often speak about money, currencies, etc. That also causes both functional areas to be assessed differently with the KPIs that they use. This calls for other participants in the IBP process, compared to participants in the S&OP process.

The 8 common pitfalls when implementing IBP

Be aware of the following risks related to integrated business planning:

- Lack of commitment in some of the needed departments

- If the S&OP process was not yet implemented or stable, IBP is too big of a step

- Targets and forecasts are mixed

- Information not available

- Discussion about numbers instead of the underlying assumptions

- Discussing only short horizon instead of midterm

- Too granular plans and discussions

- Thorough understanding of trade-offs is lacking

Want to know more? Experience IBP!

Because IBP is simple but not easy, a real-life experience creates enormous value for learning about this topic. The participants will feel and recognize the important issues in this process. In our business simulation game, The Cool Connection , we have incorporated the most important functions and decisions.

In this business game the team is forced to make a yearly financial budget and quarterly forecasts. The objective is to close the gaps between prediction (the budget and forecasts) on one hand and attained performance on the other. The best performing teams are both profitable and predictable at the same time. In business game The Cool Connection the team is almost experiencing a real-life IBP process.

Besides our business games, you can learn more in our articles about topics such as Total Cost of Ownership (TCO) , strategic alignment and external alignment and collaboration .

Now you know

Now you know that IBP is a next step for companies that already have an S&OP process in place, by integrating the financial planning cycle in this cross-functional process. IBP prompts companies to include planned revenues and costs in their annual budget cycle. Budget and financial forecasting must be aligned and integrated with the steps from the original S&OP cycle. Integrating finance sounds simple but is not easy at all. Supply chain people and finance people tend to speak a different language. Make sure to be aware of the 8 common pitfalls when implementing IBP.

You might want to learn more about

Learning is the process of acquiring new understanding, knowledge, behaviors, skills, values, attitudes, and preferences. There are many ways to learn but what works best? And why does it matter? In this article, Inchainge discusses everything you need to know about learning.

The Cool Connection

The Cool Connection is an innovative web-based business simulation game. It engages participants in making strategic decisions in the management of a manufacturing company of personal care products. Working in teams of four, participants will represent the functional roles of sales, purchasing, supply chain management and finance. They will be confronted with various real-life, real-time dilemmas.

- Total Cost of Ownership

When buying new equipment, the price tag only tells you part of the story. Energy costs, maintenance, and repair fees are often several times higher than the initial price! But often these are left unconsidered and hold nasty surprises further down the line. Calculating the Total Cost of Ownership is an important step when planning new investments.

- Strategic Alignment

Understanding what strategic alignment really is and why it is important can make the difference between being a successful company and failing. Due to its complexity, the supply chain often faces challenges in aligning its strategy properly and working as one. In this article, Inchainge discusses everything you need to know about strategic alignment.

- External Alignment and Collaboration

In an increasingly global and connected world, companies rarely execute supply chain operations themselves, but must outsource certain tasks. To make sure that supply chains across several companies run smoothly, external alignment is essential. In this article, we’ll discuss everything you need to know about external alignment.

Dive into our knowledge base

- Key Performance Indicators

- Sales & Operations Planning

- Blended learning

- Delivery formats and scalability

- Experiential learning

- Flipped classroom

- Learning cycle

- Soft skills

- Building (virtual) teams

- Leadership skills

Supply chain

- Data analytics

- End-to-end Supply Chain Management

- LARG Supply Chain

- Logistics footprint

- Omnichannel

- Supply Chain

- Supply Chain Finance

- Supply Chain Management

- Supply Chain Risk management

- Supply Chain Volatility

- The Bullwhip Effect

- Sustainability

- Carbon footprint

- Circular Economy

- Does Green Governance drive the ride to a sustainable future?

- Everything You Need To Know About Eco-Efficiency

- Greenwashing: Everything you need to know

- Is it possible to measure the Triple Bottom Line?

- Sustainability v/s Circularity

- The 3Ps Series: People

- The 3Ps Series: Planet

- The 3Ps Series: Prosperity

- The Butterfly Diagram

- The Value Hill

- What are the 3Ps of Sustainability?

- What do we know about the Triple Bottom Line?

- Value Chain

Privacy Overview

- Recognition

Integrated Business Planning

Embracing change: the power of integrated business planning.

In today’s dynamic business landscape, conventional planning processes riddled with departmental silos often hinder visibility and efficiency. However, a transformative shift is underway. Forward-thinking companies are embracing digital transformation and adopting Integrated Business Planning (IBP) to empower their activities with enhanced coordination and collaboration. This blog delves into the definition of IBP and explores the substantial benefits it’s brings to organizations in a modern setting.

What is Integrated Business Planning?

IBP is considered a best practice approach that seamlessly integrates financial and operational data from across the organization. This strategic method allows companies to optimize their output by connecting strategic plans with sales, operational, and financial plans. The result is enhanced visibility of the intricate relationships between resources, capabilities, and results. Through IBP, organizations collectively develop a comprehensive go-to-market plan that reflects contributions from every department.

Main objectives of Integrated Business Planning

IBP establishes a framework to achieve the following key goals:

- Align company plans and resources with corporate strategy: IBP ensures that all parts of the business are aligned with the strategic goals, focusing on financial performance as much as on operational capabilities.

- Improve visibility and collaboration across the business: By bringing together various functions—such as sales, production, logistics, and finance—IBP fosters collaboration and transparency across departments.

- Enable more accurate and forward-looking decision-making: With a unified view of business data and forecasts, companies can make more informed decisions, anticipate market changes, and react proactively.

Core elements of Integrated Business Planning

IBP consists of a series of interconnected processes that work together to create a unified business plan:

- Product and portfolio management: Managing the life cycle of products and aligning the product portfolio with market demands and strategic objectives.

- Demand planning: Estimating customer demand to guide supply chain and business planning.

- Supply planning: Ensuring the organization can meet the demand plans with optimal resources.

- Financial review and integration: Tying operational planning to financial planning and analysis to ensure that business plans are financially viable and aligned with financial goals.

- Strategic business planning: Aligning all business plans with the company’s long-term strategic goals, including financial objectives.

- Integrated reconciliation: Harmonizing plans across the business to ensure alignment and commitment from all departments.

Key benefits of Integrated Business Planning

IBP offers a multitude of advantages, including:

- Enhanced agility: Respond faster to market changes and capitalize on new opportunities.

- Improved financial performance: Make data-driven decisions that optimize resource allocation and profitability.

- Better risk management: Proactively identify and mitigate potential risks that could impact your business.